Table of Contents

- 1. Salesforce (CRM) – Earnings Review

- 2. Earnings Round-Up — MongoDB, Dell & Ulta

- 3. Mid-Week News — Meta, PayPal, Progyny & SoFi

- 4. Lululemon (LULU) — Earnings Review

Yesterday, I published Nvidia, CrowdStrike & SentinelOne earnings reviews, which can be found here.

1. Salesforce (CRM) – Earnings Review

a. Salesforce 101

Salesforce is the 3rd largest (maybe 2nd largest now) enterprise software firm on the planet. It provides a broad suite of products to help clients optimize customer interactions. The overarching niche is called Customer Resource Management (CRM). Salesforce offers a variety of cloud services to its customers. There’s a sales cloud, which perfects consumer touch-points. There’s a commerce and marketing cloud to build online storefronts and augment promotional activity. There’s a service cloud to handle customer issues and inquiries. There’s also a platform cloud, which includes Slack.

Most recently, it debuted its data cloud. This is an aggregated analytics service to ingest, organize & glean insight from 1st party data. It conjoins siloed context and “unlocks” previously disparate sources for client value creation. It’s similar to what Snowflake does (even through the two partner elsewhere), but more for managing customer relationships. MuleSoft and Tableau are both key pieces of this data cloud. MuleSoft integrates apps and data to enable management of these products within Salesforce. Tableau is a data visualization tool to create automated progress reports and suggestions to leverage findings. Finally, it offers industry-specific clouds for sectors like healthcare. These are customized to meet specific regulatory and operational needs. All of these clouds and products make up the firm’s subscription & support revenue, which represents 93% of its total business. Professional services make up the rest.

Separately, Salesforce offers a product called Einstein One. This is a full set of AI tools, including outcome prediction, chat bots, image recognition, sentiment analytics and more. It’s considered a general-purpose AI platform infused into all Salesforce products. Most recently, through an OpenAI partnership, it debuted Einstein GPT. Einstein existed before the GenAI wave, but is now getting an upgrade thanks to it. Einstein GPT allows Salesforce clients to plug into language models (including OpenAI, Anthropic and Cohere) to make workflows more productive, intuitive, conversational and automated. It features a low code tool set to reduce the barrier for non-experts to build applications; it also boasts expert-level tools to build more complex apps. That’s Salesforce in a nutshell. Now, the quarterly results.

