In case you missed it from this past week:

1. Updated Operating Income (EBIT) Comp Sheets

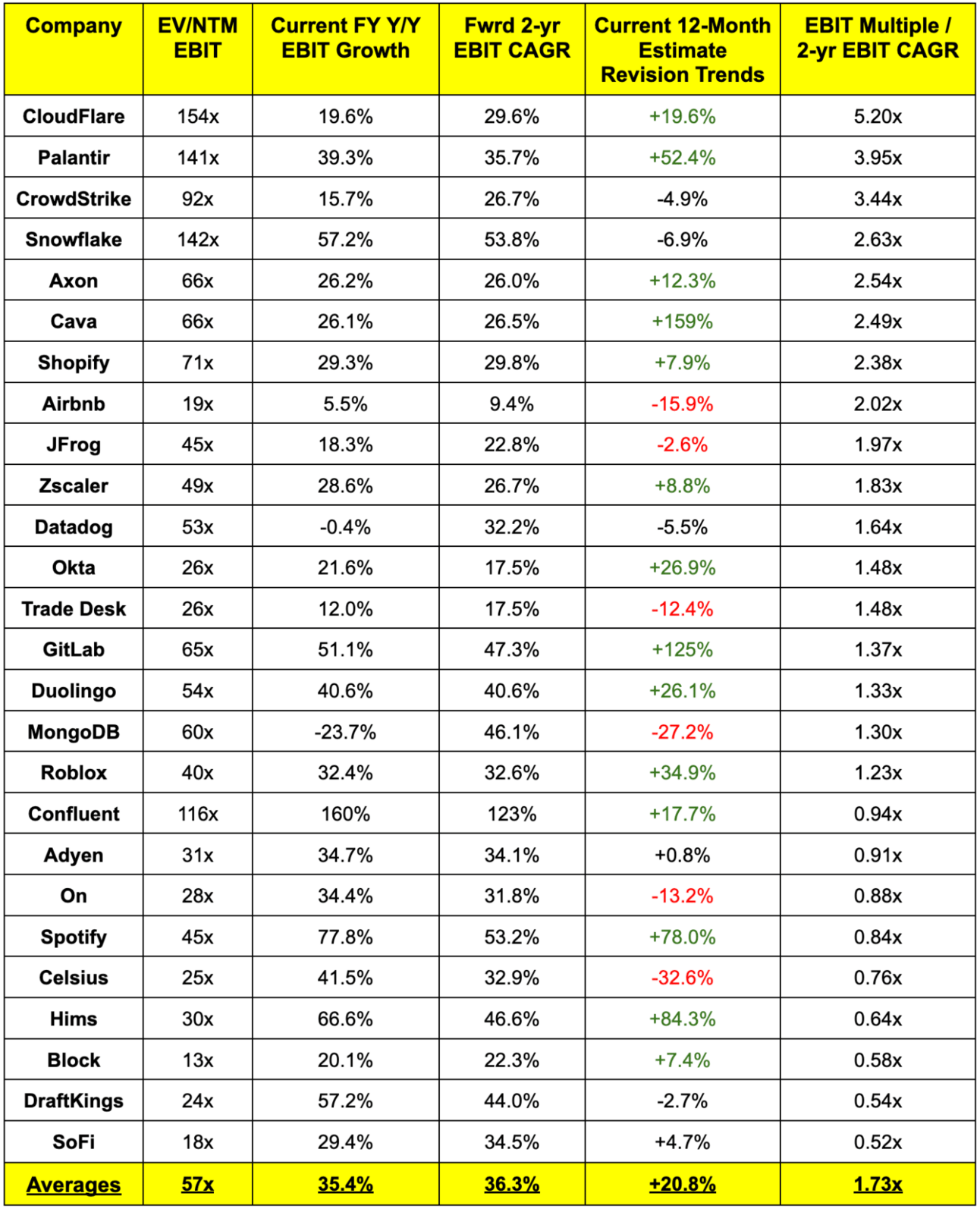

a. Mature Growth & Bellwether Brands

Caveats:

- I excluded the profit growth hit from PayPal now counting stock compensation as a non-GAAP income statement expense starting this year.

- I skipped this year’s profit growth for Starbucks to avoid creating a chart outlier. PEGs don’t do a good job reflecting large restructurings & operational overhauls like SBUX is currently enduring. Had I not done this, SBUX’s reading on the right-most column would have by 6.0x.

- Fiscal years are not identical. That’s why I use next 12-month multiples. At the same time, the time periods for the profit growth columns are not apples-to-apples. They’re as close as we can get.

