Table of Contents

- 1. Broadcom (AVGO) – Earnings Review

- 2. Alphabet (GOOG) – CFO Anat Ashkenazi Interview …

- 3. MongoDB (MDB) – Earnings Review

- 4. PayPal (PYPL) – CEO Interview with Morgan Stanl …

- 5. DraftKings (DKNG) – Founder/CEO Interview with …

- 6. Meta (META) – Chief Product Officer Interview w …

- 7. Duolingo (DUOL) – CFO Matt Skaruppa Interview w …

- 8. SoFi (SOFI) – Regulation & Capital Markets

- 9. Starbucks (SBUX) — Leadership

- 10. Headlines

- 11. Macro

Content already sent this week:

- My Current Macro View

- Zscaler & On Running Earnings Reviews

- CrowdStrike Earnings Review, 4 Earnings Snapshots & a Summary of the Uber CEO Interview with Morgan Stanley

- Updated Holdings & Performance

Read 30+ more detailed earnings reviews from this season on Meta, The Trade Desk, Amazon, AMD, SoFi, Shopify, Airbnb & so many more companies here.

1. Broadcom (AVGO) – Earnings Review

Broadcom creates & manufactures a slew of semiconductor-related equipment within data center, networking and industry-specific use cases. Chips and high-performance compute (HPC) can’t all be packed into the same corner of a data center. GPUs must be able to connect to one another to drive better bandwidth and performance, with faster, more efficient model training and inference to cut costs. This is where Broadcom thrives.

It also offers a range of software tools, which significantly broadened out with its VMWare acquisition. VMware offers virtual, localized layers of software that sit on top of hardware. This allows the centralized hardware to run several different operating systems from the same place. The company, which is now a Broadcom unit, calls these “virtual machines” or virtual private clouds. By reducing hardware requirements, VMWare saves its clients money.

This company does not compete with Nvidia in terms of designing GPUs. It does, however, create application-specific integrated circuits (ASICs) for more specialized workloads. It also makes variable processing units (XPUs) which are the high-performance accelerator subsection of ASICs. All XPUs are ASICs but not all ASICs are XPUs. These are often used to optimize data center, networking and GPU performance. In some cases, this can replace various needs for more generalized chips like GPUs. Furthermore, its core niche focuses on networking and connectivity, which competes with Nvidia’s switches and its SpectrumX networking product.

b. Key Points

- Strong quarter and guide.

- Fantastic hyperscaler traction.

- Surgical VMWare integration.

- Slow recovery in non-AI semiconductor revenue as expected.

c. Demand

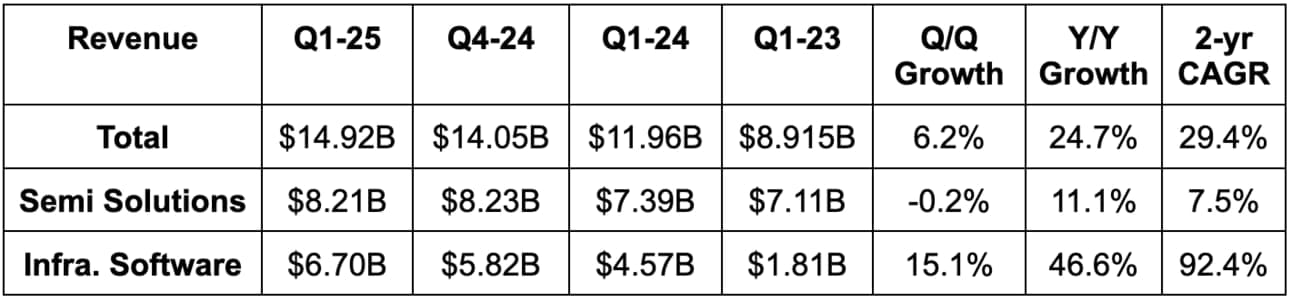

- Beat revenue estimate by 2.2% & beat guidance by 2.3%.