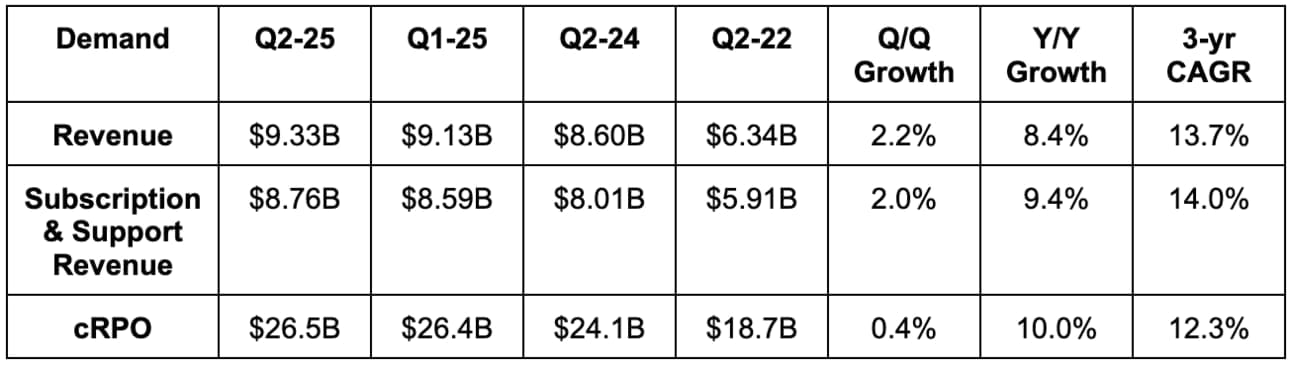

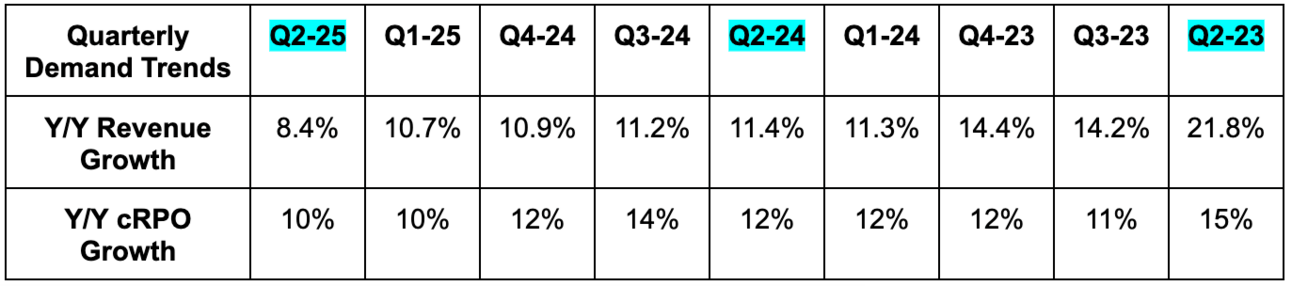

b. Demand

- Beat revenue estimate by 1.0% and beat guidance by 1.1%.

- Foreign exchange neutral (FXN) revenue growth was slightly ahead of estimates. Revenue rose by 9% Y/Y FXN.

- Beat current remaining performance obligations (cRPO) estimate by 0.8% and beat guidance by about 0.9%. Outperformance was helped by strong bookings and some early renewals. cRPO rose by 11% Y/Y FXN.

Q1 pulled some revenue forward due to the leap year, which led to tougher comps. Japan, India and Canada were cited as standouts this quarter. The USA and Europe “remain constrained.” Revenue attrition was stable at 8%.

Sales cloud growth of 12% was stable Y/Y; service cloud growth slowed from 12% Y/Y last year to 11% this year; marketing & commerce growth was 7% Y/Y this year vs. 10% Y/Y last year; Integration and Analytics growth was 14% this year vs. 16% last year. Growth was fastest in Asia and slowest in North America.

