Table of Contents

- 1. Salesforce (CRM) — Earnings Review

- 4. Earnings Round-up – Zscaler (ZS); Okta (OKTA); …

- 9. DraftKings (DKNG) and Flutter (FanDuel; FLUT) – …

- 11. Market Headlines, Sell-Side Notes & Macro

- Heading 1

1. Salesforce (CRM) — Earnings Review

Salesforce 101:

Salesforce is the 3rd largest enterprise software firm on the planet. It provides a broad suite of products to help clients optimize customer interactions, sales and marketing. The overarching niche is called Customer Resource Management (CRM). Salesforce offers a variety of cloud services to its customers. There’s a sales cloud, which perfects consumer touch-points. There’s a commerce and marketing cloud to build online storefronts and augment promotional activity. There’s a service cloud to handle customer issues and inquiries. There’s also a platform cloud, which includes Slack.

Most recently, it debuted its data cloud. This is an aggregated analysts service to ingest, organize & glean insight from 1st party data. It conjoins siloed data and “unlocks” previously disparate sources for client value creation. It’s similar to what Snowflake does, but more for managing customer relationships. MuleSoft and Tableau are both key pieces of this data cloud. MuleSoft integrates apps and data to enable management of these products within Salesforce. Tableau is a data visualization tool to create automated progress reports and suggestions to leverage findings. Finally, it offers industry-specific clouds for sectors like healthcare. These are customized to meet specific regulatory and operational needs. All of these clouds and products make up the firm’s subscription & support revenue, which represents 93% of its total business. Professional services make up the rest.

Separately, Salesforce offers a product called Einstein One. This is a full set of AI tools, including outcome prediction, chat bots, image recognition, sentiment analytics and more. It’s considered a general-purpose AI platform infused into all Salesforce products. Most recently, through an OpenAI partnership, it debuted Einstein GPT. Einstein existed before the GenAI wave, but is now getting an upgrade thanks to it. Einstein GPT allows Salesforce clients to plug into language models (including OpenAI, Anthropic and Cohere) to make workflows more productive, intuitive, conversational and automated. It features a low code tool set to reduce the barrier for non-experts to build applications; it also boasts expert-level tools to build more complex apps. That’s Salesforce in a nutshell. Now, the quarterly results.

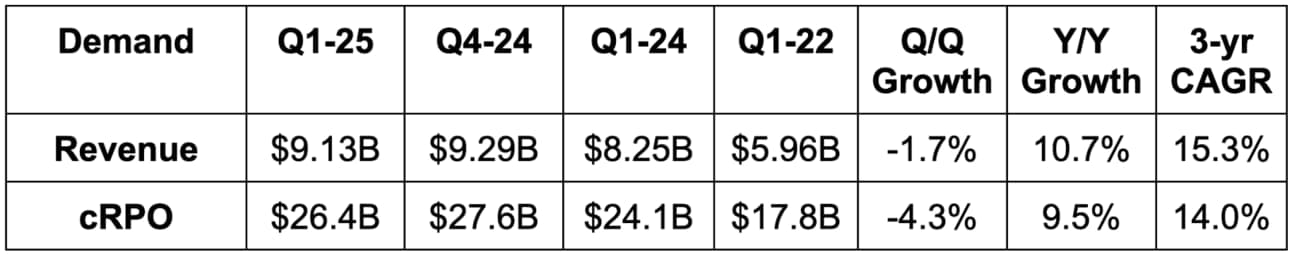

a. Demand

- Barely missed revenue estimates by 0.1% & barely missed guidance by 0.2%. Foreign exchange neutral (FXN) revenue growth was 11% Y/Y.

- This was blamed on professional service and licensing revenue headwinds and a “measured buying environment.” More later.

- Subscription and support revenue rose 12% Y/Y and 13% Y/Y FXN. Leap year added 100 bps to growth rates here, while MuleSoft and Tableau licensing revenue timing helped a bit too.

- BIllings rose by 3% Y/Y and missed expectations by 5.9%. This is not good, but the metric can be quite lumpy on a quarterly basis. As long as it doesn’t become a trend, it’s not a huge deal.

- Missed 11% Y/Y current remaining performance obligation (cRPO) growth guidance by 100 basis points (bps; 1 basis point = 0.01%).

