In case you missed it, our detailed PayPal Earnings Review from this afternoon.

This was a very long 16-hour work day. If there’s an extra typo or two in the reviews, I apologize. Struggling to keep my eyes open and Uber + Disney both report tomorrow morning.

1. Brief Earnings Snapshots — Chipotle and Spotify

a. Chipotle (CMG)

A full review of this report will come on Saturday or maybe early next week.

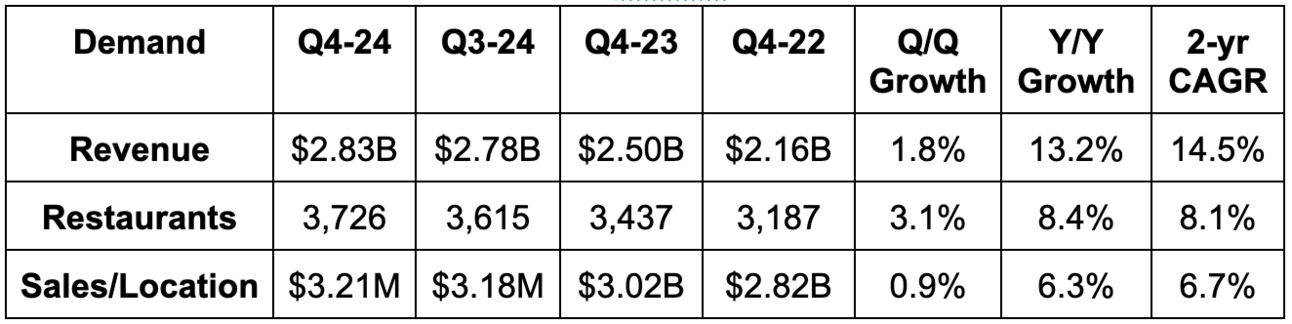

Results:

- Missed revenue estimate by 0.7%.

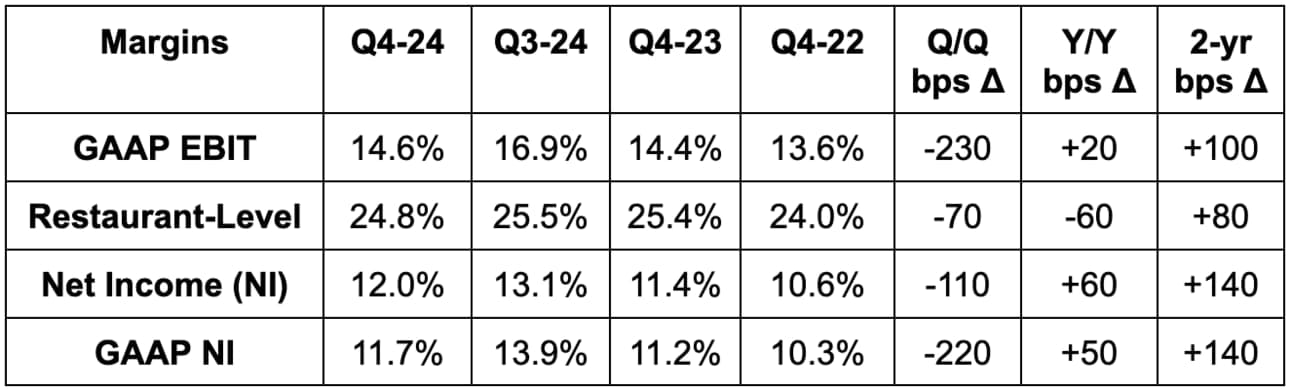

- Missed EBIT estimate by 3.3%.

- Beat 24.5% restaurant-level margin estimate by 30 bps.

- Met GAAP EPS estimate.

Balance Sheet:

- $748M in cash & equivalents.

- $868M in long-term investments.

- Diluted share count fell by about 1% Y/Y.

Guidance & Valuation:

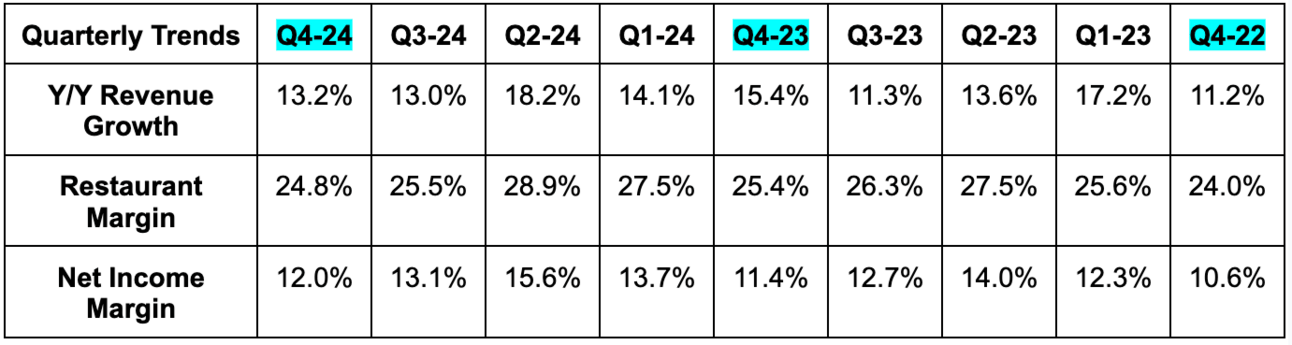

For the full year, 9% store growth and about 3% comparable sales growth guidance for 2025 leave us with about 12% revenue growth guidance for the year. This missed 13.3% growth estimates. If we instead assume “low-to-mid single-digit” growth means 4%, then it only slightly missed estimates.