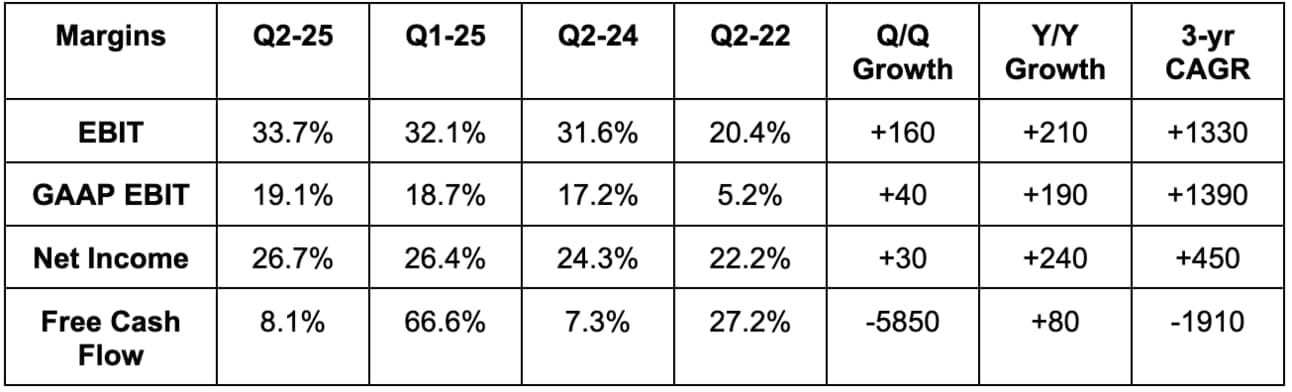

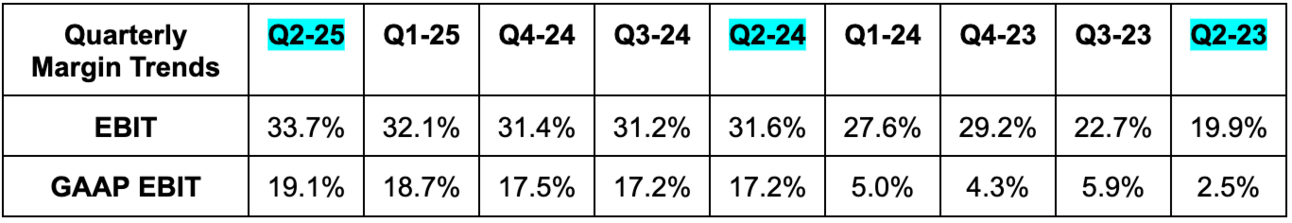

c. Profits & Margins

- Beat EBIT estimates by 5.9%.

- Beat $1.32 GAAP EPS estimates by $0.17 & beat guidance by $0.15.

- Beat $2.36 EPS estimates by $0.20 & beat guidance by $0.19. EPS rose by 20.8% Y/Y.

d. Balance Sheet

- $12.64 billion in cash & equivalents.

- $5 billion in strategic investments.

- $8.4 billion in total debt (none of it is current).

- Diluted share count fell by 1.3% Y/Y.

- Paid out $384 million (about $0.39 per diluted share) in dividends vs. $0 Y/Y.

e. Guidance & Valuation

Q3 guidance:

- Revenue guidance missed by 0.9%.

- $1.48 GAAP EPS guidance beat by $0.06.

- $2.43 EPS guidance met expectations.

Annual guidance:

- Reiterated annual revenue guidance, which met expectations.

- Reiterated 10% FXN subscription & support revenue growth.

- Slightly lowered GAAP EBIT guidance. This is due to higher stock comp costs.

- Raised EBIT guidance by 0.9%, which beat by 0.7%.

- Reiterated $6.08 GAAP EPS guidance, which slightly beat estimates by $0.02.

- Reiterated $9.90 EPS guidance, which slightly missed estimates by $0.02.

- Raised 22.5% GAAP operating cash flow growth guidance to 24.0%, which beat 23.2% growth estimates.

- Raised 24.5% FCF growth guidance to 26%, which beat 25% growth estimates.

Guidance assumes macro headwinds will persist. It also continues to see professional services as a growth headwind for the rest of the year, mainly due to tougher comps.

Salesforce trades for 25x this year’s earnings. Earnings are expected to rise by 23% this year and by 10% next year.

f. Call & Release

About Agentforce:

Pretty much the entire call was spent walking through Salesforce’s new Agentforce. Agentforce is an AI-powered platform with a diverse set of agents to automate various sales and service tasks. It brings together all of Salesforce’s work in Einstein AI, Customer360 (data unification across disparate source for apps) and elsewhere to create an end-to-end GenAI platform that actually drives value. He lamented on the money wasted by companies thinking they need to do all of this work alone and also the routine customer “disappointment” stemming from Microsoft Copilots.

“This is not more Copilots. So many customers are disappointed in what they bought from Microsoft because they're not getting the accuracy and the response that they want. Microsoft has disappointed so many customers with AI."

Founder/CEO Marc Benioff

“Agentforce is deeply integrated in our platform and combines our Data Cloud and Einstein while extending the power of our Customer 360 apps in ways that we didn't think possible a year ago. This reduces cost, scales workforces and dramatically improves customer and employee experiences.” –

Salesforce President Brian Millham

Conversely, Benioff is adamant that Agentforce will drive “immediate return on investment,” which is a prerequisite for the software GenAI monetization wave finally kicking into high gear. These agents don’t replace humans, but do replace the tedious, mundane, repetitive tasks they were once required to do to truly unleash their productivity. And? The sheer diversity of use cases that can be enhanced with agents is notable. It requires very little prompting to schedule patient care cycles, handle basic customer inquiries, accelerate drug discovery, hunt for new deal pipeline, manage loyalty programs, as well as summarize documents and cases. These are just a few examples. All of this is nice, but I think real case studies offer more valuable evidence to drive his point home.

