Today’s Article is Powered by Savvy Trader:

1. When to Sell?

We constantly discuss fundamental research as the basis for justifying an investment. But when is it time to sell? While the answer to this question is highly subjective, we do have our opinions which we will briefly share in our typical long-term investing point of view.

a) When I Exit a Position

The decision to continue holding a company and allocating time, energy and money to the business must be emotionless and rational. Investments do not deserve our loyalty and certainly don’t deserve our unconditional love. They don’t care about you or me. Falling in love with a stock is a great way to let bias interfere with a calculated sell or hold decision.

So what’s involved in cool, calm and collected decision making? It all starts with identifying a stock with a solid bull case and learning it. Knowing the prospects, performance, and execution is the only way to judge a stock. It’s how I can know when an investment case is deteriorating or if things like sentiment are simply turning irrationally negative. So? It’s the only way I know if overly negative price action is to be approached with greed or caution. If we are relying on an incomplete argument to support a buy or hold decision, we leave ourselves extremely vulnerable to approaching alpha-fostering price action with anxiety rather than opportunism. In sum, determining when to sell is as simple as identifying if there is a broken stock, or a broken company.

What are some good reasons to exit a holding? Here’s an incomplete list:

- Sharply slowing revenue growth over a string of several quarters.

- Margin or market share deterioration over a string of several quarters.

- An increasingly fragile balance sheet with shrinking liquidity and/or skyrocketing debt.

- Egregious stock-based compensation and maligned leadership compensation incentives.

- C-suites serving as a revolving door of entrants and exits.

- Signs of a toxic work environment (like high employee churn).

Here’s an incomplete list of bad reasons:

- A new competitor just entered the large, fragmented market.

- The CEO sold some shares.

- This person was elected President of the USA instead of this person.

- The CPI print was a little too high this month.

- The stock sold off after a strong earnings report.

- This person on social media says it’s a bad investment in all capital letters.

- A sell side analyst downgraded the name.

You’ll notice that poor financial performance over a “string of several quarters” is generally required to manifest an exit decision for me personally. Businesses are not perfect, hiccups are somewhat inevitable and a “one strike you’re out policy” is too harsh and premature. Iconic companies throughout their histories have ALL had missteps and exogenous factors or mistakes weigh on performance from time to time. Microsoft messed up Windows 8 and Zune, iPhone 6 dealt with bending issues and Amazon has flopped on several product releases. These 3 companies are 3 of the most successful in the history of humanity. It’s when missteps become more consistent that they become more concerning.

b) When I Trim a Position

The section above intentionally ignores valuation, but valuation is a highly important part of investing -- especially now that real rates are not negative and stimulus is not being pumped into the economy. To me, valuation is never a reason to completely exit a fundamentally thriving company. Why? Because profit estimates forming presumed valuations are routinely wrong. And furthermore, stock prices are living, breathing entities that go from expensive to cheap with no notice. We have no crystal ball. If valuations become stretched to the upside but the company continues to perform, we maintain a smaller position because of our belief that the company will grow into the stock price.

With that being said, valuation and multiple expansion is THE MAIN reason for personal decisions to trim holdings. Investing is all about seeking out compelling risk/reward. As multiples expand, that risk/reward naturally becomes less favorable. That doesn’t mean capital appreciation based on more multiple expansion can’t happen, but it does make that source of future profit less likely.

In terms of rules, I am deeply in the Peter Lynch camp of utilizing PEG ratios to judge valuations. A PEG ratio takes the P/E ratio and divides it by rate of earnings growth. For the sake of smoothness, I use 2 or 3 year earnings compounded annual growth rates (CAGRs) for the denominator. Again, this is just how I do things and many other bright individuals will invariably have a related, yet different process. As an overgeneralized rule of thumb, as holdings cross a PEG ratio of 2x or greater, I often will elect to trim 5%-10% of a position. As PEGs expand further beyond 2x in increments of 25-50 basis points (bps), I elect to make similarly sized trims. Why is there a bps range rather than a preset number?

It goes back to financial estimates sometimes being wrong. For holdings like Uber and Amazon, I don’t think analyst expectations have come remotely close to modeling the incremental efficiency and cost cuts that have been built into the models. Other reasons for the range include:

- For some companies like the Trade Desk, we have a several years-long track record of constant beats and raises vs. consensus estimates. In this case, PEG ratios formed with forward estimates probably are unfairly high.

