Table of Contents

- 1. Visa (V) – Earnings Review

- 2. Amazon (AMZN) – Chips

- 3. PayPal (PYPL) – (Life in the) Fastlane

- 4. Enphase — Quick Earnings Snapshot

- 5. ServiceNow (NOW) — Earnings Review

- 6. Chipotle (CMG) — Earnings Review

- 7. Disney (DIS) – Films & Comcast

- 8. Duolingo (DUOL) – Competitive Read Through

- 9. CrowdStrike (CRWD) – Reparations

- 10. Alphabet (GOOGL) – ChatGPT

- 11. Meta (META) – WhatsApp & Llama 3.1

- 12. Market Headlines

- 13. Macro Data

1. Visa (V) – Earnings Review

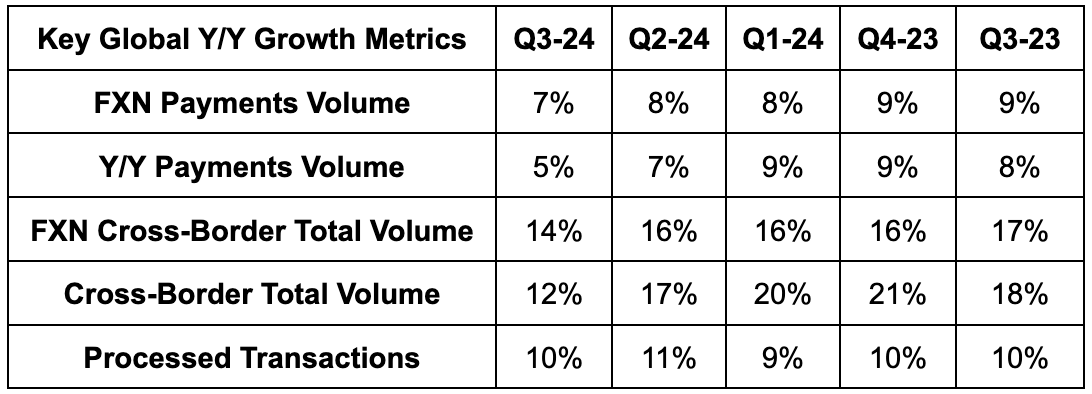

a. Demand

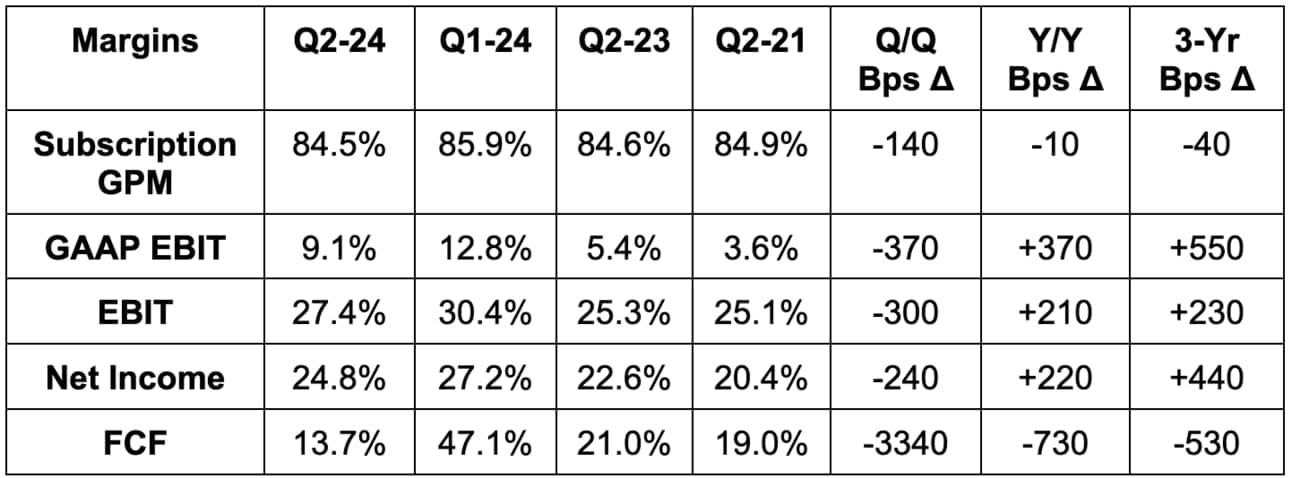

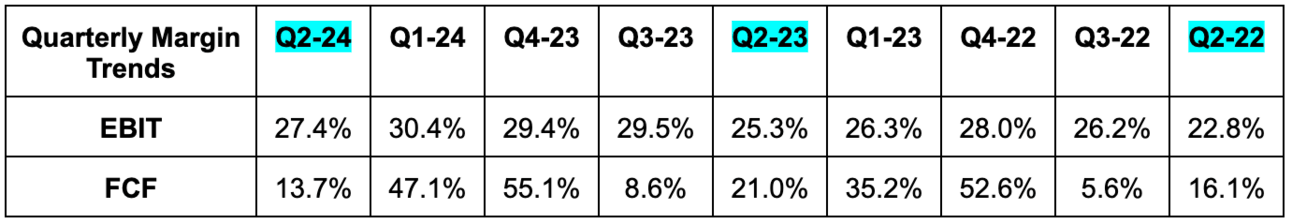

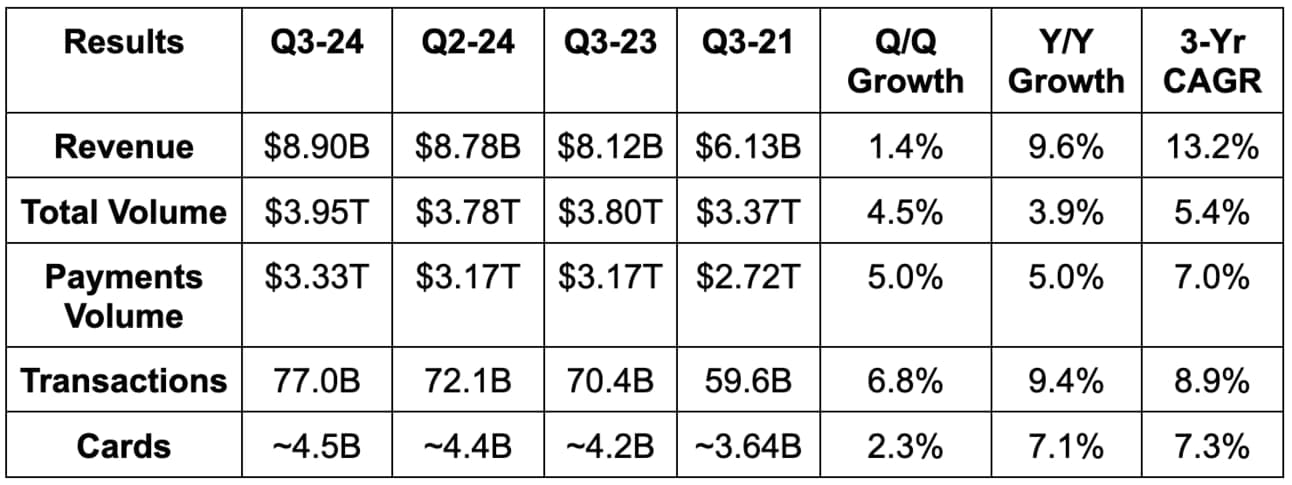

Visa roughly met its foreign exchange neutral (FXN) double digit revenue growth guidance & slightly missed revenue estimates. Its 13.2% 3-year revenue compounded annual growth rate (CAGR) compares to 15.3% last quarter and 14.9% 2 quarters ago.

