Table of Contents

- 1. Adobe (ADBE) — Brief Earnings Snapshot (Review …

- 2. Oracle (ORCL) – Detailed Earnings Review

- 3. MongoDB (MDB) – Detailed Earnings Review

- 4. Alphabet (GOOGL) – Willow

- 5. Uber – Cruise & a Timely CFO Interview

- 6. Duolingo (DUOL) & SoFi (SOFI) – Downgrades

1. Adobe (ADBE) — Brief Earnings Snapshot (Review Saturday)

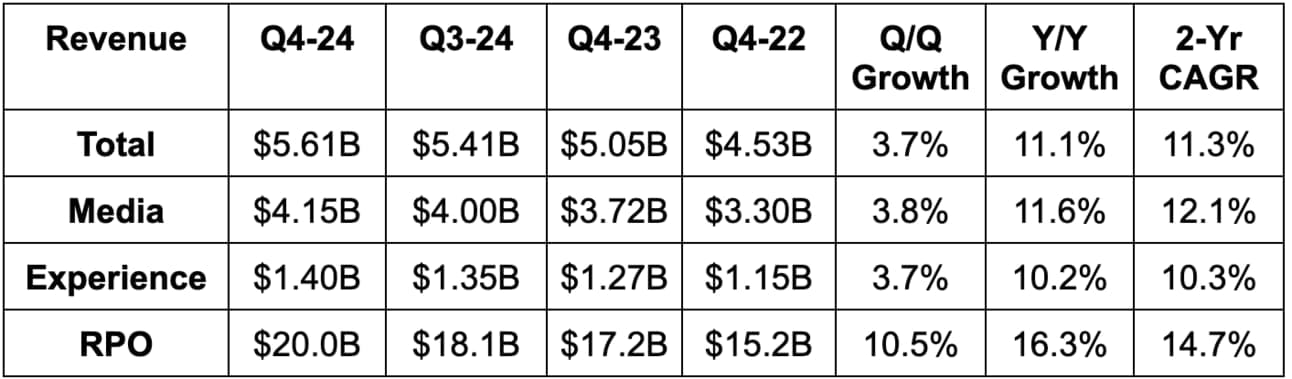

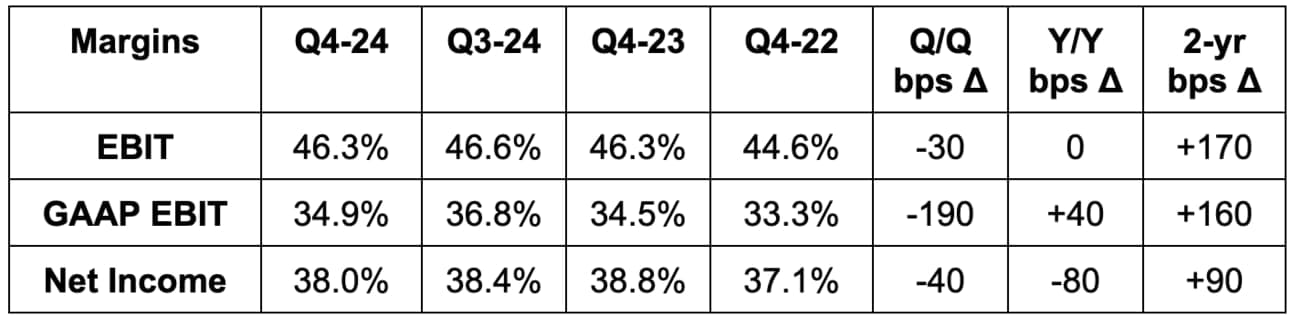

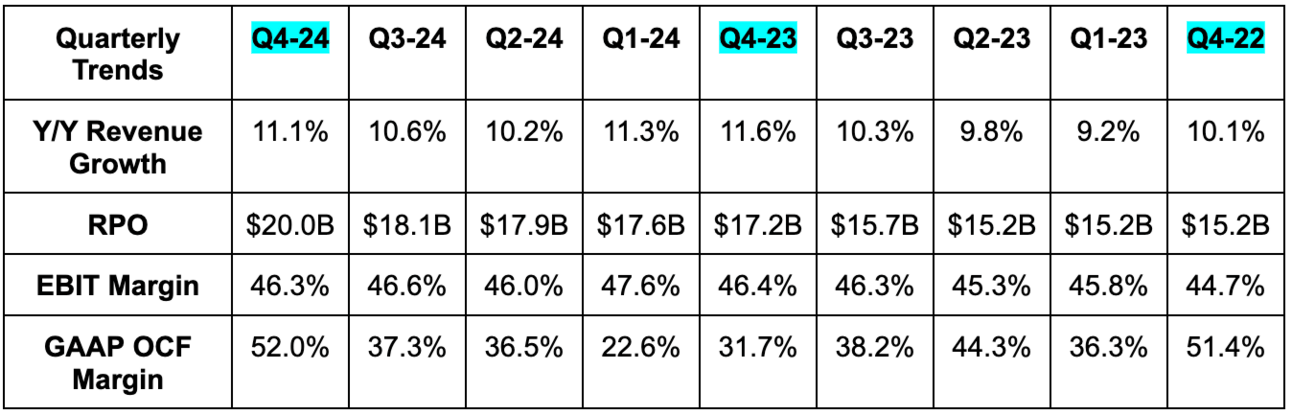

a. Results

- Beat revenue estimate by 1.3% & beat guidance by 1.5%.

- Digital media revenue beat guidance by 1.1%; digital experience revenue beat guidance by 2.2%.

- Beat EBIT estimates by 2.8%.

- Beat $3.67 GAAP EPS estimates by $0.12 & beat guidance by $0.18.

- Beat $4.67 EPS estimates by $0.14 & beat guidance by $0.13.

- Beat operating cash flow (OCF) estimates by 10.6%.

