Today's piece is brought to you by Commonstock:

1. The Trade Desk (TTD) -- Earnings Review

“In our current environment, our demonstrated ability to invest in growth and self-fund our high growth rates through profitable long term cash flow generation sets us up well for the future.” — CFO Blake Grayson

a. Demand

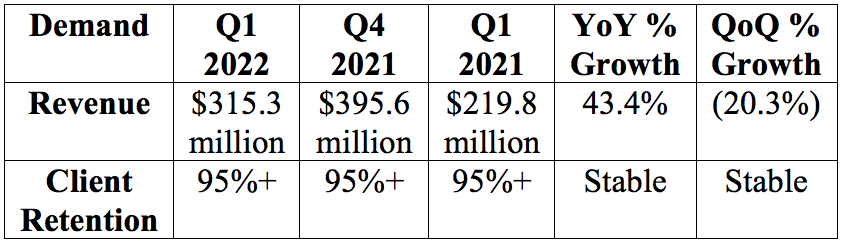

The Trade Desk guided to “at least” $303 million in revenue while analysts were looking for $304.3 million. It posted $315.3 million, beating its expectations by 4.0% and analyst estimates by 3.6%.

More demand context:

- Q4 is always The Trade Desk’s best quarter of the year by a sizable margin.

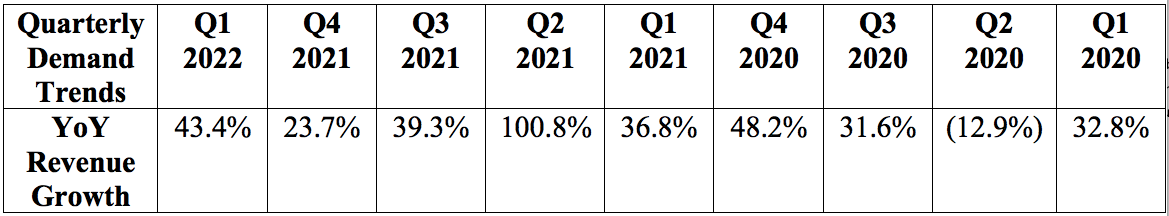

- The Trade Desk will have one of its toughest YoY growth comps next quarter due to the 100%+ growth in Q2 2021 from a demand backlog unwind as the ad market recovered post-pandemic shock.

- This was its fastest YoY Q1 growth rate in 4 years... on a much larger revenue base.

b. Profitability

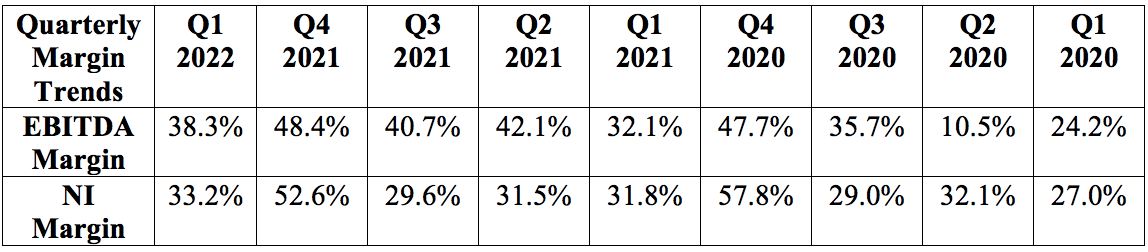

The Trade Desk guided to approximately $91 million in EBITDA while analysts were expecting $92.4 million. It generated $121.0 million in EBITDA, beatings its expectations by 33.0% and analyst expectations by 31.0%.

More margin context:

- GAAP Operating Margin in Q4 2021 was hit by $158 million in stock-based compensation paid out to Co-Founder/CEO Jeff Green for meeting performance benchmarks. Operating margin was 33.6% without this charge.

- There’s $616 million left in this package which will vest through 2026.

- GAAP Net loss of $15 million in the quarter (4.8% margin) resulted from this as well.

- Margins continue to be slightly propped up by temporarily lower OpEx via the virtual environment it’s still partially operating in.

- Going forward, The Trade Desk expects to lean more heavily into growth and see normalizing OpEx which could lead to slowing or flattening margin expansion in 2022 and 2023.