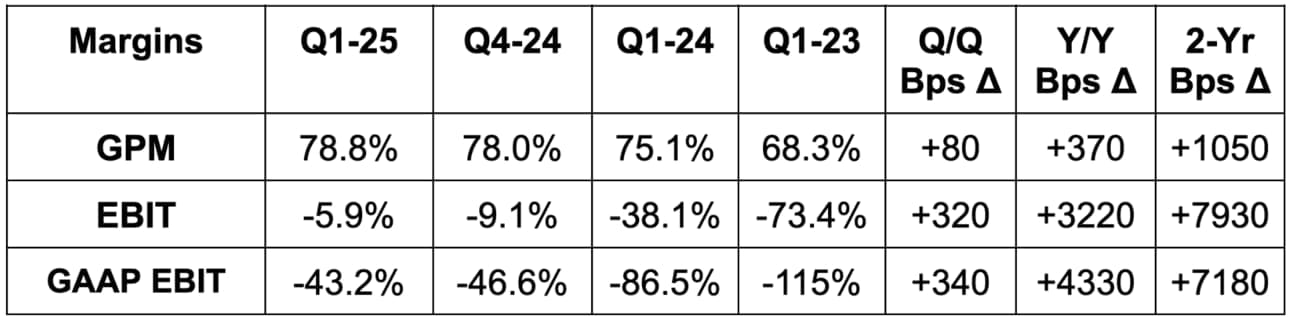

b. Profits & Margins

- Beat $1.43 GAAP EPS estimates & beat identical guidance by $0.13 each (9% GAAP net income beat).

- Beat $2.37 EPS estimates & beat identical guidance by $0.07 each (3% net income beat).

- Missed EBIT estimates by 1.0%. This means the EPS beats were powered by net interest income or tax favorability, rather than operating profitability.

- Beat free cash flow (FCF) estimates by 12.6%. This was modestly helped by tax payment timing.

c. Balance Sheet

- $17.7B in cash & equivalents; $5B in investments; $9.5B in debt.

- Diluted share count fell by 0.3% Y/Y. It bought back a little more than $2 billion in stock vs. $2 billion last year, but $750 million in stock comp diminished the positive impact of this repurchasing.

- Salesforce instituted its first dividend last quarter. It paid out $388 million (or $0.40/share) in dividends this quarter.

d. Annual Guidance & Valuation

- Reiterated annual revenue & EBIT guides, which both missed by 0.4%.

- Slightly lowered annual subscription revenue guidance from above 10% Y/Y growth to 10% Y/Y growth.

- Lowered annual GAAP EBIT margin guidance from 20.4% to 19.9%. This was related to lower-than-expected voluntary employee attrition, which isn’t all that concerning in my view.

- Slightly lowered annual $6.11 GAAP EPS guide by $0.03, which met estimates.

- Raised $9.72 annual EPS guide by $0.18, which beat by $0.11.

- 22.5% Y/Y operating cash flow (OCF) growth and 24.5% Y/Y FCF growth were both reiterated.

Key assumptions in its guidance include:

- Buying environment from Q1 lasts all year.

- Revenue attrition remains at a stable 8%.

- Continued FX headwinds of $100 million – no changes here.

Salesforce trades for about 21x this year’s earnings. Estimates should be stable following this report and EPS is expected to grow by 19% Y/Y.

e. Call & Release

AI & Data:

Just like last quarter, the intersection of the Salesforce data cloud and its work in AI was the key theme. As Benioff explains (and so do we frequently in this newsletter), models are racing towards commoditization. They all pull from large swaths of the exact same public data. So what makes them unique? Infusing a client’s unique and relevant training data into these models. Salesforce has 250 petabytes of client data that’s ripe for model seasoning; it also has a data cloud that allows customers to tear down data lake and data warehouse (structured and unstructured data) siloes to utilize all of it in a cohesive, categorized manner. That’s how to get the most out of the AI strategy: by having a superior data foundation, which Salesforce is pushing hard to facilitate.

The Salesforce Zero Copy Partner Network blazes a more direct trail between the Data Cloud and other large databases. It allows customers to openly query and use data across these sources to avoid constant data copying and higher storage/processing costs. Partners include all three hyperscalers, Snowflake, Databricks and IBM.

