1. Alphabet (GOOGL) — Earnings Review

a. Demand

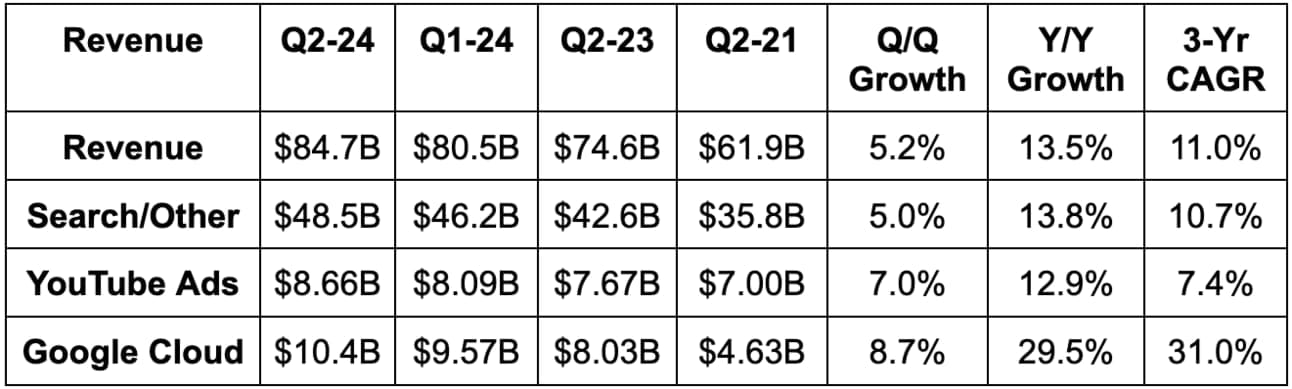

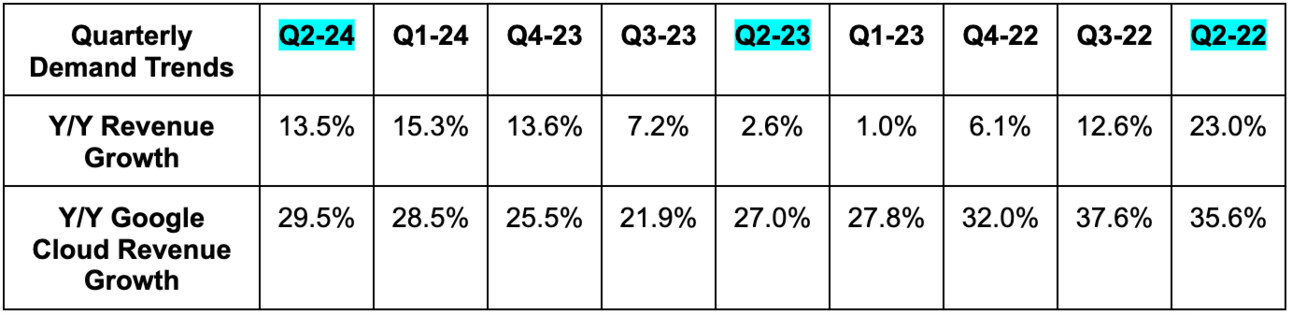

- Beat revenue estimates by 0.5%. Foreign exchange neutral (FXN) revenue growth was 15% Y/Y.

- Beat search revenue estimates by a comfortable 2.0%.

- Beat cloud revenue estimates by 2.6%.

- Missed YouTube advertising revenue estimates by 3.2%.

