During the week, I also published:

- An article that includes: Oracle & MongoDB earnings reviews; coverage of Alphabet’s Willow release, a timely Uber CFO interview & GM Cruise news; Duolingo & SoFi analyst downgrades.

- A portfolio update, my current holdings & a performance update.

Table of Contents

- 1. Costco (COST) – Brief Earnings Snapshot

- 2. Adobe (ADBE) — Earnings Review

- 3. SentinelOne (S) – Co-Founder/CEO Interview

- 4. Disney (DIS) – CFO Interview & Moana 2

- 5. Broadcom (AVGO) – Earnings Review

- 6. Shopify (SHOP) – CFO Interview

- 7. DraftKings (DKNG) – CEO Interview & State Gambl …

- 8. Headlines

- 9. Macro – Inflation Data

1. Costco (COST) – Brief Earnings Snapshot

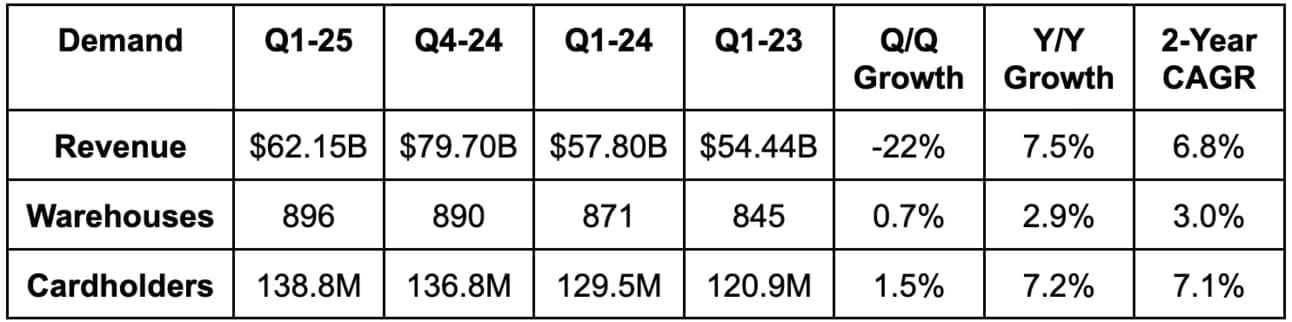

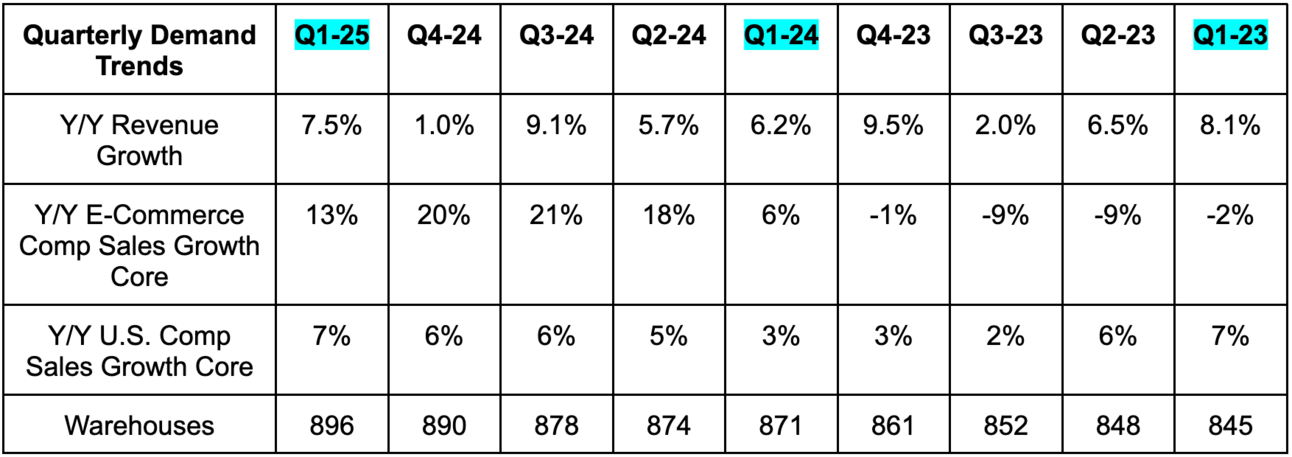

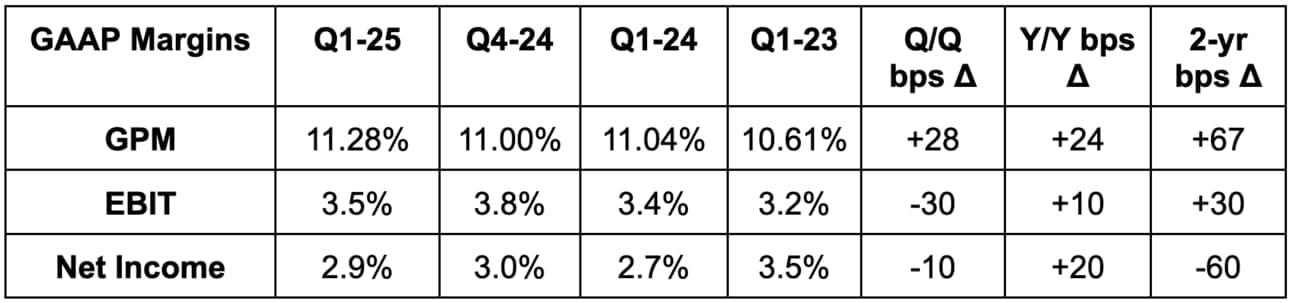

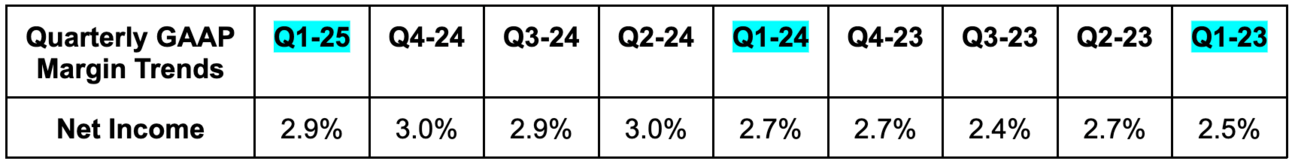

a. Results

- Beat revenue estimates by 0.3%. Reports revenue monthly.

- Beat EBIT estimates by 0.6%.

- Beat $3.80 GAAP EPS estimates by $0.24.

b. Balance Sheet

- $11.8 billion in cash & equivalents.

- $5.75 billion in debt.

- Share count rose by lower than 0.1% Y/Y. We can call this flat.

c. Valuation & Important Quotes

EPS is compounding at a steady 11% multi-year pace.

"Inflation was once again essentially flat in the quarter across all core merchandise."

Costco CFO Gary Millerchip

“Our members are willing to spend as inflation comes down as long as those sort of 3 key ingredients that I mentioned are there for the member as well: items, quality and value… I think we're seeing a lot of similar consumer trends as in the last few quarters… We're seeing members being very choiceful about how they're spending the dollars.”

Costco CFO Gary Millerchip

2. Adobe (ADBE) — Earnings Review

Adobe is a software giant that invented the .pdf file (co-founder John Warnock specifically). It provides programs to create and imagine, handle customer interactions and process documents. Revenue is split into two main buckets: Digital Media and Digital Experiences. Digital Media is made up of its “Creative Cloud” and “Document Cloud.” The Creative Cloud includes Photoshop and Illustrator. It’s what empowers creation, iteration and perfection of digital design. The Document Cloud, including the ubiquitous Adobe Acrobat, allows for secure PDF (Personal Document Format) management and collaboration – among other things.

Finally, its Experience Cloud includes Adobe Analytics and other products like “Campaign.” Campaign is its (intuitively-named) marketing campaign tool. Experience Cloud covers end-to-end customer interactions with a real-time customer data platform (CDP), ensuring that those interactions are optimized. It also publishes some greatly appreciated macro data on overall commerce spend.

