1. GoodRx (GDRX) — Earnings Review

A. Demand

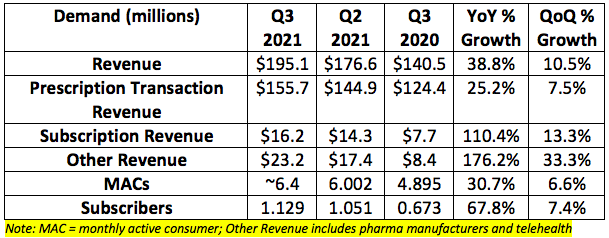

GoodRx guided to $193-$197 million in quarterly sales while analysts expected $194.9 million. GoodRx generated $195.1 million in sales beating its own midpoint by 0.5% and analyst estimates by roughly 1%.

Note that GoodRx’s core prescription price-comparison product was hurt by the pandemic as elective care halted and prescription volume declined. The company continues to believe that the pandemic is impacting growth here with a 1 billion+ un-diagnosed visit care backlog. This points to a demand acceleration when this backlog finally does unwind likely throughout next year. Telehealth was helped by the pandemic but is a much smaller piece of the company’s business overall.

“When the country reopened after the vaccine became available, we expected utilization to rebound with normal seasonal trends returning. However, what we’ve seen is a continued backlog reflecting a lag in utilization recovery. Whether due to physician capacity limits, new variants or delaying care, we believe this is largely temporary. We continue to believe the unwinding of the diagnosis backlog will serve to fuel future growth. We are well-positioned for when utilization does increase and regular patterns resume.” — Co-CEO Trevor Bezdek

The company is seeing improvements in utilization trends but not a return to normal like it anticipated. It believes prescription volumes will “return fully to pre-pandemic levels in a quarter or two” according to CFO Karsten Voermann. Lower cold and flu season activity hit revenues by $5 million in the year over year period — that hit was “smaller” during this quarter as progress continues.

Despite this headwind, the company still met expectations and reiterated its 2021 guidance (covered below) thanks to strength from other parts of its business. If 25.2% prescription transaction growth is a trough, that works for me.

B. Profitability

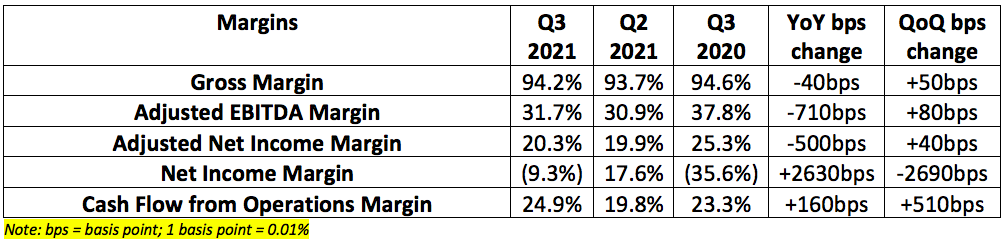

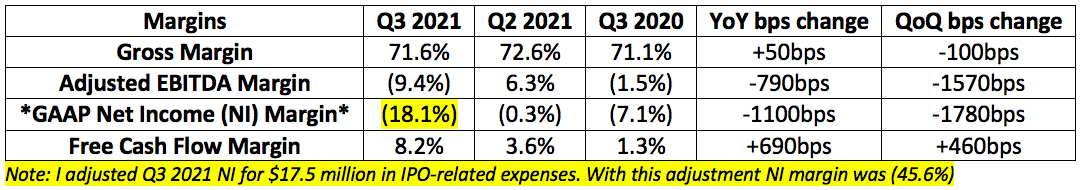

GoodRx guided to a roughly 30% adjusted EBITDA margin. It posted a 31.7% margin beating expectations by 170 basis points.

Net income margin in the third quarter was hurt by a $55.5 million swing in tax benefits vs. the second quarter of this year and a $20.1 million non-recurring stock-based compensation charge in connection with the IPO.

