1. Nanox (NNOX) — Earnings Review

A. Business updates

This company is pre-revenue and pre-commercialization. At the company’s current quarterly burn rate, it has roughly 3.5 years of cash on hand.

On the SEC:

Nanox received a subpoena from the SEC to turn over documents relating to its Nanox.ARC machine and its costs. The company is in full cooperation and I do not expect this to be an issue going forward but this has led to an incremental $600,000 in costs for the company. Investigations into young companies with no revenue, bold claims and a stock 80% off all-time highs are somewhat common. It’s not good, but it’s a yellow flag to me and not red.

On the Korea factory:

Production in its Korea chip factory is still “highly likely” on pace for broad production in the 2nd quarter of next year. We shall see.

On multi-source resubmission:

“We’re still in the process of responding to the FDA after receiving their comments [the deficiency letter] on the first multi-source submission. We are planning a second submission in the near term that will cover the next version of the multi-source Nanox.Arc. We believe that the feedback we received from our first submission will inform any subsequent submission.” — Outgoing CEO Ran Poliakine

As a reminder, the company has been telling us to expect a re-submission of the multi-source (multiple x-ray tubes) machine by the end of this year. It expects to submit it within the 180 day window and has 7 weeks left to do so. It still plans to produce 1,000 units in 2022 and the company continues to gain “more and more traction” for new Arc deployment contracts.

After/if its multi-source application gets clearance, Nanox plans to submit more 510Ks to the FDA to clear additional Nanox.Arc use cases.

B. My take

Nanox remains my smallest and most speculative investment. If it can move from development stage to commercial distribution, the upside here will be immense. The value proposition of a $150 X-ray tube writes itself and then some. Still, there is absolutely no guarantee that it will be able to execute and operational blunders in the past do cast doubt. I paused adding two quarters ago in light of the production delay and that pause will continue — but I have 0 interest in selling any shares. This will be a binary outcome: either a historic winner or a giant loser. Time will tell.

Click here for my broad overview of Nanox’s business.

2. Ozon Holdings (OZON) — Earnings Review

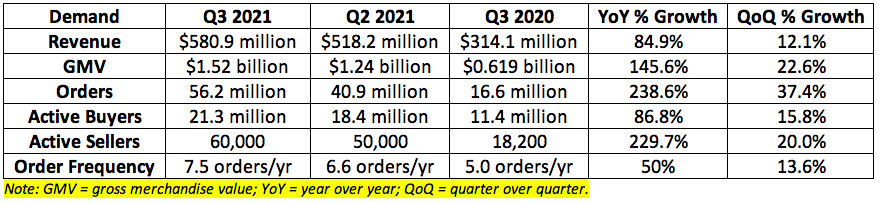

A. Demand

I used an exchange are of 1 Russian Ruble = $0.014 dollars for all Revenue and GMV numbers.

Ozon was expected to generate $579.1 million in revenue. Results were roughly in line but — based on what exchange rate we use — could be reported as a beat or miss.

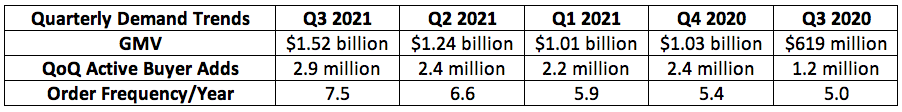

Ozon benefitted from renewed pandemic outbreaks in Russia during the quarter. Partially as a result of this (and due to strong execution as well), every single key demand growth metric for Ozon meaningfully accelerated vs. Q2 2021 and Q3 2020. Its NPS scores “improved” during the quarter despite spiking volumes. Advertising revenue growth of 150% YoY (more than half of Ozon’s sellers now use its advertising tools) and 165% marketplace commission growth were the two primary contributors to the success.

This was the highest active user growth rate that the company has posted over the last 7 quarters (comparing to other periods of severe pandemic pain) and the 7th consecutive quarter of total order growth over 100%.

Ozon now has 60,000 active sellers vs. just 20,000 at the beginning of 2021. Demand for Ozon’s analytics tools, advertising products and now financial tools is all supercharging this growth.

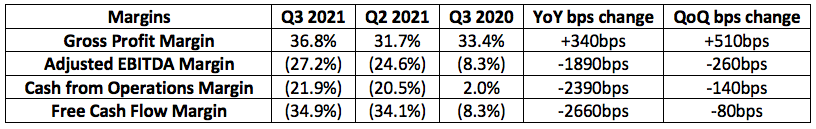

B. Profitability

Ozon lost $158 million in EBITDA during the quarter. It was expected to lose $141.5 million meaning it missed expectations by 11.6%. This is again greatly impacted by the exchange rate I selected and could have been reported as a beat.

Note that Ozon reports margin lines as a % of GMV and not revenue. I calculate its margin lines as a % of revenue which makes gross profit margin look better and the rest look worse.