- The highest quality growth companies in the world deserve premiums vs. everything else in the market. From my portfolio, I put Meta, Amazon and CrowdStrike (1 out of 1 in terms of scale, margins and growth) in this bucket.

When using a P/E ratio in isolation, we can be tempted to call a 10x earnings firm cheap and a 50x earnings firm expensive with no other context. But what if the first company compounds earnings at 2% annually and the second at 50% annually? The PEG will allow us to credit this growth with the first company sporting a hefty 5x PEG and the other 1x. This is why I prefer PEGs. If there is no net income to value, I use EBIT. If there’s no EBIT, I begrudgingly use gross profit. Revenue should never be used for valuation multiples as the quality of $1 in revenue differs massively between companies. Some can spend $1 on $10 in revenue. Some can spend $20 on $10 in revenue. Both have $10 in revenue.

c) Euphoria Creeping Back In

Euphoria seems to be creeping back into the market sentiment fold. This is not a repeat of the Fed Bubble, but fear is briskly being replaced with greed. Fundamentally broken companies like Nikola -- just a couple years removed from being caught pushing their semi truck down a hill in a demo video -- are jumping 60% in a single session. Coinbase has doubled in the blink of an eye and the most speculative holdings in my portfolio are the ones rising the most.

I will always be predominately invested. But in a world where I embrace “greedy when fearful and fearful when greedy” it is time to shift away from the greed I’ve been exercising for the last year + and to take a more balanced market view. Some valuations are getting nutty, I’m again hearing that “fundamentals and valuations don’t matter” way too often, and macro (despite a great looking CPI and PPI this week) still has significant challenges. So? All of this is to say that I have entered trim mode (with the exception of a couple holdings) and will likely push my cash position from the current 4.72% level to somewhere closer to 10% if things stay this fun. Nothing major, just some gradual cash building and preparation for the next dip.

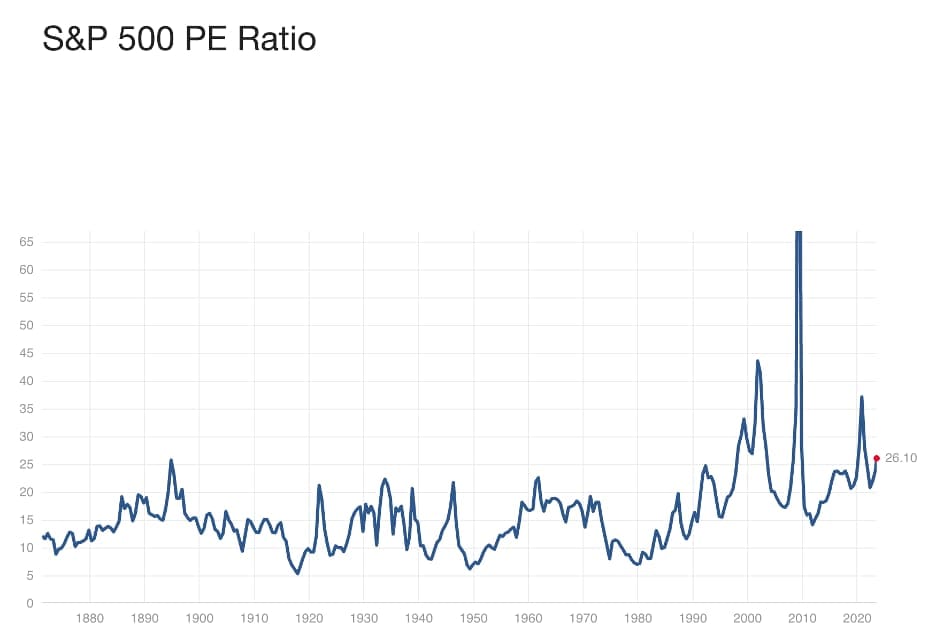

Raising a bit of dry powder for the market’s next inevitable fit seems prudent at this time as risk/reward deteriorates with steeper valuations. Many companies have set themselves up to demolish estimates this year, but that doesn’t change the fact that 26x earnings for the S&P 500 is somewhat stretched:

2. Meta (META) -- Roblox, Threads & More

a) Roblox

In the race for extended reality (XR) market share, content will be king. Both Apple and Meta will have to build ecosystems and incentives that win the hearts, minds and work of talented 3rd party developers. While that will be imperative, jumpstarting the content ecosystem with key partners will be another important piece of the puzzle. Apple has inked important deals with firms like Disney and Unity while Meta has its own relationships with entertainment juggernauts like Paramount. Now, according to a Roblox developer blog and confirmed by Zuck himself, Meta will add the immensely popular Roblox platform to Quest.

