Table of Contents

- 1. Lululemon (LULU) – Earnings Review

- 2. Nike (NKE) – Earnings Review

- 3. Adobe (ADBE) – Earnings Review

- 4. The Trade Desk (TTD) – NBC & Disney

- 5. Disney (DIS) – Proxy Fight

- 6. Progyny (PGNY) – Investor Conference

- 7. Apple (AAPL) – Antitrust

- 8. SoFi (SOFI) – CEO Interview

- 9. Market Headlines

- 10. Fed Statement & Powell Presser

- 11. Portfolio

1. Lululemon (LULU) – Earnings Review

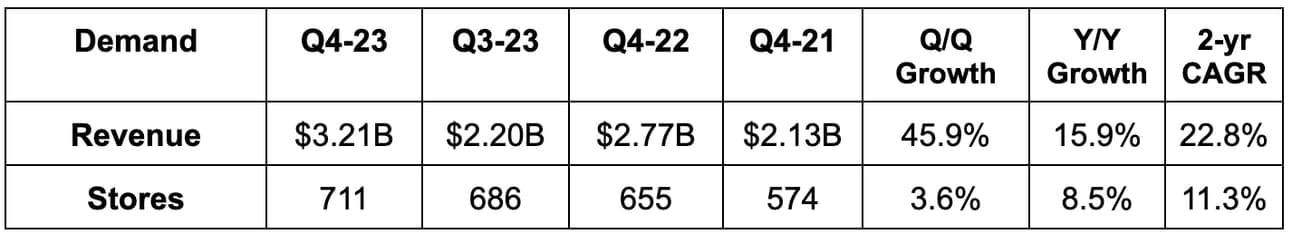

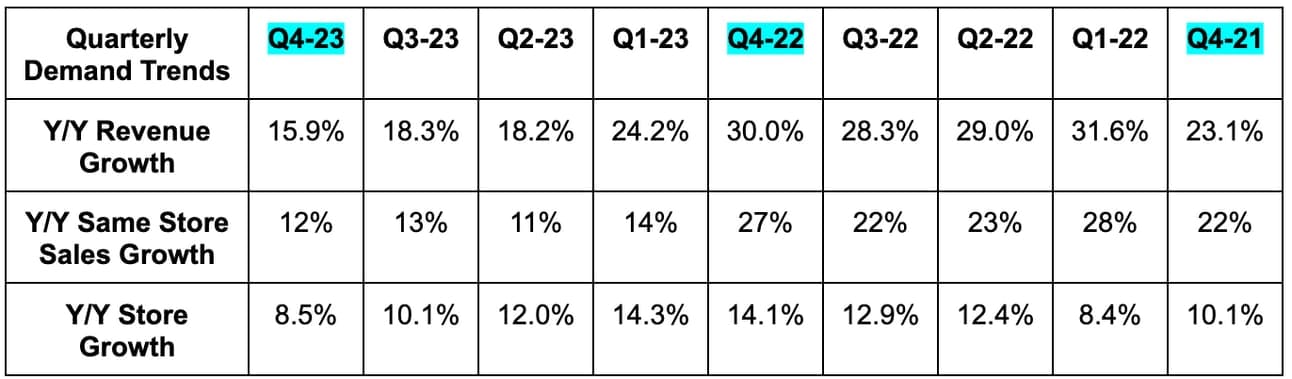

a. Demand

Lulu beat revenue estimates by 0.3% and beat revenue guidance by 1.6%. Its 22.8% 2-year revenue compounded annual growth rate (CAGR) compares to 23.2% Q/Q & 23.3% 2 quarters ago.

- Americas revenue was 81% of total vs. 86% Y/Y and rose 7% Y/Y.

- China Mainland revenue was 9% of total vs. 6% Y/Y and rose 56% Y/Y.

- Rest of World revenue was 9% of total vs. 8% Y/Y and rose 32% Y/Y.

For the full year, Women’s revenue grew by 13% Y/Y, men’s grew by 15% & accessories by 40%.

