1.ServiceNow (NOW) – Earnings Review

ServiceNow 101:

ServiceNow is one of the largest enterprise software firms in the world. It automates workflows, tech stacks and projects to augment customer efficiency. For this reason, it calls itself the “leading digital workflow company.” Workflow automation buckets include: service management, operations, asset management, security, customer management, employee management and creator management. These are further grouped into workflow buckets like “customer & employee workflows,” “creative workflows” and “technology workflows.” Two products to know within the tech workflow category include Information Technology Operations Management (ITOM) and Information Technology Service Management (ITSM). The names of these products tell you exactly which types of workflows they’re meant to automate.

All products and services are neatly tied into its “Now Platform.” The firm describes this overarching ecosystem layer as a way to “optimize processes, connect silos and accelerate innovation on a single unifying platform.” That’s a fancy way of saying that it makes every piece of work more seamless and expedient.

To bolster automation capabilities, ServiceNow has been hard at work on GenAI innovation. Its Now Platform “Vancouver” release got the ball rolling by consolidating all GenAI model and app projects into an intuitive set of products. It recently built on that debut with a Now Platform “Washington D.C.” release. This is essentially a large batch of GenAI-inspired upgrades to the Now platform. It adds to the progress of the Vancouver release. Washington D.C. more seamlessly ties together NOW’s product categories to drive better interdepartmental work and communication. It makes using all of its tools and capabilities across teams more intuitive and obvious.

ServiceNow also offers the “workflow studio” as a unified workspace to manage productivity across teams. It seamlessly refreshes databases without complex coding; it goes deeper in terms of intelligently automating customer service and order management workflows. This is a constant pursuit to make its clients happier and their lives easier.

These platforms form the foundation for its own GenAI apps. A key example of these apps is “Now Assist AI,” which is close to $100 million in average contract value (ACV) on its own already. This is ServiceNow’s GenAI assistant/companion being infused across most of its products. Several iterations of this product have been launched for various ServiceNow workflow categories. More GenAI product examples include:

- The AI Lighthouse Program: This aims to expedite GenAI adoption through Nvidia and Accenture partnerships. NOW brings the apps; NVDA brings the hardware; Accenture brings the professional services.

- The RaptorDB Lighthouse Program: Its newest database built to support the speed and needed scalability of GenAI use cases. It offers an extensive list of 1st and 3rd party data sources to utilize, with easy conversational querying to up-level data scientist productivity. Models need relevant data to stand out from the jumbled pack. This lowers the cost to process that data for model training and will alleviate scale bottlenecks by 27Xing the pace of analytic inquiry response time.

- StarCoder 2: This provides access to large language models (LLMs) to automate code creation. Bring Your Own (BYO) GenAI model support allows for ultimate developer flexibility as they pick and choose which models serve them the best.

- The NOW App Engine: ServiceNow’s platform for building apps. Creator Studio was just added to the NOW App engine to push its “low-code app leadership” to fully no-code building.

“Plus SKUs” are how ServiceNow bundles all of its GenAI work into subscription packages. It up-charges clients for access to these SKUs, as its approach to GenAI monetization has been more aggressive than most. These Plus SKUs do things like automate customer service, expedite issue resolution, guide workflows and provide more conversational fetching/querying of a firm’s data.

