Taiwan Semi (TSM) — Earnings Review

Taiwan Semi builds chipsets for other companies like Nvidia, AMD and Qualcomm. It does so in its highly expensive, highly complex chip fabrication plants. These are called “fabs” for short.

Needed Definitions:

- Fab means a factory.

- Nanometer (NM) describes the chip technology. Smaller NM is more advanced, as it uses smaller transistors. This means TSM can pack more transistors into a single chip while making those chips more energy efficient and cost-effective.

- “Advanced Technology” revenue is revenue from 3nm (N3), N5 & N7 technology. Anything under 7nm is “advanced.”

- Wafer refers to the raw materials (like silicon) that are used to manufacture chips. Wafers are used to build integrated circuits (ICs), with the transistors within these ICs guiding and facilitating functions. Nvidia’s Blackwell and Hopper chips are considered ICs.

- While traditional foundry services entail the actual creation of a chip on a silicon wafer and testing these products, packaging involves storing, integrating and prepping chip components with thermal protection, connectivity equipment and encapsulation (physical damage protection).

- Lithography is the process of etching chip patterns onto wafers. A light-sensitive material is added to wafers, “masks” are placed on top to guide where light and chemicals (used to manipulate wafers) etch desired patterns. Lithography is paramount to TSM’s production.

- Chip-on-wafer-on-substrate (CoWoS) is a packaging process that combines chips into a single unit. It allows chips to be vertically stacked and connected to improve speed and performance.

- AI Accelerators, as the name indicates, accelerate high-performance compute (HPC) workloads in the realm of AI. GPUs are a type of AI accelerator, along with Application Specific Integrated Circuit (ASICs) (custom chips for specific use cases), Google’s Tensor Processing Units (TPUs; for machine learning). Some don’t include high-bandwidth memory (HBM) in this category, as HBM is for memory rather than things like data processing. TSM does include this. HBM facilitates ultra-low latency, high-bandwidth support for querying and data processing tasks as a wonderful complement to Nvidia’s Blackwell GPUs, for example.

a. Key Points

- Another quarter of outperforming growth and market share gains.

- Fantastic margin performance for Q4 and the year.

- Brightening multi-year outlook.

- Temporary gross margin headwinds will not persist.

- Manufacturing footprint expansion on or ahead of schedule; new technology ramping as planned.

- Not overly concerned with recent regulatory developments.

