Part 1 – Intro to LatAm & Nu Holdings

Teeing Up the Conversation:

Nu Holdings was founded in Brazil 11 years ago. It’s a financial technology (fintech) firm with a broad range of credit, savings and other services for its clients. It aims to drive financial inclusion via easier access and seamless use cases as Latin America modernizes its monetary systems. The company calls 54% of Brazil’s population its clients (vs. 36% in mid-2022) and has more recently made steady progress in Mexico and Colombia. It has capitalized on a strong LatAm demographic featuring:

- A 40%-50% underbanked population rate (depending on the source).

- 80%+ credit card-less rates in Mexico and Colombia.

- Brisk middle-class growth with 40%+ of the aggregate population under the age of 30.

- A tech wave that is ahead of many developing nations, yet behind North America.

- A 90%+ smartphone penetration rate (consumers are familiar with app-based products).

- Increasingly business-friendly regulation.

- A $270 billion total addressable market (TAM) as of Q4 2021.

Its total market opportunity between the three nations is 14% of the USA’s total GDP and 60% of the total LatAm GDP. The competitive dynamics outside of the U.S. are far easier, the economic growth is faster (and more volatile) and the markets are less efficient. As we’ll see later, that same inefficiency breeds opportunity.

Here, we will explore how Nu has won with these products to date, its prospects, its risks and the investment case overall. I read everything there is to read on Nu; I dug through filings; I watched every company video; I interviewed the Chief IRO who took the company public; I scraped together insight from every single buy & sell-side contact I have in the space. This piece is the culmination of borderline-obsessive research organized and summarized in a way that shrinks months of learning down to 60 minutes. Let's begin.

Product Basics:

Nu’s core products are its credit cards, zero hidden fee and commission bank accounts, and personal loans. Aside from that, Nu provides investment accounts with the broadest asset-class access, lowest fees and lowest minimums on the market. With NuInvest, investors can enjoy the cheapest access to equity markets, treasury bonds, agriculture bonds, real estate and the very first Brazilian ETF with a dividend. Nu handles renewal of all expired bonds for its fixed income products, which is unique in LatAm. It also offers insurance products in a creative, asset-light fashion (discussed later), a shopping marketplace with exclusive discounts and so much more. Every product is tied neatly into a slick, easy-to-use app with 24/7 liquidity and customer service. And as you can see below, traction is excellent.

Everything is growing nicely as of its most recent quarter while active customers rose 27% Y/Y to 82.6 million:

- Active credit card customers rose 19% Y/Y to 41.2 million.

- Active NuAccounts (bank accounts) rose 31% Y/Y to 73.0 million.

- Active invest customers rose 85% Y/Y to 17 million.

- Active personal unsecured loan customers rose 30% Y/Y to 7.9 million.

- Active small and medium merchant accounts rose 50% Y/Y to 2.4 million. More on this later.

- Active insurance policies rose 60% Y/Y to 1.6 million.

Nu also offers something called “Caixinhas” (or “Money Boxes”) in its app for savers. This is a complementary tool to allocate money into buckets to meet specific financial goals (similar to SoFi vaults). It can be used for financial planning, tax preparation and even as collateral to raise credit limits. For Nu’s merchant accounts (discussed in detail later), these money boxes can be used for corporate budgeting and investing into highly liquid, low risk federal bonds. These are available for Brazilian and Mexican customers, and soon to be Colombian too.

The growth engine for Nu is wonderfully simple. It generates revenue via interest income, interchange fees and some commissions on products offered through partners. Its North Star is to rapidly compound customers and revenue per customer while maintaining one of the lowest cost banking platforms in the world.

Part 2 – The Formula

Nu’s edge vs. the competition and its momentum come from a few pieces. Here, we’ll dissect each of the pieces and how they connect to form the beginnings of a strong competitive moat.