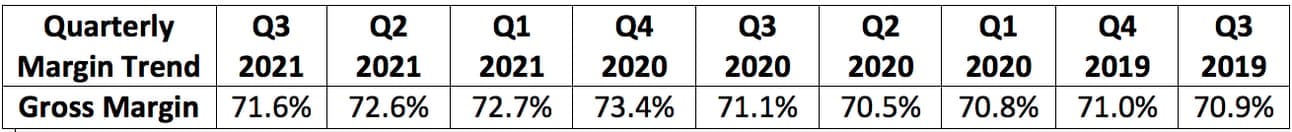

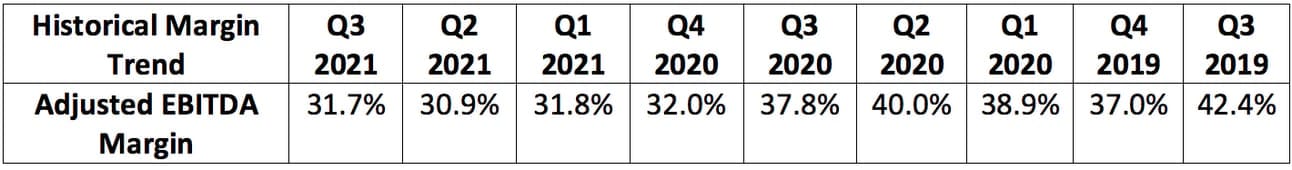

GoodRx has been expecting a shrinking adjusted EBITDA margin as its lower-margin telehealth segment gains more traction and it rapidly grows headcount and marketing to support demand. It sells products here at cost to drive cross-selling and traffic to its other platforms. This margin trend is depicted below:

C. Guidance

GoodRx was expected to guide to the following for the 4th quarter:

- $216.9 million in revenue. It guided to $212-$222 million beating expectations at the midpoint by 0.4%.

- $66.4 million in adjusted EBITDA. Its margin guidance implies forecasts of $65.1 million missing expectations by 2.0%.

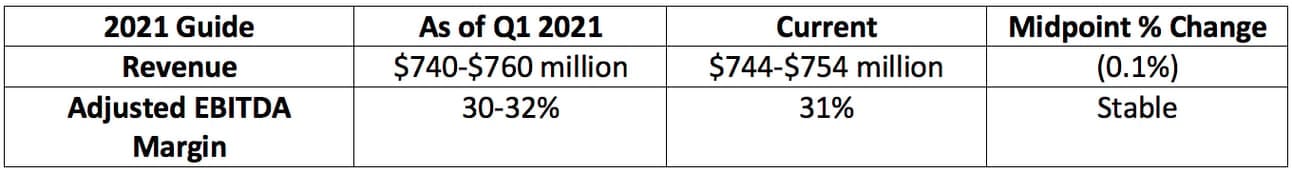

Note: GoodRx removed annual guidance last quarter and re-instated it this quarter. This reiterated guidance is despite the time lag on the elective care backlog unwind. It is still not unwinding which would feed the company’s prescription business. GoodRx anticipated this backlog would have already begun to unwind in its Q1 2021 guide.

D. Co-CEO Doug Hirsch Notes

General notes:

- GoodRx has now saved Americans $35 billion on prescriptions vs. “over $30 billion” last quarter and “over $20 billion” when it went public last year.

- Average savings rate is now 80% vs. 79% sequentially. It was 71% at the time of the IPO last year and 59% in 2016.

- Consumers and healthcare professionals both reward GoodRx with a lofty +90 net promotor score (NPS). Healthcare professional NPS was +86 at the time of its IPO and consumer NPS is stable at +90.

- Over 2 million prescribers have a patient that has used GoodRx.

- GoodRx plans to extend into health insurance by “navigating customers through the insurance process as their trusted advocate.”

- This would probably resemble a marketplace like one of its telehealth products

- The GoHealth partnership will be a big part of this launch

- Hirsch highlighted the recently announced “Fetch Rewards” partnership. Click here to read my take on what it means.

