Table of Contents

- 1. DraftKings (DKNG) & Flutter (FLUT)

- 2. The Media Landscape – Netflix (NFLX) & Disney ( …

- 4. Amazon (AMZN) – Pharmacy, AI, a Sell Side Darli …

- 5. Meta Platforms (META) – Reality Labs Re-Shuffle

- 6. Shopify (SHOP) – Channel Checks

- 7. Lemonade (LMND) – The Puppet Master

- 8. The Trade Desk (TTD) – Case Study

- 9. Updated EBIT comp sheet for Growth Tech

- 10. Market Headlines

- 11. Macro Data

There have been no changes to the portfolio since the mid-week update sent to Max subscribers.

1. DraftKings (DKNG) & Flutter (FLUT)

A few weeks ago, we covered the progressive sports gambling tax policy adopted in the new Illinois state budget. This implemented a step-series of effective tax rate hikes as sports gambling vendors crossed certain revenue thresholds. Rising tax levels for sports gambling over time (and also iCasino) are quite likely. Budgets and deficits need to be addressed and this is a very easy way to do that.

Higher tax rates in isolation foster black market momentum and make converting gamblers to legal channels more difficult. And while that headwind may be inevitable, it’s not what was alarming here. DraftKings and Fanduel both do very well in New York despite that state’s up-to-51% tax rate. DraftKings also does very well in New Hampshire with its identical tax ceiling, but it’s a monopoly in that state, which makes winning far easier. Overall, higher tax rates have shown to accelerate the death of smaller, weaker players and expedite the consolidation process. They’ve made the big boys bigger and stronger.

What is alarming about the Illinois law is that it forces DraftKings and Fanduel to pay higher blended tax rates than anyone else. The key here is the relative disadvantage both will have to overcome in Illinois, as the smaller players are gifted with a cost base advantage. The changes in Illinois mean DKNG’s tax rate roughly doubles from 15% to 30% for a $60 million EBITDA hit (6% of next year’s profits). They’ll have promotional and marketing levers to reduce this impact, but the headwind will still be largest for this player and Fanduel.

Massachusetts was considered a state where tax hikes and a progressive tax policy were possible. Encouragingly, last month, a proposal to hike the rate there from 20% to 51% was struck down. New Jersey and Michigan are the two other states considered to be the most vulnerable (mainly just for flat rate hikes, but still progressive policy too). And? There has been nothing in the proposals or developments for either state suggesting a progressive system was imminent. That could always change, but isn’t likely at this point. That’s led to growing confidence in the tax status quo next year. New Jersey does have a proposed bill to hike the tax rate from a flat 13%-15% to a flat 30%. It doesn’t seem to be a priority – at least as of now. And even if it were, the proposal avoids the least compelling progressive tax outcome. Illinois is looking more and more like an anomaly in terms of tax policy. That’s great news for the budding duopoly in this space.

2. The Media Landscape – Netflix (NFLX) & Disney (DIS)

a. Netflix Houses

There were three Netflix expansion questions analysts have been asking for years. When will you introduce ads, when will you enter live sports and when will you go omni-channel? The ads and live sports questions have been answered with the new subscription tiers and purchase of NFL rights. Now its omni-channel plans are becoming clearer. Netflix plans to open two large “Netflix Houses” with experiential events and accommodations. Rumored attractions include a Squid Game replica of the Glass Bridge Challenge episode. In-person isn’t brand new to Netflix. It’s done some live plays and other small experiences around the globe like its Knives Out murder mystery party. This simply represents a larger push into the space.

The two planned destinations will fill currently vacant malls in the greater Dallas and Philly areas; they are tiny in size compared to Disney and Universal resorts. Still, if those two companies are any indication at all, this should be a positive financial driver for Netflix. The omni-channel leveraging of valuable IP has been the secret sauce of Disney and Universal for decades. The added consumer touch-points work to deepen the connection and relationship a fan has with a brand or character. Netflix has been missing that. Now? It’s plugging the gap.

b. Disney Content

The Acolyte’s (new Star Wars show) early reviews have been bad. Interestingly, Forbes and some other outlets are reporting large cohorts of “review bombers” dead set on bringing down the ratings. This appears to be anti-woke blowback as, incredibly, there are already 10,000 reviews on Rotten Tomatoes 3 episodes into the new season. The wildly popular Mandalorian show got 2,500 reviews during the entirety of its last season. I say this to point out how noisy the initial takeaway from the show has gotten. Let’s see what they have to say about how it drove streaming sign-ups during its next quarterly report.

