1. Taiwan Semiconductor (TSM) – Earnings Review

a. Demand

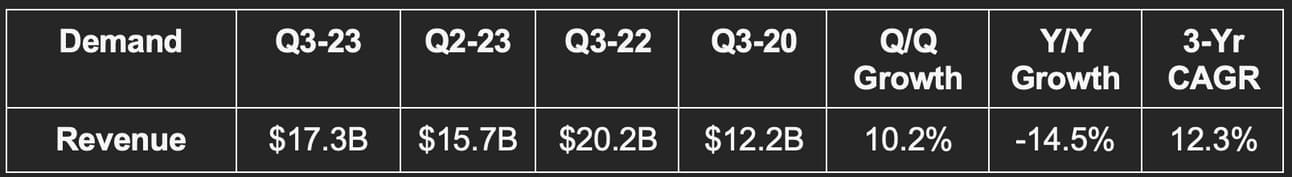

TSM beat revenue estimates by 3.6% and beat its own quarterly revenue guide by 1.2%. This quarter’s 12.3% 3-year revenue compounded annual growth rate (CAGR) compares to 14.7% last quarter and 17.2% 2 quarters.

b. Margins

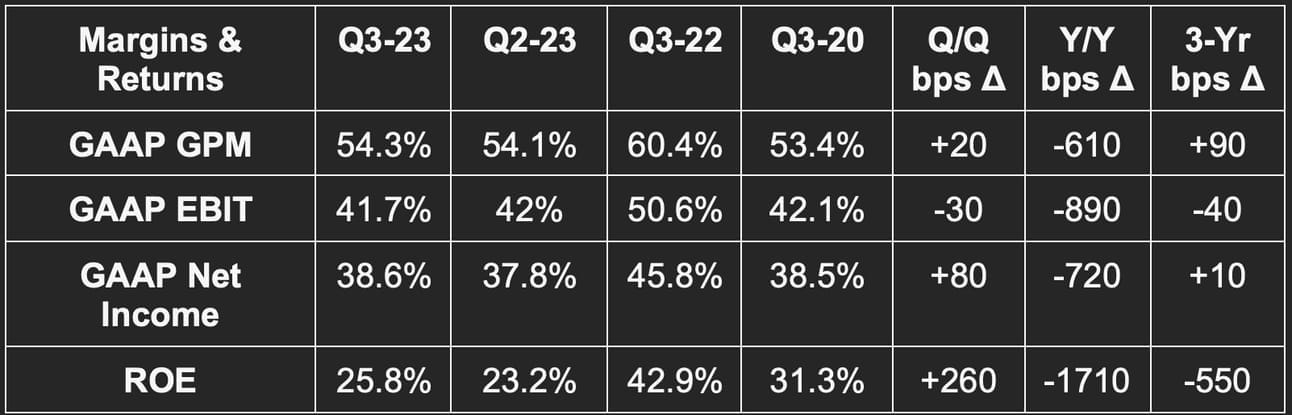

- Beat GAAP gross profit margin (GPM) estimates by 130 basis points (bps) & beat guidance by 180 bps.

- Beat GAAP EBIT estimates by 7.4% & beat guidance by 8.1%.

- Beat GAAP net income estimates by 11.4%.

c. Balance Sheet

- $48B in cash, equivalents & marketable securities.

- $28.9B in bonds payable.

- Inventory rose 20% Y/Y & 11.8% Q/Q.

- Dividends rose 9% Y/Y.

d. Next Quarter Guidance

Taiwan Semi beat revenue estimates by 4.9%, beat EBIT estimates by 5.8% and beat 52.3 GAAP GPM estimates by 20 bps.

e. Call & Release Highlights

Needed Definitions:

- Fab means a Factory

- Nanometer (NM) describes the chip technology. Smaller NM is more advanced as it uses smaller transistors. Its newest 3 NM technology also includes an upgraded transistor technology to bolster the capacity. This means TSM can add more transistors to a single chip while making those chips more energy efficient and cost-effective.

- Wafer refers to the raw materials (like silicon) that are used to manufacture chips and manipulate the materials with desired tasks.

Macro & Inventory:

TSM sees its client base’s “inventory digestion” (AKA slower buying) continuing into Q4. Most clients are quite cautious in the current macro and geopolitical environment and so are buying more sparingly. This impacts TSM’s demand as the manufacturer of chips for these clients. Importantly, it’s seeing “early signs of demand stabilization” within its 2 largest end markets: Personal Computing and smartphones. This, despite timid buyers, will allow TSM to reduce its inventory position Q/Q in Q4 and as we head into 2024.

