1. Sea Limited (SE) – Earnings Review

a. Demand

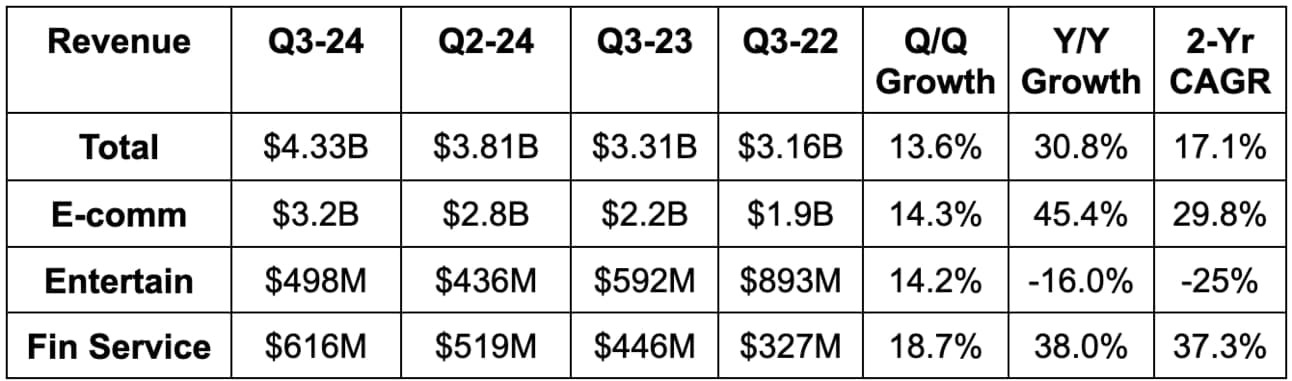

- Beat gross merchandise value (GMV) estimates by 2%. Missed active user metrics by about 1%.

- Beat revenue estimates by 6%. E-commerce beat by 6%; digital entertainment beat by 2.5%; digital financial services beat by 13%.

- 17.1% 2-yr revenue compounded annual growth rate (CAGR) compares to 13.4% Q/Q & 5.9% 2 quarters ago.

