Table of Contents

- 1. Broadcom (AVGO) & Adobe (ADBE) – Earnings Summa …

- a. Broadcom (AVGO)

- Strange Accounting Items to Note:

- Broadcom Demand:

- Broadcom Profits & Margins:

- Broadcom Balance Sheet:

- Broadcom Annual Guidance & Valuation:

- Broadcom Call & Release:

- Take:

- b. Adobe (ADBE)

- Adobe Demand:

- Adobe Profits & Margins:

- Adobe Balance Sheet:

- Adobe Guidance & Valuation:

- Adobe Call & Release:

- Take:

- a. CFO Interview

- b. Some Thoughts

- 3. Okta (OKTA) – CFO Interview

- 4. AMD (AMD) – CFO Interview

- 5. American Express (AXP) – CFO Interview

- 6. Progyny (PGNY) – Investor Conference

- 7. Market Headlines

- 8. Powell Press Conference & Macro Data

Max Subs — there have been zero changes to the portfolio since the mid-week update detailing my new holding. I’m also going to publish the Starbucks article on Monday. I reached the maximum article length for this newsletter platform and was not able to include it in this piece.

1. Broadcom (AVGO) & Adobe (ADBE) – Earnings Summaries

a. Broadcom (AVGO)

Broadcom creates & manufactures a slew of semiconductor-related equipment within data center, networking and industry-specific use cases. It also offers a range of software tools, which significantly broadened out with its VMWare acquisition. This company does not compete with Nvidia in terms of designing GPUs. Instead, it focuses on networking and connectivity, which competes with Nvidia’s switches and its SpectrumX networking product.

Strange Accounting Items to Note:

Broadcom’s VMWare acquisition is impacting several company metrics. It’s greatly benefiting overall revenue growth, as well as infrastructure software revenue growth. Even for the Q/Q comparison, a full quarter of VMWare contribution impacted growth materially. Finally, the acquisition is greatly hurting GAAP margins due to the M&A-fueled stock compensation, restructuring and integration costs.

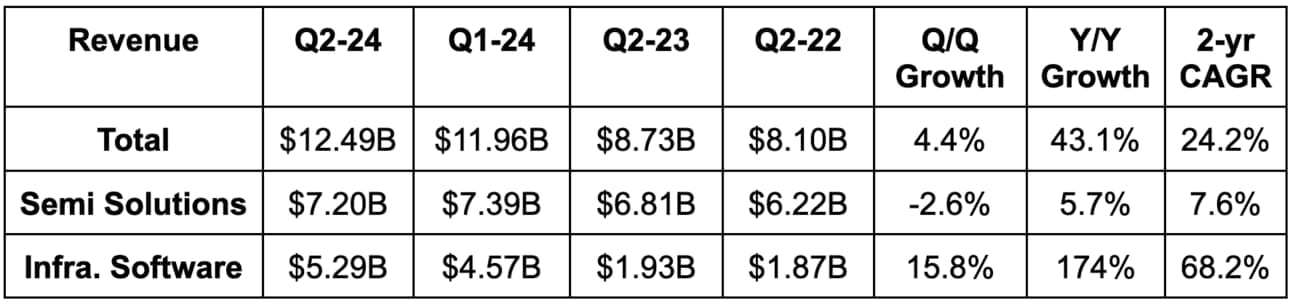

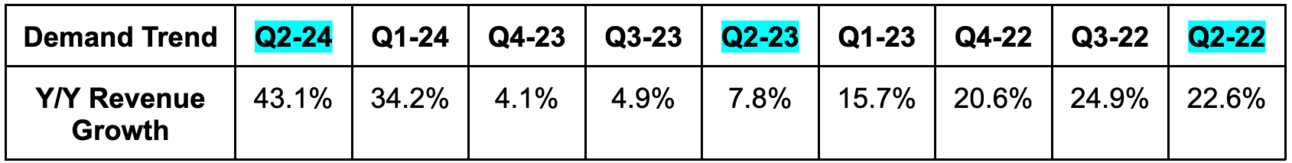

BroadcomDemand:

Broadcom comfortably beat revenue estimates by 4.1%. Organic revenue growth was 12% Y/Y. AI-related revenue rose 280% Y/Y to reach $3.1 billion.