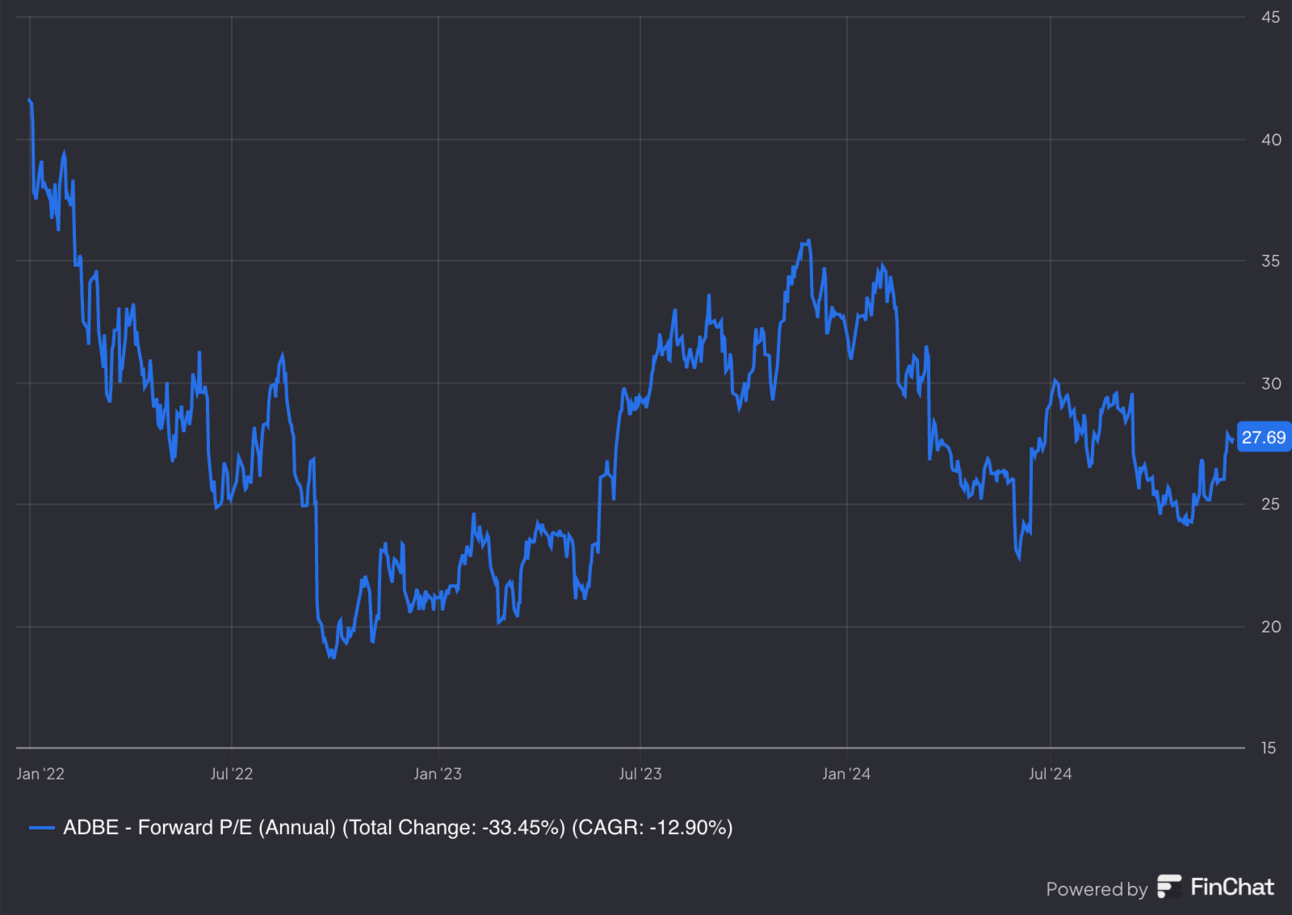

b. Guidance & Valuation

- Annual revenue guidance missed by 1.6%.

- Annual $3.87 GAAP EPS guidance missed by $0.03.

- Annual $20.35 EPS guidance missed by $0.18.

- Q1 guidance missed on revenue and was roughly in line on EPS.

EPS is expected to compound at a 13% clip during the next two years.

c. Balance Sheet

- $7.9 billion in cash & equivalents.

- $5.6 billion in total debt.

- Diluted share count fell by 1.2% Y/Y.

2. Oracle (ORCL) – Detailed Earnings Review

a. Oracle 101

Oracle provides a slew of software and hardware tools for on-premise and cloud environments… with an understandable focus on a continued shift towards cloud deployments. It has 3 main segments that tie very closely together.

Oracle Cloud Infrastructure (OCI) is its fully managed business for infrastructure services (virtual machines, storage, managed high-performance compute data centers etc.). This segment also includes platform services to build apps in its safe, controlled environment (serverless and container-based).

Strategic software as a service (SaaS) includes Oracle NetSuite. This is a set of applications for enterprise resource planning (ERP), customer relationship management (CRM), human capital management (HCM), e-commerce and more. It’s hard at work on launching more industry-specific software apps across areas like Healthcare. It has a more customizable, feature-rich version of this product suite called Oracle Fusion geared towards larger customers.

The last segment is Oracle Database (OD). Creating valuable apps from GenAI infrastructure requires great models and great data products to properly season those models. That’s where its Oracle Database (OD) product comes in. It provides a not only structured query language (NoSQL) database for unstructured data, which is highly important in the age of GenAI. Oracle closely integrates with the 3 big hyperscalers to allow its OD database products to run anywhere. This also means that customers can migrate their on-premise databases to the cloud via OCI or through any of these hyperscalers, diminishing the friction associated with using OD. Oracle believes that this data cloud interoperability provides inherent cost advantages with data transferring. Cost benefits are estimated to be “several times cheaper” for model training than any competitive product, according to leadership.

