Table of Contents

- 1. Adobe (ADBE) – Earnings Summary

- 2. Oracle (ORCL) – Earnings Summary

- 3. Snowflake CFO Interview

- 4. CrowdStrike CFO Interview

- 5. Cloudflare CFO Interview

- 6. Datadog CFO Interview

- 7. New PayPal Partners & Signs

- 8. SentinelOne & Lenovo

- 9. Amazon & Shopify Updates

- 10. Alphabet Regulatory News

- 11. Market Headlines

- 12. Macro

I sent two portfolio updates (including an exit), Fed presser highlights & a short piece on rate cut beneficiary themes during the week. The SoFi investment case is quickly progressing.

To new readers: While I do closely cover news for my holdings, most of the coverage at this point is non-holdings. Talking about a stock does not mean I own shares.

1. Adobe (ADBE) – Earnings Summary

Adobe is a software giant that invented the .pdf file (co-founder John Warnock specifically). It provides programs to create and imagine, handle customer interactions and process documents. Revenue is split into two main buckets: Digital Media and Digital Experiences. Digital Media is made up of its “Creative Cloud” and “Document Cloud.” The Creative Cloud includes Photoshop and Illustrator. It’s what empowers creation, iteration and perfection of digital design. The Document Cloud, including the ubiquitous Adobe Acrobat, allows for secure PDF management and collaboration – among other things.

Finally, its Experience Cloud includes Adobe Analytics and other products like “Campaign.” Campaign is its (intuitively-named) marketing campaign tool. Experience Cloud covers end-to-end customer interactions with a real-time customer data platform (CDP), ensuring that those interactions are optimized. It also publishes some greatly appreciated macro data on overall commerce spend.

The snapshot of this report was posted last week. This is the more detailed version.