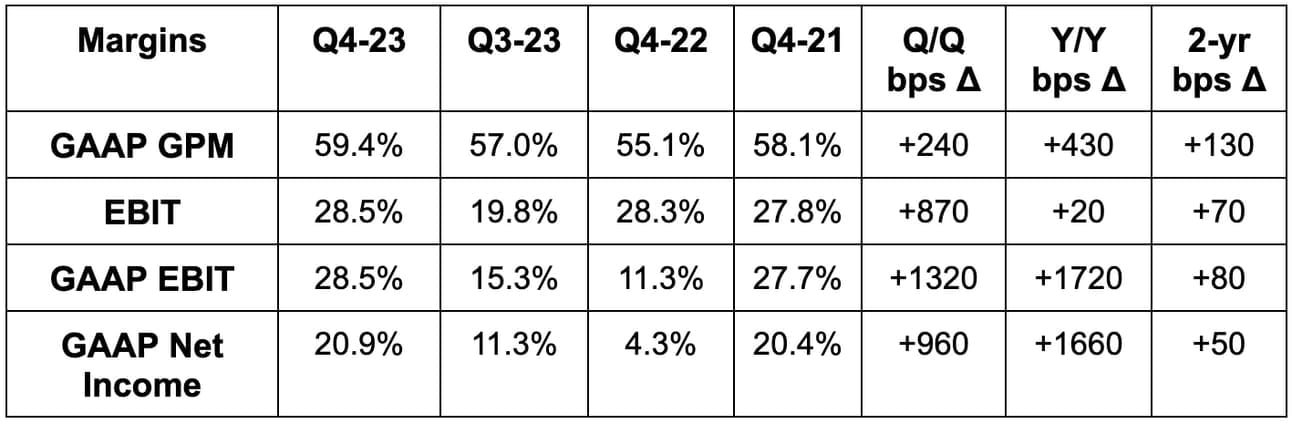

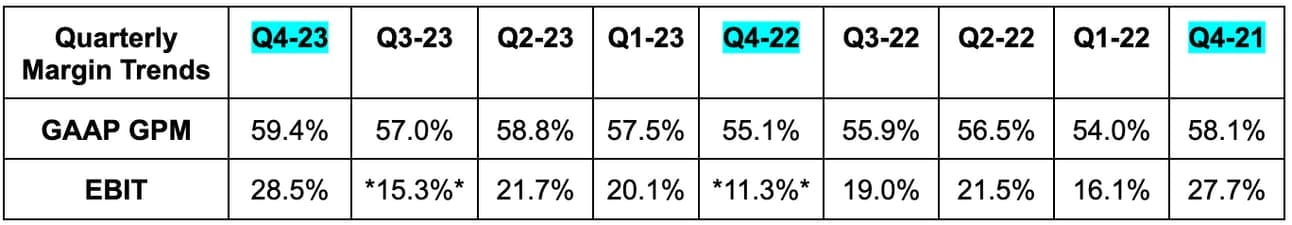

b. Profits

- Beat $5.02 GAAP earnings per share (EPS) estimates by $0.27 & beat guidance by $0.40.

- Beat GAAP gross profit margin (GPM) estimate by 70 basis points (bps; 1 bps = 0.01%).

- Beat GAAP earnings before interest & tax (EBIT) estimates by 2%.

- Operating margin rose 110 bps Y/Y in 2023; EPS rose by 27% Y/Y in 2023.

c. Balance Sheet

- $2.2 billion in cash & equivalents.

- Inventory fell 9% Y/Y.

- Share count fell 1% Y/Y.

- $400 million in available credit capacity.

d. Guidance & Valuation

Lulu’s annual revenue guidance missed by 1.7% while its $14.10 EPS guidance missed by $0.16 (or 1%). It reiterated its 2026 financial targets and even hinted at doing a bit better than them. The EPS guide excludes potential benefits of share repurchases, but that would likely only add a penny or two to the result. Other annual guidance notes include:

- Flat Y/Y gross margin.

- 10 bps of EBIT margin leverage. This implies a 23.3% margin vs. 23.1% expected for a moderate beat. EBIT margin will be down in Q1 due to brand marketing investments discussed in the next section.

