Table of Contents

- 1. Earnings Round-Up – American Express (AXP) & In …

- 2. Nu (NU) – Mexico & Going Global

- 3. SoFi (SOFI) – Analyst Note & Quick Thoughts on …

- 4. PayPal (PYPL) – Venmo & Leadership

- 5. Meta (META) – Leaning In, Hardware, Databricks …

- 6. Headlines

- 7. Macro

I already published the detailed Netflix Earnings Review this week. Click here to read.

Next week, things will get wonderfully busy:

- Monday – SoFi Earnings Review

- Wednesday – Meta, Tesla & Starbucks Earnings Reviews

- Thursday – Microsoft & Apple Earnings Reviews

- Saturday – Intel, Visa, Mastercard & ServiceNow Earnings

Nearly 40 more earnings reviews will then be sent out in the weeks ahead.

The seasonal discounts for annual plans are ongoing. I take great pride in sending high-quality, data-driven, non-sensationalist coverage on every name in the coverage network. These articles are a labor of love… and I enjoy every second analyzing and writing them for you. If you’d like to vastly streamline the time it takes to keep with your holdings, subscribe here.

1. Earnings Round-Up – American Express (AXP) & Intuitive Surgical (ISRG)

As a reminder, earnings “reviews” are highly detailed. Earnings “round-ups” and “summaries” are 30,000 ft. views for companies outside of the core coverage network. For this specific round-up, the American Express piece is more detailed, as the commentary on credit and economic health is highly instructive for many other names.

a. American Express (AXP) – Earnings Summary:

Demand:

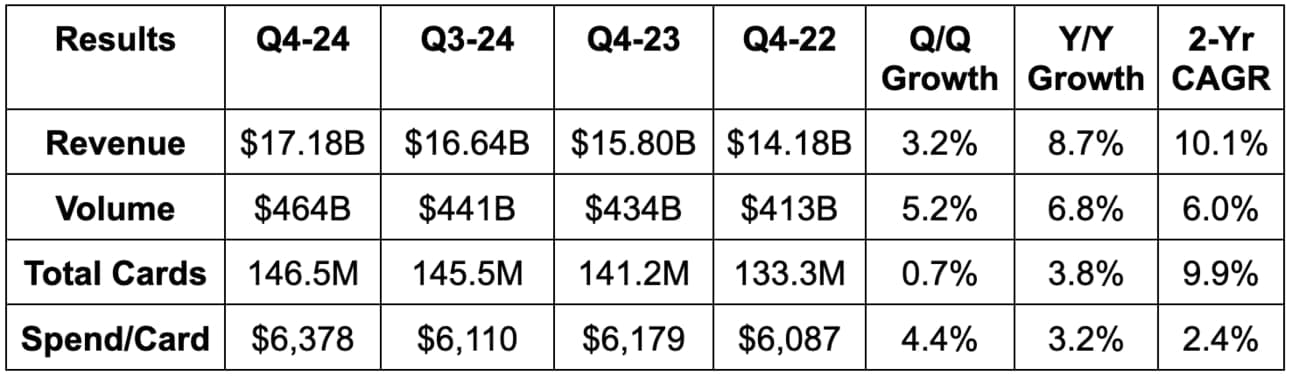

AXP met revenue estimates & roughly met its approximately 9% Y/Y growth guidance.

Profits, Margins & Returns:

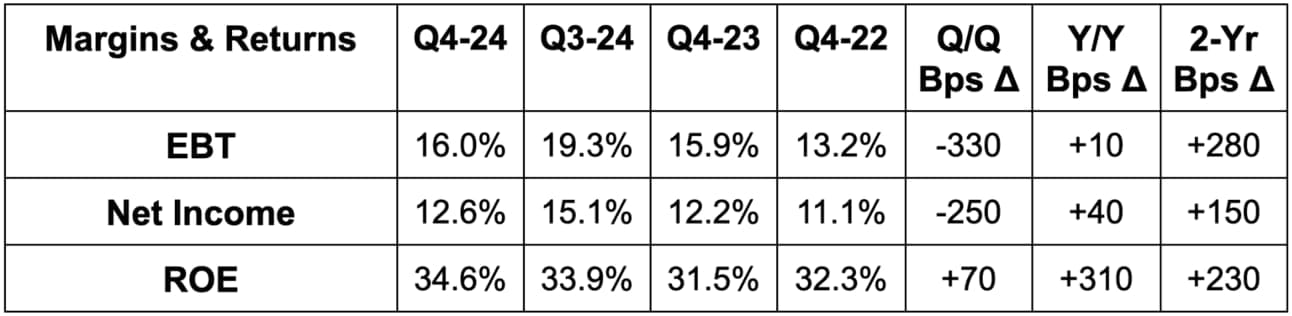

- Missed EBT estimates by 1.9%.

- Slightly beat $3.03 EPS estimates by a penny & beat guidance by $0.11.

- Beat return on equity (ROE) estimates comfortably (wide range of estimates from source to source).

Balance Sheet:

- $40.6 billion in cash & equivalents.

- $139.4 billion in customer deposits rose 8% Y/Y.

- $51 billion in total debt.

- Dividends rose by 17% Y/Y to $0.70 per share

- Diluted share count fell by 3% Y/Y.

Annual Guidance & Valuation:

- 9% revenue growth guidance beat 8.2% growth estimates. This represents a 0.7% beat in dollar terms.

- $15.25 GAAP EPS guidance missed $15.28 estimates by $0.03.

- Reiterated long term targets calling for 10%+ revenue growth and mid-teens EPS growth.

AXP is expected to compound EPS at an 11% clip for the next two years. I think estimates will be mostly stable following this report.

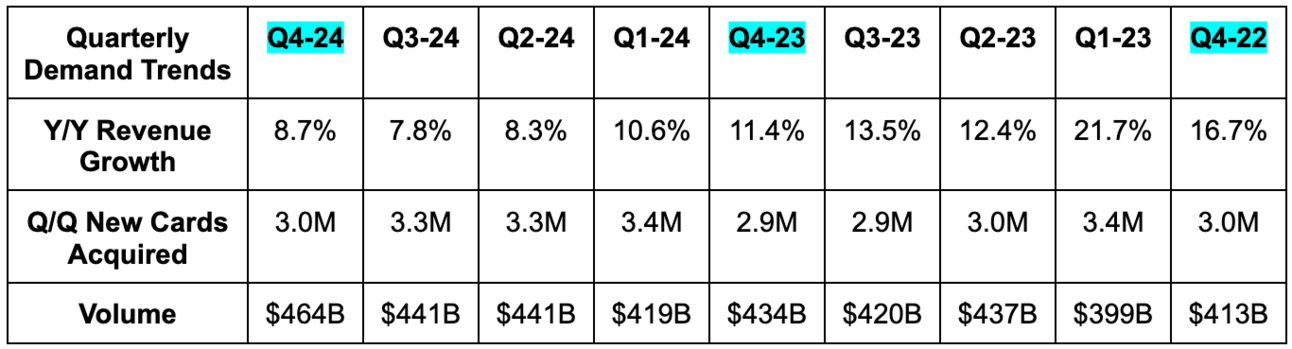

“For now, we're assuming 2025 billings growth will be similar to the full year 2024 number. However, if spend growth continues at the elevated Q4 level throughout this year, we would expect to come in at the higher end of our revenue range, all else being equal.