“With a large available market in front of us, we see significant opportunities ahead and continue to be motivated to invest thoughtfully in the business, placing high importance on hiring to support growth which enables us to keep distancing ourselves from the competition.” — CFO Blake Grayson

The Trade Desk eclipsed $1 billion in cash & equivalents for the first time during the quarter. It has no debt.

C. Guidance

Q2 2022:

- Analysts were looking for $364.7 million in revenue while The Trade Desk guided to “AT LEAST” $364 million.

- Analysts were looking for $126.6 million in EBITDA while The Trade Desk guided to $121.0 million, missing expectations by 4.6%.

The anticipated sequential EBITDA drop is due to the aforementioned OpEx normalization and pressing down harder on the gas pedal to take more market share thanks to the company’s excellent margins and balance sheet.

The Trade Desk does not guide to annual results.

d. Conference Call Notes from Co-Founder/Co-CEO Jeff Green

On the quarter:

- The Trade Desk continues to grow well in excess of even the most optimistic digital advertising growth forecasts (14% from Zenith) as it continues to take more market share.

- The secular tailwind that is the shift to digital advertising was strong enough to deliver an across-the-board beat and overcome inflationary and supply chain challenges weighing on marketing spend aggression as well as the war in Ukraine temporarily impacting European ad spend.

“The Trade Desk is firmly established as the default DSP for the open internet and we are well-positioned to grow and grab share regardless of the macro environment.” — Co-Founder/Co-CEO Jeff Green

On CTV rapidly embracing AVoD:

“I have spent many of the last 10 years publicly predicting Netflix and everyone else would eventually show ads. Netflix’s announcement to make ads part of their future and so many other great things are happening in CTV. I can’t think of a time that the TV landscape had more positive changes in a short period of time.” — Co-Founder/Co-CEO Jeff Green

Because CTV ads are only purchased and shown to logged-in viewers, this is the perfect environment for selling data-driven ads… this is likely why it’s The Trade Desk’s fastest growing segment.

In just a matter of months Disney+, HBO Max and Netflix all announced broader intentions to introduce ad-supported pieces to their streaming businesses. As a reminder, Netflix leadership explicitly told us on their last call that they weren’t interested in building programmatic capabilities internally -- like Amazon is doing -- which is great news for The Trade Desk.

Furthermore, Green was rather excited about Discovery now owning Time Warner as he called their team “one of the savviest in programmatic advertising.” The Trade Desk has intimate advertising relationships with both Disney and HBO Max -- Green is “extremely confident” in developing deep relationships with every streaming platform.

With the three streaming titans all quickly embracing ads, this places added pressure on everyone else to mirror the enhanced programmatic targeting capabilities to keep from falling behind in terms of return on ad spend (ROAS). For reference, advertisers will pay roughly 3X more in cost per mille (CPM) if there’s a “reasonable chance those viewers are interested.” Smaller publishers can’t really afford to miss out on this and also can’t afford to build programmatic bidding platforms on their own. Enter The Trade Desk.

“As more premium CTV supply comes online, we have more than enough demand to satisfy it. We could not be more excited about what the Netflix, Disney+ and HBO Max shift means for AVoD supply… Demand is really off the charts with the move away from cable. The new CTV inventory is desperately needed with demand already lined up. These CTV players can’t alienate users. They have to provide relevance and they have to provide very few ads. So that means we’re going to see scarcity for as far as we can see into the future.” — Co-Founder/Co-CEO Jeff Green

“We started to see movement towards ad-funded CTV early on in the pandemic, but I think we’re seeing even more of it now.” — Co-Founder/Co-CEO Jeff Green

On UID2 upgrading the internet and Google:

A theme of the earnings call was “upgrading the internet” by shifting it from opt-out to opt-in -- giving consumers the ultimate choice of who is allowed access to their 1st party data. This requires that about 10% of users are logged in, in order to effectively target -- which The Trade Desk has consistently been well above thus far. CTV -- where all ads are programmatic -- greatly helps here.

Google’s degradation of 3rd party cookies merely amplified the pressing need for Unified ID 2.0 (UID2) (which is the open internet identifier The Trade Desk created) and its usage of phone numbers and emails rather than cookies to responsibly, granularly and effectively track consumers across any internet environment.

Green on UID2:

Green discussed the reliance that a steady supply of free, premium content has on advertising. At the same time, consumers are quite sensitive to ad load and repetition which makes effective identification to avoid these issues all the more important. UID2 ensures this can still be done in a way that respects and protects identity -- it can track and place ad impressions without ever sending a piece of sensitive, identifiable data to the advertiser or agency.