b. Demand

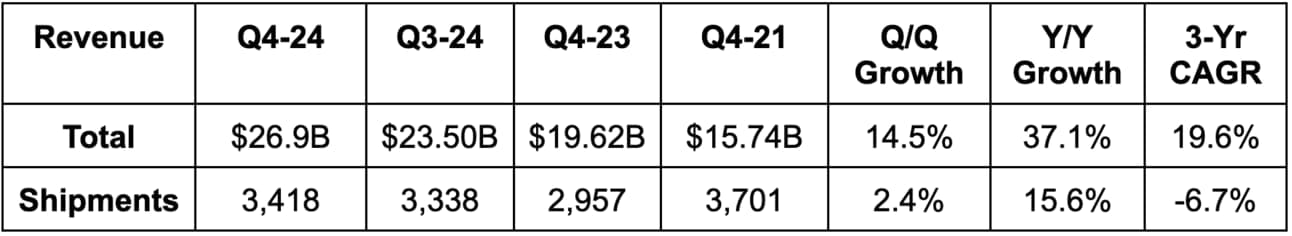

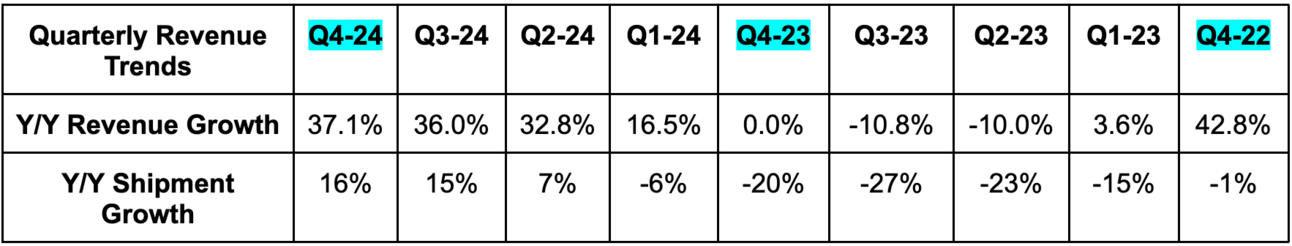

TSM beat revenue estimates by 3.6% & beat guidance by 1.5%. Its 19.6% 3-year revenue compounded annual growth rate (CAGR) compares to 16.5% last quarter and 9.8% 2 quarters ago.

c. Profits, Margins & Return on Equity (ROE)

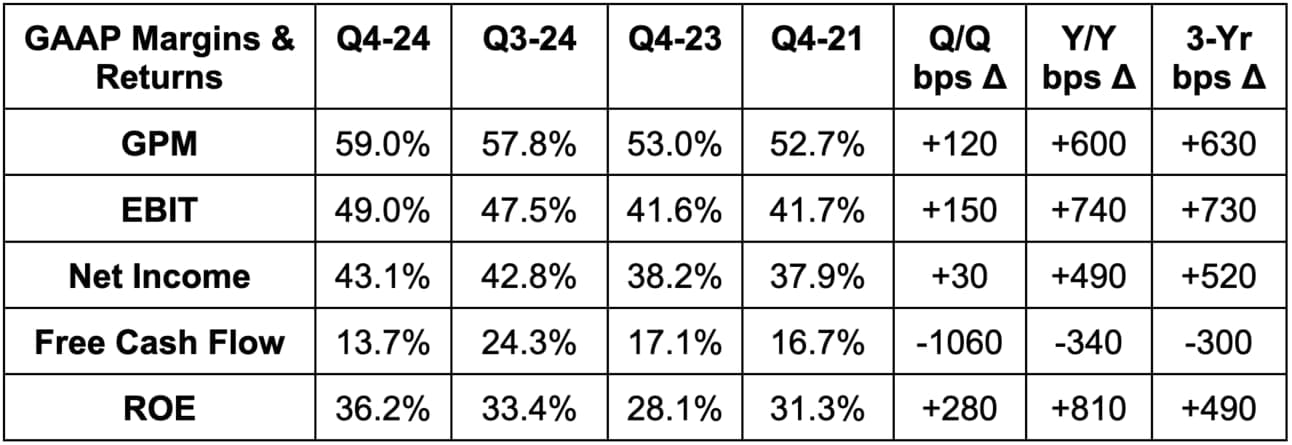

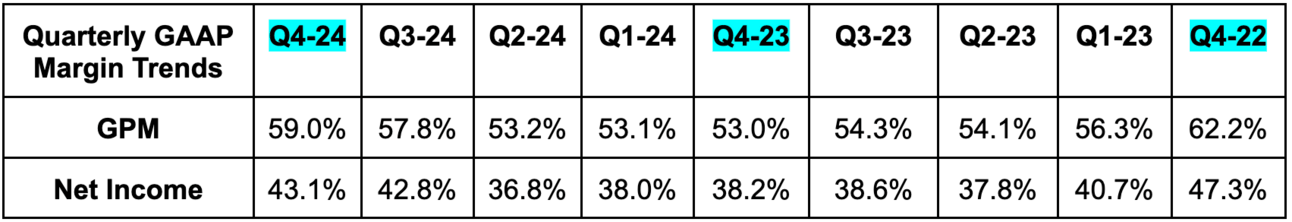

- Beat gross profit margin (GPM) estimates by 30 basis points (bps; 1 basis point = 0.01%). Beat GPM guidance by 100 bps. GPM outperformance was based on higher capacity utilization, which offset electricity inflation and new technology headwinds. Its new facilities and manufacturing technologies always debut at lower GPMs and rise from there with improving economies of scale.