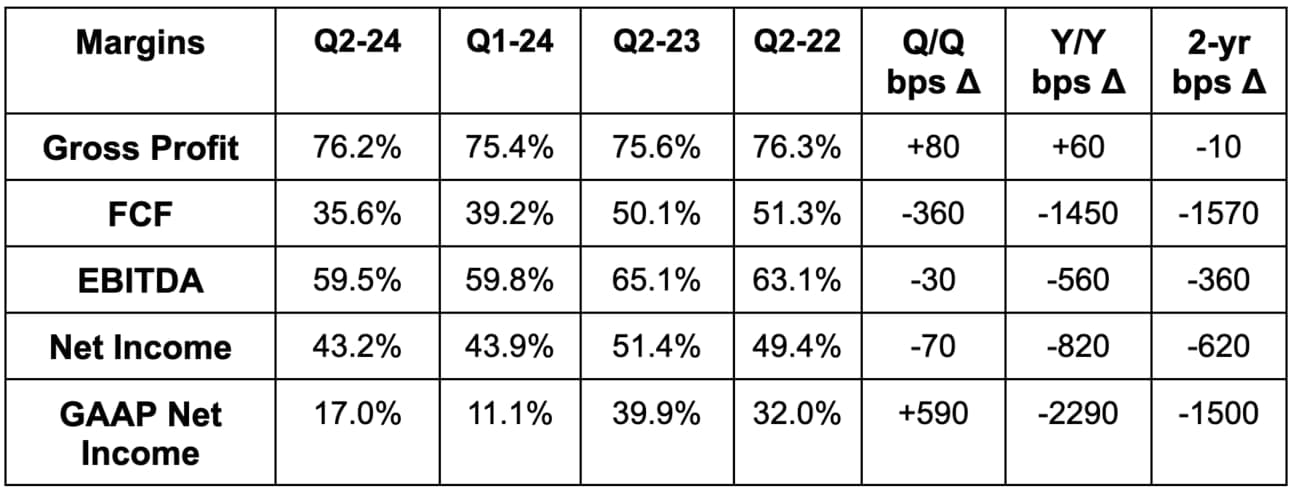

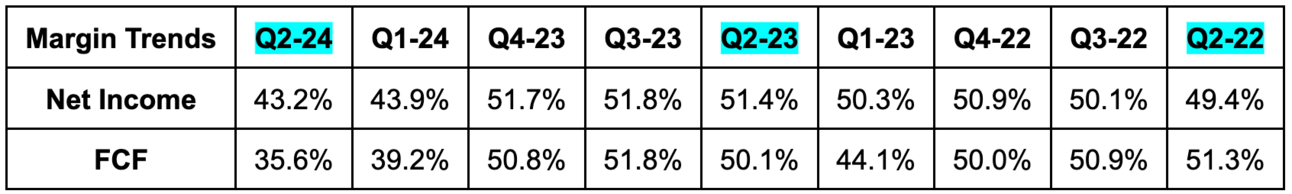

BroadcomProfits & Margins:

- Beat EBITDA estimates by 5.1%.

- Beat $4.00 GAAP EPS estimates by $0.42.

- Beat $10.84 EPS estimates by $0.12.

- Missed FCF estimates. This metric is very lumpy on a quarterly basis. Best to focus on trailing 12-month, annualized FCF. This quarter, FCF was held back by $830 million in M&A-related charges. This was the source of the miss.

- Infrastructure software delivered an 88% gross margin vs. 92% Y/Y.

- Semiconductor solutions delivered a 67% GPM vs. nearly 71% Y/Y due to a mix shift towards AI accelerators.

BroadcomBalance Sheet:

- $9.8B in cash & equivalents.

- $1.84B in inventory is roughly flat Y/Y.

- $74B in total debt. It repaid $2 billion in debt and plans to do that again in Q3 and Q4.