b. Profits & Margins

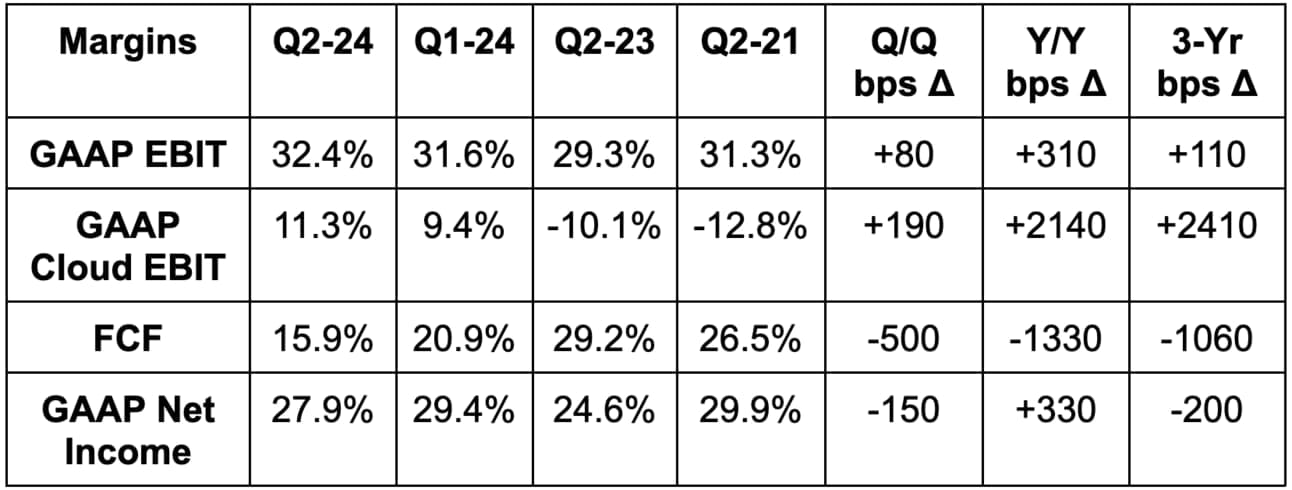

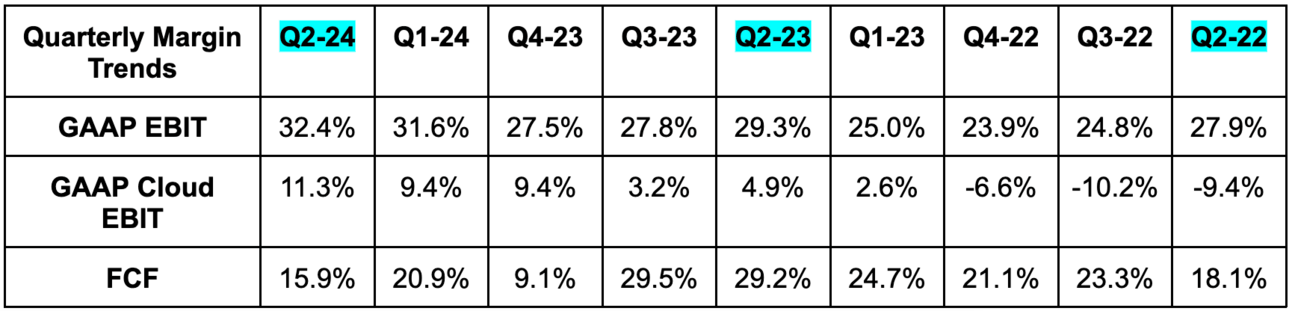

- Beat GAAP EBIT estimates by 3.4%. OpEx rose by just 5% Y/Y. R&D was the source of this. G&A fell Y/Y due to fewer legal charges and S&M was flat Y/Y/

- Beat $1.85 GAAP EPS estimates by $0.04.

- EPS rose by a robust 31% Y/Y.

- Google is lapping a $10.5 billion deferred cash tax benefit from Q2 and Q3 2023, which is making FCF comps very difficult. That, paired with hefty capital expenditures (CapEx) to build its AI infrastructure led to the weakness here.

- Google Services EBIT margin was 40.1% vs. 35.4% Y/Y.

c. Balance Sheet

- $101B in cash & equivalents.

- $13.2B in debt.

- Diluted share count fell 2% Y/Y. Bought back $15.7 billion in stock vs. nearly $15 billion Y/Y.

