In case you missed it:

- Nvidia & Cava Earnings Reviews

- Lemonade Earnings Review

- Coupang Earnings Review

- SoFi Earnings Review

- Netflix Earnings Review

- Nu Earnings Review

- Celsius Earnings Review

- Mercado Libre Earnings Review

- Amazon, Cloudflare and Disney Earnings Reviews

- Datadog Earnings Review

- Taiwan Semi Earnings Review

- Airbnb Earnings Review

- Uber Earnings Review

- Shopify & Chipotle Earnings Reviews

- Alphabet & AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- Meta, Tesla & Starbucks Earnings Reviews

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

- Spotify Earnings Review (section 3)

- The Trade Desk Earnings Review

- Hims Earnings Review

- Grab Earnings Review

- Palo Alto, DraftKings & Robinhood Earnings Reviews (sections 2, 3 & 4)

- Zscaler & On Running Earnings Reviews

- SentinelOne, Oracle & Block Earnings Reviews

- Broadcom Earnings Review (section 1)

- Adobe Earnings Review (section 1)

Table of Contents

- a. Key Points

- b. Demand

- c. Profits & Margins

- d. Balance Sheet

- e. Guidance & Valuation

- f. Call & Release

- g. Take

a. Key Points

- Solid quarter.

- Slightly underwhelming guidance.

- New inventory is working, but macro is fragile – just like for the rest of retail/apparel.

Please note that Lululemon raised quarterly guidance in January with only a few weeks left in the period.

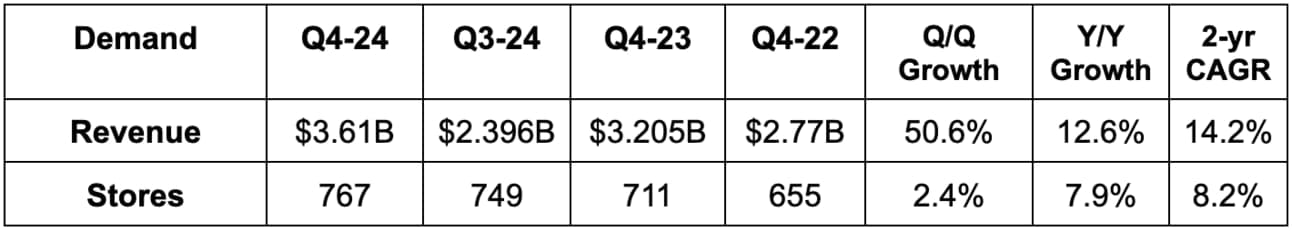

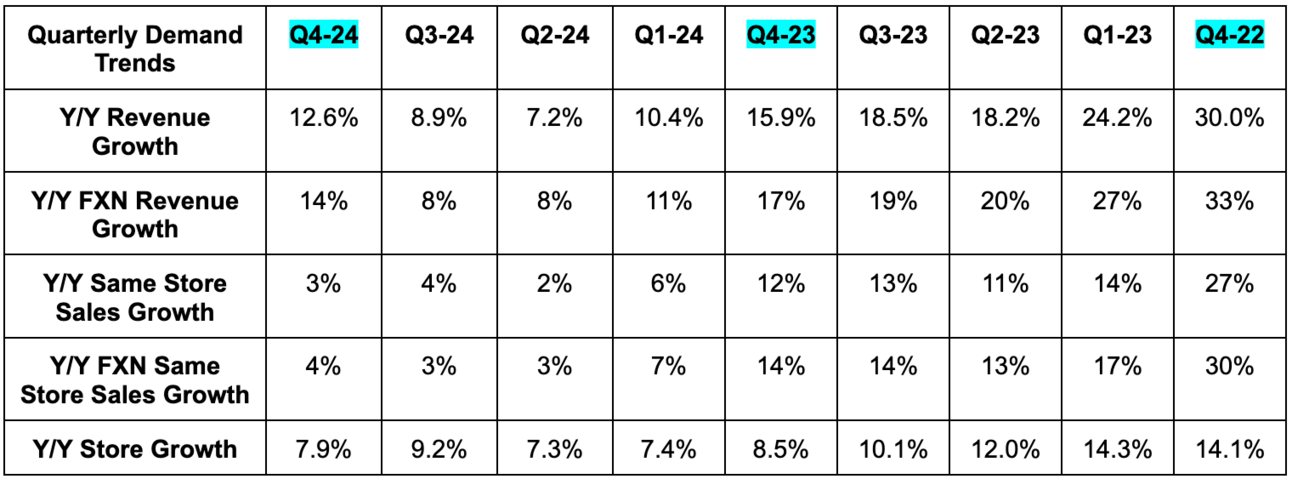

b. Demand

- Lululemon beat revenue estimates by 0.8% and beat its updated guidance by 1.1%.

- Overall revenue growth excluding the extra week in the quarter was 8% Y/Y and 9% on a foreign exchange neutral (FXN) basis.