- 12.4% Y/Y dilution is being driven by VMWare (VMW) M&A. It didn’t buy back any stock this quarter vs. $7.72 billion in buybacks Q/Q and $2.81 billion in buybacks Y/Y.

- Dividend payments rose by 27.6% Y/Y.

- Announced a ten-for-one stock split.

BroadcomAnnual Guidance & Valuation:

- Raised annual revenue guidance by 2.0%, which beat by 1.4%.

- Raised annual EBITDA guidance by 3.7%, which beat by 3.2%.

Broadcom trades for 35x this year’s earnings. Earnings are expected to grow by 14% Y/Y this year, and 23% Y/Y next year.

BroadcomCall & Release:

Infrastructure Software Solutions and the VMWare Integration:

VMware offers virtual, localized layers of software that sit on top of hardware. This allows the centralized hardware to run several different operating systems from the same place. The company, which is now a Broadcom unit, calls these “virtual machines” or virtual private clouds. By reducing hardware requirements, VMWare saves its clients money.

The integration is “going very well.” Broadcom has re-grouped about 8,000 different niche products into 4 foundational pillars to simplify go-to-market and cross-department communication. It’s also making “good progress” in moving all VMware revenue recognition to annual subscription models.

So far, 3,000 of Broadcom’s 10,000 largest clients have opted for these new products to better-leverage on-premise hardware. Most are signing multi-year contracts, which is leading to VMWare annualized bookings value (ABV) rising from $1.2 billion to $1.9 billion sequentially. While VMWare did about $3.3 billion in quarterly revenue during its last report as a standalone company, Broadcom sees cross-selling momentum pushing this quarterly revenue rate to $4.0 billion.

But VMWare is not just another revenue growth driver for Broadcom… it’s also a real profit driver as well. SG&A functions have been consolidated to eliminate monthly costs, and VMWare’s quarterly expense rate fell from $2.3 billion to $1.6 billion Q/Q. Broadcom sees this getting down to $1.3 billion by the end of its fiscal year. Growth and margin accretion are what M&A is supposed to deliver. This was a massive undertaking and has gone quite smoothly so far. Props to the team.

Semiconductor Solutions for AI:

Broadcom’s GenAI niche is predominately in networking revenue. Superchips and high-performance compute (HPC) can’t all be packed into the same corner of a data center. GPUs must be able to connect to one another to drive better bandwidth and performance, with faster, more efficient model training and inference to cut costs. This is where Broadcom thrives, which is why the explosion of AI infrastructure (or when Nvidia’s Jensen Huang calls “AI factories”) is leading to its networking revenue rising to 53% of total for this bucket. All in all, it expects this rapid build-out of HPC infrastructure to power 40% Y/Y networking growth next year. This compares favorably to previous 35% Y/Y growth expectations.

Broadcom doubled the number of switches sold Y/Y as its collaboration with Arisa, Dell, Juniper and Supermicro on the new Tomahawk 5 and Jericho 3 switches went well. Switches allow individual GPUs connect to one another. Its Network Interface Cards (NICs) are the actual high-speed connectors to AI factories that enable vastly accelerated pace of data processing, model training and more. They extract as much efficiency out of switches and servers as humanly (or machinely) possible. While it currently offers robust 800-gigabyte bandwidth for AI factory connectivity, this will be doubled when it rolls out the next generation of its hardware. It needs to keep innovating here quickly, as Nvidia has made switches and networking a more prominent part of its own roadmap.

AI accelerators are another important area within next-gen data center connectivity and networking. These are designed as separate machines used to augment and bolster AI workload and data processing. Per the team, “networking these AI accelerators is hard, but Broadcom has the deepest understanding of what this takes.” That’s why 7 of the 8 largest AI clusters on the planet use Broadcom Ethernet connectivity.

“We are the AI accelerator of choice.”

CEO Hock Tan

Semiconductor Solutions – Other:

- Wireless revenue rose 2% Y/Y. Broadcom continues to see flat revenue Y/Y for this segment.

