Table of Contents

- 1. Cava (CAVA) – Detailed Earnings Review

- 2. Snowflake (SNOW) — Brief Earnings Snapshot

- 3. Nvidia (NVDA) — Detailed Earnings Review

1. Cava (CAVA) – Detailed Earnings Review

a. Cava 101

Cava is a quick-service restaurant chain that sells Mediterranean food, with a focus on strong value, quality ingredients and a warm, in-store ambiance.

My Cava Deep Dive can be found here.

b. Key Points

- Another strong quarter and modestly weak guidance.

- Raised new store financial targets.

- Will expand to many more markets in 2025.

- The loyalty relaunch is going well.

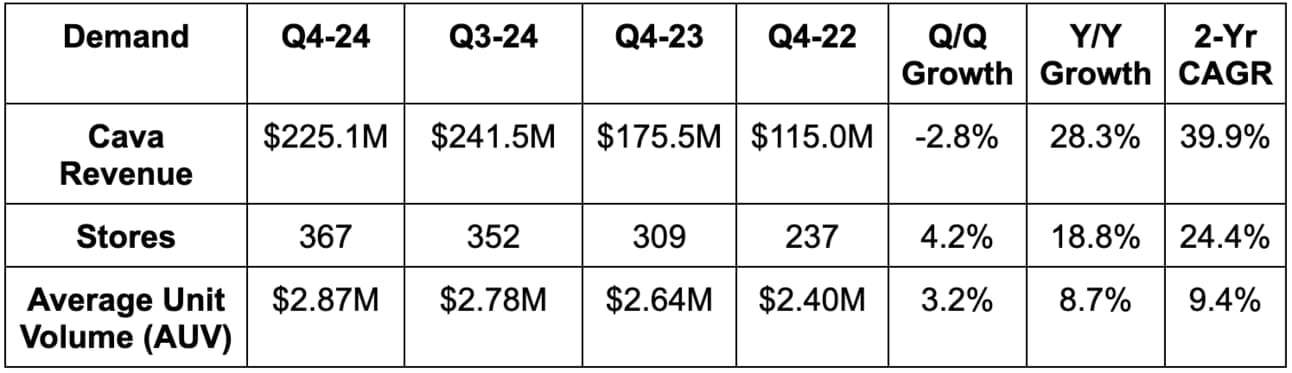

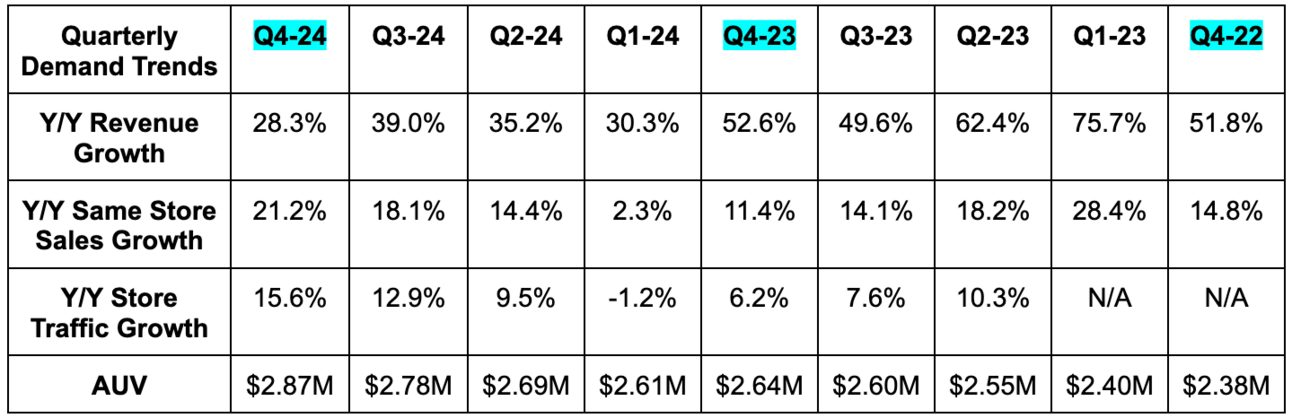

c. Demand

- Beat revenue estimates by 0.9%. Excluding the extra week in 2023, revenue growth would have been 36.8% Y/Y.

- Beat same-store sales growth guidance. Beat 18% same-store sales growth estimates by 320 basis points (bps; 1 basis point = 0.01%).