- LULU will open 5-10 stores in the U.S. (15-20 optimizations too) and 35-40 elsewhere (mostly in China).

- Inventory levels will fall through the first half of the year and resume modest growth during the second half.

- Marketing will be closer to 5% of total sales vs. 4.5% in 2023.

Lululemon expects to be a 15% revenue compounder over the long haul. In 2023, overall revenue grew by 18.6% Y/Y. This will lead to tough comps that get progressively easier throughout the year. This will happen while the inventory missteps are quickly addressed, but it baked little U.S. traffic recovery into annual guidance as this happens. For these reasons, the team’s fantastic track record & overall language surrounding guidance, I expect consistent beats and raises throughout the year. I don’t think guidance was sandbagged quite as aggressively as for Snowflake or PayPal; I do think it involves some modest under-promising amid a fluid backdrop.

Lululemon trades for 28x 2024 earnings. Earnings are expected to grow by 11.5% Y/Y.

e. Call & Release Highlights

More on Slightly Weak Guidance:

Quarter-to-date weakness for Lulu has been exclusively felt in the USA. It has been broad-based across categories, genders and geographies. All international markets are showing strength, but the U.S. is seeing softening consumer behavior. Part of this weakness was related to leadership’s execution. It didn’t have the sizing or color assortments that its customers wanted in its stores, which hurt traffic and conversion rates. While this isn’t ideal, it’s already being addressed. Lulu has restocked accordingly and, again, expects U.S. traffic growth to slightly improve throughout the year as a result. It sees more fabric and product-level innovation driving this as well as early signs of strength for its spring gear. It continued to take more market share in the U.S. and fully expects that to continue in 2024. Share gains show this to be more macro-based than anything.

Lulu’s balance sheet, margins and brand opportunity will allow it “to keep playing offense” in the U.S. while others retreat. Brand awareness is still low across all markets and its outperformance vs. competition is firmly intact. Its stores are also among the most productive in the category. The company remains well ahead on its path to realizing 2026 financial targets, and the team “doesn’t see that changing.”

Membership Program:

Its Essentials Membership Program crossed 17 million members just one year into its launch. Spend and lifetime value objectives have been enjoyed as expected. As this grows, Lululemon will become an increasingly powerful and highly targeted marketing outlet to leverage. The marketing department did so this past holiday season, with exclusive promotions for members. That prompted 250,000 incremental downloads without a boost to marketing spend.

Footwear & Innovation:

Lulu hosted a footwear launch event in February to drive category momentum. It was “pleased with the initial reaction” overall, but especially pleased with its “cityverse” men’s casual shoe. The product is “exceeding expectations” and Lululemon is adding inventory to address the outperformance. The company also hosted its “Further Event,” which showcased 10 athletes setting new personal records for distance run (in their Lulu shoes).

- New men’s golf fabric coming this year along with more Soft Jersey styles and more. It has also struggled to keep Soft Jersey inventory fully stocked, but will address that issue in the coming weeks.

- Adding more fabrics to the men’s ABC Jogger franchise.

Reporting Changes:

Going forward, Lululemon will report revenue by geography, rather than by channel. It will split reporting segments into the Americas, China and Rest of World.

Margins:

Gross margin was greatly helped by ocean and air freight costs. Markdowns were flat Y/Y, fixed cost leverage was a bit better than expected and the foreign exchange (FX) impact was 10 bps better than expected too. SG&A was 30.9% of sales vs. 29% Y/Y as it got more aggressive with brand investments. More depreciation from 2022 and 2023 distribution center investments weighed on operating and net margins, while savings from winding down its Mirror projects helped.

f. Take

I found this quarter to be disappointing. Lululemon is a consistently stellar performer, but this was not stellar. To the team’s credit, it did tell us about U.S. weakness surfacing on last quarter’s call. Despite that, weakness has been more durable than analysts (and myself) expected as it leaks into the new fiscal year. I also didn’t like the inventory scarcity missteps, but do like that they were quickly addressed.