- Server storage connectivity revenue fell 27% Y/Y. It thinks this quarter marked the bottom for the segment. It now sees revenue here falling 20% Y/Y vs. about -25% Y/Y guided to last quarter. Brightening bookings activity powered this change.

- Broadband revenue fell 39% Y/Y due to telecom demand weakness. It sees demand here bottoming during the second half of this fiscal year. It now sees a roughly 37%-38% Y/Y revenue contraction vs. 31%-32% contraction previously guided to.

- Industrial revenue fell 10% Y/Y. It now sees a 10%-12% revenue contraction here Y/Y vs. a 7%-9% contraction previously guided to.

Take:

This was a great quarter. Despite real headwinds in its non-AI-related businesses, Broadcom’s networking positioning within this wave is quite compelling. Its VMWare acquisition has been flawlessly integrated and this company just continues to deliver strong execution. There are no companies in the space besides Nvidia currently enjoying a more noticeable uplift in AI-related revenue.

b. Adobe (ADBE)

Adobe is a software giant that invented the .pdf file (co-founder John Warnock specifically). It provides programs to create and imagine, handle customer interactions and process documents. Revenue is split into two main buckets: Digital Media and Digital Experiences. Digital Media is made up of its “Creative Cloud” and “Document Cloud.” The Creative Cloud includes Photoshop and Illustrator. It’s what empowers creation, iteration and perfection of digital design. The Document Cloud, including the ubiquitous Adobe Acrobat, allows for secure PDF management and collaboration – among other things.

Finally, its Experience Cloud includes Adobe Analytics and other products like “Campaign.” Campaign is its (intuitively-named) marketing campaign tool. Experience Cloud covers end-to-end customer interactions with a real-time customer data platform (CDP) to ensure those interactions are optimized. It also publishes some greatly appreciated macro data on overall commerce spend.

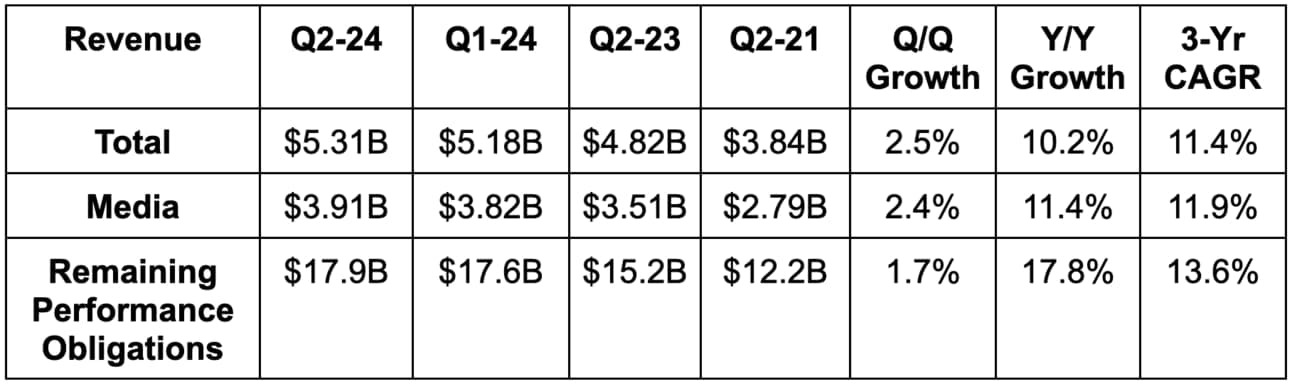

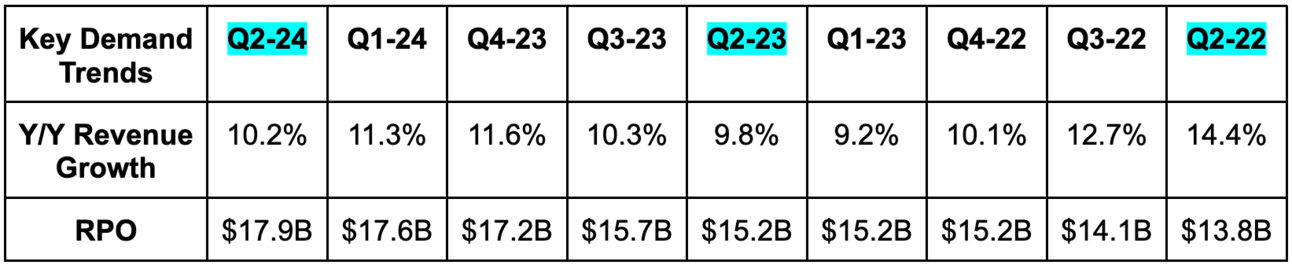

Adobe Demand:

- Beat revenue estimate by 0.4% & beat guidance by 0.7%.

- Both revenue segments were slightly ahead of guidance.

- Digital media revenue rose 12% Y/Y FX neutral (FXN). Within this, creative cloud revenue rose 11% Y/Y FXN and document cloud revenue rose 19% Y/Y FXN.

- Digital experiences revenue rose 9% Y/Y FXN to reach $1.33 billion.

- Generated $487 million in digital media net new annual recurring revenue (NNARR) vs. $440 million expected.

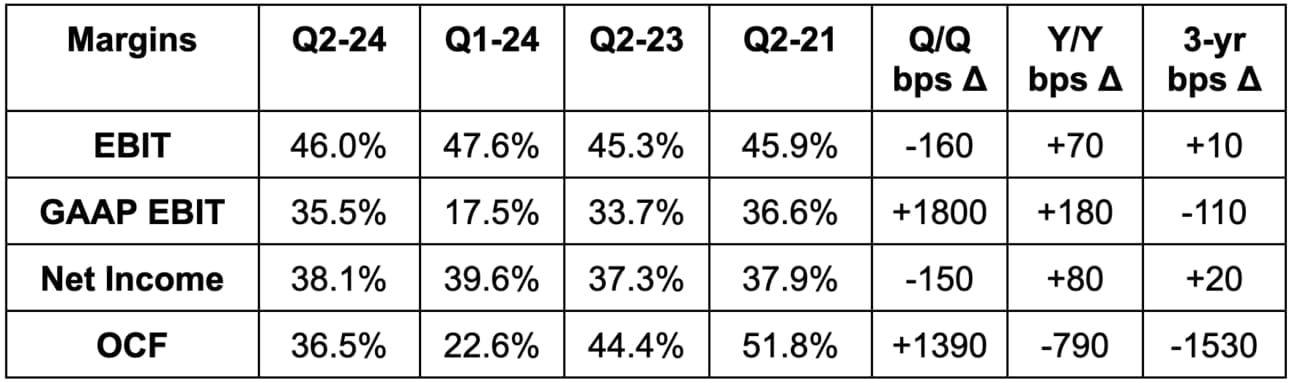

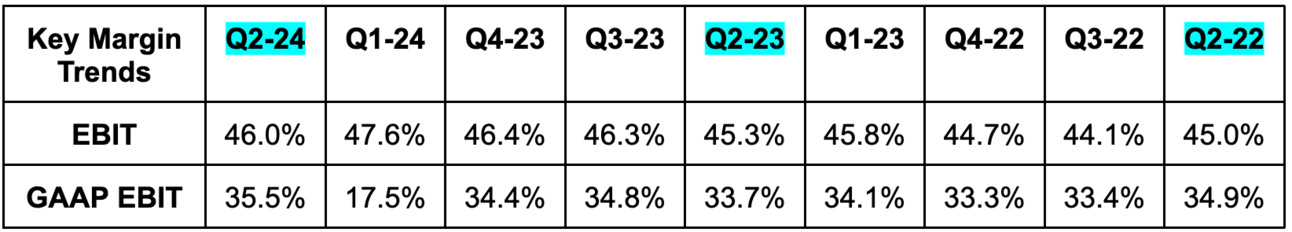

Adobe Profits & Margins:

- Beat $4.39 EPS estimates by $0.11 & beat guidance by $0.12. EPS rose by 15% Y/Y.

- Beat $3.38 GAAP EPS estimates & beat identical guidance by $0.11 each.