- Growth is adjusted for the extra week in 2023.

- Slightly beat location estimates.

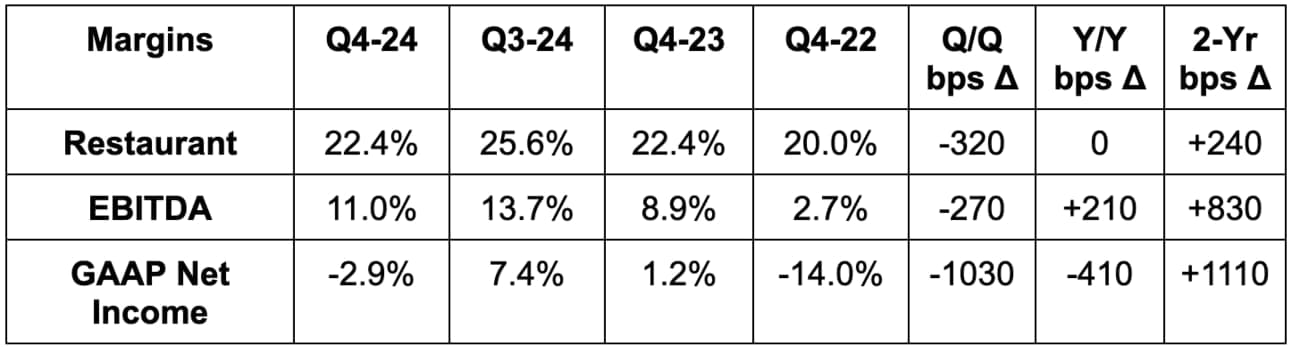

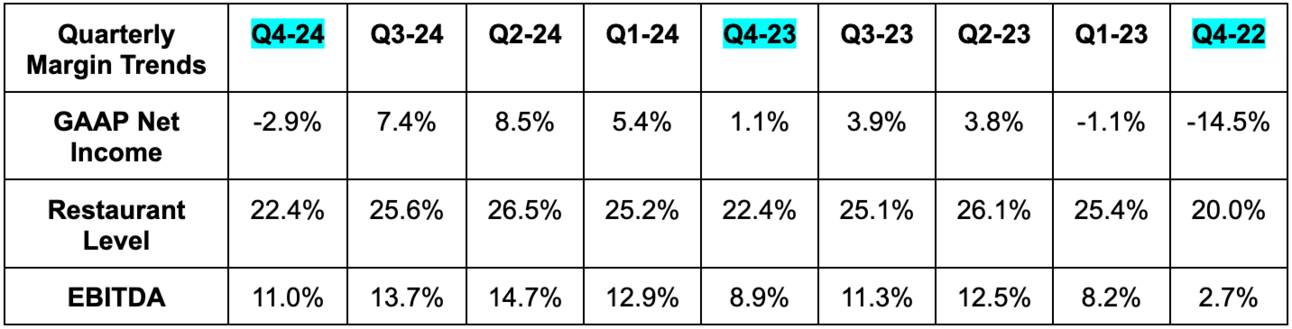

d. Profits & Margins

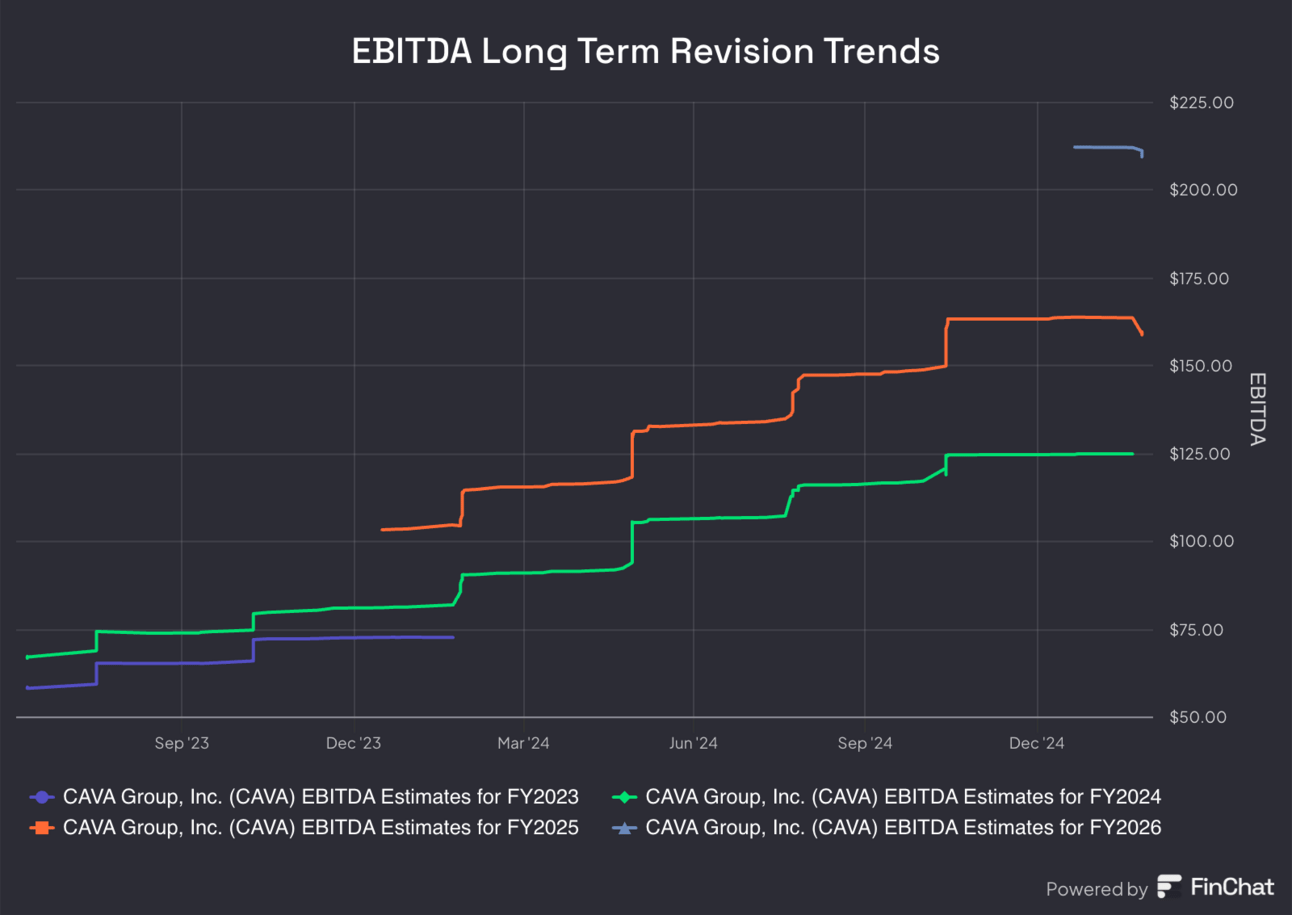

- Beat EBITDA estimate by 6% & beat EBITDA guidance by 12%.

- Missed 22.8% restaurant-level (RL) margin estimates.

- Excluding the extra week in 2023, RL margin would have risen by 50 bps Y/Y.

- The steak launch was a modest RL headwind as expected.

- Beat $2.7M GAAP EBIT estimates by $1.25M.

- Excluding tax benefits, EPS was $0.05 vs. $0.02 Y/Y, which missed $0.06 estimates by a penny.

- For the quarter, free cash flow (FCF) margin was 0.9% vs. -4.1% Y/Y.

- For the full year, FCF was $53M vs. -$42M Y/Y.

- Full year operating cash flow was $161M vs. $97M Y/Y.

For individual cost buckets, G&A was 12.6% of revenue vs. 13.9% Y/Y. Food, beverage and packaging costs were. 29.9% of revenue vs. 28.8% Y/Y due to steak. Labor and related costs were 27.3% of revenue vs. 27.8% Y/Y. Leverage was offset by 4% wage inflation. Occupancy & related costs were 7.6% of revenue vs. 8.3% Y/Y. It spent a little more than expected on other OpEx for store upkeep.

e. Balance Sheet

- $366M in cash & equivalents.

- No debt.

- Undrawn $75M credit revolver with an option to increase that.

- Diluted share count rose by 1.1% Y/Y.

f. Guidance & Valuation

For the full year, same-store sales growth guidance of 7% missed 8% estimates by a point. Its 25% RL margin guide, which includes a 100 bps headwind from a full year of steak, missed 25.4% estimates. EBITDA missed by 6%. It continues to expect 17%+ store growth in 2025. They love to under-promise and over-deliver, and the most popular time to do that is when offering brand new annual guidance.

