Table of Contents

- 1. Broadcom (AVGO) – Earnings Summary

- 2. Samsara (IOT) – Earnings Snapshot

- 3. Amazon (AMZN) – Yipit

- 4. Celsius (CELH) – CEO Interview with Barclays & …

- 5. CrowdStrike (CRWD) – CFO Interview with Citi

- 6. DraftKings (DKNG) – CEO Interview with Bank of …

- 7. Microsoft (MSFT) – Azure VP of Data Arun Ulag I …

- 8. Shopify (SHOP) – Roblox

- 9. Macro

- 10. Market Headlines

I sent Zscaler and Okta earnings reviews, Nvidia regulatory news and a GitLab snapshot during the week. I also sent some portfolio updates.

1. Broadcom (AVGO) – Earnings Summary

Broadcom creates & manufactures a slew of semiconductor-related equipment within data center, networking and industry-specific use cases. It also offers a range of software tools, which significantly broadened out with its VMWare acquisition. This company does not compete with Nvidia in terms of designing GPUs. Instead, it focuses on networking and connectivity, which competes with Nvidia’s switches and its SpectrumX networking product.

Strange Accounting Items to Note:

Broadcom’s VMWare acquisition is impacting several company metrics. It’s greatly benefiting overall revenue growth, as well as infrastructure software revenue growth. Finally, the acquisition is greatly hurting GAAP margins due to the M&A-fueled stock compensation, restructuring and integration costs.

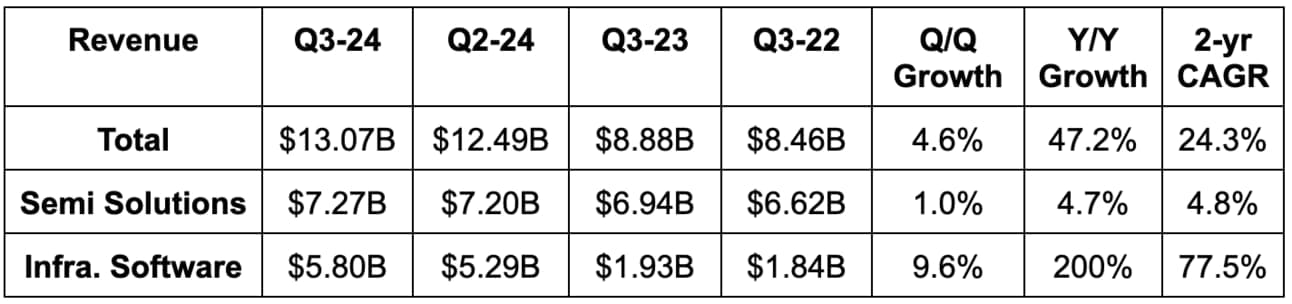

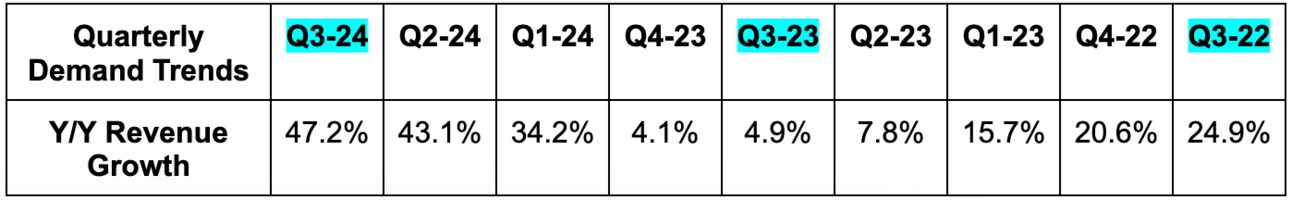

a. Demand

- Revenue beat by 0.8%. Revenue growth excluding VMWare M&A was 4% Y/Y.

- Semi Solutions revenue missed by 1.9%.

- Infrastructure Software revenue beat by 5.0%.

