Table of Contents

- 1. Oracle (ORCL) – Earnings Review

- 2. Block (XYZ) – Earnings Review Part 2

- 3. SentinelOne (S) — Earnings Review

1. Oracle (ORCL) – Earnings Review

a. Oracle 101

Oracle provides a slew of software and hardware tools for on-premise and cloud environments… with an understandable focus on shifting towards cloud deployments. It has 3 main segments that tie very closely together.

Oracle Cloud Infrastructure (OCI) is its fully managed business for infrastructure services (virtual machines, storage, managed high-performance compute data centers etc.). This segment also includes platform services to build apps in its safe, controlled environment (serverless and container-based).

Strategic software as a service (SaaS) includes Oracle NetSuite. This is a set of applications for enterprise resource planning (ERP), customer relationship management (CRM), human capital management (HCM), e-commerce and more. It’s hard at work on launching more industry-specific software apps across areas like Healthcare. It has a more customizable, feature-rich version of this product suite called Oracle Fusion geared towards larger customers.

The last segment is Oracle Database (OD). Creating valuable apps from GenAI infrastructure requires great models and great data products to properly season those models. That’s where its Oracle Database (OD) product comes in. It provides a not only structured query language (NoSQL) database for unstructured data, which is highly important in the age of GenAI. Oracle closely integrates with the 3 big hyperscalers to allow its OD database products to run anywhere. This also means that customers can migrate their on-premise databases to the cloud via OCI or through any of these hyperscalers, diminishing the friction associated with using OD. Oracle believes that this data cloud interoperability provides inherent cost advantages with data transferring. Cost benefits are estimated to be “several times cheaper” for model training than any competitive product, according to leadership.

Oracle is (re)-emerging as a digital infrastructure titan. While the company did take longer to roll out its high-performance compute product suite, it has since achieved fantastic traction.

b. Key Points

- Average quarter with strong guidance and fantastic bookings.

- Stargate is not yet included in the remaining performance obligation (RPO) figure.

- Created a new product for foundational model access within OD.

c. Demand

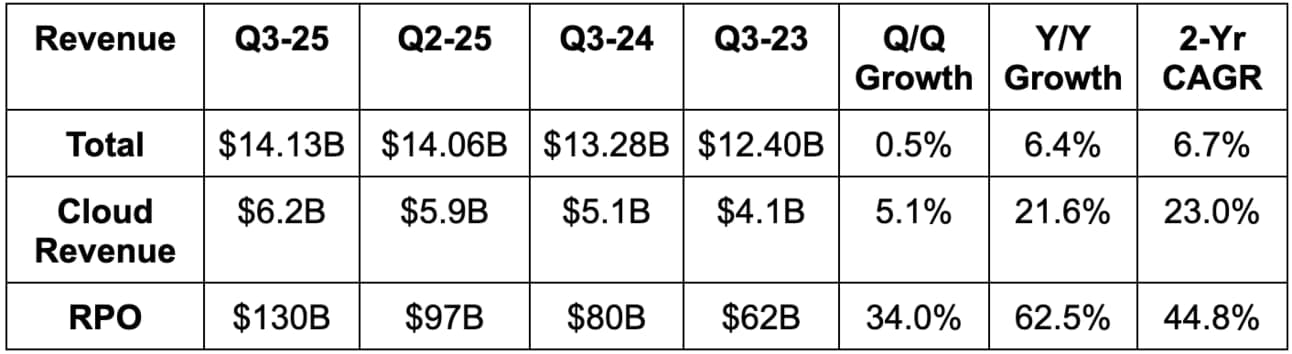

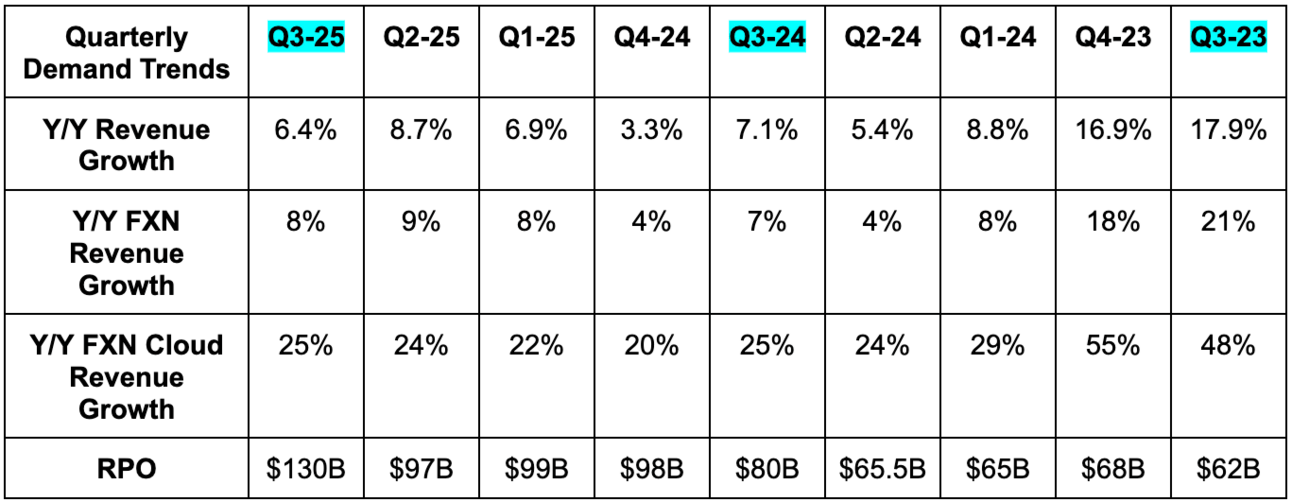

- Missed revenue estimates by 1.9% & missed guidance by 1.5%. It also missed its 10% Y/Y foreign exchange neutral (FXN) revenue growth guidance by 2 points.