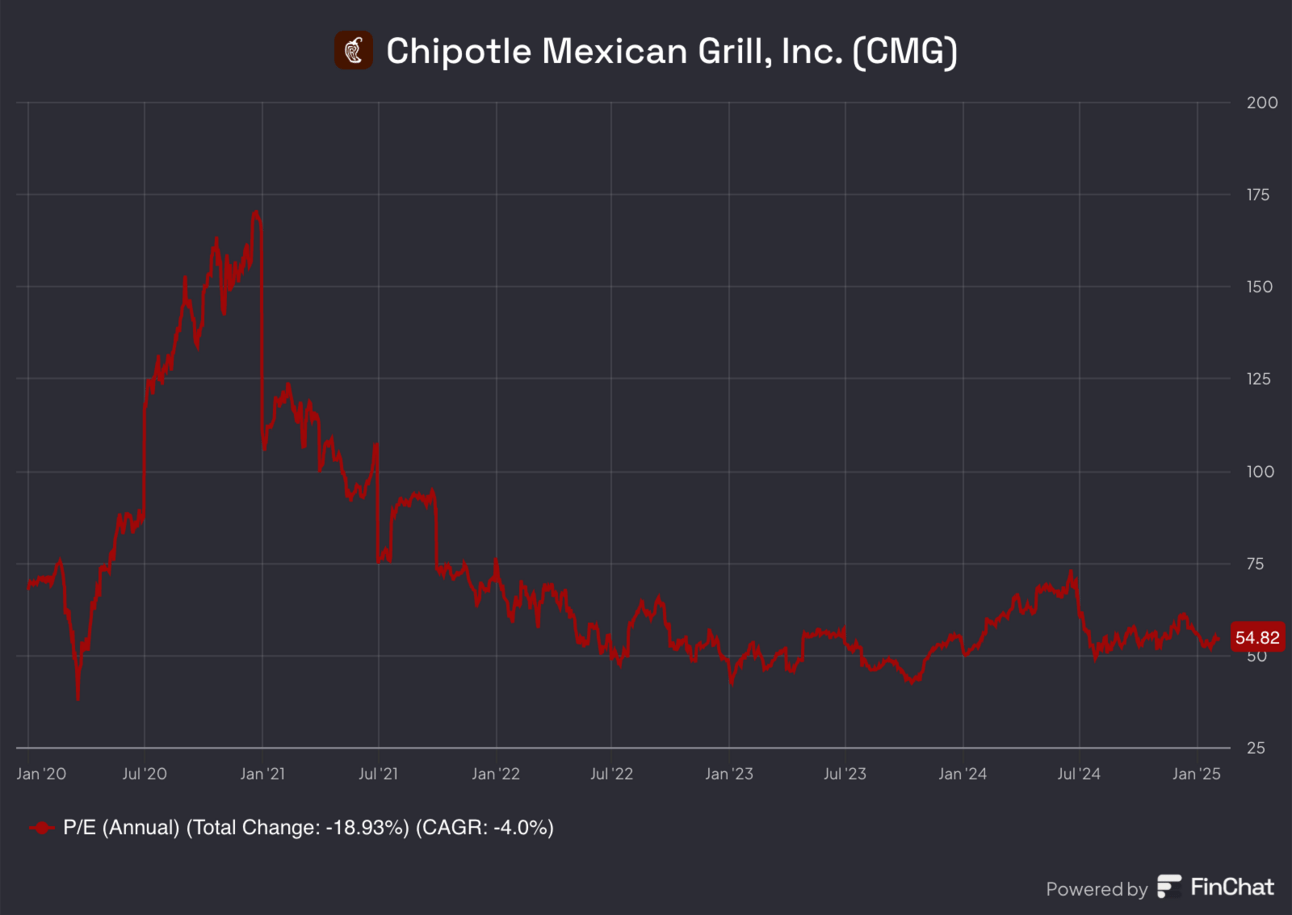

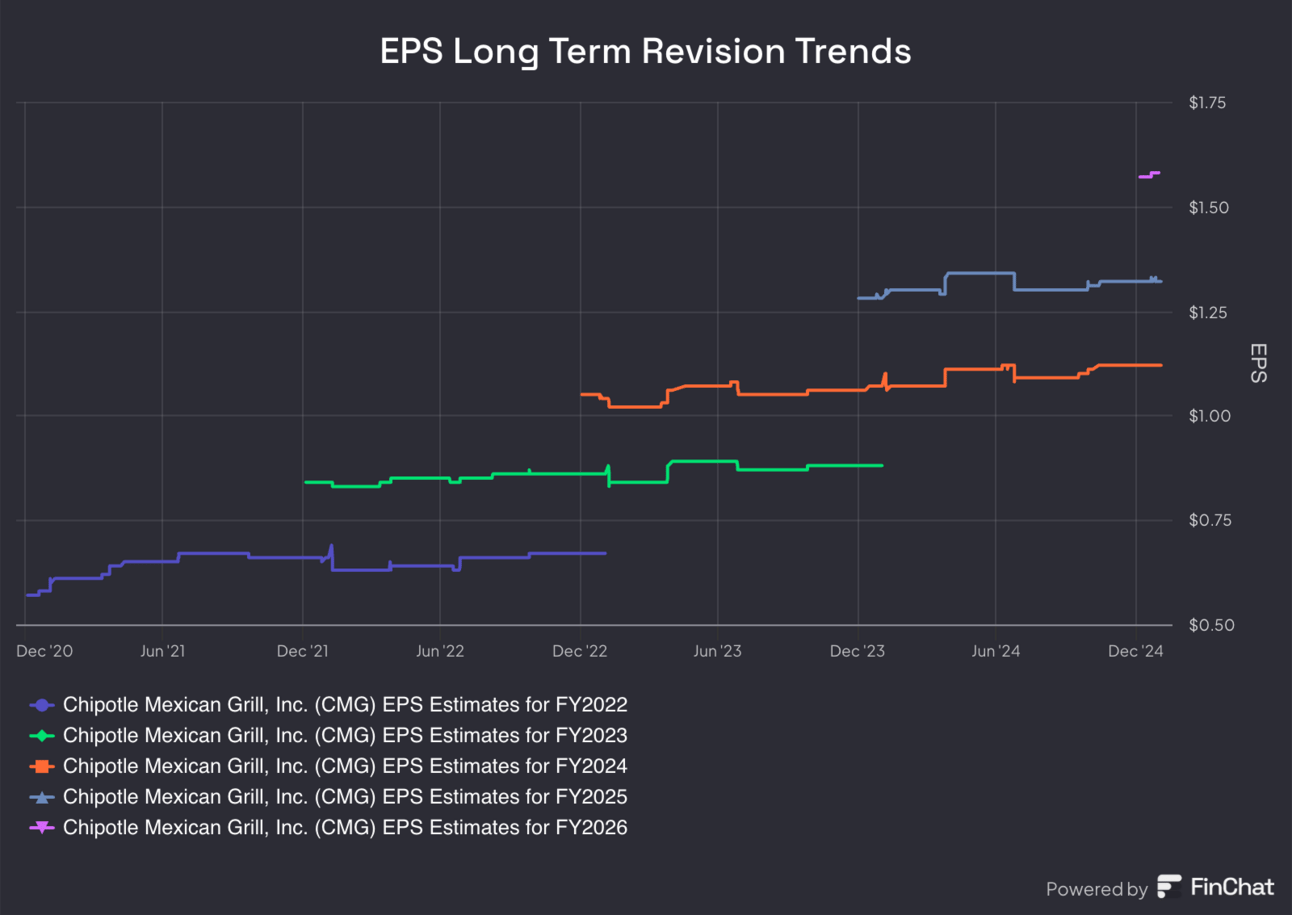

Chipotle trades for 42× 2025 EPS estimates. EPS is expected to compound at a 19% clip for the next two years. Estimate revisions will likely fall a bit after this report.

b. Spotify (SPOT)

A full review of this report will come on Saturday.