Cost to Acquire & Serve:

Lending and credit are commodities. When something is deeply commoditized, competing on input cost intensity is one of the only ways to stand out. Nu excels at minimizing input costs. Nu’s customer acquisition cost (CAC) is $7 and “one of the lowest among global banks and fintechs.” Specifically, leadership thinks its CAC is 85% lower than competing incumbents. The digital nature of its tech stack yields more targeted and profitable marketing and lower fixed costs. It pairs this reality with a referral network that provides the vast majority of its new customer growth, cutting CAC further. That’s the beauty of offering great products: your members are magically inspired to spread the good word for free. Nu is very Duolingo-like in this regard.

Once it gets customers in the virtual door, its active cost to serve is $0.90 per month and near global industry lows. Its goal is to keep that under $1.00 or about 85% better than the competition. That means its growth spend is immediately delivering a solid contribution profit considering its $11.40 monthly revenue per retained user. In its first quarter with a customer, it makes $11.40 & spends $9.70 between servicing and acquiring. By quarter two, that $9.70 cost falls to $2.70 as CAC doesn’t recur for retained users. Its cost to serve has not grown, which is expected to continue… but the $11.40 average financial benefit merely builds as its most mature cohort has a $27 ARPAC (and briskly rising). That paves the way for explosive operating leverage that we’ll observe later on.

Cost of Funding:

Nu’s rapid deposit growth removed a key advantage that legacy incumbents had enjoyed. Now that it can use deposits, rather than warehouse credit or other expensive debt, its cost of funding the credit business is plummeting. Specifically, its cost of funding is 84% of the blended interbank Brazilian and Mexican rate while it yields significantly more profit from using these deposits to fund the rest of its business. Cost of funding actually bottomed at 80% of blended rates two quarters ago, but a mix shift to Mexican credit this past quarter led to the small rise.

Direct deposit proliferation also drives very easy credit card and other financial service cross-selling and virtually $0 in added CAC. This is true across all fintechs and is how firms like Robinhood can justify paying their entire interchange cut in rewards – they are counting on this deposit halo effect coming. Nu enjoys the exact same halo effect, but with far less competition in LatAm, enabling it to win with fewer rewards. Good recipe. The cross-selling that this process nurtures amplifies the cost to acquire and cost of service edges already discussed.

Cost of Risk or Credit/Underwriting Quality – Qualitative Setup

The other way to stand out in credit and banking is via stronger underwriting and risk pricing efficacy vs. the field. The digital, cloud-native make-up of its organization puts it in a better position to aggregate and leverage customer data profiles than a bank still running on paper and pencil. It has systems in place to utilize any and all structured AND unstructured data, which puts it in a pole position to capitalize on GenAI-based efficiency and constant underwriting upgrades. GenAI models need large swaths of relevant data to actually be useful. Nu has both massive data scale and an ability to readily use it better than the competition.

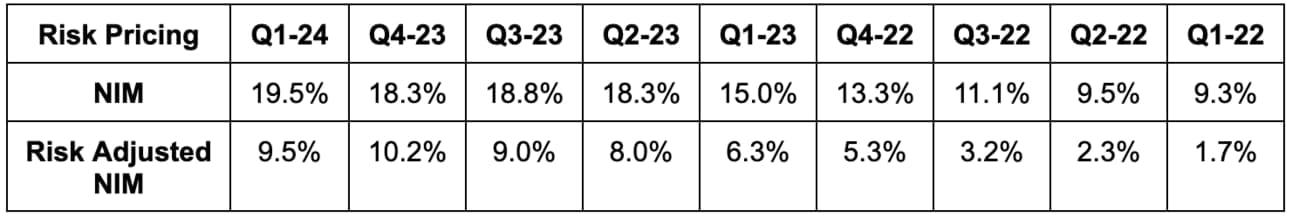

Their risk scoring improves with scale more directly than an incumbent from Brazil can claim. And as clients utilize more products, this data usage strength is bolstered even further. And as you can see, trends here are quite strong:

This unique recipe means a more granular customer data profile for serving each borrower. Still, we have to be careful here. Many, many lenders will pound their chests about a better algorithm or model that means they can price borrowers more accurately. In reality, these underwriting algorithms are black boxes. As public investors, we will never have the level of technological access needed to determine if they actually are uniquely valuable. No outsider actually knows how they work, we can only monitor the results. So? Claims of underwriting superiority are fine, but backing those claims up with concrete data is vital. Nu does just that.

