Table of Contents

- 1. Amazon (AMZN) – Prime Day/Week, CrowdStrike (CR …

- 2. Alphabet (GOOGL) – AI Data & More

- 3. Big Bank & Credit Earnings – Bank of America (B …

- 4. Uber (UBER) – More Autonomous Vehicle (AV) Part …

- 5. Mercado Libre (MELI) – Argentina

- 6. Meta (META) – AI Models & Control

- 7. DraftKings (DKNG) – Prediction Markets

- 8. SoFi (SOFI) – Student Loans

- 9. Analyst Updates

- 10. Macro

A lot of this week’s content was already sent:

- Detailed Netflix & Taiwan Semiconductor earnings reviews.

- My current portfolio & performance vs. the S&P 500.

- My quick conversation on new JP Morgan data fees with PayPal leadership.

- Weekly podcast with StockMktNewz & FutureInvesting. This episode’s theme was when to trim/sell.

1. Amazon (AMZN) – Prime Day/Week, CrowdStrike (CRWD) & More

a. Amazon – Prime Days

Amazon told the public that the 4-day Prime event surpassed any 4-day period in its history that included a shopping event. I’d hope so. This is the first time they’ve extended this event from 2 to 4 days, so not surpassing previous records would have been significantly concerning. Good to hear that didn’t happen. Perhaps more importantly, Adobe reported 30.3% e-commerce industry growth over that period of time, which is materially better than its 28.4% estimate. Considering Amazon owns nearly half of the U.S. ecommerce market and consistently takes market share, it’s reasonable to assume outperformance for everyone likely means solid results for Amazon as well. EPS estimates for 2025 have ever-so-slightly ticked higher since the event, but candidly, we could call that positive movement a rounding error.

b. CrowdStrike

CrowdStrike added its Falcon Model Context Protocol (MCP) and CrowdStrike AI Red Team (managed security help) to its AI Agents and tools offering on the AWS marketplace. AWS was the first channel partner to deliver more than $1B in cumulative sales to CrowdStrike, and this should simply bolster that momentum.

- Amazon is eliminating some AWS jobs. AI continues to shift and, in some cases, reduce talent needs.

- Amazon debuted Kiro as a new integrated development environment (IDE) for software package creation. This makes work more conversational and multi-modal (with both text and image-based inputs). It features a host of agents to automate testing and performance optimization to emulate “having an experienced developer constantly reviewing your work.”

2. Alphabet (GOOGL) – AI Data & More

Ben Thompson (@benthompson) wrote a great article this week and I wanted to paraphrase the key point. Cloudflare’s AI crawler blocking practices help companies safeguard data from large language models (LLM) and agent data scraping. Alphabet uses its own crawler (Googlebot) for AI Mode and AI Overviews. So? If a merchant wants distribution on Alphabet’s properties, they must grant access to Googlebot. This means most agents and models don’t have access to about a fifth of the world’s internet traffic – but Alphabet does. This should deepen its data advantage vs. the field. Apps/models are only as good as the data they can use. And considering it already has distribution to 2B people for 6 products, this will merely extend its already large lead.

- Waymo is greatly expanding its Austin service coverage through Uber.

- In addition to Azure and Oracle, OpenAI will begin using Google Cloud for some ChatGPT workloads.

- Alphabet will potentially offer a slimmed-down version of YouTube in Korea to appease regulators and overcome antitrust issues. This won’t include YouTube Music.

