In case you missed it, I published my portfolio earnings season preview this week. That piece also included my updated holdings, performance and some more detail on this week’s digital advertising news.

I also published detailed Netflix and Taiwan Semi Earnings Reviews.

Table of Contents

- 1. Bank of America (BAC) – Earnings Snapshot & Cre …

- 2. Nvidia (NVDA) – China Trade War Chip

- 3. SoFi (SOFI) – Positive Capital Market Signal

- 4. Tesla (TSLA) – Production & Market Share News

- 5. Alphabet (GOOGL) – Miscellaneous News

- 6. DraftKings (DKNG) & Flutter (FLUT)– State Gambl …

- 7. Headlines

- 8. Macro

1. Bank of America (BAC) – Earnings Snapshot & Credit Data

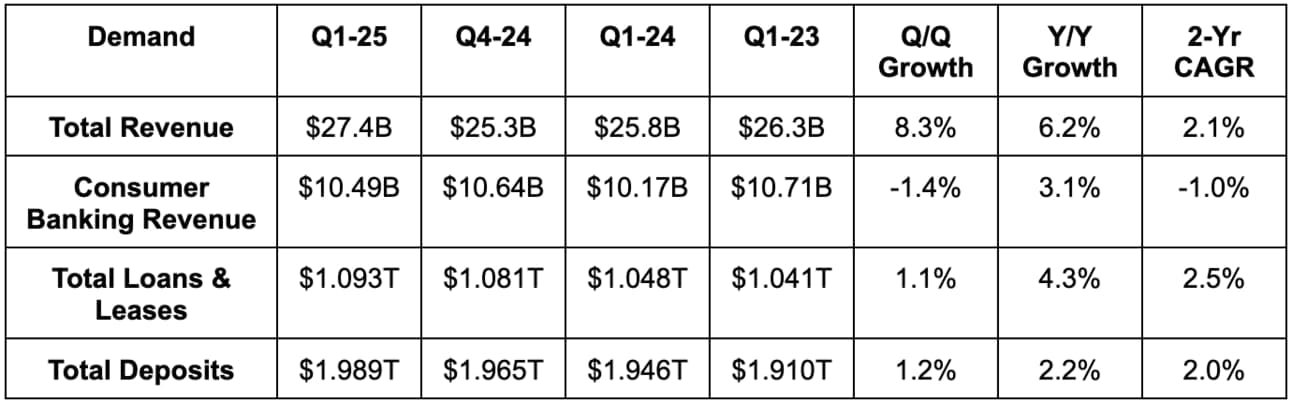

Demand:

- Bank of America beat revenue estimates by 1.7%. It also beat fully taxable equivalent (FTE) net interest income (NII) guidance by 0.3%.