a. Demand

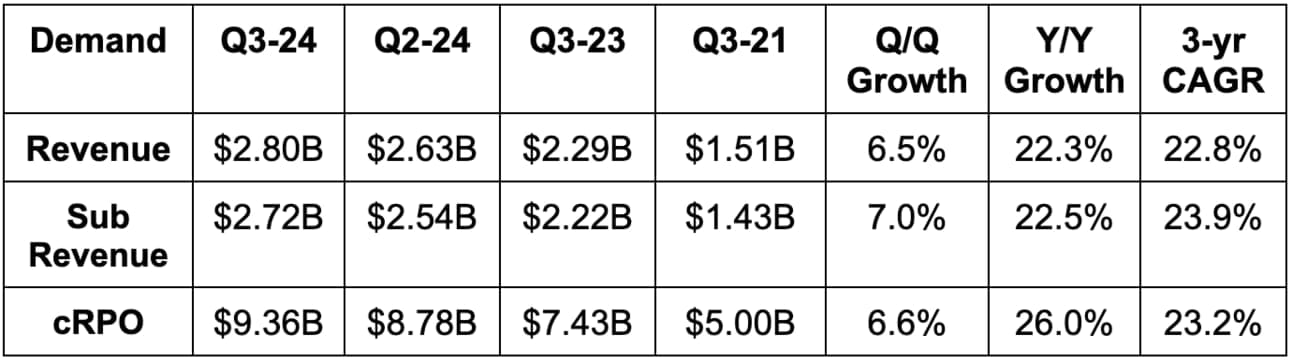

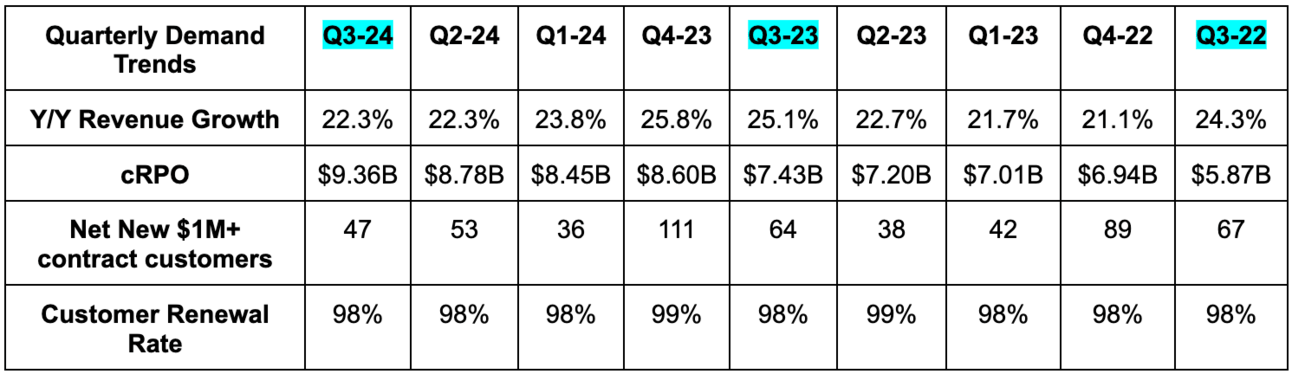

- Beat revenue estimates by 2.2%. The 22.8% 3-year revenue compounded annual growth rate (CAGR) compare to 23.1% last quarter & 24.1% two quarters ago.

- Beat foreign exchange neutral (FXN) current remaining performance obligation (cRPO) growth guidance of 22% with 23.5% Y/Y growth. The actual growth beat was larger due to FX help.

- Beat subscription revenue estimates & beat identical guidance by 1.8%.

- NOW closed 15 deals worth $5 million+ in average contract value (ACV), representing 50% Y/Y growth.

- Technology, media and telecom were industry standouts during the quarter, along with retail, hospitality and continued Federal government strength.

