Table of Contents

- 1. Nu Holdings (NU) – Earnings Review

- 2. Uber (UBER) – Spring Product Event

- 3. Disney (DIS) – CEO Big Iger Interview

- 4. Netflix (NFLX), Magnite (MGNI), The Trade Desk …

- 5. Earnings Round-Up – Sea Limited (SE); Alibaba ( …

- 6. Progyny (PGNY) – Leadership Interview & My Chan …

- 7. Amazon (AMZN) – AWS Leadership

- 8. Starbucks (SBUX) – Rough Patch? Or Something Mo …

- 9. Duolingo (DUOL) – OpenAI

- 10. Lululemon (LULU) – M&A

- 11. CrowdStrike (CRWD) – Position Management

- 12. SoFi (SOFI) – Student Loans

- 13. Snowflake (SNOW) – Iceberg Tables & M&A

- 14. Market Headlines

- 15. Macro

- 16. Portfolio

1. Nu Holdings (NU) – Earnings Review

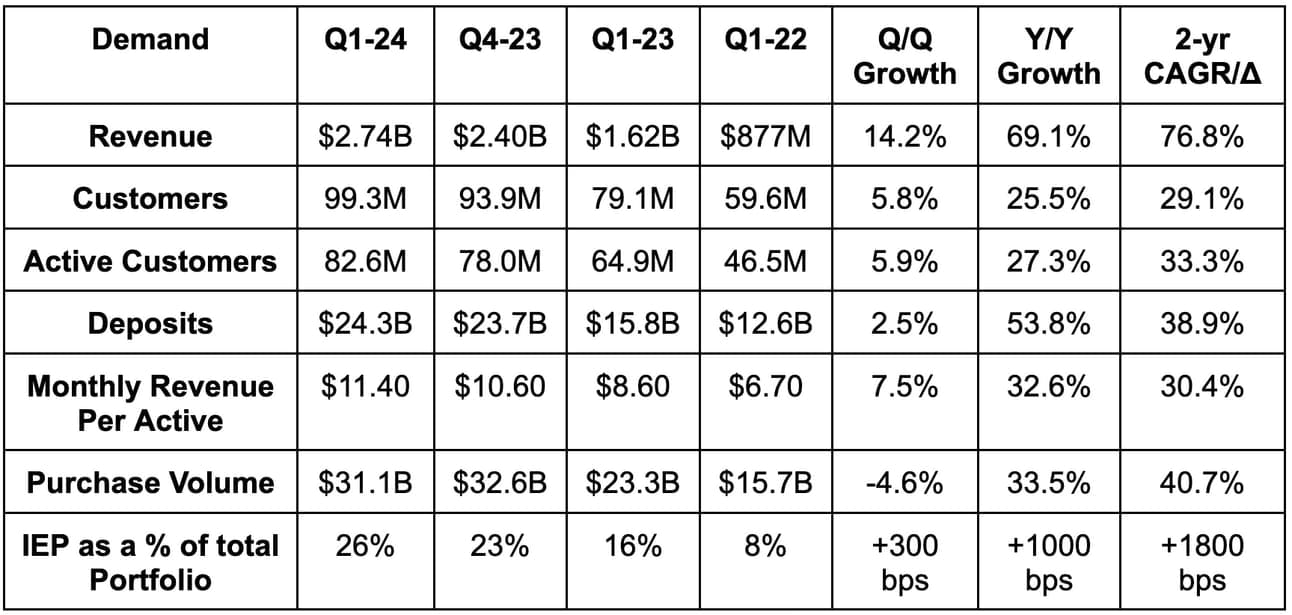

