1. Microsoft (MSFT) — Earnings Review

“The case for digital transformation has never been more urgent or clear: Digital technology is a deflationary force in an inflationary economy.” — Microsoft CEO Satya Nadella

a. Demand

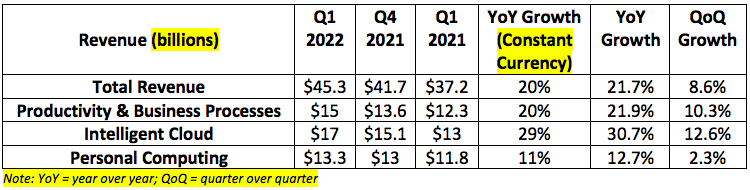

Guidance was for:

- $14.5-$14.75 billion in Productivity & Business Processes. It beat expectations by 2.6% at the midpoint.

- $16.4-$16.65 billion in Intelligent Cloud. It beat expectations by 2.7% at the midpoint.

- $12.4-$12.8 billion in Personal Computing. It beat expectations by 5.6% at the midpoint.

- $43.75 billion total revenue using segment midpoints. It beat expectations by 3.5% at the midpoint.

Xbox growth was expected to be in the “low single digit range” — its results were in line. LinkedIn was looking for growth in the high 30% range and posted results at the upper end of that range.

b. profitability

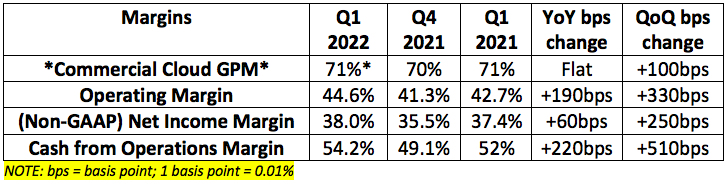

Microsoft was expected to earn $2.07 per share. The company reported $2.27 per share beating expectations by 9.7%. GAAP earnings per share came in at $2.71 thanks to a $3.3 billion tax benefit.

Commercial cloud gross profit margin (GPM) was expected to be 70%. The company generated a 71% cloud GPM beating expectations by roughly 100 basis points (bps).

*Commercial cloud GPM includes a 4% hit from a change in accounting estimates for the useful life of server assets. Without it, commercial cloud GPM would have been roughly 75%. There will be another 4% GPM hit next quarter from this change.*

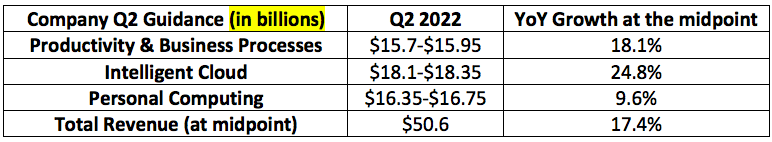

c. Next Quarter Guidance

Analysts were hoping Microsoft would guide to roughly $48.9 billion in next quarter revenue. It guided to $50.6 billion (using the midpoints of its segment guidance) which is 3.5% ahead of estimates.

d. Satya Nadella Conference Call Notes

General notes:

- 78% of the Fortune 500 now uses its cloud offerings vs. 75% QoQ.

- GE Healthcare and P&G moved vital workloads to Azure during the period.

- Kimberly Clark, The NBA and SoftBank all picked Azure for their SAP workloads.

- Microsoft has doubled total developers on GitHub to 73 million since buying it in 2018; GitHub has added 70 enterprise customers with 84% of the Fortune 100 now using it.

- Power Platform (low-code tools, robotic process automation (RPA) and business intelligence (BI)) monthly active users grew 76% YoY to 20 million; It’s now used by 91% of the Fortune 500.

- Confirmed LinkedIn hires grew 160% YoY and advertising revenue grew 61% YoY; it now has 800 million members.

- 138 firms have 100K+ Teams users vs. 124 sequentially.

- Users with 10K+ employees integrating their 3rd party tech stack pieces into teams (like ServiceNow) grew 82% YoY.

- PayPal and Toyota picked Microsoft’s new Viva product to enhance the work-from-anywhere connection and productivity within enterprises.

- Security customers grew 50% YoY.

- “Windows 11 is the biggest update to our operating system in a decade… We are delighted with the early response to Windows 11.” — Nadella

- Microsoft enjoyed “record first-quarter gaming monetization and engagement.” I find this encouraging considering we are exiting a pandemic.