b. Profits & Margins

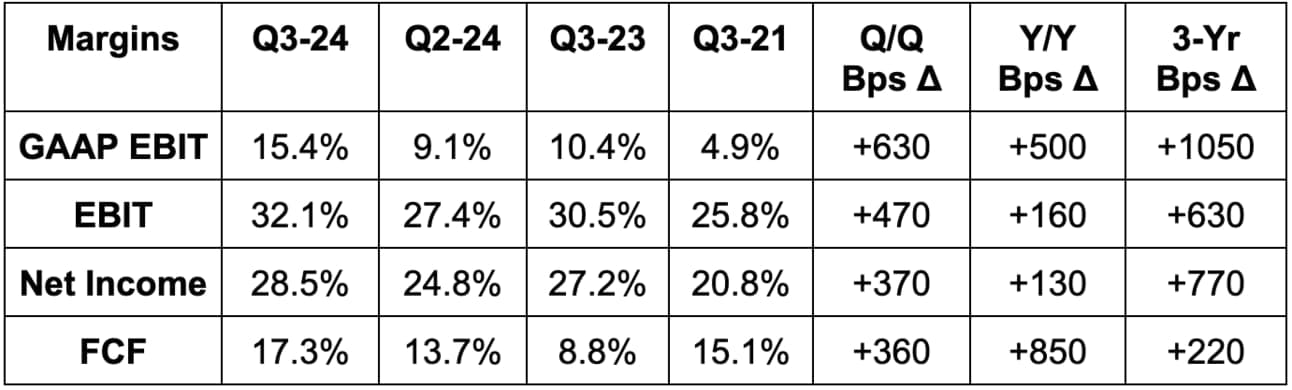

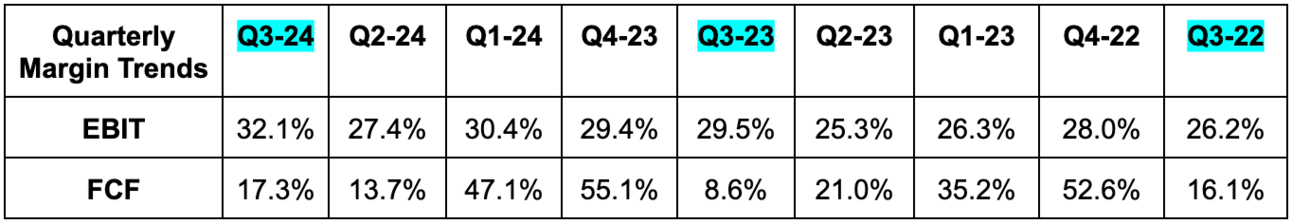

- Beat EBIT estimates by 7.2% & beat EBIT margin estimates by 260 basis points (bps; 1 basis point = 0.01%).

- Beat $3.45 EPS estimates by $0.27.

- Beat free cash flow (FCF) FCF estimates by 21%.

c. Balance Sheet

- $9.1 billion in cash & equivalents.

- No debt.

- Stock comp was 15% of sales vs. 18% of sales Y/Y. It continues to repurchase shares to offset dilution. Expects roughly zero dilution in 2024.

- NOW accelerated head count growth as planned. That will “prudently” continue.

d. Guidance & Valuation

- Raised annual subscription revenue guide by 0.7%.

- Reiterated annual subscription GPM, FCF and EBIT margin targets.

- Its Q4 29% EBIT margin guide missed by 170 bps. Based on the annual EBIT margin reiteration, this isn’t concerning.