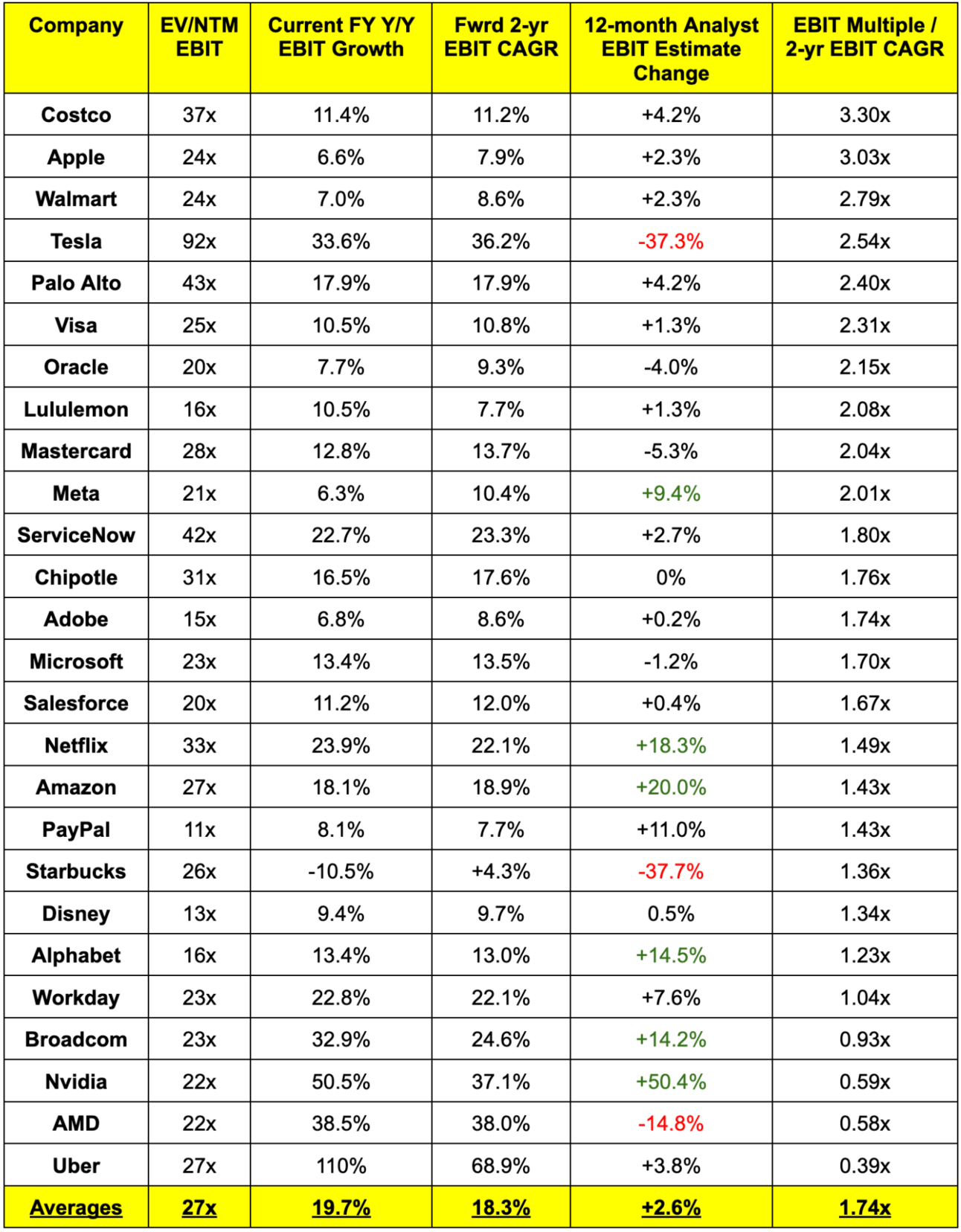

b. Fast Growth

Caveats:

- Duolingo, Axon Cava, Celsius, SoFi, Trade Desk, Roblox, On Running, DraftKings and Airbnb make no non-GAAP EBIT adjustments. For these firms especially, it is highly important to account for stock comp in an uniform manner. For this reason, I used non-GAAP EBITDA and deducted estimated depreciation and amortization charges. This added 1-4 turns to the multiples for each company mentioned. I did the same thing for Block as its adjusted operating income and consensus adjusted EBIT estimates are (for whatever reason) not identical.

- For DraftKings, I skipped this year’s projected 427% profit growth. Had I not done this, its score on the right-most column would have been 0.12x. I did the same thing for Datadog as it uses 2025 as an investment year and that’s temporarily halting its very steady profit growth. Had I not done this, DDOG’s score on the right-most column would have been 3.78x.

- Finally, I skipped this year’s projected -24% Y/Y profit growth for MongoDB. Candidly, I did not want to do this but did anyway to avoid having a severe outlier in the chart. Profit contraction is coming from the same headwinds it has spoken about for multiple years now (lapping abnormally strong licensing performance). Had I not made this decision, MDB’s score on the right-most column would have been around 10.1x.