a. Lemonade 101 & Key Points

Lemonade offers renters, home, auto, pet & life insurance in the USA and parts of Europe. The company’s tech-native foundation eliminates legacy fixed expenses to lower cost of service. It builds on this edge by obsessively iterating on its underwriting algorithms to ensure accurate underwriting.

For a full review of its recent Investor Day, click here.

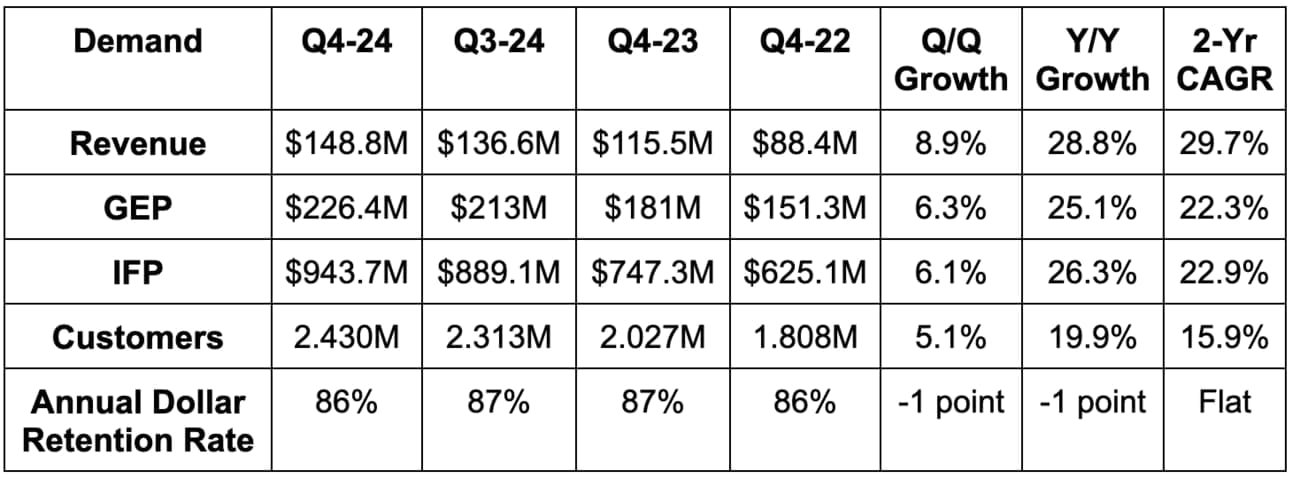

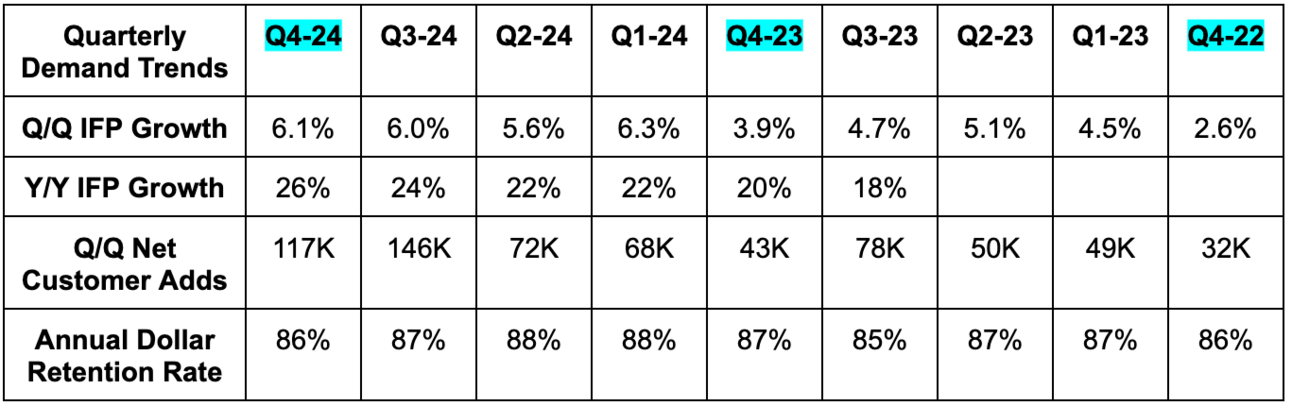

b. Demand

- Beat revenue estimates by 2.8% & beat guidance by 2.6%.

- Beat gross earned premium (GEP) guidance by 1.3%.

- Slightly beat in force premium (IFP) guidance.

- Premium per customer rose by 5% Y/Y.

- Annual dollar retention rate was 89% excluding the plans it proactively cut (in mainly California) throughout the year.