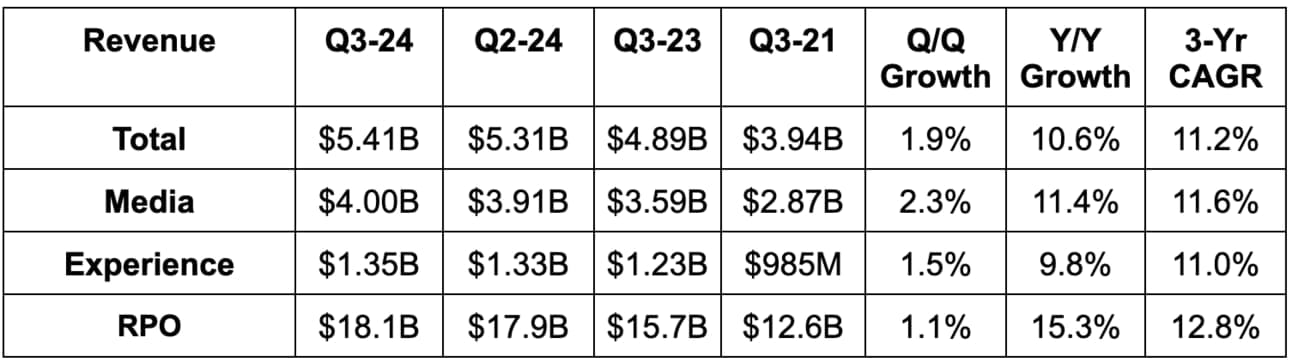

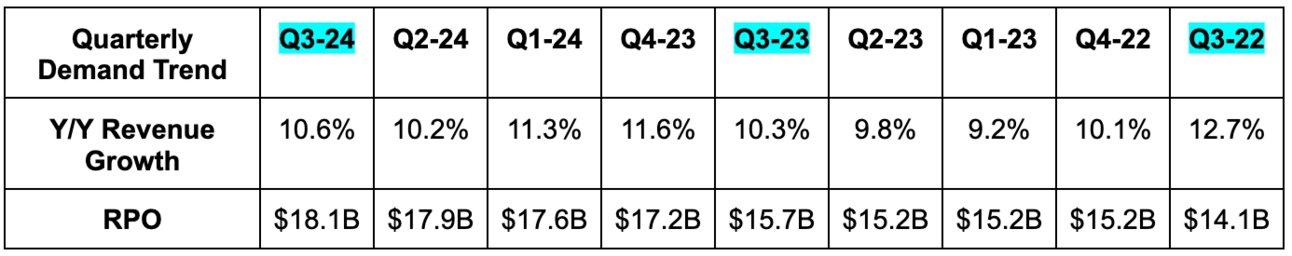

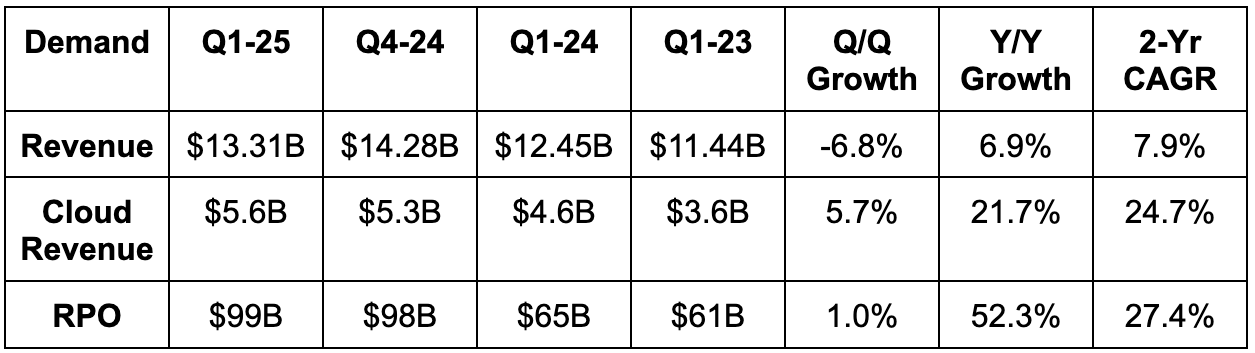

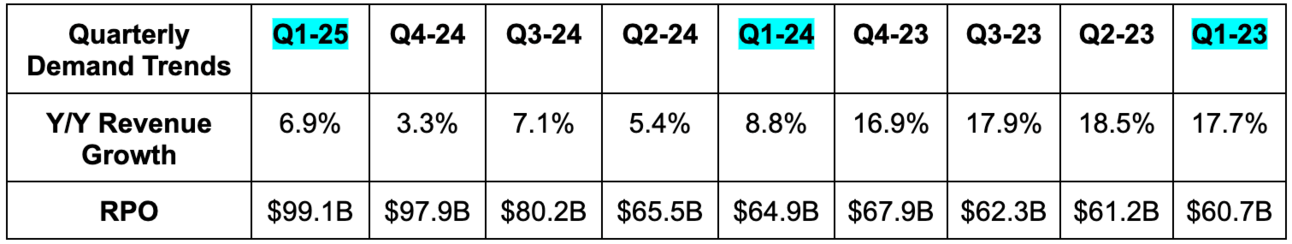

a. Demand

Beat revenue estimates by 0.7% & beat its guidance by 0.8%.