Oracle is (re)-emerging as a digital infrastructure titan. While the company did take longer to roll out its high-performance compute product suite, that has since achieved fantastic traction. The results you see below are the byproduct of it taking its fair share of this infrastructure boom.

b. Demand

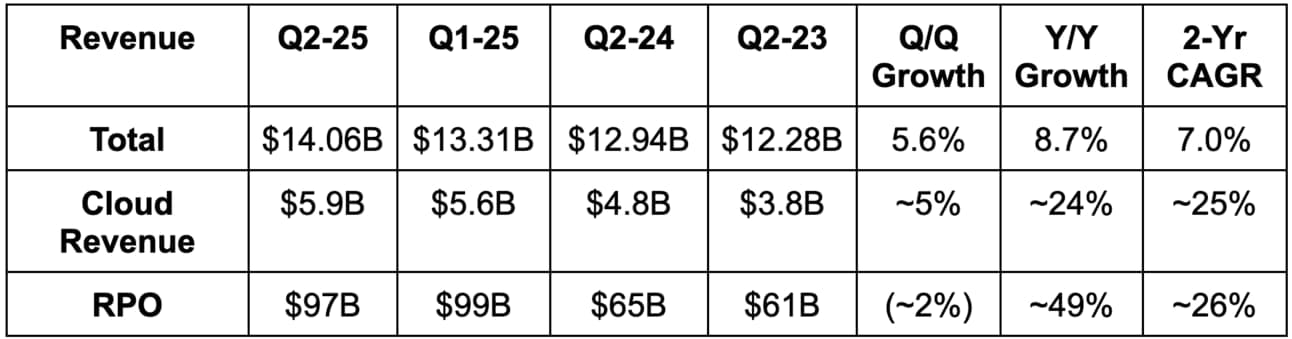

- Slightly missed revenue estimates & slightly missed guidance.

- Beat 8% foreign exchange neutral (FXN) revenue growth guidance by generating 9% FXN growth, meaning the revenue miss was FX-related.

- Cloud Services & License Support revenue missed by 0.5% and grew by 12% Y/Y FXN. This includes OCI, OD and strategic SaaS apps.

- Cloud License revenue beat by 2%; hardware revenue beat by 1%; services revenue beat by 0.4%.

- Oracle also reports “cloud revenue” which includes all infrastructure and software services. It met 24% FXN cloud revenue growth guidance.

- Cloud revenue was held back by 2 points from exiting its advertising business.

- Remaining Performance Obligations (RPO) FXN growth was 50% Y/Y. Rapid growth is thanks to rising interest in large, long-term contracts, and it thinks this growth will keep accelerating.

- Short-term deferred revenue (part of RPO) beat by 1% and rose by 8% Y/Y.

- Cloud-based RPO rose by 80% Y/Y and is now 75% of total RPO.

- “All segments exceeded internal forecasts,” per CEO Safra Catz.

