Table of Contents

In Case you Missed It:

- Alphabet & Tesla Earnings Reviews.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio earnings season preview.

- My latest portfolio & performance.

- Big Bank Credit & Economic Data from this season (section 3).

1. ServiceNow (NOW) — Brief Earnings Snapshot

The detailed ServiceNow earnings review will be published on Saturday with granular commentary on the conference call, other investor materials and my take. That will come alongside Intel and Deckers coverage. For now, here’s the brief snapshot:

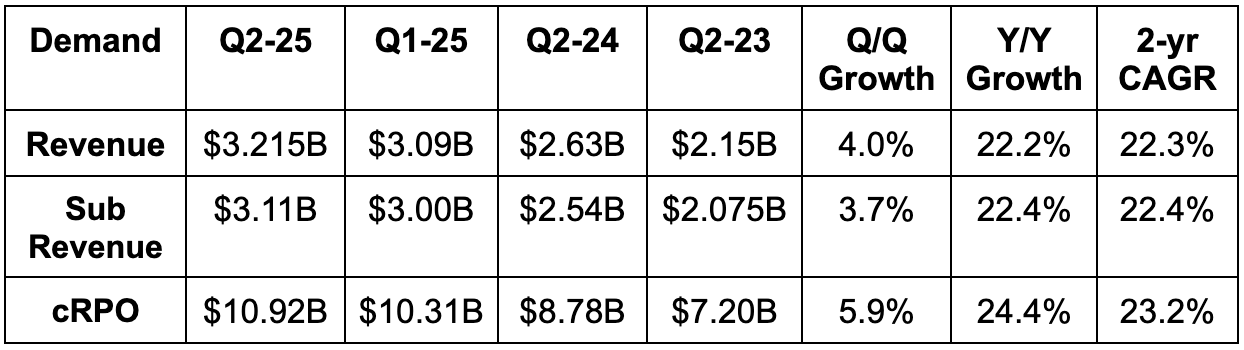

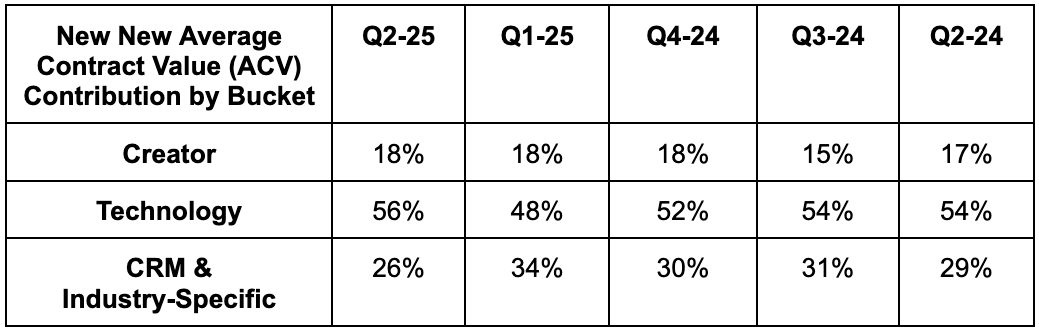

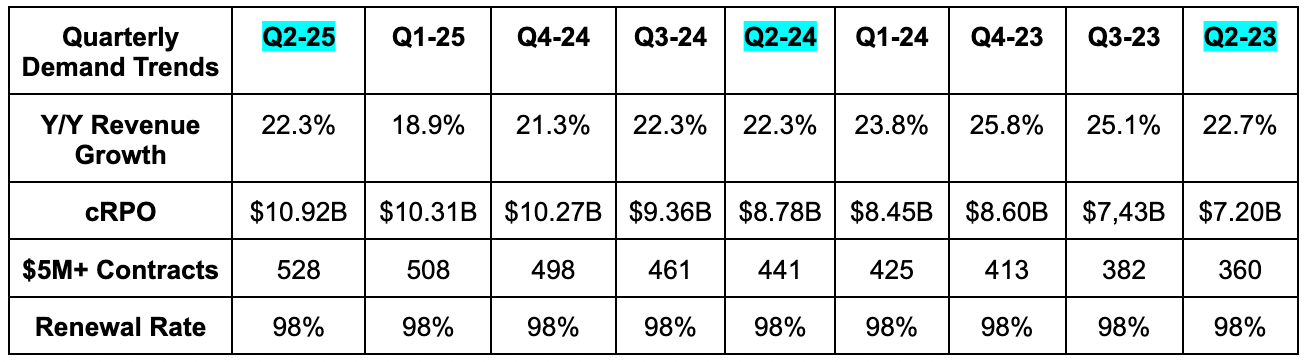

a. Demand

- Beat revenue estimates by 3%.

