To view my current portfolio & sign up for my free, real-time transaction alerts, click here.

1. CrowdStrike (CRWD) -- Institutional Channel Checks & An Accolade

a) Channel Checks

Stifel raised their price target on CrowdStrike to $220, and I don’t care about that at all. So what do I care about? The reasoning behind their bullishness. The institution surveyed an extensive cohort of CrowdStrike customers which revealed momentum remaining consistently strong for its services. Great news -- but maybe not all that surprising to those closely following the space. RBC threw in another bullish note this week in response to a strong demand pipeline. Love to hear it. Perhaps that’s why the company has 716 active job openings while countless other public firms pull back on hiring or layoff their talent. CrowdStrike is scooping up this dislocated talent hand over fist.

b) Accolades

CrowdStrike’s indicators of attack (IoA) tool was recognized this week by CRN as one of the 10 most popular new Cybersecurity products for 2022. Another day, another trophy for George Kurtz and his team. Finally, Frost & Sullivan named CrowdStrike a recipient of its Global Technology Innovation Leadership Award in endpoint security. Its frequently relevant and impactful innovation was the deciding factor.

2. Upstart (UPST) -- New Partner & Auto

a) New Partner

Upstart announced Alliant Credit Union as its newest referral network partner. This is the largest credit union win for Upstart to date… by far. Alliant has 650,000 members and over $15 billion in assets making it one of the 10 largest credit unions in the United States. Since the company announced a relationship with the National Association of Federally Insured Credit Unions (NAFCU), it has been able to seamlessly add new partners here -- regardless of a volatile economy.

I’ve seen some take to Twitter to voice their opinion that these pieces of news don’t matter. I think that they are entirely wrong. Upstart’s platform today is severely funding constrained. It is turning down borrowers left and right due to unavailability of capital market or partner funding to originate these loans. As long as record inflation, record low consumer confidence and aggressive monetary tightening persists, this funding will likely remain challenged.

Infusing a massive credit union like this one into the referral fold provides Upstart more funding capacity to place loans AND a lot more data to season its own models. Upstart’s marketing spend also directly floats with its conversion rate which has been hit by these funding issues. Translation? More funding supply raises Upstart’s conversion and justifies more marketing spend from the company to juice growth & traffic.

It’s objectively a significant win. Furthermore -- when loan appetite does return with easing macro concerns -- Upstart leaning back on capital markets and fast money hedge funds for its growth will again make its operations look incredible during fun times, and awful during down times. So? It needs to continue shifting its funding mix to partners like Alliant to build a more sustainable model. These partners can hold loans to maturity, have access to lower cost of capital, and so are innately more sustainable funding partners amid macro deterioration. They still pull back -- especially now while Upstart continues to build out its proof of concept -- but significantly less than capital market investors.

The company is trying to find longer term capital market funding to more reliably conduct loan origination across cycles. But that’s just a transitional Band-Aid. The real prize needs to be partners funding the vast majority of its loans. We’re getting there, but long way to go.

b) Auto

Upstart’s Auto Retail product launched in Ohio and Texas this week.

Click here for my Upstart deep dive.

3. Shopify (SHOP) -- "Collabs"

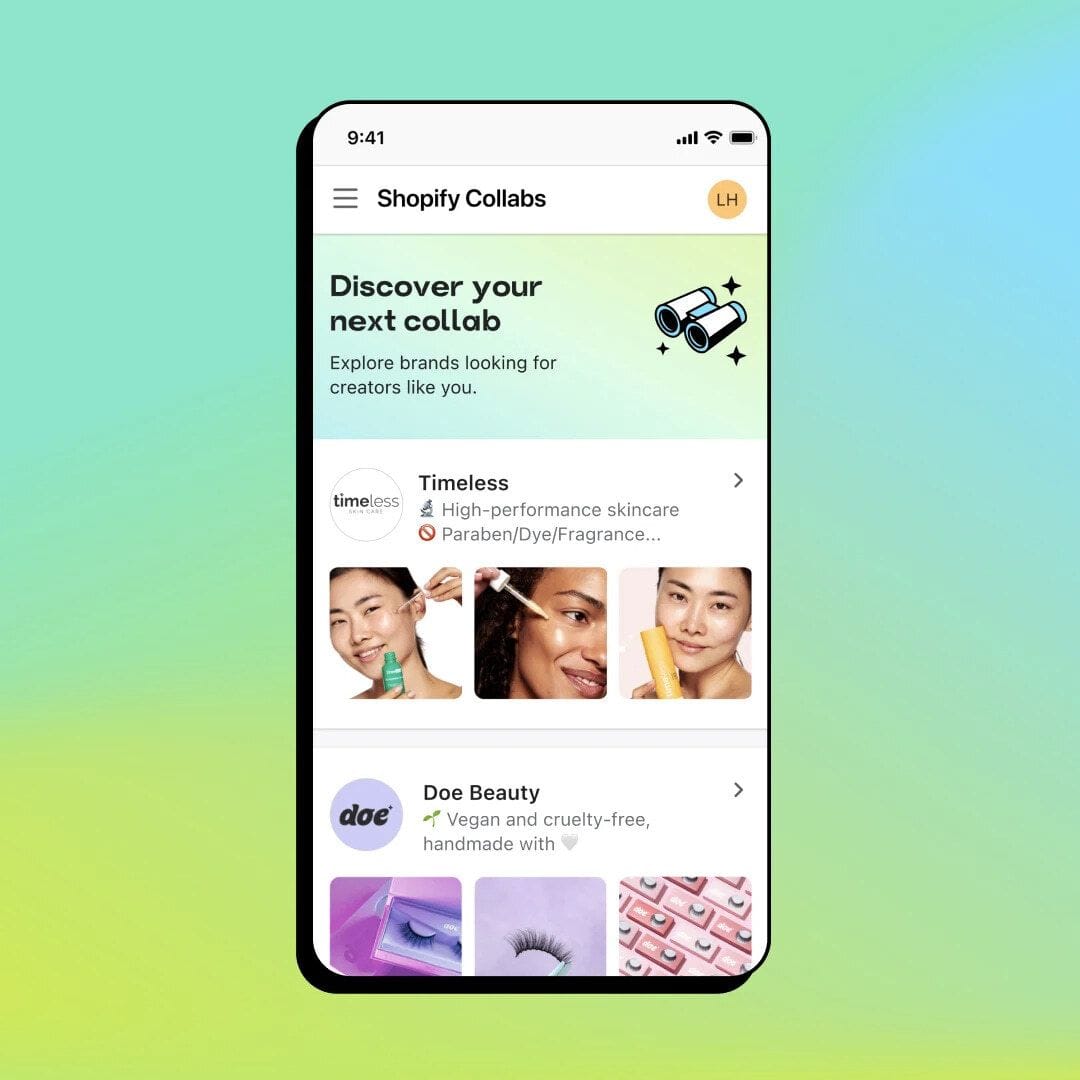

Shopify debuted “Collabs” this week as its latest product enhancement. Collabs is a unique spin on influencer marketing that companies like Revolve have used to thrive. What it does is allows creators (after approval) to search through a curated list of merchants most relevant to their own brands. They can then use Shopify’s “Linkpop” function to pick and choose individual items from a merchant's site to display on their own shop. When they generate sales, they share revenue with the merchant.

Shopify believes in creators being the future of entrepreneurship. Still, just 4% of these creators are full time due to the severe challenges in identifying marketing opportunities. I can attest to this firsthand. Aside from writing, communicating and pitching sponsors is my most time consuming activity. Shopify is trying to make this search process FAR more targeted and relevant. Creators are helped with monetization while merchants reach new, incremental audiences. This tool plugs directly into Shopify’s social partners like TikTok, YouTube and Instagram through the Shopify Integrations tool.

From the Company Press Release

Today, Collabs is now live for all North American merchants.

Anything Shopify can do to create value for its merchant base is the primary key to its long term success. If merchants don’t get incremental value from being on Shopify, they’ll just go to another solution. The company has done things like leverage its built-in consumer base to create marketing tools for merchants, and Collabs is its latest attempt at differentiation. To me, this seems like a very timely launch, but we’ll have to see what kind of traction it gains.

Click here for my Shopify overview.