CEO Stephen Squeri

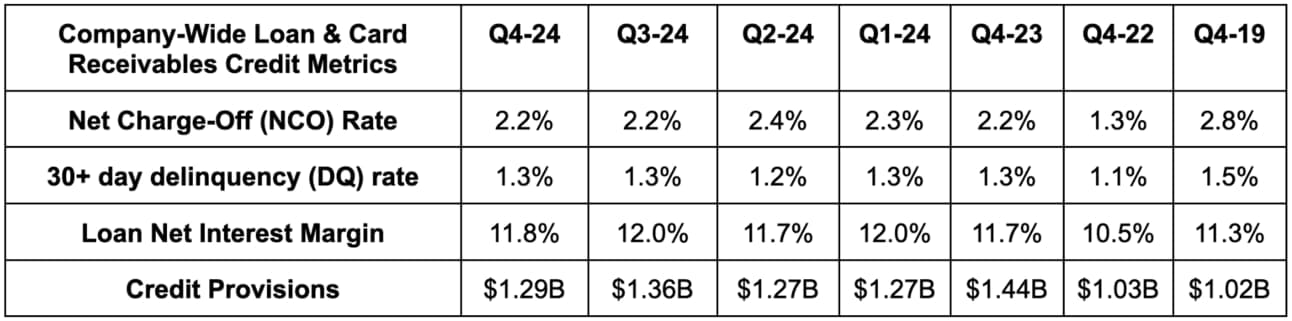

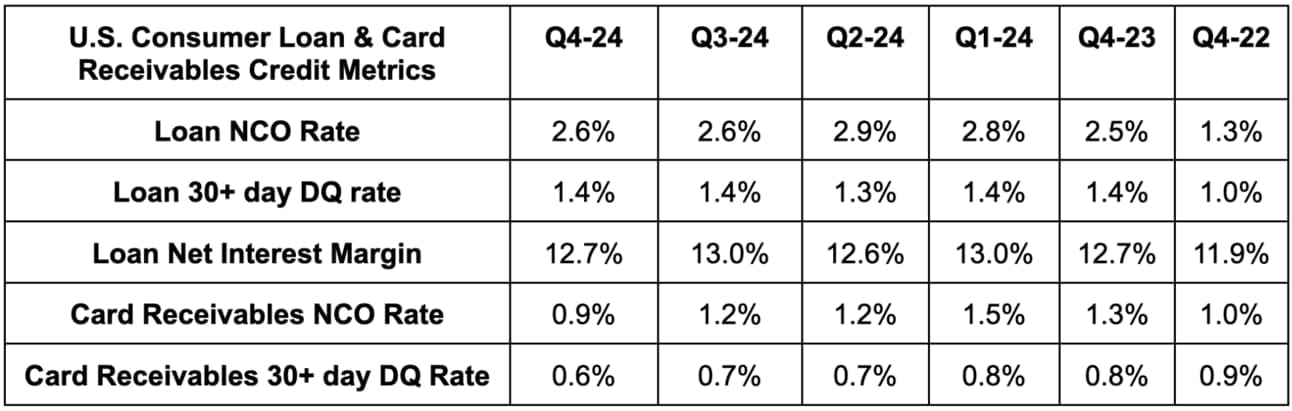

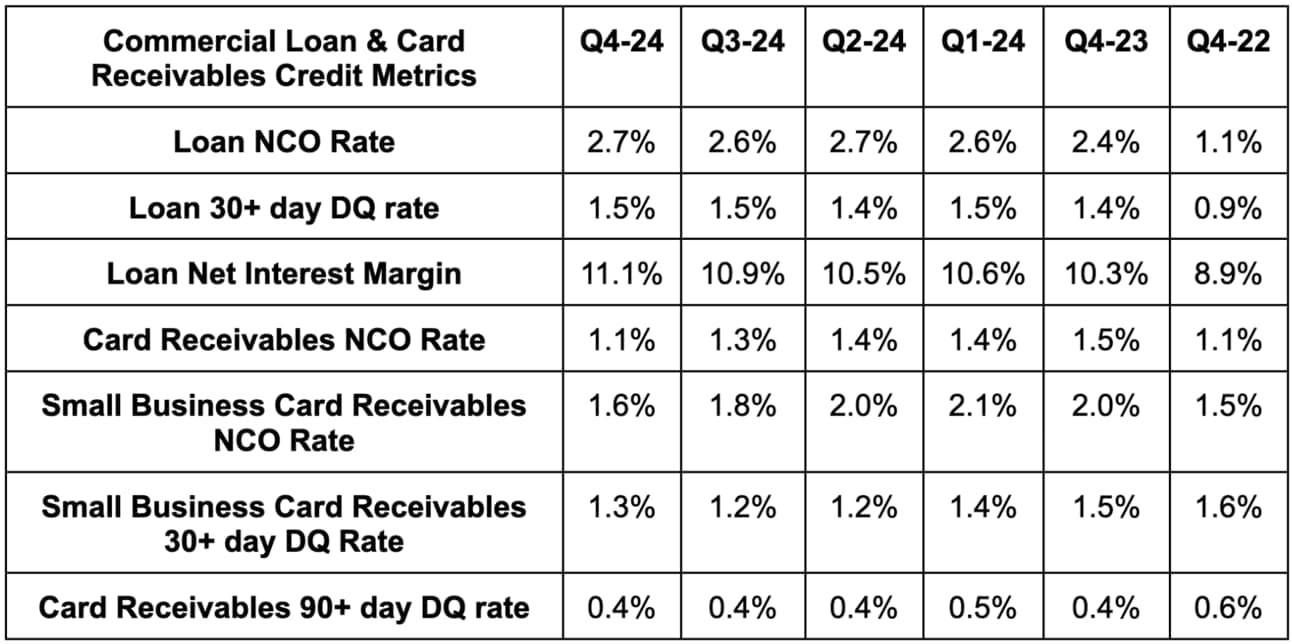

Credit & Economic Health Commentary:

“We exited the year with increased momentum… driven by stronger spending from our consumer and commercial customers during the holiday season. We maintained our best-in-class credit performance.”

CEO Stephen Squeri

“U.S. Consumer spend was up 9% year-over-year in the quarter as strong holiday spend drove momentum versus Q3… Notably, all generations saw an uptick in spend this quarter compared to Q3.”

CFO Christophe Le Caillec

“We continue to make strides in our International business… Q4 spend results were strong across our businesses, and we feel good about the spend acceleration we saw. While growth in Q1 will be impacted by the grow-over from leap year in 2024. So far, the first 3 weeks of January look more in line with Q4 trends.”