3. Big Bank & Credit Earnings – Bank of America (BAC), JP Morgan (JPM) , American Express (AXP) etc.

a. Bank of America (BAC)

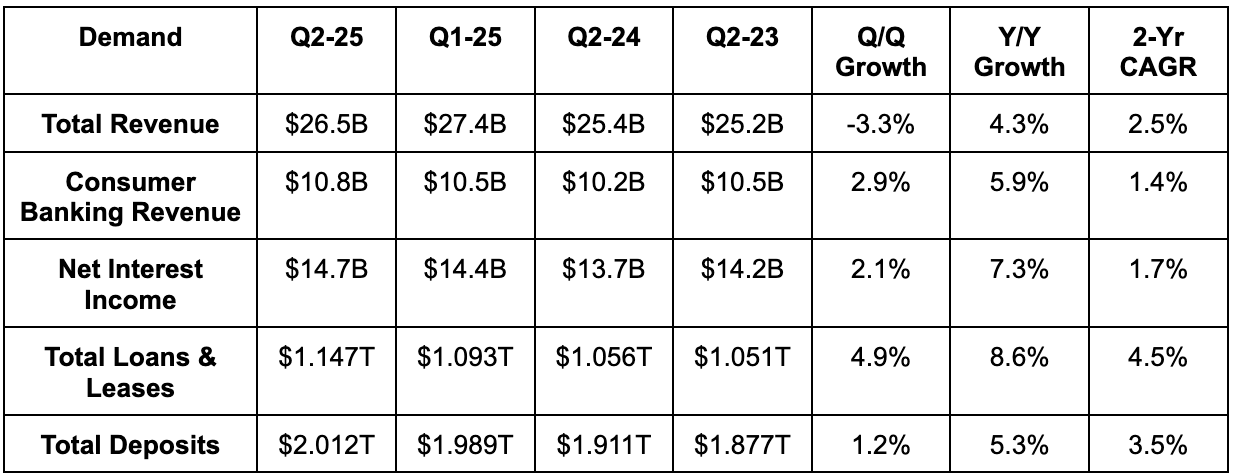

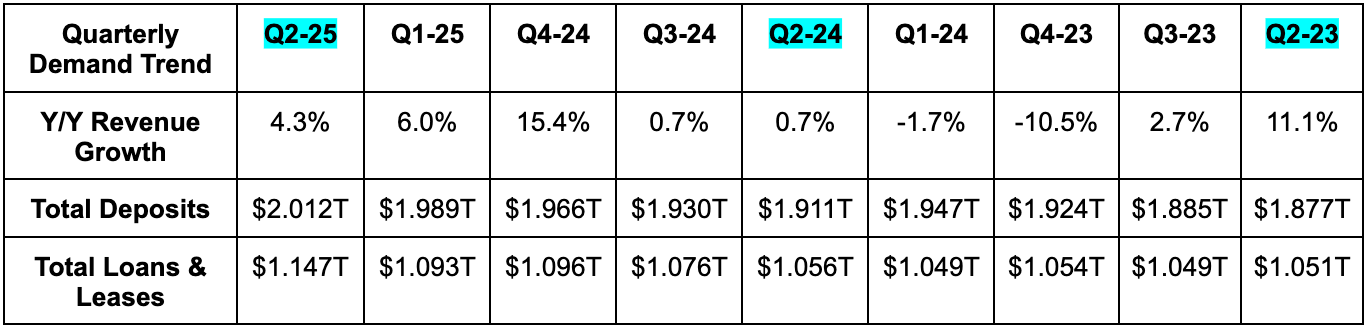

Demand:

Bank of America missed revenue estimates by 1%.