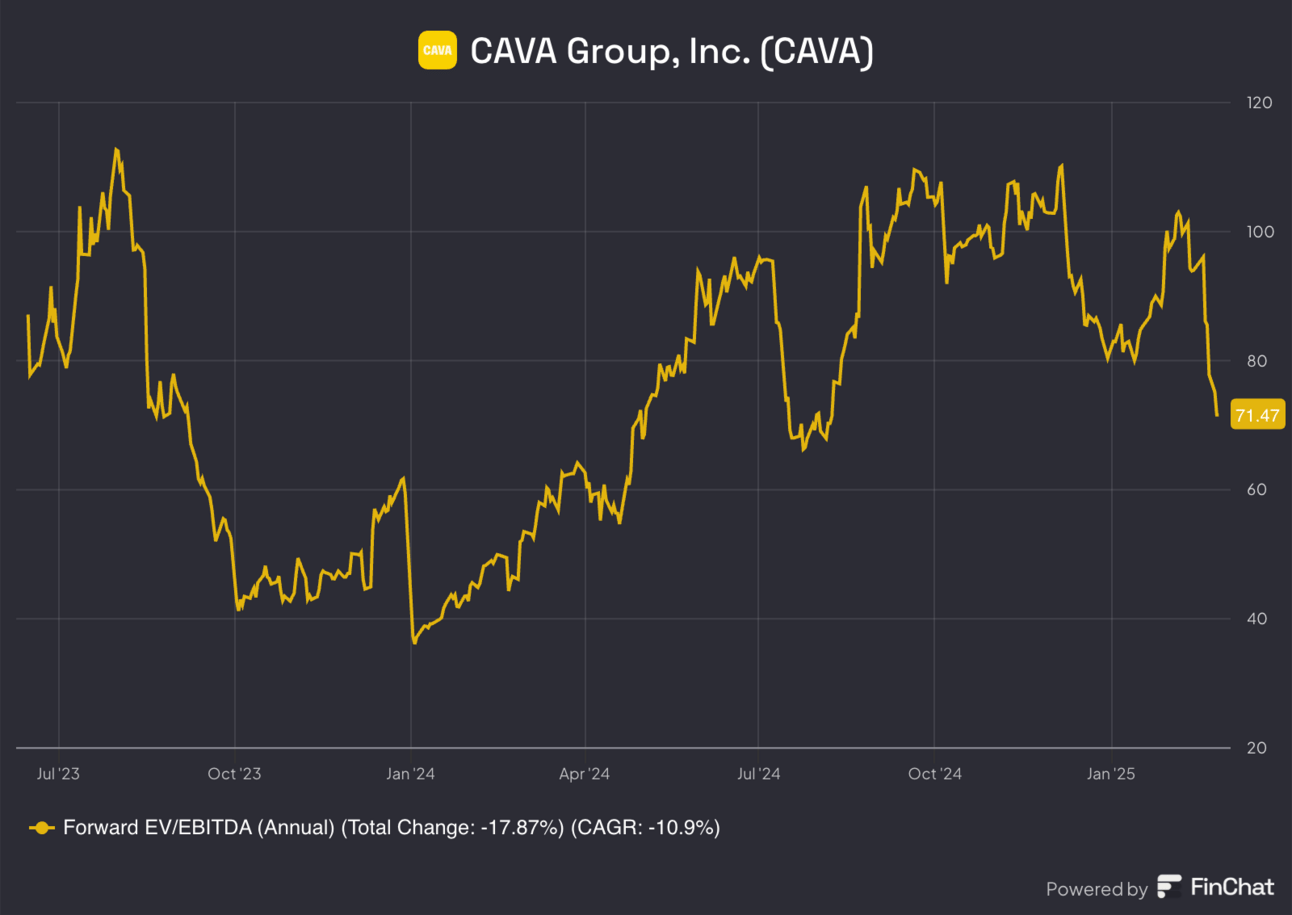

Cava trades for 71× 2025 EBITDA. EBITDA is expected to grow by 26% this year and by 29% next year. It also trades for 137× 2025 FCF. FCF is expected to grow by 60% this year and by 10% next year.

“Our guidance takes into consideration what we are currently seeing in the business and the fluidity of the macroeconomic policy environment. Our business continues to be and remains strong and resilient. That strength is appropriately reflected in our guidance.”

CFO Tricia Toliver

g. Call & Release

What’s Working?