Cost of Risk or Credit/Underwriting Quality – Liquidity, Expanding Credit Bands & Credit Health

Liquidity:

Nu’s capital ratios are in great shape. Specifically, NuBank’s (owned by Nu Holdings umbrella company) Capital Adequacy Ratio (CAR) is roughly double the 6.75% regulatory minimum. That does not even consider the $2.4 billion in excess cash that Nu Holdings (the umbrella company) has to allocate to NuBank if needed. Notably, Nu doesn’t sell any receivables like many others in the U.S. (SoFi, Lending Club, Upstart etc.), so this robust cash pile is not a temporary byproduct of liquidating loans.

This effectively makes its CAR triple the regulatory minimum while its profitability continues to rapidly improve and feed the balance sheet. How does this relate to risk and underwriting? Nu’s excellent liquidity position means that it can comfortably utilize the massive deposit liability growth to fund its credit book. Deposits give it the low cost vehicle to do this; fantastic liquidity gives it the keys to drive this vehicle. The result? Its cost of risk is 10% lower than Brazilian incumbents. That was a 15% lead before expanding more aggressively into Mexico. Its 40% loan-to-deposit ratio vs. 100%+ for a typical Brazilian bank leaves a massive runway to keep enjoying this lucrative formula.

Its managed credit risk (credit cards and personal loans) also continues to “outperform apples to apples competition for delinquency in the face of a more challenging backdrop” according to CEO David Vélez in the firm’s most recent quarter. That’s helping to facilitate things like sky-high ROE expectations of 120%+ for its long term personal lending business.

Legacy banks have access to the same low cost funding that Nu does. Fintechs boast a similar branchless configuration and digitally-native architecture compared to Nu. The real magic here is in its ability to combine the cost advantages enjoyed by incumbents and disruptors. It pairs these together to create the kind of cost model that nobody else in its market enjoys. It has the needed licensing to behave like a bank and the needed foundation to do so more efficiently and effectively.

Credit Band Expansion:

Great news, but it will be interesting to see how this develops as it continues to expand further down the credit spectrum in Brazil for 2024. As of its most recent public appearance, the team told us this expansion was going “as well or slightly better than expected.” So far, so great as it outperforms competition across nearly every income bracket:

“Personal loan cohorts continue to exhibit expected behavior, enabling us to increase originations for yet another quarter.”

CFO Guilherme Marques do Lago

Nu pulled back on personal lending in Q2 2022 as credit metrics showed fragility and it needed to reset and sharpen its underwriting parameters. It also reduced interest rate discounts vs. incumbents and moderated growth of the portfolio while these things played out. The aim was to “strengthen the credit resilience” amid somewhat uncertain times, but not terrible times. This proactive decision has facilitated the rapid personal loan growth we’ve seen since it accelerated originations from the Q2 2022 trough. In Q1 2024, personal loan volumes rose 88% Y/Y for more context.

It showed us the maturity to reel things in and maintain its balance sheet health for the long haul, rather than chasing risky originations to prop up revenue growth for a quarter or two. And again, even as it expands to riskier credit cohorts, it’s still full speed ahead here as it properly prices volatile risk. Nu has an 8% share of overall lending in Brazil (including secured, which we’ll cover shortly). It doesn’t see this as a ceiling, considering its current customer base represents much more than 8% of Brazilian lending. It already has the users in its ecosystem. It doesn’t need to go find them; it merely needs to continue successful cross-selling.

As briefly mentioned, going forward, Nu leadership told us that it will “expand the risk profile to newer cohorts” as it grows more confident in its underwriting. Tracking how this shapes up as its book of credit exponentially grows will be perhaps the most important thing for investors to do.

“Our personal loan cohorts continue to exhibit expected behavior. This is enabling us to continue to increase originations… we see an opportunity to expand credit with attractive returns and robust resilience. This may lead to higher delinquency rates, which we expect to be more than offset by additional revenue.”