a. Demand

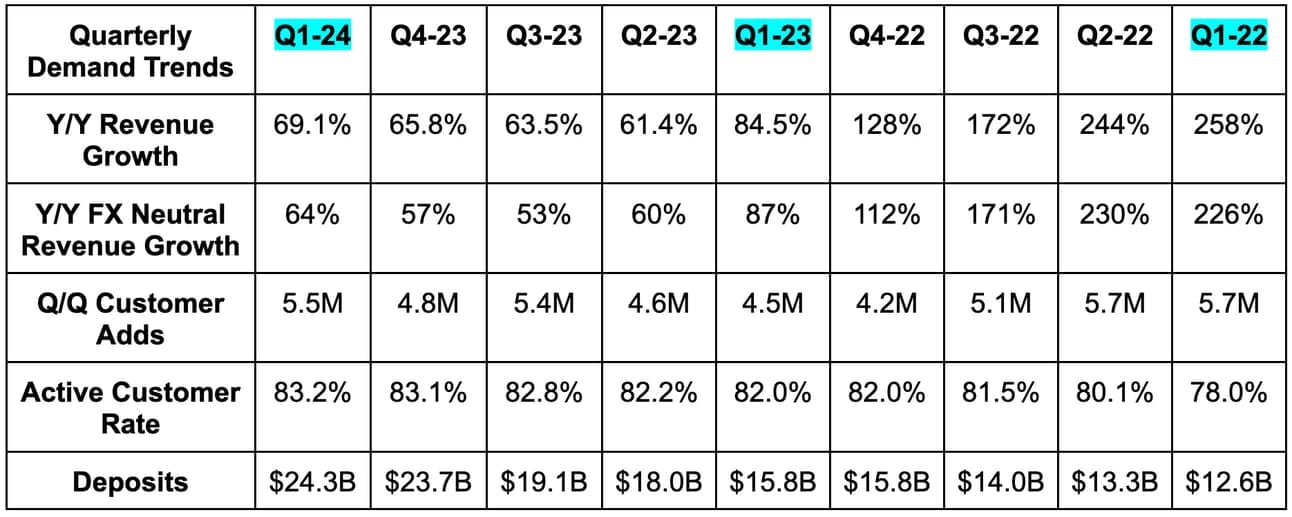

Nu beat revenue estimates by 8.3%. Revenue grew by 64% Y/Y on a foreign exchange neutral (FXN) basis. Its 77% 2-year revenue compounded annual growth rate (CAGR) compares to 94% Q/Q and 111% 2 quarters go.

- Interest income and gains/losses on financial instruments revenue rose 76% Y/Y FXN to $2.28 billion.

- Fee and commission revenue rose 22% Y/Y FXN to $456M.

- Purchase volume rose 30% Y/Y FXN.

- Deposits rose 53% Y/Y FXN.

- The interest earning portfolio (IEP) rose 86% Y/Y FXN.

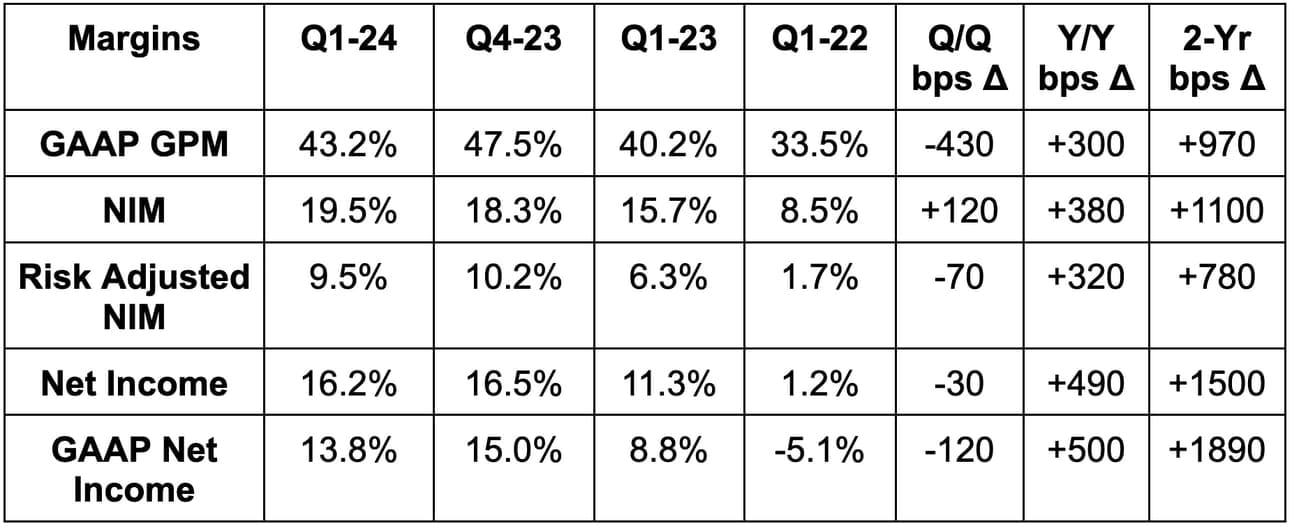

b. Profits, Margins & Credit Metrics

- Beat 42.6% GAAP gross profit margin (GPM) estimates by 60 basis points (bps; 1 basis point = 0.01%).