CFO Christophe Le Caillec

“We continued to see healthy loan growth and we achieved record net card fees. We achieved these results while maintaining our best-in-class credit performance.”

CFO Christophe Le Caillec

“We saw an improvement in small business sentiment in the fourth quarter, which linked to stronger organic spending by our small business customers through the holiday season.” –

CEO Stephen Squeri

Brief Thoughts:

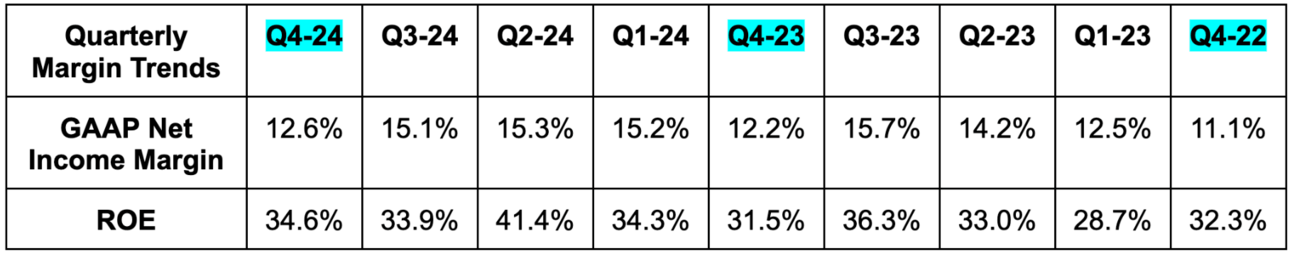

Credit thankfully looks as good as you would expect for a company that caters to highly affluent individuals like this one. It’s good to see both DQ and NCO rates for the company well below 2019 levels and good to hear their brightening point of view towards consumer and economic health entering 2025.