Not only will this be a vast injection of fresh, relevant content into Quest, but will mean a large ecosystem of Roblox developers more motivated and driven to build XR experiences for the Quest App store. Roblox developers, with very little XR-experience, will be able to easily use Meta’s tools and Roblox’s cross-channel presence to leverage their existing titles for use within the XR ecosystem. The direct relationship and integration should drive a larger proportion of Roblox’s 66 million DAUs to Quest. Roblox’s malleability will mean these gamers can play with Roblox users across devices including Xbox and Apple’s iOS.

To start, Roblox will beta test within Quest’s app incubator. That soft launch will allow Roblox and its 3rd party developers to A/B test in a low stakes environment and craft the best experiences before broadly rolling out. Roblox’s user base is gigantic, young, and now can play its beloved games directly on Quest. Great news… but for a revenue stream that will not be needle moving in the coming years.

b) Threads

Here’s a fun fact: Meta’s new Threads app reached 100 million users in less than a week. That represents 8% of the time ChatGPT took to reach that level and 2% of the time it took TikTok. Threads is thriving right out of the gate thanks to the unparalleled network that Meta’s Family of Apps provides. Some data is pointing to engagement peaking following the first few days, but Meta leadership continues to post mind-boggling stats on how quickly the service is proliferating.

What’s the monetization potential here? Evercore sees Threads reaching $8 billion in revenue by 2025. That’s just 5.2% of total projected 2025 sales, but should represent a larger proportion of annual EBIT as this app should boast margins closer to its other apps vs. Metaverse investments. The large caveat here is that we don’t know how much of this new Threads engagement is stealing time from Meta’s other apps. Is it incremental or cannibalistic? The reality is likely a combination of both as creators prompt their newsletter and Twitter followings to join the new community (like me 🙂). Some of the engagement growth, however, will inevitably cut into time spent on the other platforms.

Today, the app stinks. Meta rushed it out to launch as Twitter was dealing with its self-inflicted engagement limit drama and hesitant advertisers. The plan was to get something released and then to work on fine tuning and product tweaking from there. That’s now taking place as subtle new features pop up on the app daily. Will Twitter die? We hope not and don’t think so. Leadership there has even talked up record setting engagement in recent days. Still, will Threads likely win at least the occasional eyeballs from Twitter? Probably so. The master of copycatting strikes again. Whether it’s Stories, Reels or now Threads, Meta is the king of using social media competition for its own product R&D.

c) More Meta News

- Meta continues to embrace open-sourced AI. It will release a commercial version of one of its latest models for developers to build on top of. These models allow for automated generation of images, code and more.

- It’s new speech model can more accurately account for accents and impediments.

- TD Cowen upgraded Meta to overweight due to expected estimate beats, Reels engagement strength, Threads potential and the ability to cut more costs. There was some other alt-data that surfaced this week on strong Reels monetization trends. As always with alt-data, this could just be noise. It’s either good news or irrelevant.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for freehere. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible throughthis link.

3. SoFi Technologies (SOFI) -- Mortgages & a Noto Interview

a) Mortgages

Two weeks ago, we discussed the debut of SoFi’s first mortgage product following its acquisition of Wyndham Capital. Since then, all of our inboxes have been inundated with SoFi promotions showcasing unique mortgage offers. These two pieces of news indicate that the company is ready to push external marketing for home loan originations. The service and time-to-fund issues it was having with backend fulfillment partners appear to potentially be behind it, and the timing is perfect.

Mortgage rates are in the process of peaking right now. With rate cuts directly feeding mortgage demand, macro headwinds are turning to tailwinds right as SoFi is becoming aggressive. This should provide a great offset to cooling personal loan demand as variable to fixed personal loan refi demand wanes amid falling rates (less likely to want to lock in a rate if your rate is variable and yields are falling). Finally, SoFi has very little mortgage market share. It dominates in student refi, has rapidly built share in personal and thinks it now has the recipe to follow that path within home loans. Considering the gigantic size of this credit bucket, traction here would quickly become impactful to overall performance. We’re optimistic.

b) Interview

SoFi’s CEO Anthony Noto was interviewed on CNBC this week. He was immediately asked about Morgan Stanley raising its SoFi price target and downgrading it to underweight. There were three reasons behind the note. The first two were on valuation risks to its book of credit and student loan headwinds from the proposed payment on-ramp. We’ve extensively covered why the credit book is safe in previous articles. Here’s a summary of the main points:

- Its credit niche is highly affluent with average income over $150,000 per year and an average FICO over 750.