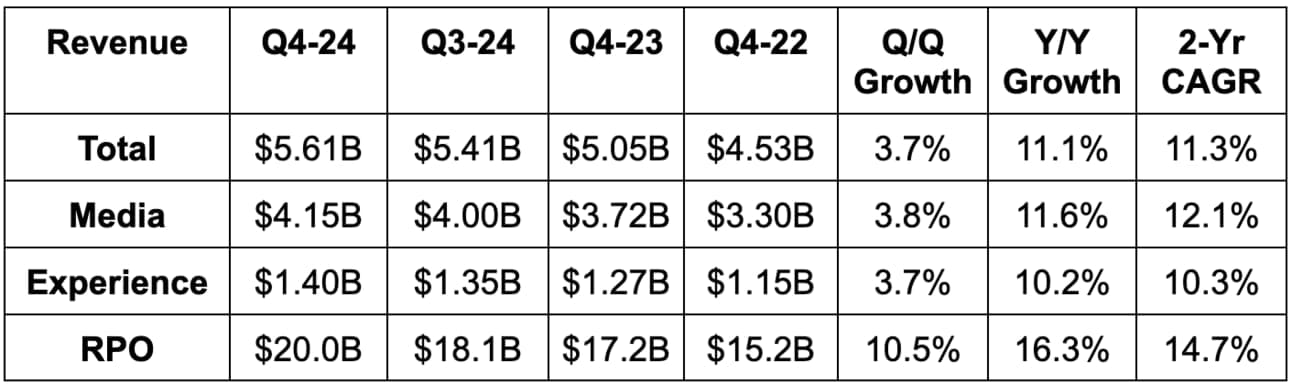

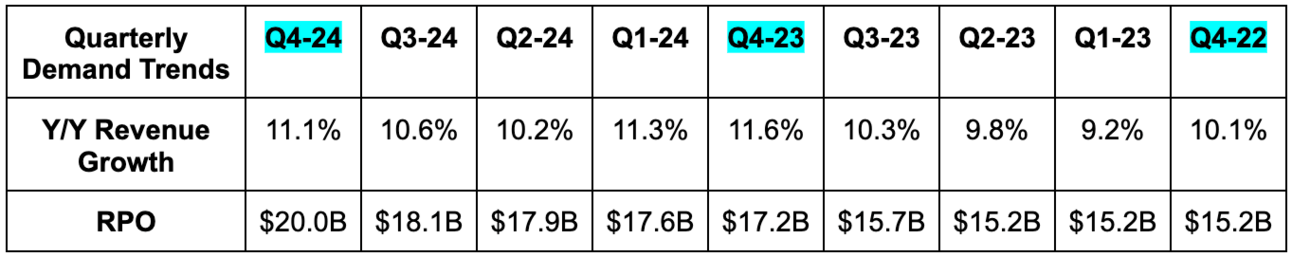

a. Demand

- Beat revenue estimates by 1.3% & beat guidance by 1.5%.

- Digital media revenue beat estimates by 1% & beat guidance by 1.1%.

- Digital media net new ARR beat estimates by 4.5% & beat guidance by 5.1%. Smallest beat here in a while.

- Digital media generated just over $2 billion in net new ARR for the year for the first time.

- Digital experience revenue beat estimates by 1.7% & beat guidance by 2.2%.

- Remaining Performance Obligations (RPO) beat by 2%.

“Black Friday/Cyber Monday played out about as expected.”

