Table of Contents

- 1. Nike

- 2. Datadog (DDOG) – Product Releases

- 3. Nu (NU) – M&A

- 4. Hims (HIMS) – Short Report

- 5. Nvidia (NVDA) – Shareholder Meeting

- 6. Micron (MU) – Earnings Summary

- 7. Amazon (AMZN)– Product & Investment Updates

- 8. Meta (META) & Apple (AAPL) – Making Up?

- 9. Shopify (SHOP) – Channel Partner and Shopify Ed …

- 10. Progyny (PGNY) – M&A

- 11. Market Headlines

- 12. Macro

1. Nike

a. Demand

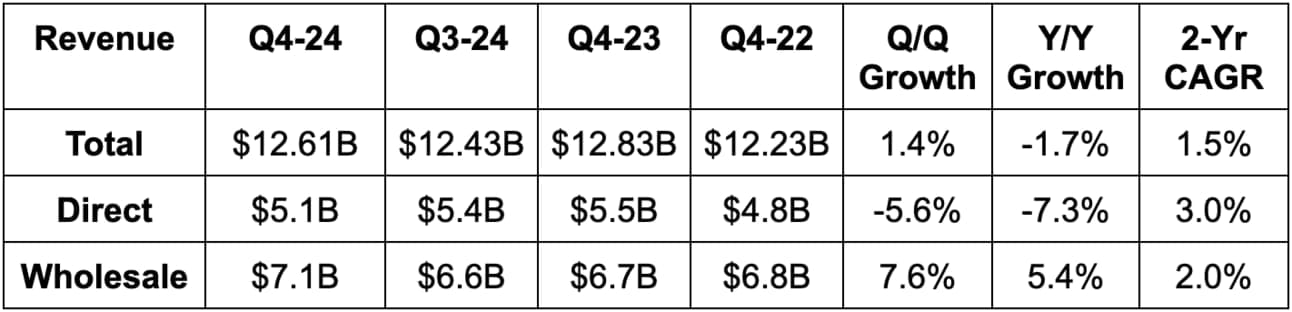

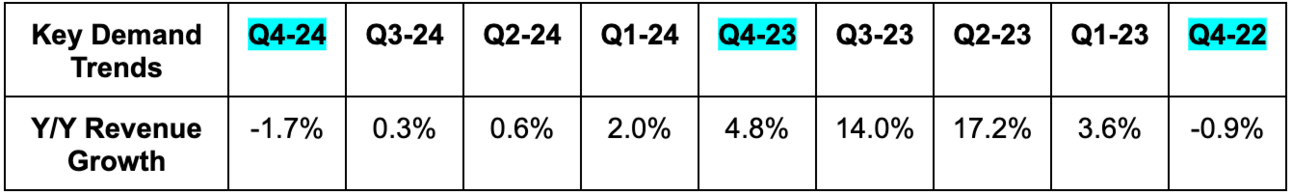

Nike missed revenue estimates by 2%. It also missed its slower revenue growth guidance, with -1.7% Y/Y growth posted. Foreign exchange (FX) headwinds were a bit stronger than expected, but that was not the only source of the miss.

U.S. revenue fell 1% Y/Y; Europe revenue fell 2% Y/Y; China revenue rose 3% Y/Y. Equipment growth was the strongest across all of these markets. Apparel growth was slow, yet positive. Footwear growth was negative (aside from slow growth in China).

b. Profits & Margins

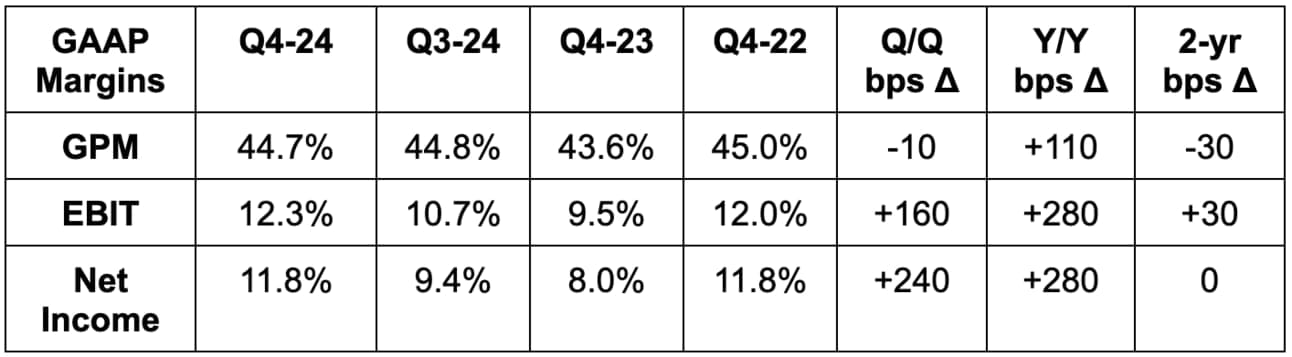

- Roughly met GAAP EBIT estimates.