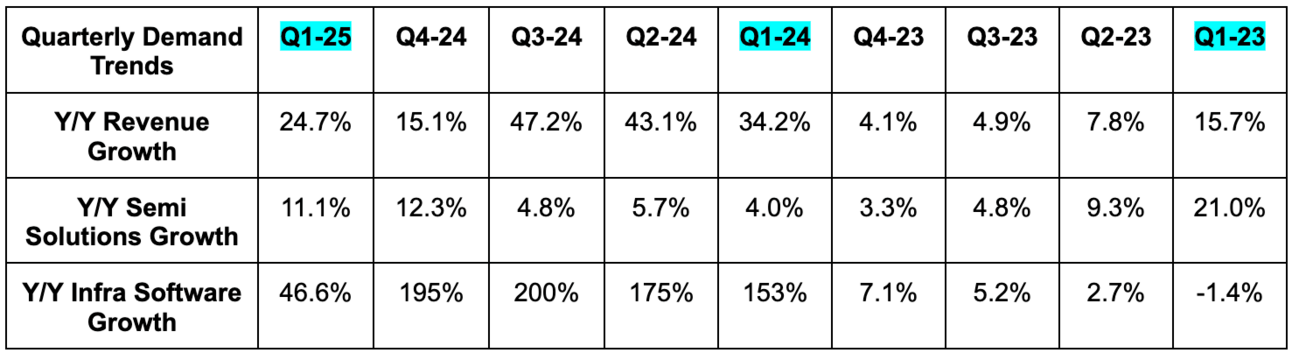

- Semiconductor Solutions revenue beat estimates by 0.8%, while 11.1% Y/Y growth beat 10% growth guidance.

- Within Semiconductor Solutions, AI revenue rose 77% Y/Y to $4.1B. This beat guidance by 8%.

- Infrastructure Software revenue beat estimates by 3.5%, while 46.6% Y/Y growth beat 41% Y/Y growth guidance.

- Infrastructure Software revenue is still being helped by its VMWare acquisition. Comps normalize starting in Q2.