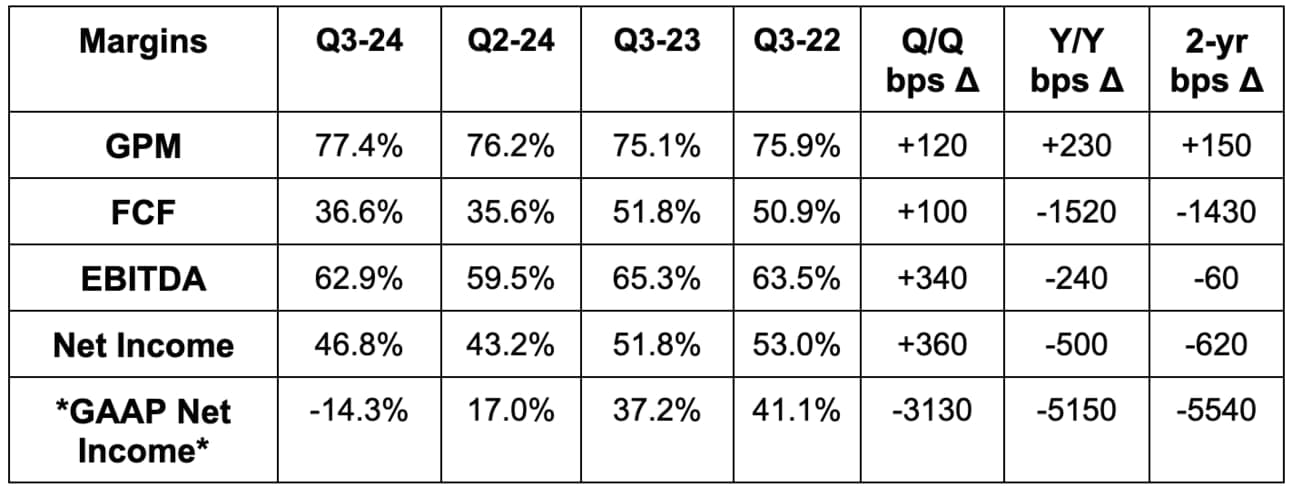

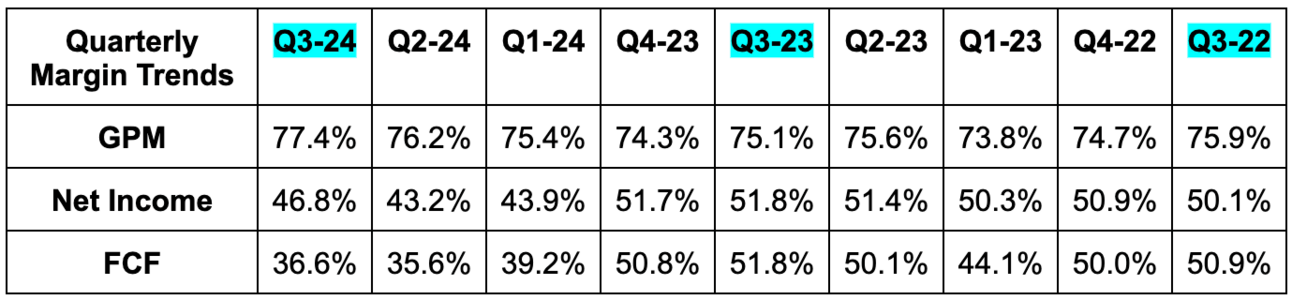

b. Profits & Margins

- Beat EBITDA estimate by 4%.

- Beat $1.21 EPS estimate by $0.03.

- Beat 76.5% gross profit margin (GPM) estimate by 90 bps.

- Missed free cash flow (FCF) estimate by 25%. There’s restructuring and VMWare M&A noise in here that is quite difficult to model.

c. Balance Sheet

- $9.95B in cash & equivalents.

- Inventory roughly flat Y/Y.

- Roughly $72B in total debt.

- Diluted share count rose by 9% Y/Y.

It swapped $5 billion in floating rate debt with cheaper senior notes during the quarter. AVGO also used cash from the sale of a VMWare segment to reduce debt by $4.2 billion. It will pay down another $1.9 billion in senior notes in Q4.

d. Fourth Quarter Guidance & Valuation

- Revenue guidance slightly missed.

- EBITDA guidance beat by 1.2% (64% margin guide vs. 63% expected).

- It sees a 76.4% GPM vs. 76.6% expected.

AVGO will begin offering quarterly guidance again now that it has moved far enough away from the VMWare purchase.

AVGO trades for 26x forward EPS. EPS is expected to grow by 14% this year and by 26% next year.

e. Call & Release

Infrastructure Software:

The VMWare integration continues to go wonderfully smoothly from a financial perspective. VMware offers virtual, localized layers of software that sit on top of hardware. This allows the centralized hardware to run several different operating systems from the same place. The company, which is now a Broadcom unit, calls these “virtual machines” or virtual private clouds. By reducing hardware requirements, VMWare saves its clients money.