Excluding a one-time charge related to the change in inventory valuation estimates, gross profit margin for the quarter was 38.1%. Gross margin is expected to further improve in 2022. Gross margin improvements this quarter were attributed to “optimizing investments to achieve greater efficiency” plus a 16.1% lower operating cost per order per CFO Igor Gerasimov and was “despite a temporary surge in cost pressure from the 150% warehouse capacity growth and last mile infrastructure added during the quarter.” The company continues to get more out of the fixed cost portion of its asset base as volumes accelerate.

Worsening margins (aside from GPM) are due to fulfillment and delivery expenses rising to 18.6% of GMV vs. 4.2% year over year as Ozon scales its courier business. Sales and marketing expenses also rose from 1.9% of GMV to 6.5% YoY with technology expenses rising from 0.8% of GMV to 3.7% YoY. Furthermore, adjusted EBITDA was negatively impacted by a one-off expenditure on an R&D project and an adjustment to its inventory valuation allowance estimate. Without these charges, adjusted EBITDA margin would have been (25.1%).

The company has roughly $1.72 billion in cash on hand.

C. Outlook

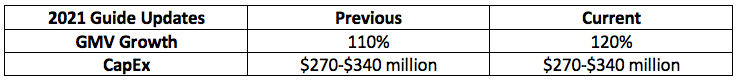

Ozon has now raised its GMV growth rate by 10% in each quarter this year — from 90% growth at the start of the year to 120% today. Its capital expenditure (CapEx) guide has not budged during that time. The company continues to find operating leverage in the business model.

D. Business updates

On a dive into the creator economy:

Ozon launched a self-employed entrepreneurs product starting in October to sell unique, handmade goods. Sounds like Etsy in Russia.

On growth & success:

- Russian e-commerce remains just 10% of commerce in Russia compared to 21% in the United States and 27% in China.

- Russia has internet penetration rates similar to these countries and so its own e-commerce penetration rate is expected to reach 21% by 2025.

- Customers placing at least 1 order per week rose from 500,000 to 2 million year over year.

- The company now offers 46 million stock keeping units (SKUs) vs. 9 million year over year and 27 million sequentially.

- 3,000 cross-border sellers from 26 countries across Asia and Europe are using Ozon’s platform.

- Ozon doubled its pick up locations and quadrupled its sorting capacity YoY.

- Ozon maintained its 98% on time delivery rate in the quarter — this is stable sequentially and up vs. 95% at the time of its IPO last year.

- The company continues to open more dark stores throughout Russia with its dark store count doubling QoQ.

- Ozon’s growth continues to outpace all competitors in the region.

- Ozon’s newest customers continue to have the highest order frequencies.

- Ozon grew its top of mind brand awareness leads over competition during the quarter. That trend is shown below:

On newer verticals:

Ozon re-branded Oney Bank to Ozon Bank during the quarter. This segment will mostly focus on “providing infrastructure and payment solutions deeply integrated with the core e-commerce platform.”

Ozon card issuances rose to 1.6 million which is up 60% sequentially. These holders continue to order 60% more frequently than non-holders. Ozon also integrated its loyalty points offering to deepen the utility of the card — results so far have been “promising.” Ozon’s financial products now make up nearly 15% of total GMV.

5 thousand sellers now use Ozon’s “Flexible Payment Plan” — up 109% sequentially. This is a payment scheduling product to boost liquidity and lower net working capital needs for sellers.

Ozon Credit is now issuing loans to Ozon sellers. According to the company, this product relies on 40 variables and its machine learning algorithm to foster more accurate quantification of risk. It also debuted a buy now pay later feature this year.

Ozon Express — its one-hour delivery service for over 20,000 SKUs — expanded outside of Moscow and St. Petersburg following successful debuts. Ozon express has even created a private label brand for goods like coffee and food. Daily orders for Express have doubled sequentially.

Ozon debuted an ad-tech business during the quarter to better monetize all of the impressions on its platform. It also launched a streaming service to grow its social commerce business.

On international expansion:

Sales in Belarus (9.4 million population) have 10Xed since the beginning of the year. Ozon launched a sorting center and branded pick-up points there during the quarter.

The company opened sorting centers in Kazakhstan (19 million population) during the quarter. Kazakhstan is expected to enjoy 41% e-commerce growth through 2025.

E. My take

This was another remarkably positive quarter for Ozon. Gross margin continues to expand and the GMV growth outlook continues to be raised quarter after quarter. This company remains in aggressive spending mode to capture all of the low hanging fruit in Russian e-commerce. So far, so very good. A lot of companies say they’re the “Amazon” of another geography — Ozon’s success, rapid product expansion and aggressive spending actually provides some evidence of this being the case.

Click here for my broad overview of Ozon’s business.

3. Tattooed Chef (TTCF) — Earnings Review

A. Demand

Tattooed Chef was expected to post $64 million in sales for the quarter. It posted $58.8 million missing expectations by 8.1%.

The miss in revenue was attributed to timing the rollouts of distribution contracts.

The sequential decline in branded sales as a percentage of total sales was entirely due to the foods of New Mexico Purchase which is currently producing solely private label products. It will begin producing Tattooed Chef-branded products next year. The company still sees branded sales as a % of total sales reaching 80%+ in the coming quarters — branded sales are higher margin.

