Table of Contents

- 1. Updated Free Cash Flow (FCF) Valuation Comp She …

- 2. Alphabet (GOOGL) – Miscellaneous

- 3. Uber (UBER) – Unlikely Friends?

- 4. Micron (MU) – Earnings Review

- 5. Nike (NKE) – Earnings Review

- 6. The Trade Desk (TTD) – Mixed Notes

- 7. SoFi (SOFI) – Product Launches

- 8. Duolingo (DUOL) – Alt Data & More

- 9. Mercado Libre – Argentina & Advertising

- 10. Analyst Updates

- 11. Headlines

- 12. Macro

In an effort to continuously augment the value we provide, we’re adding a new section to News of the Week articles. We’ve purchased access to sell-side research reports from several different institutions, and will be summarizing the key updates in an “analyst updates” section every week.

1. Updated Free Cash Flow (FCF) Valuation Comp Sheets

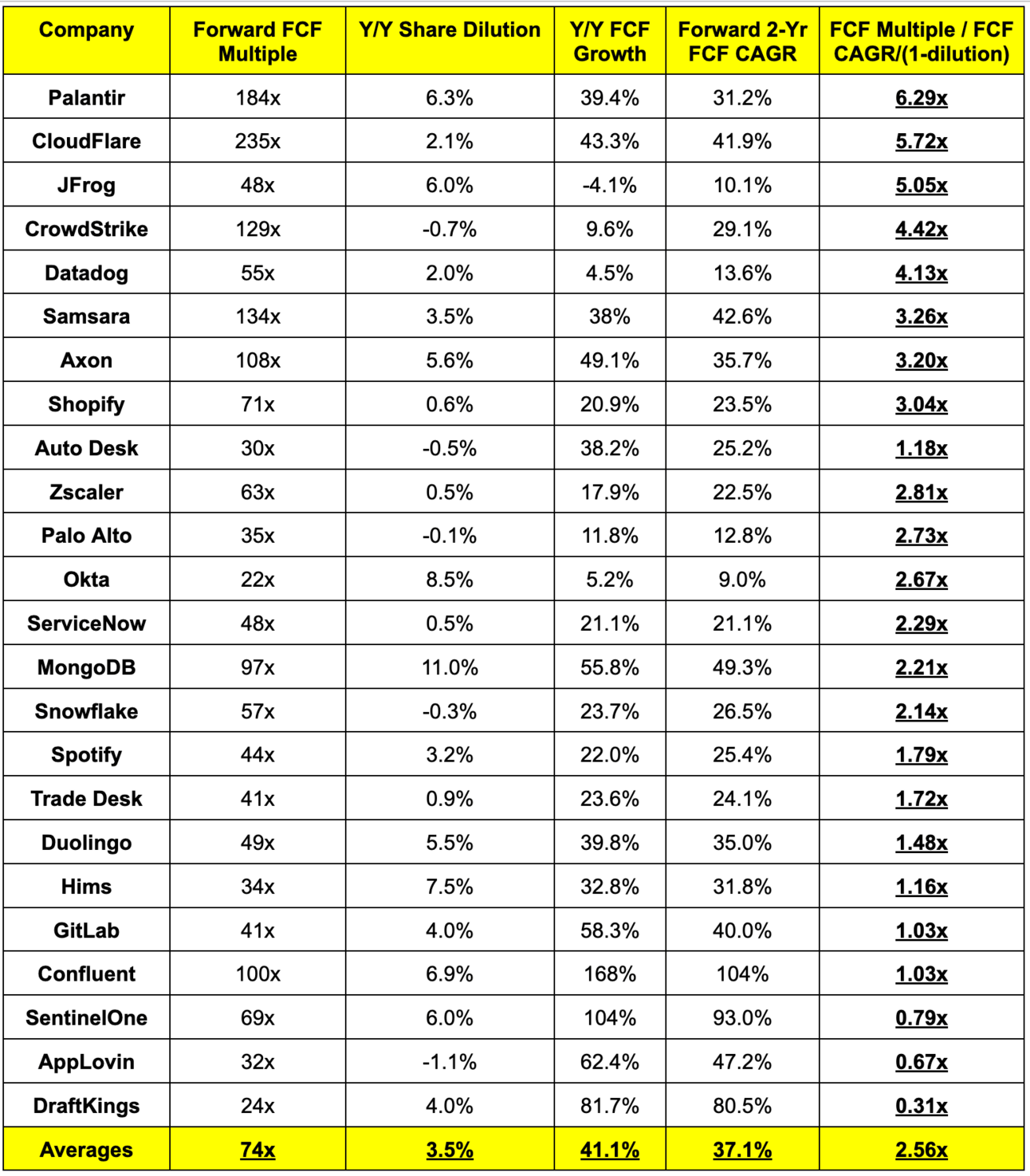

a. Fast Growth

Needed Notes:

- The rightmost column is an iteration of Peter Lynch's PEG ratio. It uses FCF instead of net income, penalizes companies for more dilution & uses 2 years of compounded profit growth, rather than 1.

- Datadog & JFrog are both expected to deliver very little FCF growth this year. Had I skipped this year for the FCF CAGR, Datadog would have had a 29.5% CAGR & a growth multiple of 1.90x. JFrog would have had a 26.7% CAGR & a growth multiple of 1.90x as well.

- Confluent & SentinelOne this year are both comping vs. roughly breakeven FCF. To avoid using the overly easy comp, I skipped a year in the CAGR calculation. Confluent’s CAGR would have been 258% & SentinelOne’s CAGR would have been 358%.