The business generated $3.8 billion in revenue vs. $3.3 billion last quarter, as Broadcom marches to its goal of $4 billion in quarterly revenue there. Broadcom is pushing aggressively to simplify product offerings and shift to subscription revenue. A big part of that is its “VMWare Cloud Foundation” (VCF). That simply refers to its full suite of products that “virtualizes an entire data center and creates a private cloud environment on-premise for enterprises.” This differs from a public cloud approach, like we see from Amazon, Microsoft, Google and others. Maintenance is generally more cost intensive, but private clouds are considered more secure. This quarter, VCF was 80% of total VMWare business as annualized VCF bookings rose 32% Q/Q.

On the cost side, Broadcom cut VMware’s OpEx rate again from $1.6 billion to $1.3 billion sequentially. It now sees reaching or beating its $8.5 billion in EBITDA from the acquisition roughly one year ahead of schedule. It is routine to see financial goals and presumed synergies prove to be overly optimistic in large scale M&A. That was not at all the case here.

Semiconductor Solutions:

Networking revenue exploded higher this quarter, with 43% Y/Y growth. This is being carried by the explosion in demand for high performance compute data centers amid the GenAI boom. Relatedly, hyper-scaler demand remained exceedingly strong. Broadcom’s GenAI niche is predominately in networking revenue. Superchips and high-performance compute (HPC) can’t all be packed into the same corner of a data center. GPUs must be able to connect to one another to drive better bandwidth and performance, with faster, more efficient model training and inference to cut costs. This is where Broadcom thrives. All in all, AVGO sees $12 billion in 2024 AI revenue vs. $11 billion last quarter.

Some product highlights:

- Switches allow individual GPUs to connect to one another. Its PCI Express Switches doubled shipments Y/Y.

- Its Network Interface Cards (NICs) are the actual high-speed connectors to AI factories that enable vastly accelerated pace of data processing, model training and more. Its NICs are enjoying triple digit Y/Y growth.

- AI Accelerators are another important area within next-gen data center connectivity and networking. These are designed as separate machines used to augment and bolster AI workload and data processing. Custom AI accelerators grew 3.5x Y/Y thanks to great demand from mega caps.

- Tomahawk 5 and Jericho 3 rose 4x Y/Y. These are Ethernet switching products that help blaze connections between various parts of the data center.

The non-AI portions of networking revenue bottomed for Broadcom as expected. Growth for the segment was 17% Q/Q, and it sees positive Q/Q growth continuing next quarter. It saw an expected recovery in server storage with 5% Q/Q growth. In wireless, revenue rose 1% Y/Y and it sees 20% Q/Q growth for the segment next quarter thanks to industry launches. Broadband revenue fell 49% Y/Y as telecom players and service providers continue to manage spend.

f. Take

Nothing wrong with this quarter. All of the segments that should be strong for it outperformed and it again raised its AI revenue guidance for the year. Nvidia has just trained investors to demand monster beats and raises for GenAI hardware darlings, and AVGO is in that group. It’s understandable to see the quarterly guidance miss be punished, but I don’t think long term investing bulls should be overly concerned about this report. It was solid for the most part. Not amazing… certainly not terrible.