On digital transformation:

“We are building Azure as the world’s computer, with more data center regions than any other provider. We’re partnering with mobile operators like AT&T, Verizon and Telefonica as they embrace new business models & bring ultra-low latency, as well as compute and storage power, to the network and edge.”

e. CFO Amy Hood Conference Call Notes

General notes:

- Xbox Series X and S consoles as well as PCs all continue to be supply constrained.

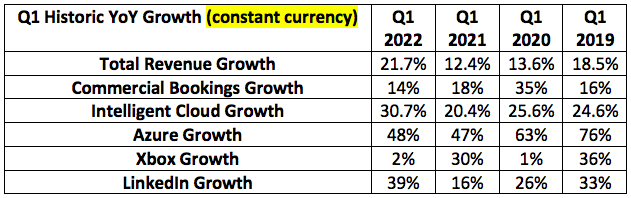

- Commercial bookings growth of 14% was impacted by fewer large long-term Azure contracts ; for evidence of this being the case, remaining performance obligations grew 29%. This is a great forward-looking demand metric.

- Headcount grew 14% YoY.

F. My take

There’s not much for me to say other than great job Microsoft, again. They endured supply chain issues and tough YoY comparisons to deliver yet another remarkably positive quarter. When every single analyst question begins with something along the lines of “congratulations on the strong results” is when we know things went extremely well.

2. Facebook (FB) — Earnings Review & Facebook Connect

a. Demand

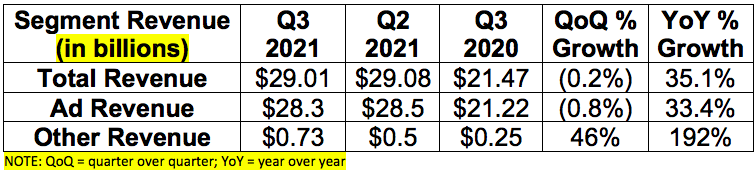

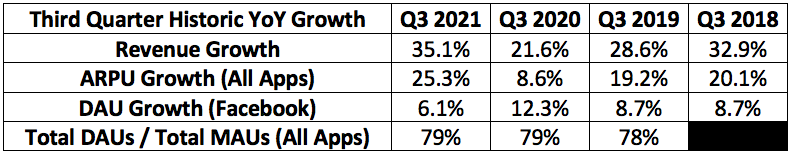

The company was expected to generate $29.58 billion in total revenue. It posted $29.01 billion missing expectations by 1.9%. This miss was despite a $259 million foreign exchange (FX) rate boost during the quarter. Without it, revenue would have missed by 2.7%.

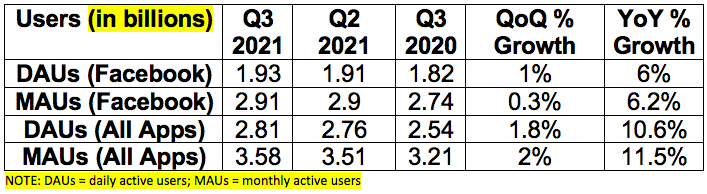

Facebook was expected to report 2.92 billion monthly active users (MAUs) for its entire family of apps and 1.92 billion MAUs for just Facebook. Its results were in line.

Only Facebook daily active users (DAUs) grew in the United States/Canada for the first time in 5 quarters with MAUs growing for the first time in 2 quarters. These users are more lucrative for Facebook’s business vs. the rest of the World.

Ad revenue and average revenue per user (ARPU) shrank sequentially in the United States, Europe and Canada as Apple’s App Tracking Transparency (ATT) and Identifier for Advertisers (IDFA) changes took hold. ARPU grew in the rest of the world where Android is far more prevalent to point to this truly being the case. The impact of these changes on Facebook’s business is expected to peak this quarter.

