1. Disney (DIS) — Earnings Review

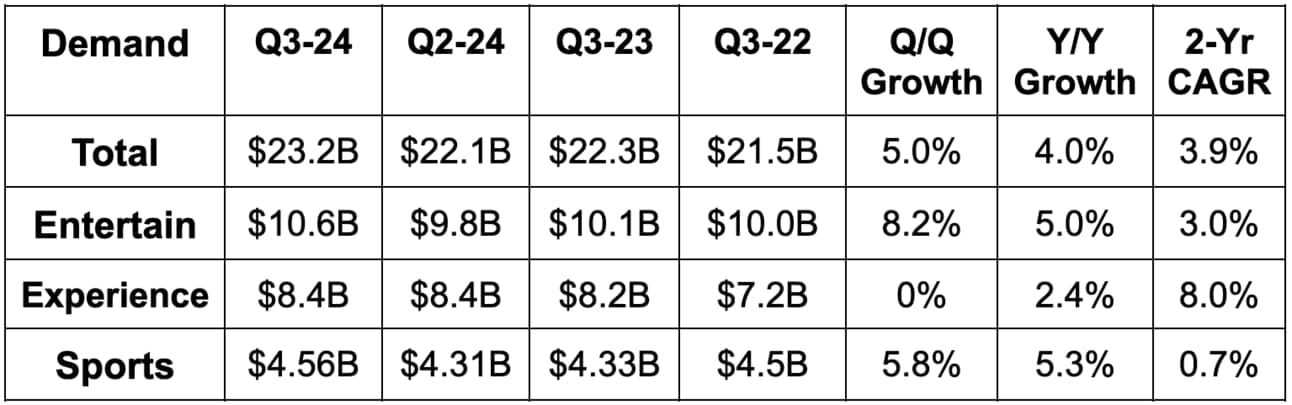

a. Demand

- Slightly beat revenue estimate.

- Slightly beat core Disney+ subscriber guide.