- Beat EBIT estimates by 4.9% & beat guidance by 4.7%.

- Beat $0.43 EPS estimates by $0.02.

- TSM spent $11.2B in CapEx this quarter, which represents more than 100% Y/Y growth. TSM spent $29.8B in total CapEx in 2024 vs. $30.4B in 2023. The metric is very lumpy on a quarterly basis.

d. Balance Sheet

- $65B in cash & equivalents.

- $8.8B in inventory vs. $8.2B Y/Y.

- $30B in bonds payable.

- Share count flat Y/Y.

- Dividends rose 33% Y/Y vs. 30% Y/Y growth last quarter.

e. First Quarter Guidance & Valuation

- Q1 revenue guide beat by 2.6%.

- Q1 58% GPM guide beat by 120 bps.

- Q1 EBIT guide beat by 2.6%.

TSM’s “Foundry 2.0” total addressable market (TAM) calculation includes all wafer production as it did before. It also now includes packing, testing and mask making in it. It sees Foundry 2.0 industry growth accelerating from 6% to 10% next year, “supported by robust AI demand” as well as gradual improvement in its non-AI categories. In line with this rising sector optimism, TSM set its initial 2025 growth target at roughly 25%, which compares favorably to its roughly 23% initial target set last January for 2024. It loves to under-promise and over-deliver, as any well-run company should. Also for 2025, it expects to spend about $40 billion in annual CapEx, which represents 34% Y/Y growth. It does expect to enjoy some significant depreciation expenses rolling off, which should help offset depreciation and allow that expense growth to be around 8%-9% Y/Y.

Finally, we got updated 5-year CAGR expectations from leadership. Last quarter, they were asked for an update to the 15%-20% 5-year CAGR expectation for the years 2021-2026. It declined to provide that information, but included it in this report (as it often does for Q4 earnings). For the next 5 years, it raised this 17.5% CAGR expectation to nearly 20%. Really good. 5G will continue to be a solid growth story, but this is really a byproduct of a GenAI-related explosion within the overarching AI accelerator bucket. This immensely compelling AI subsection of high-performance compute (HPC) tripled to roughly 15% of its overall revenue; it sees this segment doubling in 2025 to keep it on its 5-year growth path. TSM also thinks the AI accelerator 5-year CAGR for the entire sector will approach 45% through 2028. Its forward-looking visibility is telling leadership that this cycle isn’t close to over. If they’re right, that’s great news for TSM, as well as Nvidia, Broadcom, AMD, Marvel etc.

“As a key enabler of AI applications, the value of our technology platform is increasing as customers rely on TSMC to provide the most advanced process and packaging technologies at scale in the most efficient and cost-effective way.”

CEO C.C. Wei

EPS is expected to grow by 30% this year and by 19% next year. Estimate revisions should continue to be materially positive following this strong report.

f. Call & Release

2 Recent Regulatory Developments:

- This month, the Taiwanese government significantly eased restrictions that prevented companies like TSM from manufacturing chips with its most advanced technology in the USA. This paves the way for TSM to complete its 2nd and 3rd factories in Arizona, which are expected to produce chips with its N3 technology. More on this later.

- The USA added new AI chip export restrictions targeted at China. Taiwan was excluded from this change. This could potentially limit TSM’s ability to sell advanced chips to China, although there are already restrictions in place from the Taiwanese government that limit TSM’s ability to offer its latest and greatest technology there anyway. Here’s what leadership had to say about this:

“We don't have a complete analysis yet, but we don’t think this is all that significant. It’s manageable. We’re applying for special permits for customers being restricted and we believe they will get some permission outside of the AI area.”

CEO C.C. Wei

Demand Breakdown:

“Due to the strong demand for our 3-nanometer and 5-nanometer process technologies, we continued to outperform the foundry industry in 2024.”

CFO Wendell Huang

74% of revenue came from “advanced technology” products vs. 69% Q/Q & 67% Y/Y. Within this bucket:

- 26% came from 3N vs. 20% Q/Q and 15% Y/Y.