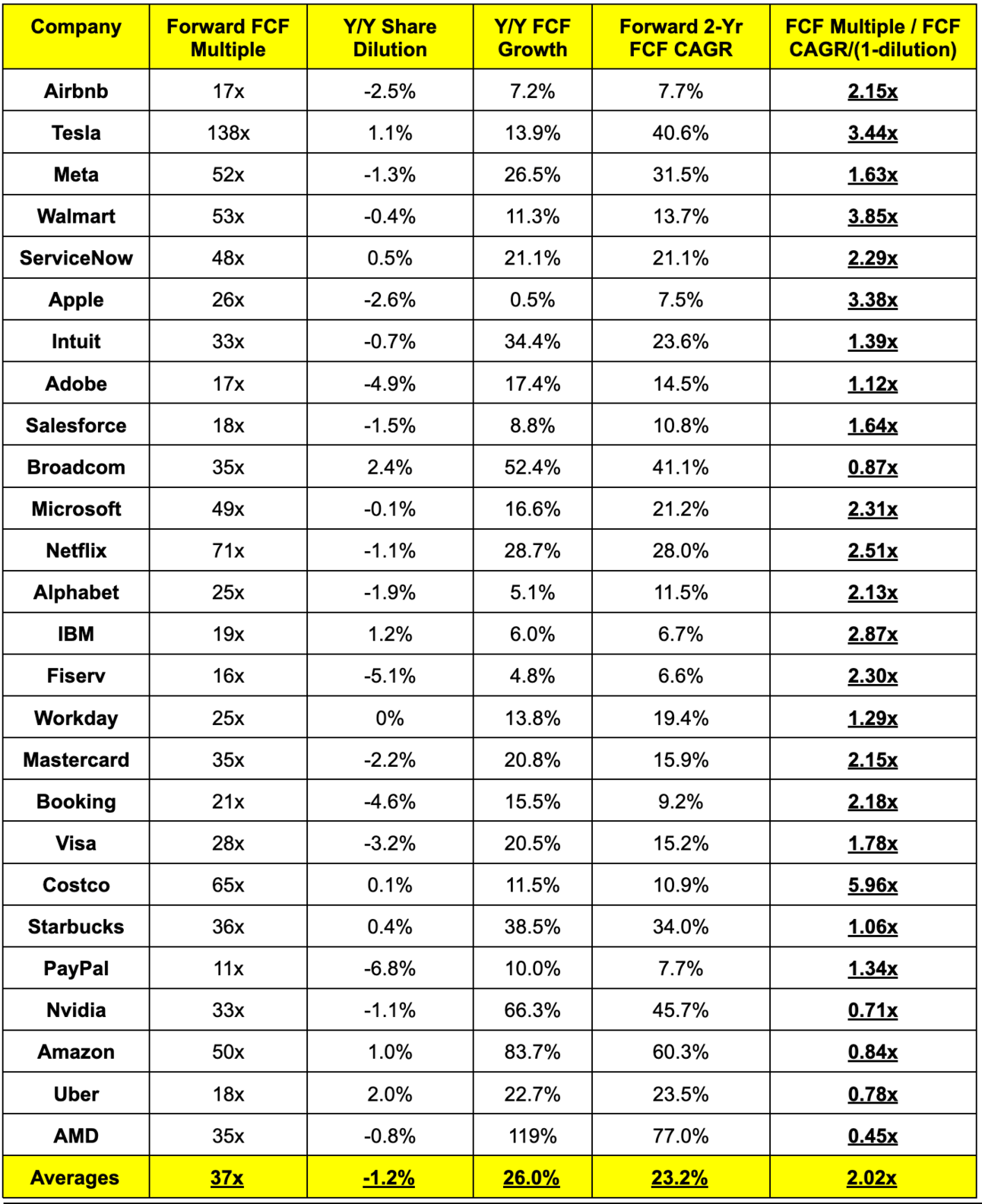

b. Mature Growth

Needed Notes:

- I skipped this year’s profit growth for the following names:

- Airbnb — had I not done this, the CAGR would have been 3% and the FCF score (far right number) would have been over 4x.

- Mastercard — had I not done this, the CAGR would have been 8% and the FCF score would have been over 4x.

- Meta — had I not done this, the CAGR would have been -7%.

- Microsoft — had I not done this, the CAGR would have been 3% and the FCF score would have been over 16x.

- Starbucks — had I not done this, the CAGR would have been 6.3% and the FCF score would have been nearly 6x.

- PayPal — had I not done this, the CAGR would have been 3% and the FCF score would have been nearly 4x.

- Disney was excluded because there’s no FCF growth expected for the next two years.

2. Alphabet (GOOGL) – Miscellaneous

a. Open AI

OpenAI is using Alphabet’s Tensor Processing Units (TPUs) for some of its ChatGPT compute needs. On Friday, news came out confirming that the cloud deal announced between the two earlier in the month includes usage of the tech giant’s high-performance chips. Along with ChatGPT gearing up to use AMD’s new GPUs during the 2nd half of the year, this marks the first and second instances of OpenAI diversifying away from NVDA’s chips. Similarly to Application-Specific Integrated Circuit (ASIC) chips, TPUs are custom chips, purpose-built for specific workloads, such as Google Cloud. ASIC players like Broadcom and TPU vendors like Alphabet continue to find more product-market fit for their hardware, more meaningfully complementing general-purpose GPU juggernauts like Nvidia and AMD.

b. Gemma 3n