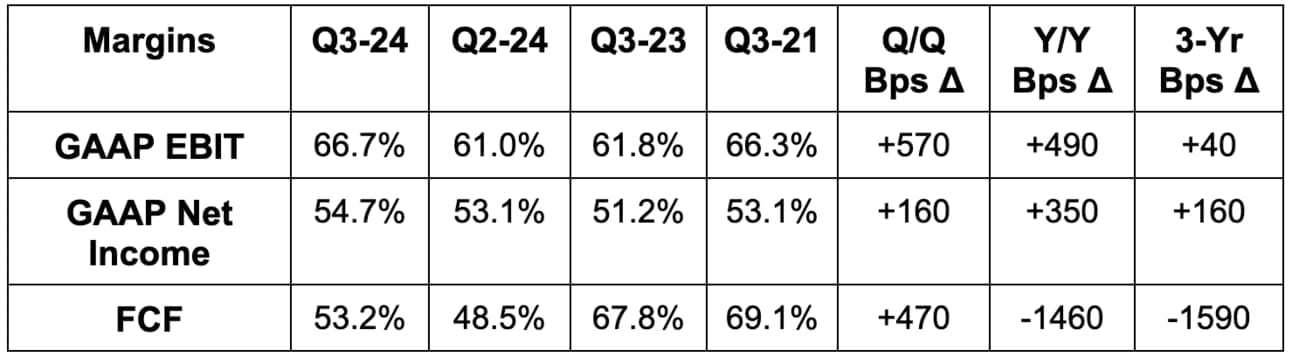

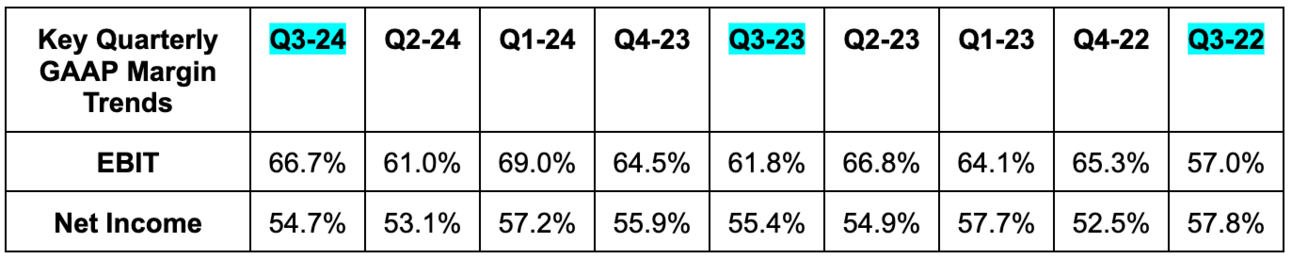

b. Profits & Margins

- Met low double-digit earnings per share (EPS) growth guide with 12% Y/Y EPS growth (13% Y/Y FXN growth).

- Non-GAAP EPS rose 12% Y/Y. GAAP EPS, which includes noisy items like legal provisions that aren’t relevant to run-rate operations, rose 20% Y/Y. Focus on non-GAAP for this Visa metric.

- Non-GAAP operating expenses rose 14% Y/Y due to more marketing and personnel costs.

- GAAP operating expenses fell 4% Y/Y due to fewer legal expenses.

- Missed GAAP EBIT estimates by 1.0%.

- Roughly met GAAP EPS estimates.

c. Balance Sheet

- $12.95B in cash & equivalents

- $3.7B in ST investment securities; $3B in LT investment securities.

- $20.6B in total debt

- Share count fell 2.5% Y/Y

- Dividend payments rose 12.5% Y/Y. Visa will pay a $0.52/share dividend in September.

