In case you missed it:

- SentinelOne, Oracle & Block Earnings Reviews from Wednesday.

- Latest Portfolio & Performance Update from Thursday

- 30+ earnings reviews on the Mag 7, Uber, Snowflake, Mercado Libre, The Trade Desk, Cloudflare & so many more from this season.

Table of Contents

- 1. Adobe (ADBE) – Earnings Review

- 2. ServiceNow (NOW) – M&A

- 3. DraftKings (DKNG) – Prediction Markets

- 4. Alphabet (GOOGL) – Gemma

- 5. Contextualized Headlines

- 6. Macro

1. Adobe (ADBE) – Earnings Review

a. Adobe 101

Adobe is a software giant that invented the .pdf file (co-founder John Warnock specifically). It provides programs to create and imagine, handle customer interactions and process documents. Company revenue is split into two main buckets: Digital Media and Digital Experiences. Digital Media is made up of its “Creative Cloud” and “Document Cloud.” The Creative Cloud includes Photoshop and Illustrator. It’s what empowers creation, iteration and perfection of digital design. The Document Cloud, including the ubiquitous Adobe Acrobat, allows for secure PDF (Personal Document Format) management and collaboration – among other things.

Finally, its Experience Cloud includes Adobe Analytics and other products like “Campaign.” Campaign is its (intuitively-named) marketing campaign tool. Experience Cloud covers end-to-end customer interactions with a real-time customer data platform (CDP), ensuring that those interactions are optimized. It also publishes some greatly appreciated macro data on overall commerce spend.

b. Key Points

- Fine quarter and reiterated guidance.

- Strong AI adoption with monetization still ramping.

- Reorganized revenue buckets to better reflect growth drivers.

c. Demand

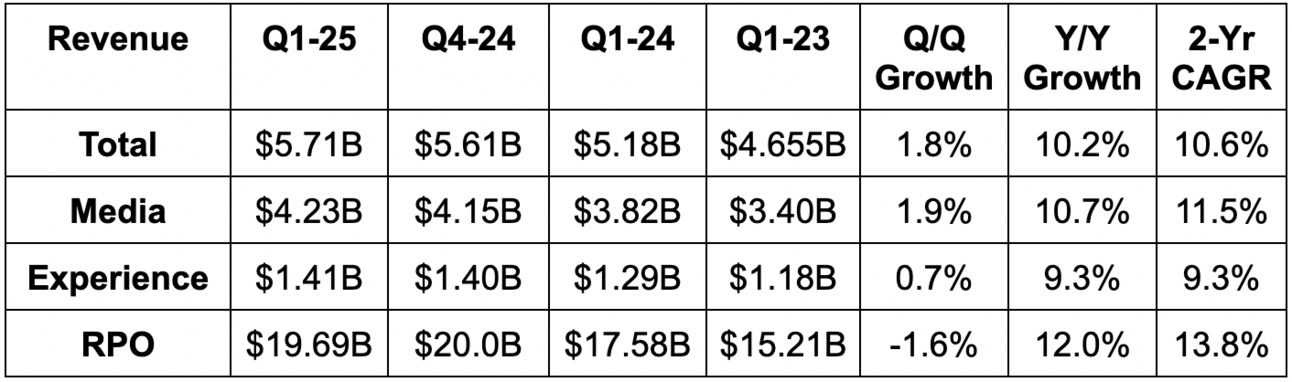

- Beat revenue estimates by 0.9% & beat guidance by 1.2%.

- 11% Y/Y foreign exchange neutral (FXN) revenue growth missed 12% FXN growth estimates.