d. Profits & Margins

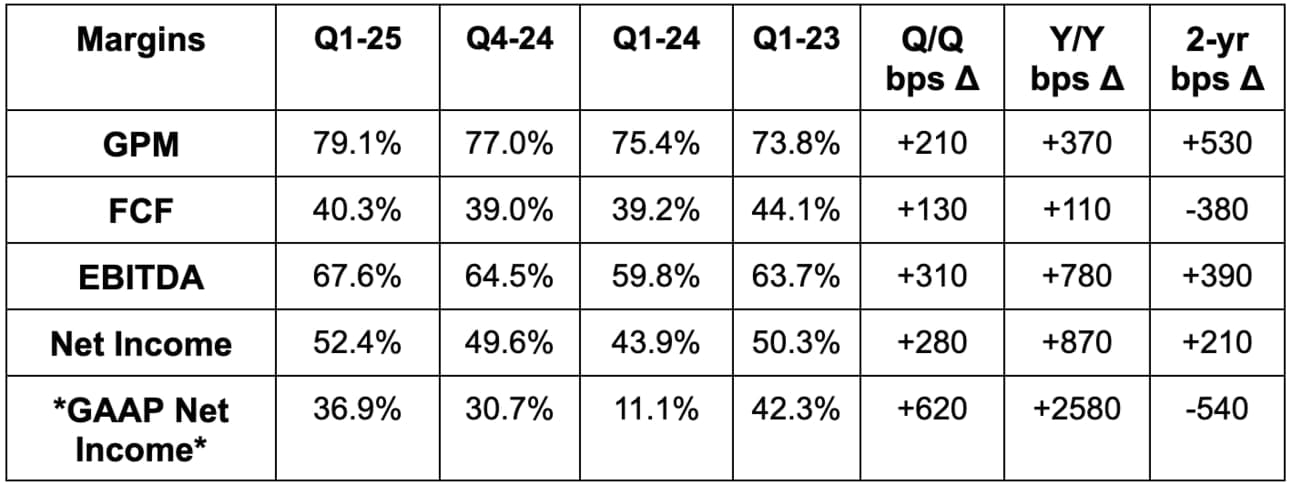

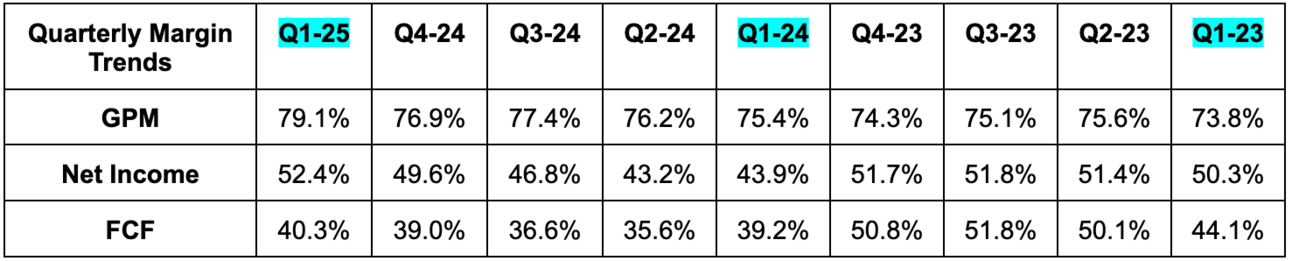

- Beat 78% GPM estimates by 110 bps. Infrastructure Software revenue outperformance and favorable semi revenue mix.

- Missed FCF estimates by 13.5%. This metric is quite lumpy on a quarterly basis. This also continues to be impacted by VMWare M&A and R&D expense tax deductibility delays from renewal of a tax code. These are hard to model, which is why a quarterly cash flow number is often noisy.

- Beat $1.51 EPS estimates by $0.09.

- Beat $0.84 GAAP EPS estimates by $0.30.

- GAAP margins are still being affected by the VMWare M&A. Comps normalize starting in Q2.

- Beat EBITDA estimates by 4.4% & beat guidance by 4.6%.

- Non-GAAP OpEx fell by 10% Y/Y.

e. Balance Sheet

- $9.31B in cash & equivalents.

- $1.91B in inventory vs. $1.76B Q/Q.

- $66.6B in total debt. Reduced total debt by $1.1B during the quarter.

- Diluted share count rose 3.6% Y/Y.

- Dividends +14% Y/Y.

f. Guidance & Valuation

- Revenue guidance beat estimates by 1.2%. Guidance represents 19% Y/Y growth.

- EBITDA guidance beat estimates by 3.4%.

- As described below, it plans to accelerate R&D spend for its XPU and networking businesses in Q2. This led to a 66% EBITDA margin guidance vs. 67.6% this quarter. This is still obviously very lofty and represents 900 bps of Y/Y expansion. Investing to stay ahead of the pack and delivering that level of leverage is quite strong.

- Guided to a roughly 79% GPM.