d. Q4 Guidance & Valuation

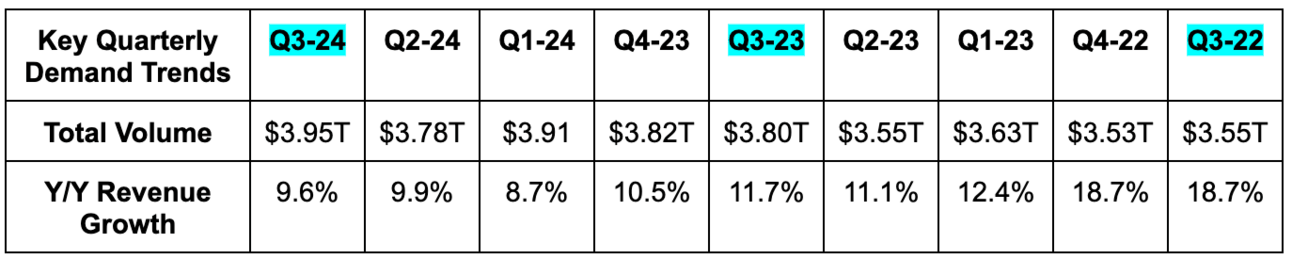

Visa expects low double-digit adjusted net revenue growth, which roughly met 11.5% Y/Y revenue growth estimates. It also expects adjusted EPS growth in the “high end of the low double-digit range,” which roughly met 12% Y/Y EPS growth estimates. It also sees payments volume and processed transaction growth stability, with cross-border volume growth slowing a bit Q/Q. Visa continues to see the same revenue result that it did at the beginning of the year. This is despite lower currency volatility (which hurts its business) and macro weakness across mainly Asia.

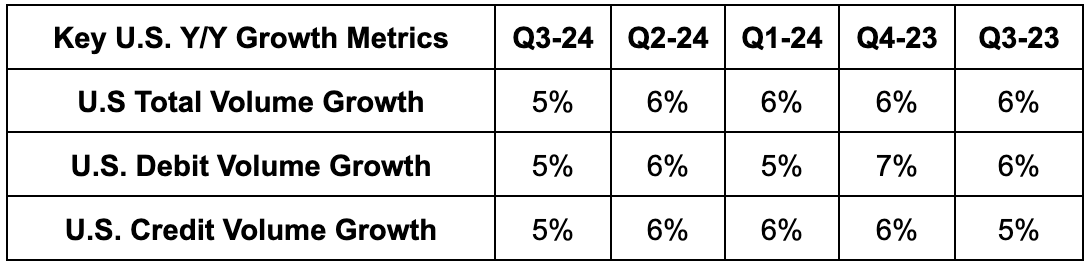

Quarter-to-date, U.S. volume is up 4% Y/Y overall (4% for debit; 3% for credit). The deceleration from Q3 “does not appear to be from any 1 factor, but many including weather, timing of promotions, the CrowdStrike outage and other things.” If only they could just say what “other things” means. My best guess is macro.

Visa trades for 25x this year’s earnings. Earnings are expected to grow by 13% Y/Y this year and 12% Y/Y next year. Here’s how its earnings multiple compares to historical norms:

e. Call & Release

More Key Business Driver Data:

“Our payments, cross-border and processed transaction key business drivers were relatively stable.”

CEO Ryan McInerney

“U.S. payment volume growth was generally in line with last quarter when adjusting for leap year… Moving to international markets, total payments volume was relatively stable with Q2 when adjusted for leap year.”

CFO Vasant M Prabhu

Serving its Customers:

Results from its new annual global client engagement survey were encouraging. Its net promoter score (NPS) rose 3 points Y/Y to 76. I always say NPS should be taken with a grain of salt, as it’s subjectively calculated and internally derived. Still, as long as methodology isn’t changing Y/Y, it’s good to see that metric moving higher.

For this year’s Olympics, it has been pushing very hard to distribute its visa-branded cards. It now has 6 million of those cards in circulation vs. 5 million Q/Q. It also has added 100,000 new merchants as Visa customers in France for the events.

Partnerships Around the Globe:

- In Western Europe, it added 10 million additional credit credentials in an expansion of its Lloyds Banking relationship. NatWest also launched a new Visa Travel card and added the firm’s transaction control and card benefits services.

- In Korea, it expanded its partnership with KB Kookmin (large issuer) to incorporate its consulting and marketing services.

- In North America, it extended its Wells Fargo relationship and added its consulting services to the mix.

- In India, it launched a new co-branded card with Adani One and one with Tata Digital as well. These are two large wins.

- In Peru, Yape and its 15 million users with Visa credentials can now send money peer-to-peer using the Visa Direct network. Together, the two recently launched tap-to-pay functionality there too.

- In Vietnam, the 3 leading digital wallets also now have Visa enabled as a funding source.

- In Latin America, it partnered with Unicomer for a co-branded card and Visa Cybersource (online checkout and payments platform).