Green further added that on-boarded publishers are already enjoying rising CPM due to their impressions becoming more valuable with the enhanced visibility, measurability and ultimately return on ad spend (ROAS) that UID2 provides.

UID2’s freeing of safe and scalable first party on-boarding along with The Trade Desk’s Solimar ad-platform and its retail relationships all equip the firm with a data marketplace that -- according to Green -- “has the potential to be the largest in the world.” Additionally, a recent marketplace design refresh has led to higher ROAS for its clients.

For a final note, while The Trade Desk built UID2, it intentionally does not own it. The firm is fixated on avoiding conflicts of interest (even though it is starting to encroach on supply side utility) and this is one of the ways users are guaranteed that the service is unbiased.

Mediavine case study:

This agency handles ads for 8,500 publishers. It opted in to UID2 and saw:

- CPMs double

- Enhanced privacy with the same level of identification.

On OpenPath:

Open Path -- which is The Trade Desk’s channel for publishers with their own yield management capabilities to directly access inventory -- is off to a good start:

“In the days following the OpenPath announcement, we had more than 100 inbound inquiries from major publishers looking to join the initiative.” — Co-Founder/Co-CEO Jeff Green

Interestingly, adoption of OpenPath frees publishers to activate their own first party data and to connect that to the demand side to ultimately enhance overall targeting efficacy. This, in turn, makes impressions worth more to advertisers which ends up boosting publisher revenue from ad sales as well as ROAS for advertisers. I know that The Trade Desk likes to say it isn’t doing yield management so this isn’t technically competing with the supply side. If it looks and acts like a duck, it’s a duck -- this is a certain degree of supply side intrusion.

On EUID -- Europe UID:

“UID2 is an open-source project and EUID is a version of it to meet the specific needs, including regulatory, of the market… Building a specific version allows us to give partner reassurance that data will not leave Europe -- even for international companies. EUID is the most GDPR-compliant identity solution in the market today.” — Co-Founder/Co-CEO Jeff Green

e. Notes from CFO Blake Grayson

On Solimar:

Solimar adoption is over 80% with “continued promising results.” The team is now all but guaranteeing adoption will reach 100% by year’s end.

On the retail media business:

“We are seeing green shoots in our retail media business, with Q1 representing our first full quarter of operations in this space. We’ve brought on more retail partners and are cautiously optimistic as spend continues to ramp.” — CFO Blake Grayson

The Demand Side Platform (DSP) that it built for Walmart “did really well in its first full quarter” with 200+ large brand advertisers opting into test budgets.” The measurement marketplace is working wonders to connect ad dollars to sales to enhance the value of these retailer impressions for all stakeholders. As a reminder, it has also signed on Walgreens, Gojek, Home Depot, Target and many, many more to partner in a similar capacity. This is a massive opportunity for the company in my biased opinion and its entirely ahead of it.

On channel contributions -- all unchanged sequentially:

- Video = about 40% of sales (including CTV which is its fastest growing segment).

- Mobile = about 40% of sales.

- Display = about 15% of sales.

- Audio = about 5% of sales.

More notes from Grayson:

It continues to take meaningful CTV share in Europe. Spend in Europe struggled in Q1 but “through April had recovered with a little room to improve.” This is far more upbeat commentary than we’ve heard from some of the other global advertisers this quarter.

Midterms are shaping up to be “the biggest political cycle ever. The Trade Desk thinks it could even outpace the 2020 Presidential cycle. That’s not normal for midterms.

Just like in 2020 and amid previous downturns, The Trade Desk thrives when CMOs have to tighten their budgets and focus on maximizing ROAS wherever possible. That’s exactly what this company does so well. Hence the upbeat forward guidance.

Noted that Google entered the upfront fold this year and scheduled theirs at the same time as Disney did which “is no way to win friends.” This fed into a larger theme of strenuous relationships between tech giants and content creators -- they’d rather work with The Trade Desk.

“Media companies are leaning into partnerships with us in ways like never before partially because we are not trying to compete with them and don’t own any content.” — CFO Blake Grayson

f. My Take

This would have been a surprisingly good quarter if the company didn’t post surprisingly good quarters every three months. With all of the macro-headwinds weighing on overall advertising spend growth, chief marketing officers seemed to once again flock to The Trade Desk for objective, transparent and precise campaign optimization.