2.Samsara (IOT) – Earnings Snapshot

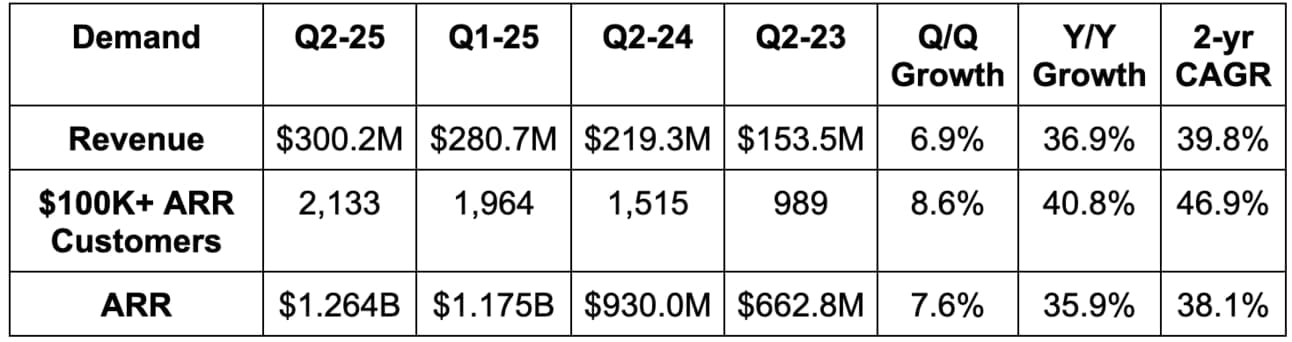

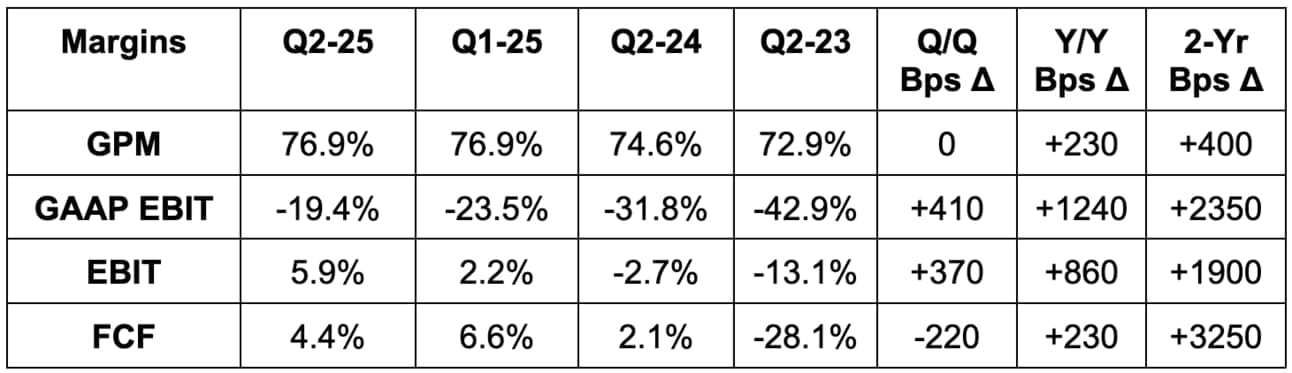

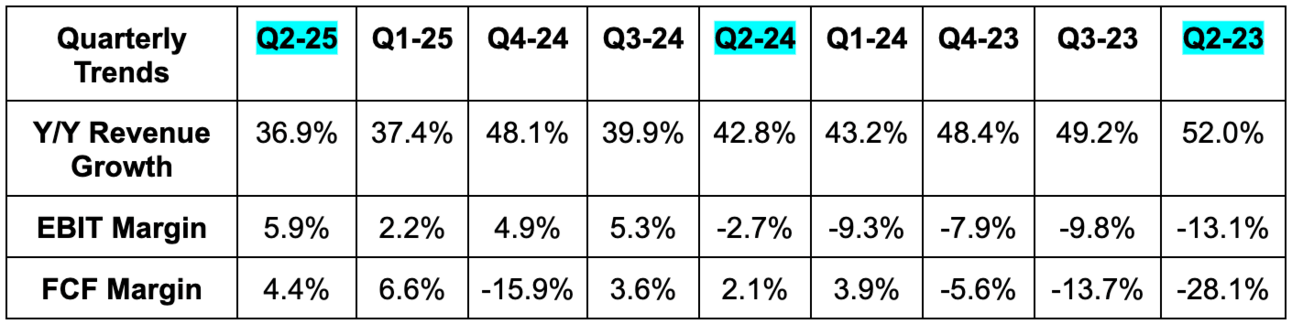

a. Results

- Beat revenue estimate by 4.3% & beat guidance by 4.5%. Its 39.8% 2-year revenue compounded annual growth rate (CAGR) compares to 40.2% Q/Q & 48.2% 2 quarters ago.

- Sharply beat -$5M EBIT estimate by $22.6M & beat guide by $23.6M.

- Beat $0.01 EPS estimate & beat guidance by $0.04 each.

b. Guidance & Valuation

- Raised annual revenue guide by 1.4%, which beat by 1.3%.

- Sharply raised $36M annual EBIT guide by $25M, which beat by $25M.

- Raised $0.14 annual EPS guide by $0.03, which beat by $0.04.