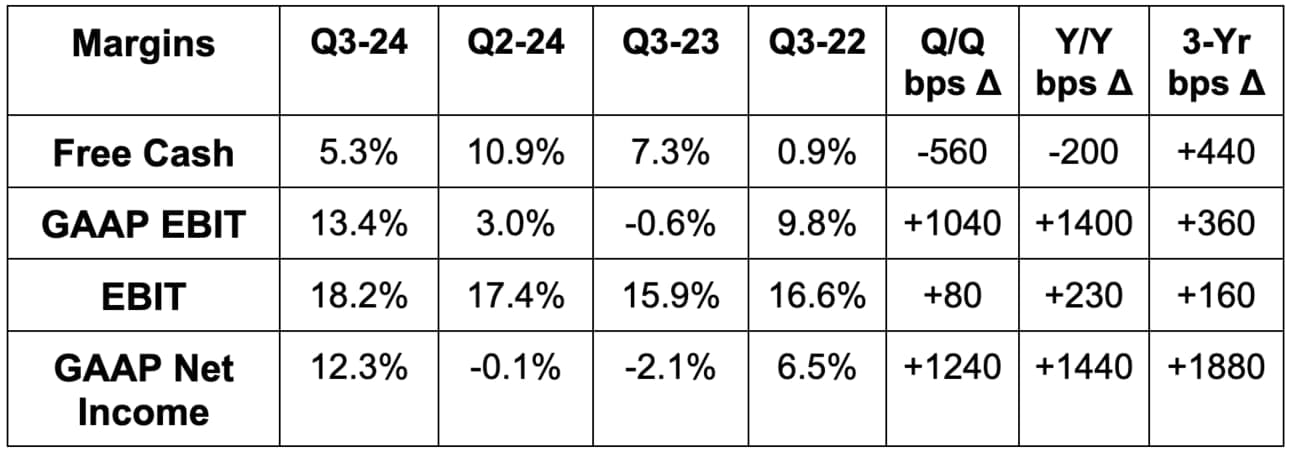

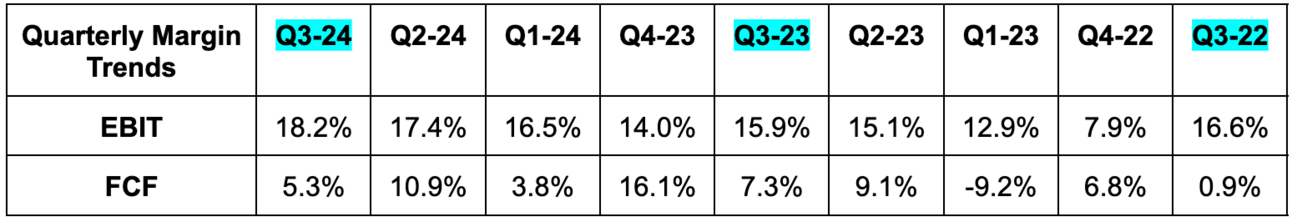

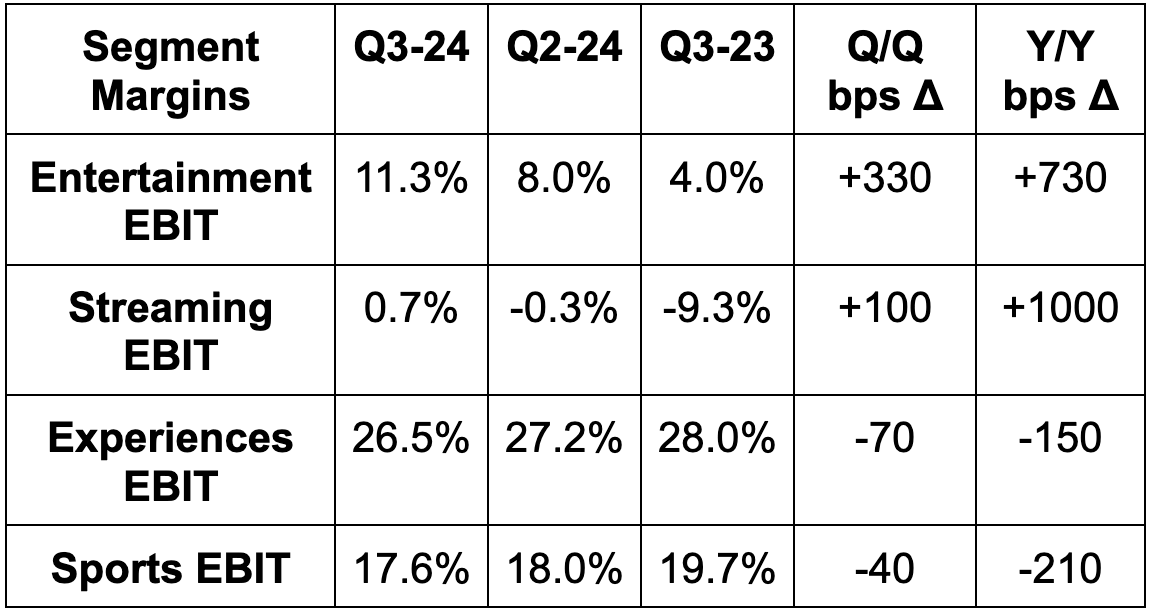

b. Profits & Margins

- Missed free cash flow (FCF) estimate.

- Beat EBIT estimate by 8.8%.

- Beat $1.19 EPS estimate by $0.20. Sharply beat GAAP EPS estimates, but this is largely just because it’s hard to model quarterly restructuring levels.

c. Balance Sheet

- $6B in cash & equivalents.

- $4.6B in investments.

- $1.2B in land.

- $39.5B in debt.

- Diluted share count is flat Y/Y.

- It’s now paying a small dividend once more.