- GoodRx partnered with CoverMyMeds during the quarter to create new, custom branded discounts “supported by the pharma manufacturers.”

- The company also is launching a branded drug-integrated co-pay card to further support its thriving pharma manufacturer solutions business

“CoverMyMeds is a leader in biopharma-supported solutions for patient affordability and, as a leader in consumer affordability solutions, we see this as a natural partnership.” — Co-CEO Doug Hirsch

On GoodRx Health:

GoodRx Health — its research database for all things healthcare — officially launched during the quarter. This service offers strictly vetted and curated healthcare information to consumers for free. It focuses on topics in health knowledge, financial guidance on healthcare costs, medication information and more “trustworthy research.” The emphasis will be on quality here to ensure this becomes a relied upon (and accurate) source of needed information.

While this product will not cost anything to use, this should serve as another top-of-funnel entry point into the GoodRx ecosystem to drive more traffic and revenue for the company. It also will serve as another marketing vehicle (of relevant consumers) for its branded pharma manufacturer partners to advertise discounts to.

The product’s main newsletter now has 5 million readers.

E. Co-CEO Trevor Bezdek Notes

On physician traction and telehealth:

25% of GoodRx’s visits are now from providers vs. 17% at the IPO; over 400,000 doctor offices now distribute GoodRx materials.

GoodRx care — the company’s direct to consumer telehealth product — enjoyed triple the demand it realized at the beginning of the pandemic with a 5 star rating.

65% of GoodRx Care visits are driving cross-selling activity vs. 60% sequentially and 30% year over year.

On the pipeline:

“During the quarter we started to build a promising pharma manufacturer solutions pipeline for 2022.”

F. CFO Karsten Voermann Conference Call Notes

The pharma manufacturer solutions segment’s revenue tripled again year over year while maintaining net revenue retention over 150%.

“There is the potential for large deals in the 4th quarter which could accelerate growth further.”

Non-prescription transaction revenue made up roughly 20% of sales in the quarter vs. 16% at the beginning of the year. This is expected to rise to 22%-24% next quarter.

G. My take

The company’s largest business segment remains challenged. Despite this, GoodRx still re-instated the guidance it offered at the beginning of the year which didn’t assume any of the macro-headwinds the company is facing today. I found that immensely encouraging and a sign that the new products are all continuing to work. The combination of growth and profitability that GoodRx provides is nothing short of elite — and I believe it will only get better from here.

My GoodRx deep dive will be published in the coming week.

2. Olo (OLO) — Earnings Review

A. Demand

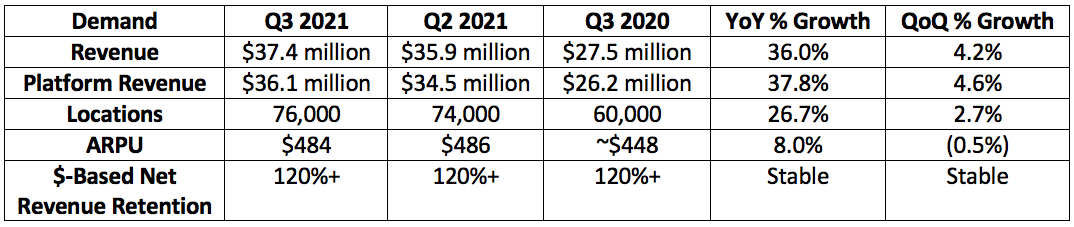

Olo guided to $36-$36.5 million in revenue for the quarter. It posted $37.4 million in revenue beating its midpoint guidance by 3.2%.

Analysts at the beginning of the year expected Olo to add 9,000 active locations in all of 2021. It has now added 12,000 active locations through the first 9 months of the year.