- 34% came from 5N vs. 32% Q/Q and 35% Y/Y.

- 14% came from 7N vs. 17% Q/Q and 17% Y/Y.

Just like the last several quarters, HPC use cases continued to power this growth engine. Specifically, HPC is now 53% of total revenue vs. 51% Q/Q and grew 19% Q/Q. The 5G revolution and hardware upgrade cycles keep making smartphones another, smaller growth driver as well. This bucket is now 35% of revenue vs. 34% Q/Q and enjoyed 17% Q/Q growth.

- Internet of Things (IoT) revenue was 5% of total & fell 15% Q/Q.

- Automotive revenue was 4% of total & rose 6% Q/Q.

From a market share perspective, it was another great year for the company as competitors like Intel struggle and TSM excels. Industry-wide revenue within Foundry 2.0 (which now includes both packaging and testing revenue as of a few quarters ago) rose 6% Y/Y. That was materially below its previous forecast of 10%+ Y/Y growth. Despite this, TSM delivered 30% revenue growth vs. its beginning-of-year expectation of 23%. It did change the areas included in Foundry 2.0 growth mid-year, but this was still much better than expected on an apples-to-apples basis.

New Technology:

In a world where TSM is the king of its niche, everyone else is trying to catch up. So? Constant iteration and improvement is needed – just like for Nvidia rolling out Blackwell and eventually Rubin. Complacency kills and an obsessive paranoia stemming from thinking your competition will catch up tends to inspire faster innovation and serve capable companies very well. Furthermore, as Nvidia CEO Jensen Huang often puts it, failure to address “compute inflation” (needing perpetually more compute power than ever before) is the enemy of progress. The way to avoid this failure is to create chips that are increasingly more powerful and efficient, which is why it is so important for TSM fabs to support this endeavor. Together, TSM and its customers help make things like ChatGPT, Microsoft Copilot, Llama 3 and so many other things possible. They make usage of massive amounts of compute power efficient enough to turn GenAI app pipe dreams into reality. Data and compute are scaling rapidly. Chip performance needs to as well.

Leadership is adamant that its developing N2 and A16 (1.6 millimeter) technologies will deliver needed incremental performance gains and maintain its market leadership. TSM expects the number of new N2-based chip designs (“tape-outs”) to be higher than for N3 and N5, as the world continues to possess an “insatiable need for energy efficient computing and almost all of the innovators work with TSM.”

Specifically, N2 offers a 12.5% speed boost vs. N3E (most advanced N3 offering) at identical power or a 25% power improvement at identical speed. Chip density is also 15% higher, to allow partners to pack more compute capacity into each individual AI accelerator. N2P is an iteration of N2 that offers more performance benefits than N2. Large-scaled production for the N2 family will ramp during the 2nd half of 2026. Its A16 offering will also come later in 2026, and will feature a super power rail (SPR). This is a power source that attaches on the back-end of a chip, which, per TSM, offers better gate (building blocks for chips) density and design flexibility. It also features a 9% speed improvement or 17.5% power improvement vs. N2P. It is always sprinting and that will not change.

Within HBM, Taiwan Semi plans to have a much larger presence than it currently does. It’s working with “all memory suppliers” (including Micron on its latest HBM products) and thinks high volume production that actually moves the revenue needle will take just 6-12 more months. It’s coming. This is one of the most exciting growth areas within the overarching GenAI hardware boom and TSM will have a sizable piece of the opportunity… just like for GPU and ASIC manufacturing.

“Let me assure you that, whether it's ASIC or it's graphic, they all need a very leading-edge technology. And they're all working with TSMC.”

CEO C.C. Wei

Gross Margin:

As it usually does in its Q4 calls, TSM leadership walked us through the various factors that influence its profitability and how these factors would unfold in 2025. FX is one of them, and we’ll focus on the others that are actually in TSM’s control. First is technology ramp-up cycles. The N3 ramp-up costs will fade throughout 2025 as utilization rates “moderately increase” Y/Y towards more mature levels. This should be a modest gross margin tailwind, as it extracts more economic value from this now largely-completed investment. That’s the lone tailwind that it cited for 2025.