Conversely, Disney’s Inside Out 2 movie is thriving at the box office. The film crossed $155 million in its opening weekend in the U.S. alone, which means the $200 million budget production will likely be very profitable. It should also be a great subscription driver for Disney+.

- Nielsen reported flat month-over-month Disney streaming viewing hours for May. Netflix fell a bit, Hulu fell a bit, and YouTube rose.

3. Datadog (DDOG) – Product Debut

A key theme within data observability and analytics is bringing work, assets and insights directly to the data. This has a way of cutting data transfer and storage costs and uplifting applications with more context-rich insight. It’s why Snowflake and MongoDB are so focused on helping developers use their platforms to not only query needed info, but also to build apps. Datadog is making a similar push within the somewhat related observability and monitoring realms of data architecture.

This week, the firm debuted the Datadog App Builder to “make self-service apps and integrate them right into monitoring stacks.” The focus of this app-building tool is enabling companies to power granular use cases and accelerate the remediation of any observed issue within their ecosystems. It also comes with pre-built templates and no-code writing tools to shrink app creation time from weeks to hours – even for beginners.

By putting overarching observability, issue flagging and remediation under one roof, Datadog tears down vendor silos, creating a faster course of action and better-informed reparation. It eliminates the need for data scientists and security analysts to go hunting for needed context to diagnose & repair. This further amplifies Datadog’s ability to consolidate point solutions within the broad DevSecOps sector. More vendor consolidation means more revenue, better margins, better retention and better outcomes. It helps everywhere.

4. Amazon (AMZN) – Pharmacy, AI, a Sell Side Darling etc.

RxPass is now available for Prime Members with Medicare. This allows 50 million more consumers to access 60 common prescriptions, with fast and free delivery all for $5 per month. Whether it's this development, Prime Video investments, Project Kuiper, grocery delivery, music streaming etc., the world-class Prime subscription keeps getting… well… more world-class. There’s a reason why so many other companies are trying to emulate the value of this subscription in their own sectors to improve revenue quality and overall retention. More utility is what creates the justification to flex pricing power and still enjoy very low churn. That’s what Amazon Prime does, and this announcement is simply one more compelling product within a sea of value creation.

In other potential up-selling and retention-juicing news, Amazon is gearing up to debut Alexa AI this summer. This, as with Apple’s Siri, should greatly bolster the actionable use cases that can be conversationally queried/activated. It could easily be used to perfect product discovery and to support its thriving e-commerce marketplace. I’m sure there are many more plans for it than I can’t even fathom. There will be a basic version of this product and a premium version costing $5-$10 per month.