- Paid out $2.47 billion in dividends vs. $0 Y/Y. Initiated its first dividend last quarter.

d. Guidance & Valuation

Google continues to expect EBIT margin to expand Y/Y in 2024. It is the only mega-cap tech company that continues to commit to this. Still, Q3 EBIT leverage may be more muted than the first half of the year. The added CapEx for data center capacity started in Q3 2023 and will begin to lead to higher Y/Y depreciation expense in Q3 2024. Furthermore, it moved a Pixel hardware launch and the coinciding expenses to Q3 2024, which will mean more revenue… but at lower margins. Finally, Google will begin to lap Asian merchant seller strength that began in Q3 2023, which could weigh on revenue growth and profits a tad.

- Reiterated that quarterly CapEx will remain at or above $12 billion in 2024. CapEx rose from $6.9 billion to $13.4 billion Y/Y this past quarter.

- Headcount will grow a bit next quarter as it hires new graduates.

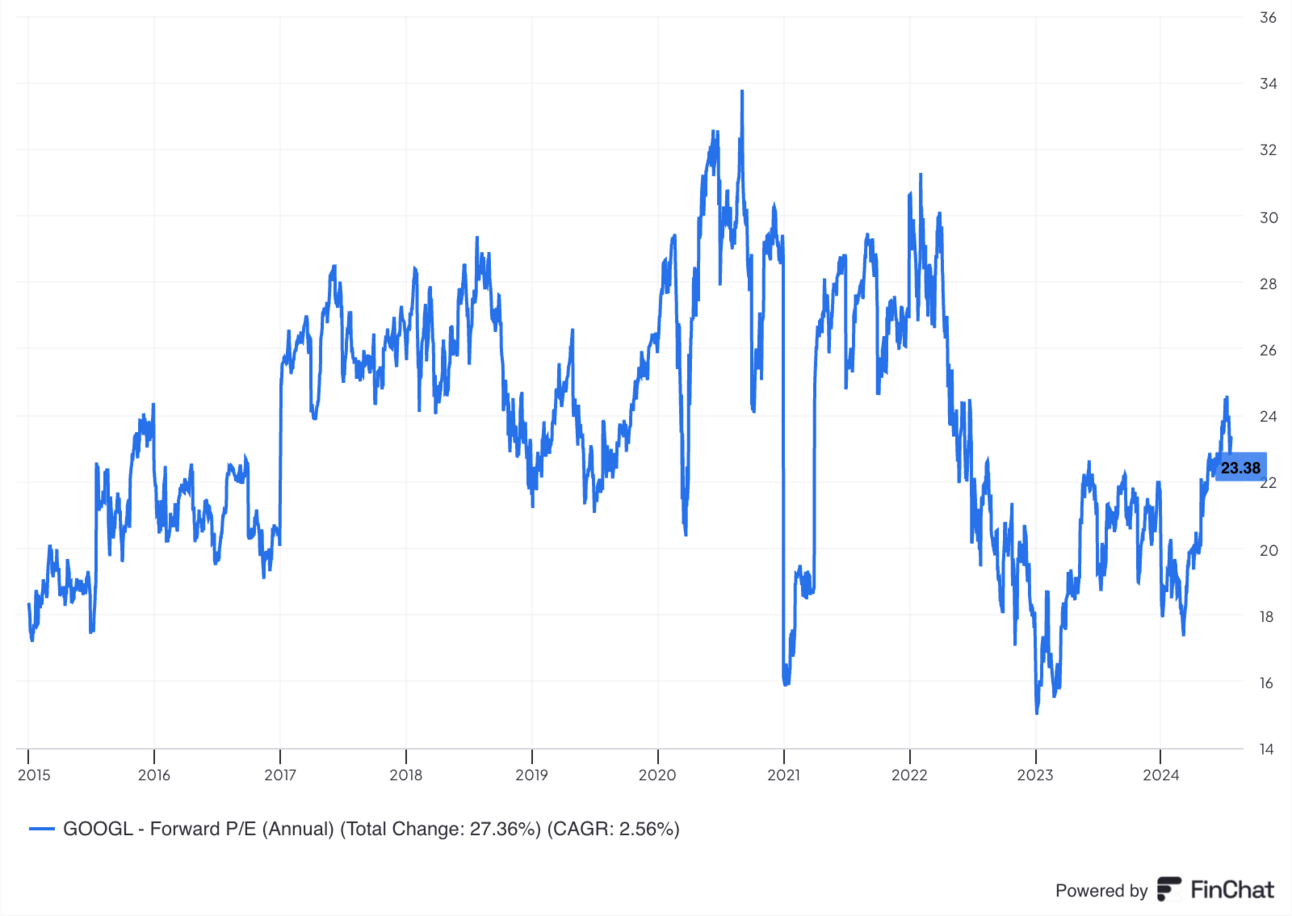

Google trades for 23× 2024 EPS. EPS is expected to grow by 31% Y/Y this year and by 14% Y/Y next year. Here’s how its current multiple compares to historical norms:

e. Call & Release Highlights

The main theme of the call was how GenAI is being infused across its product suite to improve product utility and monetization potential. Notably, Google is already generating “billions” in revenue from this GenAI work and has 2 million developers using its tools to date. 1.5 million developers are now using Gemini tools specifically. As a reminder, Gemini is Google’s series of foundational models used across its suite of products. It leads the world on key performance indicators such as long context understanding… and this brings us to another key idea.

GenAI model winners will be those with the most money, infrastructure, talent and data. Google provides all 3 of those strengths as well as any other firm on the planet. Scale matters… GenAI favors established incumbents… this is that incumbent. Google is internally innovating across all layers of GenAI – hardware, models & apps – and thinks its in-house approach will allow its product teams to move faster than others. As foundational models and GPUs race to commoditization, that extra inch of innovation will make all the difference in the world.

GenAI Hardware News:

- The 6th generation of Google’s Tensor Processing Unit (TPU) for neural networks and machine learning is 67% more efficient with 5x higher peak compute capacity than the 5th version.

- Google’s A3 was a high performance compute chip. Google and Nvidia teamed up to create the A3 Mega, which is equipped with Hopper 100 (H100) GPUs. A3 Mega doubles GPU networking capacity compared to A3.

- Google isn’t worried about overbuilding data center capacity or overbuying chips. It has many ways to allocate excess compute (these assets have long useful lives) if it thinks it has too much. Leadership sees the real risk in not building enough.

AI Customers so far include – The U.S. Air Force, Uber, Deutsche Bank, Best Buy, Mercado Libre & Gordon Food Service (and almost all private GenAI unicorns).

Search:

Search was arguably the most impressive piece of this quarter. While this company was thought to be in trouble a year ago as Microsoft stormed back onto the search scene, it seems to have admirably fended off this competitive threat. A 2% beat on a revenue metric with this much analyst coverage is (in my mind) quite strong.

Search Generative Experience is now called AI Overviews. This gives GenAI-powered responses to fielded queries at the top of Google search results. These experiments across North America and some other geographies are showing clear signs of higher engagement and higher user satisfaction (especially for younger users). More value always leads to monetization potential for Google, and it doesn’t think this time will be any different.

Importantly, Google isn’t supplanting the publishers and merchants that have made its search database special… it’s using AI overviews to feed them more traffic. New ad placements right above and below these passages are proving quite valuable and relevant for searchers. Google will add shoppable links to these AI overview ad placements in the coming months.

In Google’s obsessive pursuit to “re-engineer the cost base” foundational model usage is a key focus area. It now has 4 different Gemini model sizes with various amounts of parameters. It’s actively working on better matching these 4 models with the appropriate types of queries. This will help cut cost per GenAI query, which had been a key concern for Google until very recently. It will also improve latency and the overall user experience (UX). Commentary last quarter about the margin profile for GenAI search ads being similar to other ad types was encouraging.

New AI-powered search tools:

- Search by taking a picture with your Android device. This pairs very nicely with AI overviews.

- Circling an item on the web to search debuted this week.

- Virtual try-on-and-shop ads are now beta testing. This is leading to large engagement and click through rate (CTR) uplifts early on.

- Project Astra is a new multimodal AI model Google is working on for day-to-day life. This is a buzz phrase to remember in the coming quarters.

Cloud:

- Google was not asked about its rumored bid to purchase a cloud security platform called Wiz.

- Google thinks its cloud platform’s cost for model training and inference is an edge. Most public cloud platforms will say the exact same thing.