Cava’s value proposition is clearly resonating based on its masterful results since going public. What’s working? This gets back to what I talked through in the deep dive. Cava is combining elite service levels with strong operational rigor practiced for every single decision made.

What’s Working — Tech & Human-Driven Service:

Cava empowers its workers to have easier, enjoyable and more rewarding jobs. In turn, they feel inspired to take better care of customers, stick around for longer and drive a better omni-channel experience. Pairing this with quality food, a warm in-store ambiance and affordable prices has been a winning recipe.

For example, after careful testing of its new labor deployment model, it’s enjoying improved distribution and placement to create organized and less overwhelmed workers. As a result, store productivity and throughput are both rising. It thinks there’s even more to do here to improve speed of service, throughput and store average unit volume (AUV ) from already strong levels. It knows a lot of the high-volume stores still deal with long lines and this is one way it hopes to alleviate that service issue.

Next, as part of its Connected Kitchen initiative, its AI video technology is delivering expected objectives in 4 test stores. This will be added to more locations this year. As a reminder, the product tracks ingredient depletion and nudges employees to replenish needed items. This technology will be used for its in-store food prep lines, as well as the digital order make-line. As yet another example, its new kitchen display system (now in 25 stores) is improving order accuracy rates across channels, while improving customer service ratings.

“As we focus on running great restaurants in every location, every shift, we will integrate new technologies and tools to support our team members and enhance the guest experience.”

CEO Brett Brett Schulman

Lastly, I think its revamped loyalty program is a solid case of creating great, personalized customer service at scale. The new approach has been “warmly received” and raised the percentage of sales from the program by 230 bps since relaunching. Furthermore, 50%+ of redemptions are from the entry-level subscription tier, which is what Cava was hoping for. As of now, this is really just a bankable points model where customers are compensated for engagement. Looking ahead, 2025 will be the year where Cava fully leverages the power of its 1st party data to create more personal, granular and delightful experiences. This is how it will make the brand feel intimate while expanding across the nation.

As an important aside, internal development of this loyalty program is no small feat. It’s not normal for an $11B chain to do everything on their own. This is the byproduct of Cava carefully building its malleable, microservice-based foundation to enable faster learning and iterating. The deep dive covered this in more detail. For the sake of this piece, just know that this foundation was a prerequisite for all of the good work Cava is doing today.

- The program tested access to its new garlic ranch pita chips for 200 redeemed points instead of 400 during the quarter. This was the most redeemed item it has ever had. It will do a lot more of this in 2025.

Lastly, I think price will become an increasingly strong differentiator for Cava service quality. Since 2019, Cava menu inflation has been 15% vs. about 35% for the sector (23% total CPI growth). This year, it plans to hike prices below the rate of inflation while its peers do the opposite. Strong operations and supply chains allow it to consistently find more margin and pass part of the relative savings onto customers. This is more of the same.

- Expectations of just 1.7% menu inflation this year mean the 7% same-store sales guide is mostly related to traffic.

What’s Working — Disciplined Operational Rigor:

The other reason Cava is thriving is because of its obsessive operational rigor. The microservices foundation set the stage for them to closely track and optimize every tiny variable within their business, and they spend a lot of time doing so. They resemble Duolingo in this light.

The team doesn’t roll out a new ingredient until it has been intricately tested and they know it will work; they don’t implement new store technology until it obviously creates value; they don’t change loyalty program experiences until they’re certain it’s the right move. There is no guessing here. There is small-scale testing that expands to more stores as Cava learns and grows more confident in a given initiative. They always walk before they can run, always follow their playbook and always deliver product introductions on or ahead of schedule. Great team.

Thriving Stores:

Cava stores are absolutely crushing it. In a year when most publicly traded competition struggled to maintain positive traffic, Cava had to cut marketing spend in key markets because lines were too long. Not normal. What an amazing problem to have. When looking at newer store vintages, 2024 is pacing to be its best year yet. This consistent outperformance led to Cava revising its new store financial targets it offered when it initially went public. For years 1 and 2, it now expects AUV of $2.3M and $2.5M, respectively. This represents a $200K boost for both figures. Furthermore, RL margin for year 2 is now expected to be 22% vs. 20% previously. Despite a small upward revision to restaurant CapEx estimates, it boosted its year 2 cash-on-cash returns estimate from 35%+ to 40%+. Very good.