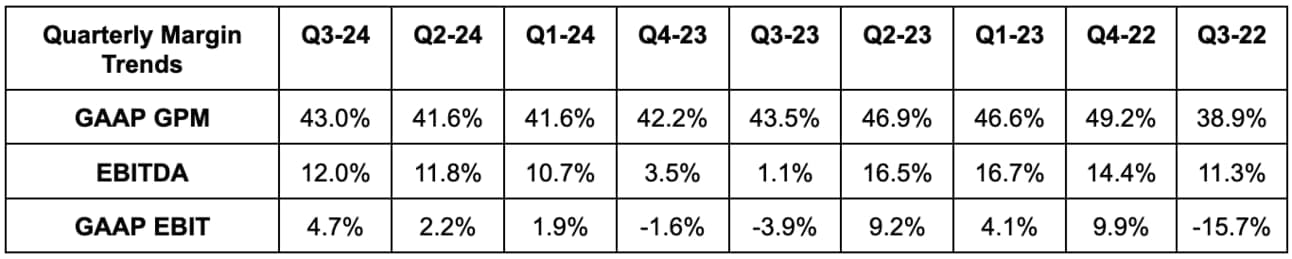

b. Profits & Margins

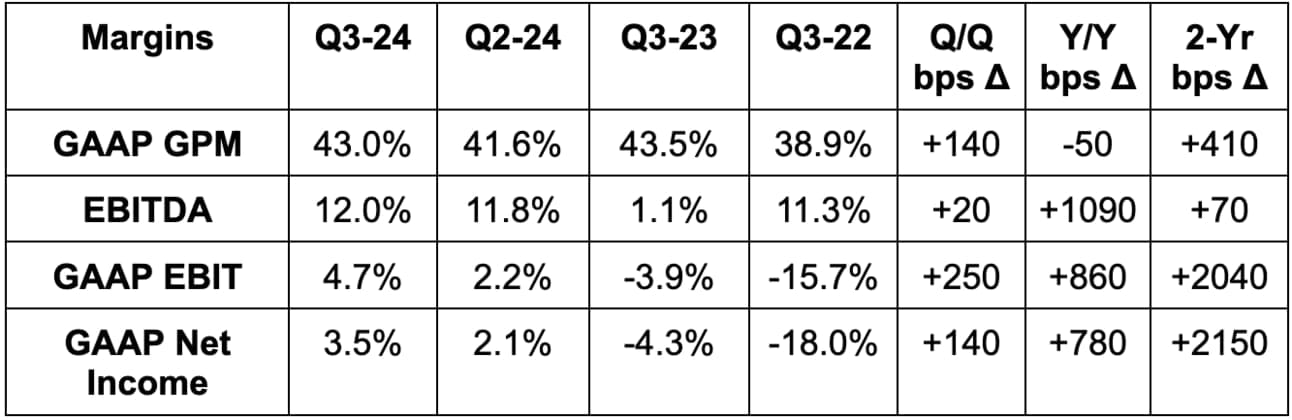

- Beat EBITDA estimates by 7.5%. Financial services and entertainment drove the beats.

- Beat $135 million GAAP EBIT estimates by $67 million or about 50%.

- Slightly missed $0.25 EPS estimates by a penny. Its tax bill rose by 50% Y/Y and was larger than expected, which explains the small miss paired with the GAAP EBIT outperformance.

c. Balance Sheet

- $9.9 billion in total cash, equivalents & investments.

- Diluted share count rose by 0.8% Y/Y.

- $319 million in total debt ($142 million is current).

- $2.85 billion in total convertible notes ($151 million is current).

d. Guidance & Valuation

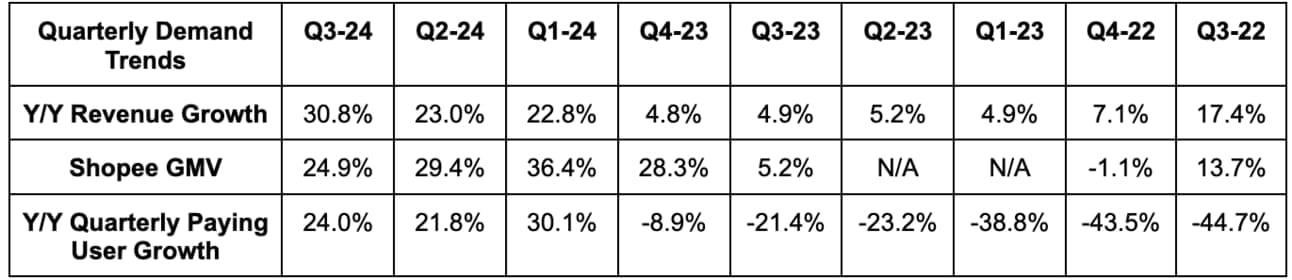

SE reiterated ~25% Y/Y Shopee e-commerce marketplace growth.

EPS is expected to grow by 86% next year and by 27% the following year.

e. Call & Release

E-commerce (Shopee):

Its e-commerce platform, called Shopee, is performing well. Gross orders rose 24% Y/Y vs. 40% Y/Y growth last quarter while GMV rose by 25% Y/Y vs. 29% Y/Y growth last quarter. Core marketplace revenue rose by 43% Y/Y. This bucket consists of transaction fees and advertising (+49% Y/Y), as well as value added services like logistics (+29% Y/Y).