At the company’s peak valuation in early 2021, it sported a sales multiple over 40X. Now, it likely sports an earnings multiple of under 40X. There are few firms that I see as having such high likelihood of sustainably brisk and profitable long term compounding, and I plan to take advantage of this severe multiple compression at my typical slow pace. It could always get cheaper, but I’m happy to own this company at this price for the long term.

2. Duolingo Earnings Review:

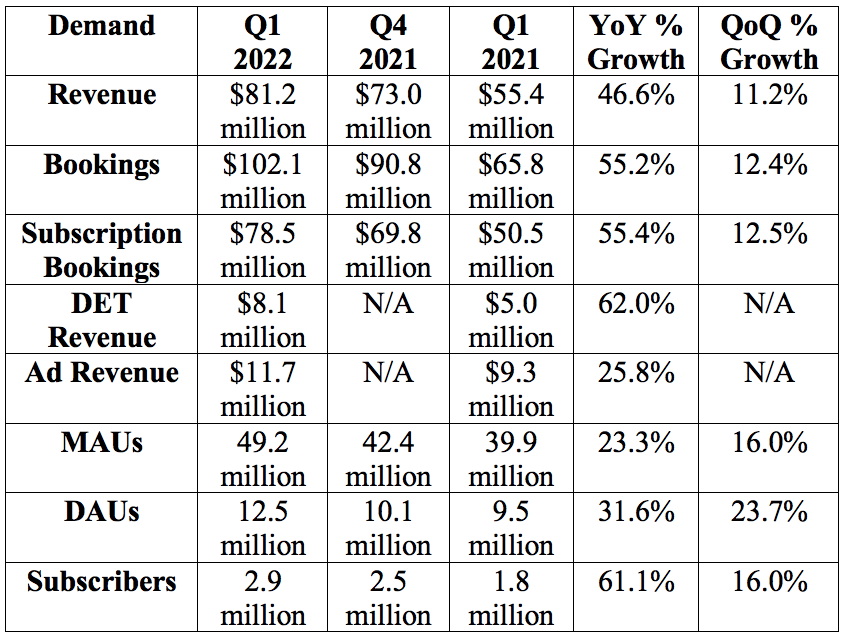

a) Duolingo Demand

Duolingo guided to $77 million in sales with analysts expecting $77.5 million. It generated $81.2m in revenue, beating its expectations by 5.4% and analyst estimates by 4.8%.

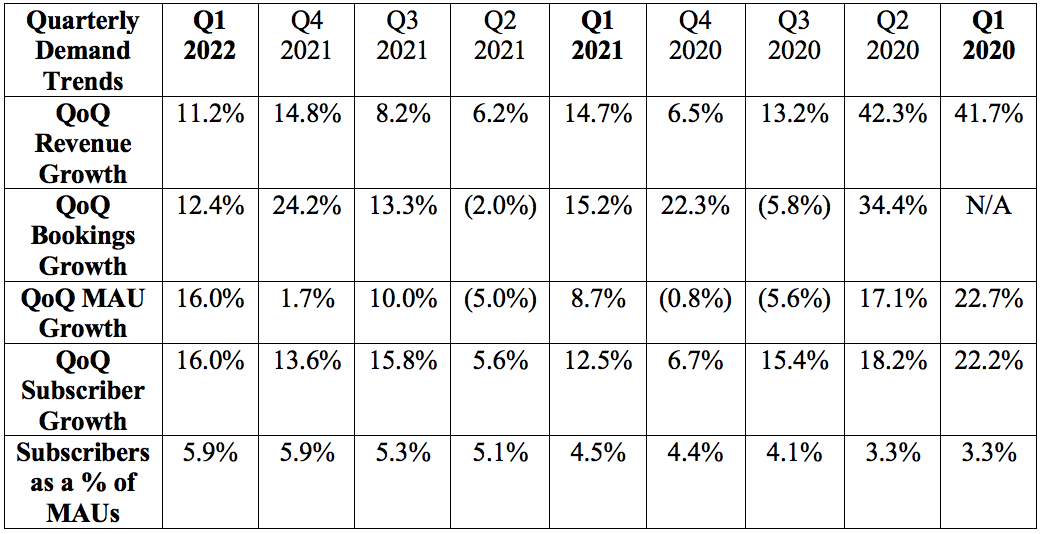

More demand context:

- This is the first time Duolingo broke its DET and advertising revenue out into separate buckets.