Advertising Tools:

Google introduced 30 new GenAI tools for better campaign creation, targeting and measurement while upgrading several existing tools. There are 4 big tools to discuss. Performance Max (PMAX) is its campaign creation service with Gemini infused right into it. The automated campaign material generation tool PMAX offers leads to a 6% conversion boost. Demand Generation (Demand Gen) is exactly what it sounds like: a tool to extend audiences and sharpen targeting to uplift the number of relevant eyeballs a campaign can affordably reach. Broad Match is another tool that it uses to sharpen ad matching once demand generation has uncovered the most desirable customers to reach. Product Studio is its group of free AI tools to create images and designs for advertising.

- Demand Gen + PMAX = 14% higher conversions for advertisers. When also using broad match, that positive conversion impact rises to 25%.

- Advertisers using its AI-powered impression profit optimization tool are enjoying a 15% profit uplift vs. advertisers only using revenue as their key performance indicator (KPI).

- Tiffany used Demand Gen to deliver a 2.5% uplift in brand consideration, 5.6x lower cost per click and a 100% boost to CTR.

YouTube:

YouTube revenue was the lone disappointment on the top line this quarter. The reasons weren’t very concerning. Comps simply got much tougher, it lost the benefit of leap day, FX headwinds intensified and content timing issues were the icing on the cake. Leadership remains adamant that the underlying business tends and the ad environment are both fine.

- 17 straight months of leading streaming market share. Across all content forms, it trails only Disney.

- Sports streaming viewing hours rose 30% Y/Y.

- YouTube Shorts monetization rate continues to improve Q/Q.

- Shopping ads will be a key focus area going forward. Watch time for these ads rose 25% Y/Y as it introduced product tagging to help with product ID and its affiliate marketplace to help match creators with opportunities.\

Final Notes:

- Google is earmarking another $5 billion for Waymo.

- Google won’t deprecate cookies as it “now favors consumer choice.” It probably has more to do with how many times its privacy sandbox product replacement has been delayed.

f. Take

This was a good quarter. The search revenue result was excellent, YouTube revenue was meh, and the rest of its segments were strong. YouTube weakness seems to be transitory and outperformance across other segments seems to be more structural. I find it impressive that this company is investing as aggressively as it is in GenAI while briskly expanding margins. I find it impressive that search has fended off Microsoft, OpenAI and others so effortlessly. I find Google impressive. Good quarter from an elite team and an elite company.

