1. Earnings Snapshots — DraftKings (DKNG) & Cloudflare (NET)

Full reviews for both of these companies will be published alongside Coupang on Saturday.

a. Cloudflare (NET)

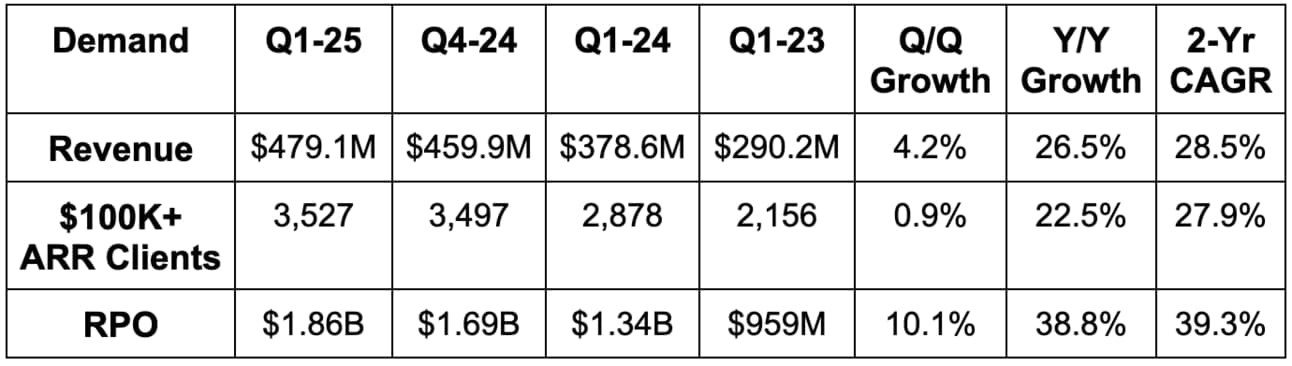

Results:

- Beat revenue estimate by 1.9% & beat guidance by 2.3%.

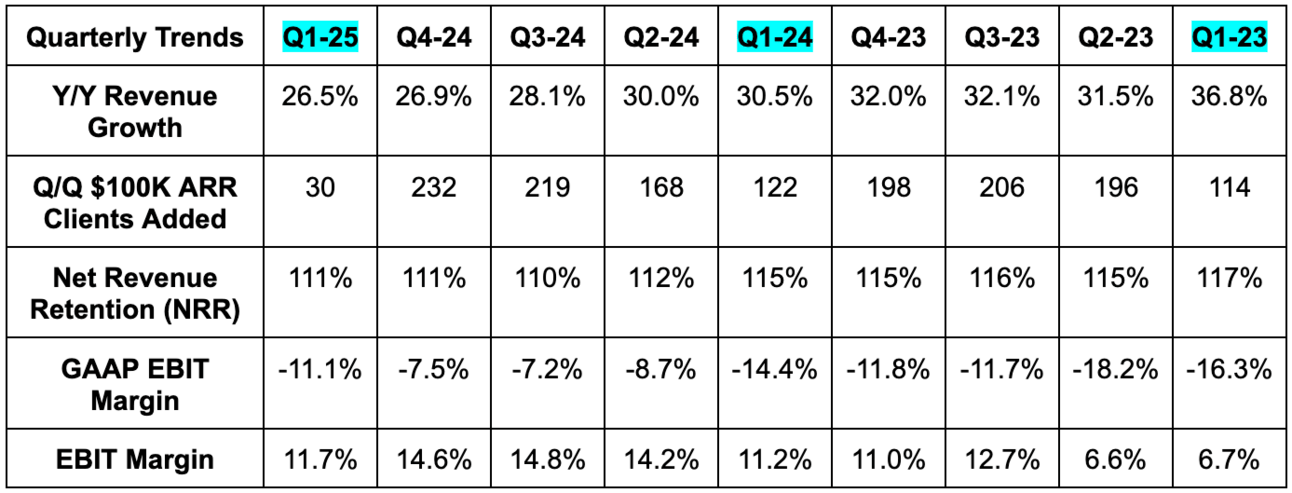

- 28.5% 2-yr revenue compounded annual growth rate (CAGR) vs. 29.4% last Q & 30.2% 2 Qs ago.

- Missed $100K annual recurring revenue (ARR) client estimate by 3.3%.