- Beat 19% foreign exchange neutral (FXN) Y/Y revenue growth estimates with 21.5% Y/Y growth.

- Beat subscription revenue estimates by 2.4% & beat guidance by 2.6%.

- Beat 19.5% FXN subscription revenue growth estimates & beat 19.5% growth guidance with 21.5% Y/Y growth.

- Beat current remaining performance obligation (cRPO) estimates by 0.6%. It beat 19.5% FXN cRPO growth guidance with 21.5% Y/Y growth.

- The average contract size for their $5M+ customers rose from $13.5M to $14.5M Y/Y.

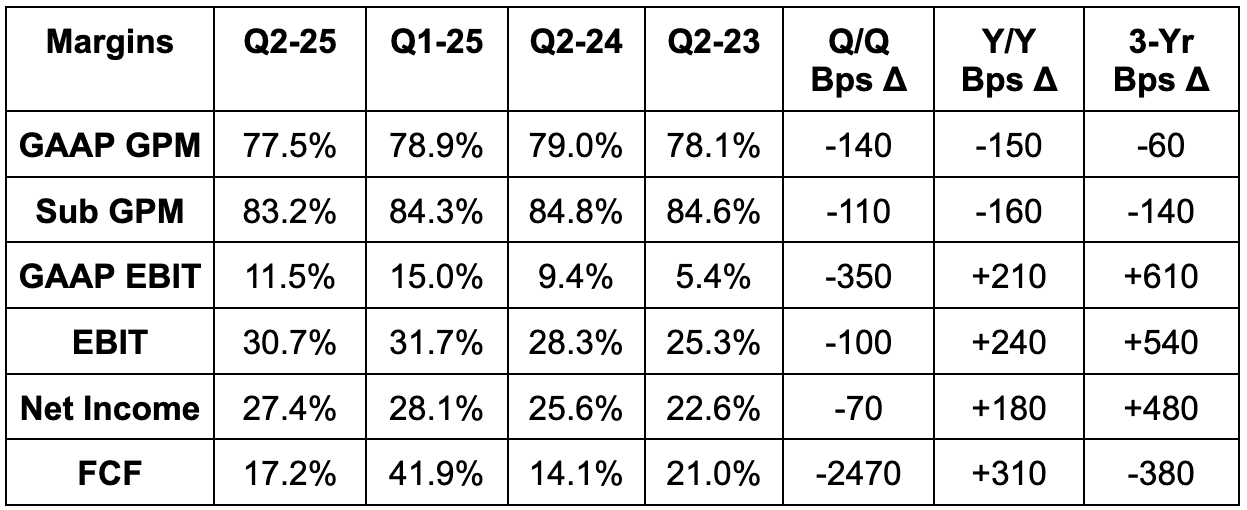

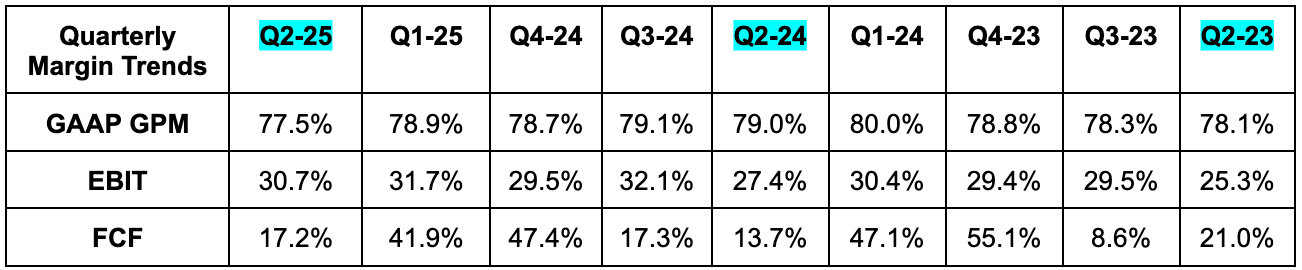

b. Profits & Margins

- Slightly missed 83.4% subscription GPM estimate by 20 basis points (bps; 1 basis point = 0.01%).

