I sent most of this week’s content during the week:

- Monday’s short article included:

- A new transaction

- My overall portfolio & performance updates

- Wednesday’s article included:

- Nvidia, CrowdStrike & SentinelOne Earnings Review

- Thursday’s article included:

- Salesforce & Lululemon Earnings Reviews

- Ulta and Dell Earnings Coverage

- PayPal Fastlane News

- SoFi Sentiment

- Meta Llama Progress

- Progyny IVF Regulation

- A new transaction (which happened as telegraphed in the article)

- Today’s article includes:

- MongoDB Earnings Review

- Okta & Marvel Earnings Coverage

- Apple News

- Market Headlines

- Macro

Next week, I will cover Zscaler, Gitlab, Samara and Broadcom earnings and more. I’m still organizing the SoFi investment case to organize all of the research I’ve done over the last 4 years. It will come in September.

1. MongoDB (MDB) – Earnings Review

a. MongoDB 101

MongoDB is a key player in data storage and analytics with a document-oriented setup. This differs from legacy relational style databases and next-gen versions like Snowflake’s. How so? Legacy relational databases store data in static rows and columns linked by implemented formulas. These databases look like giant Excel spreadsheets and use structured query language (SQL) to work. Legacy relational databases cannot seamlessly handle unstructured data like MongoDB’s data lake can. This is a large limitation considering how important unstructured data is for GenAI use cases. Legacy relational databases struggle to scale and unlock the most advanced querying. The datasets are fixed, with formatting and filtering more limited. The lack of ability to provide “not only SQL” (NOSQL) can slow performance and diminish value. MongoDB’s NOSQL database and document-style data storage fix these issues. That’s why the pace of migration continues to ramp up.

Importantly, NOSQL is not better when it comes to structured data querying and data consistency as well. Not superior, just better at certain things. For evidence of this, arguably one of the most disruptive players in the general database world is Snowflake. Snowflake’s data warehouse is a relational database… just a next-gen version. It offers NOSQL, better scalability via separation of data and compute, and unstructured querying. It went with a “make relational databases much better” approach, while MongoDB implemented a “move to NOSQL” approach. Snowflake is considered more advanced in structured data. Some would argue its security and governance offering is better too. MongoDB stands out when it comes to flexibility, ease of use and unstructured data prowess. In this light, they technically are complementary tools and can be used in tandem in some cases. Still, both continue to encroach on the other’s territory, like we see in other areas like cybersecurity, programmatic advertising and DevSecOps.

The firm’s most exciting product is called MongoDB Atlas. This is a cloud-native database service that implements a group of servers (or a cluster) to actually store data for app creation within its platform. The nature of MongoDB’s product allows clusters to be easily added to or subtracted for easier flexing up & down as needs fluctuate. It also offers MongoDB Realm as a mobile environment for app creation, MongoDB Stitch to build apps without servers or any needed infrastructure maintenance and MongoDB Search for data querying. Finally, it offers MongoDB Data Lake specifically for unstructured data, which directly competes with players like Snowflake.

Some more products to know:

- Vector Search allows clients to seamlessly scrape insights from data. It allows for theme-based querying rather than just word-based. It also provides retrieval-augmented generation (RAG). This pushes semantic search results into associated large language models to uplift querying precision.

- MongoDB AI Applications Program (MAAP) offers a series of templates, guardrails and 3rd party integrations to diminish GenAI app creation friction.

- Enterprise Advanced refers to its on-premise (Atlas is cloud-based), database and app bundle. It allows companies to purchase licensing for subscription-based usage (rather than paying for consumption under Atlas).

- MongoDB 8.0 is its latest no standard query language (NoSQL) database. This offers 60% performance boosts and better time series (timeline-based) data services.

- Atlas Stream Processing allows for real-time data ingestion. That matters a lot for app developers who constantly toy with, split test and render every single little detail within their apps. Real-time access to data querying helps make that process more painless.

Reminder:

For the last two quarters before this strong report, the company had disappointed the street with sharp annual guidance misses. It pocketed $80 million in unused Atlas revenue commitments and multi-year licensing business last year. That $80 million will not recur. That chunk was essentially pure margin, which makes the profit hit larger than demand. Keep this in mind as we go through its financials and why they look underwhelming.