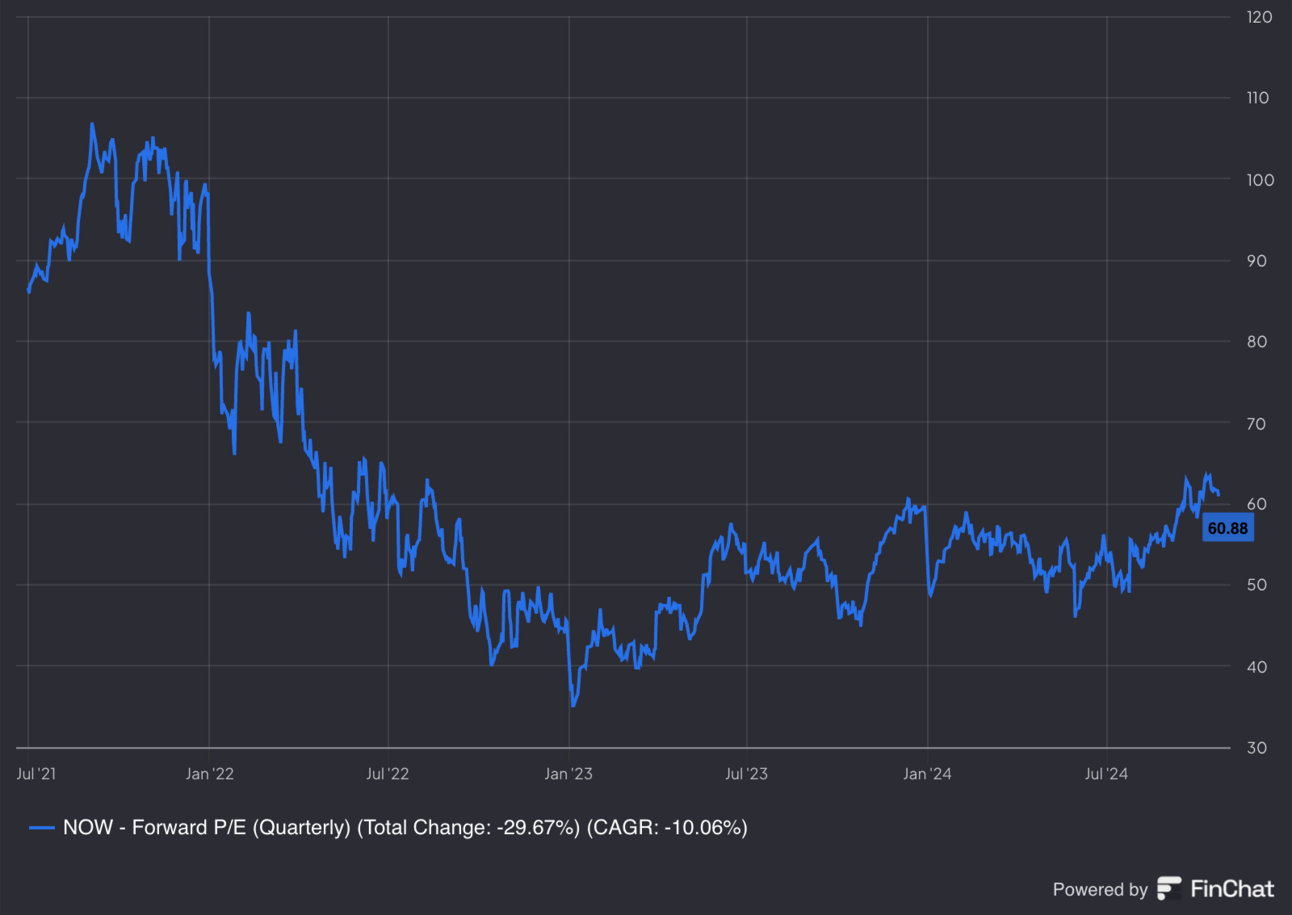

Now trades for 61x forward EPS. EPS is expected to compound at a 25% clip over the next two years.

e. Call & Presentation

The Platform Play:

Every quarter, ServiceNow reminds us how obvious of a workflow platform play it is. As I’ve spoken about for years now, platforms mean vendor consolidation, broader interoperability, better outcomes and lower costs. They allow companies to do “more with less” and unlock durable demand amid the more challenging macro backdrops. This quarter, we simply got more data confirming this enterprise as a true software platform.

It signed its 2nd largest new logo ever, included ITSM and ITOM in 15 of its 20 largest deals and cross-sold its security and risk products in 14 of its 20 largest deals. Customer, employee and creator workflows were all in 13+ of its largest 20 deals (customer workflow volume rose 50% Y/Y). Finally, 18 of its top 20 deals included 7+ modules. It continues to grow its list of $1 million+ customers and even added 6 contracts worth $10 million+ during the quarter.

And when ServiceNow doesn’t have the module a customer wants? It partners openly with world-class firms in complementary areas of software to ensure customers have open access to whatever they need… with one interface and one user experience… all on ServiceNow.

Now AI Assist and the Now Platform Xanadu Release (will be in NOW 101 section next quarter):

The Now Assist AI product continues to be its “fastest growing product ever.” It added 44 customers with contracts worth more than $1 million, with 6 of those being brand new logos.