4. The Trade Desk (TTD) -- Accolade & a Study

a) Forrester

Forrester named The Trade Desk as the top leader in business to business advertising. That piece of the company does not get much attention, but perhaps it should get more. Not only does The Trade Desk provide the most robust and utility-building ad platform for agencies to tap into relevant consumers, but it does so for enterprise marketing as well.

All of this is vital for The Trade Desk continuing to outperform advertising markets and overall economic growth regardless of where we are in the macro cycle. Amid times of exogenous turmoil, marketing budgets -- regardless of if they’re targeted at consumers or other businesses -- are among the first to be shrunk. This forces CMOs to extract as much return on ad spend (ROAS) as they possibly can with their now more finite resources. Time and time again, The Trade Desk has shown its ability to optimize for ROAS for these clients -- which is why it took more market share this past quarter than at any point in its history and is why its growth continues to accelerate in the face of daunting obstacles. I’ve said it before and I’ll say it again: The Trade Desk is best in breed.

b) Canada Study

The Trade Desk ran a survey with YouGov of 1,000 consumers in Canada. The findings were encouraging and unsurprising:

- 70% of respondents under age 44 are cutting the cord.

- Linear remains the go to for live content -- but that’s now shifting with almost 40% of Canadians watching sports via “nontraditional means.” 9/10 of the most watched shows are live sporting events. This is the final domino to fall.

- ~50% of viewers have multiple streaming services.

- 48% prefer to see ads over paying a subscription.

Click here for my TTD Deep Dive.

5. Duolingo (DUOL) -- Math

Duolingo’s lovable founder took to Twitter this week to announce an expansion of a Duolingo beta program. It’s Math App is now available for testing with a large cohort of customers.

Duolingo is clearly the de-facto digital language learning platform. To be an iconically successful investment, I think it needs to establish a significant niche as a go-to platform for all learning. That would expand its already large and growing addressable market more than 10 fold. Early success with its children’s literature product and Duolingo English Test offer concrete evidence of its ability to use the language learning product as a core for building adjacent product lines. We’ll see how this math product does -- I’m optimistic.

Click here for my Duolingo Deep Dive.

6. SoFi -- SoftBank

SoftBank continues to sell off large blocks of its SoFi stake. To me, this troubled institution's liquidity needs or views on SoFi don’t matter much to me. I simply include this because I know readers will ask me why it’s missing if I don’t.

7. Penn National Gaming (PENN) -- Barstool

Penn’s stake in Barstool -- as part of the original deal terms -- rose from 36% to 50% this past week. Penn was able to do that at the original $450 million valuation which represents about 2X 2021 Barstool sales. As part of this maneuver, Penn gained the right the purchase the remaining 50% of Barstool which it announced it chose to do at a $650 million valuation.

Barstool has been a shining star for Penn since it acquired a stake in the polarizing sports media company. With nearly 100 million social media followers across platforms, this company has a wildly passionate base of “Stoolies” eager to support the brand. The effect of this has come in the form of things like more efficient market share gains with less promotional spend in sports gambling and immediate 20-30% traffic boosts from re-branding table games and retail sports books to Barstool. Barstool has also effectively and drastically lowered the median age of a Penn consumer -- thus lengthening the runway for its growth.

Penn’s casinos boast a leading regional market share in the United States, its Score Media is the most popular app and book in Canada, and Barstool is a freight train going full speed ahead. This is a North American entertainment powerhouse in the making -- just my view.

8. Meta Platforms (META) -- Reels

Meta is expanding its Facebook Stars program. As a reminder, this initiative allowed for more direct, fully interactive connections between loyal fans and influencers through Reels. This week, Facebook announced that it will now enable these influencers to generate revenue through their popular content. This is a continuation of Facebook trying to cater to content creators with more favorable revenue sharing agreements.

The program began beta testing a few months ago with some of its most popular creators. The results have been very encouraging to date. Creators can cross-post these Reels to both Instagram and Facebook.

Finally, an account on Twitter (@Fbbagholder) posted a redacted congressional study on the efficacy of Reels vs. TikTok. It revealed what we already knew: Reels has a long way to go to catch up to the appeal of TikTok. And Meta knows that. This was a long report that I plan to cover in detail next week. For now, I wanted to share that overarching takeaway and provide a link for anyone wanting to read it themselves.