One quarter doesn't make or break an investment. Near-dramaless excellence has been a cliche for this firm long before I started covering it. That long track record of success pushes me to be more forgiving amid a moderately poor showing (v. expectations) like this was. I expect performance to improve in Q1 and throughout 2024 and I added to my stake after the report. Still, the multiple compression needed to justify me adding again have widened a bit following this blunder. That could easily revert if next quarter goes as I expect it to.

2. Nike (NKE) – Earnings Review

a. Results

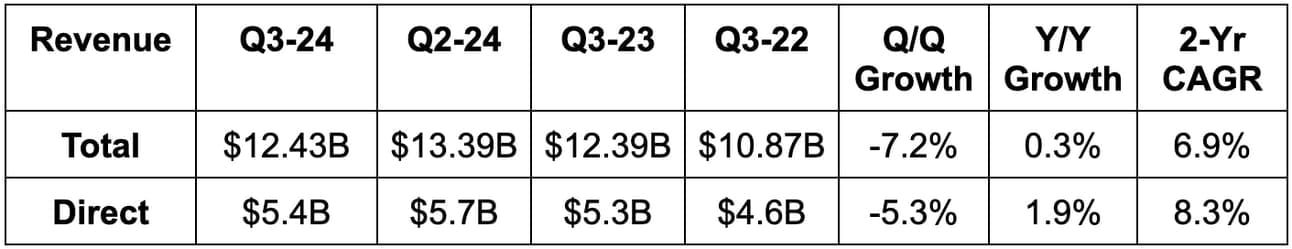

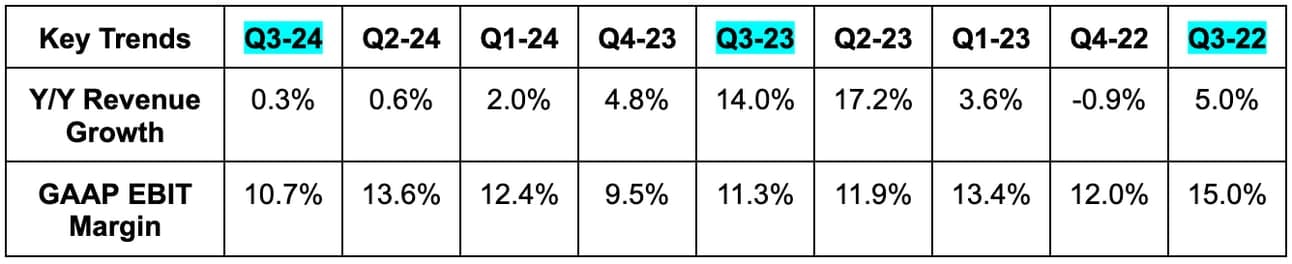

- Beat revenue estimate by 1.1% & beat its revenue guidance by about the same amount.

- Beat $0.71 GAAP EPS estimates by $0.06. GAAP EPS included $0.27 ($405 million) in restructuring charges for the quarter.

- Ex-restructuring, EPS rose 24% Y/Y.

- There will be restructuring charges in Q4, but a much smaller amount.