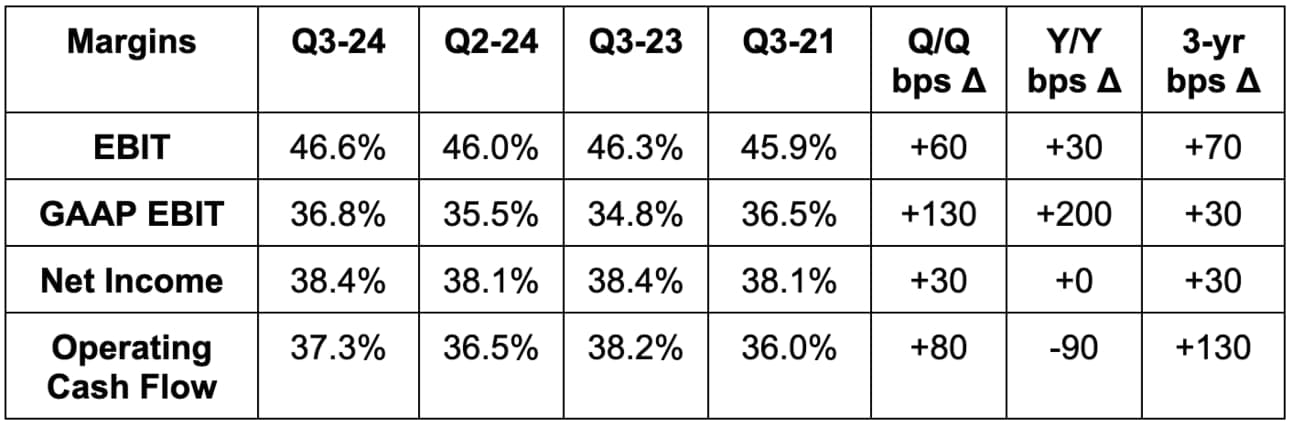

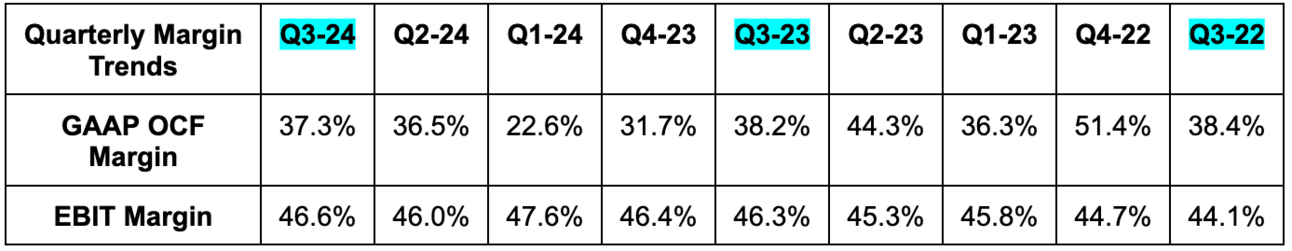

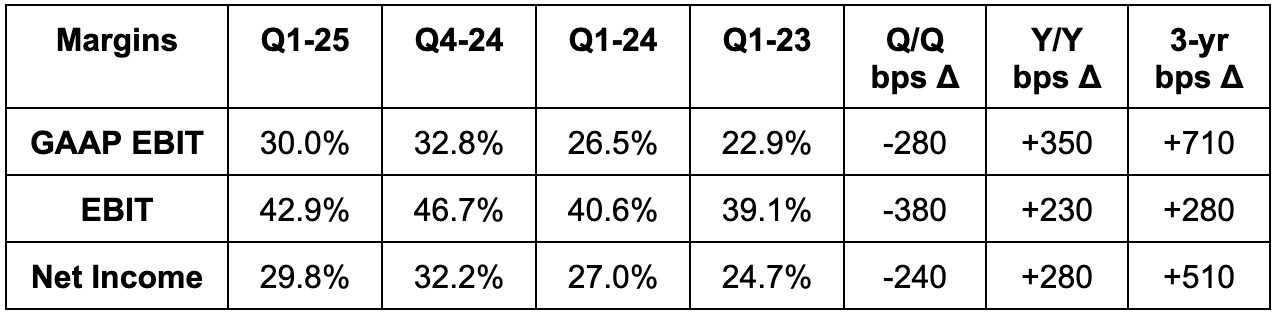

b. Profits & Margins

- Beat $3.50 GAAP EPS estimate by $0.26 & beat guide by $0.28. GAAP EPS rose by 23% Y/Y.

- Beat $4.54 EPS estimate by $0.11 & beat guide by $0.12. EPS rose by 13.7% Y/Y.

- Beat EBIT estimate by 2.4%.

- GAAP Operating Cash Flow (OCF) rose 7.9% Y/Y to $2.02 billion.

c. Guidance & Valuation

- Missed Q4 revenue estimate by 1.3%. Some deals expected to close next quarter closed this quarter, which impacted Q4 revenue guidance.

- Sees $5.525 billion in total revenue ($4.1 billion digital media; $1.37B digital experiences).

- Sees $550 million in digital media net new ARR.

- $3.60 GAAP EPS guidance & $4.65 EPS guidance slightly missed estimates by a few pennies each.

