1. PayPal Demand

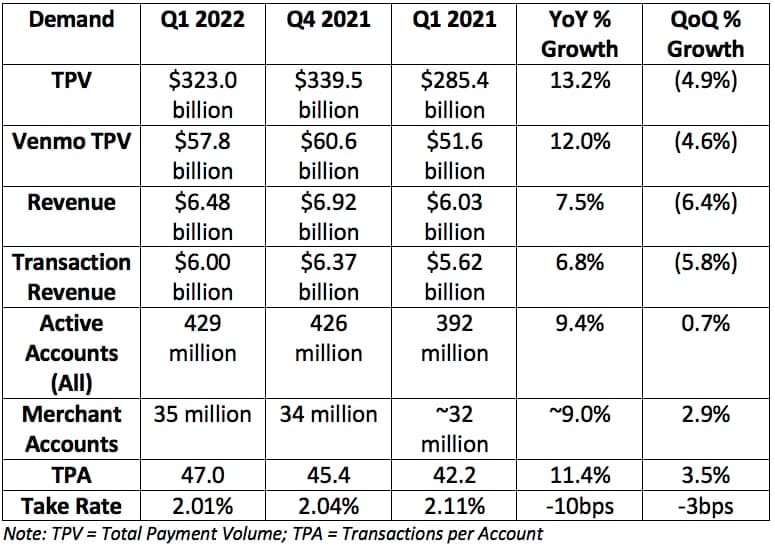

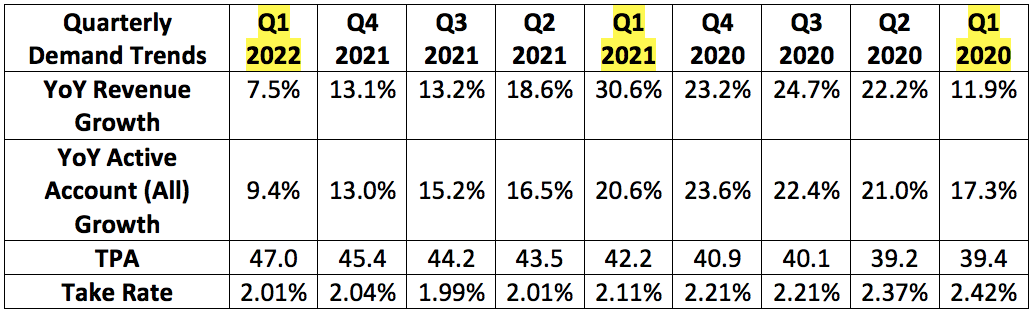

PayPal guided to roughly $6.40 billion in first quarter revenue with analysts expecting $6.41 billion. The company posted $6.48 billion, beating expectations by roughly 1%. This 7% revenue growth metric would have been 15% ex-eBay as PayPal continues to deal with the temporary headwind of eBay shifting to a managed payments system. We will be through this headwind by July of this year.

Ex-eBay spot rate growth:

- 17% total payments volume growth (13.2% including eBay)

- 24% total transaction growth (18% including eBay)

Also note that Q1 2021 was PayPal's best quarter, ever. During that period, it grew revenues by nearly 47% on an apples to apples basis as e-commerce adoption exploded higher. PayPal continues to take e-commerce payment marketshare meaning this slowing growth is a factor of macroeconomic turbulence that will eventually fade.

PayPal added 2.4 million net new active accounts during the quarter.

PayPal has been struggling to grow TPA by a double digit % for several quarters. This 11.4% growth was actually closer to 19.0% YoY when normalizing for eBay. To me, this is a clear sign of the super-app journey beginning to bear fruit.

2. PayPal Profitability

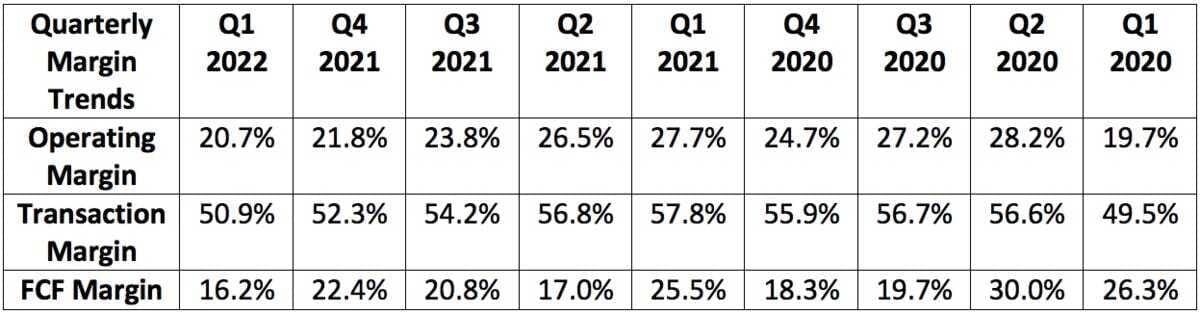

PayPal guided to $0.87 in earnings per share (EPS) with analysts expecting $0.88. It posted roughly in-line results of $0.88. This result is in light of $0.36 in headwinds via eBay, higher taxes, lapping credit reserves and ending Russian operations. Without these obstacles, PayPal would have earned $1.24 per share vs. $1.22 YoY. Keep in mind that we are comping vs. a historically great PayPal Q1 2021 in which its EPS growth was over 80% YoY.

More exogenous factors weighing on margins:

- Cross Border volume as a % of total company TPV vs. 14% vs. 17% YoY in light of supply chain headaches and geopolitical tension. It collects higher fees on cross border sales due to its currency conversion service.

- A shift back to credit from debit (post-stimulus checks) raised transaction expenses.

- This prompted volume-based expenses to jump back from 42% of sales to 49% of sales YoY.

- Transaction margin is also being impacted by PayPal's rapidly growing Bill Pay product which comes with a lower take rate.

- eBay was higher margin business than the rest of its operations.

- The aforementioned lapping of credit reserve releases propping up Q1 2021 net income.

Also note that free cash flow contraction was predominately an unfavorable shift in working capital.

PayPal bought back $1.5 billion in stock year to date -- a notably accelerated pace vs. previous quarters.

3. Guidance

Q2 2022:

- Analysts were looking for $7.09 billion in sales. PayPal guided to $6.8 billion, missing expectations by 4.1%.

- Analysts were looking for $1.11 in EPS. PayPal guided to $0.86, missing expectations by $0.25.