Checkout:

Visa’s click-to-pay and Visa Payment Passkeys, which allow users to login with biometrics, are now testing with European merchants representing 50% of its e-commerce volume there. It’s hard at work on adding tap-to-pay, tap-to-authenticate, tap-to-add-a-card and tap-to-send-money functionality for all of its customers. Tap-to-pay rose 8 points to 84% of total face-to-face transactions ex-USA this year (over 50% in the USA now). This is highly important for Visa and rightfully a priority.

New Flows:

New Flows revenue rose 18% Y/Y FXN as Visa Direct transactions rose 41% Y/Y (boosted by debuts and traction in Latin America) and commercial payments volume rose 7% Y/Y FXN. On the commercial end, it added new B2B relationships with Cintas and new data partnerships with Celero in Brazil. Wells Fargo is also now using its expense management program in a white-labeled capacity for 6,000 of its enterprise clients.

For Visa Direct, it launched new partnerships with several notable clients across Europe and also ZheShang Bank in China for cross-border service. Nuvei also extended its Visa partnership to add cross-border P2P payments in 30 countries. Visa+ is a piece of software allowing P2P payments using unique identifiers, which it calls “paynames.” This is now live on PayPal and Venmo.

Value Added Services:

Card benefits performance was strong, with travel, entertainment and food all standouts. The Visa Infinite Fast Past in Brazil (basically TSA pre-check) crossed 1 million travelers during the quarter. It also added a new relationship with OpenTable, deepening the available benefits for its cards and co-branded arrangements.

For its acceptance solutions, utilization of its tokenization and e-commerce services went well. iFood (largest delivery service in Brazil) is now using Visa Verifi for dispute and chargeback prevention. Worldpay in North America is now using Visa to cut payment fraud rates too. The card giant’s “account-to-account risk scoring” solution called Visa Protect is showing a 40% fraud detection improvement 3 months into beta testing.

Macro:

Asia Pacific continues to be the weak spot. Inbound APAC travel did improve a bit, but outbound travel improved at a slower pace. It attributed this to “macroeconomic pressures.” In the USA, spend from its more affluent customers is stable and resilient. Spend for its lower income cohorts has shown signs of slowing.

e. Take

Visa is a fantastic company with one of the deepest moats on the planet. You can explicitly see that in their crazy 60%+ GAAP operating margin at this scale. As Bezos famously says, “your margin is my opportunity.” Visa has built a fortress around its business, making pursuit of market share unattractive for new entrants. Mastercard is in the exact same spot. More wonderfully boring and rock-solid execution. For the overall economy, this echoes what we’ve heard from large banks. The economy is fine, but slowing. Affluent consumers are faring better than less affluent consumers.

2. Amazon (AMZN) – Chips

Amazon is reportedly testing its own chips to reduce its need for Nvidia GPUs. Shared customers are yearning for alternatives that aren’t so crazy expensive and Amazon thinks it can provide them. This follows Tesla’s Elon Musk commenting on feeling a need to match Nvidia’s GPU prowess for itself to try to avoid paying ridiculous prices for Nvidia’s GPUs. The world is trying to piece together hardware to sort of, kind of emulate the utility and efficiency of Nvidia’s Hopper and Blackwell platforms.

This highlights how much pricing power Nvidia still has, and how flexing that pricing power is pushing ecosystem participants to find other solutions. But? Nvidia’s absurd pricing power relies on a large tech lead. They’re racing as fast as they can to continue iterating and finding performance gains to ensure they stay ahead. It’s a daunting task for competitors to keep up. AMD hasn’t been able to do it. We’ll see if mega-cap tech can. Amazon, Google, Tesla and Microsoft all continue to try to replace part of their Nvidia reliance while also readily partnering with them and buying billions in GPUs from them. Interesting dynamic.

3. PayPal (PYPL) – (Life in the) Fastlane

PayPal is rolling out Fastlane as we speak. It hosted an event this past week where it reiterated and talked up stats like an 80% guest checkout conversion rate. That is excellent and compares to industry averages around 50%. There are always real risks associated with traction for any new product. And while Fastlane’s success is uncertain, I think there’s a good chance that it could be highly impactful for the company overall.