- Beat $0.83 GAAP EPS estimates by $0.16.

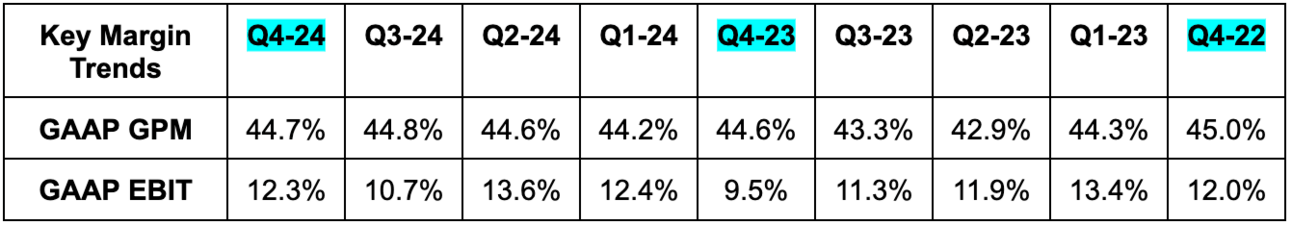

- Missed 45.3% GAAP gross profit margin (GPM) estimates by 60 basis points (bps; 1 basis point = 0.01%) and missed its guidance by the same amount. Strategic price hikes, lower ocean freight rates and lower product input costs drove the expansion seen below.

Nike’s effective tax rate was 13.1% vs. 17.3% Y/Y. Without this help, net income margin would have been 11.3% instead of 11.8%. EPS would have been $0.94 vs. $0.66 Y/Y instead of $0.99 vs. $0.66 Y/Y without this help. Also note that net income margin last quarter ex-restructuring charges was 13.0%.

SG&A expenses fell 7% Y/Y due to flat demand creation expenses and lower operational overhead costs.

c. Balance Sheet

- $11.6 billion in cash & equivalents.

- $8.9 billion in total debt.

- Inventory fell 11% Y/Y.

- Dividends rose 7% Y/Y.

- Diluted share count fell 2.5% Y/Y.

d. Guidance & Valuation

In Nike’s last quarter, it previewed fiscal year (FY) 2025 guidance by telling us that revenue and earnings would grow. Between “revised timelines” to product launches, management of classic footwear supply, macro (especially China) and some other issues discussed later on, it now sees revenue falling at a mid-single-digit clip for the full year. It also sees 20 bps of GPM expansion and positive SG&A cost growth for the year too. Analysts wanted 50 bps of GPM expansion and more EBIT margin expansion than this guidance implies. It was a miss across the board.