- Beat EBIT estimate by 12.3% and beat 27% margin guidance by a robust 370 bps.

- Beat $3.57 EPS estimates by $0.52.

- Beat $1.60 GAAP EPS estimates by $0.24.

- Beat free cash flow (FCF) estimates by 19%.

c. Balance Sheet

- $6.1B in cash & equivalents.

- $4.65B in long-term investments.

- $1.49B in long-term debt.

- Share count rose by 0.7% Y/Y.

d. Guidance & Valuation

For Q3, subscription revenue guidance beat estimates by 1.5%. Total revenue estimates for the quarter haven’t yet moved, considering the best was modest. Q3 30.5% EBIT margin guidance missed 31.5% margin estimates; EBIT dollar estimates fell by 5% following the call as a result of this. It also guided to 18% Y/Y FXN cRPO growth for Q3.

For the full year, NOW raised subscription revenue guidance by 1% and raised FXN growth guidance from 19.5% to 19.75%, showing the strength wasn’t solely related to currency favorability. Total revenue estimates (NOW doesn’t guide to that number) rose very modestly following the call, which tells us this guide was slightly above consensus. It reiterated EBIT and FCF margin guidance, which both met estimates. When paired with the very modest revenue outperformance, profit estimates should subtly tick higher in the coming days.