- Data cloud was in 25% of the firm’s $1 million+ deals for the quarter. The product added more than 1,000 customers for the second consecutive quarter.

- Data cloud records ingested and processed rose 42% and 217% respectively. These are key performance indicators for the product’s trajectory.

- Salesforce is using its own work (and OpenAI’s work) in AI to save its software developers 20,000 hours/month in coding time.

- McKinsey sees ¾ GenAI use cases eventually coming from front office product categories like Salesforce’s

As an aside, many have asked if I think GenAI is cannibalizing software spend. I think that’s possible to some extent… but if it is, I also think that will be short-lived. All of the amazing consumer apps and interfaces that will come from GenAI require a large foundational infrastructure to first be in place. That’s why we’re seeing such massive CapEx numbers from the hyperscalers. That’s why hardware is enjoying all of the GenAI fun today. That will not last forever. The foundation will be laid, quality companies that can build solid use cases will begin to monetize at scale, and this narrative will dissipate. That’s how I see things.

Cross-Selling & Customer Wins Highlighted:

Salesforce is best-in-breed in terms of its ability to consolidate vendor point solutions and cut expenses for its customers. That strength was again apparent this quarter. Half of its 50 largest deals and 6 of its 10 largest deals included 6+ cloud products. Industry-specific clouds were also in 5 of its largest deals, including Paychex. This customer went with its financial service industry cloud and the data cloud to more proactively pursue customer renewals.

- Slack was in half of its 50 largest deals including Rocket Mortgage.

FedEx went with the data cloud for its ability to “generate expansive savings” and foster a “more efficient and profitable FedEx.” Products making this happen include automated “next best action for seller” suggestions, its Einstein virtual assistant, opportunity scoring, lead generation and more. Air India also purchased its data cloud service to help conjoin its loyalty, reservation and other siloed data warehouses. It’s also using Einstein to automate case summaries for customer service interactions to free up employee time.

- Einstein wins during the quarter included Siemens and Autodesk.

I think the most encouraging customer win during the quarter, aside from Autodesk, was a CrowdStrike expansion. The endpoint and cloud security disruptor added Salesforce’s data, marketing, commerce and revenue clouds during the quarter – along with MuleSoft. It was already a Slack and Einstein One user. CrowdStrike is broadly viewed as among or the best-in-breed for pretty much all of its products. It sets the innovation curve in cyber security. Why does this matter for Salesforce? Some of CRM’s products are viewed as somewhat dated. With that in mind, it’s nice to see a leader in a high tech sector standardizing on Salesforce’s platform. CrowdStrike has already enjoyed a 30% project delivery pace boost with the new Salesforce tools.

M&A:

A few quarters ago, Salesforce disbanded its M&A team, proclaiming that it had all of the assets it needed. During this past quarter, rumors swirled that it was considering a purchase of Informatica. That led some to believe it was struggling a bit to find longer term organic growth. They were asked about this on the call. Benioff committed to making sure any large-scale M&A was accretive to customers rather than dilutive. I’m candidly not sure what he means by that. Maybe he meant earnings instead. He also said they’ll remain selective; any and all M&A within its “framework” seems to be back on the table.

“As we go forward, we know that we need to slightly adjust that so that we can continue to deliver you these amazing financial metrics… we know we can continue to deliver cash flow and margin numbers at this level. We're also going to have to continue to keep our eye on the M&A framework.”

Founder/CEO Marc Benioff

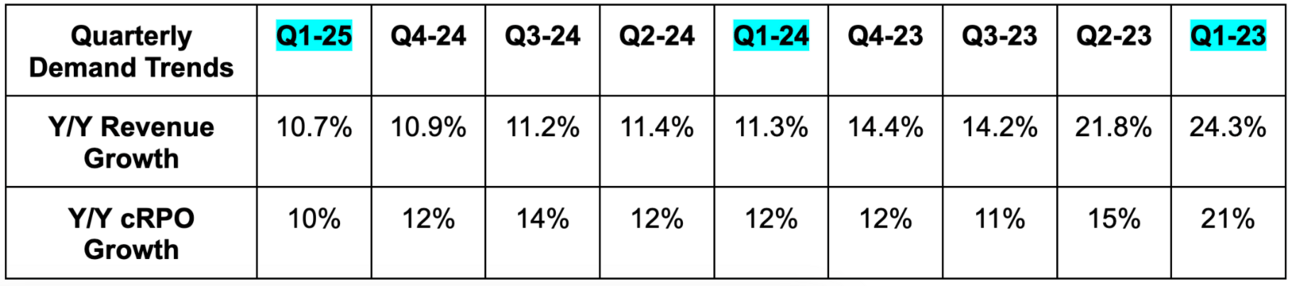

The Buying Environment & Demand:

In the fourth quarter, Salesforce cited shrinking sales cycles and an improving buyer appetite. Benioff said the demand environment took a “complete 180.” That 180 seems to have been short-lived, which can be seen in the 3% Y/Y billings growth. This quarter, things negatively reverted back to what they have seen over the past 2 years. The sales cycle again elongated, deal size compressed and budget scrutiny again rose. That’s frankly not great to hear from one of the world’s largest sellers of enterprise software.

The team also discussed some “go-to-market changes” implemented to improve processes, which apparently hurt its billings activity as well.

- Japan, Canada and India were the noted demand standouts during the quarter; things were tougher across Europe and Latin America.

- Financial services and the public sector were the demand highlights; tech, retail and consumer packaged goods were the weak spots.

- The Salesforce Starter bundle, which offers a few core products across commerce and marketing for smaller customers, is building traction and seeing strong conversion to more expensive subscription packages.

“As we entered the post-pandemic reality, companies had acquired so much software and looked to actually rationalize it, ingest it, integrate it, install it, update it. I mean it's just a massive amount of software that was put in. And so every enterprise software company kind of has adjusted during end of this post-pandemic environment.

Founder/CEO Marc Benioff

f. Take

The quarter was fine aside from the billings number. And again, billings weakness only becomes concerning when it’s a multi-quarter trend.

Salesforce had been spoiling people with solid top line results and material upward margin surprises for several quarters in a row. That did not repeat, as the EBIT margin was simply reiterated this quarter. To me, that item, the negative buying environment commentary and the small subscription revenue guidance reduction were the three negatives to pick at. We can’t call this quarter good, but I also don’t think we can call it terrible either. It’s not like maintaining an EBIT margin guide is the end of the world. Far from it.

While the short term punishment does make sense, I don’t see this as a quarter to fret for the long term Salesforce bull. The misses were all quite small. The lack of margin raise is to invest in more growth; stable revenue attrition shows that competition and bad products aren’t the root causes of weakness. And it still raised its full year earnings outlook to a level that puts it at a 21x p/e. That’s historically quite cheap for this company. It’s actually looking interesting to me here, but the large enterprise software exposure that I already have will likely keep me away.