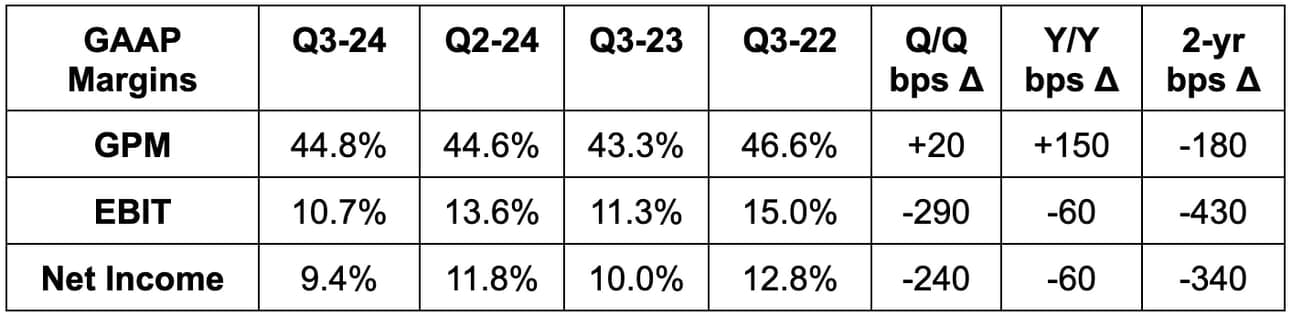

- Missed gross margin estimates by 30 basis points (bps; 1 bps = 0.01%) and its guidance by 20 bps.

- Strategic pricing and logistics disinflation powered gross margin expansion.

- Beat GAAP EBIT estimates by 2.3%.

- Sales, General & Administrative (SG&A) costs rose by 7% Y/Y with most of that driven by 10% growth in “demand creation expense.”

b. Balance Sheet

- $10.6 billion in cash & equivalents.

- $8.9 billion in total debt.

- Share count fell by 2% Y/Y. $10 billion left in buyback capacity.

- Dividends rose 6% Y/Y.

- Inventory fell by 13% Y/Y. Nike reached its lowest levels since 2020.

c. Guidance & Valuation

This year’s updated guidance:

- Reiterated 1% Y/Y revenue growth vs. 1.1% Y/Y growth expected.

- Reduced ex-restructuring SG&A spend from low Y/Y growth to no growth.

- Maintained GPM expansion guidance of 150 bps.

For next year, Nike expects revenue to grow and EBIT margin to expand. Both vague items are roughly as expected.

Nike trades for 24x next 12 month earnings. Earnings are expected to grow about 12% Y/Y during that period.

d. Call & Release Highlights

“We know Nike is not performing in line with our potential. It’s clear we need to make some important adjustments” – CEO John Donahoe

Making Adjustments – Product Newness & Innovation:

Earlier in the fiscal year, Nike made the decision to wind down supply of some legacy franchises and focus on innovation. For example, it cut older Pegasus shoe models to focus on upcoming launches. It accelerated its product roadmap by a full year and set out to vastly tighten and improve its brand storytelling, with an added emphasis on sports. The early reception has been positive to a point of “accelerating these actions” even further.

One key franchise focus will be Air. Nike will soon roll out a new air chamber to enhance the comfort and natural fit of the lineup and this tech will eventually be used across most Air models. Nike continues to see new Air launches work while these launches also improve demand for the rest of the existing product line. This $10+ billion franchise was a vital part of Nike’s past, and that will not change going forward. As evidence of shoe innovation working, most of its 20 top sellers are either relatively new or recently updated models.

Nike’s direct-to-consumer (DTC) business will be the main channel focus. It will still work closely with its wholesalers to refresh their inventory, elevate its brand presence, and grow its overall market.

“Our product portfolio will go through a period of transition over the coming quarters. But altogether, we are relentlessly focused on driving NIKE's next chapter of healthy and sustainable growth.” – CEO John Donahoe

Making Adjustments – Sharpen Organizational Focus:

Nike conducted a broad restructuring in June to reduce redundant costs and reallocate the savings back into its highest priorities. It also reshuffled its support and operational teams this quarter to streamline middle-management layers. Meta, Google and many other companies have done the same over the last couple years. It’s reducing the breadth of its brand story-telling and investing in only its highest impact marketing themes.

“Restructuring our organization to sharpen our focus, we believe, will fuel our next phase of growth.” – CEO John Donahoe

Geographic Performance:

Nike’s quarter was the polar opposite of Lululemon’s. Nike’s results for the quarter were strongest in North America, in line in China, and weak in Europe. It blamed Europe weakness on macro volatility and softening consumer demand. Lighter markdowns and a strong holiday season in North America drove the outperformance here.

- North American revenue rose 3% Y/Y with EBIT up 18% Y/Y.

- EMEA revenue fell 4% Y/Y with EBIT down 6% Y/Y.

- China revenue rose 6% Y/Y with EBIT up 3% Y/Y.