CFO Dan Durn

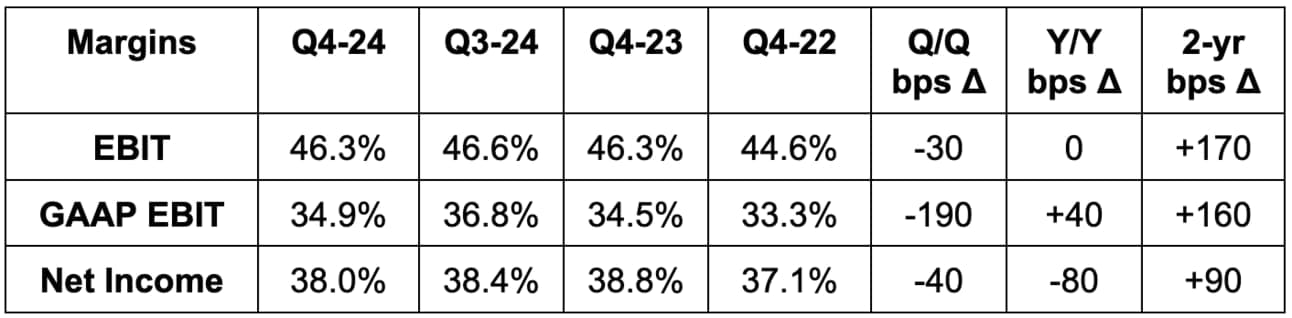

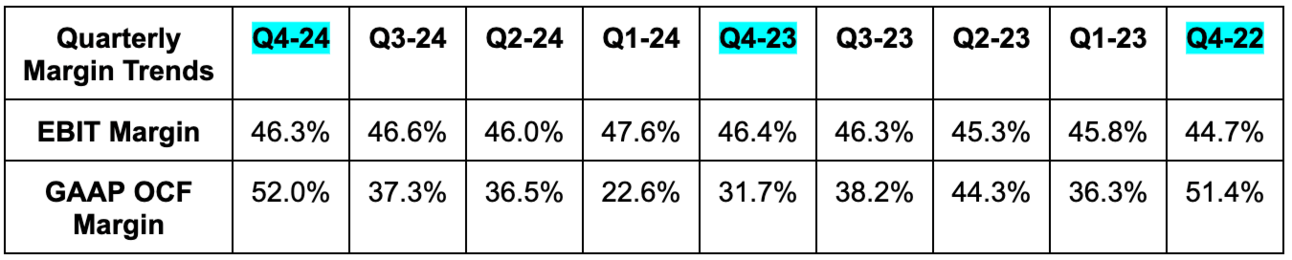

b. Profits & Margins

- Beat EBIT estimates by 2.8%.

- Beat $3.67 GAAP EPS estimates by $0.12 & beat guidance by $0.18.

- Beat $4.67 EPS estimates by $0.14 & beat guidance by $0.13.

- Beat operating cash flow (OCF) estimates by 10.6%.

c. Balance Sheet

- $7.9B in cash & equivalents.

- $5.6B in total debt.

- Diluted share count fell by 1.2% Y/Y.

d. Annual Guidance & Valuation

- Annual revenue guidance missed by 1.6%. Guidance represents 8.9% Y/Y revenue growth.

- Annual Digital Media (Document Cloud + Creative Cloud) revenue guidance missed estimates by 1.5%.

- Guided to about $17.33 billion in digital media ARR.

- Annual Experience revenue guidance slightly missed estimates.

- Annual digital experience subscription revenue guidance beat estimates by 0.5%.

- Annual $20.35 EPS guidance missed by $0.16.

- Q1 guidance missed by a similar margin for demand and was slightly ahead for EPS.

Note that ARR throughout the year is measured on a foreign exchange neutral (FXN) basis. FX changes through the year led to it lowering ARR by $117 million heading into 2025 and expects another $200 million hit at the end of next year. Finally, it expects growth mix-shift to move towards new clients and products and away from existing client expansion.

Adobe is expected to compound EPS at a forward 2-year clip of 13%.

e. Call & Presentation

Firefly Review:

Firefly refers to its family of large language models (LLMs) like Gemini for Google or Claude for Anthropic. Adobe offers these models for customer use and also creates popular services from them to automate various parts of content and CRM workflows within “Firefly Services.” This is a vital part of what powers “scaled content production” on the creative side and “scaled customer interaction personalization” on the experiences side. Pepsi and Tapestry are new users of Firefly Services as total Firefly generations (usage) rose to 16 billion vs. 12 billion Q/Q and 9 billion 6 months ago.

“Integration across the clouds is driving record customer adoption and usage.”

CEO Shantanu Narayen

Digital Media – Document Cloud:

This year, Adobe added its AI Assistant product to Acrobat and Reader. This allows for conversational querying of unstructured PDFs and will soon be able to create relevant slide decks from these documents. This quarter, it added new AI agents for contracts and scanned documents and raised the size of documents that this assistant can handle. It also added additional language support. Adobe launched its AI Assistant for the Acrobat Desktop app, joining its mobile and web offerings. And for Acrobat Web, it launched a new Adobe Express integration to help users create images and “quickly stylize” PDF content. As a reminder, Adobe Express is its overarching “quick and easy create anything app” that offers guardrails, processes and GenAI model-inspired content automation for customers. It organizes, maintains and expedites digital asset creation.