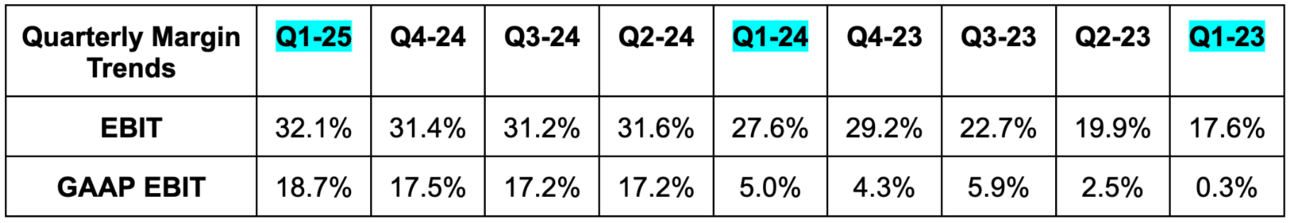

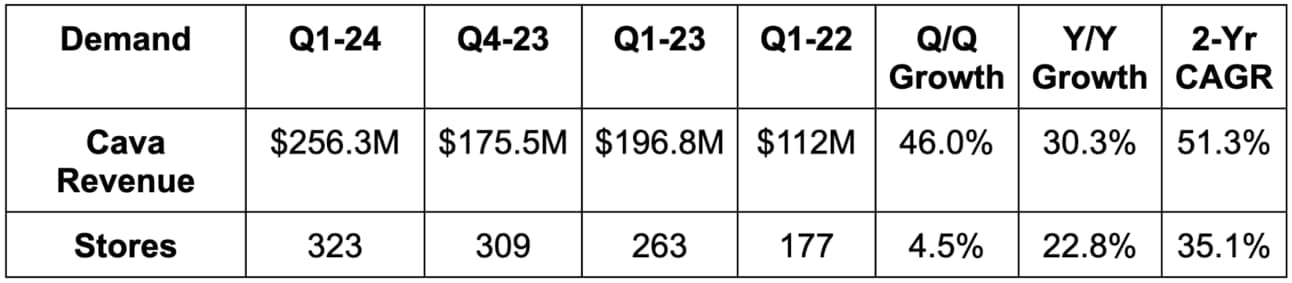

2. Cava (CAVA) – Earnings Review

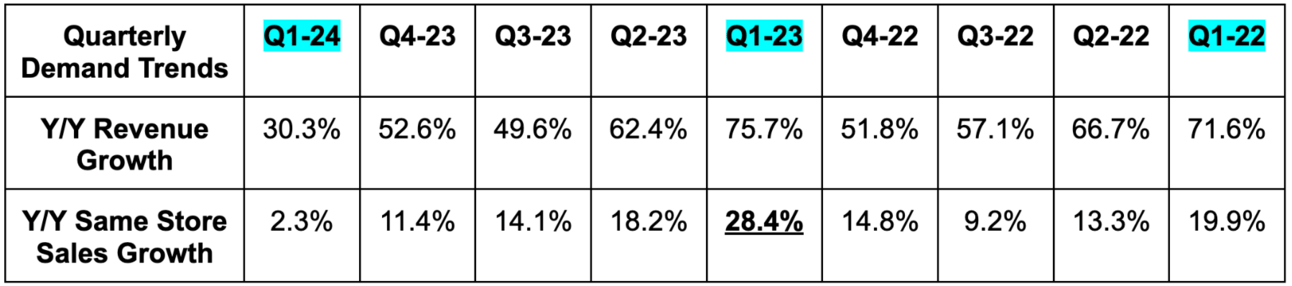

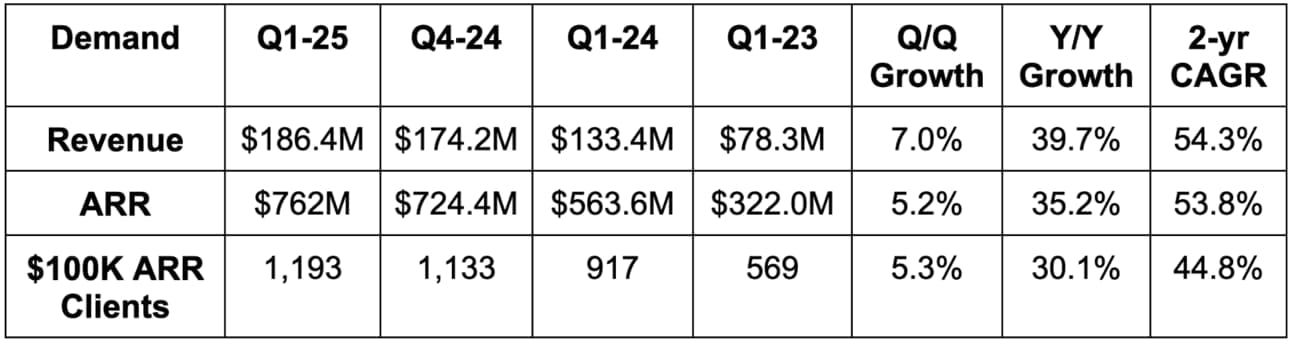

Cava beat revenue estimates by 4.4%. Its 51.3% 2-year revenue CAGR compares to 52.2% Q/Q and 53.3% 2 quarters ago. Note the same store sales (SSS) comp was extremely tough, with Q1 2023 SSS growth of 28.4% Y/Y. Same store sales growth includes 3.5% Y/Y price growth and -1.2% Y/Y traffic growth (excluding the positive impact of holiday timing).

- Average unit volume (AUV) was $2.61 million vs. $2.64 million Q/Q and $2.55 million Y/Y.

- Digital revenue mix rose from 36% to 37% Q/Q.

