Table of Contents

- 1. MongoDB (MDB) – Earnings Review

- 2. Airbnb (ABNB) — Investor Conference

- 3. Lululemon (LULU) — Earnings Review

- 4. Zscaler (ZS) – Earnings Review

- 5. Uber (UBER) – CFO Interview

1. MongoDB (MDB) – Earnings Review

MongoDB is a key player in data storage and analytics with a document-oriented setup. Last year, we dug into what this actually means. I think that’s an important read for those wanting to understand MongoDB. The piece can be found in section 3 of this article (mostly section 3 part e).

The firm’s most exciting product is called MongoDB Atlas. This is a cloud-native database service that implements a group of servers (or a cluster) to actually store data for app creation within its platform. The nature of MongoDB’s product allows clusters to be easily added to or subtracted for easier flexing up & down as needs fluctuate. It also offers MongoDB Realm as a mobile environment for app creation, MongoDB Stitch to build apps without servers or any needed infrastructure maintenance and MongoDB Search for data querying. Finally, it offers MongoDB Data Lake specifically for unstructured data, which directly competes with players like Snowflake.

Reminder:

Last quarter, the company shocked the street with sharp annual guidance misses. It pocketed $80 million in unused Atlas revenue and multi-year licensing business last year. That $80 million will not recur. That chunk was essentially pure margin, which makes the profit hit larger than demand. Keep this in mind as we go through its financials and why they look underwhelming.

MongoDB is a sandbagging king. It loves to aggressively lower the execution bar only to sharply beat that lowered bar. Most (including me) assumed that it did the same thing here. In my mind, this is why the annual guidance reduction (discussed later) was so harshly punished. The initial disappointment last quarter was related to strange, non-recurring items. This incremental guide down was related to core fundamental trends and so is more notable. Let’s dig in.

a. Demand

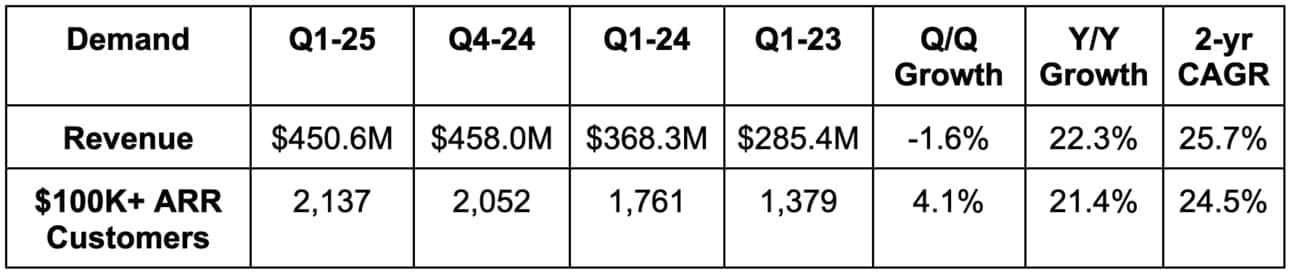

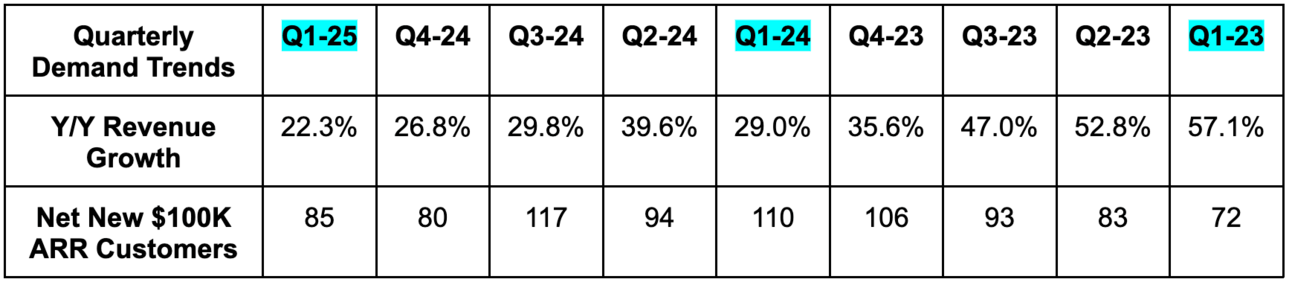

- Beat revenue estimates by 2.4% and beat guidance by 2.9%. Its 25.7% 2-year revenue CAGR compares to 38.1% Q/Q and 46.0% 2 quarters ago.