- It has a 3rd party conduct quarterly fair value markings, based on capital market demand and macro, that flow through its financial statements. This form of accounting vs. CECL makes the potential for misaligned valuations, unrealized losses and shady behavior even lower, not higher. These markings assume 2.5% GDP contraction this year which is pessimistic.

- Its loss ratios are still 50% below 2019 levels as it continues to outperform peers and benchmarks.

- It has done nothing but maintain or tighten credit standards throughout this cycle. It isn’t gaining volume by issuing riskier debt.

In terms of the former student loan on-ramp headwind, Noto seemed quite confident in the volume still coming and student loans still being a sharp tailwind for 2024. How? Interest will accrue under the proposed on-ramp and so borrowers will still be driven to seek lower rates. SoFi sees a large chunk of credit ripe for granting lower rates in today’s environment. That chunk will merely grow as we enter the rate cut phase of this cycle. It’s the people looking to extend term periods to lower principal payments who may take more time to refinance if the on-ramp is allowed. That’s a somewhat large if. It’s very unclear if this on-ramp proposal will even be allowed. The Supreme Court has struck down the administration’s ability to offer its relief plan, why would this next attempt be allowed? Expect more lawsuits and potentially another supreme court hearing.

The third reason behind Morgan Stanley’s bearish note was on it valuing SoFi as a bank rather than a tech firm. Noto welcomed this classification despite SoFi’s potentially promising tech branch, its more asset light, branchless model and its rapid growth and margin expansion. He indicated a clear path to 30% ROE for SoFi. Banks that fetch a 30% ROE typically have a tangible book value multiple of 4x-5x. SoFi’s is under 3x today. This leaves room for long term multiple expansion to feed capital appreciation while compounding should provide the largest part of this stock’s upside. Want to value it like a bank? No worries.

All in all, this was a mostly fair note. The repeated concerns around the credit business were a bit annoying, but when a stock doubles in 2 months, valuation concerns are warranted. Gains of that magnitude almost always need to be digested.

4. Uber Technologies (UBER) -- Domino’s & The Team

a) Domino’s

Domino’s is famously known for its pizza… and for making its customers have that pizza delivered directly through its app. That just changed. This week, UberEats (plus its Postmates brand) announced a new partnership with the largest pizza chain in the World. The new program will begin testing this fall with a full debut in 28 markets across North America by year’s end.

Why does this matter aside from it meaning another large, bellwether brand on UberEats? Glad you asked. There are a couple of reasons. First, this marks a sharp pivot in philosophy for the famous pizza chain. In the past, Domino’s has not only avoided support for 3rd party delivery fees, but it has allocated external marketing dollars to openly criticize the model and associated costs.

There are very few chains with Domino’s liquidity, slick app, resources and presence, yet it’s going with the unmatched power of Uber’s gigantic network. Massive partners continue to choose Uber out of respect for this verb-fueled ecosystem rather than trying to expensively build traffic on their own.

Google’s Waymo is now partnered with all Uber business segments for autonomous driving, Amazon partners with Uber for flexible fulfillment capacity and Prime member rewards, and large chain holdouts like Domino’s are accepting the need for Uber’s delivery demand augmentation as inevitable. Scale matters in the transportation of people and last mile goods. No company in the space comes close to Uber’s reach and capabilities which is likely why it was chosen as Domino’s exclusive 3rd party partner.

The argument against this upbeat takeaway would be that Domino’s is simply struggling to stay fully staffed and to preserve margins. The fact that Domino’s employee base will actually be making all deliveries on orders through UberEats puts that argument to bed. It truly is about reaching large incremental cohorts of potential customers and Uber provides that edge in unique fashion. Its client base alone is expected to be largely incremental and add a billion in sales to Domino’s business. That added billion would represent a 20%+ boost to current sales to give you an idea of how impactful this news can be. Nearly every other large pizza chain uses demand channels like UberEats… Domino’s is finally ready to follow suit.

“We’re excited to announce this unique partnership with Domino’s globally -- both starting as their exclusive third-party marketplace partner in the U.S. and making their menu available to our consumer base around the world. We look forward to bringing customers the convenience, tech & experience that are foundational to both of our brands.” -- Uber CEO Dara Khosrowshahi