CFO Guilherme Lago

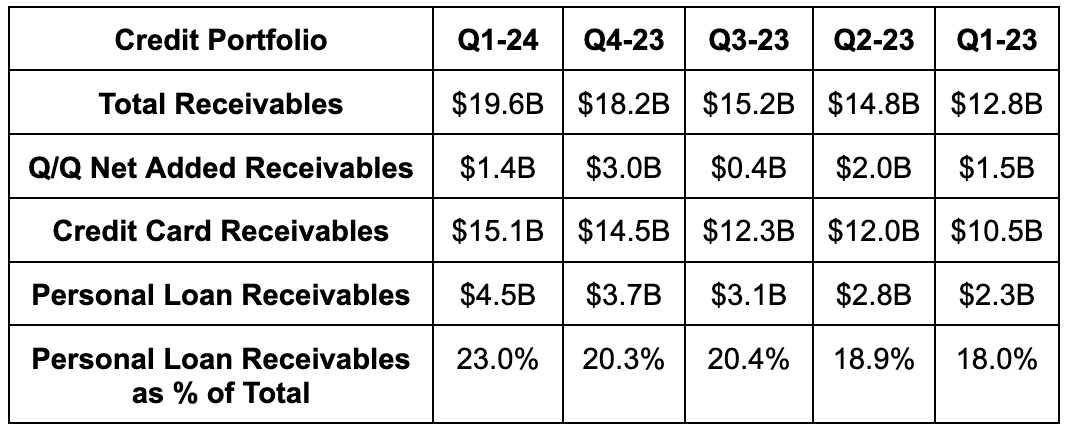

Its overall credit portfolio grew by 52% Y/Y FXN, reaching $19.6 billion this past quarter and continuing Nu’s aggressive expansion. Delinquency rates did tick sequentially higher (chart is three paragraphs lower) with the risky cohort expansion in Q1, which was expected. While that’s true, this was offset by more lending-based revenue, which enabled net interest margin to keep expanding. This Y/Y expansion was also despite another credit mix-shift away from credit cards and towards personal loans (which has higher loss rates in general). Personal loans are now 23% of its total credit portfolio vs. 15% Y/Y as of last quarter. Finally, delinquencies in Brazil always tick seasonally higher from Q4 to Q1 due to holiday and Carnival timing.

And again… delinquencies on an apples-to-apples basis are 10% better than average while it outperforms across basically every income bracket besides the ultra-wealthy.

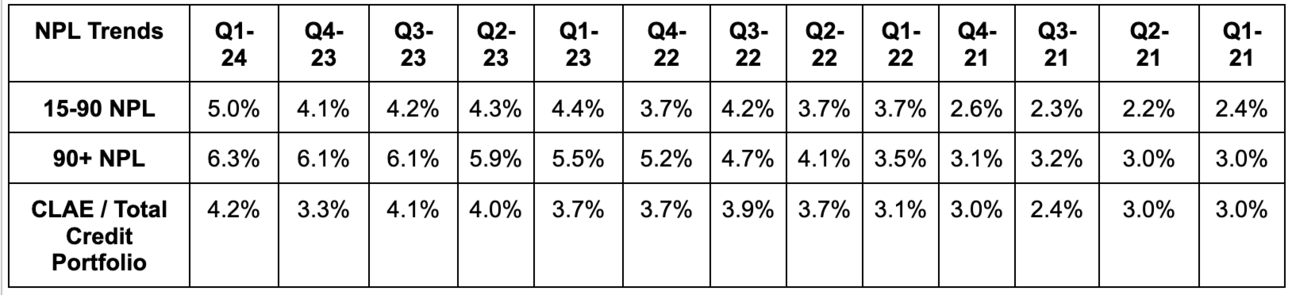

Credit Health with Macro Context:

Below are key credit trends over the last three years. This section focuses mainly on Brazil, as that’s where the vast majority of its originations have taken place to date. NPL refers to non-performing loans that are late on payments; the numbers refer to days. 15-90 day is a leading indicator with 90+ day the lagging counterpart. Additionally, 90+ day NPL doesn’t have a time limit like 15-90 day does as borrowers move out of that bucket beyond 90 days. This means 90+ day has a “stock-piling” effect as the portfolio explosively grows in size. Furthermore, all of the stimulus artificially held NPL rates down throughout 2021 and into 2022. This leaves us with the upward movement in 90+ day NPL rates.