c. Profits

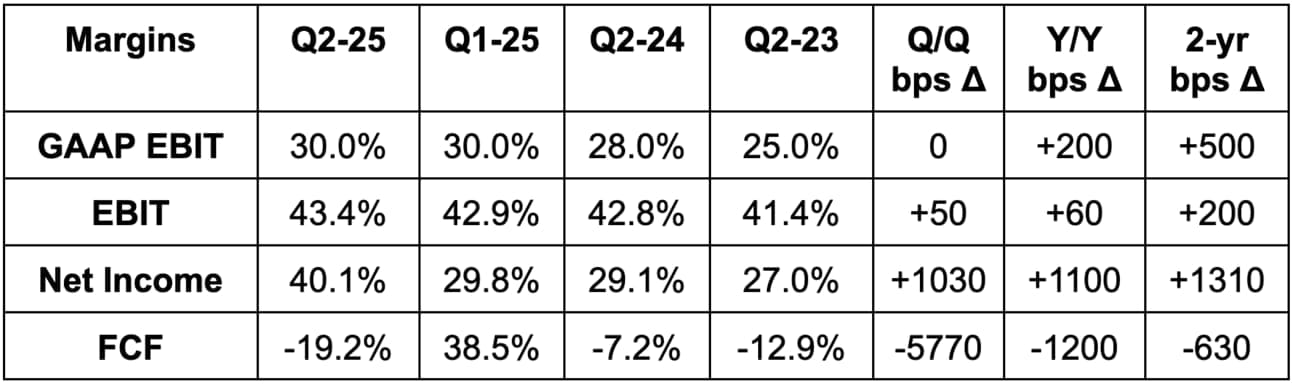

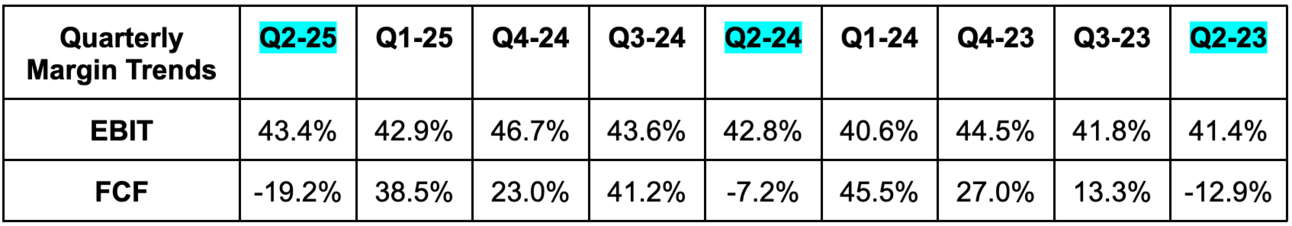

- Slightly missed EBIT estimates. Operating expense growth lagged revenue growth.

- Met EPS estimates & met EPS guidance.

- Tax rate was 20% vs. 19% expected, which hit EPS by $0.02 vs. its guidance.

- EPS rose by 10% Y/Y (10% FXN growth).

- Beat $1.07 GAAP EPS estimates by $0.03.

- GAAP EPS rose by 24% Y/Y (23% FXN growth).

- Free cash flow (FCF) is very lumpy on a quarterly basis. This is a CapEx-intensive business model; expense timing affects this item a lot. FCF for the quarter was -$2.7 billion vs. -$1.7 billion expected.

- Trailing 12-month FCF was $9.54 billion vs. $10.10 billion Y/Y. This is a better timeline to focus on for the metric.

d. Balance Sheet

- $11.3 billion in cash & equivalents.

- $88 billion in total debt.

- Dividends rose 1.4% Y/Y this year.

- Diluted share count rose 1.8% Y/Y.

e. Guidance & Valuation

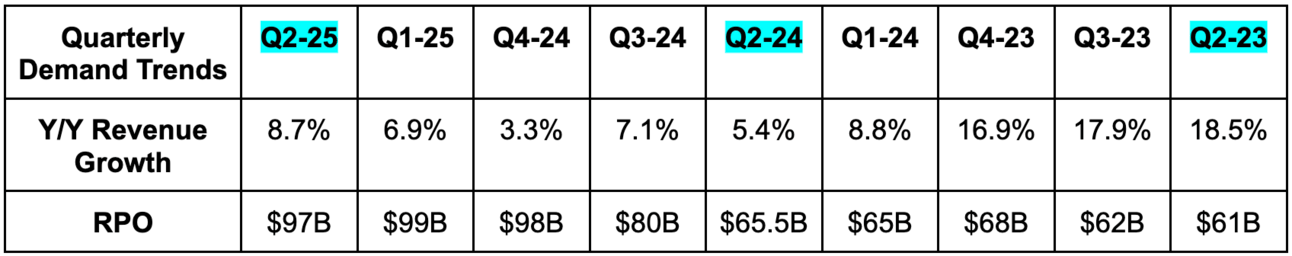

- For Q3, it guided to 8% Y/Y revenue growth vs. 10.3% Y/Y growth expected. It also guided to 10% Y/Y FXN growth, with a material FX headwind expected for next quarter.

- It expects 24% Y/Y cloud growth (26% Y/Y FXN growth).

- For Q3, it guided to $1.49 in non-GAAP EPS, which missed by $0.08. This includes a $0.03 FX headwind vs. a $0.03 FX tailwind last quarter. This also includes a $0.05 hit from previous investment losses.

- Reiterated expectations for 10%+ revenue growth for the year, which beat 9.7% Y/Y growth estimates. Also reiterated expectations for 50%+ Y/Y cloud growth.