- Beat remaining performance obligation (RPO) estimate by 5%.

- Missed EBIT estimate by 1% & beat guidance by 2.7%.

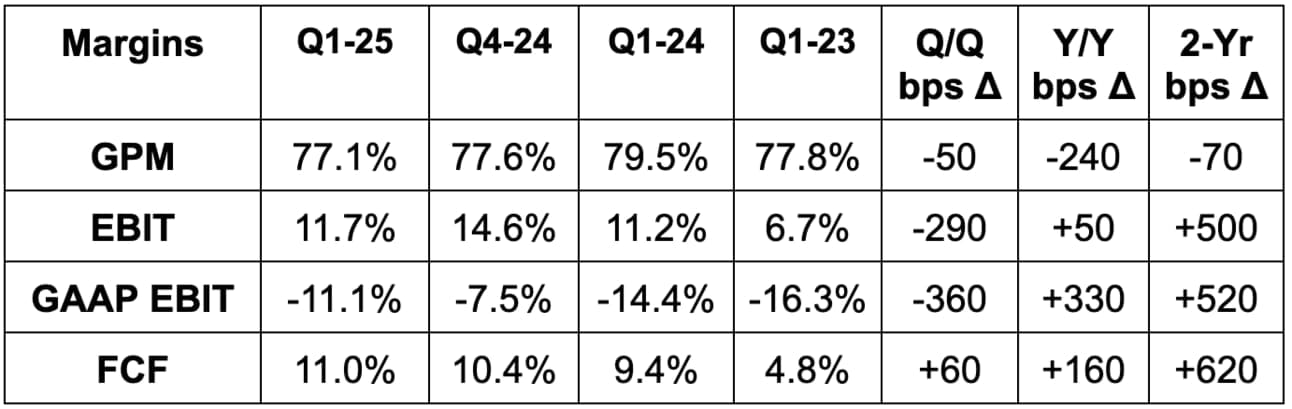

- Missed 78% GPM estimate.

- Met EPS estimate.

Balance Sheet:

- 111% net revenue retention vs. 111% Q/Q & 115% Y/Y.

- $1.9B cash & equivalents; $1.3B convertible notes; 2.1% Y/Y dilution.

Guidance & Valuation:

- Reiterated all annual guidance, which slightly missed across the board.

- Q2 guidance slightly missed estimates across the board.