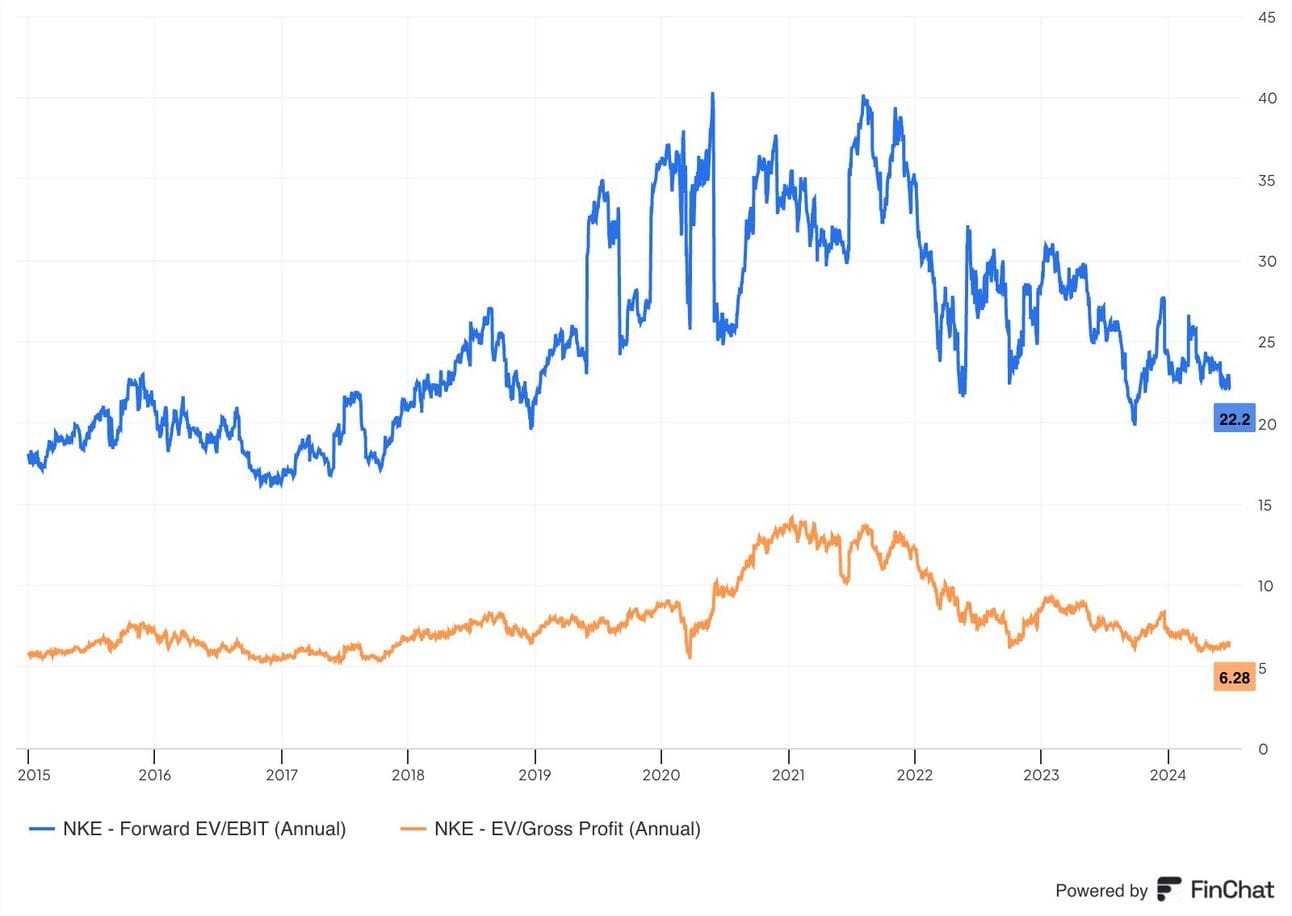

Nike likely trades for roughly 21x forward earnings. There’s no earnings growth expected this year.

e. Call & Release

Product & Organizational Changes:

Last quarter, Nike spoke on an evolving organizational and go-to-market focus to address weakening trends. It restructured its organization, removed middle-management layers for better communication and innovation velocity. It launched a multi-year product innovation cycle, accelerated the sunsetting of several legacy brands, and re-committed to perfecting impactful storytelling – with a renewed focus on sport. It also set out to improve brand distinction across its 3rd party brick-and-mortar retailer partners. Between the disruption from these changes, worsening macroeconomics, a highly promotional environment in China and a tired product assortment, we’re left with the sharp guidance reductions outlined above.

It’s not all bad news. Nike has effectively reduced small parcel fulfillment, consolidated supply chain partners, optimized spend and streamlined the organization to improve the shape of its operations. This will allow it to invest about $1 billion in savings for fiscal year 2025 to drive growth. Earmarked areas for this $1 billion in savings include “ramping ground game in key cities” and more product development budget. It will also understandably lean heavily into Olympics-related marketing. While it’s encouraging that Nike can control costs to help the bottom line, there's only so much cutting a company can do before needing revenue growth to kick in to drive profit growth.

Nike still sees its new product revenue contribution doubling in FY 2025 vs. 2024 to help offset some (not all) of the declines from its existing products.

Evolutionary Progress – Performance:

Nike’s leadership focused on the early signs of performance (training/sport) segment improvements. The segment rose double digits Y/Y, with growth across most sports. Basketball enjoyed double digit growth across all categories, with the Sabrina 1 lineup helping it take 2 points of U.S. basketball market share. A key piece of this early progress is Nike’s new “Speed Lane.” As a reminder, its “Express Lane” was implemented a few years ago, which shortened product delivery time through “hype-rlocalized design and replenishment.” Speed Lane is essentially a new iteration of this idea, which Nike thinks will deliver incremental gains on the same performance indicators. Some items under this new approach include expediting the product innovation cycle through manufacturing partners. With the help of Speed Lane, it has now “accelerated half a dozen new models,” with more coming in the second half of FY 2025.

