In case you missed it:

- Earnings Season Preview.

- Netflix & Taiwan Semi Earnings Review.

- Updated Portfolio & Performance vs. the S&P 500 with a New Holding.

Table of Contents

- a. Key Points

- b. Demand

- c. Profits & Margins

- d. Balance Sheet

- e. Guidance & Valuation

- f. Call & Shareholder Letter

- g. Take

a. Key Points

- Understandably tough quarter.

- Pulled full-year guidance. Will revisit it next quarter.

- Reiterated product roadmap schedules.

- Energy storage & generation continues to find great Y/Y growth.

Detailed coverage of the 2024 We Robot event can be found in section 4 of this article.

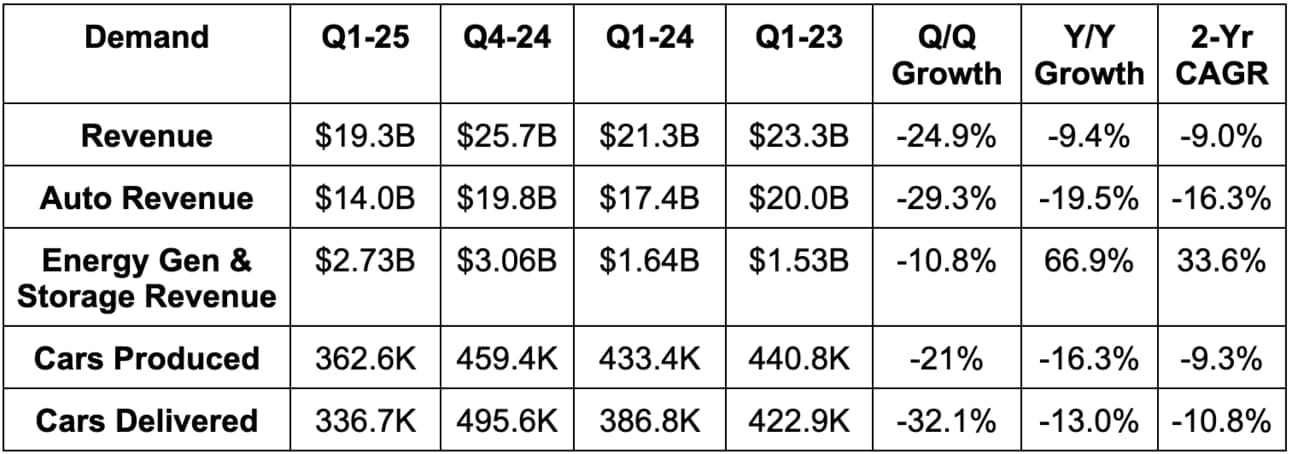

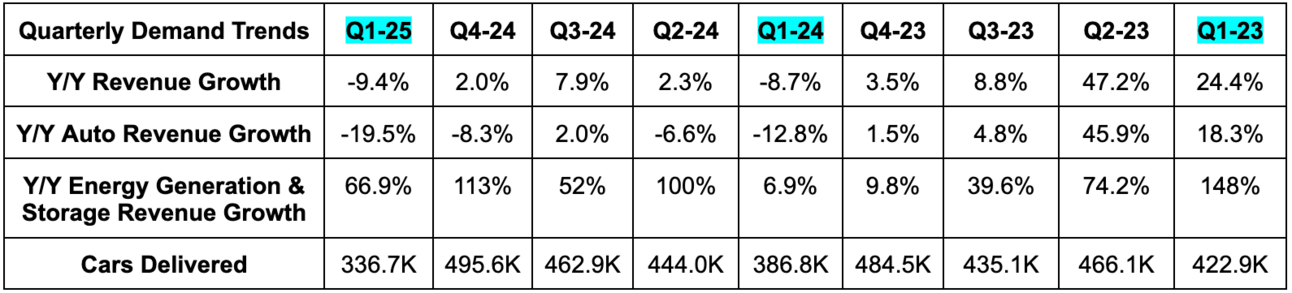

b. Demand

- Missed revenue estimates by 9.8%.

- Missed auto revenue estimates by 15.0%.

- Missed energy generation & storage revenue estimates by 11.4%.

- Missed services revenue estimates by 3.3%.

Revenue tailwinds for the quarter included regulatory credits and its energy generation and storage business. Headwinds included $300M in foreign exchange impacts, lower average selling prices and lower deliveries – partially due to its Model Y production overhaul (more later).