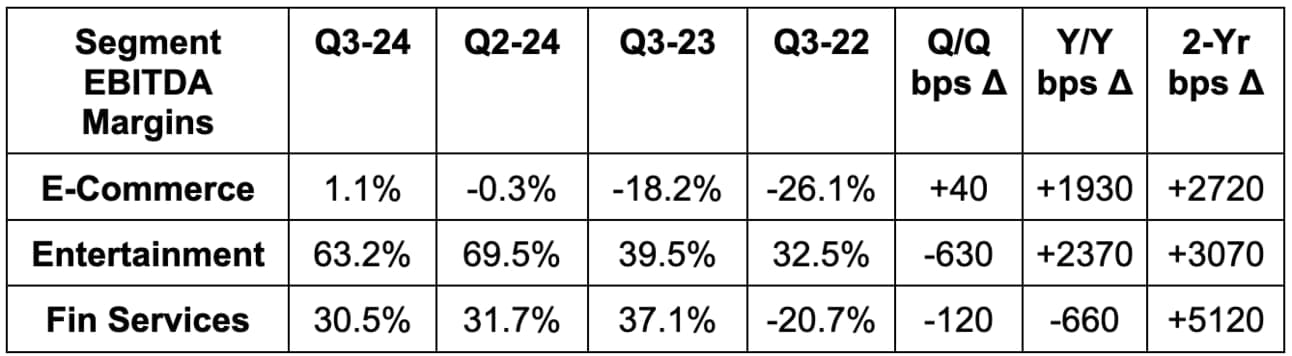

From a profitability point of view, Shopee re-inflected to positive EBITDA as expected. This positive EBITDA milestone occurred in both Asia and Brazil and is expected to continue going forward. Last quarter, the company generated a positive contribution profit for the very first time in Brazil of $0.09 per order. Encouraging to see that breakthrough followed up by another subsequent profit inflection this quarter. Also encouraging that it took SE just 5 years to turn profitable in Brazil. Buyers in that country rose 40% Y/Y while customer cohort quality improved.

While competition from Temu and Shein in Indonesia or MercadoLibre in Brazil continues to be a concern, market share trends remain positive and SE is quite pleased with its competition positioning. No changes in Asia or Brazil. There has been a lot more cross-border competition in its markets, but most of its sellers are local, so that impact is minimal.

Notably, item and advertising commission take rates also rose for SE as its markets saw further competitive “rationalization.” Great to hear. For ads specifically, the take rate rose by 30 bps Q/Q. Platform investments, targeting algorithm enhancements, easier seller onboarding and a new dashboard all helped SE’s ad business continue to command a larger piece of the pie. Sellers rose by 10% Y/Y while revenue from these sellers rose by 25% Y/Y.

“Many of our markets still have very low e-commerce penetration rate. This puts us in a great position to continue to grow as e-commerce penetration improves.”

Founder/CEO Forrest Li

More E-commerce Differentiation:

Like for other global marketplaces, a big piece of SE’s competitive positioning is its fulfillment network. This is where Shopee Express (SPX) Delivery, its rapid delivery service, comes into play. It has worked hard to more deeply integrate with logistics partners over the last few quarters, and it thinks this work is paying off. 50% of SPX orders were fulfilled in 2 or fewer days (vs. 70% in 3 or fewer days last quarter) while costs continued to fall. Other services like its “change of mind” 15 day return policy are also helping drive higher basket sizes, which means more order batching to cut costs (as well as more revenue). Generally speaking, large investments to enhance efficiency and service levels have yielded significant input cost intensity relief. It has created an end-to-end, vertically integrated supply chain for SE and its merchants to drive interoperability and better outcomes. It’s passing some of the coinciding savings onto buyers and sellers to deepen its value proposition. And speaking of price advantages, it offers the best prices in its markets according to a Portrait survey.

Finally, live streaming on the marketplace continues to boost engagement and be a popular tool for merchants to use to stand out. Investments over the last year here have “paid off.” Streamers rose by 50% Q/Q while streamers who bought something from a merchant rose by 15% Q/Q. A lot of this success is coming in Indonesia, where it’s the largest live streaming e-commerce platform and continues to enjoy steady operating leverage.

Basket size is higher for these shoppers, which means better margins and retention. It also just debuted a new YouTube partnership where content creators can put shoppable Shopee links right on their pages.

Financial Services (SeaMoney):

SeaMoney’s consumer and small business loan book rose by 73% Y/Y to $4.6 billion. It reeled in 4 million first-time borrowers and generated 60% Y/Y growth in loan customers. The company is aggressively leaning into originations and is doing so while delivering resilient credit metrics. Its 90+ day non-performing loan (NPL) rate actually improved a bit Q/Q to 1.2%. Furthermore 48% Y/Y growth in credit loss provisions materially lagged overall asset growth. SE is effectively using its rich customer data profiles within Shopee (tons of payment history) to give its underwriting models a key edge over others. This approach seems to be working, just like it does for other similar business models around the globe.

Credit across SE’s markets is very underserved and demand is robust. Still, it’s going slowly here to ensure strong performance remain strong. For example, it starts first-time borrowers without ample data on very small credit limits. It slowly, carefully raises those limits over time as a customer demonstrates strong tendencies. That’s pretty common practice, but it’s easier said than done to stick to this discipline over chasing faster growth. That’s always tempting.