In fitness, which it considers its largest market share opportunity, it enjoyed double digit apparel growth and broad-based health for this specific subsection.

In running, it called the environment a “competitive battlefield.” Hoka and some other players are proving to be formidable competitors. Fashion cycles have a way of making trendy new entrants go away; we’ll see how Hoka and On Running can fare. Nike thinks it has “realigned resources” to take this competitive “challenge head-on with confidence.” As a reminder, it has intentionally pulled back on older models under its Pegasus shoe line to lean into new releases (which rose 20% Y/Y). One of these new releases, the Pegasus 41, is enjoying strong early reviews and will be supported by “Nike’s most comprehensive running campaign in years.” So far, sell-through of these new models among wholesale partners and Nike Direct was called better than expected. More launches are coming within this model and several others.

Looking ahead, double-digit growth in order books for North American running (for the holidays and next spring) is bolstering the team’s confidence in this segment’s continued strength. As you can see, there are pieces of the business growing nicely. These pieces are just not large or powerful enough to offset overall declines.

Evolutionary Progress – Lifestyle:

Things are not brightening within the lifestyle category. Revenue fell across all segments and geographies, which offset performance growth. The result missed its expectations due to “softer traffic, more promotional needs and lower footwear sales.” Weakness was the worst in April and May, but still prevalent in June. Softness was the most aggressive within its digital business, with revenue declining by 10% Y/Y. Nike thinks it needs to do a better job on reacting to changing consumer preferences. It will also prioritize full price sales more strongly to protect the long term value of its franchises and marketplace.

Amplifying this current pain is its decision to accelerate the timeline of “tightening total supply of certain footwear franchises across channels.” This will “create several points of fiscal year 2025 revenue headwinds.” The team took us through some previous history that hints at these moves may bear fruit. For example, in 2018 it “recalibrated supply for some Jordan Brand franchises” and rapidly saw growth return to positive territory. That’s when Jordan “started a multi-year run of strong double digit growth.”

- This strategy has helped it regain the #1 women’s lifestyle category position in Korea. Hopefully that’s a sign of things to come in other, more challenged markets.

One of the bright sports for this category was its retro running segment. This is where, like Disney, Nike can utilize its deep vault of iconic franchises to bring old offerings back to life with lower added cost and risk. Its Y2K shoe portfolio is enjoying rapid growth and will help its retro running business triple (small revenue base) next year.

Macro:

Nike does think macro weakness is adding to the soft sales that it’s currently seeing. Some of the challenges are self-inflicted, but some are not. We’ve seen many, many consumer discretionary brands like this one struggle in recent quarters. To help combat this obstacle, Nike is launching a refreshed lineup of sub-$100 shoes. This follows Target, Walmart, Starbucks, McDonald’s and many other companies pushing to cater to increasingly price sensitive customers.

China:

China revenue did rise 7% Y/Y FX neutral (FXN) (3% overall), but there’s more context needed. Tmall’s earlier 618 shopping event added several points to this growth rate. Without this event, Nike “fell short” of its expectations and saw broad-based traffic weakness across all Chinese channels. Nike thinks some Chinese market weakness will persist, but like Starbucks, it remains highly confident in the long term growth potential of that market. The geography remains “highly promotional,” and Nike continues to try its best to navigate through it.

f. Take

Tough times for Nike. Macro and micro-level headwinds are raging in harmony and its results are certainly reflecting that. I don’t see the innovation issues as easily fixed as I do throughput issues at Starbucks or out-of-stock issues at Lululemon. To me, this seems like a matter of a tired product assortment and missing consumer preferences. With that said, Nike is an iconic brand and I’m confident that this iconic brand is not dead. It needs some better leadership, better execution and perhaps better macro to see results brighten.

2. Datadog (DDOG) – Product Releases

Datadog debuted a slew of new products at its user conference this past week. Here, we’ll cover the highlights. First, Datadog debuted a new Agent Experience for OpenTelemetry. OpenTelemetrary (OTEL) allows companies to utilize data across various cloud apps and databases for better product interoperability. Now, customers will be able to use Datadog’s product suite and tools within the OTEL framework to power broader observability. OTEL is an open means for developers to scrape and collect insight on how apps and products are performing.

Next, Datadog introduced “Live Debugger.” This allows developers to easily sift through and uncover code that has already been deployed to runtime. This can be done without any app downtime to combine easy editing and great customer service. Alternatives require significant disruptions to operations just to debug a simple coding blunder. This means significant developer and user friction has been removed with Datadog. It also means faster time to remediation. Live Debugger isolates and pulls the misconfigured code with a direct developer environment integration for low-stress mending of errors. There are GenAI tools infused into this product to automate the testing of bugs and fixes.