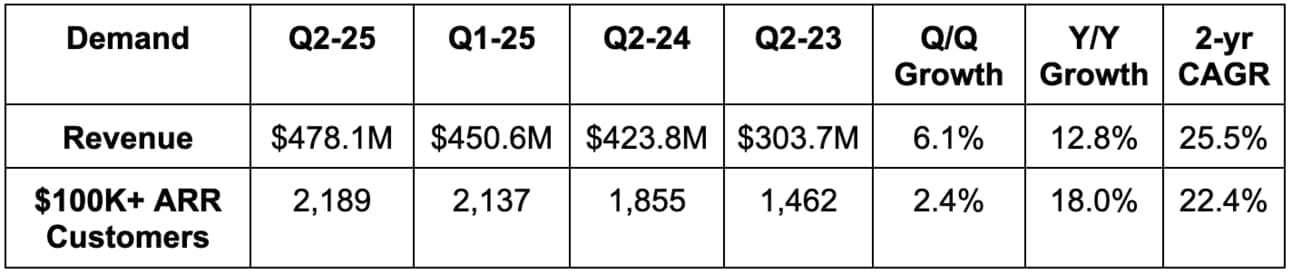

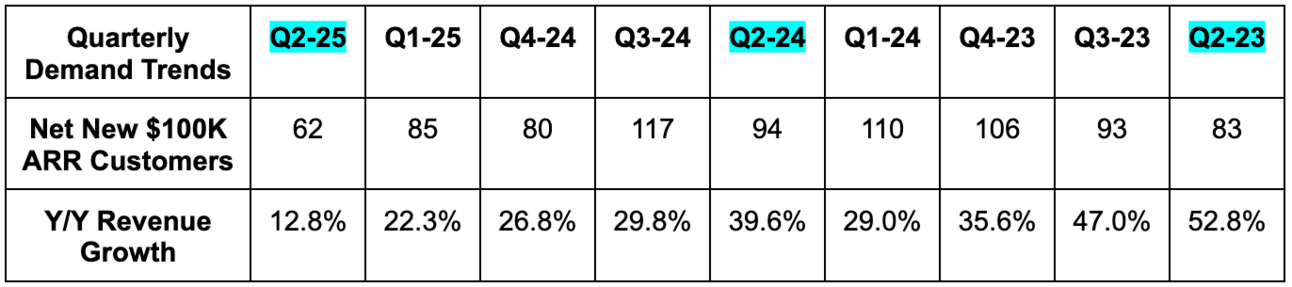

b. Demand

- Beat revenue estimates by 3.0% & beat guidance by 3.5%.

- Atlas revenue rose 27% Y/Y and represents 71% of total business vs. 63% Y/Y. Non-Atlas revenue (impacted by licensing & unused revenue notes above) fell by 13% Y/Y.

- Customer count rose by 12.7% Y/Y.

- Net revenue retention was 119% vs. “above 120%” Q/Q. A mix shift towards new business is impacting this metric like for many other software names.

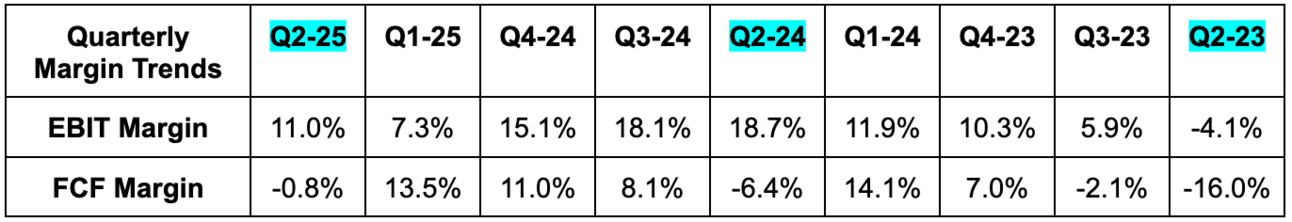

c. Profits & Margins

- Beat EBIT estimates by 41.9% & beat guidance by 43.8%.

- Beat $0.48 EPS estimates by $0.22.

- Beat -$6 million FCF estimate by $2 million.

- Margin declines were driven by the licensing and unused revenue notes already discussed.

d. Balance Sheet

- $2.2B in cash & equivalents.

- No traditional debt; $1.1B in convertible senior notes.

- Diluted share count rose by 3.9%. That really does need to slow, considering we are 7 years beyond its IPO.

e. Guidance & Valuation

- Raised annual revenue guide by 1.8%, which beat by 1.3%.

- Raised annual EBIT guide by 8.8%, which beat by 9%.

- Raised annual $2.23 EPS guide by $0.17, which beat by $0.13.

Guidance assumes consumption growth remains at Q1 levels, despite Q/Q improvements this quarter. A decision to pay cloud providers upfront for capacity is allowing it to secure better terms. This means better gross margin, but worse FCF margin considering the larger initial outlay. That will hit cash flow by $22.5 million per quarter for Q3 and Q4.

f. Call & release

AI:

AI Monetization Today:

As we frequently write about, the software layer of GenAI monetization has barely begun. Companies are racing to lay the foundational infrastructure needed to support vast, complex databases and GenAI app creation in the decades to come. For now, budgets are being allocated to that layer, while inevitable app creation spend really hasn’t meaningfully begun yet. MongoDB continues to think GenAI will not contribute to 2025 results and is mainly seeing app experimentation from customers at this point, rather than prioritization.

AI Monetization Positioning:

Frequent dialogue with customers gives leadership confidence in GenAI monetization coming. It sees itself as the “ideal data layer for AI apps” for a few reasons. First, AI app quality is fully dependent on a database architecture allowing for “rich & complex” data querying with rapid speed. Its document-oriented approach can handle all different data types, including all unstructured data, which is especially relevant in the age of GenAI. Next, as LLM performance and latency improve, using operational data in GenAI apps becomes more feasible and desirable. That directly supports demand for its core products. Thirdly, it partners with all relevant app development frameworks and model builders to give developers ultimate choice on which tools to use, with security and compliance help that “meets or exceeds expectations.”

AI Biggest Opportunities:

MongoDB sees a massive opportunity in modernizing legacy apps to position them for accelerated compute and GenAI-laced value. It thinks it’s great at automating the preparation of data movement for migrations but not great at rewriting code as it enters their ecosystem. Its Relational Migrator Product is its full service response to this; it’s meant to make migration as painless as possible. It’s using GenAI in its own work to automate re-coding, database and query language conversion for these migrations. In turn, that lowers cost, complexity and friction associated with embracing these migrations. This year, it debuted a few projects with customers to test efficiency gains stemming from this work. The results were “very exciting,” with “significant reductions in time and cost to modernize” and “dramatic improvements in time and cost to rewrite code.” It’s also determined to be the “platform of choice” for customers building new AI apps. That’s why it created the MAAP program (already defined), with broad integrations for ultimate choice and professional service help too.