Table of Contents

- 1. Tesla – Deliveries & Earnings Setup

- 2. Comp Sheets – Mature Growth EBIT Comp Sheet; Fa …

- 3. Mercado Libre (MELI) & NU (NU) – Brazilian Mone …

- 4. DraftKings (DKNG) & Flutter (FLUT) – Some Data …

- 5. Meta (META) – Another Emerging App & Some Thoug …

- 6. Microsoft (MSFT), CrowdStrike (CRWD), Palo Alto …

- 7. Market Headlines

- 8. Macro

1. Tesla – Deliveries & Earnings Setup

Tesla delivered 444,000 cars during Q1 compared to 438,000 estimates, representing a 1.4% beat. This is certainly good news for bulls. The auto industry is hyper-cyclical and rate sensitive and there was a risk that analysts had not yet baked enough weakness into their forecasts. This points to demand stability. It’s a piece of data that depicts Tesla enduring these tough times reasonably well. That, paired with some likely short covering, is why the stock responded so positively to this news.

As we head into its earnings report this month, what is left to focus on? Pricing & margins. First is the actual price tag tied to these vehicles. Tesla has slashed prices of some models to help with affordability amid the higher cost of capital environment. It has been able to offset this by pulling some input costs out of its car manufacturing processes, but overall auto gross margin did continue to erode last quarter. Tesla has frequently stated in recent quarters that it’s willing to offer lower upfront prices and rely on more software subscription upsells down the road to “harvest more margin.”

This approach makes it even more difficult for legacy automakers to build their own EV programs to compete. Remember that Tesla’s EV margins are already best-in-class by a large amount. The debut of a $25,000 mass-market model, which borrows from existing production capacity to cut program costs, will make competing even tougher for incumbents too. Potential market share gains from this debut should happen while the maturation of its Cybertruck manufacturing, 4680 cell battery production, and Model 3 production in Austin all take place. Maturation means more efficient capacity utilization and more margin.

This is the glass half-full view, with bears instead saying these cuts are in response to eroding competitive differentiation, as well as EV fatigue and recent strength in plug-in hybrids. Some simply believe that others are catching up to Tesla’s technological lead – especially in China where Tesla does a ton of business. Continued Y/Y delivery declines and Tesla beating an already sharply lowered delivery estimate are their two centerpieces of evidence. Skeptics also continue to point out how cyclical this industry is, and how the fun part of the cycle (easier monetary policy) has yet to begin.

The quarter should be a fascinating one as always. Expectations are higher vs. last report, as the company’s stock finds itself on stronger footing heading into this month’s event. “Better than feared” won’t cut it like it did three months ago. The firm will need to show real signs of turning a corner and getting back to the fundamental EV king that it has been in recent years. We shall see how they do. My popcorn is ready. It’s hard to bet against Elon… like him or not.

2. Comp Sheets – Mature Growth EBIT Comp Sheet; Fast Growth Gross Profit Comp Sheet

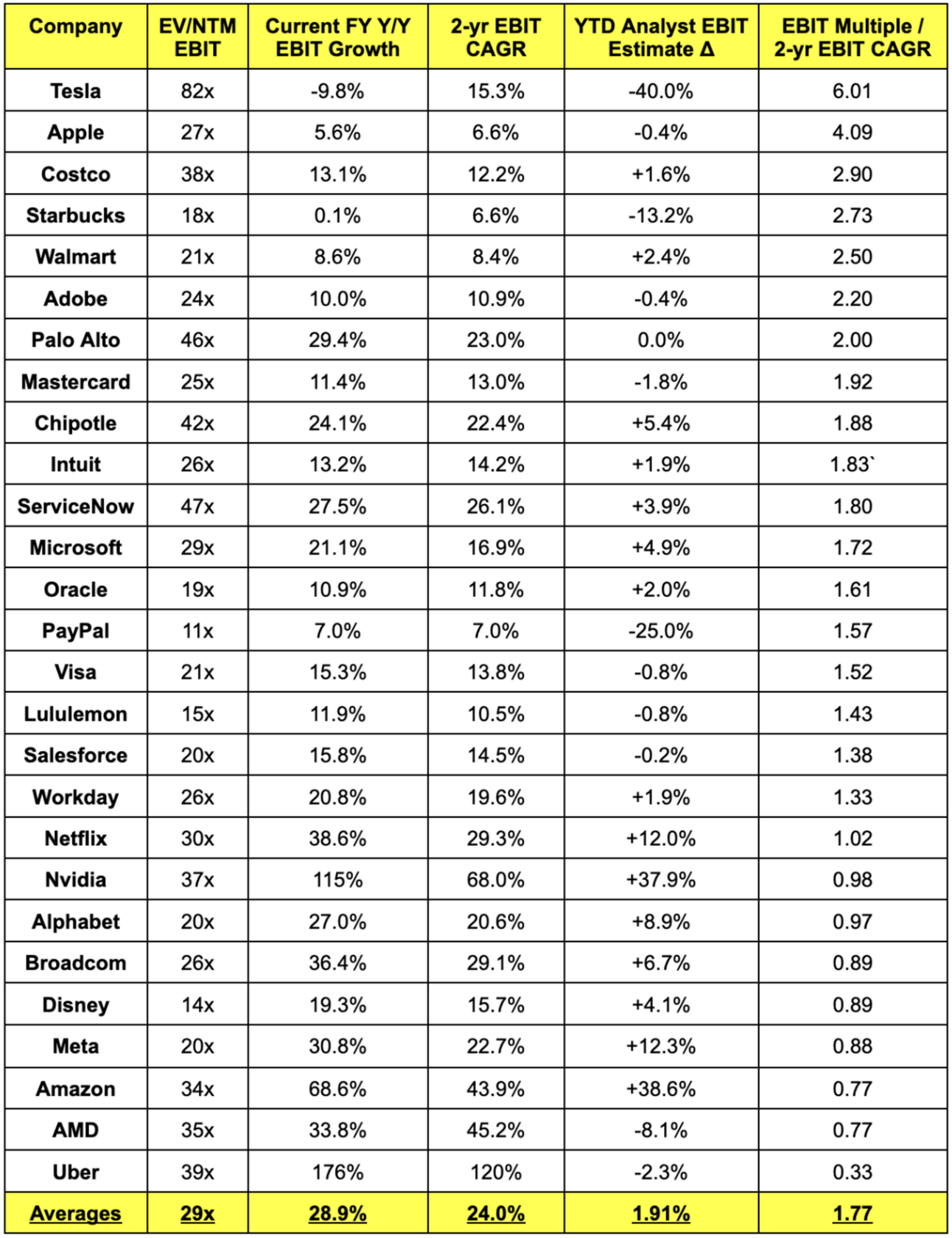

a. Mature Growth EBIT Comp Sheet

Caveats:

- I love growth multiple framework and readily borrow it from Peter Lynch. He uses a “PEG ratio.” This means price divided by earnings per share divided by net income per share growth rates. I modify this approach to use multi-year profit growth, rather than one year. I also modify it by using EBIT and EBITDA growth multiples not just net income.

- Growth multiples (like in the right-most column below) aren’t perfect. They do a poor job rewarding the highest quality companies in the world with the most certain long term runways for profit growth. I don’t think this applies to Tesla at the top, as that firm’s high multiple is a byproduct of macro cycles. For Apple, I do think this applies. It has arguably the deepest competitive moat on the planet. It makes sense (I say as a non-shareholder) for investors to be willing to pay more for that growth. The probability of it being delivered is higher than for virtually any other firm. At the same time, other world-class companies like Visa and Netflix don’t get this same premium. Interesting to note.

- Companies like Tesla and Airbnb do not make any favorable non-GAAP adjustments to EBIT. This makes them look a tad more expensive on an apples-to-apples basis.

- I pushed the CAGR timeline one year into the future for Airbnb and Intuit due to abnormally easy Y/Y EBIT growth comps for 2024 (one-time GAAP charges for each).

- I pushed the CAGR timeline out one year into the future for PayPal due to accounting changes from 2023 to 2024. PayPal now includes stock comp expenses in EBIT, which means EBIT is technically sharply declining Y/Y because it didn’t count the expense in 2023.

- Fiscal years do not perfectly match calendar years. They’re close and that didn’t make a material difference here. Still worth noting.

- Nike was excluded because it will not deliver any profit growth over the next two years.

- I used the normal CAGR period for Starbucks. I was tempted to push that timeline out a year like for ABNB and INTU, but decided not to. Had I done this, the right-most column for Starbucks would have been roughly 1.60. It’s having a tough year, which greatly impacts profit growth and the growth multiple.

Definitions:

- NTM = Next 12 months

- FY = fiscal year

- YTD = year-to-date

- CAGR = compounded annual growth rate

b. Fast Growth Gross Profit Comp Sheet

No caveats needed.

3. Mercado Libre (MELI) & NU (NU) – Brazilian Monetary Policy

Brazil’s President Luiz Inácio Lula da Silva certainly doesn’t hold back on his critique of the nation’s central bank chairman Roberto Campos Neto. He’s very public about wanting rates to be lowered, and lowered now. The Brazilian Fed chair is more hesitant to cut rates more quickly, as he understandably fears an inflation reacceleration. That’s absolutely the main risk that any central bank chair needs to guard against. Runaway inflation generally means soaring rates, a weakening economy and rising unemployment. Considering Brazil’s compelling combination of high rates and low inflation, I think the president’s qualm is actually somewhat fair (despite being a bit inappropriate). The current chair will be replaced this year by the president with someone who sees eye to eye with him on policy.

What would rate cuts mean for both of these LatAm titans? While both do some credit origination and operate in financial services, I still see cuts as a net tailwind to overall operations. The main risk is that these cuts facilitate net interest margin compression, which could weigh on financials. For Nu specifically, its shift to deposit-funded credit and continued effective underwriting will, per the team, allow it to expand NIM throughout the year. This is despite expectations for many more rate cuts in 2024. Meli also just secured formal bank licensing in Mexico. This will allow it to optimize its own balance sheet with lower cost of funding its credit book, just like Nu is doing to manufacture more NIM expansion.

The other risk is currency weakness weighing on company growth rates, although expected cuts in the USA and Europe this year should buffer that. Aside from these factors, easier policy will mean both can get more aggressive on funding personal loan originations, which is a real top and bottom line driver for both. Credit risk is the unsecured loan growth bottleneck for both enterprises, and that bottleneck becomes less pressing as access to capital becomes cheaper and money becomes more readily available.

Cuts will be a tailwind for interchange revenue, a tailwind for Nu’s investing arm and a tailwind for Meli’s e-commerce marketplace. 60% of Meli’s business comes from Brazil, with a much higher portion coming from that nation for Nu. The nation (and many others in Latin America) looks to be entering a more favorable part of its macro cycle for these businesses, and both look poised to capitalize.