Table of Contents

1. Housekeeping & Robinhood

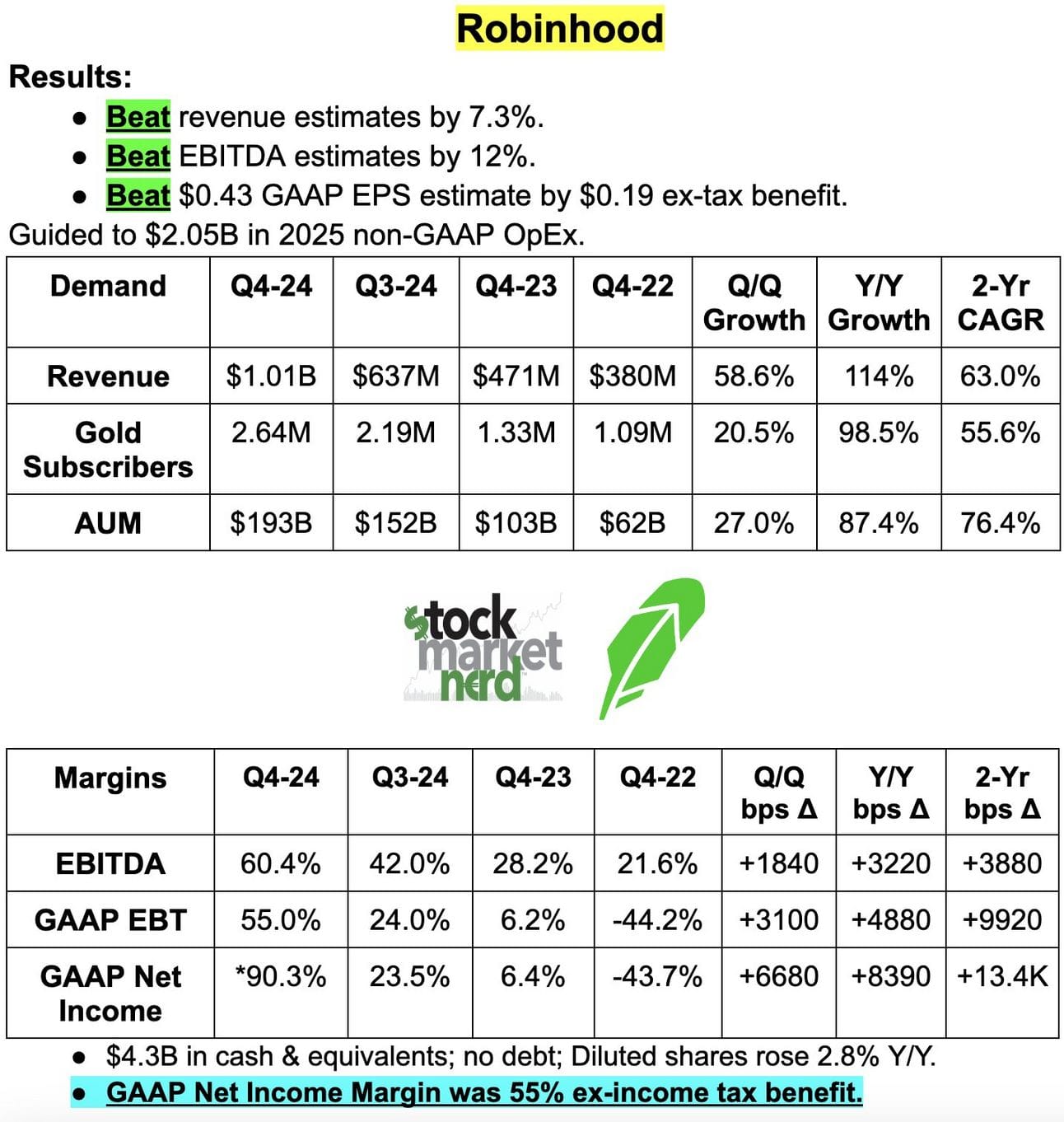

I will include more detailed coverage of the strong Robinhood quarter in tomorrow’s article. That article will also include Datadog and Airbnb reviews, as well as part 1 of my DraftKings review (their earnings call is on Friday). I’ll publish the rest of the DraftKings coverage and a Palo Alto earnings review on Saturday. For now, the Robinhood snapshot and my review of The Trade Desk’s quarter are below.

2. The Trade Desk (TTD) – Earnings Review

a. The Trade Desk 101

The Trade Desk is the leading buy-side player in open internet advertising. The firm’s two most compelling revenue segments are streaming, where it has relationships with most major players, and retail media, where it works with countless Fortune 500 vendors.

Its platform allows advertisers to bid on & purchase unique impressions with surgical precision, scale and open reporting. Purchases are essentially made on an impression-by-impression basis to uplift targeting efficacy and to double ad return metrics. Needed data is infused into every purchasing decision to ensure ads provide optimal value. No longer do advertisers need to commit millions at annual upfront events to reach audiences; they can commit to smaller purchases in real-time and with fantastic accuracy. No more guessing. They know where their most valuable consumers are; they know how to reach them and only them.

Kokai is the name of its data-driven, AI-powered advertising platform. It combines TTD’s leading open internet scale with its vast roster of 3rd parties to inject more data and signal into each decision and campaign. It tells advertisers who they should be targeting. Kokai does so through TTD’s decade of experience that allows it to essentially find groups of high-intent “copy-cat customers” with similar interests. Advertisers onboard their first party data (what TTD calls “concentrated data seeds”) and The Trade Desk does the rest. Kokai allows buyers to focus on whichever variable, key performance indicator or campaign objective they’d like to. It allows all of this to be done in a self-serve fashion or in a fully managed environment. Up to them. Finally, Kokai emulates the ease of data onboarding that has made Alphabet and Meta so popular.

Unified ID 2.0 (UID2) is its open internet, omni-channel identifier. It uses hashed emails to responsibly ensure consumer and brand comfort. It knows exactly who is accessing what site or app. Kokai tells you who to target, while UID2 tells you where they are.

Other products include:

- OpenPath allows publishers on the sell-side to directly plug into TTD’s buy-side platform. It does not replace sell-side programmatic players like Magnite, as it does not do things like yield management for these publishers. It’s just TTD’s way of letting publishers with their own resources connect more easily.

- Galileo is the firm’s product for ensuring seamless, automated first-party data onboarding.

- TV Quality Index (TVQI) uncovers the incremental value of professionally produced content as compared to user generated content.

OpenPath and UID2 are meant to support the sell-side rather than supplant it. TTD does not want to build a sell-side platform. It wants to exclusively represent the buy-side to eliminate conflict of interest. Helping sell-siders with identity and supply chain is meant to help its buyers enjoy more success.

b. Key Points

- Surprisingly tough quarter amid some operational missteps and tradeoffs.

- Several changes are being implemented to fix what went wrong.

- Zero change to the competitive landscape or its positioning within it.