Table of Contents

- 1. JP Morgan (JPM) & More Banks – Earnings Snapsho …

- 2. Delta (DAL) – Earnings Summary

- 3. SoFi (SOFI) – A Bearish Note With Some Thoughts …

- 4. PepsiCo (PEP) – Earnings Summary

- 5. Uber (UBER) & Lyft (LYFT) – RoboTaxis & Hong Ko …

- 6. Amazon (AMZN) – App Studio & Insider Selling

- 7. Starbucks (SBUX) – Sell-Side Note & Thoughts

- 8. Market Headlines

- 9. Macro

A few subscribers reached out asking for more detail on Nu’s competitive landscape in Brazil and Mexico. Thank you for the suggestion. I will have a detailed piece on this in next Saturday's article. There were also zero portfolio changes since the last update sent to Max subs.

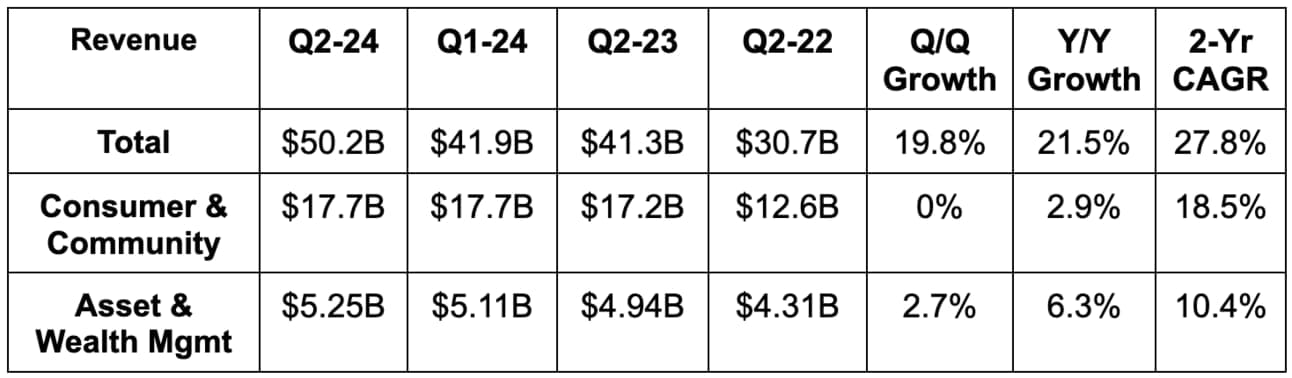

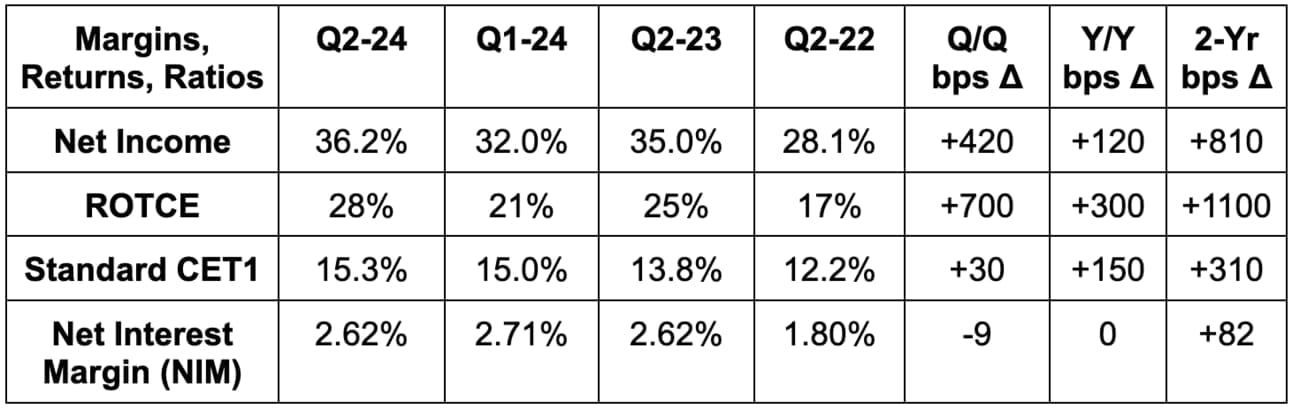

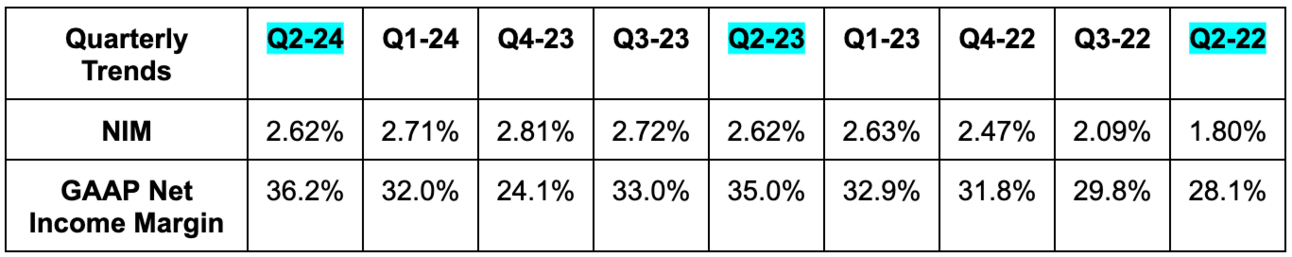

1. JP Morgan (JPM) & More Banks – Earnings Snapshot & Consumer Commentary

a. Results

- Reported revenue beat by 10%.

- Revenue growth was aided by a gain on purchase from First Republic and benefits from its equity stake exchange in Visa.

- Missed $4.51 GAAP EPS estimates by $0.11.

- GAAP margins and returns were aided by the same Visa dynamic.

- Comfortably being ROE estimates; Comfortably beat 1.31% ROA estimates by a robust 48 bps.

b. Annual Guidance & Valuation

Raised annual $90 billion net interest income guide to $91 billion; Changed sub 3.5% card service net charge off (NCO) rate to 3.4%.

JP Morgan trades for 12x this year’s EPS. EPS is expected to grow by 3.7% Y/Y this year and by -0.5% Y/Y next year. Here’s how its valuation multiple compares to historical norms:

c. Balance Sheet

- $3.05 billion in provision for credit losses vs. $1.88 billion Q/Q and $2.89 billion Y/Y.

- Provisions this quarter included $2.2 billion in net charge-offs vs. $1.4 billion Y/Y.

- Provisions this quarter also included $800 million in built reserves vs. $1.5 billion Y/Y.

- Reserve building was predominantly related to the consumer side of its business.

- $1.32 trillion in loans vs. $1.31 trillion Q/Q and $1.30 trillion Y/Y

- $2.40 trillion in deposits vs. $2.43 trillion Q/Q and $2.40 trillion Y/Y.

- $394 billion in long term debt.

- Share count fell 1.8% Y/Y.