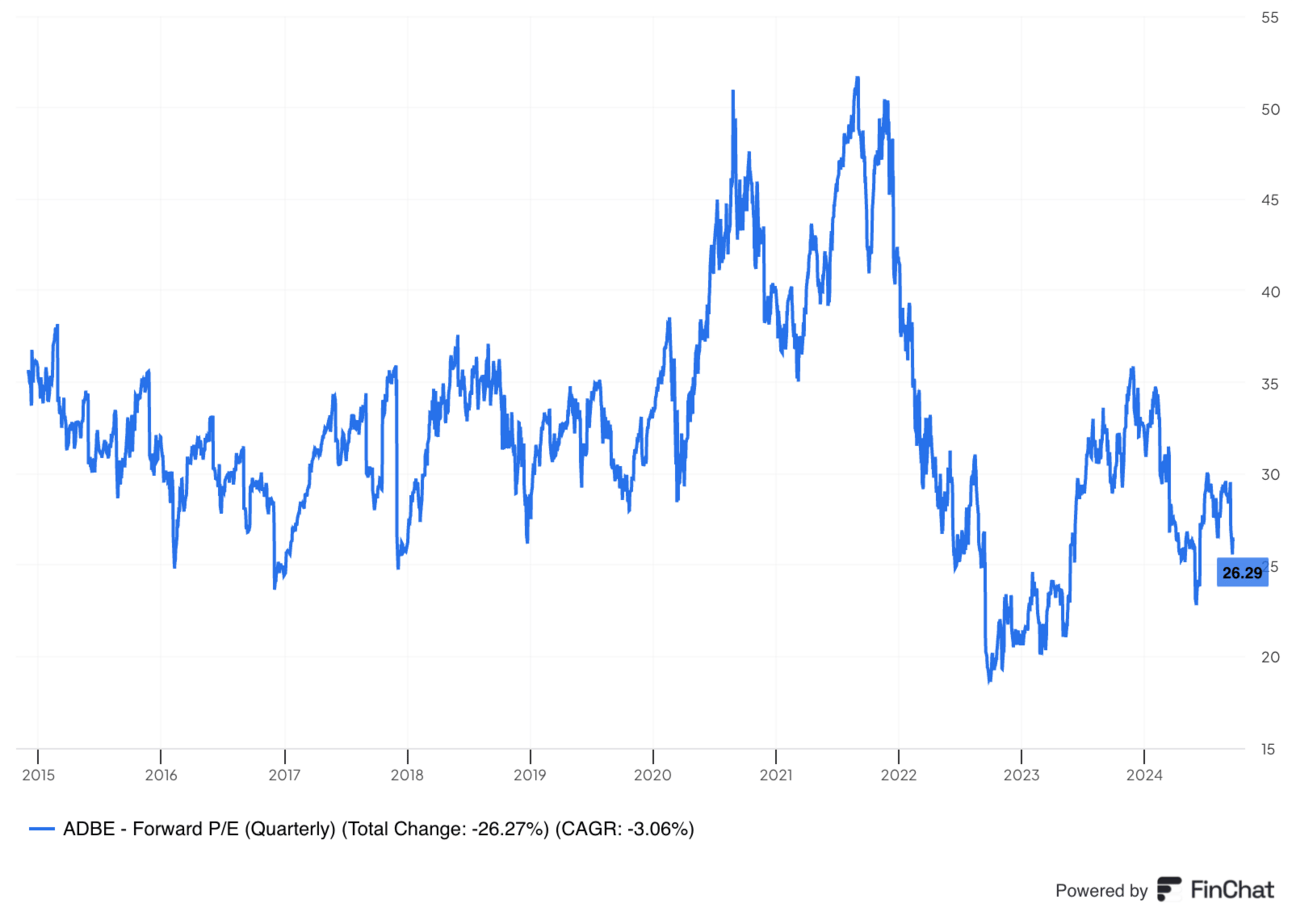

Adobe trades for 27x forward earnings. Earnings are expected to grow by 12% this year and by 13% next year.

d. Balance Sheet

- $7.5B in cash & equivalents.

- $5.6B in total debt.

- Share count fell 2.4% Y/Y.

e. Call Highlights

Digital Media – Document Cloud:

Adobe has an unparalleled amount of data within the unstructured PDF format. With the newer AI assistant in both Adobe Acrobat and Adobe Reader, it’s now actually able to allow data scientists to query conversationally; soon it will enable the creation of complete summaries or even slide decks from these PDFs. Pretty cool. Usage of the AI assistant in document cloud rose 70% Q/Q off of a small base. Its series of GenAI models (called Firefly) powers the AI assistant. For example, the image generation model is what will be used to form structured presentations out of seemingly jumbled PDFs. It’s also working on deeper integrations between its document cloud AI suite and Adobe Express (AI-infused app for creating digital assets) and, simply put, GenAI-inspired upgrades to its entire document cloud suite.