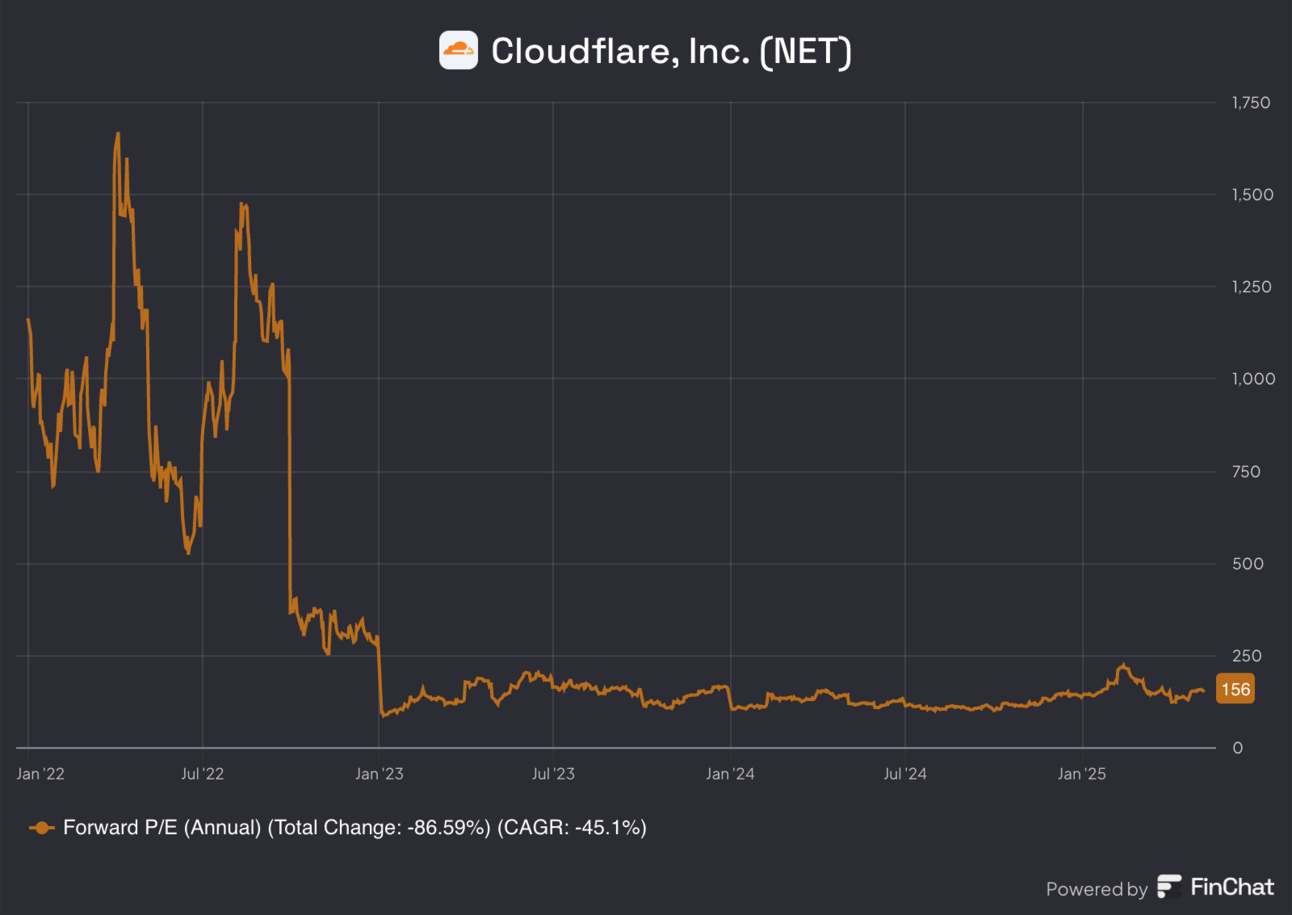

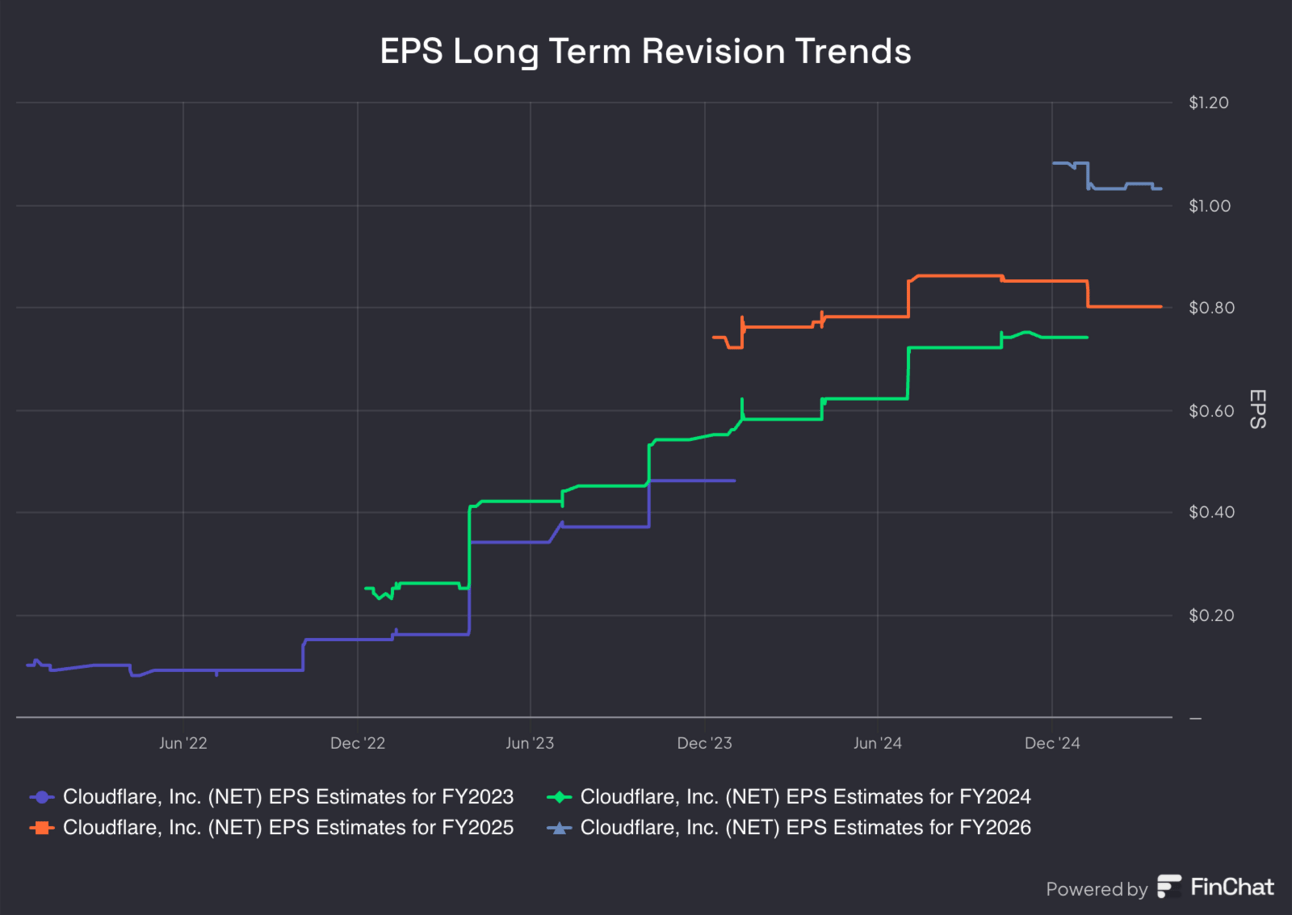

NET trades for 152x forward EPS and 181x forward FCF. EPS is expected to grow by 6% this year and by 30% next year. FCF is expected to compound at a 40% clip for the next two years.

b. DraftKings (DKNG)

Results:

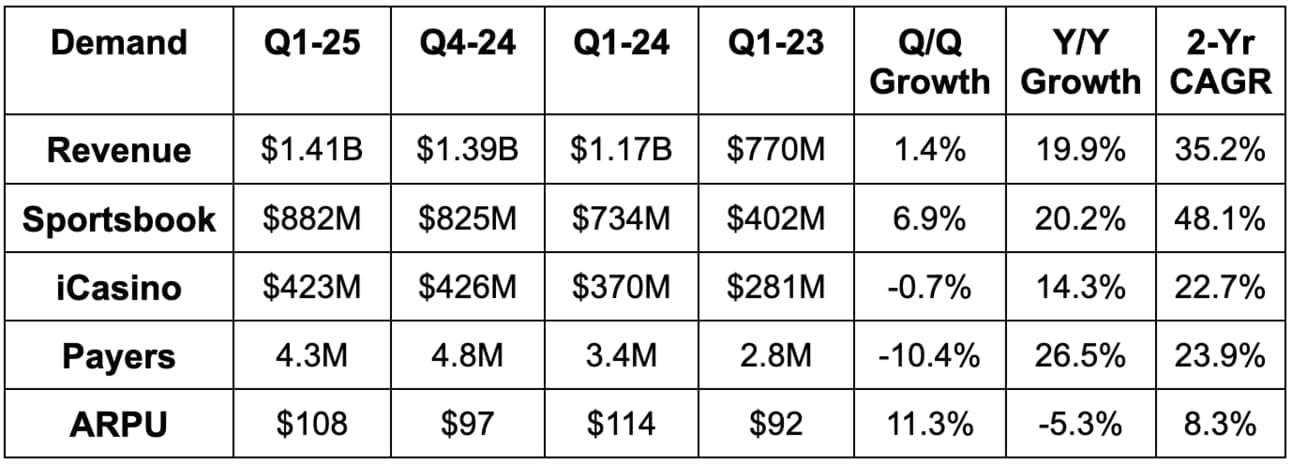

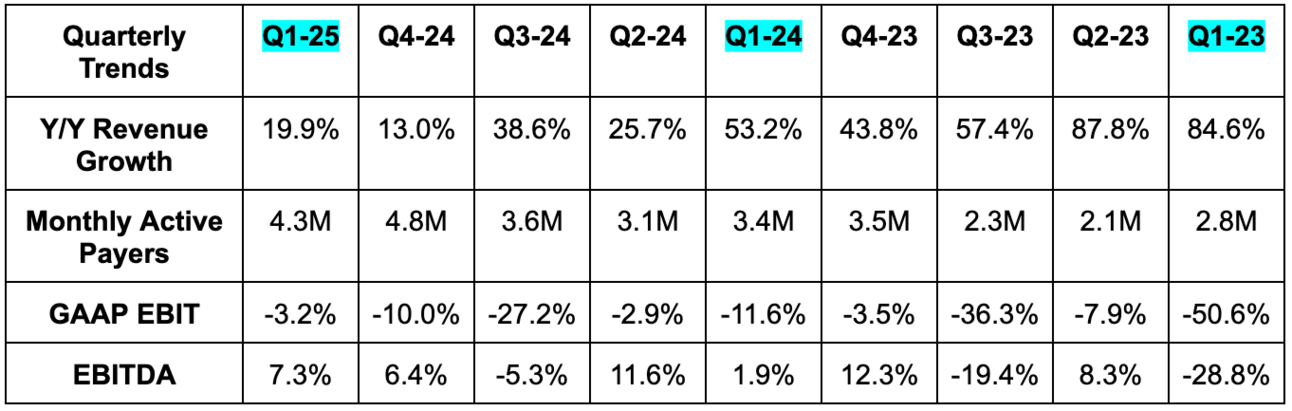

- Missed revenue estimates by 3.4%.

- Met payer estimates and revenue per payer estimates.

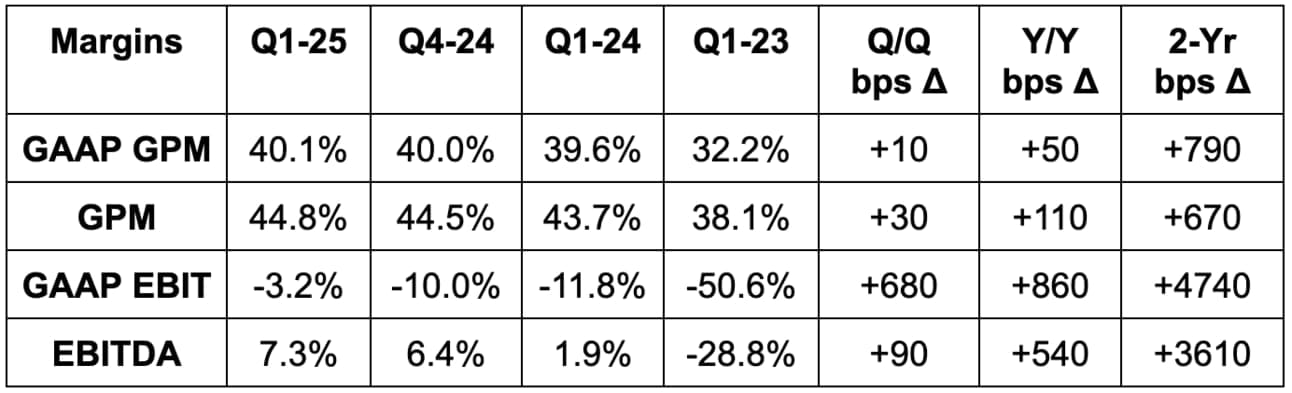

- Beat gross margin estimates by 50 bps (basis points; 1 basis point = 0.01%).

- Missed GAAP gross margin estimates by 120 bps.

- Missed EBITDA estimates by 11%.

- Missed -$0.06 GAAP EPS estimates by a penny.

Balance Sheet:

- $1.12B in cash & equivalents.

- $585B in debt.

- 4.3% Y/Y share dilution.

Guidance & Valuation:

- Lowered annual revenue guidance by 1.6%, which missed by 0.3%. Analysts had already modeled the bad outcome luck into forward guidance.

- Lowered EBITDA guidance by 11%, which missed estimates by 6.6%.