- Paid out $1.15 in dividends per share vs. $1.00 Y/Y.

- $953 billion in total liquidity vs. $826 billion Y/Y.

d. JP Morgan, Citibank and Wells Fargo Economic Commentary from the Calls

JP Morgan:

“While market valuations and credit spreads seem to reflect a rather benign economic outlook, we continue to be vigilant about potential tail risks.” – CEO Jamie Dimon

“When it comes to card charge-offs and delinquencies, there’s not much to see. It’s still just normalization, not deterioration. It’s in line with expectations… you can see a little bit of spend weakness in lower-income segments as they rotate out of discretionary spend. But those effects are really quite subtle.” – CFO Jeremy Barnum

“The economic environment is very strong and stronger than anyone would have thought given the tightness of monetary conditions. Still, you are seeing slightly higher unemployment and moderating GDP growth… so it's not entirely surprising that you're seeing a tiny bit of weakness in some pockets of spend.” – CFO Jeremy Barnum

Citi:

“After a break in progress, inflation now appears back on a downward trajectory… services spending remains in an upward trend, but there are clear signs of a softening labor market and a tightening consumer budget.” – CEO Jane Fraser

“Looking at macro, as we enter the 2nd half of the year, the U.S. is still the world’s most structurally sound economy.” – CEO Jane Fraser

“We believe we’re seeing signs of cresting when you look at U.S. banking delinquencies. We expect losses and loss rates to start to come down… cost of credit was a $32 million benefit driven by a credit allowance release reflecting improving macro.” – CFO Mark Mason

“While we continue to see an overall resilient U.S. consumer, we all see divergence in performance and behavior across FICO scores and income bands. Lower bands are seeing sharper drops in payment rates and borrowing more. That said, we're seeing signs of stabilization and delinquency performance across our cards portfolio.” – CFO Mark Mason

- Citi posted $1.82 billion in provisions for credit losses vs. $1.84 billion Q/Q and $2.48 billion Y/Y. This is its lowest provision level in over a year.