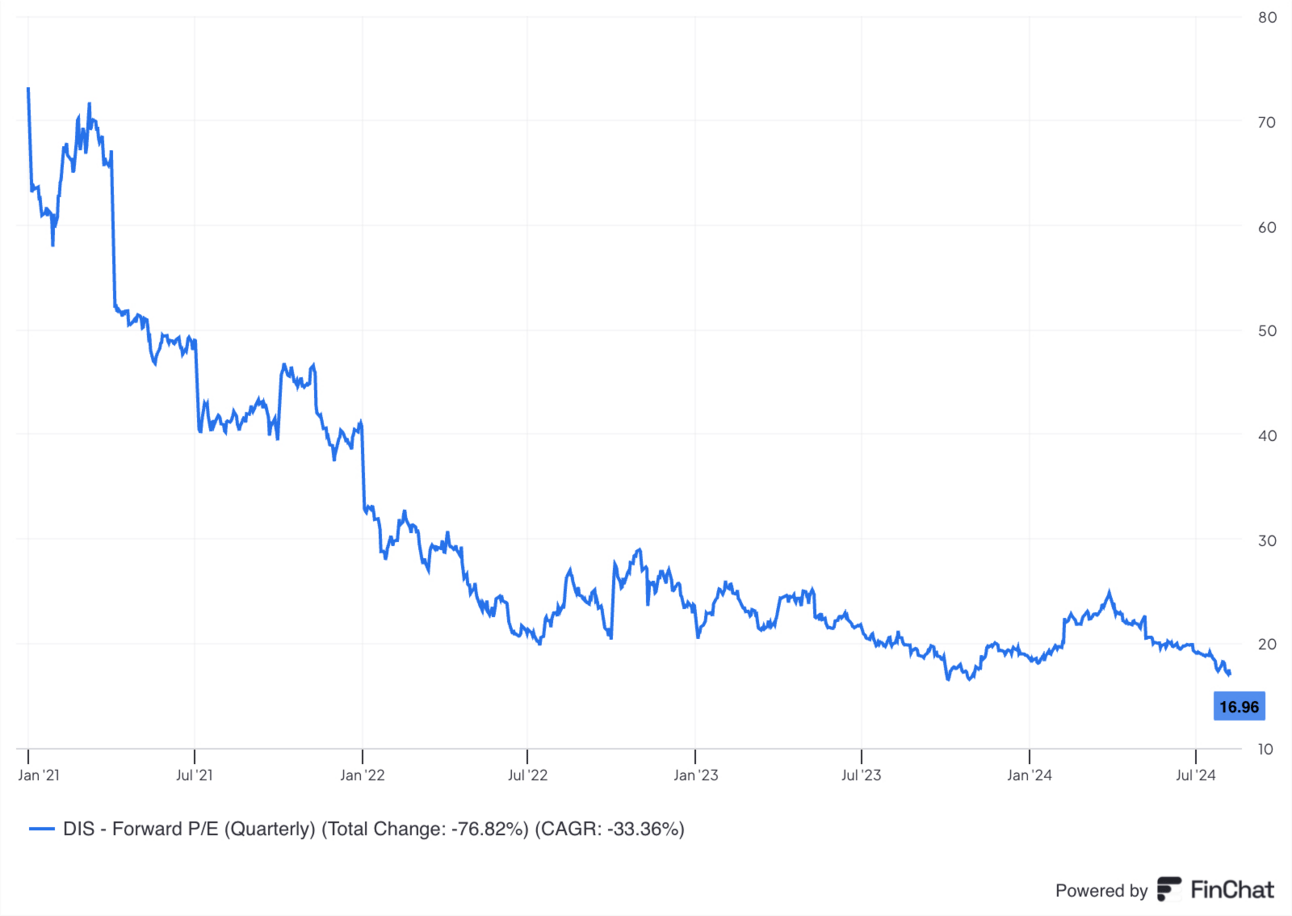

d. Guidance & Valuation

Disney raised its 25%+ Y/Y EPS growth guidance to 30% Y/Y, which beat 27% Y/Y estimates. It reiterated its $8 billion+ FCF guide on the call.

- Streaming to be profitable in Q4.

- Q4 Disney+ core subscribers to modestly grow.

- Experiences segment demand deterioration to continue. EBIT to fall by about 5% Y/Y and revenue to be flat Y/Y. Some cruise pre-opening costs are adding to EBIT decline expectations, but macro is hurting too. More later.

Disney trades for 18x this year’s EPS. EPS is expected to rise by 30% Y/Y this year and by 14% Y/Y next year.

e. Call & Release

Box Office Thriving:

Considering my Disney coverage from this past quarter, box office dominance isn’t surprising, but it is still encouraging. Between Inside Out 2, Deadpool & Wolverine and The Apes Sequel, Disney reeled in $2.8 billion in total box office sales. Deadpool & Wolverine was the largest R-rated opening ever and drove notable viewership growth in older Deadpool films. Inside Out 2 is the highest grossing animated film ever (top ten overall) at $1.5 billion and drove 1.3 million Disney+ subscriptions. It had the top release in May, June and July, led the industry with 183 Emmy nominations and tops Nielsen’s market share metrics with 11% overall TV/film share. That doesn’t suck.

All three films are directly profitable for Disney, but that’s not only one perk from actually releasing great films again. It also enjoys streaming subscriber, engagement and retention tailwinds, more consumer packaged goods (CPG) opportunity within Inside Out 2, and more great brands to leverage at its parks. Movies are Disney’s best way to spin its content flywheel and deepen omni-channel engagement with fans. Its movies have stunk lately. It responded to that by slashing a large chunk of its film pipeline, and these three releases are great signs of rapid recovery. Moana 2 and the Lion King sequel are coming later this year; Zootopia, Avatar and Fantastic Four in 2025; Avengers: Doomsday, Toy Story 5 and a Star Wars film in 2026. I’m candidly hoping Kathleen Kennedy is not leading Lucas Films when the Star Wars title is released. It’s time for her to go — every other piece of Disney’s content library is healthy besides this one.