- Beat net income estimates by 13% & beat $0.08 EPS estimates by $0.01.

- Beat GAAP net income estimates by 5% & beat $0.07 GAAP EPS estimate by $0.01.

More cost notes:

- Cost of financial and transaction services was 57% of revenue vs. 60% Y/Y. Higher costs in dollar value terms were more than offset by higher revenue. Higher costs here are being driven by geographic expansion as well as intentional expansion to riskier credit cohorts. More later.

- Overall operating expenses (OpEx) were 22% of revenue vs. 25% Y/Y. Higher stock-based compensation ($128 million vs. $65 million Y/Y) and higher taxes from stock comp (due to its higher share price) diminished GAAP operating leverage this quarter. Nu remains one of the lowest dilution high-growth firms that I cover.

Nu’s annualized return on equity (ROE) now sits at 27%, which is already among best-in-class banks in Latin America. This is despite carrying $2.4 billion in excess capital within Nu Holdings and despite heavy up-front investments in Mexico and Colombia. ROE is already over 40% in Brazil, specifically.

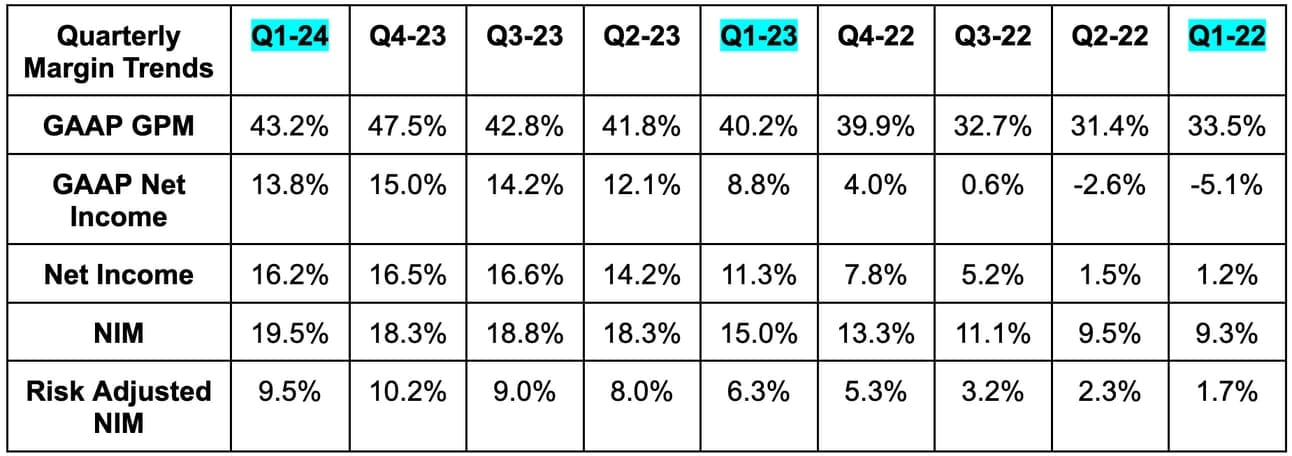

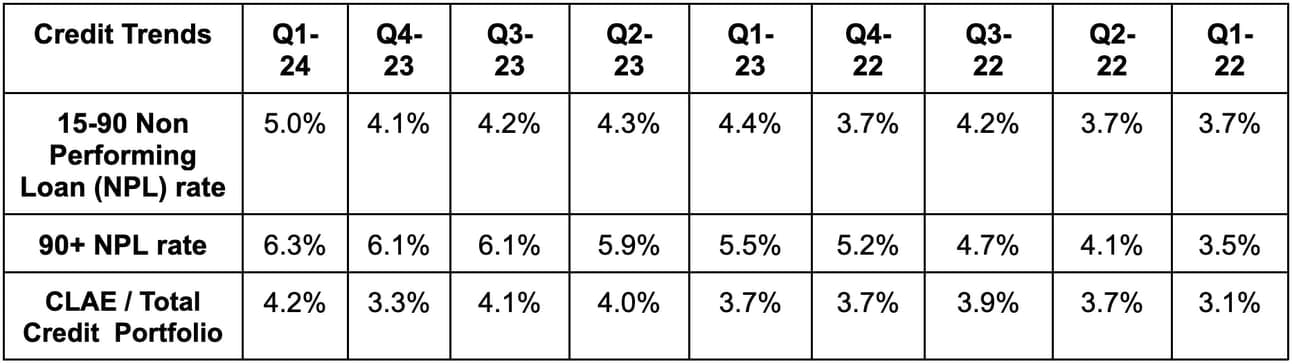

The rise in NPL and CLAE intensity was as expected. This is related to a few things. First, Nu is expanding to riskier credit buckets. Additionally, its credit portfolio’s mix shift from credit cards to unsecured personal lending is a headwind for NPL and CLAE. Personal loans are now 23% of the total credit portfolio vs. 15% Y/Y. Finally, Nu always sees a material step up in delinquencies and losses from Q4 to Q1 – just like the industry as a whole. Holiday and Carnival timing are likely contributing factors; considering this isn’t at all specific to Nu, it’s not concerning in my view. It continues to effectively underwrite and deliver delinquencies 10% better than average. I don’t care if NPL and CLAE are rising, IF that rise is more than offset by more revenue. Expanding gross margin, NIM and risk-adjusted NIM serve as direct evidence of that being the case.

These are the metrics to track most closely! Expansion means they are pricing risk effectively. Nu told us that this riskier credit cohort expansion is going “as well or slightly better” than expected.