It’s also getting more aggressive with originating credit for non Shopee users. For example, it’s running a successful new program for phone purchases in physical stores. Much more to come here, as now 50% of its loan book is from outside of the Shopee ecosystem. This does eliminate the lucrative advantage of underwriting customers you know better than anyone else. Still, if they can continue delivering these credit metrics despite shifting to this source of growth, it should be full speed ahead.

Entertainment (Garena):

Sea Limited thinks Garena bookings growth will reach 30% Y/Y for 2024. For this quarter, bookings rose by 24% Y/Y to greatly outpace -16% Y/Y revenue growth for the segment. This is related to negative revenue growth during recent quarters still being reflected in the Y/Y comp. Bookings calculates forward-looking demand, and offers strong evidence of revenue growth quickly rebounding in the quarters ahead. This segment was aggressively helped by the pandemic pull-forward, but seems to be getting back to a point of more structural, reliable demand. Free Fire continues to be its standout game several years after launching. SE’s continued obsession with in-game enhancements (it thinks) is the largest reason why, with 25% Y/Y daily active user growth and 25% Y/Y download growth offering evidence.

Momentum in its core markets is solid while North Africa is quickly turning into another promising expansion opportunity. It hosted the largest ever e-sport event in Morocco and generated significant social media buzz to build brand awareness.

- Quarterly active users rose 15.5% Y/Y to 628 million.

- Quarterly active paying users rose 24% Y/Y to 50 million.

Marketing:

The big debate surrounding SE’s business over the last few years was growth stickiness. Skeptics argued that its revenue growth was entirely and permanently reliant on spending more marketing dollars. They thought of recent margin improvement as temporary and unsustainable if SE ever wanted to grow revenue again. They thought ramping competition would yield rising customer acquisition cost (CAC) and permanent margin pressure. Optimists believed in rising unaided brand awareness, easier comps and the firm’s track record of growth before the pandemic. They thought of these factors as obvious evidence for SE being able to generate top line expansion without sales & marketing (S&M) scaling in tandem.

This quarter bodes very well for the bulls. S&M fell 4.3% Y/Y overall and by 11% for its e-commerce segment, which is where marketing reliance was thought to be sharpest. And as you can see in the demand section, it delivered 30% Y/Y revenue growth despite these cuts. G&A rose by 12% Y/Y while R&D rose by 8% Y/Y to both greatly lag the pace of revenue growth as well. The EBITDA explosion is the byproduct of all of this and should have the optimists quite good about their point of view.

f. Take

This was an excellent quarter. It tells all of us that SE doesn’t solely rely on more OpEx to fund revenue growth. It’s showcasing fixed cost leverage and compelling economies of scale. Its consumers are a lot more loyal than some thought than, with this financial data offering clear signs. This company took a lot of heckling throughout the post-pandemic hangover for global e-commerce. It responded by fixing its cost base, shifting its focus, delivering more unique value and executing. The team deserves a ton of credit.

2. Lemonade (LMND) – Investor Day Review / Investment Case Update

A link to my most recent earnings review can be found here.

Price, Conversion & Loss Ratio:

Lemonade talked a lot about leading with price when it went public a few years ago. Since then, the theme was put more on the back-burner, while the idea of wanting to offer cheaper plans was maintained. During this event, price competition again became a core topic. And why do they care so much about this? Because for every 10% discount they can offer to customers, they enjoy a 50%-150% boost to plan conversion rates. That allows them to harvest more overall profit dollars, thanks to the overall growth tailwind offsetting the lower fees. At the same time, intentionally lower premiums per plan also (all else equal) means a higher loss ratio.

Lemonade knows that conversion gains make accepting this concession more than worth it. This is a choice it will likely make as it remains in rapid growth mode. As that growth eventually slows with scale and age, price is a lever that it could easily pull to drive more long term operating leverage. It is focused on maximizing profit dollars rather than perfecting short term gross loss ratio (GLR). Considering this, I find the excellent GLR performance in 2024 to be even more notable.

Lemonade’s business model provides two durable cost advantages to make undercutting the competition an even more obvious decision. First, it has no agents. It does pay a 16% premium share to its growth spend financier (essentially cost of debt), but those commissions are finite. They last 3 years until General Catalyst (the partner) is repaid. These are not perpetual expenses. Furthermore, this also means there’s no disintermediary (as leadership constantly reminds us) between Lemonade’s platform, brand and the end consumer. So? It has more open access to all of a customer’s relevant data. This means it knows when to surface a cross-sell offer at the perfect time; it means the firm can augment claim handling speed/accuracy and can further personalize experiences. Generally speaking, all of that leads to higher lifetime value (LTV) without added customer acquisition cost (CAC).