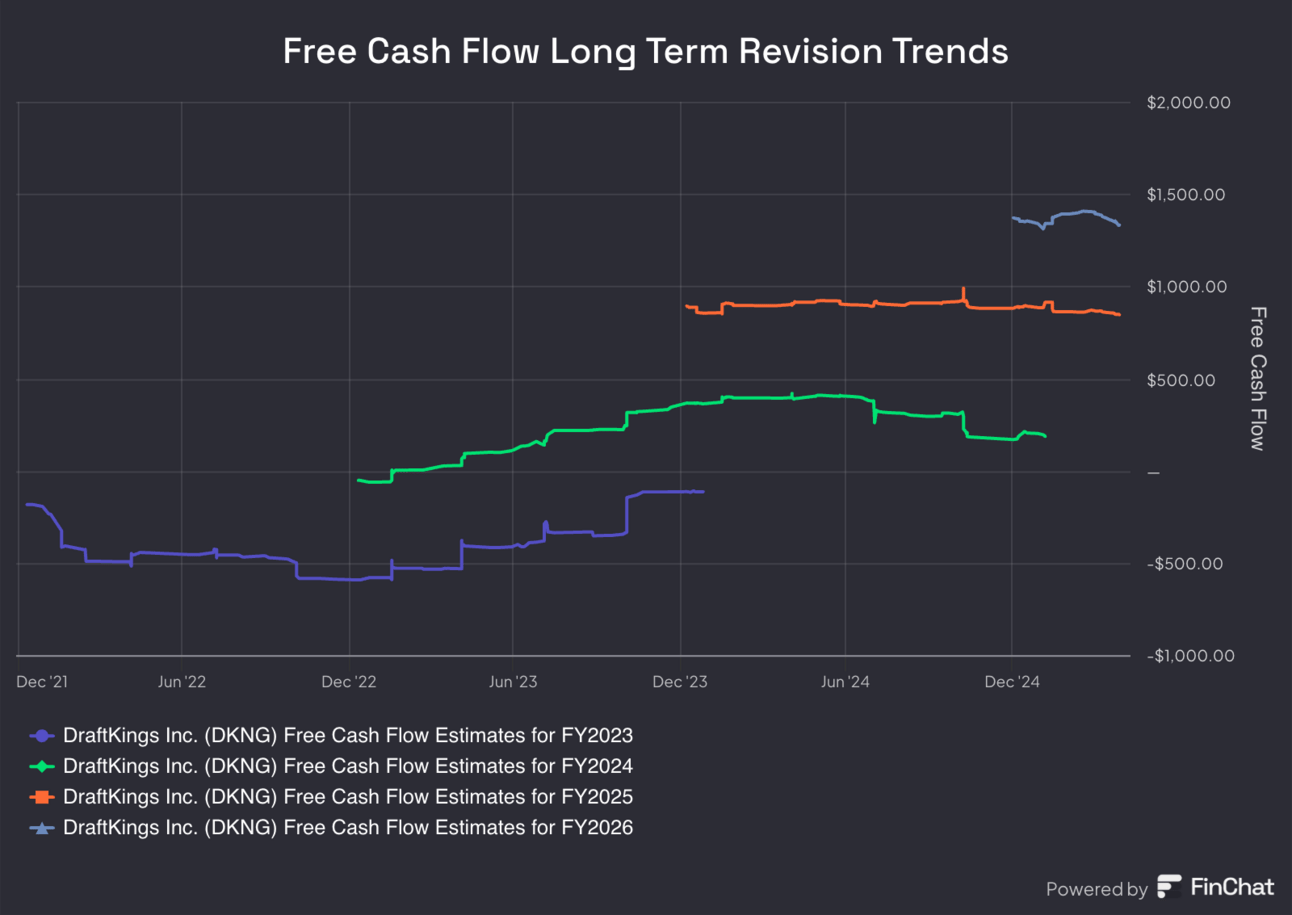

- Lowered FCF guidance by 12%, which missed estimates by 11%.