- Atlas is now 70% of total revenue vs. 65% Y/Y.

- Atlas customer count rose by 14.7% Y/Y.

b. Profits and Margins

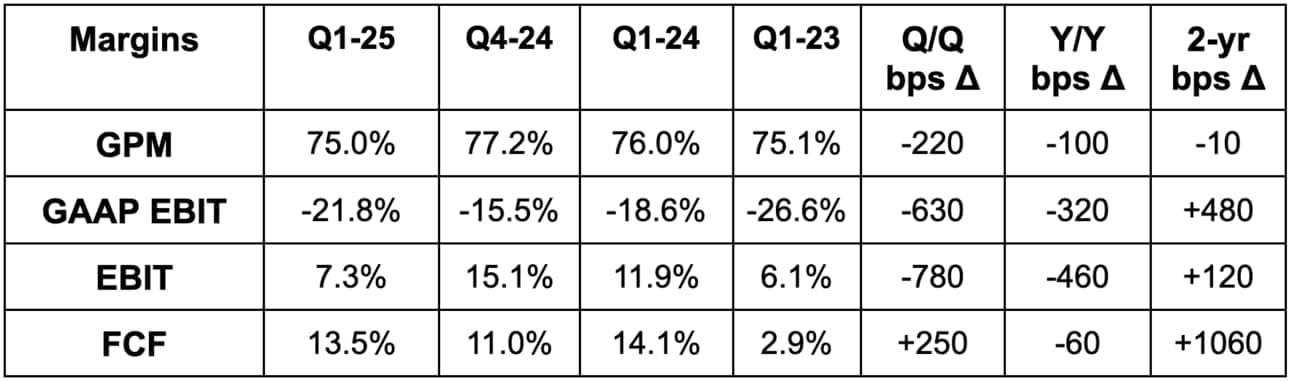

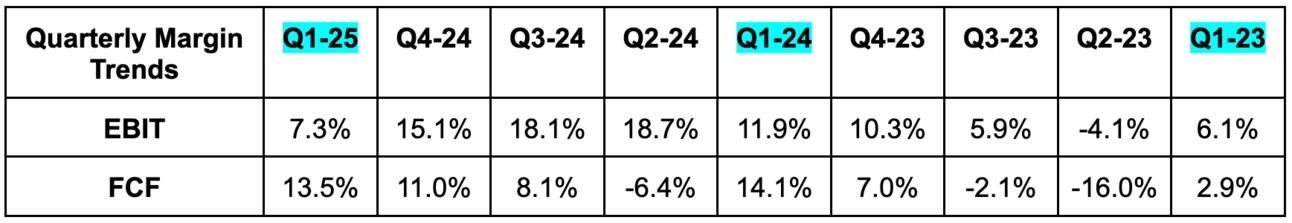

- Beat $25M EBIT estimate by $8M & beat guidance by $9M.

- Beat $0.37 EPS estimates & beat identical guidance by $0.14 each. EPS fell from $0.56 to $0.51 Y/Y.

- Beat free cash flow (FCF) estimates by 74%. FCF rose by 18% Y/Y.

Please note that Atlas proliferation drives gross profit margin (GPM) contraction. Its legacy on-premise business is higher margin.

c. Balance Sheet

- $2.1B in cash & equivalents.

- No traditional debt.

- $1.14B in senior notes.

- Diluted share count rose by 4% Y/Y.

d. Annual Guidance & Valuation

- Lowered annual revenue guidance by 1.3%, which missed by 2.6%.

- Lowered annual EBIT guidance by 9.3%, which missed by 11.7%.

- Lowered annual $2.38 EPS guidance by $0.16, which missed by $0.21.

- Lowered non-Atlas revenue growth due to a lower than expected large deal pipeline.

- Next Q missed across the board.

We’ll cover why that happened later in the article.