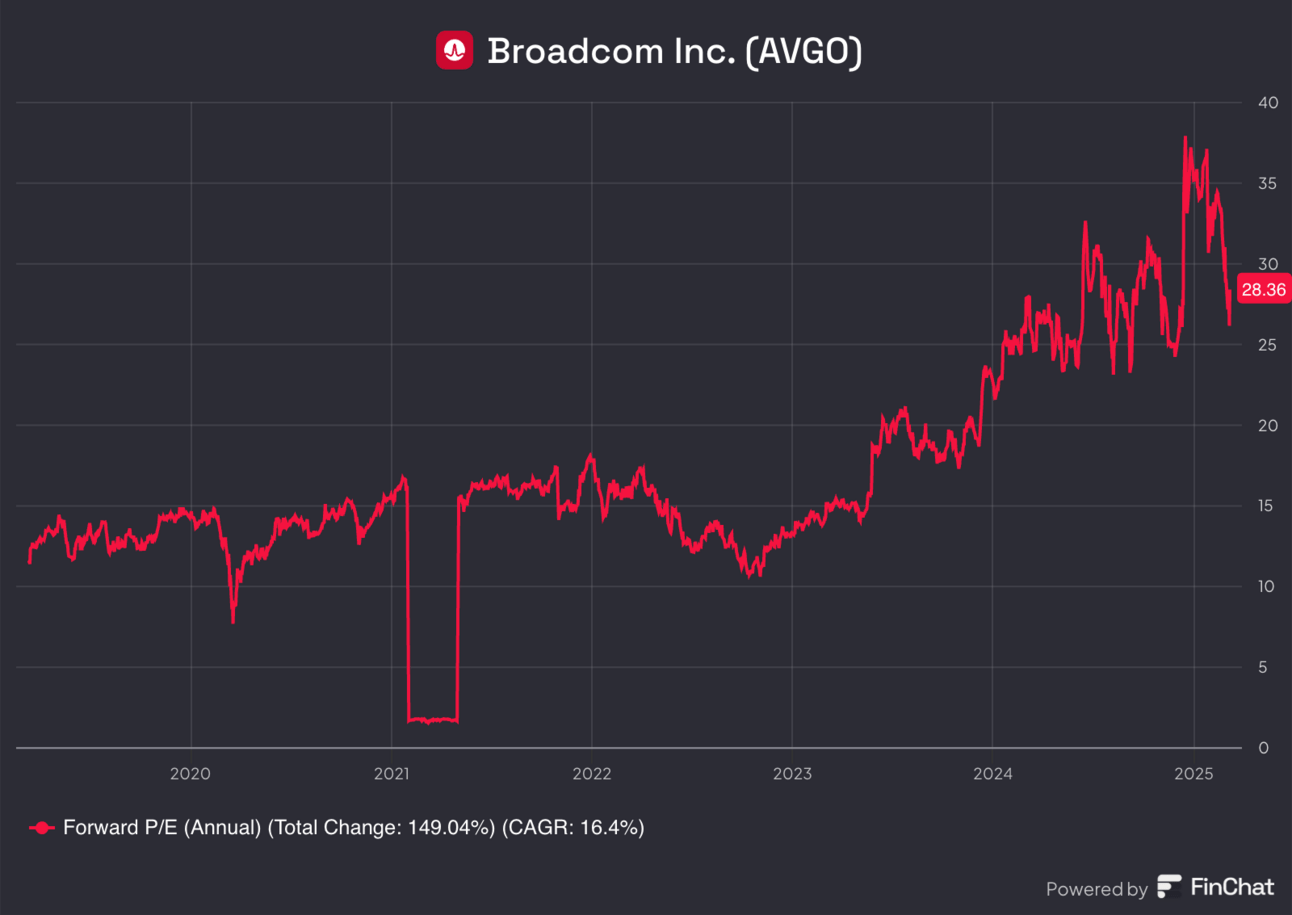

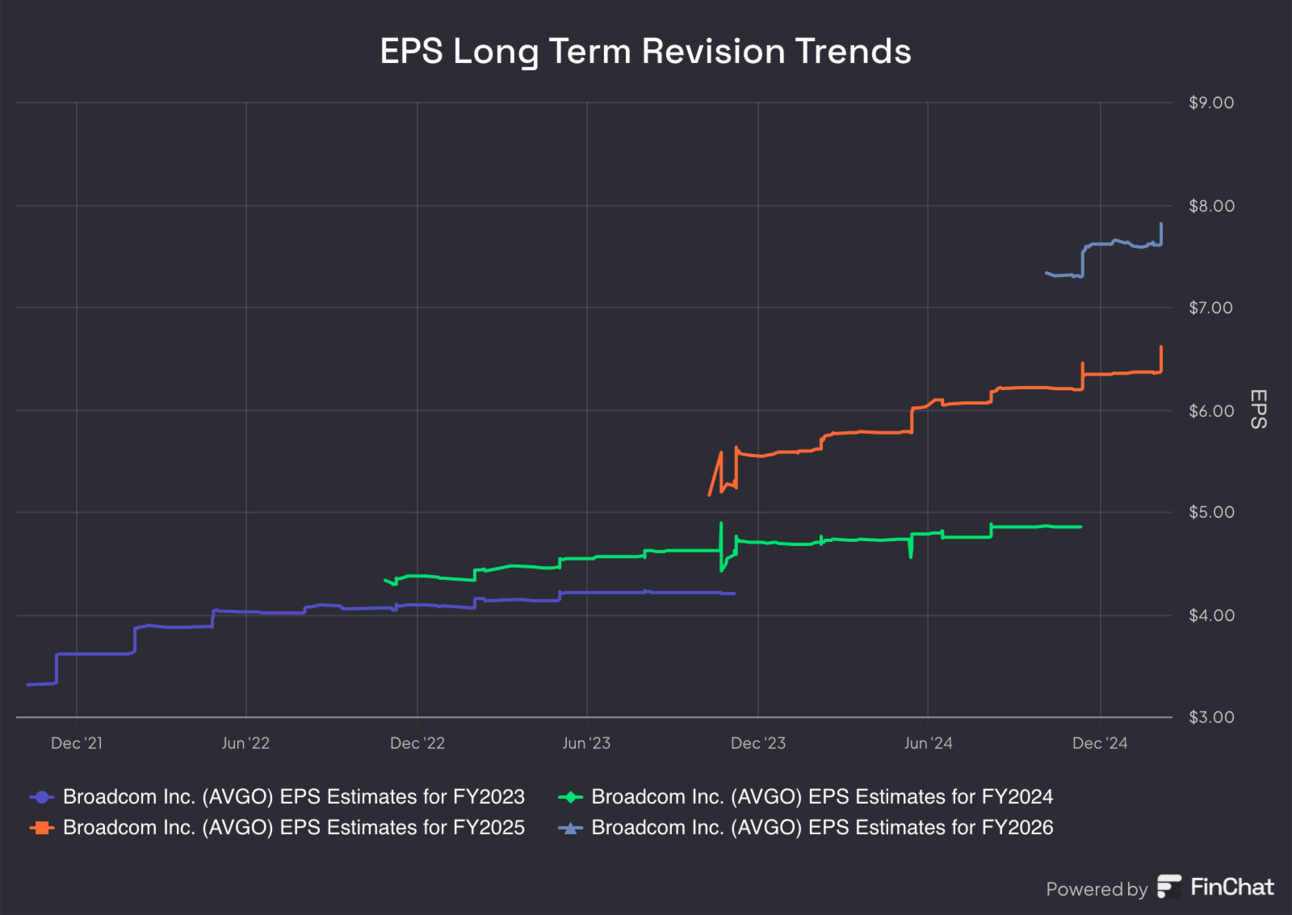

Broadcom’s EPS is expected to grow by 36% this year and by 18% next year.

g. Call & Release

Semiconductor Solutions – AI:

The AI portion of this bucket grew by 77% Y/Y to reach $4.1B and materially surpassed expectations. It sees this momentum carrying into Q2, with expectations of 7% Q/Q and 44% Y/Y growth to reach $4.4B. Networking performance from its Jericho and Tomahawk switches was excellent and so was its XPU result on the compute side of things. And despite all of the DeepSeek noise, Broadcom is still seeing “hyperscale partners invest aggressively in their frontier models.” Interestingly, most of that demand is still for pre-training, as the shift to inference brought on by training deflation and reasoning models hasn’t dramatically shifted its own demand to inference. Importantly, it thinks its products are well-positioned to cater to both use cases.

To stay ahead of the competition and nurture demand growth, it’s accelerating R&D spend in two areas. It’s pushing full speed ahead to tape out (finish a design concept) the very first 2 nanometer XPU so it continues to pack more compute into each chip. Fewer nanometers enable higher chip density and productivity. It’s also working to double Tomahawk 5 capacity to enable more chip connections, larger, more flexible compute clusters and better productivity. Its Tomahawk 6 switch is also now taped out to “enable AI clusters to scale to 1M XPUs.”