In total, ad impressions still rose 9% YoY with price per ad rising 22% YoY thanks to comping over a pandemic period featuring weak pricing.

b. Profitability

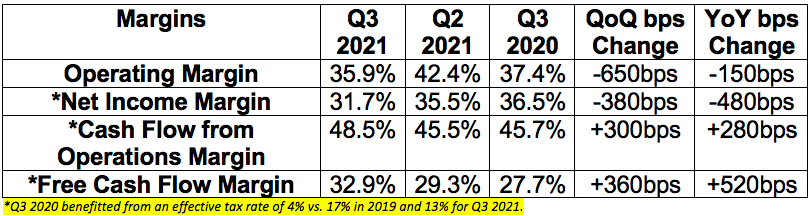

Facebook was expected to earn $3.19 per share. It earned $3.22 per share beating expectations by 0.9%.

c. Mark Zuckerberg Conference Call Notes

On the whistleblower and recent accusations:

“My view is that what we are seeing is a coordinated effort to selectively use leaked documents to paint a false picture of our company.”

“When we make decisions, we balance competing social equities like privacy while supporting law enforcement. It makes a good soundbite to say we don’t solve these impossible trade-offs because we’re focused on money. In realty, this isn’t primarily about our business but about balancing social values. I repeatedly call for regulation here because I don’t think companies should be making these decisions themselves.”

Zuckerberg highlighted an interesting case study of polarization in the United States to depict Facebook’s independence from this issue. General levels of American polarization have been rising for decades while other countries with similar social media consumption patterns have seen diminished polarization.

The company is set to spend $5 billion on “safety and security” this year — more than any other tech company on both a relative and absolute basis.

On the creator economy and age demographic:

“I am optimistic that Reels will be as important for our products as Stories is. Reels is already the primary driver of engagement profiles.” — Note: Reels is Facebook’s short-form video competitor to TikTok

The company is planning several family of app upgrades to make short-form video a larger part of the focus.

Zuckerberg spoke about a reinvigorated focus for Facebook on attracting young adults (18-29) to their platform rather than just maximizing total users. He called this a “north star” and Reels will be a central piece of this ambition. I found this bit of the call concerning as it depicts Facebook’s opinion that it needs to do a better job competing for young people than it currently is.

On Commerce:

“We have an exciting program planned this holiday season to work with the businesses that have invested the most in Shops to identify what works to find new customers and accelerate growth. Our plan is to then scale those solutions more broadly in 2022.”

On “building the next computing platform” and “bringing the metaverse to life”:

“I view this work as critical to our mission as delivering products like you’re there with another person is the holy grail of online social experience. The metaverse is the successor of the mobile internet. Over the next decade, these platforms will unlock the experiences I’ve wanted to build before I even started Facebook.”

Zuckerberg announced a new goal to help the metaverse reach a billion people and hundreds of billions of dollars in digital commerce.

Facebook views this product diversification as also “reducing dependence on delivering services through competitions” — AKA cutting Apple out of their value chain wherever possible. Zuckerberg reminded us that this endeavor will not be profitable for years.

The company will begin to disclose the revenue and operating profit results of its Facebook Reality Labs independently from the rest of its business. The aim is to provide more transparency into the capex Facebook is spending on the segment. Specifically, the investments will reduce operating profit by $10 billion next year. Zuckerberg expects that $10 billion to grow even more thereafter.

d. COO Sheryl Sandberg:

On iOS 14 privacy/targeting changes:

“We’ve encountered 2 challenges from Apple’s changes. One is the accuracy of our ad targeting decreased thus increasing the cost of driving outcomes for our advertisers. The other is that measuring those outcomes became more difficult.”

Sandberg reiterated Facebook’s belief that the privacy changes have resulted in Facebook underreporting real-world conversions. In reality, these conversions are higher and Facebook’s value to advertisers is greater.

“We think we’ll be able to address more than half of the underreporting by the end of this year and we’ll continue to work on this into 2022.”

The worst is likely behind us for iOS 14 targeting headwinds.

On e-commerce and supply chain issues:

“E-commerce is no longer growing at the pace it was at the height of the pandemic. These factors have been compounded by major supply chain issues and global shortages leaving many with less inventory. This reduced appetite to generate demand and impacted advertising spend.” — Note: Snap Inc. leadership made similar comments on its call.

On new advertiser tools:

“We started rolling out a new conversion leads optimization goal for high-quality leads with advertisers able to integrate their customer resource management (CRM) tools with Facebook via our Conversions API.”

Using this goal and the conversions API together raises lead-to-sale conversion by 20% so far.

e. CFO Dave Wehner:

General notes:

- Headcount growth will likely be around 20% next year like it was this year.

- 2022 margins will be worse than 2021 with all of the planned spending.