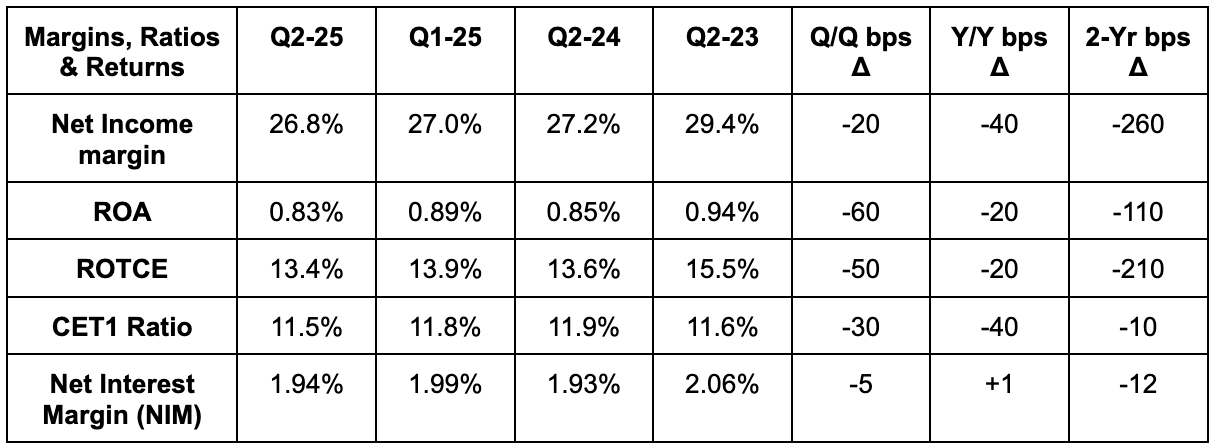

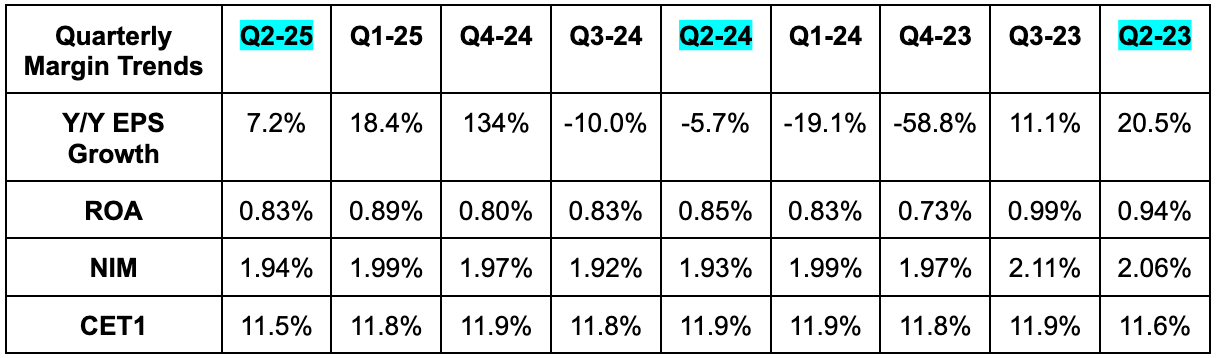

Margins, Returns & Capital Ratios:

The company beat $0.86 EPS estimates by $0.03. Outperformance in lending and asset trading drove the beat.