Clearly this means each store can contribute more to the financial engine than originally thought. And? There’s another more subtle perk here that I find equally enticing. More productive stores mean locations in fringe markets that weren’t quite attractive enough to pursue now are. This expands the addressable market for Cava stores and amplifies the opportunity for growth. That opportunity was already big, as it hasn’t even entered several major markets in the USA. Along these lines, it will enter Detroit (thank you), Pittsburgh and Indianapolis this year.

Marketing Machine:

Cava is getting really good at marketing. Through influencer partnerships and strong word-of-mouth growth, its brand awareness is rising. This is leading to “people waiting for them” to open stores, which means a quicker AUV and revenue ramp.

Food & Catering:

The steak launch continues to outperform and drive incremental traffic. Despite this impacting RL margin a bit, management is quite excited about traction. In 2025, Cava will likely follow the same menu promotion cadence it did last year. There will be one major introduction and a few seasonal items.

Cava is progressing in its catering tests. It will expand from very limited access to debuting in a singular major market this year. A national rollout of this is probably coming at some point in 2026. Just like consumer packaged goods (CPG), this represents another opportunity to make its stores and its manufacturing even more productive.

h. Take

Despite the modest 2025 guidance weakness, I think this was a good quarter. The company continues to outperform all peers in terms of store health, growth, and AUV expansion. It continues to effectively nurture its loyalty program and is thriving in every single new market it enters.

This is a special company with a special team and a sky-high valuation multiple that I’m not willing to pay. I love everything else about the investment. I would love to own this name at some point. For now, all I can do is admire the company from a distance. Getting closer… but not there yet.

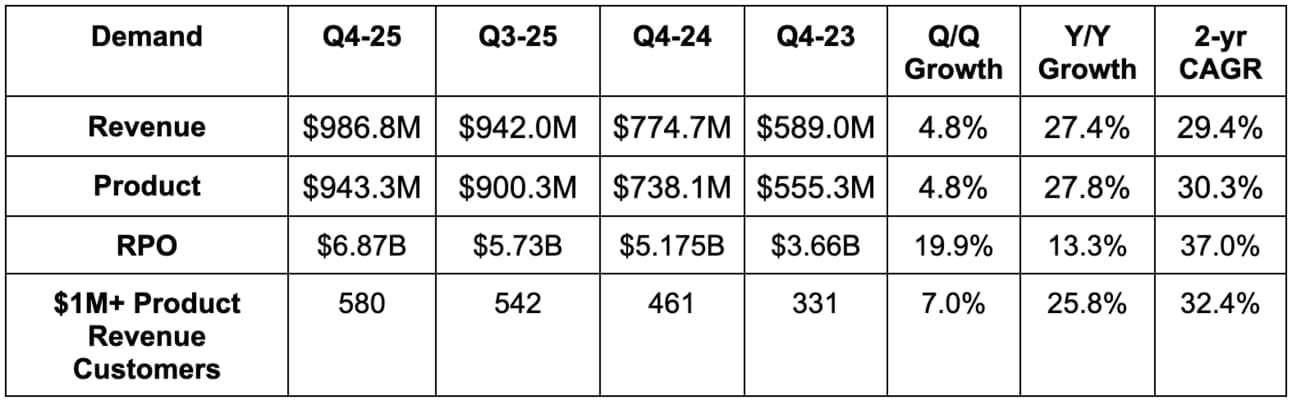

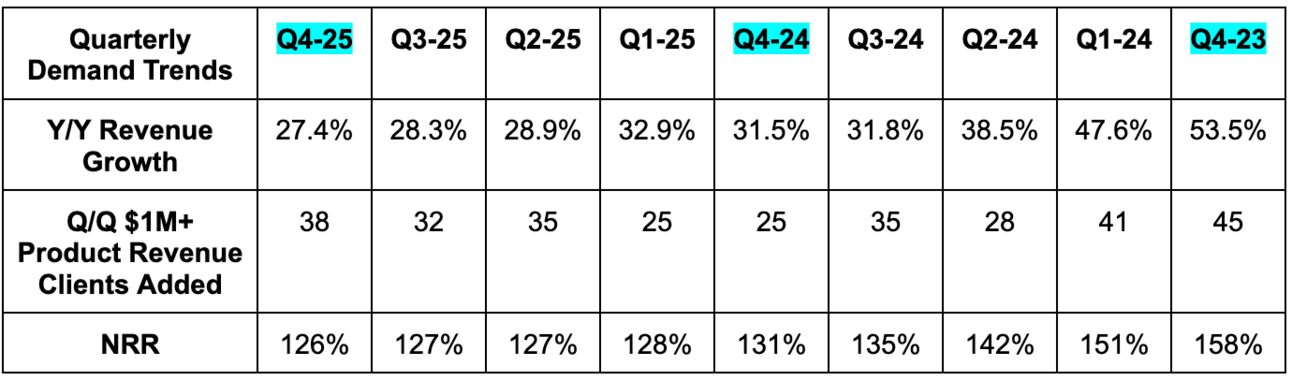

2. Snowflake (SNOW) — Brief Earnings Snapshot

Full review coming tomorrow alongside Duolingo.