Thirdly, Datadog added new security tools to augment its observability platform’s reliability. These include agentless scanning of cloud environments to uncover any misconfigurations or poor hygiene. Releases here also include new data and code security products specifically for Amazon customers. The code security tool will also be helpful for the aforementioned Live Debugger tool. Importantly, these data and code security tools also include a new large language model (LLM) observability tool to monitor and secure these valuable assets. This LLM observability tool offers “out-of-the-box evaluation and sensitive data scanning” for LLMs. It can rank the quality of model inference and response accuracy rates and helps optimize cost across most major LLM providers too.

Kubernetes clusters are batches of compute power that help run an app. This helps with timing of when apps are in runtime and flexible scaling of compute capacity based on dynamic needs. Datadog introduced Kubernetes Autoscaling to help customers optimize cost across their Kubernetes capacity needs. It highlights redundant, misused and unnecessary workloads to be addressed. Next, Datadog introduced “Datadog On-call.” This combines Datadog observability with incident response management, ranks vulnerabilities and helps expedite remediation with more direct context. Lastly, the company announced Log Workspaces to drive better interoperability within a company. This allows teams to work more closely together on identifying issues and creating cross-department workflows for remediation.

In the world of enterprise software, you’re only as good as your latest and greatest innovation, the conjoining utility of your overarching platform and your go-to-market. This shows Datadog’s fixation on staying ahead on those first two items.

3. Nu (NU) – M&A

Buying Hyperplane:

Nu made an interesting acquisition of a USA-based firm called Hyperplane. This is a 2-year-old company with $6 million in venture funding to date. The acquisition is likely very small (actual terms not disclosed) and will not be directly material to results. So why do we care? Glad you asked.

Hyperplane is a data intelligence platform with a series of foundational models that assist clients in building and powering highly customized and personalized financial services. It helps banking clients train and deploy custom models with their own, secured first party data at impressive scale. With Hyperplane, customers can tap into its managed infrastructure to build more relevant, light-weight products. Its models span use cases like interface, risk, collections and marketing.

For Nu, this will simply deepen the granularity of its existing suite. It will allow Nu to nudge customers with promotions; it will allow Nu to dynamically toggle home screen presentations, based on a customer’s individual preferences; it will allow Nu to gain an even better sense of what its consumers want and when. It will help in many, many ways. Nu is already ushering in a “new era of faster, personal finance products.” This merely builds on that.

Nu has made great efforts to position itself to ingest and handle large swaths of data for AI-based leveraging. Thanks to this, it will immediately be able to take advantage of Hyperplane’s model-building prowess. And? Hyperplane will get an immediate injection of data, to accelerate the model seasoning specifically for Nu product improvement. Hyperplane will “power core machine learning capabilities'' to extend the consumer experience lead that Nu already enjoys in its markets.

Two other Potential Areas for Value Creation:

It’s clear that Hyperplane will be a tool to improve Nu’s consumer-facing suite. Still, Hyperplane was born as a business-to-business company to enable legacy and next-gen financial institutions to modernize their banking cores. Will Nu look to package and license these tools itself to sell to competition? It’s possible. I candidly hope they don’t decide to do this. The firm’s consumer experience lead in its geographies is massive. I don’t think the added revenue opportunity tied to this potential licensing is worth potentially eroding its competitive edge.

Secondly, it’s interesting to note that Hyperplane is based in Silicon Valley. There are 63 million people of Latin American descent in the United States. That’s more than a quarter of the population of Brazil. Nu could partner or secure needed licensing to jump-start a business for under-served customers. Partnering is the realistic avenue, but who knows if they can figure out how to get a charter here. Competition in the U.S. is much more fierce; regulation is more strict; but the opportunity could still be a compelling one as Nu inevitably expands beyond its 3 nation footprint.

My Nu deep dive will be published on Monday.

4. Hims (HIMS) – Short Report

There was a short report published on Hims this past week. The piece centered on the company’s push into GLP-1 weight loss drugs. The broad issues highlighted were its ease of prescribing these medications and the quality of its supply chain partners. It cited some patients who had grown ill from taking its prescribed medications, but as many pointed out, it neglected to mention these consumers took impermissible dosages. It’s disingenuous that this tidbit wasn’t included by the publisher and I do think the short report was intellectually dishonest. Still, it did highlight some of the issues that I see with the HIMS bull case that I wanted to discuss.