- Credit provisions roughly doubled Y/Y due to rapid origination growth.

For NIM and risk-adjusted NIM, a bit of context on the Q/Q decline is needed. First, rapid Mexico deposit growth contributed, as the cost of deposits there is higher than in Brazil. Next, a federal collections program (that Nu took full advantage of) propped up net interest income by more than $60 million in Q4. Without this impact, risk-adjusted NIM would have been flat Q/Q. The company sees NIM and risk-adjusted NIM rising throughout the year. It doesn’t usually offer any guidance, but leadership did let this slip during the Q&A.

Also note that Brazil and Mexico are likely going to continue cutting rates throughout the year. It sees NIM and risk-adjusted NIM rising regardless of this. That’s related to the continued rise in loan-to-deposit ratio (LDR). These deposits, before being used to originate credit, earn federal bond-level yields. As LDR rises, net interest income (NII) soars without a similar boost to cost of capital. That means more margin; effective underwriting for broader credit cohorts allows that tailwind to be fully enjoyed. This is not just true for unsecured loans, but its budding secured lending franchise too. Shifting from bond yields to secured lending yields is positive for NIM. Rate cuts will also accelerate the velocity of money and support interchange revenue growth.

c. Balance Sheet

Nu Bank has $1.2 billion in excess cash on top of its $2.1 billion capital requirement. The cushion grew considerably Y/Y. Nu Holdings has another $2.4 billion in cash & equivalents that it can allocate to Nu Bank if need be. There is no need. The balance sheet is in great shape.

- $6 billion in cash & equivalents; $650 million in financial assets held at fair value.

- $1.4 billion in borrowings.

- Diluted share count rose 1.4% Y/Y.

d. Vague Guidance & Valuation

- Gross margin for the year should be flat vs. 2023. Brazilian gross margin gains will be offset by aggressive Mexico and Colombia investments, as well as expected Mexican deposit growth. Cost of these deposits is higher in Mexico than in Brazil.

- NIM to expand throughout the year.

Fun fact: Entering 2022, sell-side expected Nu to generate $6.7 billion in 2024 revenue. Today, that expectation is $11.2 billion.