These investments are well-placed, considering fantastic hyperscaler demand. As a reminder, it has 3 larger hyperscaler customers (such as Alphabet) that it expects to deliver a serviceable addressable market (SAM) of $75B by 2027. That’s more than its current annual revenue base and it feels poised to capture the bulk of it, based on its 70% market share of the related hardware. Last quarter, it talked about two new hyperscaler customers and it expects to tape out XPUs for these clients this year. But wait, there’s more. During the quarter, the company began “deeply engaging” with two additional hyperscalers. Importantly, the 4 newer prospective clients are incremental to its $75B SAM estimate.

Importantly, these 4 companies are not yet customers. These are just design wins for now. In the world of semiconductors, design wins are often a dime a dozen, with actual deployment much more rare. But? Broadcom is unique here. It is highly picky with the type of client it will build XPUs with. It only works with the highest-volume vendors and only does these for vendors with a strong likelihood of large-scaled deployment.

Where is all of this hyperscaler demand coming from? Hardware superiority. Broadcom is convinced that its best-in-class hardware paired with its customers’ “excellent software” is a winning combination for creating custom XPUs to optimize performance of their infrastructure. Whether that’s optimizing for capacity, GPU utilization, memory, latency, resource allocation across training and inference or anything else, Broadcom is world-class in this regard. Hock considers these 4 prospective companies to be “partners” at this point in time. They’ll become customers when AVGO begins shipping to them at volume. Time-to-market for projects like this is somewhat lengthy. Moving from concept to design to production often takes a couple years, but the company does think it can turn these partners into meaningful revenue before FY 2027.

“In the process of working with the hyperscalers, it has become very clear that while they are excellent in software, Broadcom is the best in hardware. Working together is what optimizes via large language models.”

CEO Hock Tan

Semiconductor Solutions – Non-AI:

Non-AI revenue within this bucket fell 9% Q/Q. The recovery for this cohort was called “slow.” In terms of subsections, broadband rose by more than 10% Q/Q due to strong telco spend levels; server storage fell a bit Q/Q, but should grow sequentially in Q2. Enterprise networking was and should remain flat Q/Q. Wireless drove most of the weakness here as expected. Overall for non-AI semi revenue, it sees 0% Q/Q growth next quarter. Encouragingly, bookings growth will remain strong on a Y/Y basis, which points to potentially accelerating growth later in the year.

- EBIT margin for Semiconductor Solutions overall expanded from 55% to 57% Y/Y. GPM expanded by 70 bps Y/Y to roughly 68%.

Infrastructure Software:

Growth was temporarily aided by two things this quarter. First, it is the final quarter of inorganic contribution from VMWare in the Y/Y comps. Second, several large deals slipped from Q4 to this quarter, which were signed as expected.

Broadcom continues to do very well with VMWare integration and cross-selling. Part of this work has meant converting from a license-based business to a subscription-based business, which is 60% complete. The other major part has been up-selling customers to the VMWare Cloud Services (VCS) package. This “enabled the entire data center to be virtualized and customers to create their own private cloud environment on-premise.” It’s no longer predominately virtualizing CPUs in isolation. It is virtualizing CPUs, GPUs and every other piece of the data center. 70% of its 10,000 largest customers are now using VCS vs. 45% Q/Q.

The product that virtualizes GPUs is called VMWare Private AI Foundation. This was announced last May with Nvidia, and now has 39 enterprise customers. Broadcom sees continued healthy demand for CPU bookings (VMWare’s main financial driver), and sees a great opportunity to do more with high-performance chips too. It also continues to prioritize on-premise service with VMWare Private AI Foundation alongside public cloud deployments as well. It thinks the GenAI explosion will keep data privacy and security more important. It thinks this will slow public cloud workload migrations as some enterprises “recognize they want to run AI workloads on-premise. That’s not something we often hear from others.