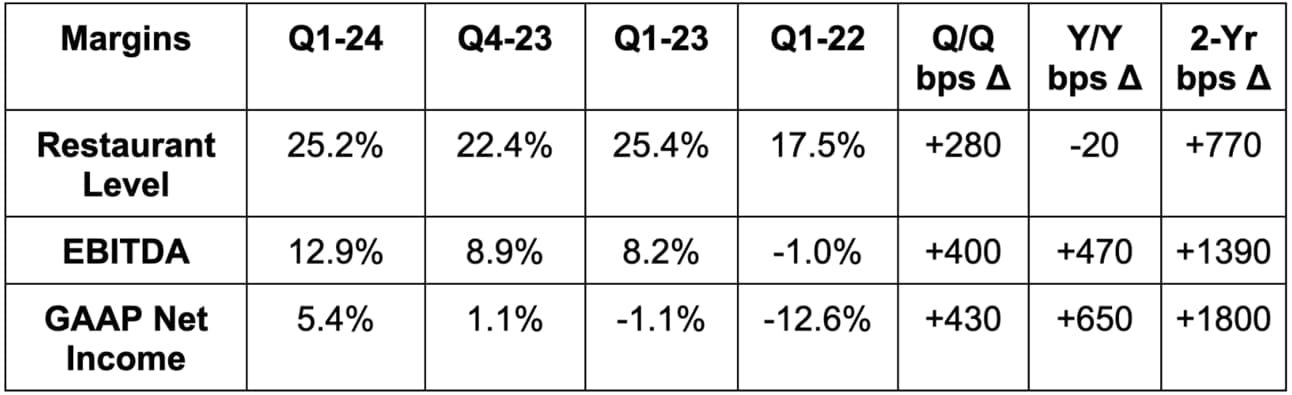

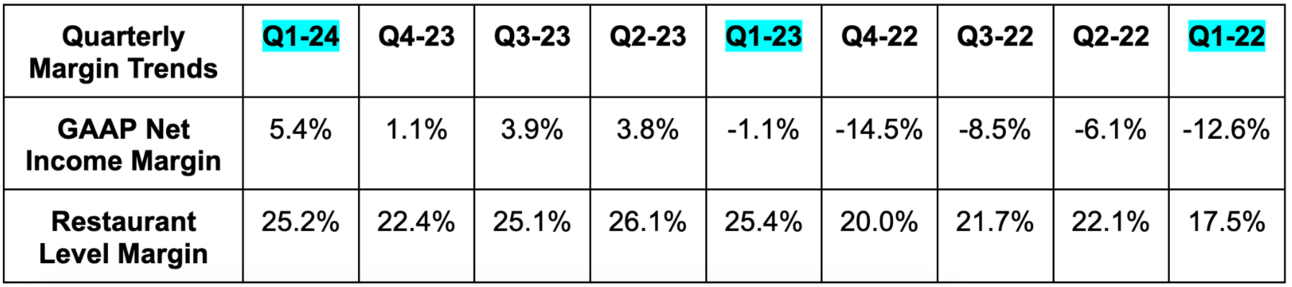

b. Profits & Margins

- Beat EBITDA estimates by 44%.

- Beat $0.05 GAAP EPS estimates by $0.07.

The restaurant-level margin decline was actually better than expected. The company has been telegraphing heavier labor investments (8% Y/Y wage growth) and store expansion investments as weighing on this margin line throughout 2024. It did get some help from food input costs this quarter, but sees that help vanishing for the rest of the year – largely due to its debuting of a steak dish. G&A as a percent of revenue was 13.1% of sales vs. 14.3% Y/Y. Less performance based stock compensation helped leverage here while more investments in growth offset the leverage a bit.

c. Balance Sheet

- $329 million in cash & equivalents.

- No debt.

- $75 million in undrawn credit capacity.

- Stock comp was a very modest 2% of revenue. Share count growth is exponential due to the IPO.

“Our strong balance sheet and ability to self-fund growth put us in a position of strength to continue gaining market share.” – CEO Brett Schulman

d. Annual Guidance & Valuation

- Raised EBITDA guide by 15.2%, which beat estimates by 11.4%.

- Raised same store sales growth (SSS) guide from 4% to 5.5%. This implies mid-to-high single digit SSS growth for the rest of the year. That optimism is based on the observed strength across all income groups. Its steak launch described below will help here too.

