Today’s Article is Powered by Savvy Trader:

1. Meta Platforms (META) & Apple (AAPL) – 2023 Worldwide Developer Conference (WWDC) Keynote

a) Apple VisionPro

The clear highlight of Apple’s WWDC keynote was its long-anticipated reveal of its first extended reality (XR) headset. Brilliantly, it is marketing this product as a “spatial computer” to distance itself from the negative sentiment surrounding Meta’s “Metaverse” vision. Here, we’ll dive into the actual product, market dynamics and the ripple effects on Meta’s business.

The design features lightweight materials and a single panel of laminated glass lining the front of the device. This transparent material allows the extensive cameras and sensors within the hardware to have a clear view of a user’s surroundings. The glass is encompassed by an aluminum frame with a button on it to take 3D pictures. The frame also features a crown (just like on the watch) which can be turned to toggle experience immersion levels to suit preferences and dynamic needs. Straps keep audio ports close to ears.

Somewhat surprisingly, the hardware is not wireless, unlike Meta’s Quest line-up. It must be plugged into an external battery pack with 2 hours of battery life. Separating the battery pack from the headset makes it smaller & lighter. This design works entirely fine for static work and gaming use cases but not so much for movement-based gaming or fitness. Apple will invariably remove the wire over time and this will not be a durable Quest edge.

VisionPro’s battery life is the same as the Meta Quest 2 device when enabling face tracking mode and compared to 3 hours of Quest 2 battery life without that turned on.

The Apple spatial computer functions to blend the physical and digital world together in an AR-based style as Apple’s “first product to look through instead of looking at.” When putting on the headset, users see a familiar display of their installed apps. They experience all of these apps with rapid hand and eye tracking, eliminating the need to use controllers while their eyes are used for things like app selection. Meta has these same features but insiders we spoke to said Apple is generally ahead in this department. For gaming, the Apple device still requires separate controllers.

Apps are displayed on virtual screens suspended within the physical environment. These apps are fully size-adjustable and have “environments” that serve as backgrounds, fully submerging the user into the space. This can help people stay more focused while working or emulate the feel of an actual movie theater while they watch a film. Pretty cool. Multiple apps can also be displayed and used at the same time. Moreover, non-IOS apps like the Microsoft Office suite will be available (same with the Meta Quest device). And, as always, the VisionPro works seamlessly with all other Apple hardware to sync work, pictures and more via iCloud. That’s a key, built-in advantage of Apple simply having most of North America on its devices. This perk alone will be enough to win over some users.

In true augmented reality (AR) fashion, objects can be pulled from the physical environment and infused into the digital workspace while MacBooks can also be merged into these spaces by looking at the computer. Users can use the device to remotely interact through the exact same app (like Google Docs but a lot more powerful) to make working from anywhere more productive. Two interesting FaceTime features include spatial audio which means if you’re talking to several people, the audio will come from the direction of whoever is speaking to you. Secondly, FaceTime comes with sensor-powered digital twins of users so that people see who they’re talking to directly, rather than through a headset. AKA… an avatar that looks quite similar to Meta’s next-generation Codec Avatars. Like “Spatial Computer” vs. “Metaverse”, not using the term Avatar was another brilliant marketing ploy. Meta isn’t ready to roll this next-gen Avatar out broadly, so Apple may be a few months ahead here.

The most cutting-edge piece of this launch is the contextual pass through lens that it features. This lens hides a user’s eyes when they’re fully entrenched in an app, yet can emulate a digital twin of their eyes (that a user can see through) when someone else enters a room. Meta is still working on perfecting this and Apple appears to be ahead here for now. Quest 3 will reportedly get a large boost in this department, so we’ll have to see how the new model compares to VisionPro.

Apple Silicon semiconductors are an instrumental piece of bringing this product to life. They freed VisionPro to pack 64 pixels into the “space of a single iPhone Pixel” and gave it the capacity to provide sharper imaging and higher quality display than 4K resolution. This is objectively sharper than what Meta offers at its lower price point. VisionPro is powered by Apple’s M2 chip for elite yet quiet performance and uses a brand-new Apple chip (called R1) to facilitate real-time sensor processing. This eliminates sound and display latency that has made motion sickness an issue for some users of Meta’s (three year-old) Quest 2 hardware. Wall Street Journal came out with a piece saying motion sickness is still an issue for Apple’s device, but this could potentially diminish that problem.

- All apps and software run on an operating system called VisionOS which Apple built as an extension of its current world-class operating systems for iPhone, Mac & more.

- Two interesting partnerships came from this launch. First, Disney’s Disney+ will be available on it immediately while Apple will work with Unity Software to integrate its apps as well.