2. Tesla (TSLA) – Earnings Review

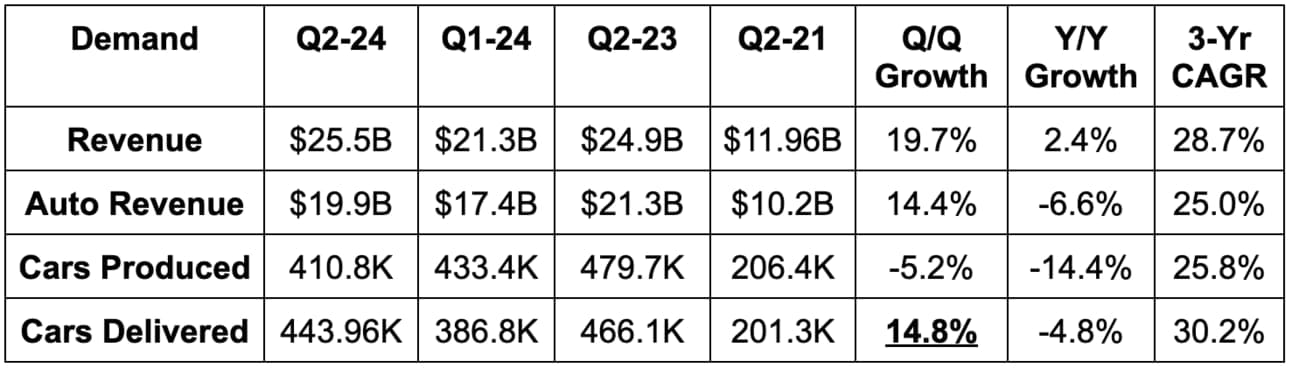

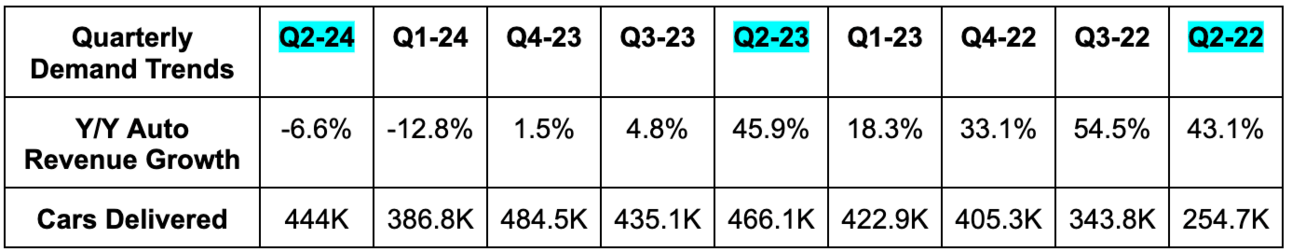

a. Demand

- Beat revenue estimates by 3.2%.

- Beat auto revenue estimate by 0.9%.

- 2 out of 3 Tesla sales during the quarter were to brand new customers.