Wells Fargo:

“Overall, the U.S. economy remains strong, driven by a healthy labor market and solid growth However, the economy is slowing and there are continued headwinds from still elevated inflation and elevated interest rates.” – CEO Charlie Scharf

“While losses in the commercial real estate office portfolio increased in the second quarter (which is what is driving overall credit losses) after declining last quarter, they were in line with our expectations.” – CFO Michael Santomassimo

Overall Theme of Big Bank Earnings Thus Far:

The 30,000 ft. view is that the U.S. economy is stronger than most expected it to be at this point in the cycle. It’s not quite as strong as the robust levels of recent years. Things are gradually slowing in a tranquil, orderly fashion. That does bode well for a soft landing or a very mild recession and for thankfully avoiding a severe recession or depression.

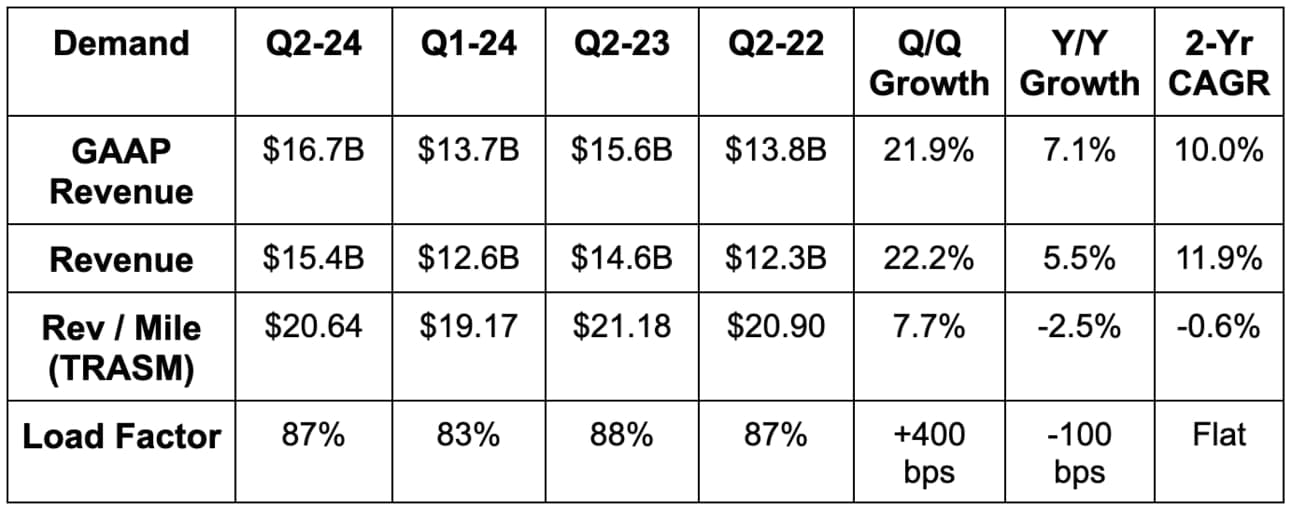

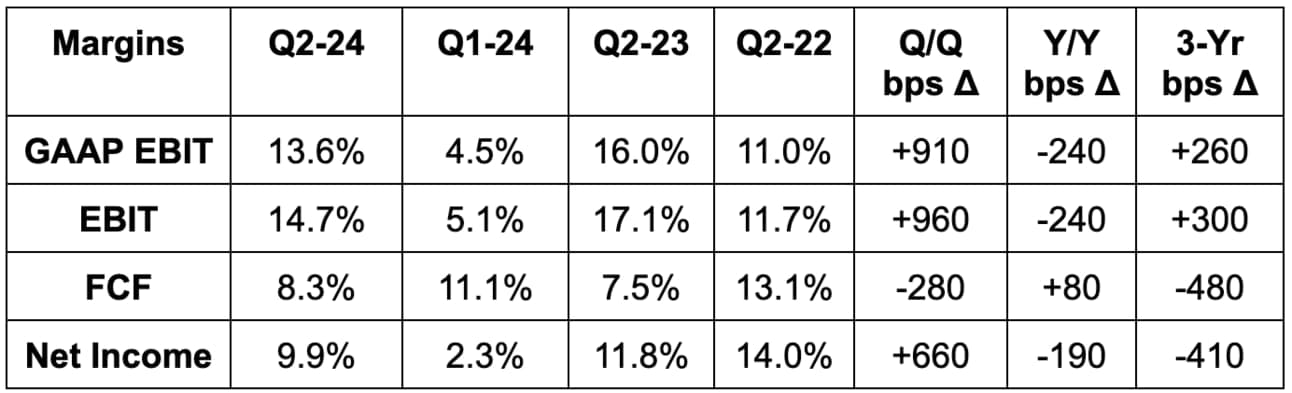

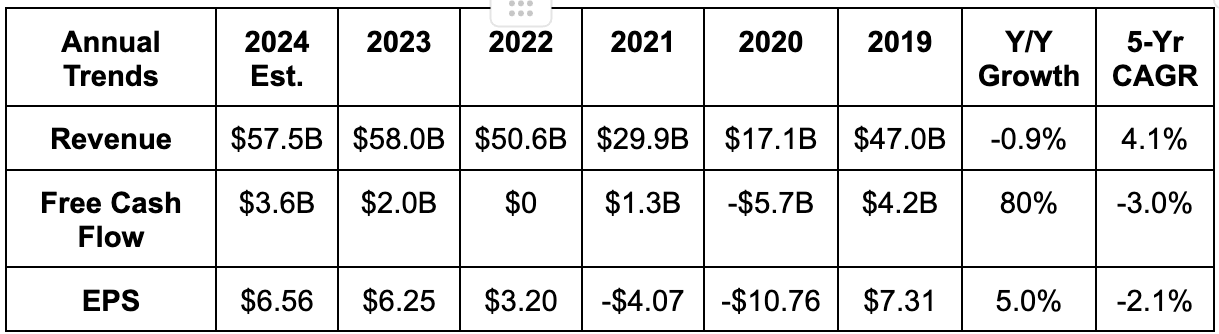

2. Delta (DAL) – Earnings Summary

a. Results

- Missed revenue estimates by 0.4% and missed its revenue guide by 0.5%.

- Met $2.27B non-GAAP EBIT estimate & slightly beat its EBIT guide.

- Met $2.36 EPS estimate & met its identical EPS guide.

b. Guidance & Valuation:

- Next quarter revenue guidance was a bit light vs. expectations.

- Next quarter EBIT guidance missed estimates by 9%.

- Next quarter EPS guidance of $1.85 missed $2.09 estimates by $0.24.