- Raised restaurant-level margin guide from 23% to 24%.

- Now expects to open 52 stores this year vs. 50 previously.

- Guidance excludes any frequency benefits from its loyalty program.

Cava trades for 210x this year’s earnings. Earnings are expected to compound at a 2-year clip of 37%, making this one of the most expensive names in its sector and the market. Many are betting on forward earnings estimates being far too low. They’ve been right so far. They need to continue being right for this to continue working, in my opinion.

e. Call & Release Highlights

Market Expansion:

Cava has already opened up 5 new stores quarter-to-date (QTD) following 14 openings last quarter. It recently entered Chicago, where long lines and a passionate fan reception are leading it to re-think how many locations can work in that important market. New stores are all outperforming internal expectations and could boost its year 2 target of $2.3 million in average unit volume (AUV) in the near future.

Steak:

After two years of testing, the firm’s sun-dried tomato steak is being rolled out across the nation. The company sees this adding momentum to its dinner demand, with dinner already making up 46% of its total sales. It also expects this to provide a tailwind for same store sales, as red meat has been missing from its menu since it removed meatballs last year. This encompasses Cava’s obsessive approach to new menu items. It tests, tests and tests some more across a few markets until it’s absolutely sure the dish will work.

Loyalty Program, Data & Running Great Stores

As we spelled out in the deep dive, Cava recently wrapped up an intense vertical integration of its entire tech stack. With this now largely in the rear-view, it’s turning its attention to better leveraging first party data. It thinks its first party data, like for everyone else, can drive more optimal customer touchpoints and better, more personal relationships. It’s now rolling out its new rewards points program, which, in early testing, has been shown to directly raise order frequency.

“We believe we are on the precipice of a decade long data transformation.” – CEO Brett Schulman

The company’s connected kitchen initiative is its way of using all of this data, with the help of GenAI partners, to “drive quality, consistency, accuracy and speed of service.” This pilot program will begin testing this year. Finally, its new labor deployment program, which balances hours across peak demand, is delivering better employee experiences in 30 test stores.

Leadership:

Jeff Gaul was named as the company’s new Chief Development Officer. He was most recently Nike’s Global Store Development VP and a Senior VP of Store Development at Sephora.

f. take

This is a fantastic company with a fantastic team putting up fantastic results. I have wanted to own this for quite some time, but just cannot get comfortable with the multiple or anything remotely close to its current multiple. I think it’s just too expensive; that doesn’t change the fact that shareholders should be enjoying this strong run. Congrats to you. I hope to own this at some point in the future.

3. SentinelOne (S) – Earnings Review

SentinelOne directly competes with CrowdStrike, Microsoft Defender and Palo Alto in endpoint security. It specializes in small-and-medium-sized business (SMB) clients and is now expanding up-market. While CrowdStrike’s overarching platform is called Falcon, SentinelOne’s comparable suite is called the “Singularity Platform.” The core use cases of the Singularity Platform are in endpoint security (like endpoint detection and response (EDR)). Like CrowdStrike, it offers highly autonomous services and a slick, lightweight, single agent to drive interoperability. This, in turn, means overarching coverage and superior breach protection vs. legacy incumbents.

Also similar to CrowdStrike, SentinelOne boasts a complementary data analytics platform (which it calls the Singularity Data Lake). This lake can ingest structured data logs from identity, case management, threat intelligence and so much more. With this capability, SentinelOne can collect data once and utilize it throughout all client use cases with that single agent. Less data siloing means its platform’s models and algorithms can be more effectively seasoned to drive better efficacy. The use cases beyond solely endpoint security mean that it can recycle this data repeatedly with little incremental cost.

Just like CrowdStrike (noticing a theme?), it’s also actively expanding into cloud security and some identity use cases too. Important cloud security acronyms:

- CWS = Cloud Workload Security. It’s an agent-based, preventative cloud protection tool to observe any bad behavior by cloud environment entrants. It sounds the alarm bell for SentinelOne’s automated breach protection and, if needed, the Managed Detection and Response (MDR) threat hunting team (called Vigilance).

- CNAPP = Cloud Native Application Protection Platform. This is a buzz phrase used to describe a firm’s full set of cloud tools.