Nu trades for 28x 2024 earnings (I think more like 25x). Earnings are expected to compound at a 2-year clip of 50% for the next two years.

e. Call, Letter & Presentation

Thriving:

Nu continues to fire on all cylinders. From a top-of-funnel perspective, it maintained a 1.3 million/month pace of customer adds in Brazil. Considering that 54% of Brazilians are already customers, that’s quite notable. It is somehow still delivering 22% Y/Y customer growth. Nu doesn’t really work very hard (i.e. spend much money) for these customers either. The “vast majority” are coming via referrals from happy customers. That’s the beauty of delighting users with better products: They’re motivated to spread the word. This also contributes to Nu’s sizable customer acquisition cost (CAC) advantage vs. the competition.

Even more encouragingly, it netted 1.5 million new customers in Mexico (+106% Y/Y), which is its first quarter with over 1 million adds there. This represents quite a sharp acceleration and shows that the Cuenta Nu high yield savings product is working like a charm there. Nu cannot grow customer count in Brazil forever and Mexico (and Colombia) represent/s a wonderful lever to raise its addressable market size. It now has 900,000 customers in Colombia as it gears up for aggressive expansion in its third market. As an aside, management continues to hint at these three nations simply being the first stage:

“We’re still only operating in 3 countries in Latin America.” – CEO David Velez

Customer growth is wonderful… but more customers with improving levels of engagement is even better. Nu is delivering exactly that. Recent cohorts continue to utilize more products vs. older cohorts (4.1 vs. 4.0 Q/Q) and continue to deliver higher and higher monthly revenue per active account (ARPAC). 59% of Nu customers now use the company for their Primary Bank Account (PBA) vs. 57% Y/Y. This upward trend directly nurtures the positive engagement themes that I just spelled out. PBAs use more products and generate more revenue for Nu.

- For core products, credit cards rose 19% Y/Y to 41.2 million, active NuAccounts (primary bank accounts) rose 31% Y/Y to 73 million and unsecured personal loans rose 30% Y/Y to 7.9 million.

- For non-core products, investment accounts rose 85% Y/Y to 17 million, insurance policies rose 60% Y/Y to 1.6 million and small and medium enterprise (SME) accounts rose 50% Y/Y to 2.4 million. That last metric was my favorite. More later.