a. Demand

- Beat revenue estimates by 3%.

- Beat remaining performance obligation (RPO) estimates by 2.3%.

- Beat product revenue estimates by 3.6% & beat guidance by 3.8%.

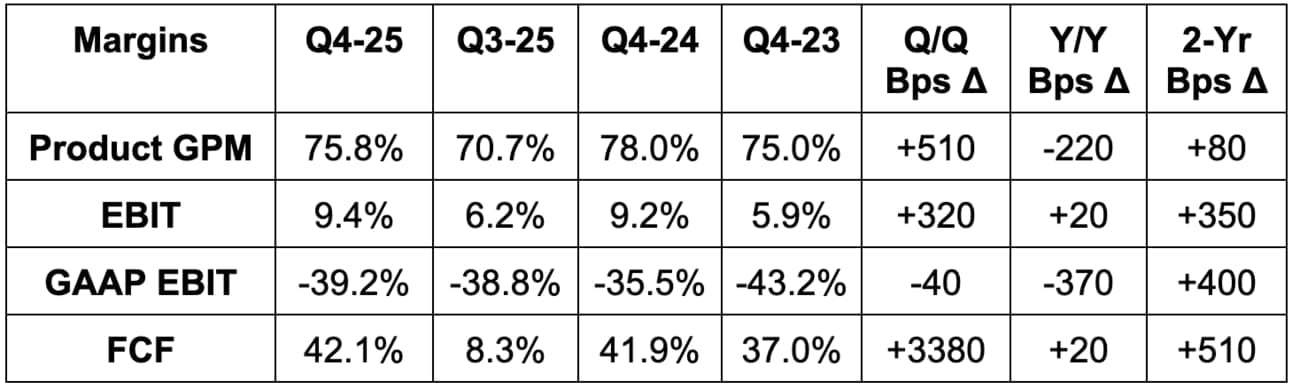

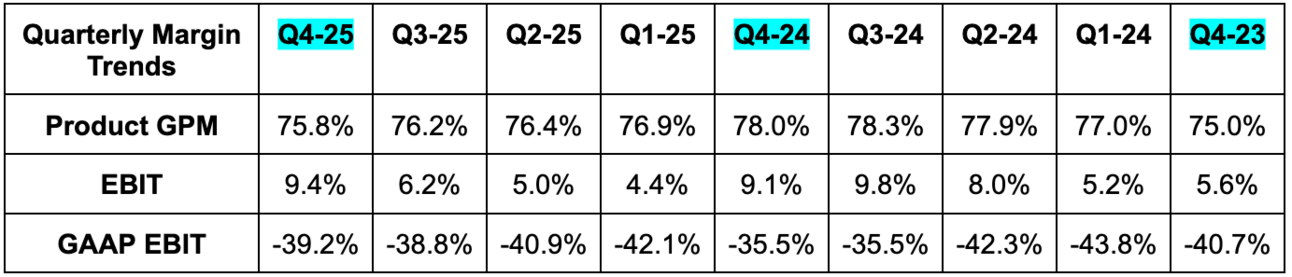

b. Profits & Margins

- Beat 72.2% GPM estimates by 40 bps.

- Beat EBIT estimates by 121% & more than doubled EBIT margin guidance.

- Beat $0.18 EPS estimate by $0.12.

- Slightly beat FCF estimate.

c. Balance Sheet

- $4.6B in cash & equivalents.

- $650M long-term investments.

- $2.27B in convertible notes. No traditional debt.

- Diluted shares rose 1.9% Y/Y.

d. Annual Guidance & Valuation

- Sees 24% product revenue growth for the year vs. 23% total revenue growth estimate.

- 8% EBIT margin guide beat 7% margin estimates.

- 25% FCF margin guide missed 26% margin estimates.