All of this AI Assistant integration work in the Document Cloud is resonating. AI Assistant queries doubled Q/Q (small base, but still) and this innovation helped facilitate 50% Y/Y monthly active user (MAU) growth for Acrobat Web specifically and 25% MAU growth overall. Furthermore, Adobe recently conducted a productivity study that revealed how the AI Assistant for Document Cloud can cut time to task completion by 75%.

“We observed year-end seasonal strength in the enterprise segment.”

CFO Dan Durn

- Document Cloud revenue rose by 18% Y/Y (17% FXN).

- Document Cloud ARR rose by 23% Y/Y (23% FXN). Generated $173 million in net new ARR.

- Abbott Labs, the U.S. Department of State, Truist, Novo Nordisk and U.S. Cellular were among customer wins for the segment this quarter.

- NNARR guidance note:

Digital Media – Creative Cloud & a Bit on Adobe’s GenAI Niche:

Its new video model is now in public beta, with interest in the product called “massive.” This helped foster 70% Y/Y growth in Premiere Pro (expensive tier for its video product) beta users, as the video model inspires many more customers to sign on. This will become broadly available early next year. As a reminder, Firefly Services is the engine powering GenAI automation, and is what led to strong adoption of apps in this suite.

During the quarter, Adobe also upgraded the Firefly Image model to 4x the pace of image generation, and continued infusing more GenAI work into Photoshop, Express and Illustrator too. Adoption of Lightroom Mobile (photo editing) was noted as a standout, with Generative Remove and upgrades to editing workflows both helping. Adobe Lightroom was named the Mac App of the year this year as well.

Adobe Express is now up to 180 integrations and added new players like ChatGPT, Salesforce’s Slack, Wix and Hubspot to the roster to bolster interoperability and diminish user friction. 4,000 businesses now use Express, while this product also had an excellent back-to-school showing, with 84% Y/Y growth in students on its premium plan.

- It has a new Firefly Audio model in beta testing.

- Creative Cloud revenue rose by 10% Y/Y (11% FXN growth).

- Customer wins included Alphabet, American Express, the U.S. Department of Defense and T-Mobile.

- Emerging market subscription momentum was flagged as a notable quarterly highlight.

The Experience Cloud:

The Adobe Experience Platform (AEP) and native apps revenue bucket crossed $1 billion this quarter with more than 40% Y/Y growth. Apps like Customer Journey Analytics and Journey Optimizer are doing quite well, as 48 Fortune 100 members are now using this suite of products. And while AEP offers foundational insight into best CRM practices, Adobe Experience Manager (AEM) (they need to change this product name) enables customers to take these learnings and deliver highly targeted ad placements and interactions with consumers. All of these tools “deliver productivity gains” while automating things like pipeline and customer lead generation. Firefly Services augments this by uncovering similarly-minded, copy-cat consumers for clients to target.

The Experience and Creative Clouds are rapidly converging around the “GenStudio” product umbrella. This unified bundle includes Firefly services, Express, all AEP apps and pretty much everything else that it offers outside of Document Cloud. If we think about it… conjoining experience and creative products makes a ton of sense. It’s one thing to understand your customers, how to talk to them and where they are… it’s another thing when the vendor who does this for you can also create beautiful, on-point marketing materials. GenStudio makes CRM an end-to-end endeavor for Adobe, while creating true differentiation vs. companies that typically only do one of these things (CRM or content creation). This will vastly “accelerate the content supply chain for customers,” with Firefly services facilitating that.

This quarter, Adobe added a new performance marketing tool to GenStudio to help customers manage ad placements across social and other channels. It plans to keep adding more & more tools to this newly organized bundle, and it will organize the enterprise go-to-market strategy around GenStudio. It expects this revamped focus to deliver a “pipeline acceleration throughout the rest of the year and beyond.”