- Reiterated expectations for doubling Y/Y CapEx in 2024 vs. 2023 to support OCI demand.

Oracle added that its pipeline growth is actually above the 50% RPO growth while its win rates are rising. Meta was the big win for this quarter to collaborate on Llama and AI agents; all of those bookings and the RPO benefit will come in Q3, not for this Q2 report. This will lead to a Q3 RPO “spike.”

“Today we’re telling you again that revenue growth will accelerate further in the coming quarters.”

CEO Safra Catz

EPS is expected to compound at a 13% clip for the next two years.

f. Earnings Call Review

OCI:

OCI revenue rose by 52% Y/Y (GPU demand up over 300% Y/Y), with OCI consumption up 58% Y/Y as “demand continued to outpace supply.” OCI now is running in 98 regions vs. 85 Q/Q. There are many more coming. The seamless micro-expansion of Oracle’s data center footprint is a rare trait within public cloud computing. Its “Gen 2 architecture” allows it to debut brand new cloud regions with just 10 racks (“soon to be 3”) and to flexibly scale its own capacity to match customer demand growth. Racks are essentially exoskeletons or physical frames that hold servers/compute capacity. It does not need to build massive footprints ahead of demand like Azure, AWS and Google Cloud all need to do.

How does it uniquely position itself to provide micro-regions while others can’t? How has it figured out profitably servicing this demand? A few ways.

It has a single next-gen data center layout. There aren’t several custom configurations to add complexity, while deep layers of automation augment its ability to deliver low cost scaling for its customers and its own financial benefit. As leadership puts it, this simplifies manufacturing, lowers cost and creates one stock of technically-identical inventory to immediately add new racks to. It’s very efficient.

“When all of our racks are the same and all of our services are the same, they become easier to automate. They're all identical. We have 1 suite of automation tools that works in all 100 of our current regions.”

Founder/Chairman/Michigan Football Savior Larry Ellison

It also offers highly dense servers to pack more punch into the same amount of physical space, while featuring high-quality liquid cooling tech to reduce waste and cost inflation. Furthermore, while everyone has focused on building bigger and bigger GPU clusters, Oracle has paired that priority with heavy investments in “building networks that rapidly move data in and out of GPU clusters.” Data transference latency & scale bottlenecks are highly costly when, as Ellison reminded us, customers are renting out space by the minute.

All in all, added efficiency allows vendors like Oracle to service smaller projects and still generate enough margin to overcome smaller economies of scale. The modular-based, uniform design of its data centers allows building for what it needs. I will say that Oracle has been capacity constrained so far this year, which has held back growth and does support the argument that it often makes sense to pre-build capacity. Still, based on its assumption that RPO and revenue growth will continue to accelerate, this approach is working.

The unique strategy here allows it to go where the big 3 aren’t willing to go. This is Oracle carving out a promising niche within public cloud computing.

- Oracle is also building some of the largest data centers in the world, with a 1.6 gigawatt project now underway. As leadership proudly tells investors, it can build larger and smaller data centers than its competition.

- Even in Oracle’s smallest rack regions, it offers all of its software services – from NetSuite to Oracle Database. As Ellison reminded us, other competitors can’t match this consistent experience across OCI.

- Oracle can also build managed cloud regions for customers within their existing legacy on-premise architecture. This allows clients to embrace cloud migrations without abandoning previous investments or ripping-and-replacing systems.

- Introduced the “largest and fastest” AI supercomputer with 65,000 Nvidia H200 chips.

- Some of the cool examples of agents being built with OCI and OD services include satellite image analysis to predict crop output and real-time weapon detection in schools.

OCI CapEx:

Flexible capacity scaling means flexible CapEx scaling in tandem with actual bookings trends. That means relatively more stable multi-year depreciation schedules. That helps offset some of the relative margin pressures of being a smaller, newer entrant and helps power the 43% EBIT margin seen this quarter. This business is still just 8 years old. Azure is 14; AWS is 18. Oracle thinks cloud gross margin will keep expanding with scale (last update was 30% a few quarters ago) in the years to come.