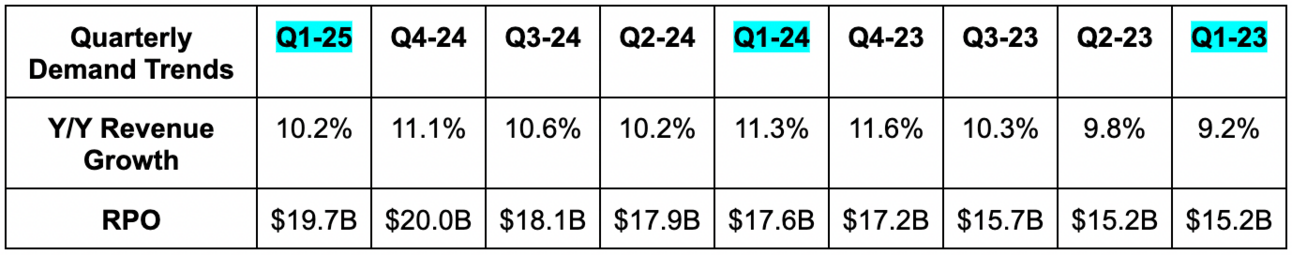

- Adobe’s 10.6% 2-year revenue compounded annual growth rate (CAGR) compares to 11.3% Q/Q & 10.4% 2 quarters ago.

- Beat digital media revenue estimates by 1% & beat guidance by 1.0%.

- Digital media annual recurring revenue (ARR) met estimates.

- Beat digital experience revenue estimates by 0.7% & beat guidance by 1.4%.

- Missed remaining performance obligation (RPO) estimates by 0.6%.

d. Profits & Margins

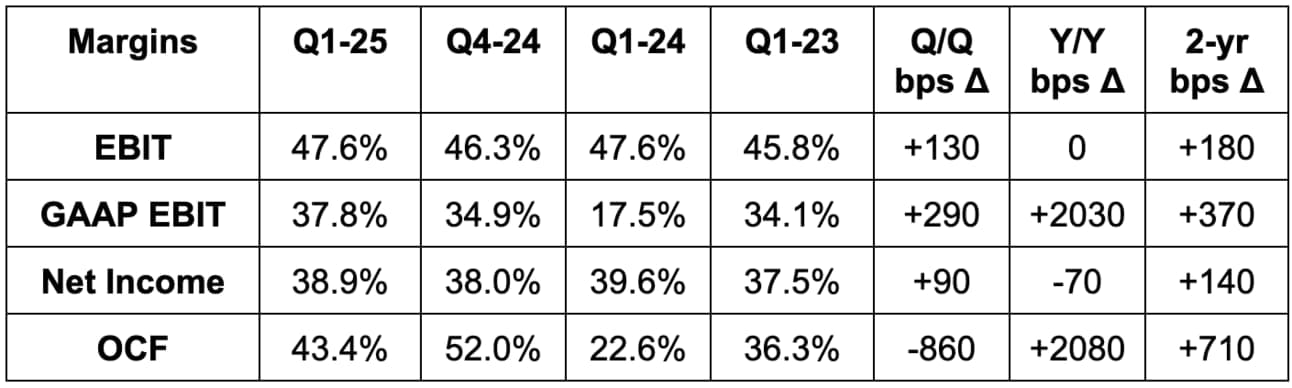

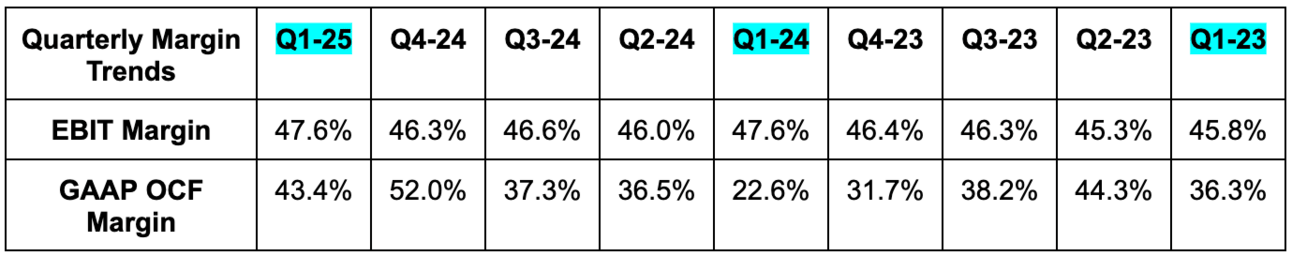

- Beat EBIT estimates by 2.2%; beat GAAP EBIT estimates by 4.8%.

- Beat operating cash flow (OCF) estimates by 22.2%.