“GenStudio extends our end-to-end content supply chain solution empowering freelancers, agencies and enterprises to accelerate the delivery of content, advertising and marketing campaigns.”

CEO Shantanu Narayen

More Experience Cloud Highlights:

- Revenue rose by 10% Y/Y (10% FXN); subscription revenue rose by 13% Y/Y (12% FXN).

- Deepened AWS partnership to offer AEP and native apps on that marketplace.

- Integrated with several advertising players like Microsoft Advertising, TikTok, Meta and more.

- Secured Allianz, American Express, Bank of America, Cisco, Disney, JP Morgan, Wells Fargo and PayPal as clients.

- This was the largest-ever bookings quarter for the Experience Cloud.

Current Approach to GenAI Adoption:

Analysts criticized Adobe on the call for the smaller-than-typical net new ARR beats and the somewhat underwhelming forward guidance. It was asked if there’s some “leaky bucket” or churn issue preventing all of this positive sentiment and momentum from generating faster growth. If things are so amazing, why does forward guidance imply net new ARR deceleration? Leadership reminded us that it beat and raised three times this past year, and does like to lean prudent with its forecasting, but the concern was still palpable. As Adobe explained, the priority is on scaled adoption rather than monetization at this point. 2025 priorities include accelerating freemium access to its various apps based on all of the new GenAI upgrades. Monetization will come over time as it uses this new value to create more expensive subscription tiers. For example, it will soon add a new tier for its Firefly video model. Monetization will happen, but that’s still a secondary focus and likely led to some guidance disappointment for next year.

“When it comes to the core business, we are very focused on introducing new value. That is going to create more segmentation and more tiering. We can align value and pricing there.”

President of Digital Media David Wadhwani

As a reminder, Adobe doesn’t participate in the infrastructure layer of the GenAI opportunity. It focuses on building great models and apps. It stands out in its ability to unleash a massive supply of data – from PDFs to customer interaction history and more – to train a broad suite of apps across all clouds, including this one. That means more content to season and train models than others have, and also more applications to which these advancements can be added. Across Photoshop, Adobe Express, Lightroom (photo editing), Premiere (video editing) and so many more tools, Adobe is racing to add GenAI value across a larger set of tools.