Lemonade’s architectural design makes up the other inherent cost advantage. This isn’t “60 stitched together systems” that competitors like Geico try to glue together. This platform doesn’t need expensive system integrators to slowly, painfully conduct any small tweak to the offerings. It doesn't have massive rosters of insurance agents who understandably fight incumbents as they try to modernize at every turn. These agents want the status quo and that makes it harder for their parent companies to change it.

Compare that to the Lemonade’s singular operating system (called Blender). From this scalable, overarching, light-weight core, it feeds every single model the needed data, context and instruction to work. From Jim (customer service model), to lifetime value models or Cooper (internal work automation model), it helps everywhere. Lemonade ships 50 software updates per week, with no disruption and with rapid, data-driven learning to constantly guide product road-map. It built its platform the right way and it can now sprint faster than anyone else.

This idea is somewhat subjective and abstract, so let’s attach some numbers to it. Since 2021, Lemonade’s headcount has compounded at a 2% clip while its top-line grew at an average pace of 25%. It is quickly approaching $1 million in premiums per employee, and sees that 4Xing over the next 6 years to depict its continued plans to rapidly compound top line with little added cost. And for Lemonade’s internal work, since 2022, the company has pocketed a full $120 million in OpEx.

This is already an instrumental part of cost leverage, with expectations of OpEx savings ramping to $1 billion over the next four years. Notably, as leadership put it, this industry isn’t like airlines, for example. Airlines cut costs by giving you less leg room or “taking away your peanuts.” Lemonade cuts costs by creating more rapid, more convenient, more automated and more delightful interactions.

It’s in a prime position to offer the best of both worlds: better service and lower expenses. You get the peanuts and the leg room for less money. For Lemonade’s business, this means a unique combination of value creation including:

- A loss adjustment expense (costs to handle claims) already that rivals incumbents despite lacking their economies of scale

- A net promoter score (NPS) and app ratings that are all best in class.

Lemonade aggressively front-loaded fixed cost at its birth to set itself up for decades of efficient scaling. While that led to bloated losses that were easy for investors to pick on, it now positions them ideally for low-cost expansion. Just like for SoFi in banking or Uber in ride sharing, it’s these sticky cost advantages that yield differentiation within a fiercely competitive field. Lemonade surely augments these edges with real-time claims handling and rapid onboarding that incumbents can’t match, but lower price is the biggest factor. Many will endure an antiquated, slow, frustrating interface for some savings. Nobody will put themselves through that just to pay more money at the end.

Humans + AI:

One more quick note on AI, automation and cost controls. While Lemonade is determined to keep headcount growth slow, it is not interested in laying off its remaining talent. It did have to rightsize headcount from over-hiring through the pandemic (like everyone else), but new GenAI innovation will not mean more job losses… just slower headcount growth. Lemonade’s claims handlers, for example, are simply shifting their roles from manually handling customer inquiries, to perfecting GenAI prompts, testing those prompts and deploying them to millions of interactions. The team took us through a demo of its Blender model and how employees interact with it on a daily basis to ensure responses are always becoming more complete & valuable. This is why the proportion of inquiries handled in a fully automated fashion continues to rise (chart below). This paves the way for lower relative headcount needs vs. other competitors.

Pet Insurance Progress:

The Pet Insurance story is remarkably positive. It has gone from $12 million to $254 million premiums in 5 years while gross loss ratio fell from 110% to 69%. It’s getting better & better with converting compelling customers and avoiding un-compelling cohorts.

Success is related to its AI-fueled automation paired with human touch in action. Jim (customer service model) can automatically approve items for coverage from unstructured screenshots & PDF documents. It can also rapidly ping a coverage specialist to handle issues with all needed context to handle issues in minutes rather than days. All of this means moving insurance applications from weeks-long, paperwork-packed ordeals, to rapid, friendly service.

For Pet insurance alone, AI help has cut $60 million in LAE expenses and moved variable costs per claim from $65 to $19 since 2021. It did all of this while maintaining best-in-class customer service scores because, again, cost-cutting automation means better service too. These benefits will merely grow with scale and model improvements.