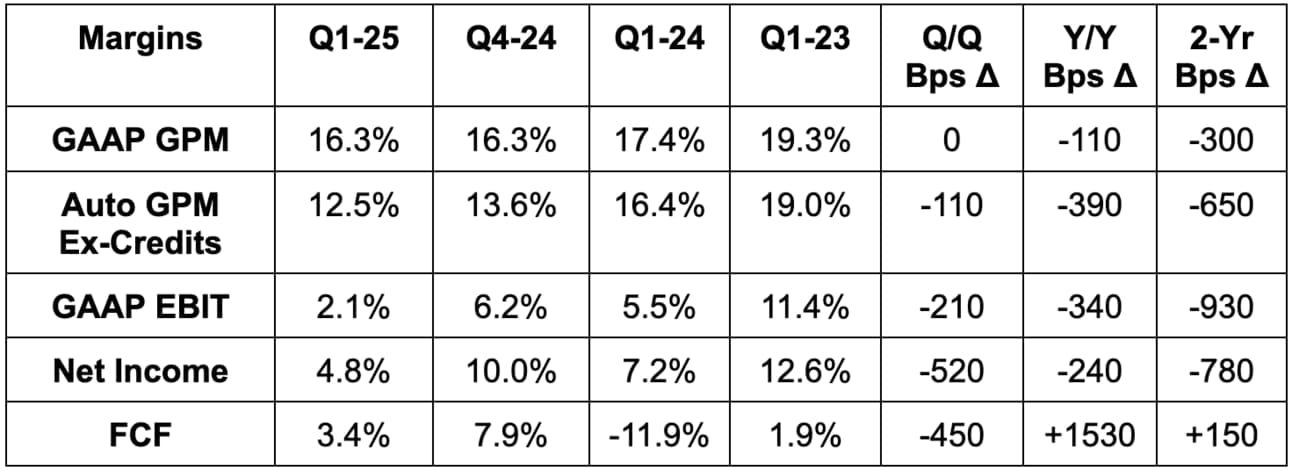

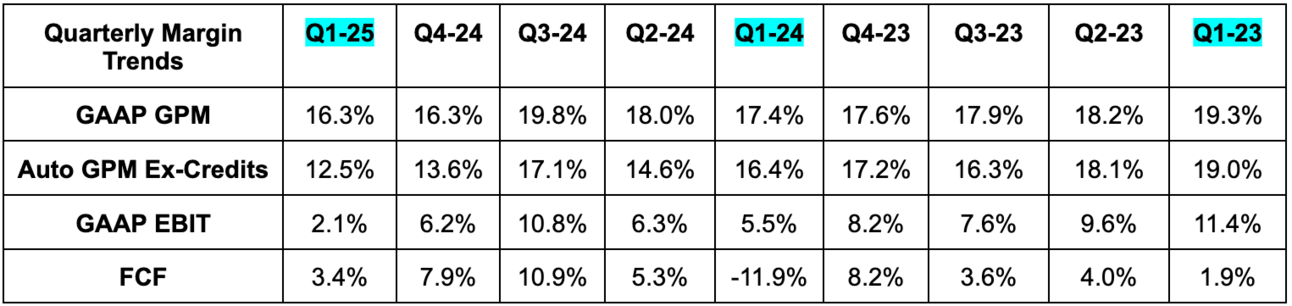

c. Profits & Margins

- Beat 15.7% GPM estimates by 60 basis points (bps; 1 basis point = 0.01%).

- Beat 11.6% auto GPM ex-credit estimates by 90 bps. Highlight of the report.

- Auto GPM ex-credits = (auto rev ex-credits - auto COGS) / (auto rev ex- credits).

- Beat 26.5% energy storage & generation GPM estimates by 220 bps.

- Missed $1.20B GAAP EBIT estimates by $800M. Not great.

- Missed $0.42 EPS estimate by $0.15. Bitcoin mark-to-market losses reduced EPS by about $0.13.

- The free cash flow (FCF) estimates I saw ranged from $200M to $1.2B between highly reputable sources. Estimates were falling quickly into this print. Tesla posted $664M in FCF.

Margin tailwinds for the quarter included regulatory credits, comping over the Cybertruck launch last year and lower input costs per vehicle. Cost efficiency gains continue an encouragingly consistent trend and came from lower raw material costs. Headwinds included lower fixed cost leverage from the Model Y refresh, AI and 22% Y/Y R&D growth. Lower average selling price, which was related to mix shift and more financing offers, also hurt profitability.

While the auto GPM ex-credit trend looks ugly, Tesla remains the most profitable electric vehicle (EV) program in the USA by a sizable margin. Whether it’s economies of scale, vertically integrated manufacturing or premium price points, it’s still the nicest house in a currently troubled neighborhood.

d. Balance Sheet

- $37B in cash & equivalents.

- $7.2B in total debt.

- 1% Y/Y dilution.

- Inventory fell by 14.4% Y/Y.

“We’ve been on the edge of death a dozen times. This is not one of those times.”

CEO Elon Musk