For the segment overall, net new ARR (NNARR) set new records and rose 24% Y/Y. Usage and user growth were positive across Reader and Acrobat, with the help of strong growth from added Chrome and Microsoft Edge extensions.

- Added multi-document support for Acrobat AI Assistant, as well as support for larger documents.

- Monetization for the AI assistant was called “strong.”

- Small and medium business (SMB) and reseller partner strength were category highlights this quarter.

- PDF sharing is going well and driving better communication and teamwork for clients (and Adobe too). Shared links rose by 70%+ Y/Y.

- Document cloud revenue rose 18% Y/Y (18% FXN).

- Added $163 million in net new ARR vs. $132 million Y/Y.

- Highlighted Charles Schwab, Disney, Home Depot and the U.S. Treasury Department as customer wins.

Digital Media – Creative Cloud:

Adobe (shockingly) added more tools for its Firefly models to Photoshop to “accelerate core creative workflows” while automating tedious tasks. That was the focus of this product section. In Illustrator, it enhanced text-to-pattern capabilities, debuted Generative Recoloring and added Generative Shape Fill (automates the conversational creation of vector graphics). It also added Generative Fill for Photoshop. Generative Remove is another AI-powered tool for Adobe Lightroom (photo editing); its strong adoption was explicitly called out by leadership. It also added generative expand functionality for Premiere Pro video editing.

- Application programming interface (API) calls (usage/traffic) rose 3x Q/Q (small base) within the creative cloud.

- Revenue here rose 10% Y/Y (11% FXN).

- Customer wins included Alphabet, Meta, Major League Baseball, Pepsi, Estee Lauder and the U.S. Navy.

- Debuted new “brush” tools for easier editing.

- $334 million in NNARR vs. $332 million Y/Y.

Document, Creative & Experience Cloud Convergence:

All three Adobe clouds are becoming more cohesive and interoperable with the help of GenAI. Document cloud is being used to vastly enhance the pace of creative cloud materials. Those materials are being readily used to drive better customer interactions in the Experience Cloud. It’s all better together. Adobe Express is really where all of this comes together, with go-to-market for this product ramping now and 1,500 enterprise customers signed during the quarter.

“We are amplifying creativity and productivity by enabling the convergence of products like Photoshop, Express and Acrobat as knowledge workers and creatives seek to make content more compelling and engaging. We're bringing together content creation and production, workflow and collaboration and campaign activation and insights across Creative Cloud, Express and Experience Cloud. New offerings, including Adobe GenStudio and Firefly Services, empower companies to address personalized content creation at scale with agility and enable them to address their content supply chain challenges.”

CEO Shantanu Narayen

GenAI:

In GenAI, Adobe sees its massive data as a key ingredient to compete. At the same time, per the team, the “greatest differentiation” comes at the user interface layer. It sees an unparalleled ability to drive value through many GenAI applications across its broad suite of tools. It also believes this broad suite of tools (again, massive dataset) better trains AI models to uplift utility.

“Given the early adoption of AI Assistant, we intend to actively promote subscription plans that include generative AI capabilities over legacy perpetual plans that do not.”

CFO David Wadhwani

For another example of products converging around GenAI innovation, Tata Consultancy Services (massive company in India) is using Adobe Premiere Pro (video editing) to transcribe videos and the AI Assistant in Acrobat to create written summaries of these videos.

- Recently debuted a Firefly GenAI model for video, imaging and vector graphics and design.

- The Experience Platform AI Assistant continues to drive incremental usage and adoption.

- Firefly has been used for 12 billion generations across Adobe’s product suite vs. 9 billion Q/Q.

Digital Experiences Business:

The company launched the Adobe Content Hub during the quarter. It’s a central destination for cross-department collaboration and content editing within the Adobe Experience Manager (AEM) (for optimizing interactions with potential customers). Broader collaboration also means more open access to AEM for 3rd party agencies that its clients routinely will work with.

Since debuting in March 2024, the Adobe GenStudio is already making an impact for some large clients. This product taps into GenAI to automate content creation, turbocharge the content supply chain and vastly bolster the amount of marketing materials a company can produce. It also comes with deep performance analytics indicating what’s actually working. Vanguard is using this tool to raise quality engagement rates with investors by 176% via more personalization. That personalization is a direct effect of GenAI making it rational to create marketing materials for smaller customer cohorts and interests.