Demand by Technology Bucket & Use Case:

Advanced technology refers to all technology buckets using 7 NM or below. This now represents 59% of TSM’s total wafer revenue vs. 53% Q/Q. 3 NM became a new disclosure this quarter as that technology ramps up. It now represents 6% of total wafer revenue. Its newest N2 technology demand is being supported by the generative AI explosion. Again, lower NM means more energy efficiency. Gen AI models are voracious consumers of energy. Any efficiency gains for clients here will be met with real interest. TSM will be ready to produce chips with 2 NM technology in 2025.

By platform, high performance computing (HPC) represented 42% of sales vs. 44% Q/Q and 39% Y/Y. Smartphone represented 39% of sales vs. 33% Q/Q and 41% Y/Y. Internet of Things (IoT) and Auto remain its 3rd and 4th largest use case platforms.

Margins:

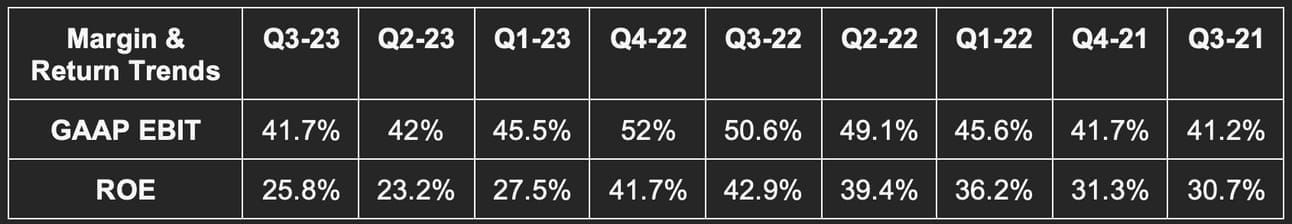

More favorable foreign exchange (FX) rates drove the gross margin outperformance. Higher capacity utilization helped too, but FX was the primary factor. Margin expansion also would have been more meaningful without the headwind from its aggressive ramping of 3 NM production. New technologies start with lower margins and those margins expand with scale… similarly to most business models.

The company reiterated its long-term 53%+ gross margin and 25%+ return on equity (ROE) targets.

Global Fab Expansion:

In Europe, the European Commission and local regulatory bodies in Germany continue to support TSM’s expansion needs. It will build a new plant in Germany for auto and industrial use cases with 12-28 NM technology. Construction should start next year and end in late 2027.

In Arizona, it “continues to develop a positive relationship with regulators.” It’s making “good progress” on the labor and material shortage issues that had been impacting its progress on various fab plans. It has now hired 1,100 employees to help build the plant. Most are from Taiwan and are experienced. It thinks it will be ready for scaled production here in early 2025. Finally, the Japan factory is on track for scaled production by the end of next year. All of these projects are margin headwinds until reaching scale. TSM is fixated on cost and efficiency controls to ensure it remains at or above long-term margin targets while these projects develop.

f. My Take

The quarter was fine and the guide was great. Semiconductors are as violently cyclical as any other industry. TSM’s guidance being so far ahead of depressed consensus AND that it’s already seeing demand greenshoots are both great signs. An impressive company that continues to effectively endure difficult times in my outsider perspective.