- The same related delinquency rate seasonality applies to these metrics too.

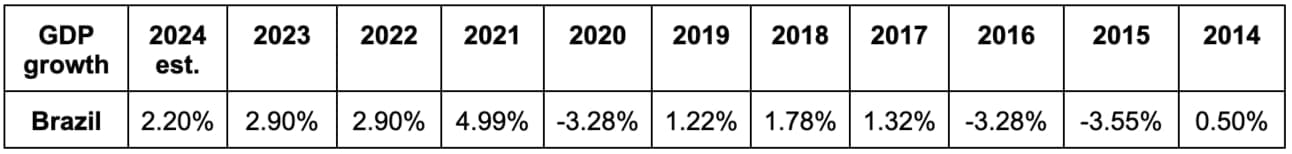

Nu was founded right at the end of a 13 year period in which Brazil grew at a robust, 3.3% average annual clip. Through that period, poverty and unemployment levels tanked, regulation got a bit easier and things were good. During its first five years of existence, Brazil’s GDP growth averaged slightly under 0.0%, with 2 years worse than -3% and 0 years better than 1.8%. In my view, that reality makes strong NPL rates during 2019 a decently good sign of underwriting strength. And this doesn’t even give Nu credit for the rapid underwriting model training that has played out over the last 5 years.

- Important aside: Mexican economic trends roughly mirrored Brazil from 2014 to today. It avoided the multi-year contraction from 2015-2016 that Brazil suffered through as it relied less heavily on commodity exports and favorable pricing to power its growth. Its more established manufacturing presence helped to weather the commodity blow. That’s the main difference here.

Specifically, 15-90 day NPL in 2019 ranged from 2.2%-3.0%. It fared well in 2020 too, but weird pandemic-era aid makes those figures irrelevant as a longer term gauge. 2019 NPL metrics and its 179% Y/Y revenue growth point to Nu’s ability to execute amid a tougher backdrop. The evidence would be even more compelling if it entailed a material recession, but Brazil likely won’t have to deal with that in the near future. Even pessimistic macro economists see 1.3% GDP growth for 2024. Brazil’s Government sees 2.2% growth while its President sees 3% growth. Furthermore, the Central Bank continues to drive easier policy with its Finance Minister (Fernando Haddad) explicitly telling the press in April that there is “more room for rate cuts and growth.” Brazil is unique with its 10.5% interest rate and low inflation combination (Mexico & Colombia are ideal in that sense too).

There is a LOT of room to cut to accommodate growth and help lenders like Nu perform even better. And while cuts could be a NIM headwind if asset yields decline faster than deposit interest rates, Nu fully expects NIM and risk-adjusted NIM to expand throughout 2024. The rising LDR is a big reason why. Nu has enjoyed three years of robust economic activity in Brazil, and that will likely remain the case. Brazil will certainly have another recession at some point, which will hurt its results to a degree. At the same time, a recession should favor (on a relative basis) stronger players like Nu to help them extend competitive leads vs. smaller, less profitable alternatives.

As you can see, NPL rates are now above 2019 levels and have been for nearly 2 years. That likely won’t change, considering its continued push into broader credit bands. While NPL rates are important metrics, as we’ve discussed, risk-adjusted NIM is the most important indicator for gauging whether Nu is properly pricing risk. Net interest margin is simply interest income minus interest paid for funding its loans. Risk-adjusted NIM accounts for riskiness of the loans and default probability by netting out CLAE from interest income.

Something else to note here is Brazil’s state-sponsored debt-repayment called Desenrola. Desenrola offers certain discounts on outstanding principal to some borrowers. This raised collections activity on delinquent loans, diminished revenue realized from current existing loans and helped CLAE fall to 3.3% in Q4 2023. The impacts to revenue and profit are roughly neutral as the increased collections offset the discounts and costs associated with the collections. The discounts specifically impact NIM and is why that metric fell Q/Q. Risk-adjusted NIM was unimpacted due to the falling credit loss allowance expense. The impact of the program is now largely behind Nu, while the majority of renegotiations from it were with non-delinquent loans. That shows this program hasn’t been materially and unfairly helping their NPL rates.