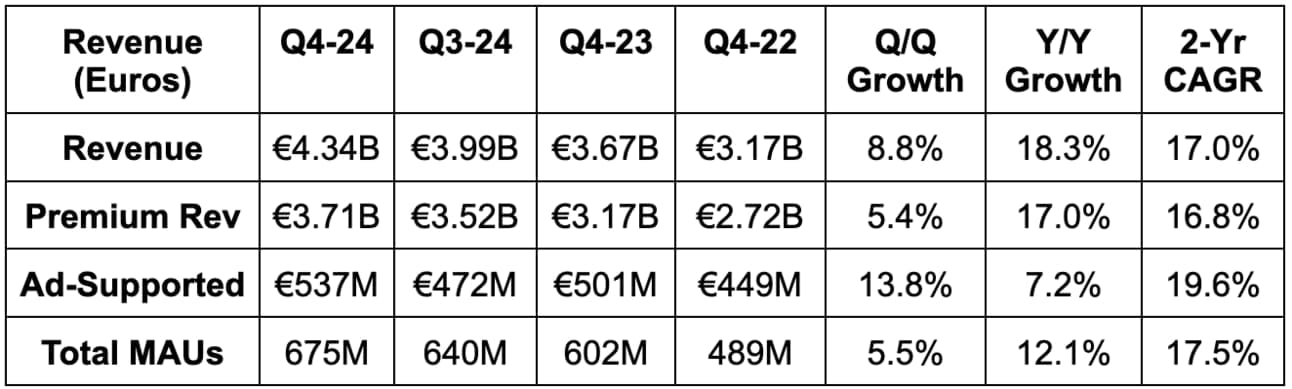

Results:

- Beat revenue estimates by 4.6% & beat guidance by 5.9%.

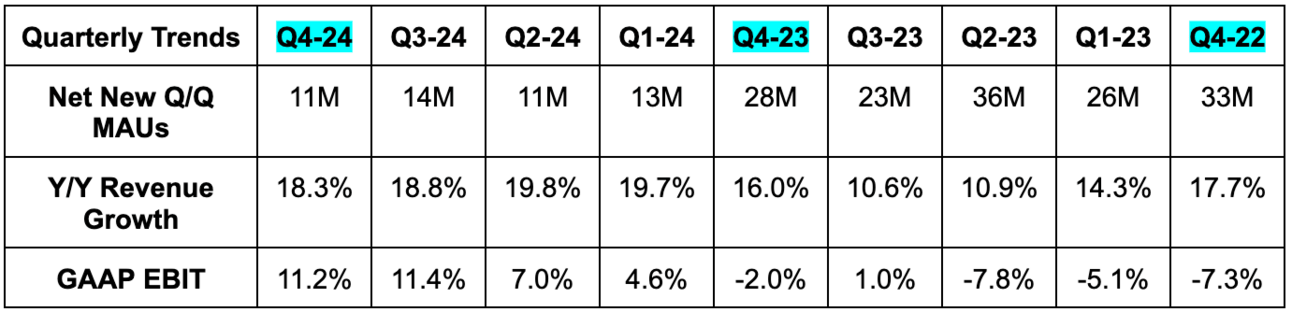

- Beat net new monthly active user (MAU) guidance of 25 million by a robust 10 million.

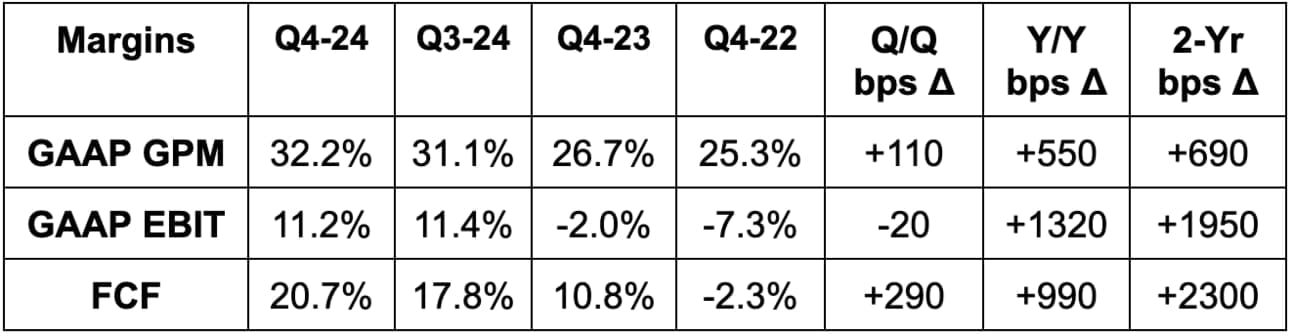

- Beat EBIT estimate by 1.5%. EBIT missed due to the rising stock price and therefore a higher-than-expected stock compensation charge.

- Beat 31.8% GAAP GPM estimates & identical guidance by 40 bps each.

- Beat premium subscriber guidance by 1%.

Balance Sheet:

- €4.78B in cash & equivalents.

- €1.54B in exchangeable notes.

- Diluted share count rose by 6.6% Y/Y.

- Basic share count rose by 3.1% Y/Y.

Guidance & Valuation:

Spotify trades for 56x 2025 earnings estimates and likely somewhere at or a little over 50x after revisions. It also trades for about 37x 2025 FCF estimates and likely a few ticks lower after revisions. EPS is currently expected to grow by 100% Y/Y this year and by 8% Y/Y next year. FCF is expected to grow by 45% Y/Y this year and by 2.5% Y/Y next year.