f. Take

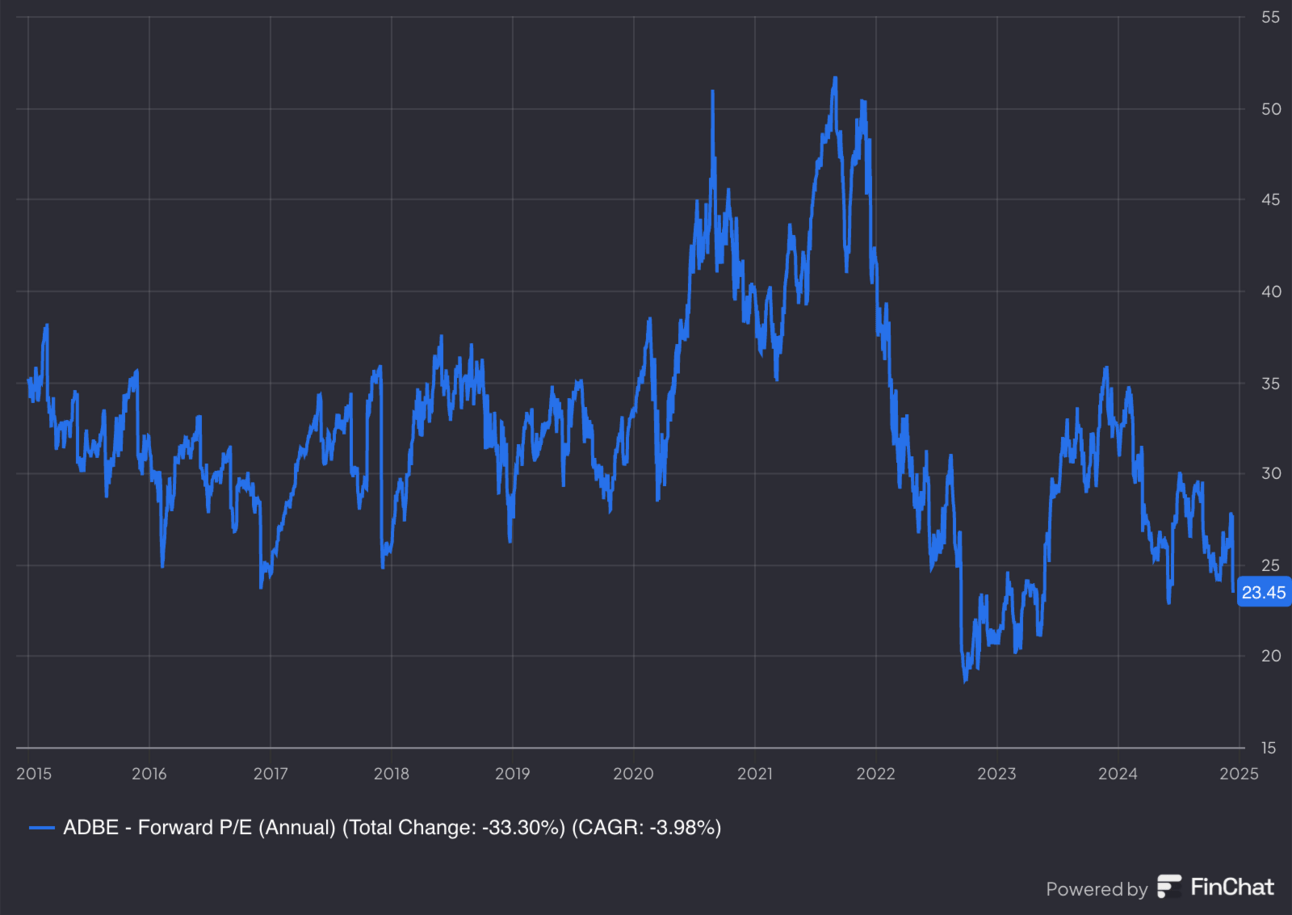

The quarter was not terrible, but it was underwhelming for one of the highest quality names in software. It likely will raise new concerns around how meaningfully Adobe can turn GenAI momentum into financial gain, as the monetization so far has been more muted than for others. That adds to noise surrounding Canva and other competition beginning to steal market share, which is where the concerned sell-sider questions came from. Still, the firm continues to steadily compound top and bottom lines at massive scale and continues to be optimistic about GenAI monetization being a “when” rather than an “if”. I do see clear differentiation in pairing the experience and creative use cases together, which makes me optimistic about where GenStudio can go. And I do still see this as a fantastic company at a somewhat reasonable valuation. The multiple is starting to look quite tempting, but, as of now, I prefer to own other names. It’s interesting.

3. SentinelOne (S) – Co-Founder/CEO Interview

Ongoing Momentum:

Co-Founder/CEO Tomer Weingarten spoke about the net new ARR acceleration seen last quarter that positively diverged from typical seasonality. While everyone thought this would come from the CrowdStrike outage, it has actually come from the firm’s own better execution. It’s just a few quarters into its go-to-market overhaul and bringing on much more enterprise talent to pursue larger contracts. The fruits of those changes began to pay off last quarter, with SentinelOne in a better competitive position (per Tomer) than it has been in years. This should lead to a continued acceleration in net new ARR growth through most of next year. He didn’t want to call this a formal forward guide, but this was still wonderful to hear. SentinelOne has always had great tech. A leading, 5th straight perfect detection score from Mitre indicates that clearly, especially considering competition refused to participate in this study. Now? It’s combining elite tech with stronger go-to-market motions.

“It’s just a very different picture than we had last year… I'm fairly confident that we can keep accelerating net new ARR and that next year is going to look better in terms of net new ARR. But, I don't want people running in all kinds of speculation. I just think that the strength you've seen in Q3 should carry on. And I think every indication that we have sitting here points in that direction… “I'm more encouraged now than I've been in a while… It's clear that we're going to have a better year next year than the one we had this year.”

Co-Founder/CEO Tomer Weingarten

“Q4 has traditionally been a strong quarter for us, and I think it's going to continue to be a strong quarter for us.”