Checkout is a commodity. PayPal stands out with brand trust and merchant adoption. It’s trying to catch up to others like Shopify in terms of friction. There are no massive 30%+ conversion advantages to be had in checkout. Just stealing a few incremental basis points of conversion is considered a large win for merchants… and rightfully so. A few basis points can have a real impact on overall financials. Imagine what 3,000 basis points can do. This is how PayPal can stand out once more and why an unknown airline executive called it the “most exciting uplift to conversion” they’ve ever seen. Maybe a bit dramatic, but you get the point. It’s how it can mine its massive consumer scale to recognize any guest that has been on a PayPal merchant site and deliver them a guest checkout that emulates the convenience of modern digital wallets. As someone who has already used it, the delight associated with side-stepping manual card entry is noticeable and PayPal’s post checkout advanced promotion tools added to that delight. It’s easy to see how this experience could turn Fastlaners into consistent digital wallet users too.

This is a massive book of business and Fastlane will inevitably need time to be a material contributor. Still, I do expect to hear just how excited leadership is about the potential impact. We all know the stock could use a game changing product release… and I think Fastlane could be that. We shall see.

4. Enphase — Quick Earnings Snapshot

Enphase exists in the wildly cyclical solar energy sector. As overall cost of capital rises, the price of its financed equipment rises too. The historically easy monetary policy in 2021 greatly helped it; the historic hiking cycle has greatly hurt it.