- The device will be available early next year in the U.S. (late 2024 globally). It will start at $3,500 a pop vs. $500 for the new Quest 3 which will launch this year.

b) The XR Market & Meta Ripple Effects

Meta dominates the headset market today with Apple now set to enter. Meta’s Quest product sales have eclipsed 20 million units and it will soon debut a new Quest 3 version this year at an accessible price point with more powerful use cases. How will Meta fare vs. Apple? A few notes on this.

First, the XR market will not be winner-take-all. You can ask whoever you want… this is a widely-held opinion that we passionately agree with. The sector will likely be concentrated, but not to a monopolistic extreme. So? In a way, the billions of dollars in cash burn Meta has invested to get to this point has been validated by Apple following suit in the space. Apple’s investments serve as a stamp of approval for headset potential and will inevitably motivate a lot more developer time and attention to build apps for the budding sector. Some of those apps will be built on Meta to enrich its content ecosystem as well as Apple’s. At the very least, Apple sees this as meaningful enough to justify a hedge against XR replacing some of its hardware use cases in the long term.

Next, the XR market is still in the top of the first inning. To drive ubiquity, the hardware will likely need to look like a pair of sunglasses, not heavier goggles. That’s why Meta partnered with RayBan. Both companies are several iterations away from this technology becoming compelling to the masses and are several years away from needle-moving results. This is likely why Apple has supposedly cut its production target on VisionPro from a million to 150,000.

Many won’t be compelled by these new models (including us). While iterations continue to advance, Apple and Meta will both copy each other’s best features for their own systems. Apple has had the luxury of Quest’s tech being public knowledge to inspire its own creation for years. Now Meta (A master of copying successful features) will have that same opportunity. Whether one headset has a unique feature vs. another today is all but irrelevant. It’s about what each is building towards. And making this product comparison more irrelevant is the fact that VisionPro will START at 7x the cost of Meta’s new Quest 3. Meta could obviously add more sensors and more cameras into its Quest 3 headset if the revenue per sale was factors higher than what it will be -- see the unsuccessful Quest Pro for evidence. The approaches are simply different.

The edge that Apple will enjoy is its decades of experience in building world-famous hardware, elite operating systems and an extensive ecosystem of content partners and developers. Meta will need to continue working hard to win the time and attention of developers and will need to strike compelling partnerships of its own to motivate hardware sales. Paramount and a rumored collaboration with Roblox would be two important near-term relationships with many more needing to come (and they will).

c) Quest 3 vs. VisionPro -- Right Now, Who Cares?

In terms of product features, the hardware is somewhat similar. The contextual lens we think gives Apple the slight edge vs. Meta today which, again, it will be emulating. It’s hard, however, to see any other tools VisionPro offers that Quest 2 didn’t already have. Hand and eye tracking is not unique although some call Apple’s eye tracking tech more powerful than Meta’s older Quest 2 device. The lack of an external battery pack needing to be plugged into the device is a Quest strength which Apple will inevitably match over time. Apple’s chip is more powerful than Quest 2’s chipset. The Quest 3 will get a large upgrade via Qualcomm’s Snapdragon line but Apple’s chipset will still be a lot more powerful. For gaming, Meta has the clear edge with 500+ titles vs. Apple’s 100+ available on the arcade along with the aforementioned lack of cord. There was also nothing in the presentation about 3D-enabled gaming from Apple which is Quest’s most popular use case today.

Again, whoever finds success in this space will find it via what the products look like in several years… not what they look like today. We can argue and bicker for hours about Meta’s ability to find success in hardware, but whoever is right likely won’t become clear for some time. XR has a long, long way to go to being as popular as having a smartphone in our pockets.

“I’ve seen this before -- me during the entire keynote.” -- Former Senior Product Designer at Meta Jon Malkemus

“There’s nothing here that we haven’t seen. It’ll come down to execution and how it all comes together.” -- Lead Designer at Meta’s Reality Labs Jon Lax

The last point we want to make is perhaps the most important. The Metaverse is currently irrelevant to Meta’s results and will be for a while. The health of its apps and its ability to continue improving its AI-powered ad targeting will be the first, second and third most important piece of how well this investment thesis works for now. And if it becomes clear that Apple will win in this area, that simply will lead to Meta pulling back on investments and watching its margins explode higher as a result elsewhere. That’s a worst-case scenario we can easily accept.

d) How Does This Shake Out?

How will this market actually shake out? We can only speculate today. After speaking with several people more familiar with the technology, our favorite opinion came from the twitter account @SupBagholder. Bright guy. His view is that Meta will continue to pursue hardware commoditization. It’s doing the same thing with the open sourcing of its AI models and did the same thing with WhatsApp.