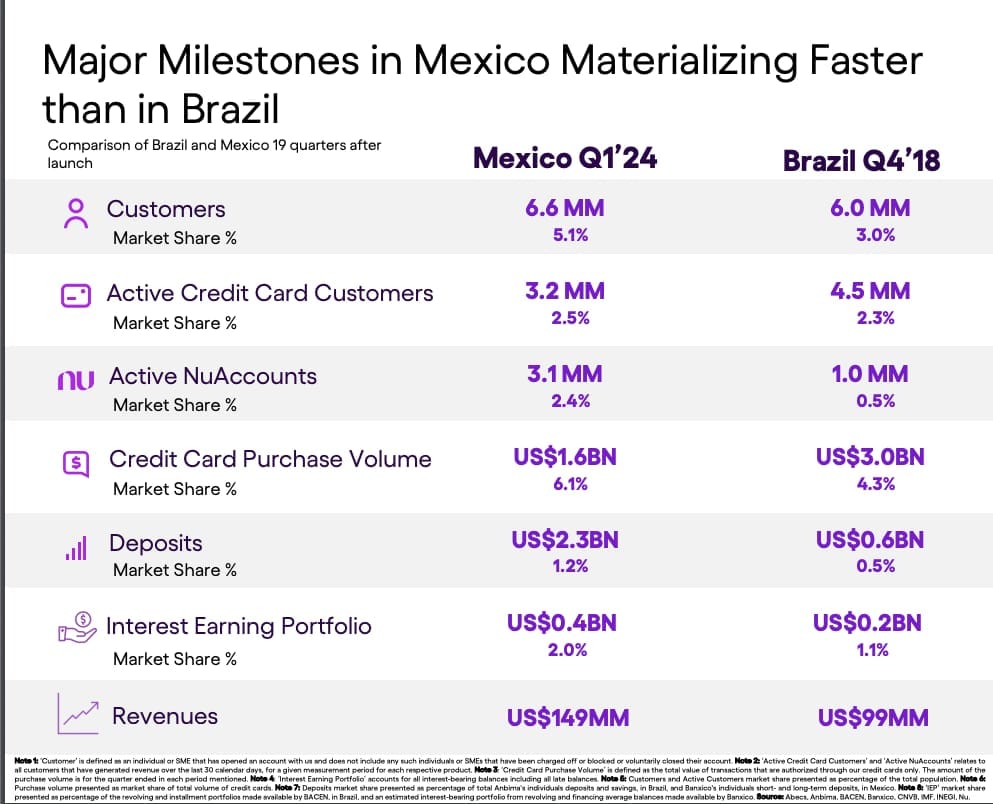

Mexico Progress Report – Nu offered a compelling graphic depicting how the Mexico launch is going after 19 quarters compared to its Brazilian progress after 19 quarters:

It’s worth noting that Nu has a stronger balance sheet, higher built-in brand awareness and sharper operating procedures today than it did 6 years ago. It makes perfect sense that things are off to a faster start thus far in Mexico. There was no guarantee that Mexico would embrace this company like Brazil has. It is.

- Nu has collected as many Mexican deposits in 4 quarters as it did in its first 19 quarters in Brazil.

- Nu believes it is now outpacing all 3 top Mexican incumbent banks in terms of new card issuance.

“Nu has been solidified as the unrivaled leader for digital banking in Mexico… We're thrilled with our performance in the early months of 2024 and are well positioned to achieve the goals we have set for ourselves for the year.” – CEO David Velez

Standing Out in Banking:

The way to win in banking and any other commodity is by finding edges within a cost structure. Nu does stand out with its slick interface and usage convenience, but cost is still the sharpest differentiator in this sector. It always will be. Its CAC is $7 vs. $6.50 Y/Y as it leans into newer markets. That’s lower than its competition. Its cost to serve remains at $0.90 per month or $2.70 per quarter, which is about 85% better than a typical bank. This is largely thanks to Nu’s branch-less business model and digitally-native operations. Its goal is to stay under $1 per month or $3 per quarter. This means a brand new customer costs Nu $9.70 during the first quarter. Considering monthly ARPAC now sits at $11.40, customers are immediately profitable for Nu. The runway for growth here is also massive, considering its most mature cohort boasts a $27 ARPAC (and quickly rising).

Its cost of risk is also 10% lower than the Brazilian average (as apples-to-apples delinquencies continue to outperform) and its cost of funding is 16% cheaper. Both of these figures worsened Y/Y due to the Mexico expansion, but remain key tools for allowing Nu to stand out from the pack.

This is how you win in banking. This is how Nu is winning in banking.

Balance Sheet Optimization & More Gross Margin Color:

The shift to installment-style credit and its overall “interest-earning portfolio” (IEP) remain in full swing. IEP overall is now 26% of its credit portfolio vs. 23% Q/Q and 16% Y/Y. PIX and Boleta financing are the standouts here. PIX is basically a nationalized Venmo in Brazil where Nu customers can use credit card limits to make transactions; Boleta uses a credit card to pay bills in installments. They both feature attractive levels of monetization for Nu and they are both products it can offer with more convenience vs. legacy banks. LDR sits at 40% vs. 34% Y/Y. Most incumbent banks sport LDRs of 100%-110%. Nu doesn't expect to push the envelope that far, but does see significant LDR upside from here.

Deposit growth this quarter needs a bit more context. Seasonality drove Q/Q declines in industry deposit levels in Brazil, which Nu is not immune to. This always happens there (aside from the pandemic-era). Importantly, deposit seasonality, paired with purchase volume seasonality, is why gross margin declined from Q4 to Q1 (we were told it would last quarter). Comparatively speaking, Nu’s sequential declines in debit and credit card volumes comfortably surpassed industry averages.

Rapid Mexican deposit growth helped buffer the inevitable deposit seasonality for the quarter. Since launching its high yield savings product broadly in Mexico, Nu has gone from $200 million in Q3 2023 deposits, to $1.0 billion last quarter and to $2.3 billion this quarter. Again, this market is becoming another promising opportunity for raising deposit levels to cheaply fund more loans. And with Nu’s capital adequacy ratio (CAR) in such excellent shape, it can easily use this liability growth to comfortably use this source of liquidity for originations. As we’ve already covered, that boosts NIM.