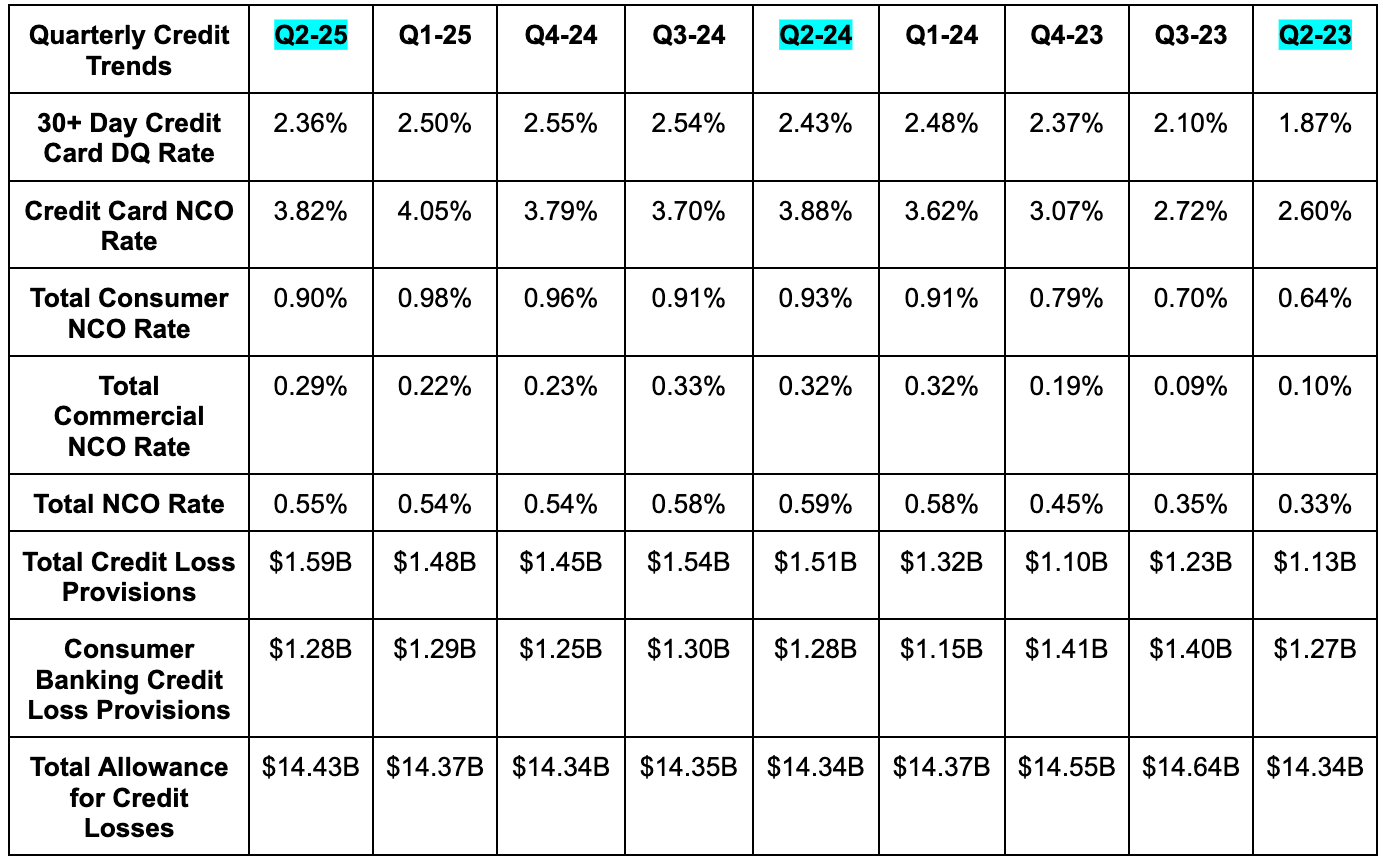

Needed Credit Definitions:

- Delinquencies are loans that are past due by a number of days. Delinquency rates are the leading indicator for credit health.

- Net charge-offs are loans that a creditor decides won’t be repaid and will instead become losses. Net charge-off (NCO) rate is the percentage of loans classified as uncollectible. This is a lagging credit indicator compared to the leading delinquency indicator.

- Reserve levels refer to the amount of funds set aside to cover potential losses for the overall portfolio. Reserves and provisions (which are also for covering potential losses for specific types of credit) are tightly positively correlated.

- Higher expected delinquencies and NCOs contribute to reserve building.

- As reserves and provisions build, allowance for credit losses grows. This is the overall balance of funds to cover losses.

Commentary on the Credit Data Below:

- Strong credit card delinquency and net charge-off (NCO) data bodes well for today and next quarter.

- Good to see consumer and commercial NCO rates both fall Y/Y. They don’t seem concerned about the modest Q/Q uptick in commercial NCO rate.

- Continued stabilization in total credit loss provisions.

Outlook & Valuation:

Bank of America continues to expect quarterly net interest income to ramp to $15.6B by the end of the year and about 6.5% Y/Y net interest income growth.