- Subscribers as a % of MAUs is Duolingo’s most important key performance indicator (KPI) for revenue growth.

- Duolingo thinks its subscribers as a % of MAUs can eclipse the roughly 12% that dating apps enjoy on average — there’s a long way to go.

- The second quarter is supposed to be Duolingo’s weakest of the year. It didn't get the memo.

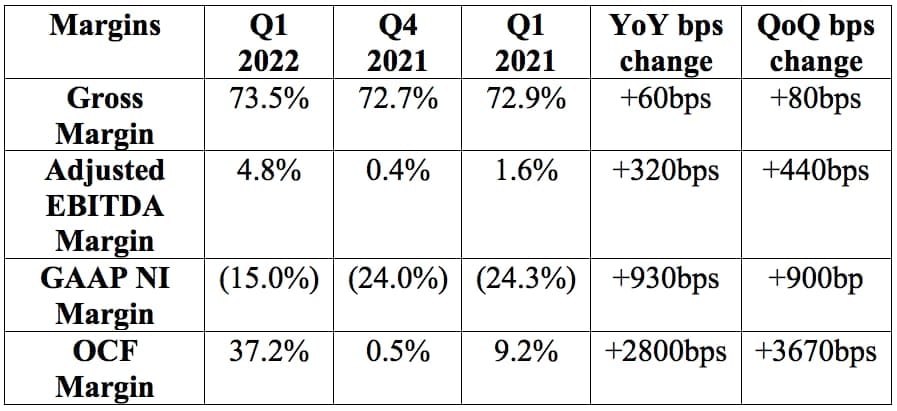

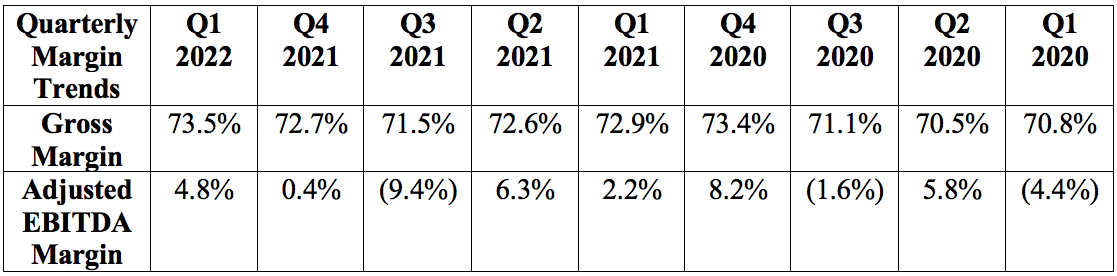

b) Duolingo Profitability

Duolingo guided to a loss of $4 million in EBITDA with analysts expecting a loss of $3.8 million. Duolingo generated $3.9 million in EBITDA, sharply beating expectations.

Analysts also expected a GAAP loss of $0.57 per share for the quarter. Duolingo posted a GAAP loss of $0.31, sharply beating expectations.

More margin context:

- Gross margin outperformance was attributed to better retention and lower app store fees charged by Google.

- DET is a drag on overall margins. Its outperforming growth is a short term margin headwind.

- Sales and marketing fell from 36% of revenue to 18% of revenue YoY (and absolute dollars spent actually shrank YoY).

- Duolingo’s vast word of mouth growth engine frees it to side-step external marketing dollars so it can pour more funding into product enhancement. This is my thesis playing out.

- R&D as a % of revenue also fell, but remained quite elevated at 37% of sales vs. 41% YoY.

- OCF margin was greatly propped up by $14.5 million in stock-based compensation during the quarter.

- Without this benefit, OCF margin for the quarter would have been 7.5%. Keep in mind this is also the entire source of the company’s net loss. So as we move away from IPO-based awards and heavy hiring activity over time, NI margin and OCF margin should converge.

C) Guidance

2022:

- Duolingo previously guided to $337 million in revenue while analysts were expecting $338.6 million.

- It updated its revenue guide to $353.5 million, representing a 4.9% raise vs. its own previous guidance and a 4.4% raise vs. analyst estimates.

- Duolingo previously guided to a loss of $3 million in EBITDA for the year while analysts were expecting closer to a $2.8 million loss.