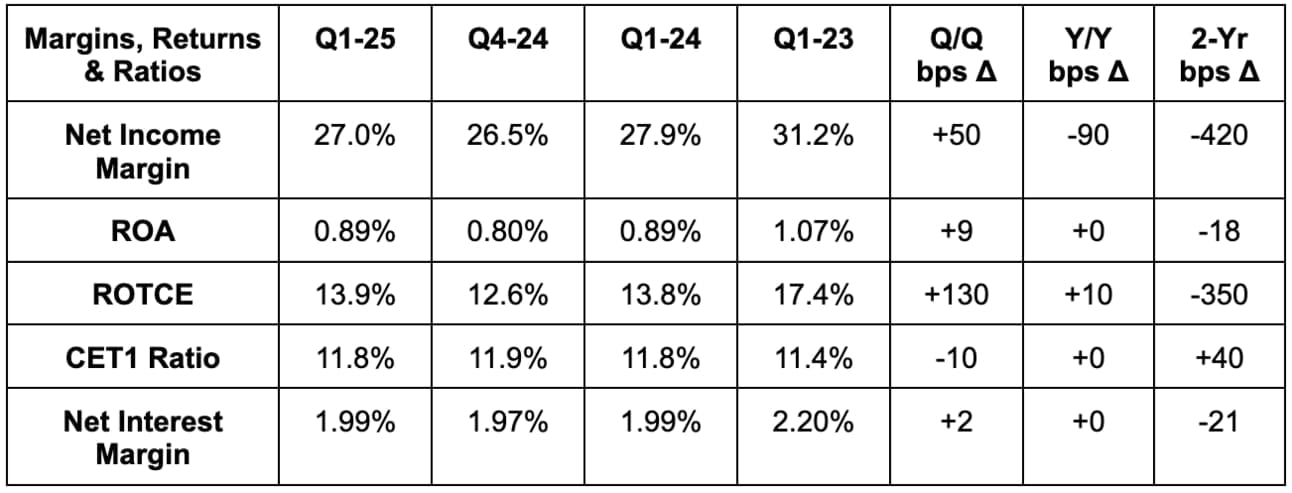

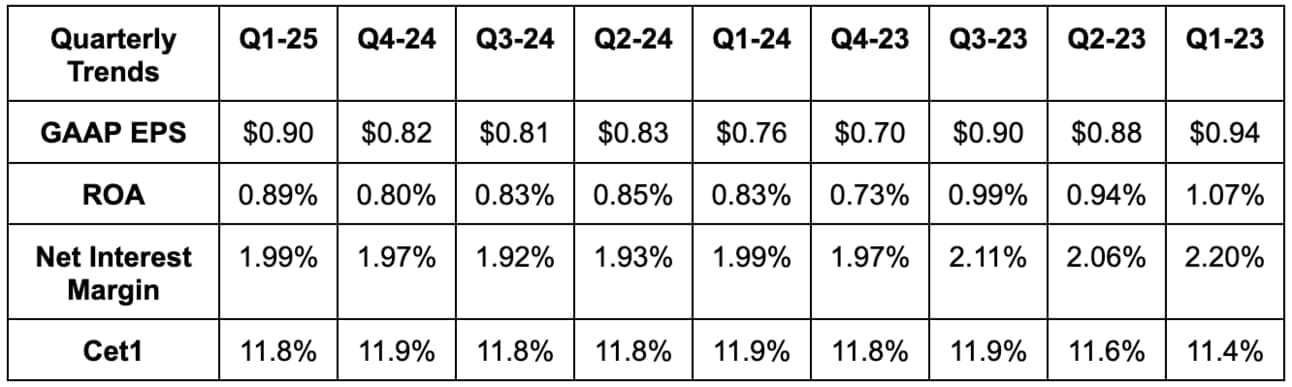

Margins, Returns & Capital Ratios:

- Bank of America beat $0.82 GAAP EPS estimates by $0.08. This is despite the non-interest expense of $17.8B vs. guidance of $17.6B. It met guidance calling for noninterest income expense leverage. and beat EPS estimates largely thanks to revenue outperformance.

- Delivered Y/Y sequential operating leverage as expected.

- Return metrics in the charts below are adjusted for special FDIC assessment.

- The regulatory minimum for BofA’s common equity tier 1 (CET1) ratio is 10.7%.

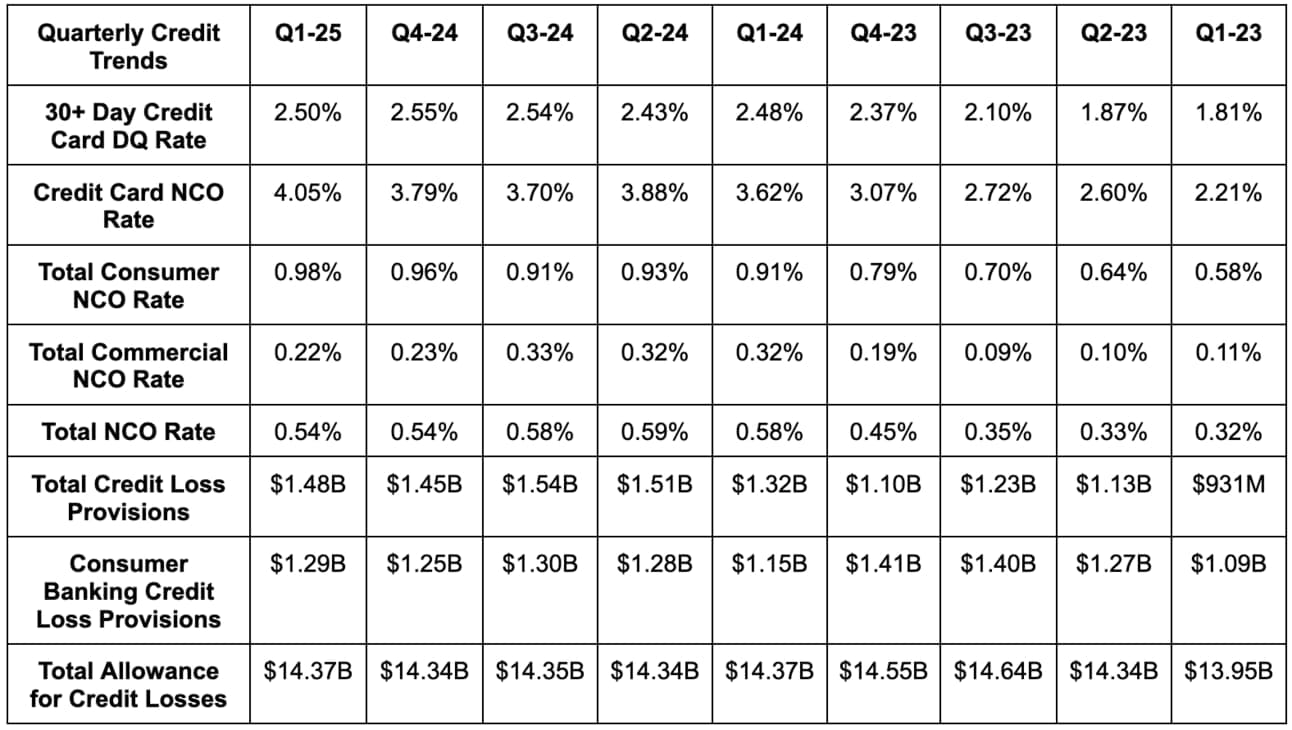

Quarterly Credit Data:

Needed Definitions:

- Delinquencies are loans that are past due by a number of days. Delinquency rates are the leading indicator for credit health.

- Net charge-offs are loans that a creditor decides won’t be repaid and will instead become losses. Net charge-off (NCO) rate is the percentage of loans classified as uncollectible. This is a lagging credit indicator compared to the leading delinquency indicator.

- Reserve levels refer to the amount of funds set aside to cover potential losses for the overall portfolio. Reserves and provisions (which are also for covering potential losses for specific types of credit) are tightly positively correlated.

- Higher expected delinquencies and NCOs contribute to reserve building.

- As reserves and provisions build, allowance for credit losses grows. This is the overall balance of funds to cover losses.

Brief commentary on the data below:

- Very similar to the data we saw from J.P. Morgan. Good to see delinquency (DQ) rate fall Q/Q and only rise modestly Y/Y.

- I’d love to see the credit card NCO rate stop rising. Its subprime exposure to this bucket is just 12% of total exposure, so this shows prime borrowers getting a tad more fragile. At the same time, Q1 sees seasonally higher NCO vs. Q4, and the Q/Q jump this year was smaller than last year, which is good news. And to make things even less concerning:

“Near term, we don't expect much change in net charge-offs, as you can see improvement in both early and late-stage delinquencies from the fourth quarter. That tells us that net charge-offs could even be a touch lower next quarter on the consumer side.”

CFO Alastair Borthwick

Considering commercial NCO is typically well below consumer for BofA, the shift to commercial loans since the Great Financial Crisis (GFC) puts it in much better shape to endure any economic downturn. Generally speaking, its non-performing loan (NPL) rate was 0.55% vs. 3.75% in Q4 2009, while NCOs are $1.5B today vs. $11B then.

Outlook:

Despite expectations for more rate cuts than it assumed 3 months ago, Bank of America reiterated a quarterly net interest income ramp to $15.6B by the end of the year. It continues to expect about 6.5% Y/Y net interest income growth.

Important Call Quotes:

“Our research team, led by Candace Browning, does not currently believe we'll see a recession in 2025. However, they've lowered their GDP growth rates for 2025 and continue to see no rate cuts during 2025. As inflation gets under control, they expect you may see them in 2026.”

CFO Alastair Borthwick

“Consumer spending has been consistently growing Y/Y. Last year, it slowed a bit and then picked up in the fall. That resulted in Q4 growth of around 4%. That pace has continued through the first part of April. We note that some retailers may say that their sales are slower and others are picking up, and it really reflects the change in consumer spending behavior. But in the aggregate, the consumer keeps pushing money into the economy.”

CFO Alastair Borthwick

“Heading into Q4 2027, our average credit card consumer FICO was 50 points lower than today.”

CFO Alastair Borthwick

“Our strong position allows us to better serve our clients in times of street, which may come ahead according to our projections.”

CEO Brian Moynihan

2.Nvidia (NVDA) – China Trade War Chip

The U.S. government is extending export bans for Nvidia. The Hopper 20 (H20) GPU that they purpose-built for that market is now banned for export. Whether we like it or not, Nvidia has the most valuable export this nation has to offer. They have the largest trade chip for this administration, and it looks like that chip will be used.

As part of the announcement, Nvidia took a $5.5 billion inventory charge, which will have a one-off impact on GAAP profits next quarter. In terms of the revenue hit, Q1 is already over. For Q2, China was set to represent about 10% of total Nvidia revenue, with the H20 likely a big piece of that. Nvidia will work to build new chips that are less powerful and eligible for eventual export, and trade developments are also highly fluid at the moment. Nvidia CEO Jensen Huang quickly flew to China to communicate his commitment to building those chips, which I found to be a bold move amid the geopolitical tension. With all of that said, I think it’s reasonable to assume this represents a high single-digit impact to Q2 revenue. The Q2 margin hit will be modestly smaller, as economies of scale for H20 are not as powerful as for its mainstream Hopper and Blackwell chips.

In other news, Nvidia committed $500 billion to build AI infrastructure in the USA and manufacture its supercomputers domestically.