Wiley is using Agentforce agents to drive 10%+ lifts in customer satisfaction rates and a 50% rise in automated case resolution. That’s with Agentforce version one, while version two is boosting automated case resolution rates by a full 90% for a large healthcare provider, ADP and the Royal Bank of Canada too.

- As an important aside, its Data Cloud is a vital complement to this product, as it offers needed context to train models more effectively and minimize hallucination (wrong answer or incorrect task) rates.

“Salesforce is going to be the first company at scale to deploy enterprise agents and not just any enterprise agents, the highest quality, most accurate agents in the world.”

Founder/CEO Marc Benioff

Agentforce Service & Malleability:

Agentforce functions as a full-service, out-of-the-box platform to upgrade workflows across its commerce, marketing, analytics and all other clouds. That’s important to note. The diversity of Salesforce’s cloud tools means more opportunity to drive vendor consolidation, interoperability and broader agent use cases without complexity. The thoughtful integrations and re-coding Salesforce conducted for all of its previous acquisitions ensure this formula is intact. That’s a differentiator in their minds.

“I can unequivocally tell you that building these agents without a complete integrated platform is like trying to assemble a plane mid-flight, it's risky, chaotic and it's not likely to succeed.”

Founder/CEO Marc Benioff

The company essentially holds the hands of customers as they look to embrace GenAI… without doing it all themselves. The company is confident that this will cut costs, and boost efficiency too. For example, one customer was excited about getting up to a 10%-40% case resolution rate. Salesforce pushed that to 90%. To help customers along their AI journeys and to communicate how it moves them from wasting money on “AI hype” to creating real value, it launched “Salesforce CTOs.” These employees are deeply technical individuals who will specialize in diminishing Agentforce onboarding friction. Whatever it can do to drive easier adoption, it will do.

- This shift in thinking away from doing it alone is strikingly similar to the on-premise to cloud computing migration we’ve seen over the last several years. Companies realized it was more efficient to rent capacity, instead of building and managing it alone. They also enjoyed significant value-added services offered by these managed cloud providers. Salesforce is trying to emulate that idea within enterprise AI software.

While Agentforce is full service in nature, it’s also easily malleable. In reality, Salesforce can’t build every niche use case for every client. Some will want to customize on top of the Agents platform to drive more relevant use cases for their own needs. Salesforce makes doing so in a no-code manner very easy with its GenAI tools like Einstein.

Agentforce and AI Trust:

Salesforce’s commitment to never sharing or impermissibly using a customer’s data will resonate more deeply in this GenAI world. It also commits to handling all compliance issues for customers. So far, this wave has been like a wild west of shady data stealing to season models. CRM doesn’t play that game. It thinks having Agentforce integrated right into this trusted platform will make companies more eager to and comfortable with embracing GenAI. That should accelerate adoption.

The Platform Play:

For customer resource management (CRM), there is no platform play that is more clear than Salesforce. That was again on full display this quarter. Multi-cloud deals rose 80% Y/Y while 16,000 customers added 1 new cloud and 4,500 added multiple new clouds. It’s newest data cloud continues to thrive and represents its strongest organic launch ever. Data cloud customers rose 130% Y/Y with $1 million customers doubling Y/Y and consumption rising 110% Y/Y. This product directly augments every other cloud Salesforce provides to more deeply establish the value of this end-to-end platform. Along these data cloud lines, Tableau secured several large wins during the quarter including the Department of Interior.

AI also continues to be another cross-selling pillar to round-out this cross-selling machine. New bookings for its AI suite doubled Q/Q as it signed deals with Alliant, Bombardier and CMA.

g. Take

Another rock-solid quarter for an elite company. The commentary on Agentforce is very exciting, although I would remind people that Benioff is always optimistic and charismatic on these calls. That charisma is generally well placed, but it’s still worth noting… especially as this quarter’s guidance revisions didn’t reflect a material uplift in demand expectations. That could just simply take more time to come. For now, we are left with wonderfully boring revenue compounding, strong leverage, more successful product debuts and more execution.