- Duolingo now expects to generate $1.5 million in EBITDA for the year, sharply beating expectations.

The company’s Q2 2022 guidance similarly outperformed across the board.

Duolingo has $577 million in cash on hand and no debt. Based on this, it likely trades around 166X free cash flow if we assume no margin expansion (overly pessimistic) and no more guidance raises. Keep in mind that it is entirely focused on spending all gross profit dollars on more growth rather than letting those dollars flow down the income statement. It trades for around 11x gross profit.

d) Notes from Co-Founder/CEO Luis von Ahn

On word-of-mouth and competition:

“We have no reason to believe there’s going to be a slowdown. Our user growth numbers are accelerating. We are not a pandemic story like other digital educational services. Furthermore, we are product driven. A lot of these other companies spend a lot of their resources on marketing. We spend on making excellent products that work and grow via word of mouth.” — Co-Founder/CEO Luis von Ahn

Duolingo’s elite brand awareness allows it to predominately focus on product improvement rather than external marketing spend. The word of mouth growth that its products foster creates a wildly efficient and sticky growth lever, accounting for the vast majority of Duolingo’s demand growth. This focus on product manifests itself in thousands and thousands of split (A/B) tests to gauge user reactions to one variable change at a time. This split testing was credited for the outperformance Duolingo delivered in every single relevant metric. For evidence, see its rapidly shrinking marketing expense as a percent of revenue above (18% of sales vs. 36% of sales YoY) paired with outperforming demand. Great combo.

Broad-based outperformance was also attributed to:

- The aforementioned compounding benefits from its extensive split testing, first and foremost (the rest of the factors are really an effect of this).

- A rise in annual subscribers as a percent of total subs -- this implies annual subs make up more than 85% of total subscribers -- offering Duolingo excellent visibility.

- Its thriving family plan was given credit for this which has enjoyed a doubling of its penetration rate since the start of 2022.

- Social features are also helping to drive more engagement and traffic via building a stronger sense of community, sharing and also competition.

- 63% of its daily users have a week+ long streak vs. 54% YoY. Shares per day from Duolingo to social media platforms are up 140% since January of this year!

- Word of mouth continues to make up over 90% of its user growth.

- Paid influencer campaigns are thriving in Southern Asia and Brazil.

It seems that Durable Capital Partners knew what it was doing over the last several months while aggressively scooping up company shares.

On 2022 plans:

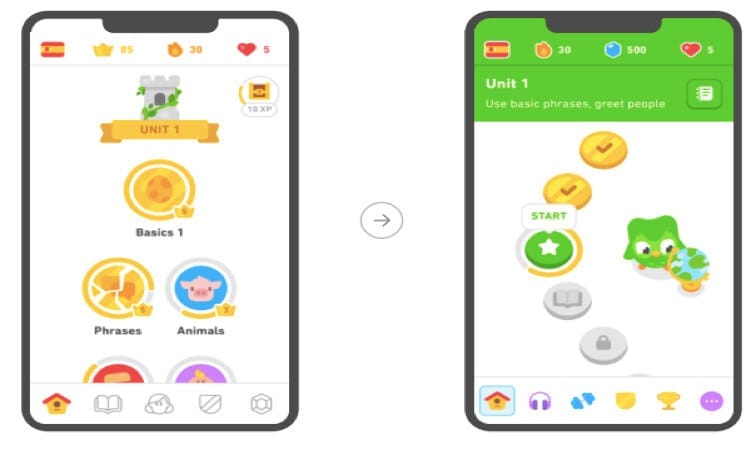

Its premium subscription -- Duolingo Plus -- is being re-branded to “Super Duolingo.” This will have all of the same features but with a “sleeker, more colorful interface. Duolingo is also upgrading its home screen to mirror level paths common in games (see below). The content will not change. This will guide users on a more structured journey to nudge them in the direction of preferred learning material order to maximize efficacy. Users often complained about “confusion pertaining to how to progress through Duolingo.” More expected benefits include:

- This will give Duolingo a more structured sense of how to “teach better” to enhance its lesson plans.

- Faster subscriber and user growth.

The Super Duolingo addition is intended to bring the subscription theme more in line with the gamified Duolingo culture. Conversely, the updated home screen is expected to have a far more directly material benefit to growth like past updates have all yielded.