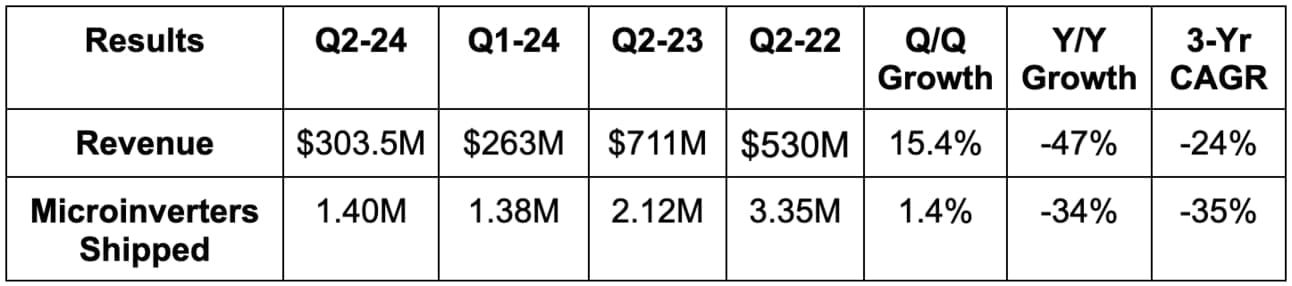

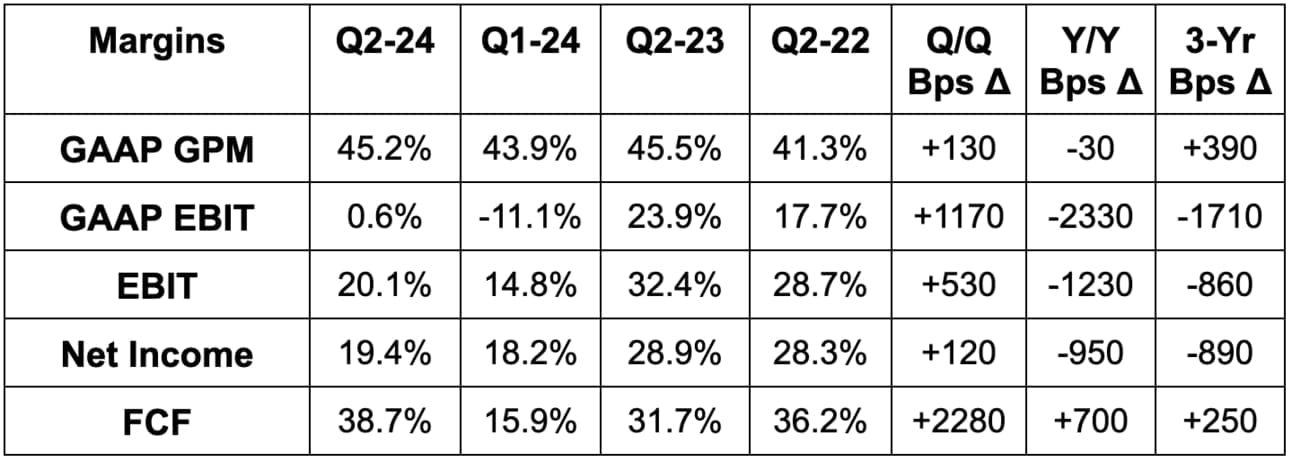

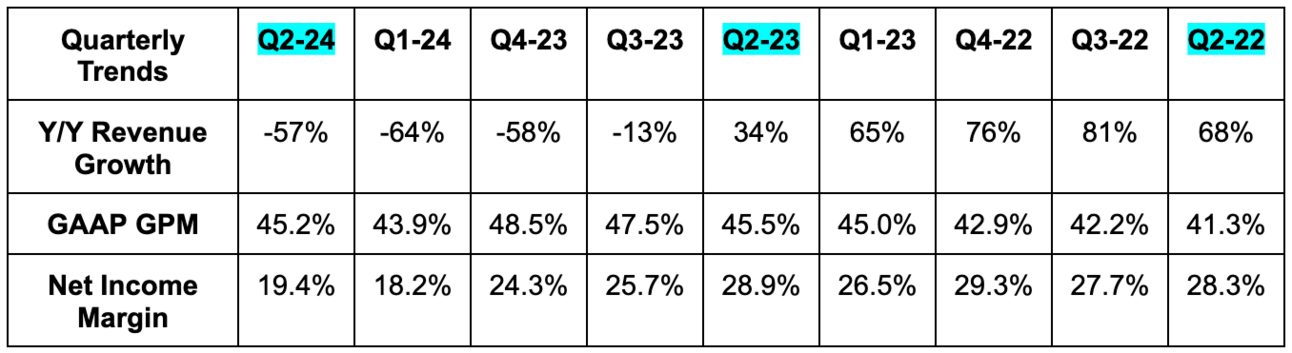

a. Results

- Missed revenue estimate by 2.1% & missed guide by 2.2%. This is actually its best result in a few quarters.

- Beat -$1M GAAP EBIT estimate & same guide by $3M; Met EBIT guide.

- Beat 44.9% GAAP GPM estimate by 30 bps & missed guide by 30 bps.

b. Guidance & Valuation

- Missed revenue estimate by 4.4%.

- Missed 47.3% GAAP GPM estimate by 80 bps.

- Missed $56M EBIT estimate by $15M or 27%.

Enphase trades for 45x expected 2024 earnings. Earnings are expected to fall by 41% Y/Y this year and rise by 89% Y/Y next year.

c. Balance Sheet

- $1.65B in cash & equivalents.

- $1.3B in total debt.

- Diluted share count fell 6.2% Y/Y.

- Basic share count fell by 0.7% Y/Y.

5. ServiceNow (NOW) — Earnings Review

ServiceNow 101:

ServiceNow is one of the largest enterprise software firms in the world. It automates workflows, tech stacks and projects to augment customer efficiency. For this reason, it calls itself the “leading digital workflow company.” Workflow automation buckets include: service management, operations, asset management, security, customer management, employee management and creator management. These are further grouped into workflow buckets like “customer & employee workflows,” “creative workflows” and “technology workflows. Two products to know within the tech workflow category include Information Technology Operations Management (ITOM) and Information Technology Service Management (ITSM). The names of these products tell you exactly which types of workflows they’re meant to automate.

All products and services are neatly tied into its “Now Platform.” The firm describes this overarching platform as a way to “optimize processes, connect silos and accelerate innovation on a single unifying platform.” That’s a fancy way of saying that it makes every piece of work more efficient and expedient.