Streaming:

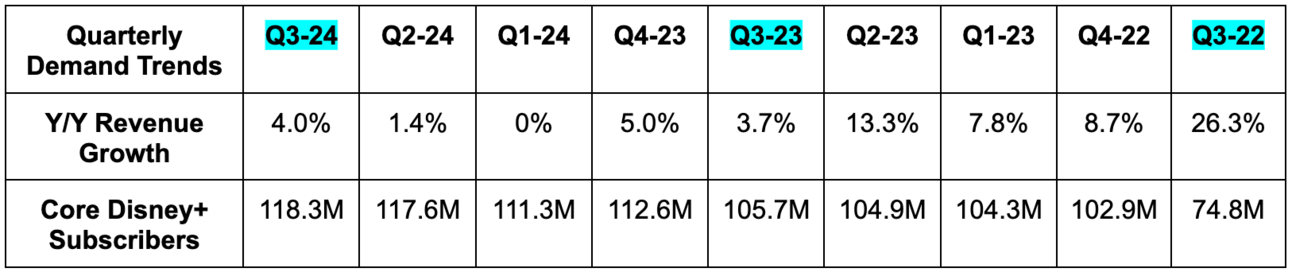

Direct-to-consumer (streaming) revenue rose 15% Y/Y. The Hulu/Disney+ integrated app experience is now live. It sees this juicing engagement and retention, which is a big piece of powering more subscriber growth. To build on this aim, as previously announced, it will add a new ESPN tile to that bundle later this year. This will feature a small chunk of ESPN’s rights, which is Disney’s first step in debuting a full, direct-to-consumer ESPN streaming app next year.

Beyond bundling, discoverability is an issue on Disney’s app. Netflix is really the only good streamer when it comes to recommendation algorithms and surfacing the right titles at the right time. Disney needs to improve on matching viewers with content most interesting to them. To help here, it will debut “Playlists” next month. This will add a bit of ABC live news content (which is #1 in the nation, again) and 4 “curated feeds” for premium subs to sort by more specific interests. It will also have a 5th feed loaded with preschool content.

- Its streaming business overall was EBIT positive for the first time. This is one quarter ahead of schedule. Both entertainment streaming and sports streaming generated positive EBIT.

- Entertainment EBIT was supposed to be negative due to India Cricket right costs. Outperforming efficiency and subscriber growth led to the positive surprise.

- It sees the positive EBIT inflection as permanent and more margin expansion in the coming years.

- Paid sharing will begin rolling out in September. It started beta testing this in June “with no consumer pushback.” This was a massive subscriber tailwind for Netflix. I think it will be a strong tailwind for Disney, but likely not as powerful. Disney will probably deal with more churn than Netflix did due to lower engagement per account.

Advertising:

While Disney needs to more frequently match streamers with relevant content recommendations, its tech stack within advertising is quite advanced. That’s great news and is thanks to Google and Trade Desk partnerships. It means that engagement gains from projects mentioned above will be met with optimal ad revenue opportunities.

Its programmatic tools are showing real promise in financial results. Within entertainment streaming (excluding sports), ads rose 20% Y/Y while domestic streaming advertisers also rose 20%. Programmatic ad revenue (open, data-driven bidding for granular impressions) rose 80% Y/Y, as it sharpened its targeting and measurement talents. This programmatic revenue growth does cannibalize some non-biddable impression sales, but the added precision within programmatic uplifts value per impression and is a net positive.

At this year’s upfronts, Disney enjoyed 5% Y/Y sales growth. It debuted “Disney Streaming Entertainment” as a new ad tool to place demand across all of its apps in a more unified fashion. Matching demand with more supply, with the help of Trade Desk, is a great way to uplift targeting efficacy.

More on Entertainment:

- Linear EBIT and revenue continued to decline as streaming replaces that legacy means of viewing content.

- Disney+ Core subs rose 1% Y/Y; Hulu subs rose 2% Y/Y.

- Disney+ average revenue per user (ARPU) fell due to mix shift to ads and bundling; price hikes powered ARPU growth abroad and Hulu ARPU rose 8% Y/Y.

On Recently Announced 25% Streaming Price Hikes:

“Every time we've taken a price increase, we've had only modest churn. We believe that as we add these new features and based on the success of our movie slate, that the pricing leverage we have has actually increased. We're not concerned.”

CEO Bob Iger