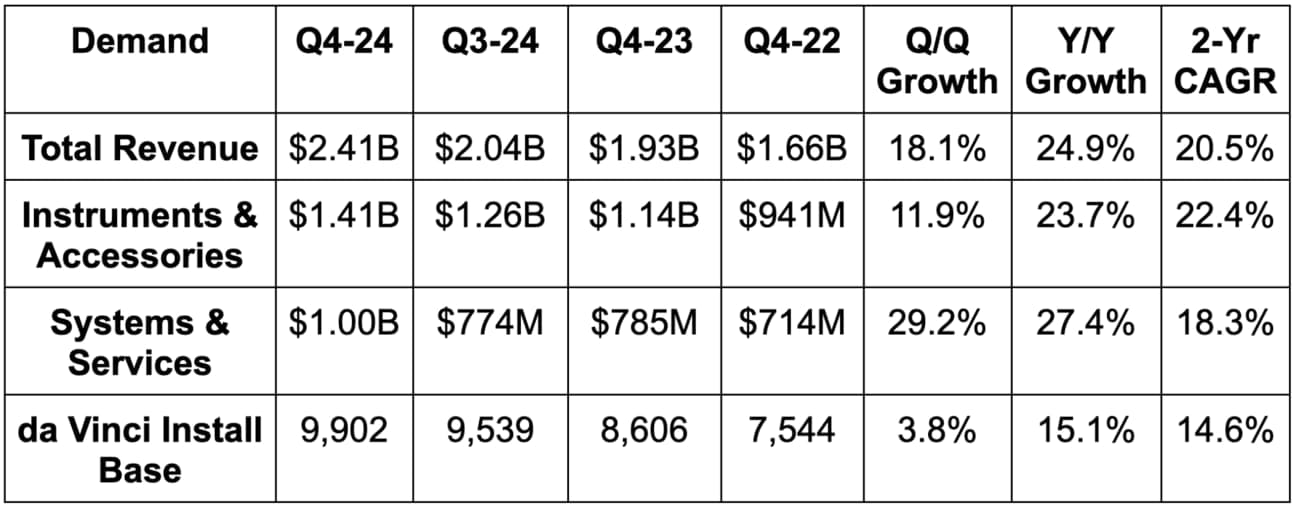

b. Intuitive Surgical (ISRG) – Earnings Summary

Intuitive Surgical creates robotics systems for various surgeries. Its first system (now on version 5) is called da Vinci and features robotic arms and tools for general surgeries. Its newer system, called Ion, is more purpose-built for lung procedures.

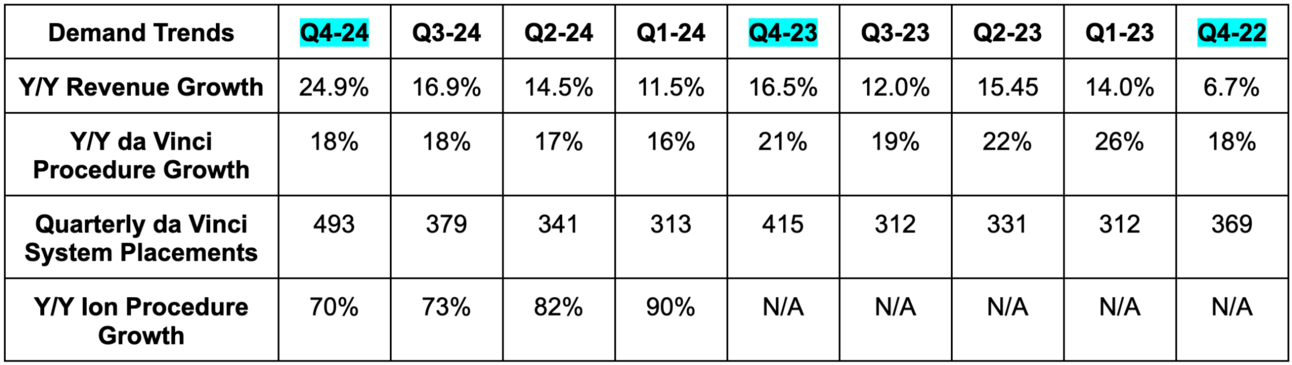

Demand:

ISRG provided preliminary guidance on January 15th, which called for about $2.41 billion in quarterly revenue, which it met. Analyst estimates only moved from $2.20 billion to $2.24 billion following the news, so this was still a beat. ISRG also guided to 18% Y/Y procedure growth, which it met. ISRG sells both the machine and consumables and the more surgeries performed, the higher the revenue.