B. Margins

Tattooed Chef was expected to lose $5 million in adjusted EBITDA for the quarter. Its results were in line. It was also expected to lose $0.05 per share but lost $0.10 per share missing expectations by $0.05.

Q2 2021 net income margin was impacted by a one-time $6 million charge relating to a change in valuation allowance for a deferred tax asset. I adjusted for this to make the sequential comparison more applicable. Q2 2021 net income margin was actually (105.1%).

The decline in gross margin both sequentially and annually was attributed to the same supply chain and raw material/freight/container input cost inflation hitting most in the space at this point in time. I have a close contact in food manufacturing (with very overlapping supply chains) who I reached out to. I was able to confirm that this was truly the case for Tattooed Chef as well as most food processors. My contact expects the issues to continue into spring of 2022 before they’re resolved.

The decline in EBITDA and net income margins were due to the company’s well-telegraphed plans to greatly accelerate marketing and operational spend to capture more growth and awareness for the Tattooed Chef brand. This was entirely expected.

C. Guidance Updates

“We are lowering our revenue guidance for the year. As a high-growth business, it is difficult to forecast new distribution wins and the timing of rollouts. I own that.” — Sam Galletti

This was the company’s second consecutive decline in gross margin outlook. Over the last 2 quarters that has now gone from 22.5% to 13% for the reasons stated above. This must revert going forward for my thesis to be maintained.

D. Notes from Founder/CEO Sam Galletti

On the branded store footprint & sales velocity:

Tattooed Chef products can now be found in 13,000 stores vs. 4,300 stores 3 quarters ago. The company expected to be in 10,000 stores by the end of this year as of 9 months ago and has already handsomely eclipsed that target. It’s confusing to see its revenue underperformance coincide with this statistic.

The company now has 6.5 stock keeping units (SKUs) per store vs. 5.8 sequentially. The goal is to get to 30.

On snack food:

“The Karsten facility is set to open at the end of the first quarter next year, and we expect to start selling ambient products then.”

On M&A:

Galletti reiterated that he thinks the added capacity from the Foods of New Mexico acquisition (Mexican/snack food expansion) and the Belmont Confections purchase (nutritional bars and snack food expansion) will contribute $300 million in incremental revenue by 2024.

SPINS data highlights on the Tattooed Chef brand:

- Distribution points grew by 315% year over year.

- Measured consumption grew by 239% year over year.

- Consumption sales rose 49% sequentially.

- Tattooed Chef is now the 4th largest brand across all of the categories in which it competes by multi-outlet sales.

- Tattooed Chef is now a top 10 brand across club, grocery and mass in every single category it competes in.

- Tattooed Chef has 50% of the top 10 highest velocity SKUs in the frozen vegetable entrée category over the last 52 weeks.

- Tattooed Chef now has the top selling new pizza SKU by velocity.

- Tattooed Chef club sales grew by 64% YoY this quarter.

E. Notes from the Tattooed Chef, Sarah Galletti

On plans for Belmont Confections:

“While the transaction has not closed yet, we have already begun testing for the new line of bars which will be on shelves at some point next years.”

On marketing:

“Paid social marketing is outperforming industry benchmarks by 2x in terms of consumer engagement.”

F. Notes from COO/CFO Stephanie Dieckmann

None of the revisions that Tattooed Chef will make to results in prior quarters will have any material impact on the numbers.

“We expect gross margin to expand in the fourth quarter and throughout 2022 as we increase branded volume and production capacity.”

G. My Take

This was a bad quarter but not quite as bad as I was expecting after the company delayed its release by a week. The supply chain and inflation issues Tattooed Chef cited are very real and very temporary — this too shall pass.

Tattooed Chef remains on very thin ice for me. I will not be adding to my stake but I am not ready to sell any shares. It is time for the company to prove it can handle the success that its brand is delivering. Gross margin needs to inflect positively and permanently and management needs to execute with far less drama. A veteran, rock star CFO would be a positive addition to allow Dieckmann to focus on her COO role.

4. Upstart (UPST) — Another Win & Two Interesting Blogs

a. A new partner

Upstart landed another top-60 credit union in BCU (Baxter Credit Union) during the week. BCU boasts roughly $5 billion in assets under management and over 300,000 members. The 2 companies had been working together since June, but now Upstart is officially ready to add it to its referral network and its rapidly growing list of partners (32 strong). Now any member fitting to customized credit parameters of BCU will be eligible to be plugged into a Baxter-funded loan.

“We are delighted to partner with Upstart to provide a digital, AI-powered lending experience to reach and lend to more eligible non-members across the nation.” — SVP of Lending at BCU Dave Brydun

A few months back, the National Association of Federally Insured Credit Unions (NAFCU) named Upstart as its preferred AI-lending partner. Since then, Upstart has seamlessly added large new credit unions to its partner roster. This should continue with CEO Dave Girouard expecting Upstart to have “hundreds” of partners down the road.

b. 2 Interesting blogs

American Banker reported that Upstart’s planned micro-loan, emergency cash product launch will feature APRs below 36%. It’s common for these types of loans to carry triple digit interest rates. This will be Upstart’s combative response to the predatory, payday loan industry.