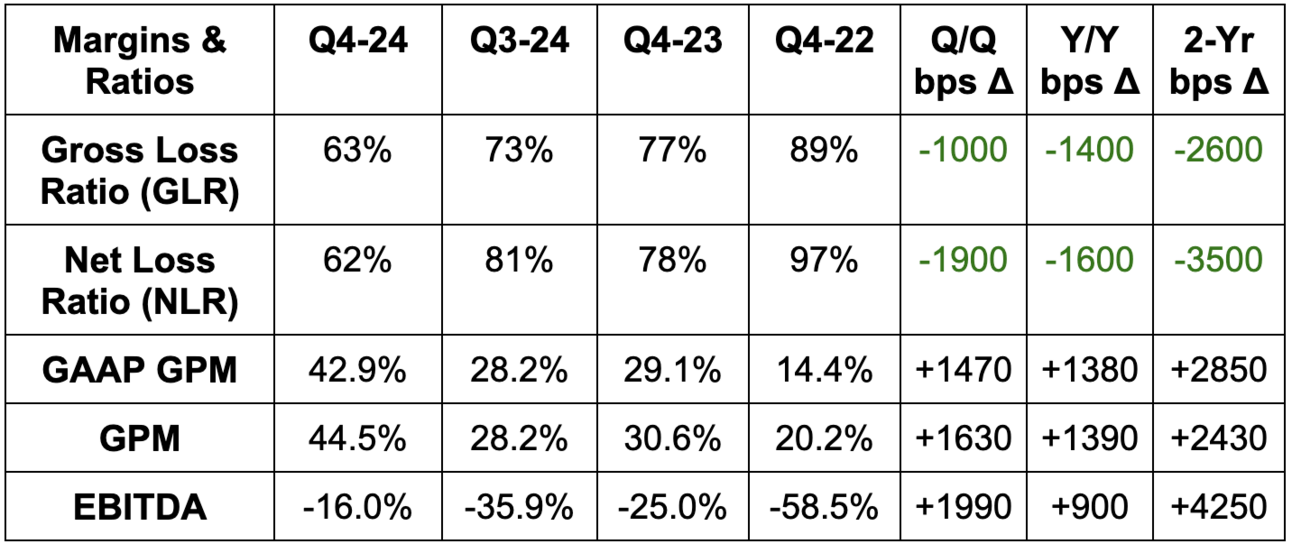

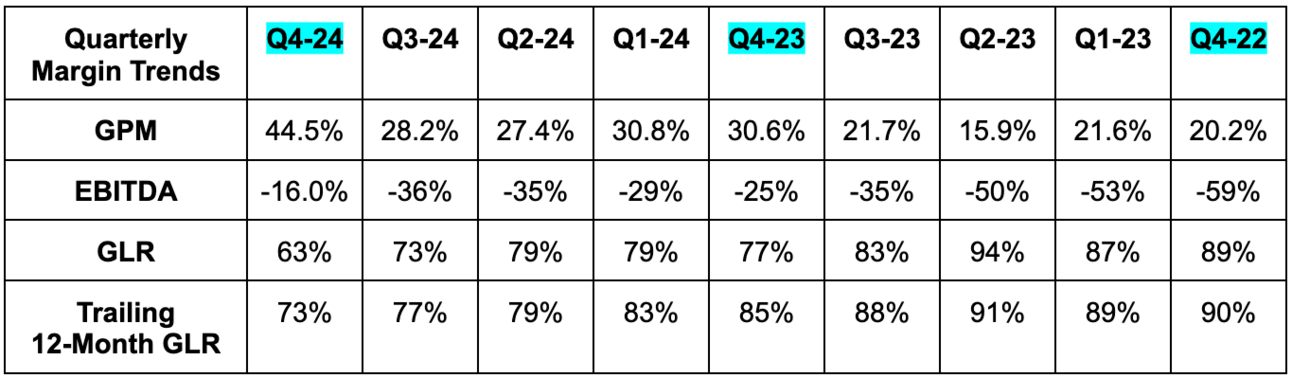

c. Profits & Margins

- Beat EBITDA estimates by 14% & beat guidance by 12%. EBITDA was -$24M vs. -$29M Y/Y.

- Beat 35.4% GAAP GPM estimates by 750 basis points (bps; 1 basis point = 0.01%). Massive beat.

Total OpEx rose 38% Y/Y in Q4 due to growth spend rising from $13M to $36M Y/Y. R&D rose by just 3% Y/Y, while G&A rose by 16% Y/Y via more interest expenses from its synthetic agent agreement. Headcount fell by 2% Y/Y.