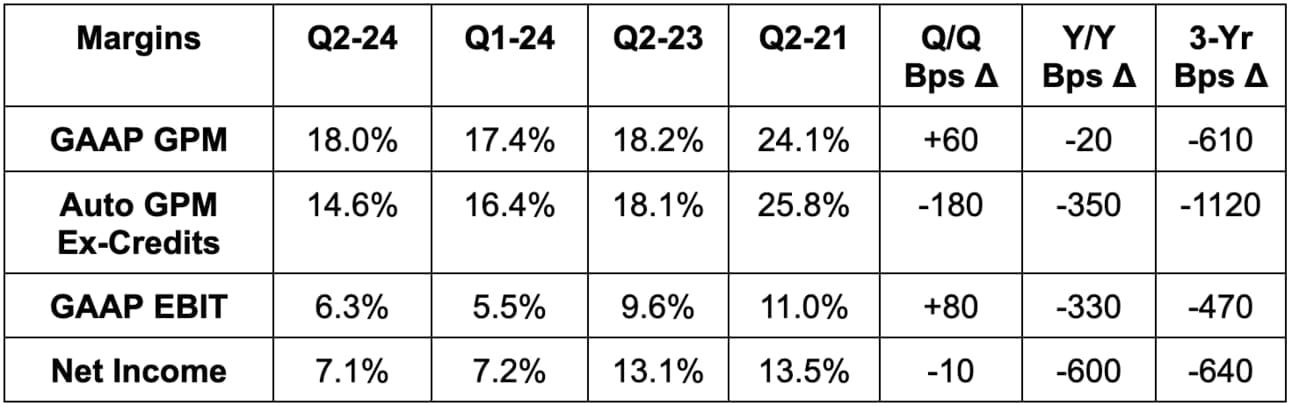

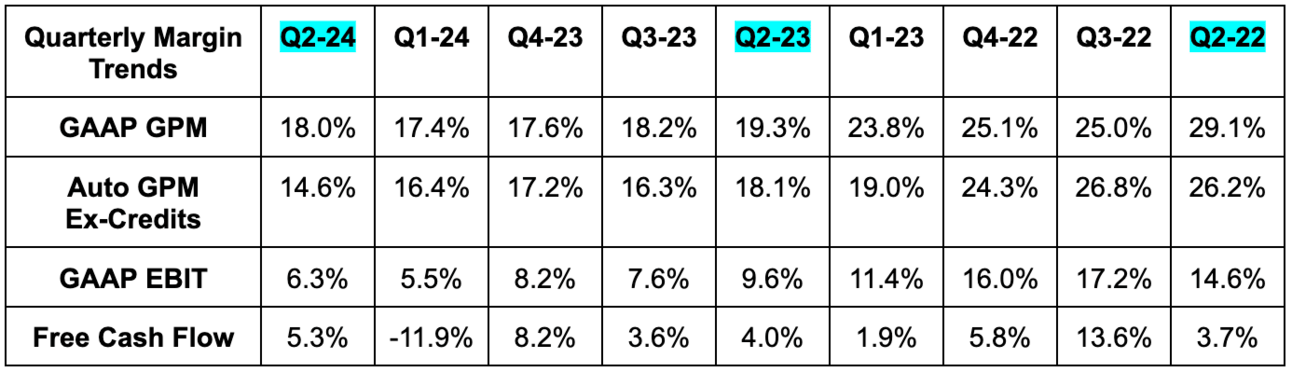

b. Profits & Margins

- Missed EBIT estimates by 13%. OpEx rose 39% Y/Y.

- Missed $0.58 EPS estimates by $0.06.

- Missed $0.49 GAAP EPS estimate by $0.07.

- Beat GAAP GPM estimates. This was powered by impressive profit strength from its non-auto businesses.

- Missed 16.2% Auto GPM ex-regulatory credits by 160 basis point (bps; 1 basis point = 0.01%). Auto GPM ex-credits: (auto rev ex-credits - auto COGS) / (auto rev ex-credits).

Tesla makes no non-GAAP adjustment to its EBIT. This quarter, it incurred a $642 million GAAP charge related to restructuring. Without this impact, it would have generated $1.85 billion in EBIT and beaten depressed estimates comfortably. Still, the non-GAAP EPS miss does tell me the sole source of the profit misses was not one-off charges. There were other factors at play, which are discussed later on.

c. Balance Sheet

- $30.7 billion in cash, equivalents & investments.

- Inventory levels rose 43% Y/Y.

- $7.7 billion in total debt ($2.26 billion is current).

- Diluted share count was roughly flat Y/Y.

d. Guidance & Valuation

Tesla doesn’t offer much forward guidance. It sees slower auto growth in 2024 vs. 2023, strong energy storage performance and no need for any capital raises.

