Table of Contents

- 1. Credit Earnings – Bank of America (BAC) & Ameri …

- 2. Disney (DIS) – Password Sharing & a New Product

- 3. Starbucks (SBUX) – Changing Approach & More

- 4. More Earnings – ASML (ASML) & Intuitive Surgica …

- 5. SentinelOne (S) – OneCon 2024

- 6. SoFi (SOFI) – Galileo & Capital Markets

- 7. Various Sell-Side Notes

- 8. Headlines

- 9. Macro

In case you missed it, this was a busy week for content:

- SoFi Deep Dive Article

- Netflix and Taiwan Semi Earnings Reviews

- Portfolio Management & Earnings Preview Article

1. Credit Earnings – Bank of America (BAC) & American Express (AXP)

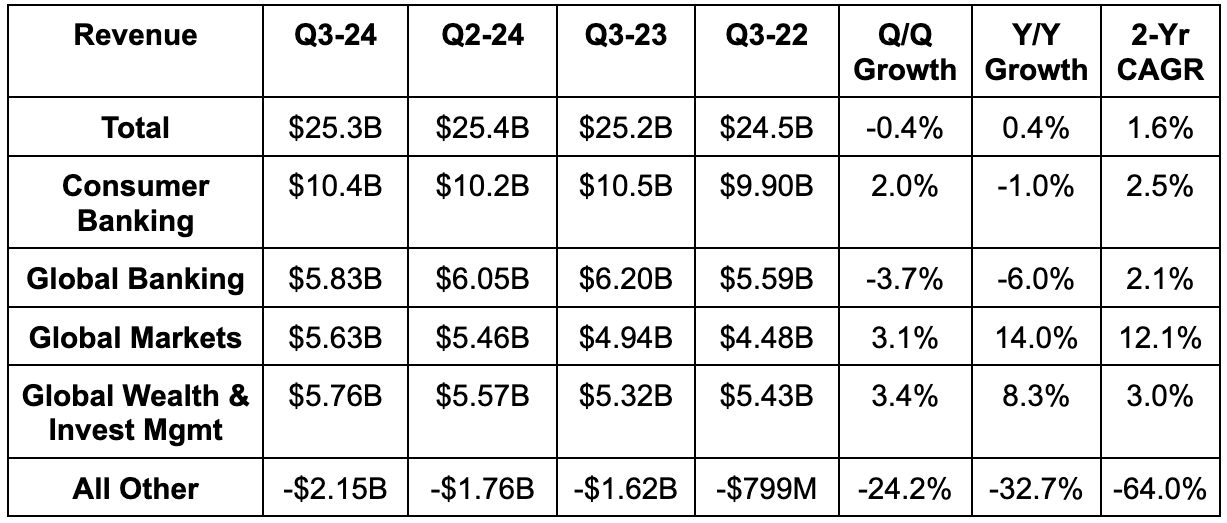

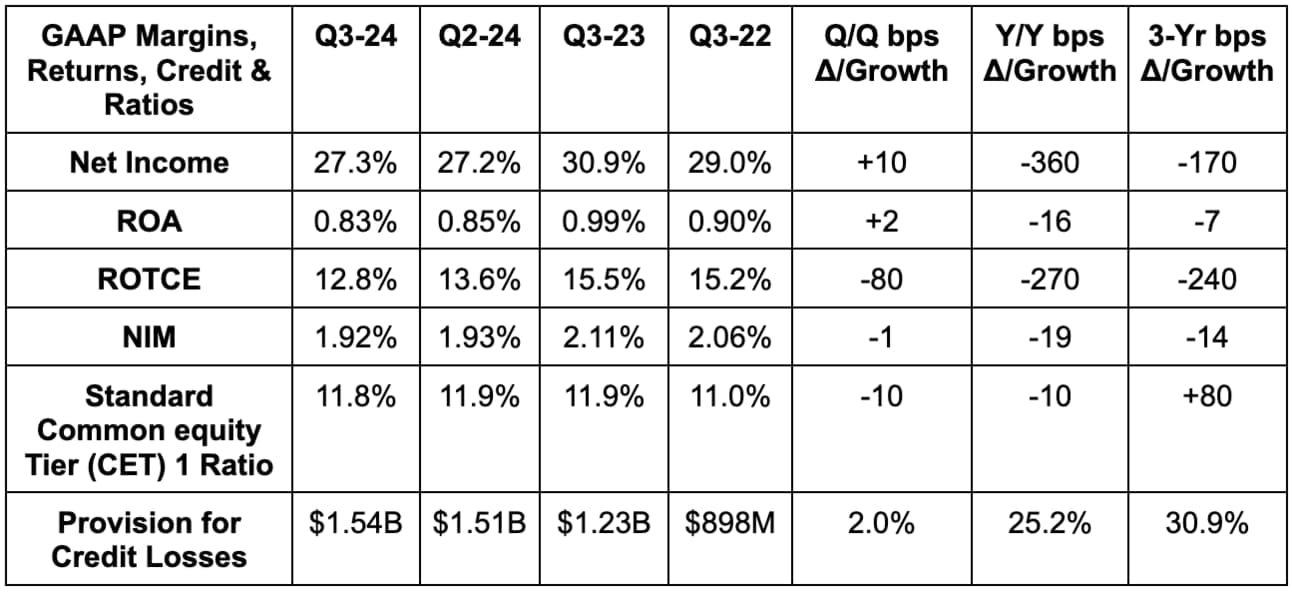

a. Bank of America (BAC) – Earnings Snapshot

Results:

- Beat revenue estimates by 0.4%.

- Beat $0.76 GAAP EPS estimates by $0.05.

- Beat book value (BV) per share estimate by 1.4%.

- Beat 0.79% return on asset (ROA) estimates by 4 basis points (bps; 1 basis point = 0.01%).

Balance Sheet:

- Average loans and leases rose 1% Y/Y.

- Deposits rose 2% Y/Y, with the quarter representing its 5th straight period for Q/Q deposit growth. At the same time, the consumer portion of overall deposits fell 4% Y/Y.

- Consumer payments rose 5% Y/Y as it delivered its 2nd best quarter for new checking accounts.

- $947 billion in global liquidity.

- Standard CET1 minimum is 10.7%.

- Dividend payments rose 8.3% Y/Y to $0.26 per share.

- Share count is down 2.3% year-to-date.

Credit Commentary:

First, some definitions and how these buzzwords relate to each other:

- Delinquencies are loans that are past due by a number of days. Delinquency rates are the leading indicator for credit health.

- Net charge-offs are loans that a creditor decides won’t be repaid and will instead become losses. Net charge-off (NCO) rate is the percentage of loans classified as uncollectible. This is a lagging credit indicator compared to the leading delinquency indicator.

- Reserve levels refer to the amount of funds set aside to cover potential losses for the overall portfolio. Reserves and provisions (which are also for covering potential losses for specific types of credit) are tightly positively correlated.

- Higher expected delinquencies and NCOs contribute to reserve building.

- As reserves and provisions build, allowance for credit losses grows. This is the overall balance of funds to cover losses.

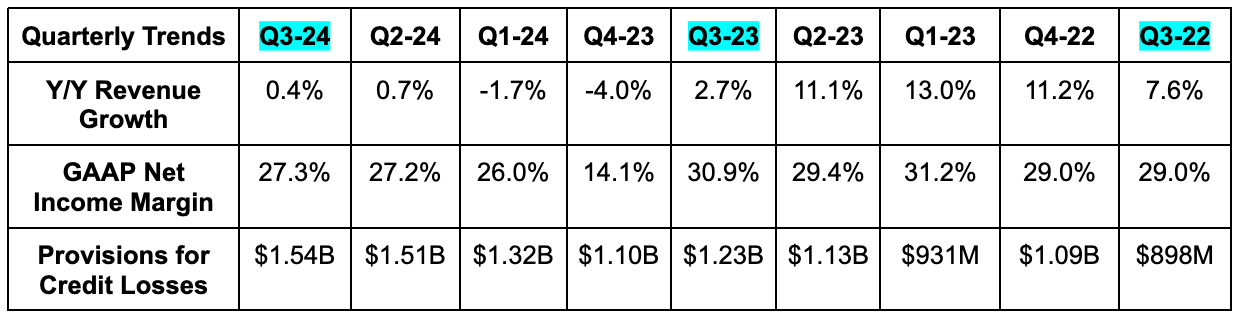

On charge-offs, consumer NCO actually fell slightly Q/Q due to lower credit card losses; credit card loss rate fell from 3.88% to 3.70% Q/Q. NCO rate rose sharply Y/Y from 0.35% to 0.58%, but the sequential improvement is a great step in the right direction. On the commercial side, NCOs rose slightly Q/Q to $490 million due to higher losses.

For provisions, BAC built $8 million in reserves vs. a $303 million build Y/Y. Specifically for consumer banking, reserves rose by $127 million vs. a $486 million rise Y/Y. For global banking provisions, BAC incurred a $229 million loss vs. a $119 million benefit Y/Y.

- Non-performing loan and lease ratio was 0.53% vs. 0.52% Q/Q and 0.46% Y/Y.