2. Intuitive Surgical (ISRG) – Earnings Review

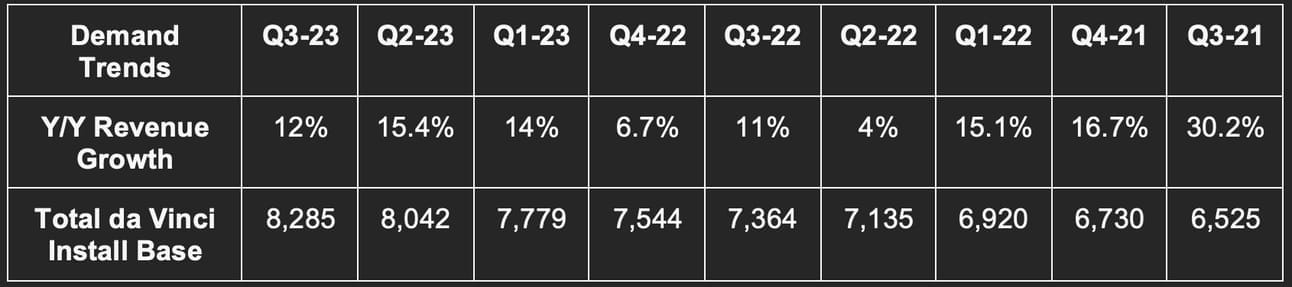

a. Demand

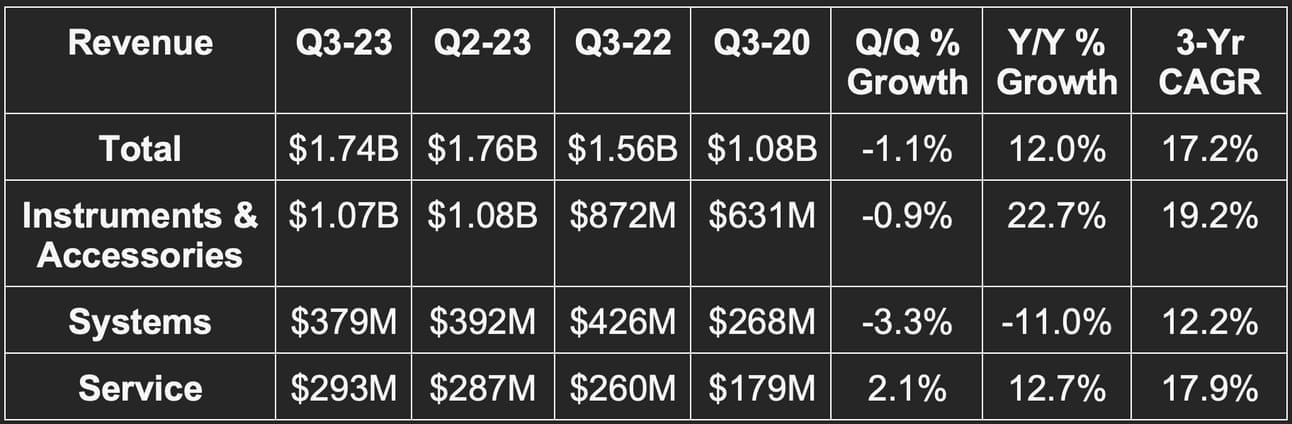

ISRG missed sell side revenue estimates by 1.7%. It does not guide to quarterly revenue. Its main surgical system (da Vinci) enjoyed 19% Y/Y procedure growth vs. 22% Q/Q and 26% 2 quarters ago. Recurring revenue rose 21% Y/Y.

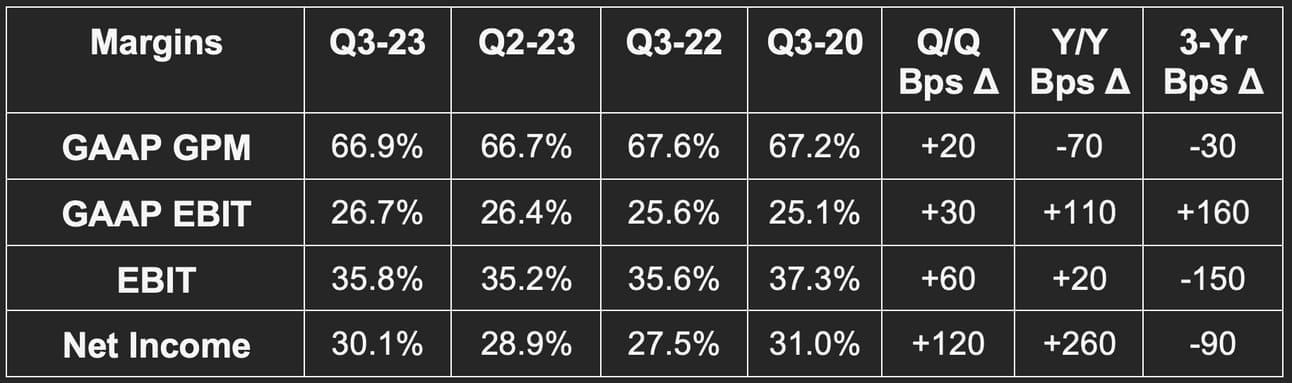

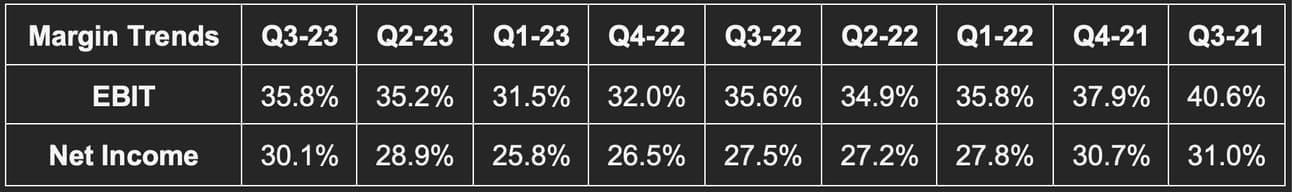

b. Margins

ISRG beat non-GAAP EBIT estimates by 1.3%, met non-GAAP GPM estimates and beat $1.42 non-GAAP EPS estimates by $0.04. It does not guide to specific quarterly profit metrics.