Finally, keep in mind that travel is a large use case for Duolingo users -- especially internationally which really has not normalized since the pandemic struck. It will eventually, and that tailwind is entirely ahead of the company. Yes, it benefits from more screen time which COVID-19 aided with. Still, its travel use case and a deep, deep presence in K-12 makes a normal world quite favorable for Duolingo… as you can see via soaring user and revenue growth on the heels of the pandemic.

On The Duolingo English Test (DET) and new products:

The product is now used by 3,600 higher education programs worldwide vs. 3,000 YoY.

“We believe that the future of standardized assessment is online, and our ongoing innovation continues to make us a pioneer in the field.” — Co-Founder/CEO Luis von Ahn

Duolingo released encouraging results from a peer-reviewed study on DET. Per the report, DET overlap rate (repeat rate for questions) sat at 0.62% which is one of the best rates in the industry. These rates can push 10-15% which makes cheating and illicit access to answers far more likely. DET solves for this.

e. Notes from CFO Matthew Skaruppa

“I do just want to mention that the world is obviously uncertain with what’s going on with war, inflation, interest rates and all of those things. We’ve taken a prudent approach to guide for the rest of the year given the uncertainty.” — CFO Matthew Skaruppa

Duolingo ABC and Math are not part of the 2022 guide. Duolingo -- like it always does -- will take time to monetize these new products to make sure that they are as close to perfect as possible.

On external marketing:

The company’s New Year’s campaign in Q4 2021 and into Q1 2022 “generated more bookings and new subscribers than ever before."

The Russian invasion led to a 513% increase in people learning Ukrainian from the start of the war to the end of the first quarter. Some are doing so in show of support while others do so to welcome refugees -- especially in Poland and other parts of Europe.

“While it’s wonderful to know that Duolingo can help in times of crisis, it’s not our intention to profit from moments like this. We donated the ad revenue from people studying Ukrainian to Ukrainian relief funds and waived Duolingo English Test fees for Ukrainian students.” — Co-Founder/CEO Luis von Ahn

f. My Take

It’s hard to imagine this report going much better than it did. Standing ovation from me. Not many companies can deliver rapid demand growth while marketing spend rapidly shrinks. Duolingo continues to do so.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service and am a daily active user.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.

3. JFrog (FROG) -- Earnings Review

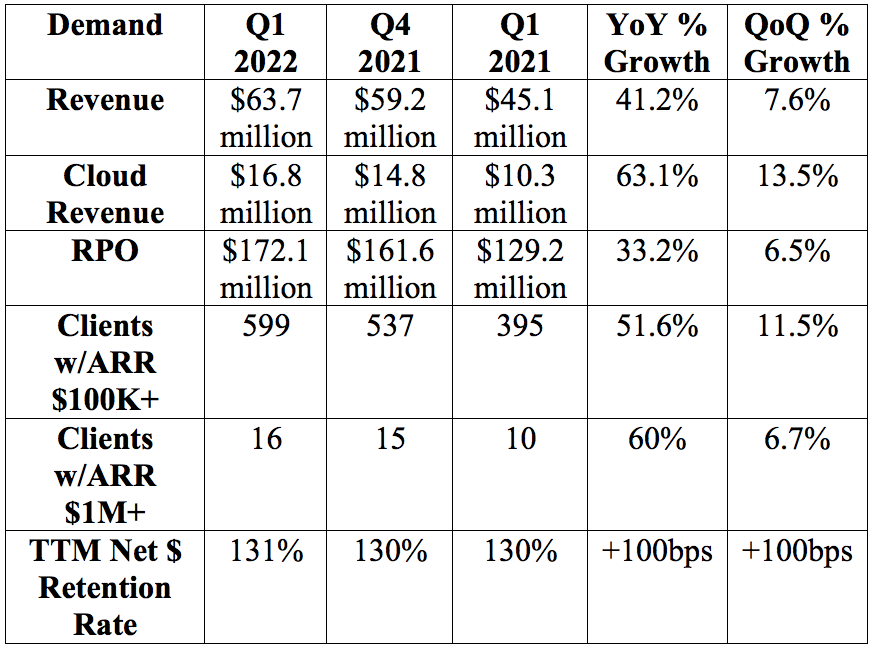

a. JFrog Demand

JFrog guided to $61.3 million in sales with analysts expecting roughly the same. It posted $63.7 million, beating expectations by 3.9%.