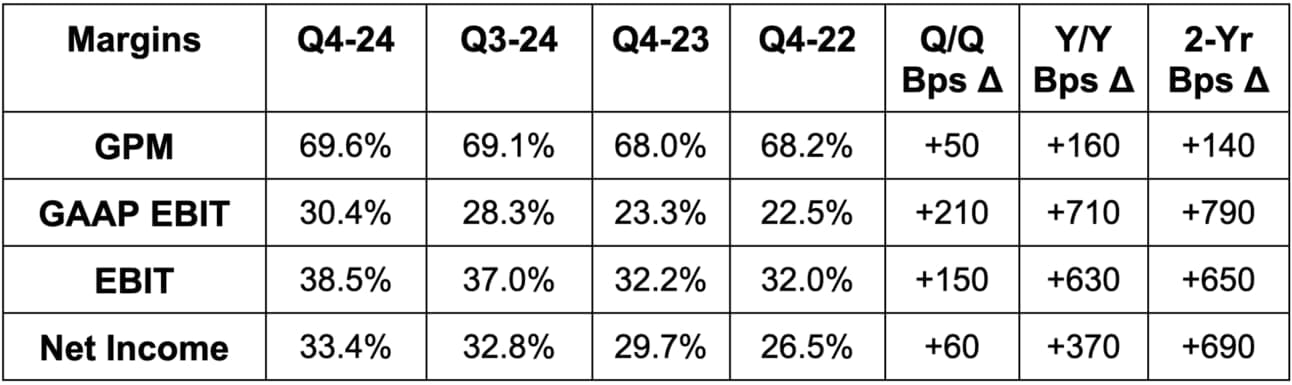

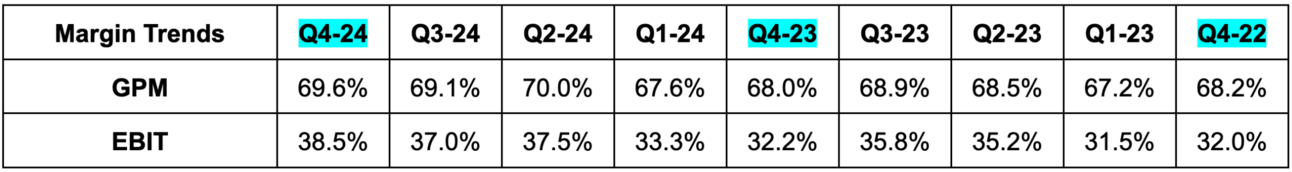

Profits & Margins:

The only items in the pre-announcement were demand related.

- Beat 68.7% GPM estimate by 90 bps.

- Beat EBIT estimates by 23%.

- Beat $1.79 EPS estimates by $0.42 or 23%.

Balance Sheet:

- $8.8B in cash & equivalents. Inventory rose 22% Y/Y to $1.49B.

- No debt. Diluted share count rose 1.5% Y/Y.

Annual Guidance & Valuation:

ISRG reiterated the same 2025 guidance that it provided in its preliminary earnings release. It expects 14.5% Y/Y procedure growth for da Vinci vs. about 15% to 16% growth expected by analysts (depending on the source). ISRG is a consistent guidance sandbagger – especially when offering new annual guidance. Systems revenue is expected to rise due to a mix shift away from leased machines to outright purchased machines, while average selling price is also expected to rise Y/Y.

It also expects a 67.5% GPM, which missed 68.3% estimates. Tariffs, which weren’t included in guidance, could negatively impact GPM. Finally, it expects about 12.5% Y/Y operating expense growth vs. about 10% growth in 2024. Based on current estimates, analysts expect 16% EPS compounding over the next two years. I think profit estimates will slightly decline following this report.

2. Nu (NU) – Mexico & Going Global

a. Mexico

5 years into Nu’s Mexico entrance, the company has now crossed 10 million customers while maintaining 100% Y/Y growth. We’re spoiled by the consistent financial performance this company churns out, which can lead investors (myself included) to take for granted wildly impressive, scaled growth like this. For context, SoFi’s business is one of the most (if not the most) impressive member growth stories for banks in the USA. And? At a similar scale to Nu Mexico, it’s sporting 35% Y/Y customer growth. These markets are not apples-to-apples; competition in Latin America is surely less intense than in the USA and the financial service opportunities are far less established. But regardless, Nu truly is one of a kind.