EPS rose 23% Y/Y.

Gross margin fell by 20 bps Y/Y when excluding a one-time Q3 2022 tax benefit.

c. Balance Sheet

- $7.5 billion in cash & equivalents.

- No debt.

- Basic and diluted share counts fell by about 1% Y/Y.

- Inventory is up 28.4% year to date.

d. Full Year Guidance

- Raised annual procedure growth guidance from 21% to 21.5%.

- Lowered its annual GPM guidance slightly from 68.5% to 68.25%.

- Lowered its annual operating expense (OpEx) guide from 13.5% Y/Y to 13.0% Y/Y.

- It expects more interest income for the year than it did last quarter via higher rates and its strong, cash-rich balance sheet.

Quarter to date, it has placed 60 surgery systems in Europe vs. 54 Y/Y, 32 in Japan vs. 32 Y/Y and 10 in China vs. 15 Y/Y. Chinese regulators continue to clamp down on anti-fraud and corruption of some ISRG customers. This pushback is slowing ISRG’s system placement growth and will continue to do so into Q4.

e. Call & Release Highlights

Macro Backdrop & Demand:

Market conditions for ISRG are “stable” Q/Q. Single port (single incision machine) installs for its Da Vinci surgical hardware accelerated a bit sequentially. Utilization growth slowed from 9% Y/Y last quarter to 6% Y/Y this quarter with general surgery across all core markets the main growth contributor. For its newer Ion surgical system hardware, procedures grew by 125% Y/Y on a smaller base vs. the da Vinci system. It placed 55 Ions vs. 50 Y/Y. For context, it has 490 Ion systems in the install base vs. 8,285 da Vinci systems.

While demand stayed relatively strong, a lot of that demand is shifting to per usage leasing contracts. 52% of placements were lease-based vs. 37% Y/Y. Customers understandably are seeking less up-front cost commitment amid these chaotic times. Leasing means lower short-term revenue collection, but features a similar lifetime value compared to an outright sale.

“Leasing allows customers the flexibility to build new capacity when and where they need it with predefined pathways for the new technology.” – CEO Gary Guthart

“Broadly speaking, da Vinci is operating at global scale and embedded in a robust ecosystem… acceptance of Ion is strong… Single port da Vinci system acceptance is accelerating with new pipeline indications… digital tools are building momentum through their early stages.” – CEO Gary Guthart

Margins:

For a complex healthcare hardware company, 2022 supply chain issues were a large headache. Rather than focusing on margin preservation, ISRG worked to “support its customers through the shocks.” Per leadership, this “diverted resources from cost reduction.” It’s now in a position where supply chains are healthy and it can refocus on operating leverage. It sees significant room for margin expansion within the Ion platform specifically.

Digital Traction:

ISRG’s SimNow is its digital surgery simulator to help professionals practice in 0-consequence environments. As a nerd, I find this to be so cool. Renewal rates for subscription-based access to SimNow have been “outstanding.” Its “My Intuitive App” is essentially a customer dashboard to access outcome, utilization and patient history data. Usage of this app rose 140% Y/Y with “strong Net Promoter Scores.”

Bariatrics (Weight Loss Surgery):

ISRG is one of the companies impacted by weight loss drug ripple effects. The drugs diminish bariatric surgery demand and started slowing the company’s growth within this segment last quarter. Growth continued to dwindle sequentially this quarter. This type of surgery represents about 4%-5% of its total volume.

f. My Take

The quarter was pretty much as expected without potential negative surprises overly impacting results. The leasing trend is eerily similar to B2B software companies seeing customers demanding shorter-term contracts to avoid hefty up-front spend. Margin expansion should continue now that it’s through the worst of supply chain shocks. This high-quality company should continue to attractively compound demand while that margin expansion takes place. Boring company in the best of ways.

3. Duolingo (DUOL) & Alphabet (GOOGL) – English Practice

a. The news

This week, Google debuted a new tool within search to practice english. It offers speaking and translation lessons with granular feedback to explain concepts and sharpen comprehension. Its “Deep Aligner” generative AI model is a key piece of this; it helps learners understand single word meaning and how word meaning can change as sentence structure is altered. This model supposedly improves sentence alignment error rates (AER) significantly vs. other models like Hidden Markov Models (HMMs). Duolingo uses HMMs as a small piece of its own language learning toolkit. Learners can sign up for daily alerts to remind them to complete lessons.