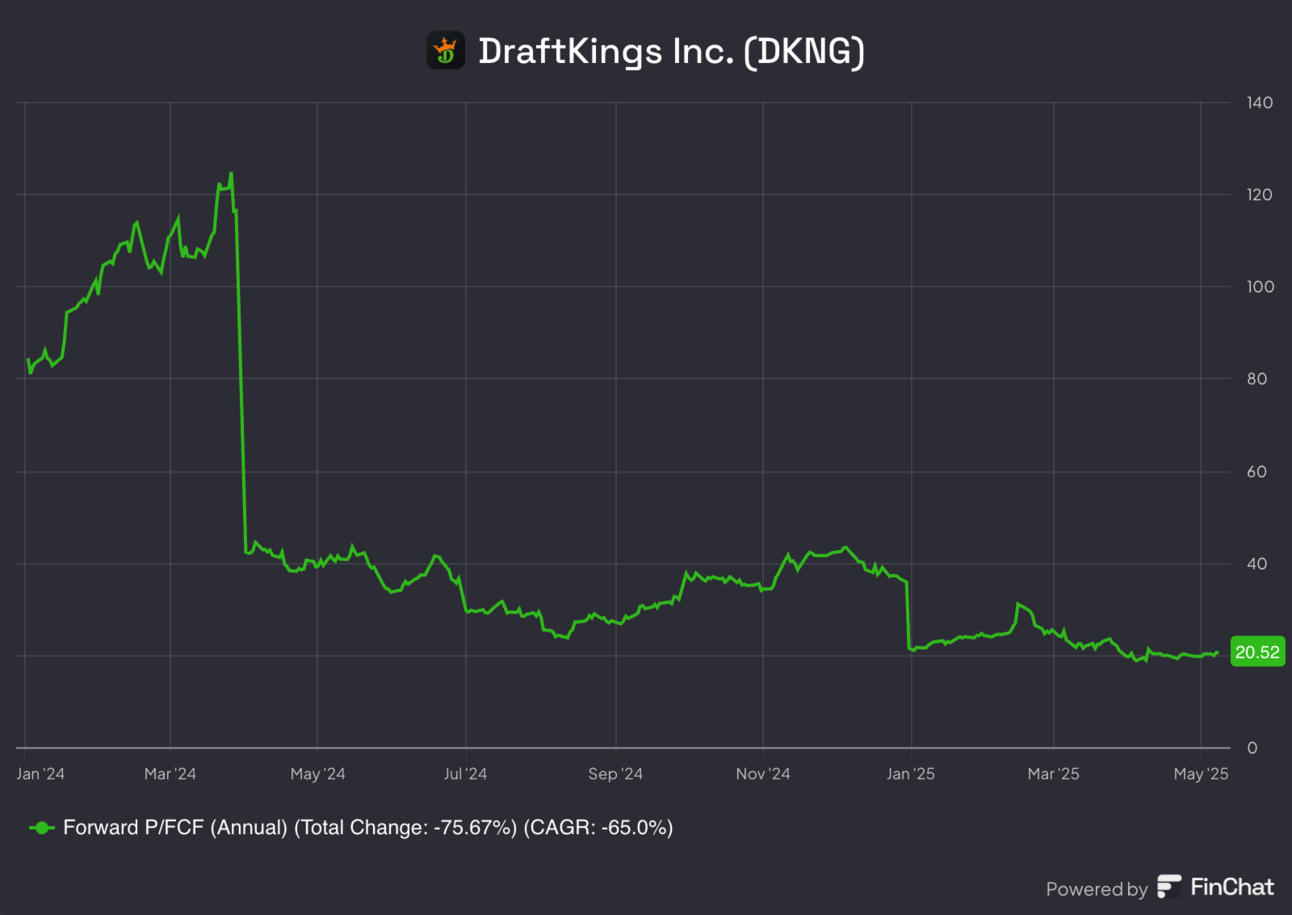

DraftKings trades for 23× updated 2025 FCF guidance. Free cash flow is expected to grow by 84% this year based on its guidance and by 77% next year based on that guide and 2026 estimates. Considering the FCF miss was related to bad luck, I don’t think 2026 FCF estimates will move much. 2025 estimates will fall to reflect the new guidance and the 84% growth projection.

As the review will lay out, all of the misses were based on historically bad outcome luck during March Madness. There was a stretch of over two rounds before the final 4 where not a single underdog one a game. Guidance would have been raised without this headwind. Just like terrible outcome luck during the NFL season. Structural (expected) hold (take) rate remains solid and bad luck will not last forever. It can easily lead to near-term volatility in results, as revenue and profit are byproducts of hold, but is not a structural concern to me. I care about thriving payer growth, market share gains, top-line expansion and OpEx control. If they’re executing in those places like they are, profits will follow when more normal outcome patterns come back. They are not changing anything about the odds structure of their bets, as again, this is not at all structural.