MDB trades for north of 100x this year’s earnings. Earnings are expected to shrink 32% Y/Y. When zooming out, it earned $0.81 per share two years ago. That represents a 2 year earnings CAGR from then to now of 67%. It way over-earned last year. Earnings growth should be around 35%-40% Y/Y next year.

e. Call & Release

Long Term Opportunity:

We’ll get into the temporary headwinds holding this business back, but the durable structural tailwinds for its niche remain firmly in place. Its document-oriented approach to data ingestion, organization and utilization is perfect in today’s world. It allows for more flexible onboarding of different, non-static formats to power easier cloud app creation. And now? In today’s multi-modal GenAI world, it thinks this flexible style of data ingestion will be perfect for powering GenAI-infused applications. Gen AI apps and models require the ability to query from a diverse set of data types. Models need to be trained and apps need to pull from these trained models. For this to happen, stakeholders need a database that supports diverse data ingestion and source code languages. That is what MongoDB provides.

Current Fundamental Weakness:

Again, MongoDB’s annual guidance offered last quarter was unanimously seen as overly conservative and intentionally sand-bagged by sell-siders. That is why its negative guidance revisions missed estimates by a materially larger margin than its own forecast. The actual quarter wasn’t the issue… the guide was the issue. It lowered a bar that many considered to be the “kitchen sink.” So what happened?

First, Atlas consumption trends were worse than expected. Recent cohorts expanded usage more slowly than expected. While this business model does benefit from subscriptions, consumption/usage swings in its products also can have material impacts on revenue generation. This was partially blamed on macro, while most other software names have said the same thing. The other factor was misplaced focus:

“While we acquired a record volume of workloads last year… we are now seeing those cohorts grow more slowly than expected. In the process of winning new workloads, we unintentionally lost some focus on workload growth potential. We've made adjustments in our processes and incentives to strike a better balance.” – CFO Michael Gordon

New workload acquisition trends were also worse than expected. Not ideal. Macro was blamed again, but MDB took some personal responsibility too. Like so many other companies (including Zscaler, which we’ll cover later in this article), it overhauled its go-to-market last year to focus on workloads with longer growth runways. It was able to address some of this weakness as the quarter progressed, but not all of it.

“New business performance for Q1 wasn’t up to our standards.”

CEO Dev Ittycheria

Slower new workload growth and workload expansion were the sources of the annual guidance reduction. That’s the bad news.

The good news is that retention rates are strong, competitive win rates are stable and it’s seeing progress in fixing sales processes. What do I think is happening here? I don’t think MongoDB is a bad company… far from it. I think its current revenue cycle timing is poor. Companies are racing to add GPU capacity, with hyperscalers enjoying faster growth as a result of this too. GenAI app creation and production is still in its infancy. The same is true for models to a lesser extent. The software boom from this GenAI boom has really not yet begun. MongoDB doesn’t benefit from massive GPU orders. MongoDB does benefit from added demand for data services and app creation. That part of the GenAI wave is coming… just not yet.

“We see a lot of experimentation, but we're not seeing AI apps in production at scale. And so I think that's the delta between the results the hyperscalers produce versus what we are seeing in our business.”

CEO Dev Ittycheria

Deal highlights for the quarter included:

Novo Nordisk is now using MDB Vector Search to accelerate drug discovery. This is shrinking drug report times from 12 weeks to 10 minutes. Vector search queries needed data to power broad app creation. It offers semantic search too, which allows clients to seamlessly scrape insight from data. It offers theme-and-idea-based querying rather than just word-based. It also provides retrieval-augmented generation (RAG). This pushes semantic search results into associated large language models (LLMs) to uplift querying precision.

2024 Priorities & Product Releases:

MongoDB is getting more proactive in nurturing channel partnerships. It finds “disproportionate returns” from winning the kinds of enterprise contracts that these relationships routinely provide. This quarter, it announced the MDB AI Applications Program (MAAP). This provides architectural templates and instructions (with a boatload of 3rd party integrations) to support GenAI app creation. Again, this is how the GPU goldrush will potentially benefit this specific business in the future. It wants that future to come sooner. Enter MAAP. Accenture is its first major system integrator partner in the program. That firm will create a “center of excellence” specifically for MongoDB app projects.

Broadly speaking, displacing legacy relational databases is MDB’s biggest opportunity. It’s great at automating the preparation and data movement of these antiquated products. It’s not great at rewriting application code as that data enters its ecosystem. It plans to lean into GenAI products to improve here. It thinks this will significantly diminish migration friction for new customers. Anything it can do to motivate experimentation with its document-style system should be great for this business, considering how much better this architecture works vs. older, archaic relational databases.