This execution also offers a small positive hint for the car insurance story that we’ll discuss next. Why is pet relevant to car? Don’t you still travel via horseback? Me neither. Interestingly, claims frequency for both products is much higher than other plans. This allows Lemonade to more expediently collect data for model seasoning. And if the last few years of pet insurance results is any indication at all, car should be able to find a good path too.

Lemonade is now the 4th most searched pet insurance vendor a few years after launching. As COO Adina Eckstein was quick to note, they got here with 5% of the marketing budget of Progressive.

Car Insurance:

Telematics Definition: Lemonade Telematics uses an app to track every single driver action – from a tap on the break to a dangerous text on a highway.

Car insurance is a large part of Lemonade’s growth engine vision over the coming decade. It has gone quite slowly with integrating Metromile, upgrading underwriting algorithms, investing in needed telematics processes and waiting for needed premium hike approvals from regulators. Those approvals have come. And? Lemonade thinks its product feature set and underwriting models are ready for primetime growth in 2025.

Lemonade thinks this product is going to come with far better pricing for its target customers than anyone else. Why? Because telematics is unique to Lemonade. Not because every other incumbent doesn’t claim to also use this technology, but because Lemonade does it better. Two reasons for this. First, its app-based telematics software is perpetual. It doesn’t stop tracking drivers after a few weeks or months. Other leaders here like Progressive do. Leadership was quick to note that while 9% of car policies in the USA do use telematics, about 1% use perpetual telematics vs. 92% for Lemonade. That matters a lot, as median policy prices change by about 23% following the typical tracking window. The always-on tracker also perfectly positions Lemonade to immediately offer service when needed. They know when that person behind you rammed into your bumper and can help you initiate a claim with little paperwork in seconds.

Secondly, Lemonade rightfully calls its telematics algorithms proprietary. Aside from one other competitor (I think Root), all other telematics users pull from the exact same algorithm templates to power their offerings. That’s what Lemonade also used for version one of its product and has since moved to custom algorithms that have delivered large observed performance gains.

A better, perpetual telematics approach will, per the team, help Lemonade routinely undercut competition by 15% for 66% of customers and by 25% for 25 of them… in fewer than 15 minutes. It was quick to point out that Geico built an insurance empire on this marketing ploy.

How can it drive such powerful savings vs. the most competitive alternatives? Aside from all of the inherent cost edges we’ve already covered, its superior telematics software for this specific product is the secret weapon. Here’s how Lemonade puts it. The algorithms uncover the ⅔ of car policy holders that are paying too much and “subsidizing the other ⅓.” Legacy underwriting treats customers as far more monotonous than they truly are. Granular underwriting reveals their true risk and will tell Lemonade exactly who to pursue at industry-leading rates. Furthermore, retention rates for cross-sold car policy holders is 70% better with loss ratios 10 points lower. This merely feeds its ability to undercut other prices.

Over the next several years, if the company executes here, pulling away those over-payers will drag up the mean risk scores for incumbent insurance books. That will make average premiums for all others naturally rise and will create a larger pool of the market that Lemonade can undercut profitably. They didn’t mention this during the event, but to me this is intuitive.

All of this is exciting, but there’s still a lot to prove here. Lemonade needs to show the world that they can effectively underwrite car policies at scale in 2025. They’re very confident, and if they’re right about this, like they’ve been right about everything else, they’ll be right. A 700,000-person car insurance waitlist (wow) offers screaming evidence that they are. The existing customer cohort expressing rising interest in this offering will be the first to be pursued next year.

Synthetic Agents:

As a reminder, Lemonade uses General Catalyst (GC) to finance 80% of its external growth spend in exchange for a 16% share of premiums. This is in place until GC is repaid with interest within 3 years. This means Lemonade’s growth spend is not a cash drain, which is why cash flow margins lead income statement margins by such a large amount. For context, it’s already FCF positive as of this quarter, but over a year away from an expected EBITDA inflection. All of this was to lock-in sustainable balance sheet health while it remained deeply unprofitable and still needed to fund its growth. As leadership reminds us, other insurers use actual agents to bear the risk of pursuing growth and then they share premiums with those agents. Lemonade is doing something very similar, but with GC financing the growth.