- Adoption of its new Workfront product for workflow optimization, management and collaboration was called “strong.”

- Subscription revenue here rose 12% Y/Y FXN.

- Native apps within the overarching Adobe Experience Platform (AEP) are strong. Whether that’s the customer journey analytics app, journey optimizer, the customer data platform, or anything else, it’s all going well per the team.

- Wins for this segment included Home Depot, Johnson and Johnson and UPS.

- Multi-cloud adoption continued to stand out and support this newer category’s growth.

e. Take

I thought this quarter was rock-solid. GenAI adoption was a key risk for this firm a few quarters ago, but it has absolutely figured things out. While it’s not moving the financial needle like it is for infrastructure players, that should change as inevitable app monetization begins. The guidance miss isn’t concerning, as it is related to deal closure timing and this firm just continues to wonderfully compound top and bottom line at its large scale.

2. Oracle (ORCL) – Earnings Summary

Oracle provides a slew of software and hardware tools for on-premise and cloud environments… with an understandable focus on a continued shift towards cloud deployments. It has 3 main segments that tie very closely together.

Oracle Cloud Infrastructure (OCI) is its fully managed business for infrastructure services (virtual machines, storage, managed high-performance compute data centers etc.). This segment also includes platform services to build apps in its safe, controlled environment (server-less and container-based).

Strategic software as a service (SaaS) offers apps for human resources, enterprise resource planning (Oracle NetSuite) etc. It’s hard at work on launching more industry-specific software apps across areas like Healthcare. The full suite of these apps is called Oracle Fusion.

The last segment is Oracle Database (OD). Creating valuable apps from GenAI infrastructure requires great models and great data products to properly season those models. That’s where its Oracle Database (OD) product comes in. It provides a no standard query language (NoSQL) database for unstructured data which is highly important in the age of GenAI. Oracle closely integrates with the 3 big hyperscalers (Azure, Alphabet and most recently Amazon) to allow its OD database products to run anywhere. This also means that customers can migrate their on-premise databases to the cloud via OCI or through any of these hyperscalers, diminishing the friction associated with using OD. Oracle believes that this data cloud interoperability provides inherent cost advantages with data transferring. Cost benefits are estimated to be “several times cheaper” for model training than any competitive product, according to leadership. Oracle is also building 23 new OCI data centers for Azure and 12 for Google Cloud to support their GenAI developments (including OpenAI’s). These multifaceted partnerships are expected to be several year drivers of OCI and database growth.

Oracle is (re)-emerging as a digital infrastructure titan. While the company did take longer to roll out its high-performance compute product suite, that has since achieved fantastic traction. The results you see below are the byproduct of it taking its fair share of this massive high-performance computing infrastructure boom.

The snapshot of this report was posted last week. This is the more detailed version.

a. Demand

- Beat revenue estimates by 0.5% & beat guidance by 0.8%.

- Beat 7% Y/Y FXN growth guidance with 8% Y/Y growth.

- Cloud revenue met 22% Y/Y FXN growth guidance & met 21% Y/Y growth guidance.

b. Profits & Margins

- Beat $1.33 EPS estimates & beat identical guidance by $0.06 each.

- Beat $0.90 GAAP EPS estimates by $0.13.

- Beat EBIT estimates by 2.4%.

c. Balance Sheet

- $10.9B in cash & equivalents.

- $84.5B in total notes payable and borrowings ($9.2B is current).

- Diluted share count rose by 1% Y/Y.

- Dividend payments were roughly flat Y/Y at $0.40 per share.

d. Guidance, New Long Term Targets & Valuation

- Oracle reiterated annual expectations for 10%+ revenue growth, which compares strongly to 9.4% Y/Y growth expectations. It also reiterated faster than 50% cloud growth for 2025.

- For next quarter, 9% Y/Y revenue growth guidance beat 8.7% Y/Y growth estimates. $1.44 EPS guidance missed $1.48 estimates by $0.04.

At an analyst event right after the earnings call (not sure why they didn’t just do it then), Oracle set new fiscal year 2026 and 2029 targets. For 2026, it raised revenue guidance from $65 billion to at least $66 billion. Sell-side estimates at the time of the change called for $64.5 billion. Strong… but 2029 targets are exceedingly strong. Oracle sees more than $104 billion in fiscal year 2029 revenue. That compares to estimates looking for $89 billion for a 17%+ beat. The stock exploded higher on this news. Finally, it sees EPS growth ramping to 20% Y/Y by 2029 as well. From its current FY 2025 to FY 2029, sell-siders called for EPS growth ranging from 13% to 16%... meaning this is also better than expected. Oracle is back. I get that this is very far off, but its large backlog and multi-year subscription business does provide incremental visibility here.