To bolster automation capabilities, ServiceNow has been hard at work on GenAI innovation. Its Vancouver Platform release got the ball rolling by consolidating all model and app work into an intuitive set of products. It recently built on that debut with a “Washington D.C. Platform” release. This is essentially a large batch of GenAI-inspired upgrades to the Now platform. It builds on the progress of the previous Vancouver platform release. It more seamlessly ties together NOW’s product categories to drive better interdepartmental work and communication. It offers the “workflow studio” as a unified workspace to manage productivity across teams. It allows for seamless database refreshes without complex coding; it goes deeper in terms of intelligently automating customer service and order management workflows.

These platforms are a foundation for its GenAI apps. A key example of these apps is “Now Assist AI.” This is ServiceNow’s GenAI assistant/companion being infused across most of its products. “Plus SKUs” are how ServiceNow bundles all of its GenAI work into subscription packages. It upcharges clients for access to these SKUs as its approach to GenAI monetization has been more aggressive than most others. These Plus SKUs do things like automate customer service, expedite issue resolution, guide workflows and provide more conversational fetching/querying of a firm’s data.

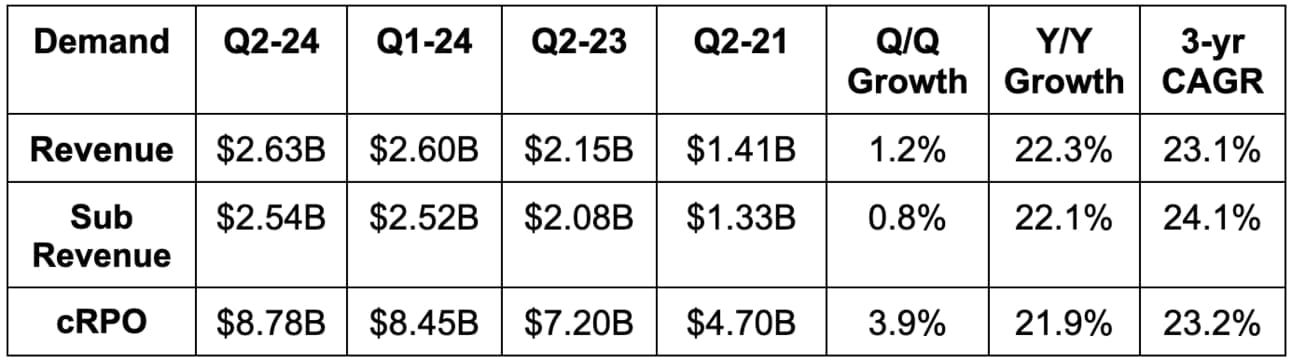

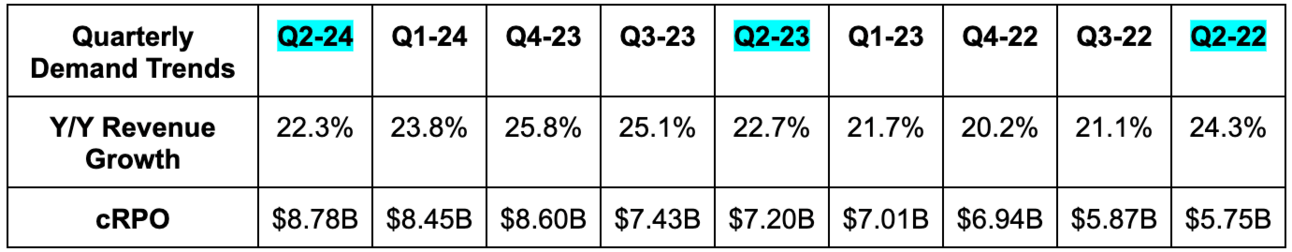

a. Demand

- Slightly beat FXN subscription revenue guide.

- Its 23.1% 3-yr revenue CAGR compares to 24.1% Q/Q & 25% 2 quarters ago.

- Beat revenue estimates by 0.8%.

- Beat 20.5% current remaining performance obligation (cRPO) growth guide by 200 bps.

b. Profits & Margins

- Beat 25% EBIT margin guidance by 240 bps and beat EBIT estimates by 10%.

- Beat $2.84 EPS estimates by $0.32.