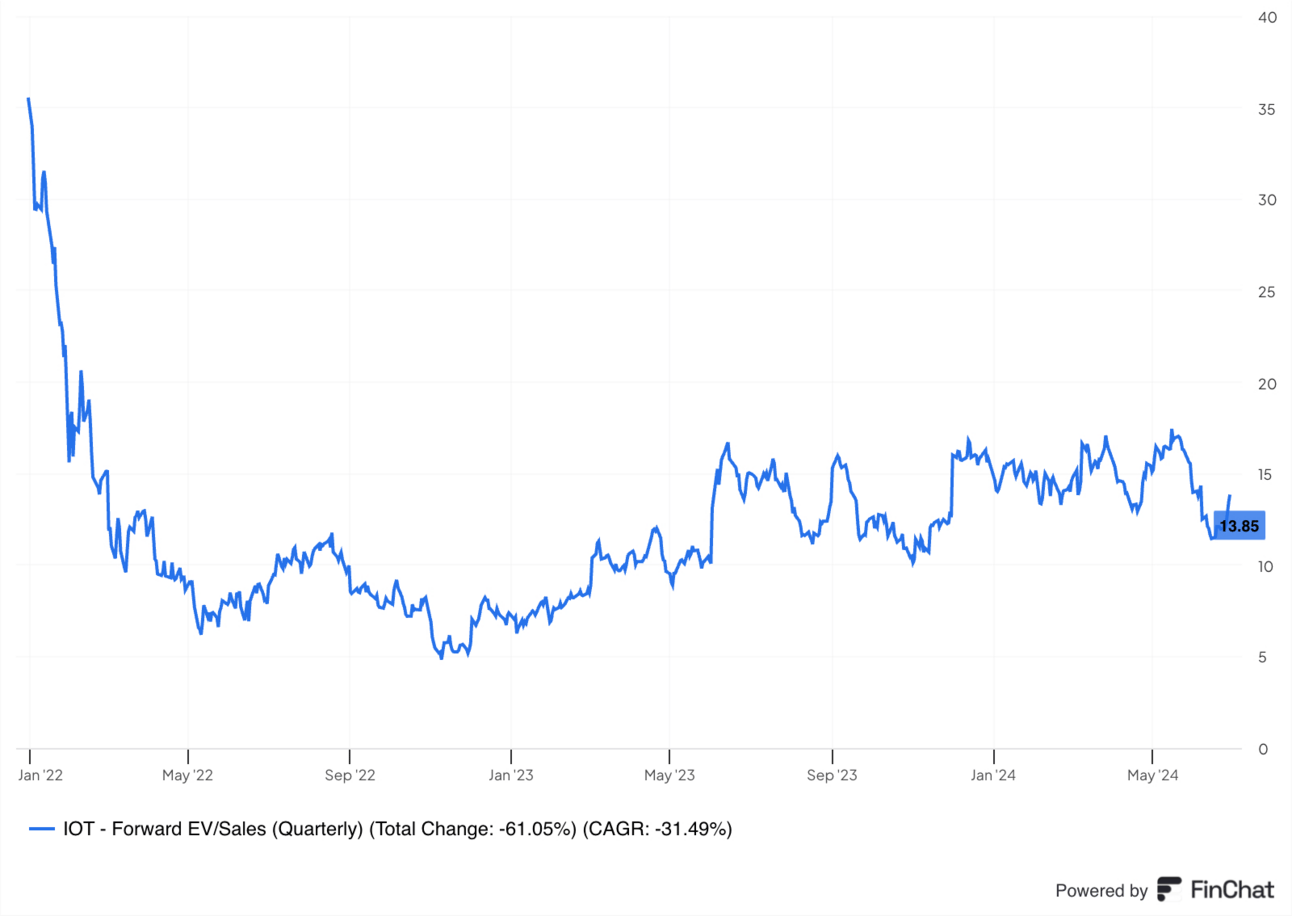

IOT trades for 230x forward EBITDA. EBITDA is expected to grow by 390% this year, by 84% next year and by 74% the year after.

c. Balance Sheet

- $670M in cash & equivalents.

- $208M in long term investments.

- No debt.

- Diluted share count rose 4.2% Y/Y.

3. Amazon (AMZN) – Yipit

Yipit, a world-class 3rd party research firm, shared some Amazon data this week that bodes quite well for the current quarter. AWS growth last week accelerated to 21.5% Y/Y to its fastest level in two years. At the same time, North American retail accelerated above 10% Y/Y to its fastest rate of the quarter. 21.5% Y/Y growth compares to consensus estimates of 19%, while North American Retail growth compares to 8.4% estimates. This is exciting, but remember it’s data for only one week.

We’ve written a lot on Amazon’s margin turnaround and all of the levers it has to pull to drive more expansion. Advertising… 3rd party selling… fulfillment localization… offering its supply chain as a service… robotics… etc. One of the most powerful bottom line drivers, however, is top line outperformance. Variable costs don’t scale in tandem with that revenue outperformance. So? Margins and profits outperform too. If this data isn’t an anomaly, Amazon should be gearing up for a very strong showing next month.