Meta will continue to flood the market with at cost (or even negative gross margin) hardware to drive adoption and accessibility on its journey to 1 billion devices sold. Doing so makes it inherently more difficult to compete with but also drives a compelling network effect which could establish a sustainable niche. That traffic will foster developer motivation to build and create content on Quest. Paramount among other key partners serve as a great jump start for populating compelling content, but independent developers will need to join as well. Traffic is that motivation and at-cost hardware lowers the barrier to building traffic scale.

In this increasingly likely Meta approach, the company will not worry about hardware being a source of EBIT. Instead, it will chase market share initially at all costs and later monetize with ads (like everywhere else) along with apps and app sale take rate. Winning a large piece of the hardware market will free it to most effectively extract value from higher margin aforementioned revenue streams.

Apple can’t really follow this play book and doesn’t appear to be doing so with its $3,500+ initial price point. The reason is that its hardware sales last quarter generated a robust 65% gross margin. Hardware is a large profit driver for this firm and racing to the bottom in terms of price per unit could damage the iconic reputation Apple has painstakingly built.

Apple also doesn’t need to sell at-cost hardware. Here I sit writing to you from my MacBook, with my AirPods in, my Apple Watch on my wrist and waiting for a message on my iPhone to tell me my food is here. Apple owns a massive chunk of the tech hardware ecosystem and has for a long time. With VisionPro integrating into the devices many of us live on, Apple can leverage that stickiness to fetch hefty premiums that Meta simply cannot justify. You can lose friends over sending a text with a green bubble vs. through iMessage. We’re kidding… sort of.

Finally, hardware is not purely incremental for Apple like it is Meta. There is a world where XR hardware advances to a point of demotivating smartphone demand. We are not remotely close to that point, but it’s a possibility. This would make Apple more reliant on a hardware-based EBIT driver vs. Meta where this endeavor is brand new for it and is purely incremental to its financials.

So, 2 different approaches: Apple is leveraging a controlled, interrelated ecosystem to command immediate high margin hardware sales. Meta’s long term strategy is selling at cost to gain market share and ubiquity for later monetization. Both can work.

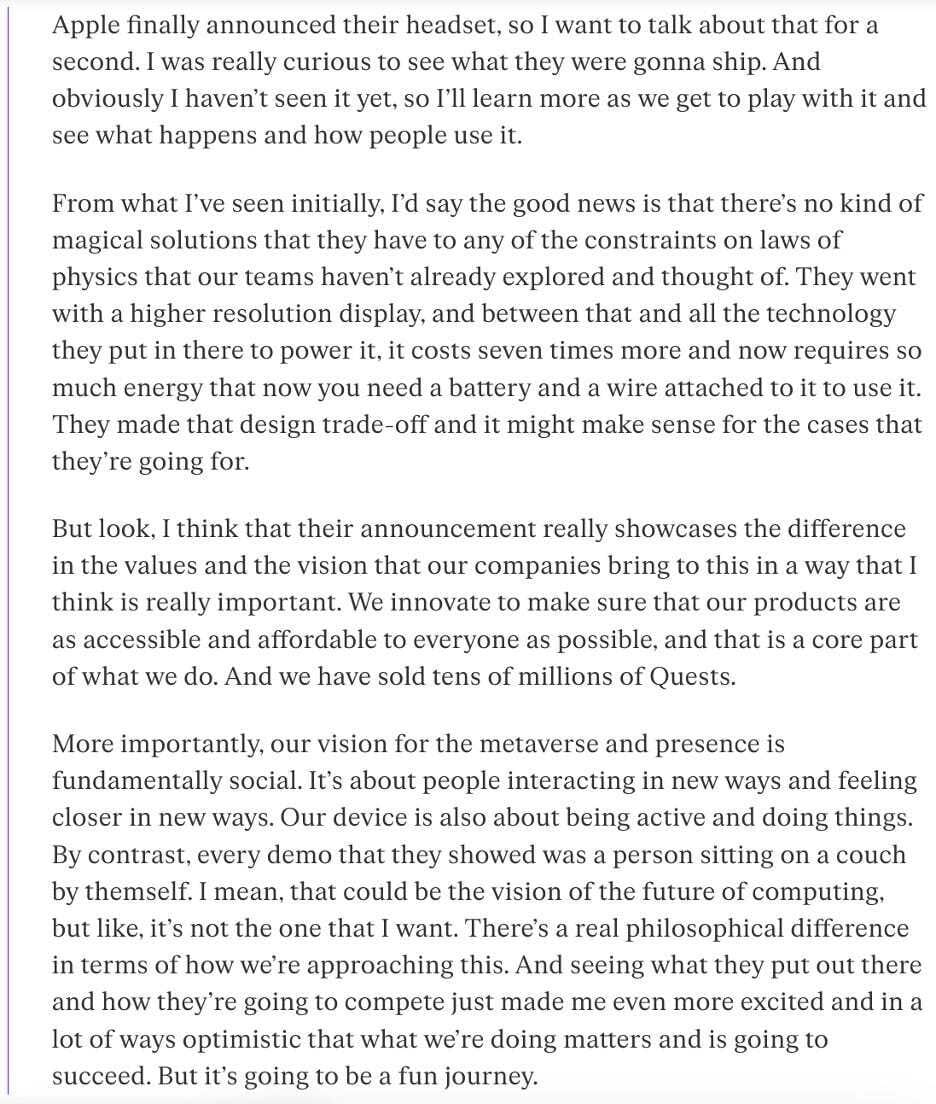

e) Zuck’s Point of View

Mark Zuckerberg’s comments on the device were leaked by The Verge. These comments mirrored our point of view. Here they are:

f) Other WWDC Announcements from Apple:

While XR was the main piece of this event, Apple also announced a slew of other upgrades to its products. Here were the highlights:

Hardware:

New MacBook 15 Inch Air with an M2 Chip making it 12x faster than any Intel-based product. Comes with 18 hour battery life. Its new MacBook Pro equipped with an M2 chip was also called out as 6x faster than any Intel-based product. There were several shots at Intel throughout the event. It also launched a new desktop product equipped with Apple Silicon’s chip IP.

Operating System (OS) Upgrades:

- New iOS 17 perks include transcribed voicemails, FaceTime voicemails and added text search filters.

- MacOS now allows you to remote start your car from your computer.

- New WatchOS with tools like mapping where on a hike you last had service and movement tracking within things like golf swings.

More Software Upgrades:

- AirDrop now supports contact and content sharing simply by putting an iPhone close to another.

- Health App is now available on iPadOS.

- Added a new game mode to prioritize performance and de-prioritize background apps not in use.

- New Safari profiles to separate work and personal search cookies.

- AirPods have a new adaptive audio mode which allows for easier toggling between noise cancellation mode and transparency mode (making it easier to hear surroundings).

- AirPlay will be live in certain hotel chains to allow casting of screens to hotel televisions.

g) More Meta News

- At an all hands-on deck meeting this week where Zuck expressed confidence in Quest’s positioning, executives reportedly celebrated the legacy Facebook app doing a better job attracting younger users in North America. That is fantastic news.

- Leadership discussed rapidly closing the TikTok vs. Reels time spent gap from 21% of TikTok to 50% of TikTok -- a massive increase in just a year. Again, this is far more important to the viability of this investment for the foreseeable future vs. Quest.

- Morgan Stanley came out with another note reiterating what we already know: Reels continues to rapidly grow adoption and engagement.

- The Twitter copy-cat app is coming soon.

- WhatsApp is launching channels to allow users to follow their favorite brands and people in a somewhat more social use case for the app. This will be separate from personal conversations to ensure proper privacy.

- Instagram and WhatsApp are both working on AI-powered chat and content bots. This will populate sites with more content to season its discovery and matching algorithms and so more precisely ensure users are shown what they want. It could also motivate more Meta verified demand (extremely high margin revenue) to stand out from AI. Meta verified launched in India this week.

2. SoFi Technologies (SOFI) -- CEO Anthony Noto Interviews with Piper Sandler

a) Piper Sandler Interview

This was a brief conversation without many new details shared. Here were the highlights:

On Guidance:

Noto remains “very confident” in the firm’s full year guidance and its path to positive GAAP net income “by” the fourth quarter. Over the longer term, nothing has changed about his view of long-term revenue compounding in the 25%-35% range. Importantly, he also reiterated that the technology segment will reach 15%-20% growth by Q4 while accelerating more thereafter. He’s fully confident in SoFi adding over $2 billion in deposits this quarter while maintaining that minimum rate of growth this year.

On Lending:

Noto told us that SoFi -- with Wyndham Capital purchased -- is now ready to “step on the gas” for its home loan marketing program. Rates aren’t conducive to marketing acceleration right now, but its product is ready to go with net promoter score (NPS) soaring for when that macro headwind abates. He also hinted at small business lending being a future product launch.

Noto is excited about student loan payments restarting. He sees a whopping $200 billion in outstanding federal loan originations at 6-7% coupons that SoFi can refinance at meaningfully lower rates. $1 billion in volume is safely worth about $40 million in high margin revenue for this dominant market participant.

He sees pent-up interest in tweaking loan duration as another source of demand as this resumes. In today’s high rate environment, SoFi can still collect immediate variable profit to self-fund the student loan product.

On the Balance Sheet:

Part of this interview was spent on SoFi’s balance sheet practices and loan accounting. The comments Noto gave were identical to his response 2 weeks ago which we’ve linked here. Its 18% leverage ratio leaves significant wiggle room (10.5% regulatory minimum) to continue collecting deposits and internally (& profitably) funding more originations. Its flexibility allows it to seek out the highest return on that asset which today is enjoyed via holding.