- Allowance for credit losses totals $14.4 billion vs. $14.6 billion Y/Y.

- Overall consumer credit and debit card spending rose by 3% Y/Y.

“Pace of money movement has been steady since late summer. Consumer payment growth continues into October. Activity is consistent with 2016-2019 when the economy was growing & inflation was under control… this is not meant to say consumers aren't wary about cost of living & rates. But overall, activity is fine. Unemployment is low and wage growth is steady. That bodes well for consumers & asset quality.”

BAC CEO Brian Moynihan

“With respect to our commercial businesses, it is consistent with a lower growth economy. Line of credit usage remains lower than pre-pandemic levels. This does not surprise us with the dramatic increase in the cost of borrowing for small and medium-sized businesses. They aren't being indolent. They want to grow. They are simply being more careful.”

BAC CEO Brian Moynihan

“On asset quality, we told you that consumer credit losses will go down this quarter given delinquency trends. We also told you that office losses would be lower. Both of these proved true again this quarter.”

BAC CEO Brian Moynihan

“We continue to have reserves for an unemployment rate of 5% by the end of 2025.”

CFO Alastair Borthwick

Guidance & Valuation:

Bank of America now expects $14.3 billion in net interest income (NII) for Q4 vs. $14.5 billion previously. This is due to rate cuts. 2025 guidance is coming next quarter.

BAC trades for 11x forward GAAP EPS. GAAP EPS is expected to grow by 5% this year and by 13% next year.

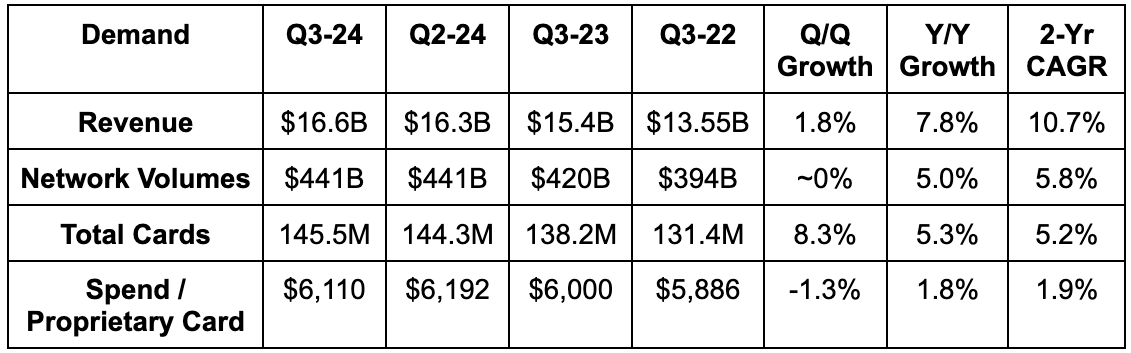

b. American Express (AXP)

Results:

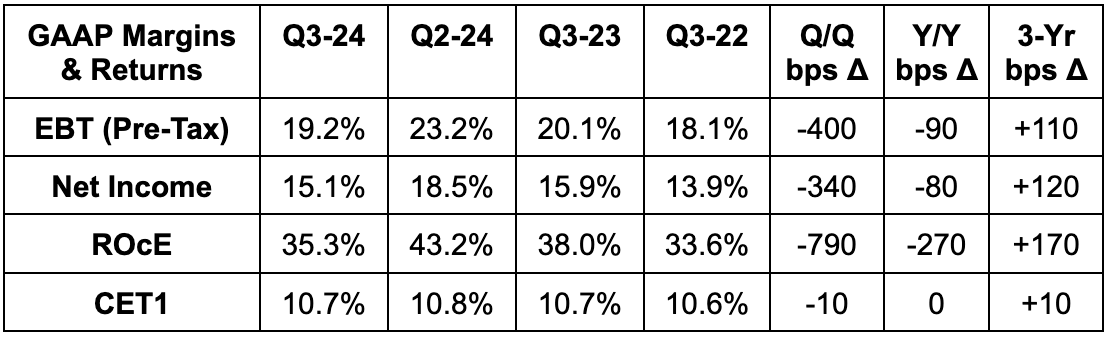

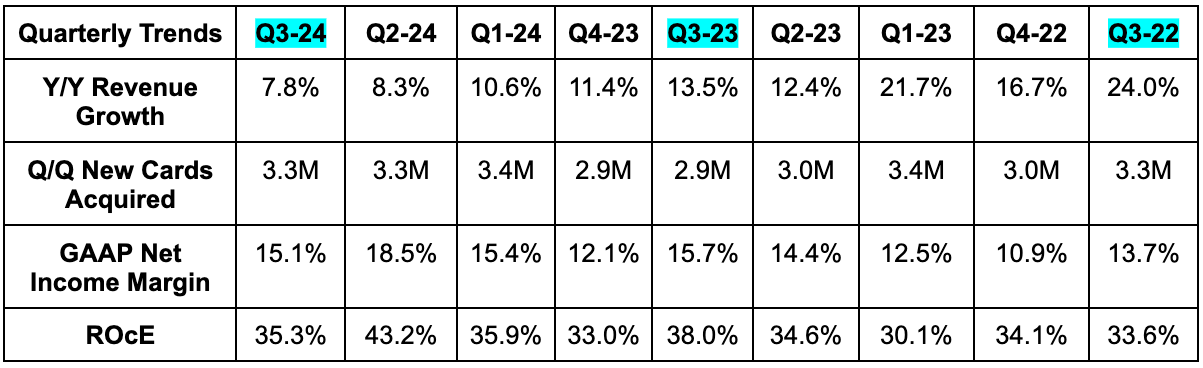

AmEx technically missed revenue estimates by less than 0.1%. I think we can call this meeting expectations. 35.3% return on common equity (ROcE) comfortably beat 32.4% estimates, while $3.49 in GAAP EPS beat estimates by $0.21 or 6%.

Balance Sheet & Credit Commentary:

- Card Member loans and receivables net write-off rate (including interest & fees) was 2.2% vs. 2.4% Q/Q and 2.0% Y/Y.

- Card Member loans and receivables 30+ day delinquency rate was 1.3% vs. 1.2% Q/Q and 1.2% Y/Y.

The consumer theme of this call was continued strong spending levels that aren’t quite as robust as post-pandemic levels:

“Spending across our affluent U.S. consumer base continued to be very stable with strong growth from Millennial and Gen-Z customers… Taking a step back, these best-in-class credit metrics are a reflection of our strategy. Our product value propositions create a powerful positive selection effect, which carries through to better credit performance.”

CFO Christophe Le Caillec

“Within Commercial Services, spend growth was up modestly and consistent with what we've seen over the past few quarters. Our fastest-growing segment again this quarter is international card services with spend growth of 13%. The breadth of this continued performance is especially worth noting.”

CFO Christophe Le Caillec

Credit trends continue to look great for this affluent customer vendor:

“Delinquency rates remain very low and in line with our prior quarters, especially taking into account the seasonal downtick we saw in Q2. Write-off rates declined to 1.9% this quarter. Looking forward, I still expect modest upward buyers to these rates as we continue to acquire new customers at elevated levels and increase our share of lending from existing customers.”

CFO Christophe Le Caillec

The only bucket of modest spend weakness for AmEx is happening within its small business segment:

“Our small business segment has been hit by macro… the same-store sales spend is certainly not as robust as it was coming out of the pandemic.”

CEO Stephen Squeri

Guidance & Valuation:

American Express lowered annual revenue estimates from 9%-11% to 9% Y/Y growth. AmEx has a run rate goal of 10% Y/Y growth. At the same time, it raised annual GAAP EPS guidance from $13.55 to $13.90. It has consistently raised its EPS guidance throughout the year, despite the revenue guidance reduction.

“I think that billed business definitely has to accelerate to get to our aspirational goal of 10% revenue growth.”