It’s worth noting that this balance sheet optimization is juicing net interest income and overall revenue growth for now. When that ends (and there’s still a long way to go), revenue will more closely track customer and product growth. This is why Nu will likely slow to 20%-30% annual growth in the coming years. That is the sell-side expectation and is intuitive to me. Still, that will not happen in the immediate future and 20%+ revenue compounding at the scale it will likely be at in a few years is very impressive.

- Total card and lending receivables rose 53% Y/Y (52% FXN) to $19.6 billion.

- Personal loan volume rose 88% Y/Y FXN to $4.5 billion.

- Credit card receivables rose 42% Y/Y to $15.1 billion. It continues to win a larger portion of its addressable market and win more wallet share of existing customers.

- The IEP portion of its credit portfolio rose 86% Y/Y to $9.7 billion.

Secured Lending Portion of Personal Loans:

Just last year, Nu didn’t do much secured lending at all. It has since debuted several products (deep dive will explore in detail), which seem to be off to a great start. This quarter, secured originations were 13.8% of total vs. 10% Q/Q and 0% Y/Y. This is important for two reasons. First, a broader credit offering caters to broader use cases and should be good for overall demand. Secondly, secured lending comes with significantly lower loss rates vs. unsecured. The actual benefit to NIM is far less pronounced, considering interest rates are lower when there’s an asset to secure or guarantee compensation. Still, lower NPL rates are always a positive for investor and capital market sentiment, and this will help there. Interestingly, the growth bottleneck for secured lending is simply putting the contracts and partnerships in place to drive adoption. It’s not credit risk appetite like on the unsecured side.

Building the partner network was not difficult, considering Nu can promote 30%-40% lower interest payments for consumers. The foundation has now been laid; Nu expects an upward rise in secured as a % of total personal originations to endure.

For now, Nu’s secured portfolio serves 50% of the Brazilian population, including pensioners and federal employees. It expects to push this to 75% by the end of 2024 with the introduction of products for armed forces members.

Building the Two-Sided Network:

Nu is quietly hard at work on building a two-sided, merchant and consumer network. That, like for PayPal and Shopify, creates abundant opportunities in commerce, marketing and unique subscription value within Ultravioleta. Amazingly, more than half of the small business owners in Brazil are Nu customers today. With only a few million SME accounts so far, it has a massive opportunity to expand right from within its existing base.

Today, the value proposition is called “basic” by leadership. It has a bank account, a debit card and a credit card. Working capital loans are just now being launched, with more lending products planned in the future. It sees businesses as even more poorly served than consumers in Brazil. This is a large opportunity, and it’s still in the very early innings. I guess that’s true for everything at Nu. Even its most mature Brazilian consumer lending products still boast just 8% market share. That’s despite Nu’s customer base representing 46% of all Brazilian loan originations.

f. Take

Flawless quarter for what has become a very special company. I love this name as a smaller core holding in the portfolio. There is still geopolitical risk, currency risk, credit risk and overall execution risk. But? For nearly a decade, Nu has faced all that risk with admirable success. That simply continued this quarter. What a team; what a report; what a company. Fantastic.

2. Uber (UBER) – Spring Product Event

a. Spring Product Event

Uber announced a slew of products and partnerships at its spring Go-GET event. The show stopper was the new UberEats partnership with Costco. Like Domino’s, these types of deals enhance the breadth of the Eats offering and should be material for overall volumes. Interestingly, like on Costco.com, non-members can also order through UberEats. Costco members can plug their information in to receive discounts.

For increasingly price-sensitive consumers, Uber is debuting a shuttle reserve product. It will partner with local fleets to allow people to more affordably book transportation from concerts, sporting events, conferences, airports etc. Riders can book up to a week in advance and get a seamless QR code ticket to redeem upon arrival. Shuttle location is also trackable and this product is much cheaper than its core UberX offering. Along these same lines, Uber is rolling out student discounts for Uber One. It will cost these students $4.99 per month vs. $9.99 for non-students. Apple Music executed this playbook perfectly to get young consumers into their ecosystem with less friction. It then upsold these consumers after they graduated and likely had more disposable income to pay a higher bill. That’s the parallel in my view.