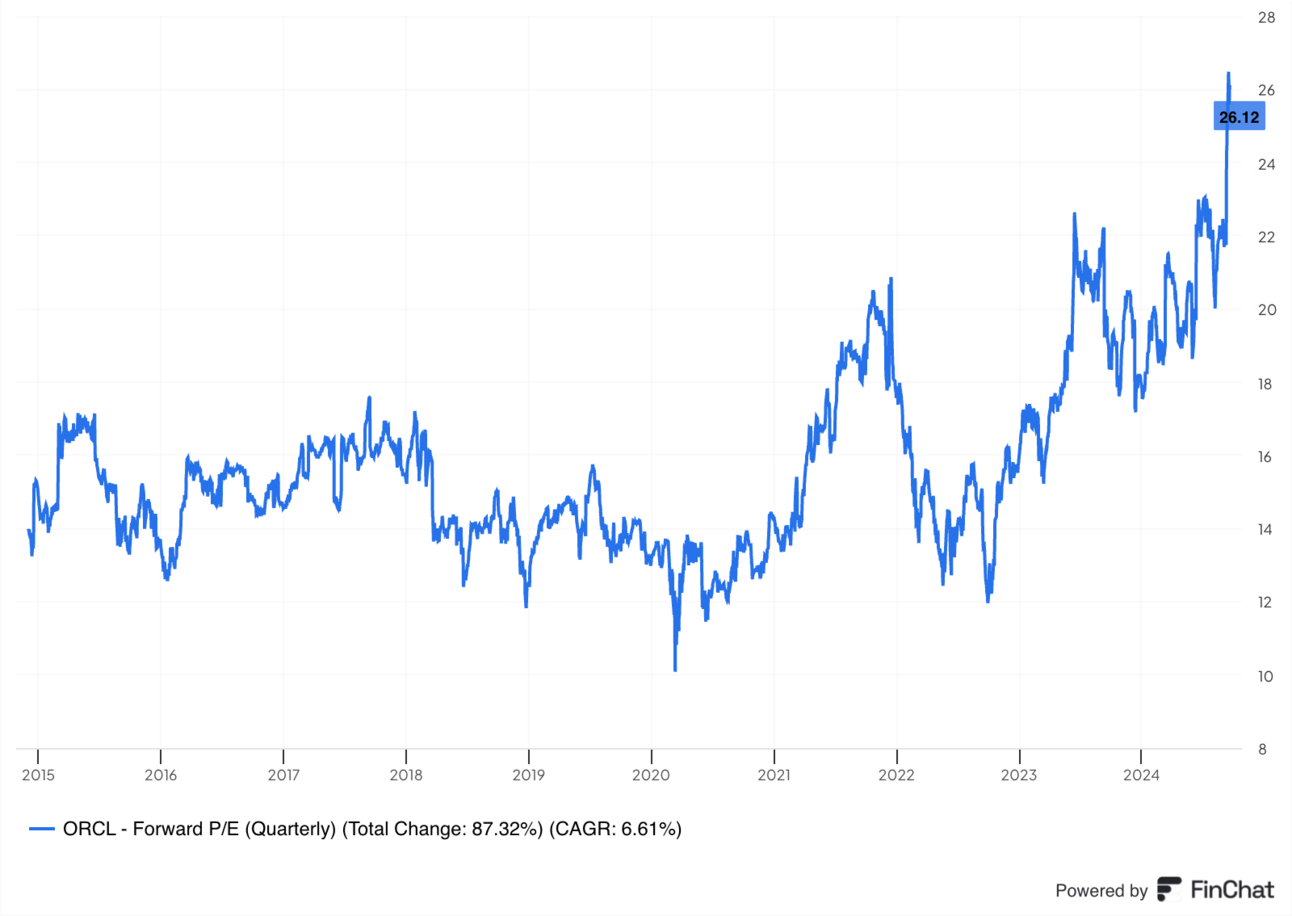

Oracle trades for 26x forward EPS. EPS is expected to grow by 13% Y/Y this year and by 14% Y/Y next year.

e. Call Notes

OCI:

Demand continues to comfortably outstrip supply, as Oracle gears up to double CapEx in 2025 vs. 2024 to support this phenomenon. There is massive demand to train LLMs and OCI + its databases (it thinks) provide the most flexible and efficient way to do this.