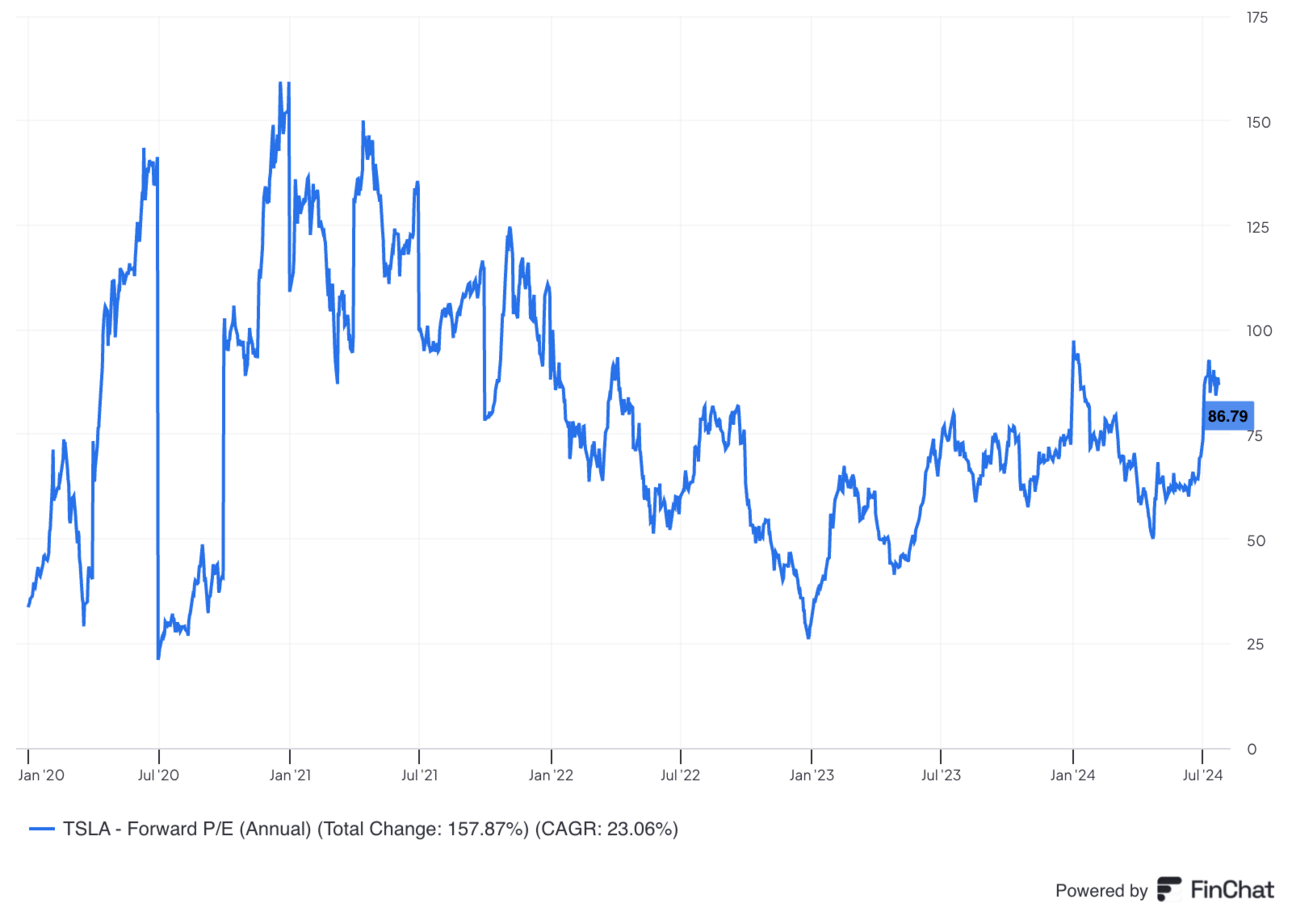

Tesla trades for about 95× 2024 EPS. Earnings are expected to fall by 18% Y/Y this year and rise by 38% Y/Y next year. Estimate trends had begun to bottom before this report, but this will likely lead to more downward pressure. Here’s how its earnings multiple compares to historical norms:

e. Call & Letter Highlights

Macro:

A heavy discounting environment from peers and high interest rates continue to heavily weigh on this business. Automotive and energy are both cyclical. Tesla’s structural share gains do buffer some of that cyclicality, but not all of it. Musk sees the pricing competition as very temporary and something the company can seamlessly weather.

Auto Business:

The mass market $25,000 model is on track for 1H of 2025 deliveries. Generally speaking, its new lineup of vehicles is still on track for 1H of 2025 deliveries too. As a reminder, these pull from existing manufacturing capacity and are more so iterations of existing models. The next-gen vehicle lineup should be a 2026 event.

Tesla continues to lean into more financing programs and affordability initiatives (like some price cuts to models and FSD) to help consumers through these tougher times. This will remain the case in Q3. Bulls will tell you what Tesla leadership tells you. They think these decisions make it even harder for negative GPM EV alternatives to try to compete with Tesla. They also think Tesla can “harvest more margin” down the road via software upsells like full self driving (whenever that comes) to eventually plug this upfront profit gap. Finally, bulls will rightfully call out how positive near-future rate cuts would be for this business.

What do bears say? That competition is catching up, Elon’s polarizing dialogue and focus on XAI are hurting the brand and investor sentiment. They’ll say FSD is a pipe dream and will simply keep getting delayed as Waymo and others race ahead. As I have been since I started investing, I’m entirely on the fence. I see credibility and weakness to both sides of this argument and have Tesla placed firmly in my too hard pile to invest. If I had to own shares or short it, I’d own shares… Elon is impossible to bet against. But luckily, as Buffett tells us, we play in a no strike game.

Cybertruck is still ramping and still a cost per vehicle headwind (Model 3 is still ramping to a lesser degree too in some factories). Without that impact, cost per vehicle fell Q/Q as it continues to enjoy better auto scale. Maturation of its 4680 cell is also a key source of this improvement, as production rose 50% Q/Q and costs tumbled. General input cost disinflation likely helped a bit too, although that wasn’t mentioned on the call.

“We saw a sequential rebound in vehicle deliveries in Q2 as overall consumer sentiment improved and we launched attractive financing options to offset the impact of sustained high interest rates.”

Slide Deck