To build on this momentum, as well as Vancouver and Washington D.C. updates, ServiceNow released the Xanadu update. The release comes with 100s of new tools and a completion of the previously announced Microsoft Copilot integration to “meet employees wherever they work.” The update works to infuse GenAI even more deeply into NOW’s product suite in two new areas. First, this adds GenAI capabilities for security and threat management workflows. The models are trained on a client’s own data and enriched with NOW’s overarching ecosystem to “accelerate incident response and improve threat containment.” It also offers transferable, automated incident summaries to help with prioritizing threats.

Secondly, the release adds new GenAI capabilities within financial and supply chain workflows – starting in sourcing and procurement. Procurement, per Gartner, is among the earliest areas of concrete value creation and material enterprise demand; ServiceNow now has the tools to help. The firm sees “immense opportunity for intelligent automation of complicated, fragmented processes.” This will “handle procurement requests, improve compliance and drive tangible business value.” That’s absolutely vital if NOW will continue to monetize its GenAI work in a hesitant macro backdrop. It has monetized better than pretty much anyone else thus far because it has found ways to actually create return on investment for customers.

Aside from these two expansion markets, the Now Assist Skill Kit is a tool to help developers deploy new GenAI prompts and workflows. ServiceNow has templates for pretty much all common needs, but it cannot possibly build models for every niche workflow. That’s where this comes into play. More new tools include:

- Chat and email reply generation.

- Integrated Development Environment (IDE) for easier app creation.

Workflow Data Fabric:

ServiceNow debuted the Workflow Data Fabric. This is a “new data layer to unify business and technology data across enterprises; it powers AI agents and workflows with real-time access to information and does things like cut transaction times by 53%. Simply put, it’s a “unified data management platform” to ensure all processes are guided by a firm’s own data and context. This works perfectly with the recently upgraded RaptorDB database used to bolster processing speeds. Per leadership, Raptor processes transactions 12x faster and data analytics 27x faster than legacy solutions.

Over the last few quarters, data has re-emerged as a vital ingredient for innovation. It never went away… focus just temporarily shifted. In a highly competitive, somewhat commoditized world of language model (LM) building, access to more relevant data is what differentiates one elite LM vs. another. I will keep saying it. Furthermore, “bringing data to the work,” as we hear from so many CEOs matters. Native integrations between databases and other software applications have a way of driving broader cohesion, more valuable querying, better decisions and lower costs. It’s conceptually similar to platform plays driving better inter-product communication.

GenAI apps and models rely on voracious data processing; when that data is closer to the final destination and more interoperable, transfer costs are lower. Zero copy partnerships with both Snowflake and Databricks for this product help a lot too. That’s why Salesforce worked so hard on their Data Cloud; it’s why Zscaler and CrowdStrike have focused so much on their own data storage scalability.

- Cognizant is the first system integrator to work with this new Workflow Data Fabric tool.

“So this is going to be an upsell opportunity for every existing installation across the world for ServiceNow.”

CEO Bill McDermott

Agentic AI:

Agentic AI allows companies to move from prompt-based chatbots to a “goal oriented” model with levels of autonomy needed to pursue that goal the best way possible. This allows the world to “evolve from the more familiar prompt-based activity to deeper contextual comprehension.” Agentic AI is designed to arrive at a concrete objective and is less commonly utilized for writing code or generating content. You can see how a model that can push towards a goal would be compelling for customers. All that client needs to say is “hey I’d like this inefficient workflow to be better” and Agentic AI can generate ways to bring that to life. NOW announced a new Agentic AI partnership with Nvidia to co-create AI Agents with Nvidia’s Inference Microservices (NIMs).

“Xanadu showcases our leadership in Agentic AI. Until now, GenAI required human prompts to initiate action. We’re deploying autonomous Agentic AI products that work with people, not just for them… It’s like hiring more people to support your workers by doing the jobs they’ve never wanted to do.”

CEO Bill McDermott