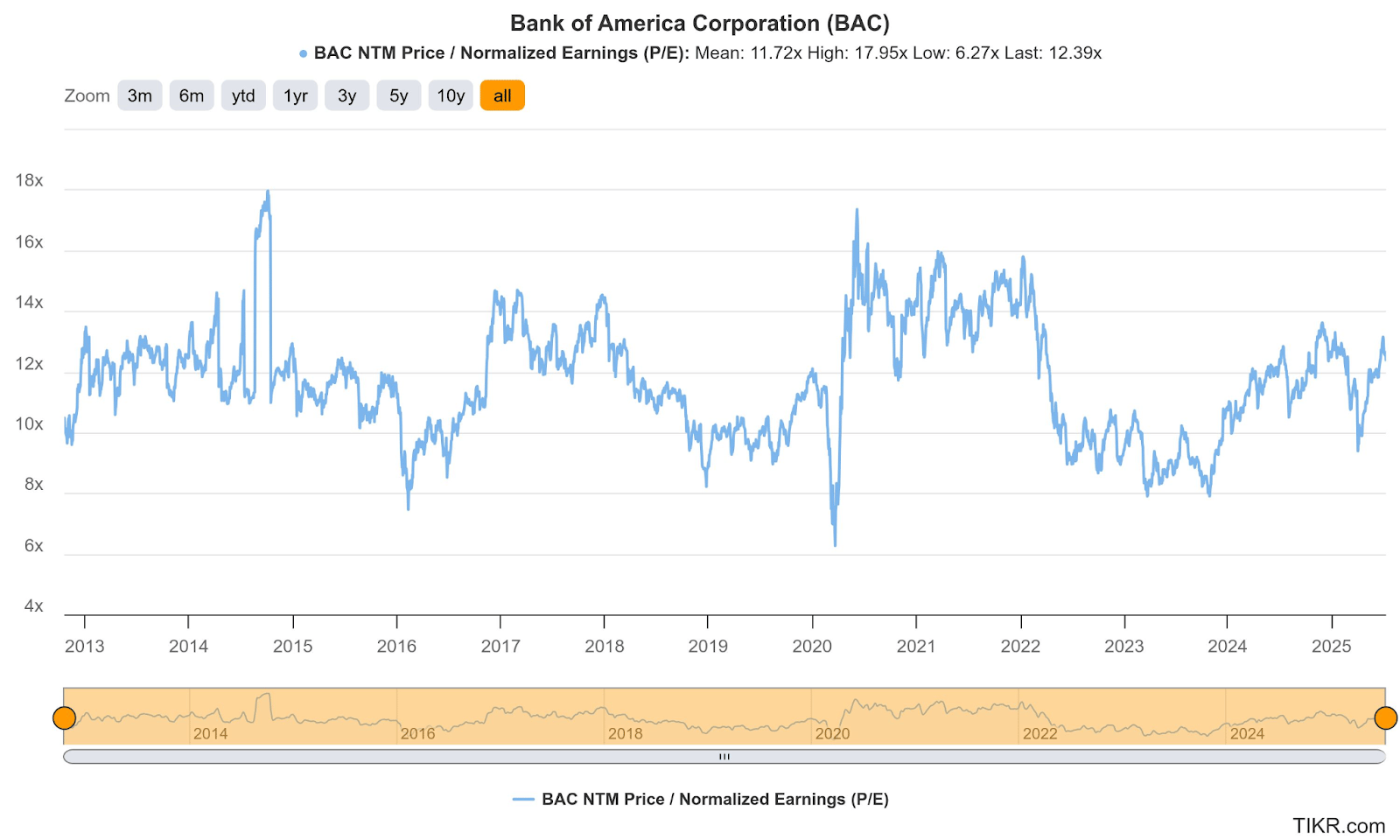

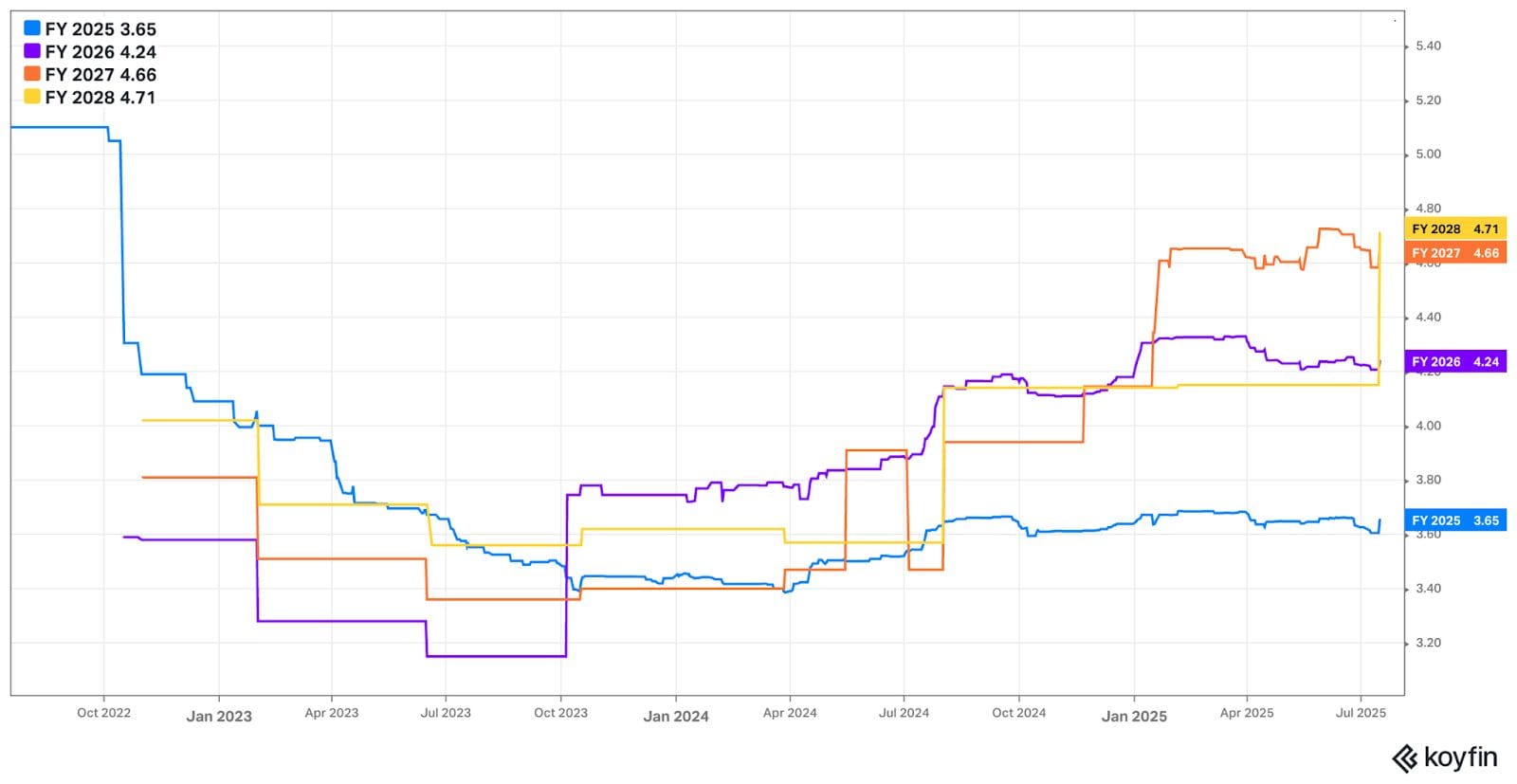

The company trades for 12x forward EPS. EPS is expected to grow by 14% this year and by 16% the following year.

Important Call Commentary:

“We continue to see a solid consumer spending data, improving credit quality from already strong statistics and plenty of household net worth growth… that leads our worldwide leading research team to continue to predict no recession, a modestly growing economy about 1.5% at the end of the year and continued no Fed rate cuts till next year.”

CEO Brian Moynihan

“Focusing on total net charge-offs again and looking forward, in the near term, we would not expect much change in the total net charge-off ratio given the steadiness of consumer delinquencies, stability of C&I and the reductions in our CRE office exposures.”

CFO Alastair Borthwick