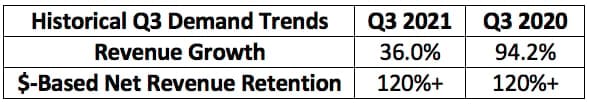

Note that the pandemic, multiple rounds of stimulus checks and also seasonality represented dramatic demand tailwinds for Olo in previous quarters as it supports off-premise dining. As a result, this quarter featured a difficult sales comparison so it is encouraging to me to see 36% YoY growth and a return to sequential growth for this — predominately transaction revenue based — company. These difficult comps will continue into the first quarter of next year with revenue and order volume growth expected to further accelerate thereafter.

“We were pleased with the continued durability of digital orders during the 3rd quarter. Despite seasonality and a continued shift to in-person dining our volumes exceeded expectations.” — CFO Peter Benevides

B. Profitability

Olo guided to $3.4-$3.8 million in non-GAAP operating income. It posted $5.1 million beating its midpoint guidance by 41.6%

Olo was expected to earn $0.02 per share in the quarter. It generated $0.03 per share beating expectations by $0.01.

The shrinking margin lines were as expected. Olo nearly quadrupled its general and administrative (G&A) expenses year over year to support “all of the new locations being added to the platform” and new product plans (Olo Pay is in beta testing). This rising G&A expense was also greatly boosted by a $7.9 million charitable stock donation which hit margins as well.

C. Guidance Updates

Olo guided to the following for the 4th quarter:

- $38.8-$39.3 million in revenue. It was expected to guide to $38.6 million meaning this guide is 1.2% ahead of expectations.

- $2.8-$3.2 million in Non-GAAP operating income.

Note that this raise to guidance includes a $1 million revenue contribution from Wisely. Without this benefit the revenue guidance would have represented a 1.5% raise. This guide also includes $800,000 in non-GAAP operating loss. Without this hit, Olo would have raised operating income guidance by 8.3%.

“We remain prudent in our approach to forecasting.” — CFO Peter Benevides

Order volume continued to remain durable and healthy into November according to Peter. Olo’s guide assumes more of a return to on-premise dining but digital ordering volumes continue to outperform even as vaccination rates rise.

D. Founder/CEO Noah Glass Conference Call Notes

On Wisely:

As a reminder, Olo recently closed on its acquisition of Wisely. Click here to learn more about the decision and the company.

“With the acquisition of Wisely, our platform will harness data from all customer interactions including non-digital orders to enable brands to build better direct relationships with their customers.”

On momentum:

Olo has now eclipsed 500 restaurant brands as customers. It was “over 400” as of last quarter and 400 when it went public just 9 months ago.

“We continue to increase the critical mass of Olo’s exclusive network of marquee and must-have restaurants.”

On New Customer wins:

- Bojangles added Olo’s Ordering module with a custom website and app — it had been an Olo Rails customer previously.

- Denny’s added Olo Network — it had been an Olo Rails, Ordering and Dispatch customer.

- As a reminder, Network allows for demand aggregation from non-marketplace channels. Olo is partnered with Google on this product to enable ordering through its search page.

- CKE Restaurant Holdings — parent company to Carl’s Jr., Hardee’s and Dave’s Hot Chicken all purchased the Olo Ordering module. Dave’s Hot Chicken purchased every Olo module. CKE abandoned their legacy technology stack to fully integrate with Olo.

- Dave’s Chicken is a rapidly growing brand with 14 stores open and 30 more openings planned for 2021. It has sold the rights to 400+ stores — and as Olo collects per-transaction and per-location revenue — this growth will directly benefit Olo’s business.

- Olo added Nascar Refuel brands as a customer to support its virtual, delivery only dining experience. This allows Nascar fans to enjoy famous dishes associated with the sport from home.

- Other notable virtual-only and rapidly growing customers include: Buddy V’s Cake Slice and Mr. Beef Burger

- The power of Olo’s partnership and open integration network helped Olo to be named as one of 5 technology vendors for the rapidly growing “Roll em up Taquitos.”

- This partnership network allows for a more customized, connected technology stack.