“Our competitors always have to land with extremely large footprints before they can even get started. We can land with smaller footprints, have consumption and expand as customers need it.”

CEO Safra Catz

OCI + Oracle Database:

Rapidly proliferating demand for cloud-based architecture means a ton of data and insight moving from on-premise to publicly-managed environments. This is creating, as leadership puts it, a third promising growth lever in OD, joining OCI and its app business. They have an “enormous pipeline of customers” wanting to bring their data to the cloud. Many want to do so with OCI while many want to do so with other cloud infrastructure. Thanks to strong AWS, Azure and Google Cloud (GCP) partnerships, it services all of this demand and creates a truly interoperable environment for lower-cost cloud-based data storage, querying and analytics. This makes model training, app creation and all other GenAI work more compelling; it extends the possibilities of where GenAI can take us and how big of a role Oracle can play.

ORCL’s database services enjoyed 28% Y/Y revenue growth to reach an annualized run rate of $2.2 billion. Almost all of this is from OCI architecture cross-selling, but the big 3 are starting to contribute. Between Azure, AWS and GCP architecture used for Oracle Database services, that business crossed a $100 million run rate. All of these contracts are new and a large chunk of capacity is about to come online. All of this means that hyperscaler-related business for Oracle is poised to enjoy a period of explosive growth.

“We’re at the very beginning of multi-cloud… it will be a multibillion dollar business.”

Founder/Chairman Larry Ellison

To add more AI tools to its overarching database service, Oracle debuted Database 23AI. Per the company, this makes it even easier to “use existing data to augment and specialize training GenAI models.” It offers theme-based vector search to deepen querying breadth and retrieval-augmented generation (RAG) to push vector search results into associated large language models (LLMs)

Quick Note on Strategic SaaS Apps:

“Strategic SaaS apps are growing rapidly. We’re enjoying more industry-based traction for apps coming online and “immediately contributing to revenue growth.”

CEO Safra Catz

Strategic SaaS revenue rose 18% Y/Y to reach an annualized rate of $8.4 billion.

f. Take

I thought this was a good quarter. RPO could have been a large beat if the Meta deal closed a bit earlier and it continues to sell as much OCI capacity as it can build. The expectation of more Y/Y acceleration in RPO/revenue growth is notably impressive, and is based on observations rather than hope. It’s delivering this stellar growth while enjoying strong OD and app-based demand. Some will pick on the next quarter revenue guide, but weakness is based on strengthening FX headwinds more than anything. Margins remain stellar and OCI leverage should have a long, long runway (like GCP a few years ago).

Oracle has positioned itself to cater to cloud demand that the big three just aren’t interested in pursuing. And? It has clearly demonstrated that this piece of the pie can be morphed into a great business. Excellent execution amid a multi-year vision to recapture this company’s technological edge. More growth… more leverage… more success. The stock volatility after a historic run is noise in my view.

3. MongoDB (MDB) – Detailed Earnings Review

a. MongoDB 101

MongoDB is a key player in data storage and analytics with a document-oriented setup. This differs from legacy relational-style databases and next-gen versions like Snowflake’s. How so? Legacy relational databases store data in static rows and columns linked by implemented formulas. These databases look like giant Excel spreadsheets and use structured query language (SQL) to work. Legacy relational databases cannot seamlessly handle unstructured data like MongoDB’s data lake can. This is a large limitation, considering how important unstructured data is for GenAI use cases. Legacy relational databases struggle to scale and unlock the most advanced querying. The datasets are fixed, with formatting and filtering more limited. The inability to provide “not only SQL” (NOSQL) can slow performance and diminish value. MongoDB’s NOSQL database and document-style storage fix these issues, which is why the pace of migration continues to ramp up.

The firm’s most exciting product is called MongoDB Atlas. This is a cloud-native database service that uses a group of servers (or a cluster) to actually store data for app creation within its platform. The nature of MongoDB’s product allows clusters to be easily added to or subtracted for easier tweaking as needs fluctuate. It also offers MongoDB Realm as a mobile environment for app creation and MongoDB Search for data querying. Finally, it offers MongoDB Data Lake specifically to house unstructured data.