For back-to-work, Uber is adding UberX Share. This allows users to reserve shared-ride spots in high density cities like New York and LA. A key priority for Uber in the coming years is to become more of a daily use case. That will be executed through things like grocery and retail delivery expansion, but also through initiatives like this one. It’s clear to me how this could become popular as back-to-work returns to style. Sort of an adult version of riding a school bus to class. Finally, Uber announced Uber Caregiver. This gives these caregivers more autonomy in booking appointments and scheduling deliveries for their patients.

There’s a key theme throughout all of this news: Broadening the depth and breadth of its product offering. That is how it stands out from the pack. It’s how it enjoys superior cross-selling levels and a coincidingly superior margin profile. It’s how it motivates stronger retention than its peers. It’s how it gives drivers higher occupancy rates, more earnings and more success. It’s how it turns those happier drivers into shorter wait times and lower surcharge rates for riders. This. Helps. Everywhere. It spins all of the positive flywheels that have made Uber so historically successful to date. This is more of the same. Whatever Uber can do to turn its massive network into another use case simply nurtures this compelling differentiation.

b. M&A

Uber is buying Foodpanda’s Taiwan operations to strengthen its market share in that nation. Foodpanda was its fiercest competition, and now they’re an asset. Uber is paying $950 million in cash. One of the many reasons why I love Uber’s free cash flow (FCF) trends. It gives them significant flexibility to do things like this, while investing in the core business, buying back shares and growing its liquidity position. Foodpanda will be merged into Uber Eats when/if this closes next year. Foodpanda’s merchant roster is arguably better than Uber in that nation.

“In order to build a world-leading service, we have come to the conclusion that we need to focus our resources on other parts of our global footprint, where we feel we can have the largest impact for customers, vendors and riders.” – Delivery Hero Co-Founder/CEO – “Niklas Östberg

Uber will also invest $300 million in Delivery Hero (Foodpanda owner) as part of this news. Delivery Hero is quite large, and this investment represents less than 5% of its overall equity.

3. Disney (DIS) – CEO Big Iger Interview

Turning the Tide & Fixing Mistakes:

Iger was asked what went wrong under Chapek’s tenure that he has had to fix. Some will argue that Iger planted the seeds for this failure and that it’s partially his fault. I think that’s a fair statement, but there were undeniably organizational pivots made under Chapek that cost this company dearly.

The best example was his decision to separate monetization and content creation teams. Iger told investors this decision created a toxic “us vs. them” mentality. It led to bloated budgets with no accountability, worsening sense of how to best distribute titles and a film division that had a very ugly 2020-2023. These teams have since been re-linked, and, if the successful Planet of the Apes sequel is any indication, things are beginning to turn around.

A second example discussed was its over-aggression with Disney+ upon its launch. It tried to “tell too many stories” and focused too little on content quality… you know… the thing that has made this company so successful for 100+ years. That has since changed with Disney cutting low-quality projects on both the film and television sides. The damage, however, had been done in terms of explosive losses mounting for this segment. Encouragingly, it has rapidly addressed this cash incinerator and (as previously discussed) streaming will turn EBIT positive this year. Disney sees it eventually reaching a 10%+ EBIT margin to help address the current linear TV decay.

Streaming Priorities:

Engagement for streaming is priority one. Its Disney+ and Hulu bundle is delivering strong engagement and retention benefits, although Iger wouldn’t quantify the uplifts. It will add an “ESPN lite” tile to Disney+ for another bundling option later this year, as well as sports content from Warner Brothers and others to that digital offering. This will launch in the fall under the name “Venue Sports.” I think it’s a mistake that the name is not some variation of ESPN, but it’s not up to me. A larger library with more compelling titles for a broader array of interests is the main piece of optimizing engagement… but not the only piece. Finally, it plans to trim some marketing spend to juice margins here too.

“We are not going to chase subscribers by discounting too much on price.” – CEO Bob Iger

Disney needs to improve its technological foundation for streaming. The firm understandably rushed the Disney+ launch during the free money era when growth at all costs was rewarded. It only had the bandwidth to make sure the interface was usable and the video streaming reliable. No other systems were in place as Disney sprinted before it knew how to walk.