In just 5 years, Nu has racked up a 12% population market share and a 23% share of adults with bank accounts in Mexico. While that’s impressive, the runway remains extremely long. As of now, 42% of Mexicans still have no access to financial services compared to about 3% in Brazil, per Fiserv. Furthermore, credit card penetration rate in Mexico is 12% vs. 50% in Brazil. Despite this, GDP per Capita is HIGHER in Mexico than it is in Brazil by about 30% while Mexican smartphone adoption rate is somewhere between 60%-80%, which is comparable to Brazil. It’s also similar to other nations like Poland and South Africa with far higher financial service adoption rates.

Usage of cash is much more popular in Mexico vs. Brazil, which means that the cash displacement opportunity is commensurately larger. To account for this, Nu has successfully grown its Mexicann brick and mortar cash withdrawal and deposit locations (through partners) to 30,000. While this isn’t its most exciting product there, it does ensure that Nu can work with customers who are very early on in their product journeys. That should engender loyalty and customer stickiness. It also positions Nu to cross-sell its other products (savings accounts, credit cards etc.) with little incremental cost. Nu has presence in 98% of municipalities there, including many without any traditional bank branches. This inherently gives Nu a leg up vs. all legacy competition and allows it to serve consumers that others can’t even reach.

All of this says that Mexicans boast serious potential, while having the level of affluence and technological modernization needed for this to be a massive growth market in the years to come. And Nu clearly has the products, brand and momentum to capture this opportunity. Recall that a few quarters ago, Nu shared an update on Mexico progress vs. Brazil the same number of years into operations. It’s promising to see this market taking off even more quickly than its home nation did.

Cost of funding and operating in Mexico is currently higher than Brazil, so growth here is currently a margin headwind. For context, it’s at a roughly 40% return on equity in Brazil and in the high 20% range for the company as a whole. I think all of this data shows us exactly why this is a concession Nu is eager to make. Mexico is rapidly morphing into another Brazil; I expect it to keep rapidly scaling with improving margins and rising economies of scale. Front-loading investments to ensure you take a large piece of the pie makes perfect sense.

As time passes… it is becoming glaringly obvious that the Mexican banking modernization opportunity will be dominated by two players: MercadoLibre… and Nu.

b. Going Global

In other international news, Nu seems to be nearing more global expansion. Leadership has been adamant that Brazil, Mexico and Colombia are simply their first three of many more markets to come. News this week points to the next expansion markets soon being announced.

In an interview with Reuters this week, Co-Founder/CEO David Vélez revealed that Nu is considering moving its business headquarters to the United Kingdom. This move could enable easier international expansion, as the UK's governing bodies will require regulatory compliance that mirrors countries across Europe and North America more closely than Brazil. It would also give Nu access to a lot more quality talent in that nation and neighboring countries.

As part of the Reuters interview, Vélez confirmed that this is meant to position Nu for global expansion beyond its first three (of many) countries in the not-too-distant future. Specifically, investors were told to expect more market debuts within the next two years. When asked which ones, he poured cold water over European expansion and said the UK news is solely based on compliance and talent. There are no plans to expand in Europe for now. Conversely, when asked about the USA, he didn’t push back at all and said this:

“When a U.S. administration suddenly sees fintech as being good for consumers and more competition, that makes it more attractive."

Co-Founder/CEO David Vélez

In light of the $150 million investment in Singapore-based Tyme Group, I think Southeast Asia and more Latin American countries (hopefully Argentina soon) are the other most likely areas of footprint expansion. Nu thrives by offering vastly broader financial inclusion with less predatory and expensive products than consumers have available in its 3 Latin American markets. There are many, many more consumers across the globe that this value proposition should resonate with. Even in the USA, there are still nearly 50 million under-banked Americans. And while I think the competitive landscape and relative efficiency in the USA will make it harder to win here, Nu seems determined to give it a go. I wouldn’t bet against them, but regardless of whether an American initiative works, I think success across the rest of Latin America and other parts of the world is quite likely.

It has already clearly already demonstrated that its model works outside of Brazil in the compelling Mexican and Colombian markets. I realize these are all Latin American countries, but the cultural, economic and lifestyle differences between the three are quite stark when compared to the USA vs. Canada for example. Nu winning across Latin America tells me that it can win in most places.