- CSPM = Cloud Security and Posture Management. CSPM reports vulnerabilities and conducts configuration analysis in any cloud environment. It can flag improper permissions or hygiene. It doesn’t stop breaches in isolation, but does offer needed alerts, which frees other cloud tools like CWS to do so.

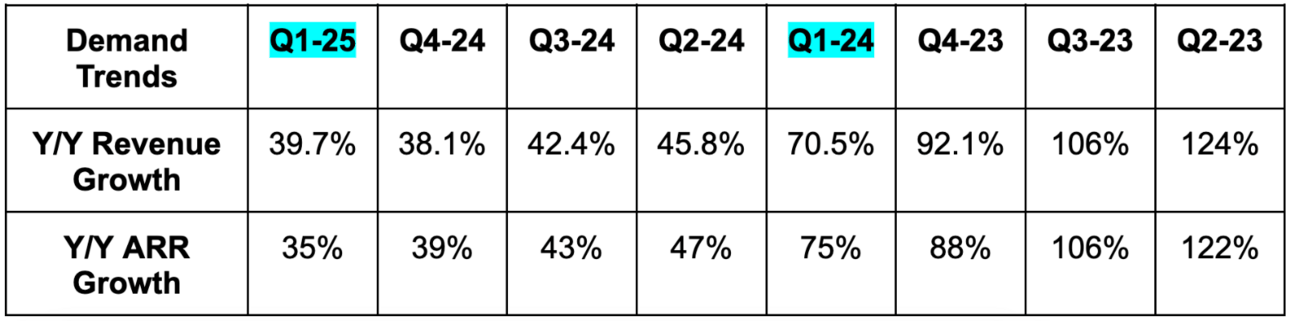

a. Demand

- Beat revenue estimates by 2.9% & beat guidance by 3%.

- Missed Annual Recurring Revenue (ARR) estimates by 0.4%.

- Dollar based net retention rate is “north of 110%” vs. 115% Q/Q. This is being impacted by a mix shift in revenue towards new client wins.

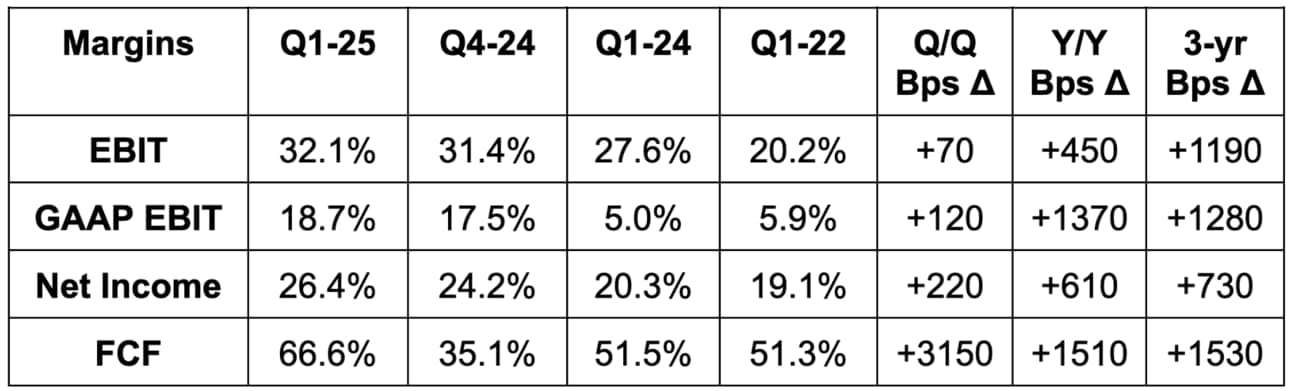

b. Profits & Margins

- Beat -$0.05 EPS estimate by $0.05. I saw many on social media report this as an 18 cent miss. That’s not accurate. -$0.23 was the GAAP EPS result; $0.00 was the non-GAAP EPS result, which the estimate was based on.

- Beat -$25 million EBIT estimate & beat identical guidance by $14 million each.

- Operating expenses rose by 5% Y/Y, largely due to headcount growth.

- Beat 77.5% gross profit margin (GPM) estimate & beat same guidance by 130 bps. Scale and cross-selling continue to power the GPM leverage.