Its CapEx will continue to directly track bookings activity, and that activity remains very strong. For evidence, OCI consumption rose by 56% Y/Y and cloud RPO rose by a whopping 52% Y/Y despite tough comps; it also reversed a normal seasonal pattern of Q/Q RPO declines for this quarter. That’s the fantastic large contract momentum in action.

Oracle now has 85 live cloud regions with 77 more projects coming soon. The largest of this is an 800 megawatt data center that supports “acres” of Nvidia GPU clusters. It will soon build a datacenter with a full gigawatt of capacity. To account for these massive energy needs, it plans to build small nuclear reactors. We’ve also just learned about Azure using nuclear power partnerships for its own infrastructure.

“That's what's required to stay competitive in the race to build one, just one of the most powerful artificial neural networks in the world. The stakes are high and the race goes on.”

Founder/Chairman Larry Ellison

Database Edge:

Ellison spoke on Oracle’s Exadata database cloud services running on its own RDMA networks. Exadata is a specialized computer system that is blazing fast and can handle massive swaths of data. RDMA stands for Remote Direct Memory Access and allows for cheaper, quicker, more efficient communication between computing systems. He also thinks this setup provides an “order of magnitude” improvement in performance, scalability, reliability and security vs. other databases, while being the first fully autonomous database for training models. The end result of this foundation is Oracle being a compelling database vendor for countless clients. Apparently, the 3 hyperscaler partners believe that as well.

Demand Context:

- SaaS rose by 10% Y/Y.

- Back office SaaS app revenue is now at an annualized revenue rate of $8.2 billion, representing 18% Y/Y growth.

- App subscription revenue rose 7% Y/Y.

- Infrastructure as a Service rose by 46% Y/Y despite 64% Y/Y growth last year.

- Infrastructure subscription revenue rose 14% Y/Y.

- Cloud services and license support revenue rose 11% Y/Y via strategic cloud apps and more. It exited the advertising app business this quarter, which hit overall cloud application growth rates by 2 points. It did this to focus on its core businesses.

- Cloud database service revenue rose 23% Y/Y. It sees partnerships with the 3 hyperscalers boosting growth here for years to come.

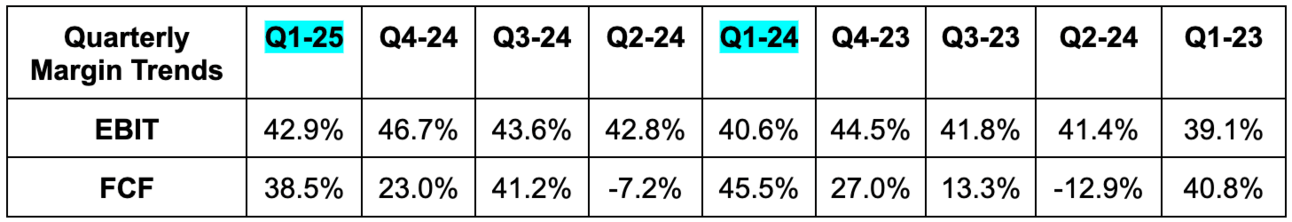

Margins:

Oracle did get a bit of help on operating expenses from extending the useful life of some servers from 5 years to 6 years. This is it trying to milk utility from general compute infrastructure and avoid spending more there as it embraces the high performance compute boom. We’ve seen many, many other companies do the same… Meta, Amazon, Alphabet, Zscaler, Cloudflare etc. Nothing shady here, although EBIT would have been a small miss without this help.

Cloud gross margin on the app and infrastructure sides continue to rise as it finds efficiencies through improving economies of scale. Really good to hear.

e. Take

The quarter was really good… the 2029 guidance that came after it was elite. It clearly shows all of us that Oracle is far from a dinosaur. It is still a go-to database vendor, with cutting edge apps and infrastructure to round out the suite. Growth is accelerating, RPO growth points to that continuing and margins are not at all suffering during a time when many are spending like crazy to keep up with competition. Really impressed with this company. Congratulations to shareholders.