On products and competition:

Switchboard is gaining momentum thanks to the current labor shortage. This module allows for more organized, efficient and profitable management of phone orders by tapping into call center agencies and allowing them to place orders with the restaurant through Olo’s module.

Almost 10,000 locations are now using Olo Expo (not a core module) to improve “front of restaurant work flows” and to facilitate front and back of restaurant communication.

“We’ve seen no change in the competitive environment.”

Olo upgraded Rails during the period to “provide additional tools and capabilities to control capacity across all channels.”

On the partner network:

As previously announced, Olo added Uber Direct and “Waitr” to its Dispatch network to expand delivery access. This will help drive down costs further and diminish revenue concentration. Olo now has more than 2 dozen delivery service providers (DSPs) in its Dispatch ecosystem.

On Olo Pay:

Olo is still on track to debut the product next year. Olo hired a new Vice President and General Manager of Payments — Tor Opedal — to gear up for this launch during the quarter. Tor was previously a VP of US Market Development at Mastercard.

“We are encouraged by what we are seeing with the brands that are live on the Olo Pay pilot and heartened by the excitement from the broad client base. We have high conviction that this will be another successful product.”

D. CFO Peter Benevides Conference Call Notes

On the pipeline:

“We’ve never been more excited about our sales and deployment pipelines in terms of new location adds and up-selling activity emerging.”

On flat sequential ARPU and volumes:

Benevides was asked if the flattened sequential ARPU could be seen as a “point of stability” with that ARPU growth expected to accelerate in the future. Benevides affirmed that this would be the case. This is partially due to Wisely but also continued cross-selling momentum and future product debuts like Olo Pay.

“We see more stability and growth in ARPU looking ahead” — Benevides

Olo is continuing to invest more aggressively in “emerging enterprise” restaurant clients. These are chains under 100 locations but growing rapidly and marks an expansion of its massive-chain-only niche. Wisely — Olo’s new customer resource management (CRM) acquisition — also generally serves smaller chains than Olo does which offers us with more evidence that this is the case.

On DoorDash Revenue Concentration and Revenue Breakdown:

Rails module revenue from DoorDash accounted for 14.3% of total sales in the quarter. This rose slightly sequentially from 13.8% but fell sharply from 21.8% year over year. Overall, DoorDash represented 16% of total Olo revenue vs. 23% year over year. New Dispatch and Rails partners like GrubHub and Uber Direct should help erode this concentration further over time.

E. My Take

Solid quarter for Olo with a modest beat and raise across the board. Comparisons will get easier next year and growth will accelerate to coincide with its already stellar cash flow margins.

Click here for my Olo deep dive.

3. Duolingo (DUOL) — Earnings Review

“Our mission is to develop the best education in the world and make it universally available. We don’t plan on stopping with just languages. As I said in our S1, I plan to devote my life to this mission.” — Co-Founder/CEO Luis von Ahn

A. Demand

Duolingo guided to the following:

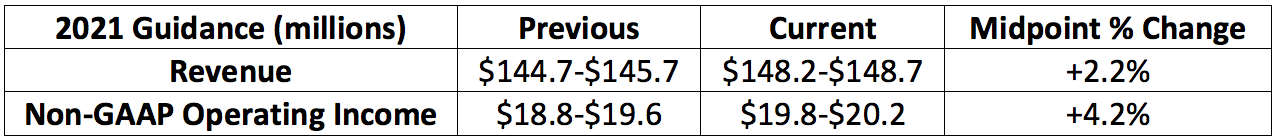

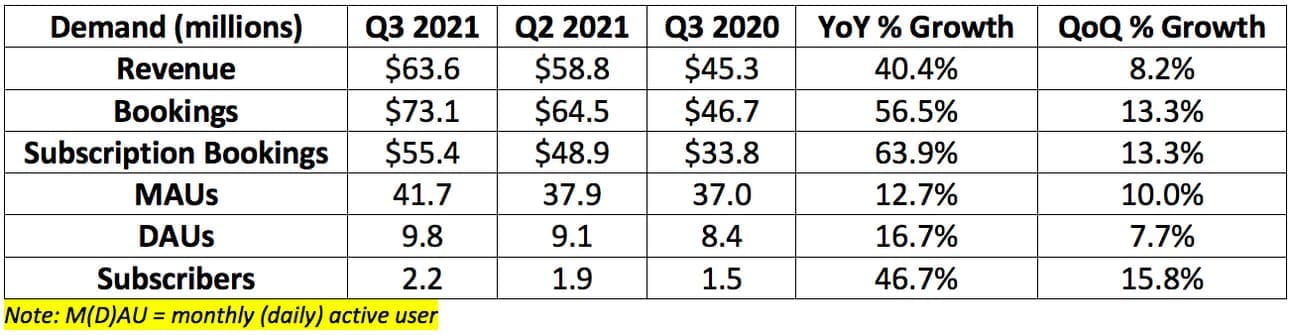

- $58-$61.5 million in revenue. Analysts were expecting $60.5 million. The company posted $63.6 million beating its own midpoint by 6.4% and analyst estimates by 5.1%.

- $63-$66 million in total bookings. It posted $73.1 million beating its own midpoint by 13.3%.

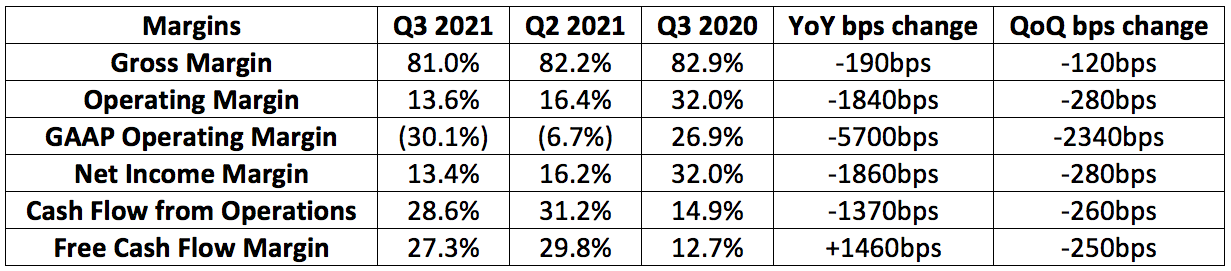

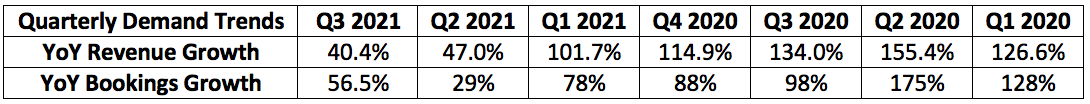

All 6 demand metrics saw sequential growth briskly accelerate:

- 8.2% vs. 0.9% last quarter for revenue

- 13.3% vs. (0.4%) last quarter for bookings

- 10.0% vs. (5%) last quarter for MAUs

- 7.7% vs. (4.2%) last quarter for DAUs

- 15.8% vs. 5.5% last quarter for subscribers

MAUs and DAUs (and all demand lines) benefited in the third quarter of 2020 from social distancing and lockdowns boosting demand for remote learning. Year over year comparisons were quite difficult which makes 40.4% top line growth all the more impressive to me.

B. Profitability

Duolingo guided to a loss of $8-$12 million in Adjusted EBITDA for the quarter. It posted a loss of $6 million beating the midpoint of its guidance by $4 million.

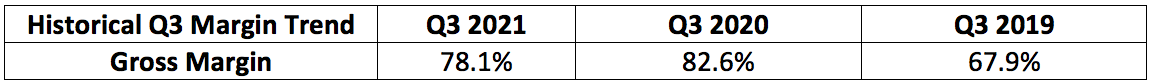

The sequential reduction in gross profit margin was attributed to “adding additional test proctors and resources” for the Duolingo English Test (DET) business: