1. The Trade Desk (TTD) -- The EU, a Case Study, an Accolade, Disney & Snapchat

a) EU

This past week, EU lawmakers signed the Digital Markets Act (DMA) and the Digital Services Act (DSA) into law. Both are structured to erode the monopoly-type power of internet players like Google and to create a responsibly open environment for data sharing. Each Act complements the previously passed GDPR legislation. The Wall Street Journal is calling this the strictest attempt to control walled gardens yet and is expected to have global ripple effects.

Stricter regulation and tighter controls on data syphoning is a net positive for The Trade Desk. Its inherent open-internet approach has found seamless compliance with GDPR -- unlike other tech giants -- and this should be more of the same. Anything that creates a more level playing field (and a more regulated one) with bigger, richer tech-giants is good for The Trade Desk.

b) ViewSonic

The electronics company wanted to grow its global businesses in a cost efficient manner. It went with The Trade Desk’s Koa engine and data marketplace to help run its media buying campaigns. ViewSonic also utilized The Trade Desk’s “Wootag” integration to further customize local solutions for ViewSonic in Asia. Here were the results:

- Koa boosted video completion rate from 59% to 81%

- The Trade Desk delivered a 47% lower average cost per completed view vs. benchmarks.

- Click through rates are 24X industry benchmarks in Germany and 11X in The UK.

That’ll do.

“Their team was instrumental in bringing our campaign to life in a timely, cost-effective manner. Without The Trade Desk’s network of partners and expertise, we would not have been able to pull off such a complex activation to this degree of efficient success.” — Global Digital Campaign Manager @ ViewSonic Billy Choi

c) Accolade

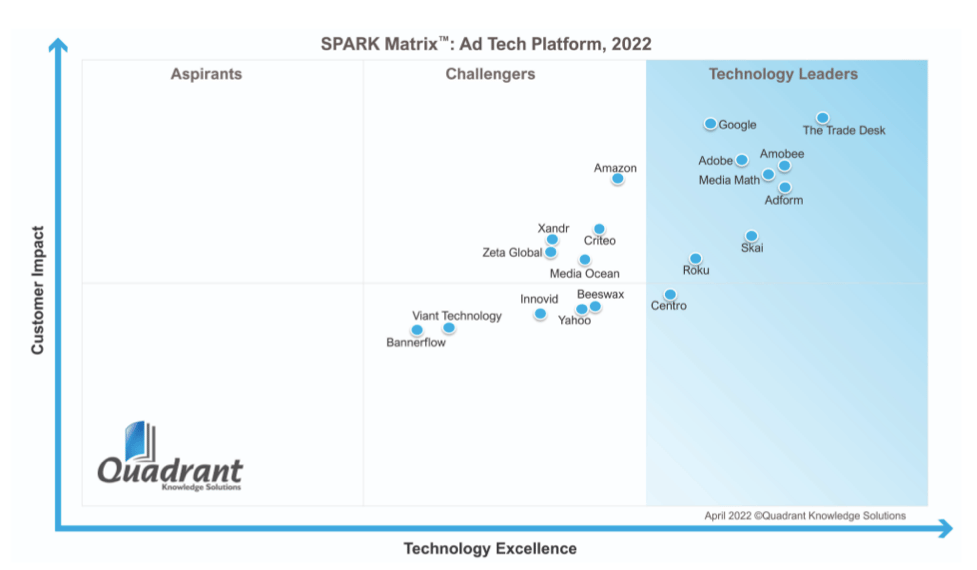

SPARK Matrix released its first competitive landscape graphic of the Ad Tech sector this week. The Trade Desk, unsurprisingly, ranked first in customer impact and technological excellence -- the two ranking variables.

d) Snapchat

Once again, poor results from Snapchat led many to conclude that the entire ad-tech sector would be challenged for the quarter. Last quarter, the company blamed macro-economically-induced ad-weakness while several others in the space posted strong results. I think this could likely be more of the same. And as a reminder, The Trade Desk re-affirmed its strong guidance several weeks ago, I'm really not concerned.

e) Disney

Disney set a new company record with $9 billion in upfront advertising sales for the year. So I guess it's not seeing the same terrible ad market that Snapchat is. Interesting. Notably, 40% of these sales (so $3.6 billion) were for streaming impressions. Considering the tight relationship that Disney and The Trade Desk have and the fact that Connected TV (CTV) is The Trade Desk's largest revenue segment, this is encouraging.

2. Shopify (SHOP) -- YouTube

Note that this is still just a watch list item.

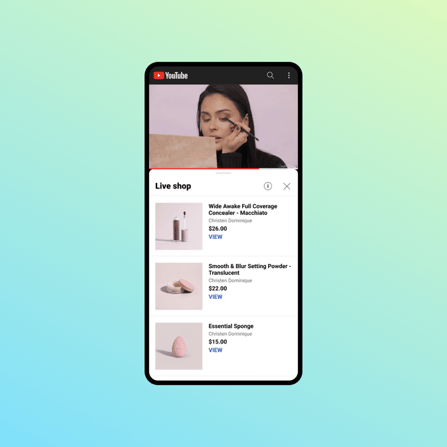

Shopify announced a deepening partnership with Google which frees a direct integration between its merchants and YouTube. With this new relationship, businesses will be able to embed their product catalogues directly into the ubiquitous site. Whether it’s live steams, on-demand videos, or the dedicated store tab, YouTube is now fully open for Shopify merchant business.

This unlocks yet another channel for merchants to sell into and further enhances the scope of Shopify’s vast integration roster. And that’s really what sets it apart in a competitive, rapidly growing field: An ability to seamlessly & intuitively connect its merchants to a greater number of key selling channels than others can. The real-time plug-in will allow for accurate product inventory displays, pricing and performance tracking. Some merchants are even eligible for Shopify-powered in-line checkout through YouTube. In-line simply means a shopper never leaves YouTube while checking out (which raises conversion rates).

Click here for my Shopify Overview.

3. CrowdStrike (CRWD) -- Accolade & Macro Tailwinds

Fortune Magazine named CrowdStrike as one of its best places to work for Millennials in 2022. While this may not sound relevant, considering how fierce the battle for new talent is within security, it certainly is.

Gartner released an update on the state of cybersecurity trends in 2022. The conclusions were uniformly clear -- breach intensity is only growing. Vendors dedicated to helping companies stay safe will continue to be in high demand.

4. Meta Platforms (META) -- Miscellaneous

- Meta is shifting resources from its news and newsletter features (Bulletin) to focus more on other pieces of the creator economy.

- Instagram is debuting in-app (in-line) shopping within direct messaging.

- Meta’s Family of Apps is fully leaning into Reels. It's turning all video content into that format.

- Instagram is ending its affiliate influencer marketing program.

- Credit Suisse thinks Meta is on the verge of “improving news flow” while cutting its targets due to macro pressures. Morgan Stanley, Deutsche Bank and MoffettNathanson all issued similar notes of still optimistic, but more cautious outlooks.

5. Lululemon Athletica -- International, Analyst Notes & Unions

a) International

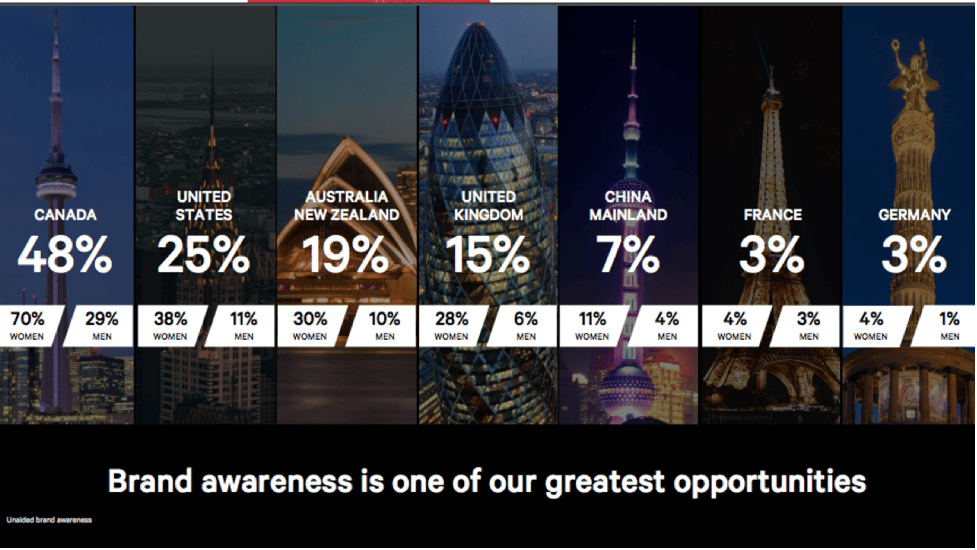

Lululemon launched in China through JD.com’s marketplace this past week. With the Chinese Giant’s hundreds of millions of users, this could be a very important launch. It’s full speed ahead for Lulu’s international expansion as it expects to quadruple that business over the next 5 years. If previous long term targets are any indication -- and that’s far from certain -- it could reach the target more expeditiously.

“The popularity of Lululemon indicates that the Chinese market acknowledges the product quality and the connection it creates between community and brand.” — JD Spokesperson

b) Analyst Notes

- Stifel, BTIG and Goldman all slashed price targets but remain upbeat on the company’s prospects

- KeyBank initiated it with an overweight rating.

c) Unions?

Some Lulu staff are petitioning for unionization in Washington D.C. This surprised me as the company hasn’t dealt with it before, but it’s extremely preliminary. We’ll see where this news goes.

Click here for my Lululemon Overview.

6. PayPal Holdings (PYPL) -- Activists, Analyst Notes and a Lawsuit

a) Activists?

There are rumors swirling that PayPal is attracting activist attention. As a note, this refers to minority shareholders (or potential shareholders) rounding up voting shares to secure board seats and influence change. This makes sense to me considering how poorly the team guided expectations through the last few years (like countless other firms) -- but I don’t think it’s necessary.

I still wholeheartedly believe in CEO Dan Schulman as his track record speaks for itself. Furthermore, I see PayPal’s “dinosaur” label as a product of our current world, not its own value proposition. Like many others, it is suffering from inflation stretching consumer budgets, consumer confidence tanking and the lapping of stimulus and e-commerce shocks. It is also dealing with a several hundred basis point headwind from its eBay operating agreement ending

All of these issues are mostly lapped after the company reports 2nd quarter earnings in a few weeks. Growth will re-accelerate regardless of macro headwinds and I think the narrative surrounding PayPal will sharply turn for the better. And with the eBay contract gone, it has been free to secure deeper relationships with Amazon, Walmart, Live Nation and several other clients. Ask yourselves, would you rather have more eBay checkout share? Or less, but while being free to work with all of these other, faster-growing marketplaces. I think the choice is clear.