“We can use AI to meaningfully reduce time, cost and risk of modernizing legacy apps.”

CEO Dev Ittycheria

- MongoDB 8.0 was recently released as the latest version of its no standard query language (NoSQL) database system. This offers 60% performance boosts and better time series (timeline-based) data services.

- The company debuted Atlas Stream Processing. This allows for real-time data ingestion. That matters a lot for app developers who constantly toy with, split test and render every single little detail within their apps. Real-time access to data querying helps make that process more painless.

f. Take

This was not good. I think the weakness is somewhat understandable, given its business model and the current backdrop. But? This was still not good. The sources of the disappointment last quarter were a lot easier to digest than the issues cited this quarter. Still, MDB’s document-oriented niche is highly relevant and should find healthier overall growth as macro brightens. It’s easy to see how performance here could sharply improve, and that’s basically a requirement at this point based on the multiple you’re playing. I still view this as a high quality company. It’s just struggling a bit right now.

2. Airbnb (ABNB) — Investor Conference

The Opportunity for Growth:

A key theme of this chat was Airbnb’s conviction in the runway being very long… even for its existing travel marketplace product in its most mature markets. While brand awareness is sky-high, that’s merely step one. Step two is turning that grand awareness into purchase consideration, high engagement frequency and eventually more revenue per aware customer.

How do they drive this awareness? In a few places. First is listing quality. Some customers are uncomfortable with the idea of booking a vacation property based on a few pictures from a random host. Listing fraud, dishonesty and availability inaccuracies are all still somewhat prevalent issues. Staying in a Marriott hotel, where quality, amenities and experience are wildly consistent, is simply more appealing to some customers.

Airbnb cannot match that uniformity and does not want to match that uniformity. Listing uniqueness is a big part of its pull. Luckily, it doesn’t really need to. There’s no discernible difference between professional and individual host list ratings. That surprised me a bit. So? It can more intentionally and safely sift through poor quality and create groupings of its highest quality, top-rated listings. It’s doing just that.

Aside from making the core product better, expanding more deeply into its underpenetrated international markets is a focus. Germany was the example used, as Airbnb hasn’t quite nailed down the marketing playbook for that unique country. It thinks it’s figuring things out and, along with other nations like Brazil, is starting to see real fruits from this labor.

- Exploring bunched bookings for events like weddings to help facilitate reserving large batches of adjacent properties (like a hotel blocks off rooms).

- Debuted more communication tools within the app to help large groups collaborate on planning their next vacation.

- Recently leaned into Spanish-language marketing to bolster the already strong momentum it’s seeing in LatAm.

- There’s likely a paid loyalty program coming at some point. It will not look like the “pay for usage” model we see elsewhere. What will it look like? We shall see.

The last area for growth has been the most disappointing one to date. Airbnb Experiences attempts to match people with world-class talents or knowledge with guests to bestow this wisdom/skill upon them. This really hasn’t taken off much since the 2019 debut. In fairness, it did greatly pull back on efforts here throughout the pandemic, and now it’s ready to lean back in. It’s newest “Icons” product matches people with celebrities and majestic listings (many Disney-themed) to wow them. This is really for the most affluent Airbnb client, but expansion here should be rapid now that the team thinks it has nailed down the foundation. It has a $73 billion annual volume run rate with one product. There are so many more things Airbnb can do to match guests with compelling housing… but also so much more beyond housing. That opportunity is entirely ahead of the firm. Outside of Icons, Airbnb wants to do a better job with forecasting the timing of travel accommodation purchases. It wants to be a bigger piece of facilitating transportation, excursions and more.

Competition:

The team was asked about Vrbo competition. In the nicest way possible, they hinted at Vrbo being a pandemic darling. Its subscale nature means a lower-quality marketplace, while its larger professional host skew means fewer unique options. There’s little listing overlap and the strengths of Airbnb’s model have turned out to be more structural in nature than for Vrbo and other smaller competitors in the USA.

Demand Environment:

2024 is looking like the first “normal” year for Airbnb since the pandemic thus far. Leisure travel demand seems to be settling in after violent swings over the last 4 years. Still, there are some pandemic accelerants that don’t seem to be going away. Long-term and non-urban stays continue to index well above 2019 levels, and that seems to be more perpetual than most assumed.