Also note that overall CLAE and credit provisions continue to grow sharply. That is related almost entirely to Nu’s rapidly growing credit book, as well as some impact from extending into riskier credit buckets.The important thing is that Nu continues to expect upward NIM and risk-adjusted NIM momentum as it optimizes the balance sheet, shifts to interest earnings assets and sharpens its underwriting skills. And again, it thinks this will be the case regardless of more rate cuts likely coming in Brazil and Mexico. Brazil has already taken its rate from 13.75% to 10.5% since August 2023, with plenty more to do.

We’ll see how they do as their underwriting standards become bolder amid stronger Brazilian growth. So far, so good.

Approach to Credit:

Nu has an interesting approach to balance sheet risk. It’s one that I personally find compelling. It will assume balance sheet risk for shorter-duration credit like unsecured personal lending or PIX-financed credit cards (PIX covered later). The near-term maturities diminish rate, currency and geopolitical risk to a point of it wanting to assume that added exposure. Conversely, for longer-dated items like mortgages, auto lending and insurance policies, it uses 3rd party funding. For example, a company called Creditas partners with Nu for auto lending origination. The loans originate through Nu’s beloved interface, with its elite customer service and without its own dollars being issued. That structure has allowed it to vastly accelerate its secured lending and match competitors without putting liquidity in jeopardy.

The image below depicts what it does all on its own vs. when it uses partners. The customer counts are now outdated, and the product suite includes many more items that we’ve already discussed. Still, the overarching idea has not changed. The purple circle is what it uses partners for with the gray circle inside of it being what it does alone:

Tying Nu’s Approach Together:

Combining better cost to acquire and serve, lower cost of funding and stronger underwriting yields some wonderfully valuable consumer outcomes. Doing so while also offering a superior interface and 10 click, pre-approved applications vs. the days-long processes for others is icing on the cake. The setup breeds a truly special lender in LatAm; it paves the way for a 30x lifetime value to customer acquisition cost (LTV/CAC) when 3x is considered excellent; it facilitates a 90+ net promoter score (NPS), which is miles ahead of the pack.

Better efficiency, lower relative cost and better fraud algorithms also mean it can pass on savings to its clients. The result? Loan interest rates that are routinely 20%-30% lower than the competition. Again, cost edges are how you stand out in any competitive market; and banking is competitive. Whether it’s this interest rate item, more savings yield, cheaper travel accommodations, lower cost equity investing etc. Nu delivers cost edges in many ways that they leverage to offer better products while expanding NIM. It’s admirably taking advantage of the vast inefficiency in Brazil’s and Mexico’s credit systems. Removing just a bit of this inefficiency fosters the kind of results that make customer jaws drop.

This asset-light configuration also makes it economically rational to service younger customers with just a few dollars in deposits. Nu can say yes to everyone, while incumbents must demand higher deposit minimums to cover higher fixed costs. A customer with $50 in deposits would be cash incinerators for legacy competition, but not for Nu. This allows it access to a consumer’s financial life earlier on. Not only does this give it a better chance to win more business later, but it also means a richer customer data profile to sharpen underwriting, offer targeted promotions, provide better, more personalized products and raise approval rates with confidence.

Nu’s architecture positions it perfectly to take advantage of this incremental data and to capitalize on the GenAI boom. It already has a chat bot/co-pilot powered by GPT 4. It’s already using these models to power underwriting, detect fraud, automate software engineering and optimize payment orchestration too. Incumbents can stitch together siloed databases and 3rd party vendors all they want to, which can be a decent bandaid. But? To emulate Nu’s rapidly-improving, always training architecture, they’d have to blow up their existing operations and start from scratch. That’s the only way to perfectly match this disruptor… and that’s why it’s having so much success in disrupting. Nu’s foundation, interface, product velocity and customer delight have proven to be quite difficult to match for anyone in Latin America to date.

