I will be publishing an updated SoFi investment case article in the next few weeks. The next long form piece after that is going to be on Mercado Libre (MELI). After that, Coupang (CPNG). Stay tuned!

During the week, I published Palo Alto & Snowflake earnings reviews, as well as some news on PayPal.

Table of Contents

- 1. Workday (WDAY) – Earnings Review

- 2. Earnings Round-Up – Intuit (INTU); Bill.com (BI …

- 3. Cava (CAVA) – Earnings Review

- 4. Uber (UBER) – General Motors Partnership

- 5. SentinelOne (S) & CrowdStrike (CRWD) – Wells F …

- 6. Amazon (AMZN) – Various News

- 7. Market Headlines

- 8. Macro

1. Workday (WDAY) – Earnings Review

Workday is a cloud-native, enterprise-facing platform that specializes in human resources, financial management, strategic planning and data analytics. At the center of WorkDay is its “intelligent data core.” This has 70 million users and one of the largest revenue bases in enterprise software to more thoroughly train algorithms and products. The data core supports security, privacy, analytics, compliance and workflow frameworks. These frameworks are all borrowed to form its Human Capital Management (HCM) platform and its Financial Services+ (FINS+) platform. It helps companies maximize job applicants, flag problem workers, drive better communication and foster more productive work. It also automates and organizes all core financial management functions for large enterprises.

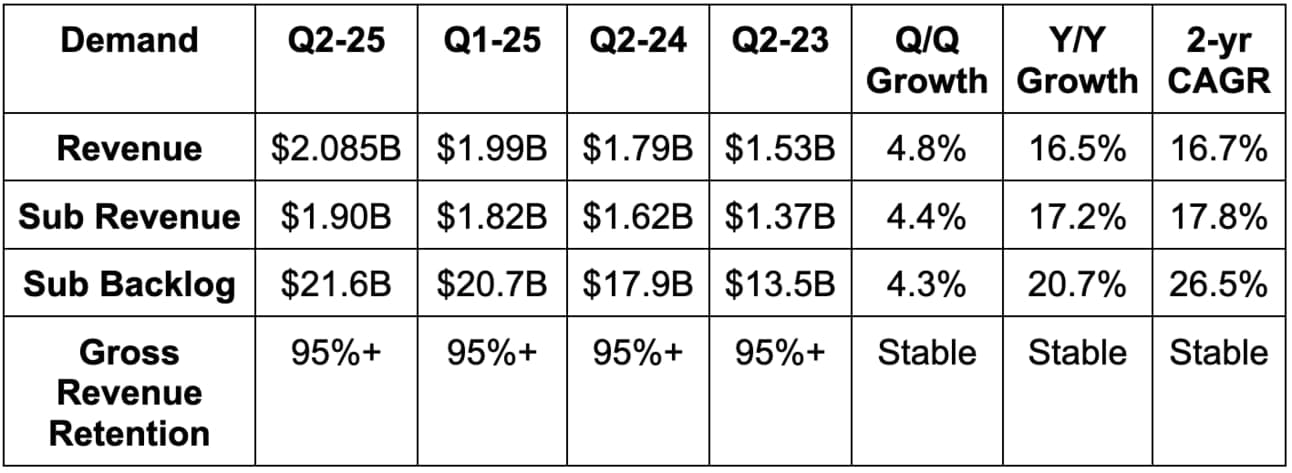

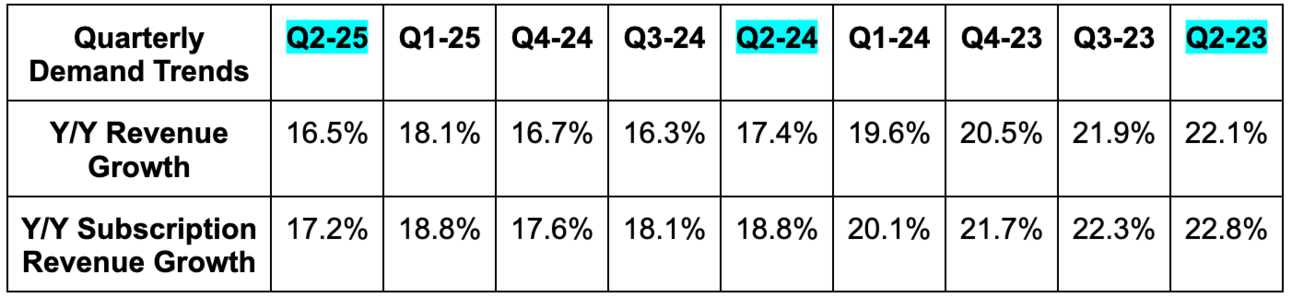

a. Demand

- Met subscription revenue estimate & slightly beat guide.

- U.S. revenue rose by 16% Y/Y; international revenue rose by 14% Y/Y.

- Beat revenue estimate by 0.8%.

- Backlog growth was held back a tad by strong early renewals in the prior year period.

- Net revenue retention remains “over 100%.” If that means 120%, it’s great. If that means 101%, it’s not. More specificity, please.

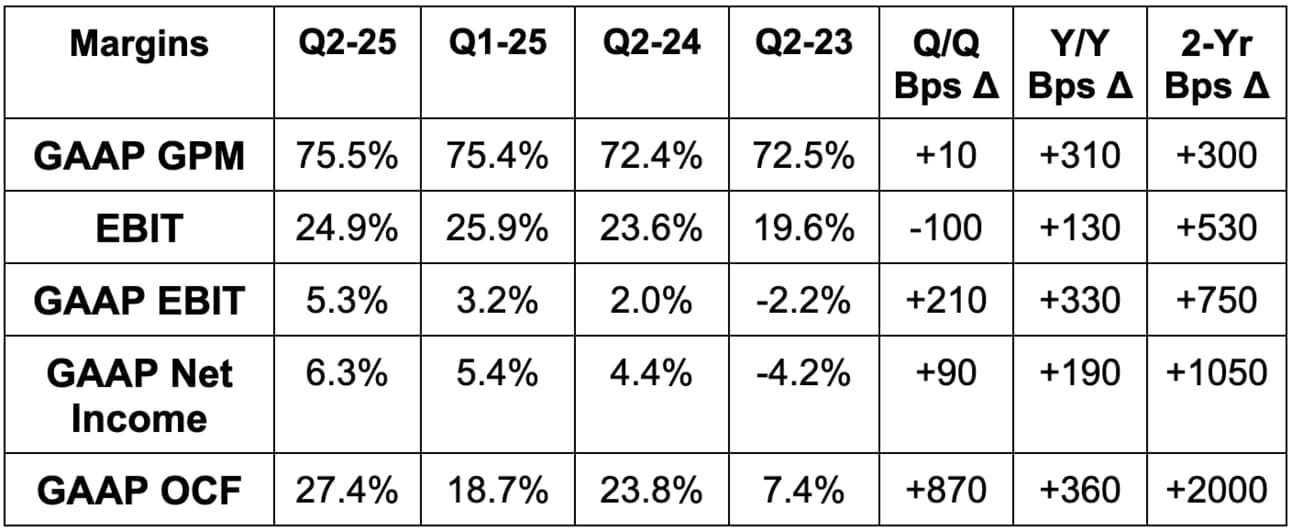

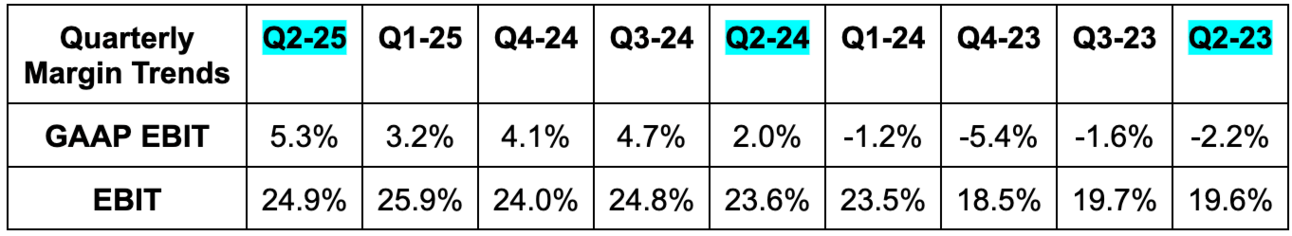

b. Profits & Margins

- Beat EBIT estimate by 1.6%; beat EBIT margin guidance by 40 bps.

- Beat $1.65 EPS estimates by $0.10; beat $0.43 GAAP EPS estimates by $0.06.

- Beat free cash flow estimates by 30%. This metric is very lumpy on a quarterly basis & related to timing of payments & collections, which is quite difficult to model.

c. Balance Sheet

- $7.37B in cash & equivalents.

- $3.0B in debt.

- Diluted share count rose by 1.3% Y/Y. Added another $1 billion in buyback capacity.

d. Annual Guidance & Valuation

- Reiterated annual subscription revenue guide, which very slightly missed estimates (could call it a rounding error and a meet). Sees 16%+ subscription revenue growth for the second half of the year.

- Raised annual EBIT margin guide from 25% to 25.25%.

- Slightly beat Q3 EBIT margin estimate.

- Backlog growth to continue being held back by strong early renewals in the prior-year period. Sees backlog growth of 14.5% in Q3.

Workday announced a small shift in its multi-year strategic approach. It will forgo some subscription revenue growth in favor of faster margin expansion and has “identified places to drive efficiency across the business. Still, it sees revenue compounding at a roughly 15% clip over that period vs. expectations of roughly 14.5% compounding. And furthermore, it sees EBIT margin getting to 30% vs. expectations of 29%. I love when companies prioritize margin expansion yet still guide to outperforming revenue growth. Strong.

e. Call & Release

Platform Play:

For the last two years, platform players have reigned in market share growth when compared to disparate point solutions. As we frequently cover, platforms mean vendor consolidation, better product cohesion, easier inter-department collaboration, broader efficiency and lower customer acquisition cost. They allow companies to do “more with less” during a time when that’s especially converted. WorkDay is the de-facto human resources cloud platform and is quickly establishing itself as a leader on the finance side too. It’s right up there with ServiceNow in workflows, Salesforce in customer resource management and CrowdStrike (yes still CrowdStrike) in cybersecurity. This is a cloud platform king, and this quarter simply provided more evidence of how true that is.

Deal scrutiny and moderating client headcount growth did not improve Q/Q. Considering WorkDay’s growth is tied to seats per client, these are both headwinds and neither is abating. Its outperforming results were in spite of this. Win rates remained very high, full-suite sales momentum remained robust and gross revenue retention remained over 95% as “clients focus on productivity,” which WDAY provides in droves. Why the resilience? Again, it allows companies to “manage the two most fundamental elements of business” (people and money) from one cohesive platform, with a complete set of use cases. That’s the formula. The formula is working.

- Customer expansions highlighted:

- Target, Nissan, Clemson and J.B. Hunt

- Customer wins highlighted:

- Lam Research, the City of Cleveland, a New Zealand Ministry and Johns Hopkins.

- Momentum was strongest within higher education, healthcare and the public sector.

Partner-Friendly & AI:

“Built on Workday” is its product that enables customers to granularly customize WorkDay apps and offerings. Workday “Extend” is the environment where this customization takes place. This bolsters potential utility and product breadth and delivered 75% Y/Y contract value growth this past quarter. Extend Pro, which combines its developer environment and GenAI work, was the largest contributor. As an augmentation of Extend Pro, WDAY introduced the Extend Developer Copilot this quarter. Like other copilots, this helps morph tedious workflows into automated, conversational tasks. It unleashes large language models (LLMs) and diminishes complexity associated with writing new programs through WDAY.

From an AI partnership point of view, the Workday AI Gateway is a fully managed connector of 3rd party developers to its AI products. It added new APIs to this tool during the quarter to enhance ease of integration and use.

- Revenue contributions from partners doubled Y/Y as it gets more aggressive in pursuing this growth outlet.

- Announced a new Salesforce partnership to “accelerate employee onboarding, financial planning and sales cycles.” It combines AI data sets to drive each other's success.

- Announced a new Employment Verification Connector within its Equifax partnership.

More on AI & New Products:

WDAY bought HiredScore last quarter to expand further into AI-powered talent matching. WDAY plans to use its algorithms to greatly enhance the value of its human resources tools for talent optimization, acquisition and management. One quarter in, HiredScore AI for Recruiting and Talent Mobility were both integrated into WDAY’s suite and are now offered as standalone products too. With HiredScore for Talent Mobility, one customer enjoyed a 40% boost in job applicants. That’s notable. GenAI has to actually provide tangible value to be monetizable. This example and a few others, like a 39% reduction in employee turnover, were called out during the call. Workday markets its AI platform as providing superior data scale and apps to power incremental utility. That’s extremely abstract, which is why I love concrete case studies here. WDAY is one of the few software names providing them.

- Workday teased many AI product launches coming at its Workday Rising event coming up.

- Added new layers of existing work automation to HCM.

- Launched a new payroll tool as part of its 2021 Strada purchase. This offers employee time management, benefits organization, tax compliance help etc.

Going Global:

Japanese traction is accelerating as recent foundational investments are paying off. It added new partners there to continue the momentum. In Australia, it was “accepted to the government's Digital Transformation Agency Software Marketplace for ERP, opening new opportunities with federal agencies.” Finally, deal scrutiny remains especially elevated in Europe. Its go-to-market team overcame this by delivering an acceleration in large deal volume.

Final Notes:

- This newer segment crossed 2,000 customers during the quarter (about 19% of total).

- Maintained 95%+ customer satisfaction.

- VNDLY, its complete workforce management tool spanning full time workers to freelancers was called out as a product standout this quarter.

- Forrester Wave again named it a leader for Enterprise Resource Planning (ERP).

f. Take

This is more of the wonderfully boring, drama-less execution we’ve come to expect from WDAY. It’s a cloud king with a massive runway and a team capable of capturing it. More compounding, leverage, cash printing and successful product debuts. Another good quarter.

2. Earnings Round-Up – Intuit (INTU); Bill.com (BILL)

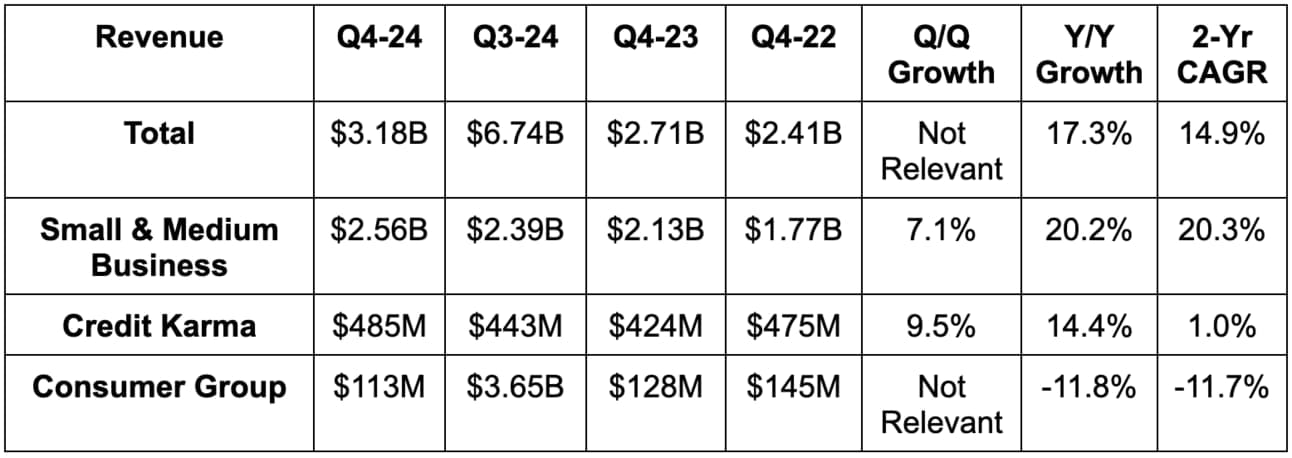

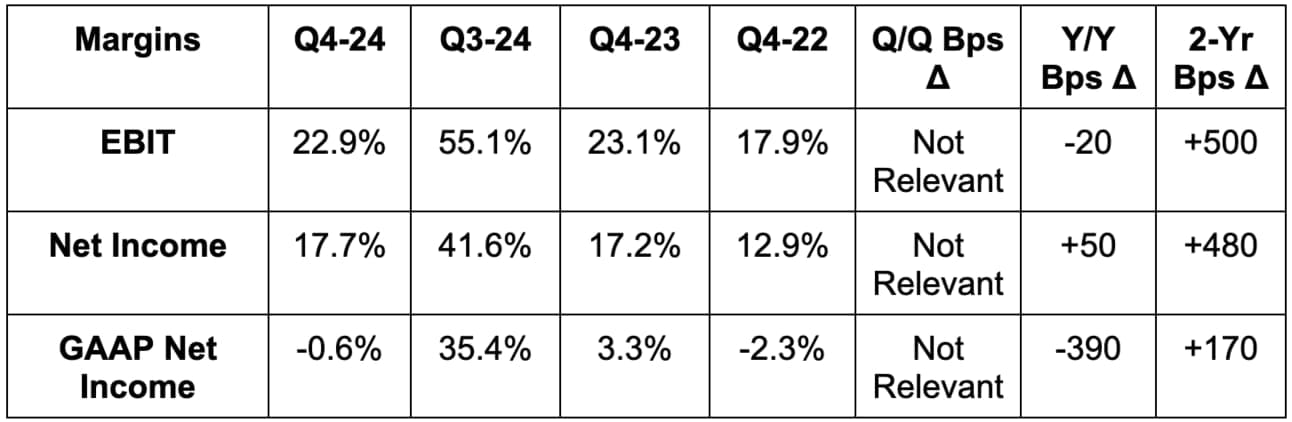

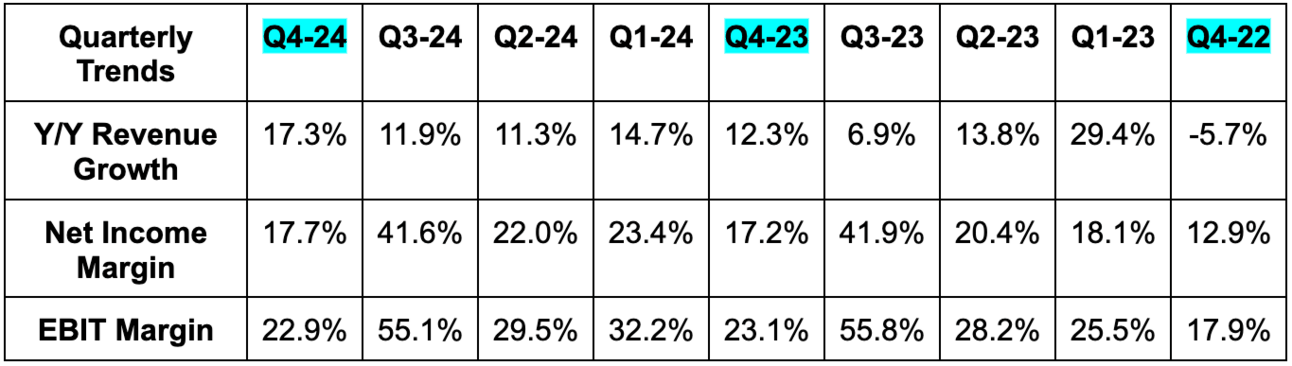

a. Intuit

Intuit owns TurboTax, Credit Karma, QuickBooks and Mailchimp.

Results:

- Beat revenue estimates by 2.9% & beat guidance by 3.2%.

- Beat EBIT estimates by 3.4%.

- Missed $0.28 GAAP EPS estimates by $0.35.

- Beat $1.85 EPS estimates by $0.14.

Tax season heavily influences quarterly revenue generation for INTU. It gets a massive fiscal Q3 bounce every year.

Balance Sheet:

- $4.1B in cash, equivalents & short term investments.

- $131M in long term investments.

- $6B in total debt ($500 million is current).

- Diluted share count fell by 1.1% Y/Y.

Guidance & Valuation:

For fiscal year 2025:

- Revenue guidance beat by 0.5%.

- EBIT guidance beat by 0.7%.

- $12.44 GAAP EPS guidance beat by $0.19.

- $19.26 EPS guidance beat by $0.10.