- Missed 26% FXN cloud revenue growth guidance by 2 points.

- Beat remaining performance obligation (RPO) estimates by 20%.

Note that exiting its advertising business lowered cloud revenue growth by 2 points. Cloud includes Infrastructure as a Service (IaaS) and Software as a Service (SaaS).

OCI (key part of IaaS) rose 51% Y/Y FXN vs. 52% Y/Y growth last quarter, with consumption based revenue +57% Y/Y. Unsurprisingly, this was driven by AI demand, as GPU consumption within IaaS rose 250% Y/Y. Training is driving the bulk of this growth.

- NetSuite rose 17% Y/Y FXN vs. 19% growth last quarter.

- Fusion rose 18% Y/Y FXN vs. 18% growth last quarter.

- Strategic back-office SaaS apps rose 18% Y/Y FXN vs. 18% growth last quarter.

d. Profits & Margins

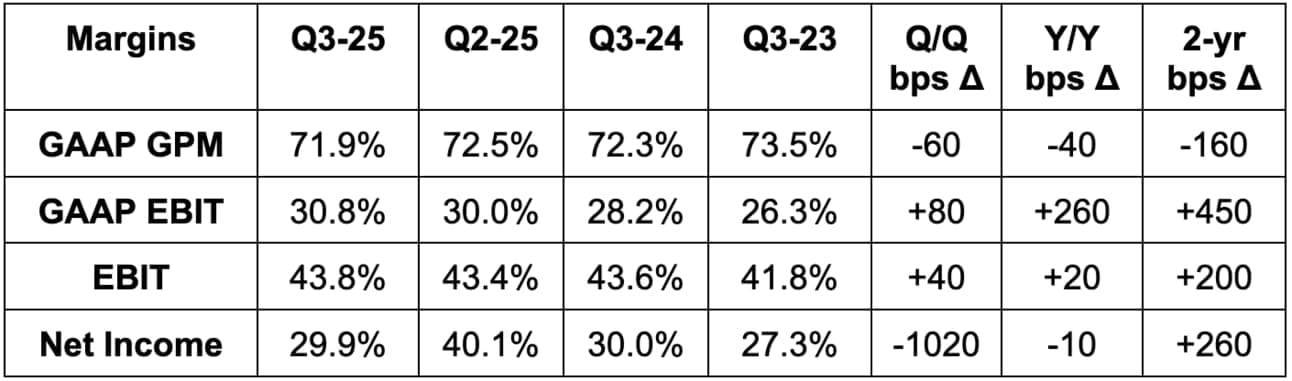

- Missed EBIT estimates by 0.9%.

- Missed $1.49 EPS estimates and missed $1.49 EPS guidance by $0.02 each.

- Higher-than-expected taxes lowered EPS by $0.02 while currency had a $0.04 larger-than-expected negative impact.

- EPS rose 7% Y/Y FXN.

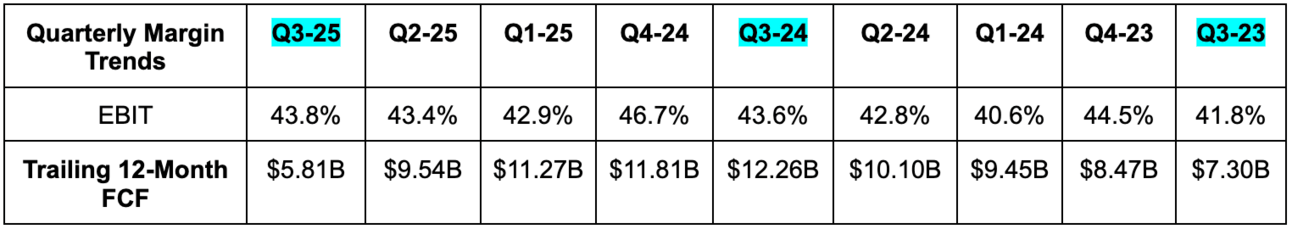

“Front-loading” of some CapEx to address capacity constraints weighed on FCF generation this quarter. “Given the demand” they’re seeing, Oracle continues to expect CapEx to double to roughly $32B in FY 2025. They remain “careful in aligning CapEx with booking trends.”

e. Balance Sheet

- $17.8B in cash & equivalents.

- Property, plant and equipment has jumped from $21.5B to $32B in 9 months. Lots of data centers.

- $96.2B in total debt.

- Diluted share count rose by 2% Y/Y.

- Dividends rose 16% Y/Y. Raised quarterly dividend by another 25% this quarter.

f. Guidance & Valuation

For next quarter, it expects 9% Y/Y revenue growth, which missed roughly 9.5% Y/Y growth estimates. Sales estimates for FY 2025 fell by 1% after this report. It also expects 26% Y/Y cloud growth and $1.63 in EPS, which missed estimates by $0.15. The EPS miss led to estimates falling for FY 2025by 2.5%. For FY 2025, it reiterated 50% Y/Y cloud growth.

For FY 2026, it guided to 15% Y/Y revenue growth, which led to very modest upward revisions to sales estimates; EPS estimates for 2026 fell by 3.5%.

Finally, it expects 20% Y/Y revenue growth in FY 2027, which is higher than its previous guidance. This led to sales estimates for that year rising by 2.6% and EPS estimates also rising ever so slightly. Their confidence in reaching these targets is rising and based on stellar bookings momentum, not hope. Finally, it expects continued OpEx discipline to drive more operating leverage in the future.

Oracle EPS is expected to grow by 8% this year and by 13% next year.