In terms of headwinds, tech mix, N2 ramp-up timing and CoWoS (already defined) expansion will be headwinds. It continues to convert some N5 manufacturing capacity to N3 in order to support thriving demand, while also ramping up its N2 technology for future deployment. Together, this will hit GPM by another 100 bps. Next, expansion to international facilities to diminish geopolitical risk and give customers more options will materially hit GPM this year too. Specifically, that will affect GPM by about 250 bps in 2025, with that rising throughout the year. This is mainly coming from Arizona and Japan. In Arizona, it already thinks its yield levels are approaching Taiwan for N4 technology (part of the N5 bucket with some upgrades). Still, smaller scale and a lack of developed supply chain are leading to this large headwind. European (Germany) expansion plans are still preliminary, so aren’t impacting things yet. Furthermore, electricity inflation in Taiwan will be another 100 bps obstacle. All in all, this equates to about 450 bps in named headwinds.

At the same time, 2024 GPM was 56.1%, which is 310 bps above its long term target. This implies expectations of a roughly 51.6% GPM, and it’s confident in re-surpassing 53% when these transitory items fade. There will always be more tech ramp-up dilution, but the large hit from global expansion shouldn’t be permanent.

Global Manufacturing Footprint Updates:

In the USA, it’s ahead of schedule for its first Arizona fab. This facility has already “entered high-volume production” for N4 technology and yield levels are already approaching its facilities in Taiwan. The next 2 fabs in Arizona are also “on schedule” and will feature its most advanced commercial N3 technology, as well as its next-generation N2 and A16 (1.6 millimeter) technologies. As an aside, it expects the “Made in the USA” label for chips created in Arizona to fetch a premium vs. its other manufacturing regions.

In Japan, its first specialty fab is up and running with “very good yield.” It will begin building its second factory there this year. In Europe, it continued to talk up strong preliminary support from Germany and the EU and is “progressing smoothly” on plans for its new Dresden facilities, which will focus on auto and industrial use cases.

Finally, In Taiwan, it continues to expand N3 capacity and prepare for future N2 deployment. It was bluntly asked if the Taiwanese supply chain can support CoWoS and Co-packaged optics (CPO) expansion plans. CPO incorporates “optical components” (things that interact with light) right onto GPUs. The more direct fusing improves speed, weight, efficiency and performance. It’s a key part of its packaging business. Leadership didn’t seem to have any concern over whether or not its home country could support the intricate manufacturing needs for these growth areas. It continues to quickly expand its packaging footprint in Taiwan as a result of this confidence.

As discussed in the guidance section, all of this expansion outside of Taiwan means higher costs for the company. Still, it expects to maintain cost leadership vs. everyone else in every country where it builds out fabs. The relative advantage will be preserved and so the competitive moat will be preserved despite the near-term gross margin headwind. I also just think this is a necessary concession to make when geopolitical tensions remain as elevated as they are. Leadership didn’t explicitly say this (they wouldn't), but that’s a safe assumption. This diminishes the risk of massive operational disruption if there is a future Taiwan invasion.

g. Take

This was yet another flawless quarter. There are “moats” in stock markets and then there are real moats. This is one of the most overused terms in financial research as most “moats” are a competitive entry or misstep away from crumbling down. In this rare case, I think “moat” is an entirely legitimate classification. Nobody can really touch its global scale, cost advantages and efficiency in fabricating advanced chips. That’s why basically every chip-maker is lining up to work with this company on their latest and great creations. Its multi-year guide clearly depicts expectations of this runway still being massive and its continued rapid innovation ensures that it will stay ahead of the pack.

The team has a fortress track record of delivering on its promises, and so I take its expectation of 2025 margin headwinds being temporary very seriously. The reasoning makes perfect sense and I do think the 53% gross margin target will eventually be raised once we get through this period of expeditious global expansion and some cost inflation.