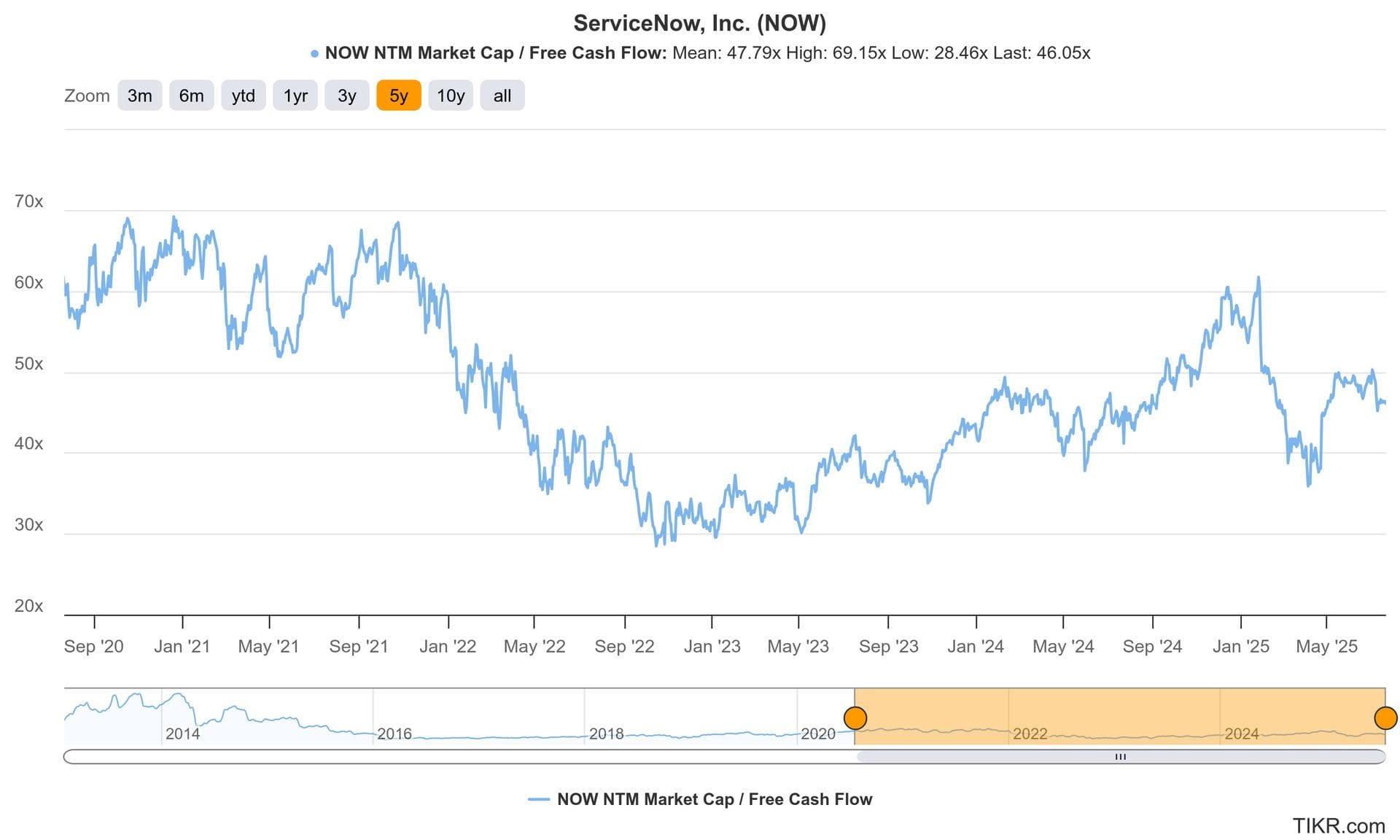

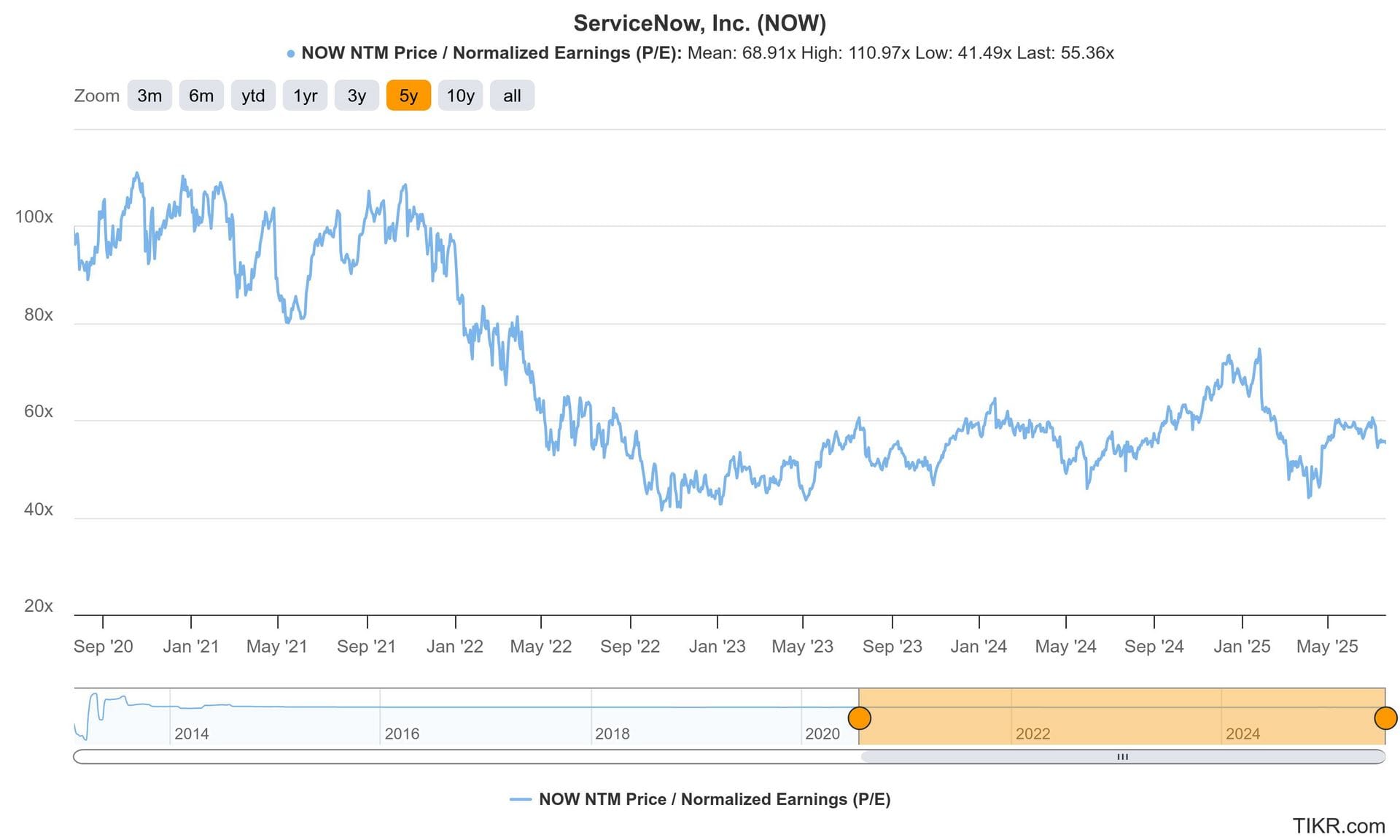

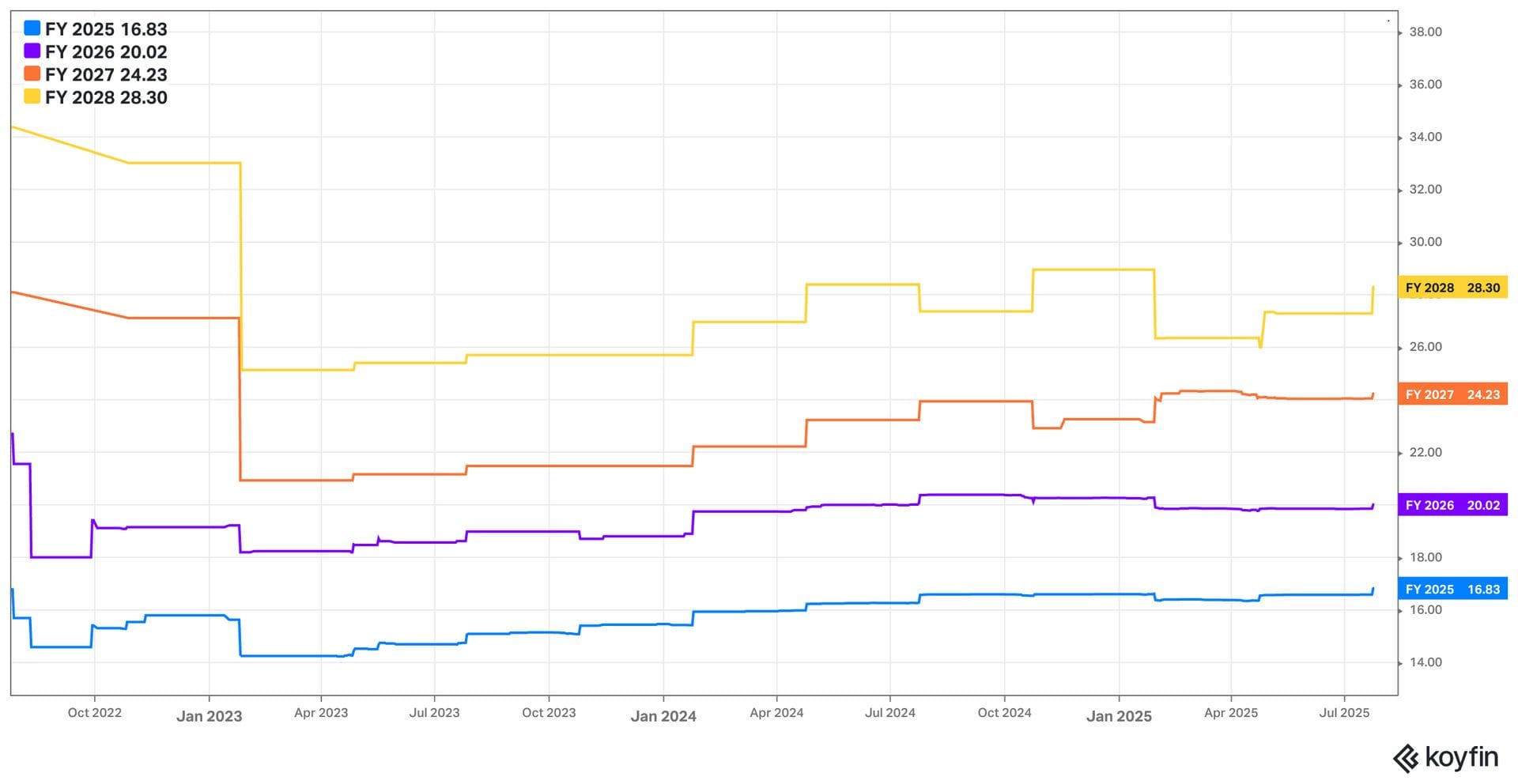

NOW trades for 46x forward FCF. FCF is expected to compound at a 20% clip for the next two years. It also trades for 56x forward EPS. EPS is expected to compound at a 20% clip for the next two years.