- In the Americas, excluding the extra week in the quarter, revenue rose by 2% Y/Y. FXN revenue rose by 3% Y/Y vs. 2% FXN Y/Y growth last quarter.

- Comparable store sales were flat Y/Y in the Americas.

- USA revenue rose by 1% Y/Y vs. 0% Y/Y growth last quarter; Canadian revenue rose by 11% Y/Y.

- In China, revenue rose by 38% excluding the extra week. FXN revenue rose by 39% Y/Y vs. 36% FXN Y/Y growth last quarter.

- Comparable store sales rose 26% Y/Y (27% FXN).

- In the Rest of World (RoW) revenue rose by 30% excluding the extra week. FXN revenue rose by 33% Y/Y vs. 23% FXN Y/Y growth last quarter.

- Comparable store sales rose by 14% (17% FXN).

- Men’s revenue rose by 12% Y/Y vs. 9% Y/Y last quarter; women’s revenue rose by 6% Y/Y vs. 8% Y/Y growth last quarter; accessories & other revenue rose by 9% Y/Y vs. 8% Y/Y growth last quarter.

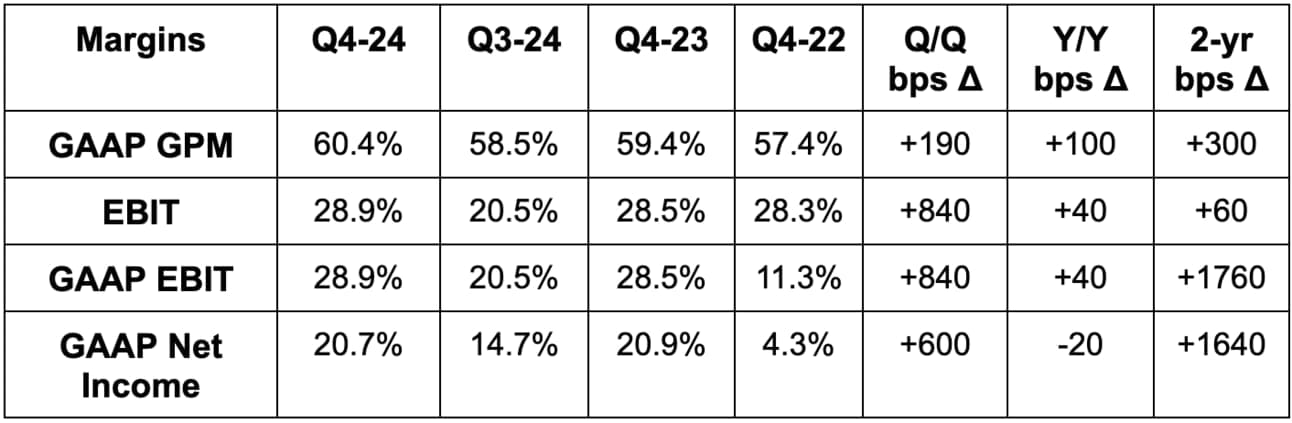

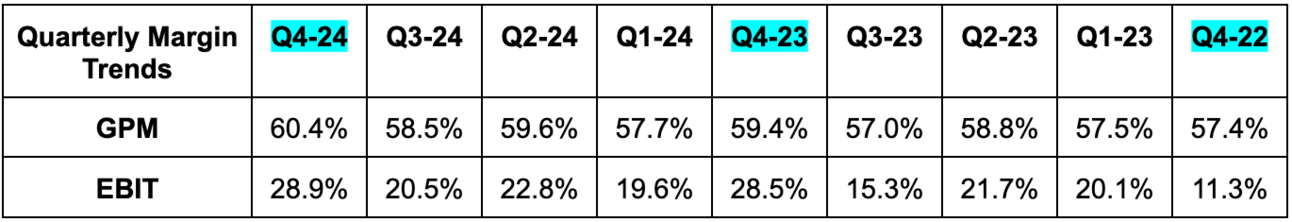

c. Profits & Margins

- Beat 59.7% GPM estimates & beat identical guidance by 70 basis points (bps; 1 basis point = 0.01%) each.

- GPM expansion was based on 160 bps of product margin expansion thanks to lower product costs, lower markdowns and lower inventory shrink (less theft & defects). That was offset by a 30 bps FX headwind and higher freight costs.

- Beat EBIT estimates by 4.2% & beat guidance by 4.4%.

- Selling, General and Administrative (SG&A) costs were 31.5% of revenue vs. 30.9% Y/Y. The deleveraging was due to corporate items, as well as depreciation and amortization (the effect of fulfillment center investments).

- Beat $5.87 EPS estimates by $0.27 & beat guidance by $0.31.

d. Balance Sheet

- $2 billion in cash & equivalents.

- $394 million in untapped credit revolver capacity.

- No traditional debt.

- Inventory rose 9% Y/Y.

- Diluted share count fell by 3.7% Y/Y. It has $1.3 billion left on its current buyback program.