CEO Stephen Squeri

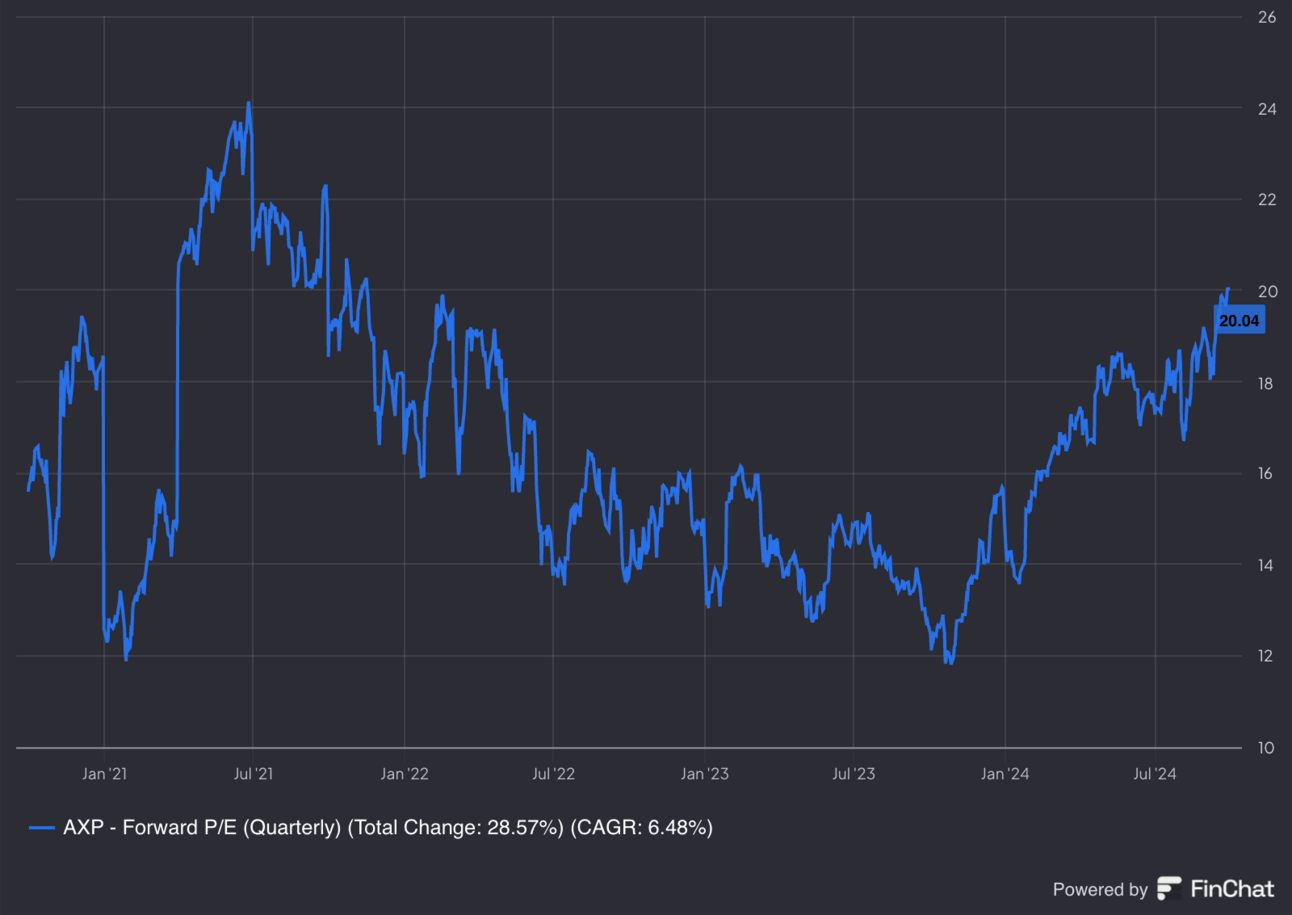

AXP trades for 20x forward earnings. Earnings are expected to grow by 18% this year and by 13% next year.

2. Disney (DIS) – Password Sharing & a New Product

Netflix has had a fantastic year in terms of subscriber growth outperformance and overall financial results. A big piece of its subscriber growth has come from password sharing restrictions, which block excess users from accessing a single account. This prompted a lot of signups. Disney is currently rolling out its own password sharing restrictions, which I expect to have a similar positive impact. The one large caveat is that Netflix has the most loyal and engaged viewer base in the sector. Disney will likely deal with slightly higher churn, but it should still be a boon to subscriber results. Between that, several box office hits and the Hulu integration, I expect a great quarter for that segment. The parks segment will remain challenged for now.

Disney is also debuting line skipping passes for $300-$450. These can only be used once per ride.

3. Starbucks (SBUX) – Changing Approach & More

a. Changing Approach

Under the old team, Starbucks was determined to win back U.S. traffic through deeper discounting. It sacrificed margin and brand preservation to accomplish this. Under Brian Niccol’s new team, a lot of those discounts and promotions are being cut. Starbucks is instead turning its attention to product quality and external marketing. Considering this premium brand has always been able to generate strong, reliable traffic growth at higher prices vs. competition, I think this makes way more sense. Fixate on what will motivate the demographic to spend the extra money on your product… you know… the taste. They’ve shown you for generations that they’re willing to pay up for a good product. That pivoted approach paired with its aim to rapidly fix throughput issues and easier comps should lead to faster growth ahead. That, however, will take time.

b. More

- Starbucks acquired a franchise partner called 23.5 Degrees in the UK. This adds over 100 new stores to its owned roster.

- Tressie Lieberman is being brought in as the firm’s new Chief Brand Officer. She previously worked with Niccol at Chipotle as its VP of Digital Marketing and, most recently, she was Yahoo’s CMO.