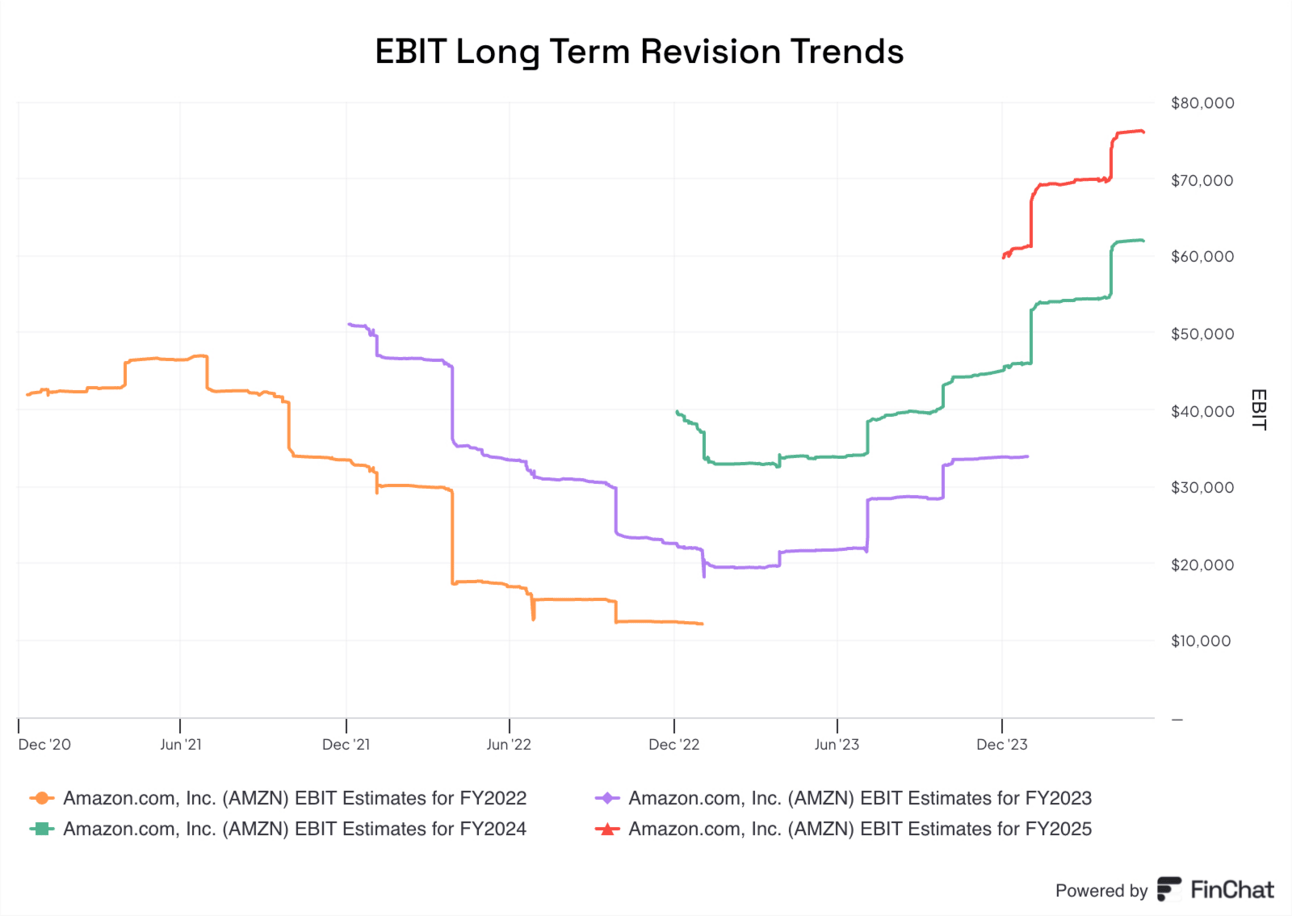

- More sell-siders are lining up to offer bullish notes on Amazon. This week, it was JP Morgan and Goldman Sachs. JP Morgan sees retail EBIT margin expansion continuing (maybe they read the newsletter). Goldman sees strong e-commerce growth through 2028 and Amazon effectively capturing that growth.

- Amazon continues to earmark billions for future infrastructure investments across the globe. This week, announcements included a 10 billion Euro investment in German cloud capacity.

5. Meta Platforms (META) – Reality Labs Re-Shuffle

Meta’s CTO Andrew Bosworth sent an internal memo to Reality Labs employees this week about an organizational re-shuffle. In it, he announced that Reality Labs would be splitting into a Metaverse division and a Wearables division. The Metaverse group will include its Quest headset and the Horizon operating system (OS), with wearables including all other hardware.

Wearables like its Ray Ban smart glasses were designed with augmented reality (AR) in mind; the Quest 3 device, conversely, “brought Mixed Reality (MR) into the mainstream.” MR and AR are very similar ideas; Still, Meta feels that focus on each should be split, with AR use cases perhaps more ready for deployment today and MR use cases offering a higher future value ceiling (just more immersive). To the team, the Quest MR unlock gives them a more intuitive and concrete path to drive Horizon OS traction. It now has a “long-term vision of how that software experience will evolve over the next two years.” Despite the lackluster Horizon traction thus far, Meta remains “deeply committed to investing in this. It is still viewed as the core software foundation to “power high quality experiences across MR and mobile.”

On the wearables side, the memo included more upbeat commentary on how well the Ray-Ban Meta glasses are going vs. expectations. Bosworth called this the “leading AI device on the market right now.” Meta is “doubling down” on building a wearables business around its Meta AI product. Part of these investments will be within the next generation of these glasses (which are expected to have hand controls) and its higher-cost hardware project called Orion.

Again, to me this is essentially splitting Reality Labs into near-term monetization and product opportunities (wearables) vs. longer term opportunities (Metaverse). It thinks the move will accelerate product velocity, improve communication and better separate the systems designed for AR (such as Meta AI so far) vs. those created for MR (such as Quest). We shall see.