The company launched a new, multimodal small language model (SLM) under the Gemma family called Gemma 3n. The 4 billion parameter is the first sub-10 billion parameter to record an LMArena Elo Score (popular ranking metric for models) over 1300. This should build on a whopping 160M downloads since Gemma debuted a year ago, as Alphabet just continues to convincingly lead the model innovation pack.

- JMP Securities upgraded Alphabet to Outperform based on AI search optimism. They cited the same 10% query uplift for AI overview users that Alphabet discussed at its last investor event.

- YouTube is adding GenAI search and discovery tools for its premium subscribers.

- YouTube Shorts now has 200B+ daily views, marking 186% growth in 15 months.

c. More

Similarweb published some alternative data this week on M/M growth for Alphabet’s AI-focused sites and on how much chatbot traffic is being directed to YouTube.

3. Uber (UBER) – Unlikely Friends?

Uber’s charismatic founder, Travis Kalanick, was forced out of the company about 8 years ago. Considering this, one may be surprised to learn that Uber and Kalanick are exploring a purchase of PonyAI’s U.S. business. Pony, which is already an Uber partner, is a player in autonomous driving with a virtual driver software platform and a sensor business too. The AV player has an important manufacturing partnership with Toyota and this partnership could lock in a lot of future supply for Uber’s network.

- Note that the Waymo launch in Atlanta that was reported as brand new information was announced in September 2024. It just started this past week.

- Canaccord downgraded Uber to hold with an $84 price target based on AV evolution uncertainty.