“Customer demand has been driven by our open ecosystem, superior load balancing and automation capabilities that allow them to intelligently pull and run workloads across both GPU and CPU infrastructure and leading to very reduced costs.”

CEO Hock Tan

- It expects 23% Y/Y growth in Infrastructure Software revenue to reach $6.5B.

- The quarterly OpEx run rate for VMWare fell from $1.2B to $1.1B Q/Q. It was at $2.7B at the time of the M&A. This helped raise EBIT margin from 59% to 76% for this segment. Fantastic acquisition execution here.

h. Take

Another strong quarter for a leader in GenAI connectivity, custom chip design and hardware optimization. The firm admirably integrated VMWare with little headache and continues to find awesome traction with large hyperscaler clients. As long as this GenAI hardware boom lasts, and mega-cap CapEx budgets say it will last at least through the year, Broadcom should continue to be a very central part of it.

2. Alphabet (GOOG) – CFO Anat Ashkenazi Interview with some Updates

On Cost Controls:

On Alphabet’s last call, many investors thought leadership walked back previous commitments to cost controls. Per Ashkenazi, that is not the case. There are no changes to the firm’s commitment to controlling costs and cutting bloat. That’s where last week’s layoff announcement came from. From 3rd-party vendor contract negotiations to cloud infrastructure optimization to back-office automation and everything else, the firm remains in cost efficiency mode.

Along similar lines, she’s quite confident in the firm’s $75B CapEx budget being put to very good use. This goes back to why its full-stack AI approach – across hardware, models, distributed apps and developer tools – means this CapEx has several productive uses. If one piece of the tech stack proves to need lower budget, this CapEx is highly “fungible” to reallocate elsewhere. These dollars will go to waste. And for more evidence of that, recall that the majority of this CapEx is from short-lived assets like GPUs and servers rather than long-lived assets like data center construction. Also recall that Google Cloud remains capacity constrained and unable to fulfill all of its current demand. Translation? This CapEx is in response to near-term demand signals and revenue opportunities. This isn’t investing for potential value creation in 5 years… more like 5 months.