Customer Obsessed – a quick note on Nu’s Philosophy

Nu aims to shock and delight customers with service that they’re not used to. This positive shock fosters fierce loyalty and a desire to use Nu for all financial services. The impact on Nu’s markets is profound as well. Aside from sky-high NPS (which is inherently subjective), Nu surveys reveal that its products are improving lives in surprisingly broad ways. 37% of its customers think Nu has directly improved their living conditions, with 27% saying Nu has boosted their emotional and mental well-being. LoveBrands ranks it as the 5th most beloved brand in Brazil, which is not normal for a bank. Fast Company calls it the most innovative firm in all of Latin America. Marketing leverage, excellent customer retention and fabulous overall results discussed later are the byproducts.

The Team, The Team, The Team:

There’s one more piece of Nu’s edge, which is more subjective and qualitative, but prevalent none-the-less. The leadership team resumes are very impressive. David Vélez Osorno is the Founder, Board Chairman and CEO. Before starting Nu, he worked in investment banking at Morgan Stanley and Goldman Sachs and got his MBA from Stanford. Most notably, he was a Sequoia Partner for two years where he ran the firm’s LatAm investment group. He has a pristine reputation.

Youssef Lahrech is the President and COO. He was hired in 2020 after working at Capital One for two decades. At Capital One, he held increasingly high-profile roles, with his final position being the SVP of U.S. Cards. He’s an MIT graduate.

Guilherme Lago is the firm’s CFO. He was first hired by Nu as its VP of Finance in 2019 and promoted to CFO in 2021. Before Nu, Lago worked at Credit Suisse for 15 years where he wrapped up his tenure as Managing Director of Investment Banking. He got his MBA from Harvard.

Henrique Fragelli is Nu’s Chief Risk Officer (CRO). He’s been in the role for 6 years, with a lack of leadership turnover here a small positive. He led HSBC’s global portfolio analytics for 3 years and worked as WestLB’s (U.K.) risk director for 2 years as well.

Jagpreet Duggal is Nu’s Chief Product Officer and has been for 4 years. He was the Director Product Management at Facebook for two years. He also worked as Google’s Head of Strategy for Google Display and as its brand advertising product lead. He graduated from Yale with a degree in Mechanical Engineering.

- Livia Martinex Chanes is the Nu Brazil CEO. She worked at Banco Itaú (key competitor) for 5 years in their tech division.

- Cristina Junqueiro is the firm’s Chief Growth Officer and a co-founder too. She also came from Banco Itaú where she helped lead their consumer credit, card and marketing divisions.

Executive compensation and incentives are reasonably well-aligned with shareholder interests. Because the company is incorporated in the Cayman Islands, it doesn’t need to disclose specific individual pay for executives. Still, it does provide some detail. The vast majority of executive compensation is paid out in restricted stock units (RSUs). Chief officers get a small fixed salary that makes up less than 5% of total compensation. In aggregate, Nu paid $123 million to executives in 2022 and $34 million in 2021 (compensation was impacted by its IPO). For context on comp intensity without that noise, it paid out $9 million in 2020.

Furthermore, of that $123 million in 2022 compensation, $78 million was from a 2021 contingent share award for David Vélez. These shares would have only been fully awarded if Nu reached $35.30 per share, but he still voluntarily canceled that $78 million in November 2022. Nu was dealing with increasingly fragile macro at the time, wanted to slow down dilution (which is now below 2%) and was looking to drive better efficiency as an organization. Vélez led by example. He saved the firm about 2% in overall dilution and $50 million in GAAP operating expenses over the next seven years as a result. Excluding this $78 million in forgone compensation, Vélez made $350,000 in 2022, with the average executive making $2.5 million. That’s not at all egregious.

In terms of how RSUs are doled out, Nu uses time-based vesting, with awards being granted in three year terms. I prefer profit and revenue-based targets to serve as the bogeys for receiving compensation. It has broad authority to issue shares to employees based on business performance and “long-term goal” progress. Finally, it has another share option plan (SOP) for executives but there are no plans to utilize that program in the future.

“While there are awards outstanding under the SOP, we do not intend to make future awards under the SOP. Any outstanding awards under the SOP that expire or are canceled shall again be available for issuance under the Omnibus Incentive Plan.”