- Beat EBIT estimates by 1.2%.

GAAP margins & cash flow margins last Q hit by $1B in M&A charges. EPS growth was helped by expense discipline.

Adobe Balance Sheet:

- $8B in cash & equivalents.

- $5.6B in debt.

- Share count fell 1.8% Y/Y. It repurchased $2.5 billion in stock vs. $1.0 billion Y/Y.

Adobe Guidance & Valuation:

Guidance assumes stable macro headwinds, continued product traction momentum and a strong Q4.

Adobe Annual Guidance (first update since FY Q4 2023):

- Adobe’s annual guidance roughly met expectations for revenue. This is 0.2% higher than the initial revenue guide it gave in December.

- Raised annual digital media NNARR guidance by 2.6%.

- Raised annual digital experience subscription revenue guidance by 0.5%.

- Its annual $18.10 EPS guidance beat by $0.08. This is $0.30 higher than the initial EPS guide it gave in December.

Adobe Second quarter guidance:

- Q2 revenue missed by 0.8%.

- Its $4.52 Q2 EPS guide beat by $0.05.

Adobe Call & Release:

AI Momentum:

The theme of this call was AI momentum. Adobe has been cast aside as an afterthought in the GenAI race. To me, that’s a byproduct of where we are in the current monetization cycle for GenAI. Foundational infrastructure is being laid today to support the value-creating software and apps of tomorrow.

While Adobe is firmly entrenched in the software and app side of things, it’s still finding early success with its GenAI features. Its Firefly GenAI model series trains on a massive sum of unstructured and structured data from documents, campaigns and more. And while GenAI certainly is bringing a wave of rapid change, it will still favor the incumbents that have the data and assets in place to actually make models and apps valuable. That’s Adobe’s strength.

Examples of products to focus on here include Adobe Express (within mainly the creative cloud), which is a full-service tool that creates visuals, improve marketing content and augment campaign design. It comes with Firefly, which infuses GenAI into these processes for more automation and rapid iteration. MAUs for this product doubled Q/Q off of a very small base.

On the Document Cloud side of things, Acrobat AI Assistant is the centerpiece. This morphs the process of reading static PDFs into one where a user “talks to the documents.” It creates document summaries and can even automate the creation of presentations from these PDFs.

For the Experiences Cloud, its AI assistant within the Adobe Experiences Platform (AEP) is helping to improve its journey optimizer and experience manager products to make every consumer touchpoint more relevant and profitable for clients. Many more GenAI AEP apps are in the works.

“We're driving strong usage, value and demand for our AI solutions across all customer segments and seeing early success monetizing new AI technologies across our Digital Media and Digital Experience businesses.”

Adobe CEO Shantanu Narayen

More on the Document Cloud:

Acrobat link sharing allows for PDFs to be exchanged with a simple URL instead of attaching a PDF file. This allows for easier collaboration and more permission control over who can do what with a document. It’s a material positive for productivity. This quarter, link sharing rose 100%+ Y/Y, drove wonderful top-of-funnel traction, enjoyed 60% free monthly active user (MAU) growth and delivered strong free-to-paid conversion. Adobe Acrobat overall saw strong MAU growth.

Wins for this segment included AstraZeneca, Chevron, Florida and Illinois State Governments and Wells Fargo. Net new annual recurring revenue (NNARR) rose 24% Y/Y to reach $165 million.

More on the Creative Cloud:

Adobe released the latest series of its Firefly Image foundational model (FM) for automated image generation. It’s beta testing generative fill and reference images. Generative fill allows for image creation based on conversation. Reference images allow users to place images next to requests to better guide the token created from the query.

Adobe Lightroom is its product for photographers to easily edit and manage photos. Generative remove is a new GenAI tool for this product to eliminate unwanted lighting or objects from a photo to help capture that perfect shot. Adobe Premiere Pro is a suite of services for optimizing audio within videos. It’s working on several new GenAI augmentations of this product as we speak. This should help make its Frame.io offering (which is its platform for video collaboration) all the more useful.