Airbnb continues to see a somewhat price-sensitive consumer hunting for deals. This is why its commitment to listing price stability over the last several quarters has resonated so well. Its price increases are tracking well below hotel peers. This is also why its price transparency change and push for hosts to eliminate cleaning fees while driving affordability have been so popular. Most individual hosts simply don’t know what the optimal listing price is. Comparable pricing tools have helped a ton here.

As an interesting aside on pricing, Airbnb is working on helping its hosts to better understand market demand. It hinted at toying with dynamic features to automatically toggle prices based on demand levels. It’s a very similar concept to Uber and Lyft.

3. Lululemon (LULU) — Earnings Review

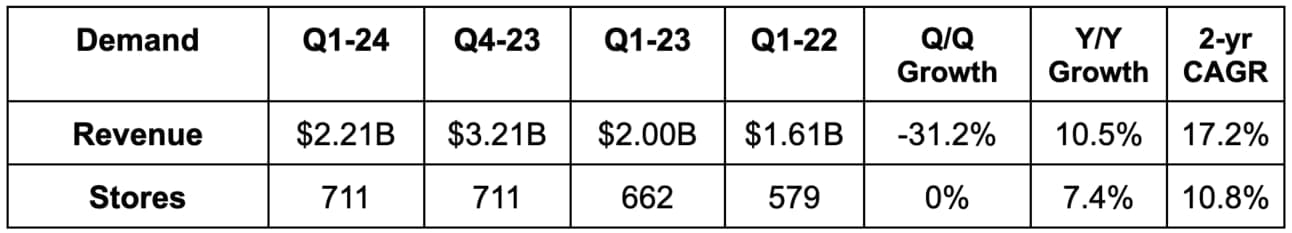

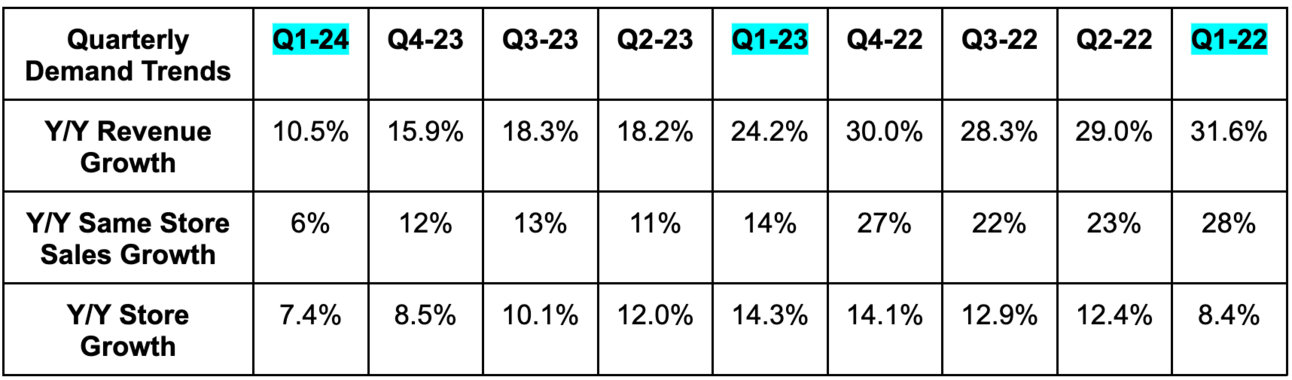

a. Demand

- Beat revenue estimates by 0.6% & beat its guidance by 1.0%.

- Accessories revenue actually found 2% Y/Y growth following historic 67% Y/Y growth in the Y/Y period.

- Foreign exchange neutral (FXN) revenue rose by 11% Y/Y.

- U.S. revenue growth was 2% Y/Y and in line with expectations. Growth was comfortably over 10% Y/Y in all other geographies.

b. Profits & Margins

- Slightly beat 57.6% GAAP gross profit margin estimates by 10 basis points (bps; 1 basis point = 0.01%).

- Beat EBIT estimates by 4.2%.

- Beat $2.40 GAAP EPS estimates by $0.14 & beat its GAAP EPS guidance by $0.16. EPS rose by 11.4% Y/Y. This was partially held back by a slight boost in Y/Y tax rate. It enjoyed fewer tax credits from stock compensation.