- Leadership pointed out that EPS was in line with record 2019 levels despite fuel costs being 25% higher this quarter vs. that period. It has realized significant operational efficiencies over the years.

Annual guidance of $3.5B in FCF and $6.50 in EPS was reiterated. This slightly missed expectations looking for a small raise to both metrics.

“Travel remains a top purchase priority and Delta's core customers are in a healthy position. The secular shift in consumer spend to prioritize experiences align perfectly with Delta's strategy and premium focus across our global network. Air travel demand is at record levels, with this past Sunday marking Delta's highest ever summer revenue day. For the September quarter, we expect continued demand strength… we remain confident in our full-year guidance." – CEO Ed Bastian

Delta trades for 7x 2024 EPS. EPS is expected to grow by 5% Y/Y this year and 15% Y/Y next year. Here’s how that current multiple compares to its historical norms:

c. Balance Sheet:

- 2.8x debt to EBITDAR ratio vs. 2.9x Q/Q & 3.0x Y/Y.

- $4.2B in cash & equivalents; $3B in equity investments;

- $18B in debt ($2.95B is current). Paid down $2.1 billion in debt year to date (YTD) using its $2.7 billion in YTD FCF. $900 million out of the $2.1 billion was repaid early.

- Diluted share count rose by 0.9% Y/Y.

- Reinstated a small quarterly dividend during the quarter. It paid out $64 million in dividends or about $0.10 per share. This will rise by 50% next quarter.

“Debt reduction remains our top financial priority.” – Presser