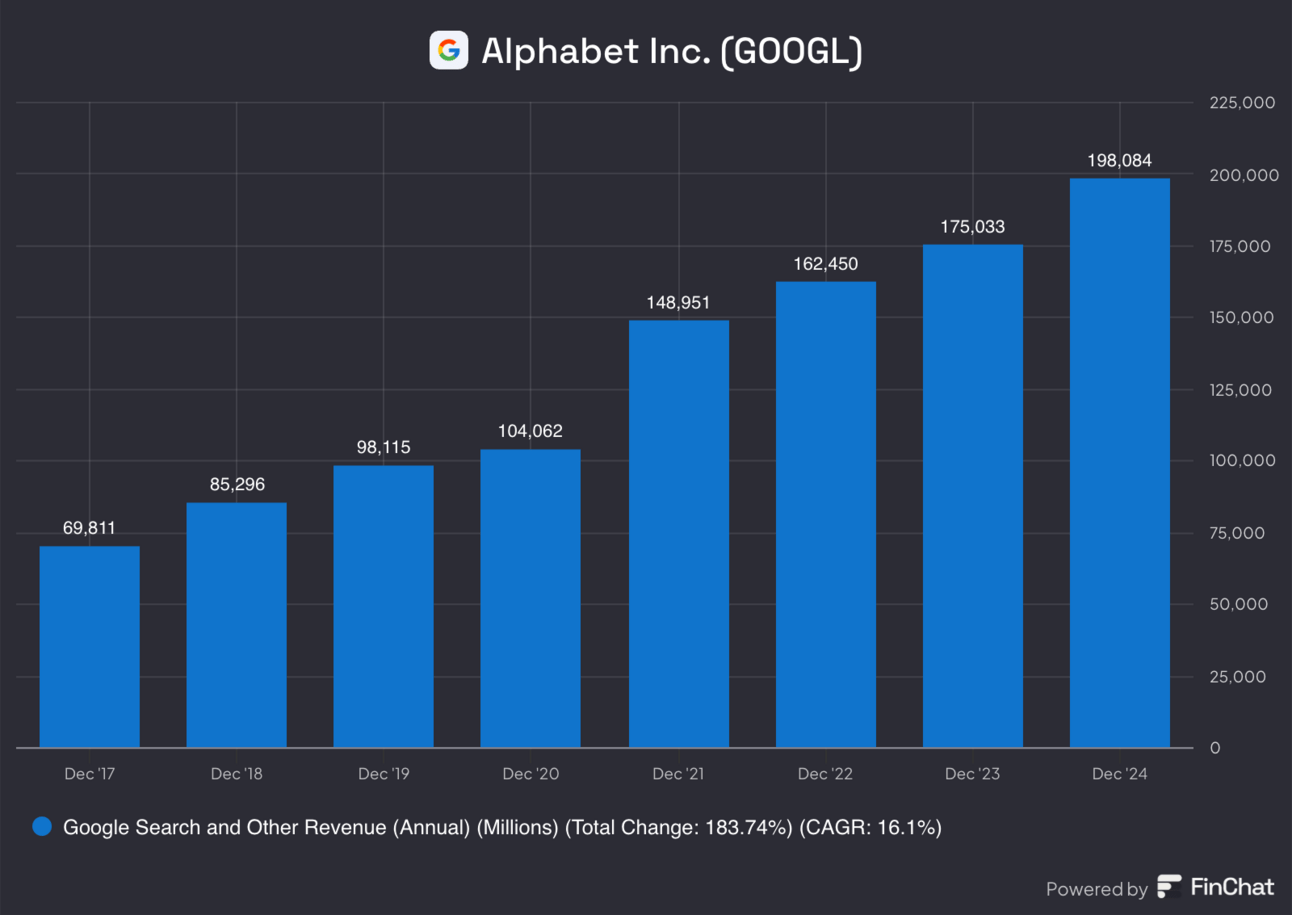

On Falling Behind in Search:

She pushed back hard against this notion, citing circle-to-search, AI Overviews, and the launch of Gemini 2 as key examples of rapid innovation. She also reminded us that this AI volume is monetizing at similar rates compared to legacy search, which had been a key concern for investors. Now, it’s clear that this innovation will not cannibalistically come at the expense of its bottom line. AI Overviews are directly raising repeat query demand and its dedicated Gemini app is raising overall engagement too. I’m personally a daily active user (DAU). Furthermore, AI is creating an explosion in query use cases and raising the overall size of the opportunity. So? Just because Perplexity or OpenAI can find a little market share on their own does not at all prevent the search business from also finding sustainable, profitable growth. Near-100% market share is not a prerequisite for that to happen. A smaller piece of a larger pie works just fine.

With 5 trillion annual queries, leading video market share with YouTube and 6 products with over 2 billion users, it has more data to season models more effectively and generate deeper, more precise and more engaging search experiences. With Gemini, DeepMind, global cloud infrastructure and its budding semiconductor business, it has all of the assets in place to leverage this data as well as anyone else can. And, with its thriving advertising business and scaled impression menu, it has a direct means to monetize all of this work. I would also call this capability unique, as shoppers are 98% more likely to trust a recommendation if it’s offered by a YouTube creator they follow and as Alphabet obsessively works to use AI to augment return on ad spend (ROAS).

While many think Google Search is decaying, recent results and company positioning tell a very different story. Isn’t it interesting that this existential risk seems to fade as the stock price rises and builds back as it falls?

Other News:

Alphabet launched AI Mode to expand on its highly successful AI Overviews launch. It offers a full page of helpful links (some shoppable and I’m sure monetizable), “advanced reasoning” and multi-modal, agentic capabilities made possible by the launch of Gemini 2. It’s now available for some Google One subscribers in early access.