- Beat $3.88 GAAP EPS estimates & identical guidance by $0.26.

- Beat $4.98 EPS estimates by $0.10 & beat guidance by $0.11.

e. Balance Sheet

- $7.43B in cash & equivalents.

- $6.15B in debt.

- Diluted share count fell 4% Y/Y; basic share count fell 3.3% Y/Y. They’ve really picked up the buyback pace amid the recent stock decline.

f. Guidance & Valuation

- Reiterated annual revenue guidance, which slightly missed estimates by 0.4%.

- Reiterated $17.33B in annual digital media revenue, 11% annual digital media ARR growth and $5.85B in annual digital experiences revenue.

- Reiterated annual $15.95 GAAP EPS estimates, which roughly met (missed by a penny).

- Reiterated annual $20.35 EPS estimates, which slightly missed by $0.04.

- For Q2, revenue guidance slightly missed estimates, $3.83 GAAP EPS guidance missed estimates by $0.07 and $4.98 EPS guidance roughly met estimates.

Adobe trades for 18x forward EPS and 20x forward FCF. EPS is expected to compound at a 12% clip for the next two years. FCF is expected to compound at a 14% clip for the next two years.

g. Call & Release

Table Setting:

The format of this earnings call was different than in quarters and years prior. Adobe no longer split things neatly into document cloud, creative cloud and experience cloud buckets. Instead, the theme was how it’s combining these products and infusing GenAI throughout all of them to augment utility, engagement, retention and subscription tier potential. It aims to use its world-class datasets – across PDFs, marketing content and creative materials – to keep aggressively building GenAI apps and models with this differentiated context. It’s the combination of great models, apps and data here that Adobe believes lets it stand out from the competition.

“We believe Adobe’s success will be driven by innovation in service of both “Business Professionals and Consumers” and “Creative and Marketing Professionals.” Reporting insights and the financial performance across these customer groups will provide a clear view of Adobe’s execution against our strategy.”

CFO Dan Durn

- The “Business Professionals and Consumers” reporting group will include document cloud Acrobat creative cloud revenue, Adobe Express creative cloud revenue. This revenue bucket rose 15% Y/Y to $1.53B.

- The “creative and marketing professionals” reporting group will include digital experience subscription revenue and all other digital media revenue not included in business professionals and consumers. This revenue bucket rose 10% Y/Y to $3.92B.

AI Accelerating the Creative & Marketing Professionals Opportunity:

Adobe continues to invest heavily in a few products to nurture the creative AI opportunity. Firefly models, services and apps are a central focus area. This can generate videos from different content modalities (thanks to the newer video model), create full scenes out of sketches, develop “custom motion design” and so much more. Dune: Part Two utilized these products and its creative suite. Most recently, Adobe incorporated a lot of the Firefly model and services work into the new Firefly Application. It thinks of this holistic product as the “more comprehensive destination to generate images, vectors and now videos with unmatched control.” And whether it’s using this content to power better customer outcomes in the experience cloud or ingesting PDFs from the document cloud to augment content generation possibilities, the Firefly App is meant to help in every facet of Adobe’s business. It’s embedded in virtually every app Adobe provides – sometimes as a complementary perk and sometimes as a premium upsell. Adobe is now offering two new subscriptions called Firefly Standard and Firefly Pro. It will soon fully release a third tier called Firefly Premium, with the initial launch happening this past week.

For Photoshop, its revamped web application and new mobile application have both been well received and are included in existing Photoshop tiers. The mobile launch is especially exciting, considering how popular smartphones are becoming for next-gen content creators. This had been a large, large hole in its product offering. Photoshop GenAI monthly active users (MAUs) rose 35% Y/Y, while Lightroom (photo editing) GenAI MAUs rose 30% Y/Y.

New Products for Creative Use Cases:

- Premiere Pro (video editing app) released After Effects, which contains a Media Intelligence tool to “help users find footage faster with natural language and captions.”

- Launched Distraction Removal (another GenAI tool) in Adobe Lightroom. This lets you cut that photobomber out of your favorite picture.

- Launched Adaptive Profiles (another GenAI tool) to study an image and automate the optimization of things like contrast.